Owner of Coach, Kate Spade Ousts CEO -- WSJ

05 Septiembre 2019 - 2:02AM

Noticias Dow Jones

By Suzanne Kapner

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 5, 2019).

The handbag company that combined the Coach and Kate Spade

brands ousted its chief executive a little over two years after a

merger that was supposed to create a U.S. fashion powerhouse.

Tapestry Inc. said Wednesday that Victor Luis, who has been CEO

for five years, is leaving immediately and will be succeeded by

board Chairman Jide Zeitlin. Mr. Zeitlin is a former Goldman Sachs

Group Inc. executive who has been on the board since 2006.

Coach changed its name to Tapestry in 2017 after spending $2.4

billion to acquire Kate Spade & Co., a U.S. rival whose founder

was no longer involved in the brand.

Mr. Luis viewed the deal as a way to reach younger shoppers and

build a collection of brands that could better compete with

European rivals. In 2015, Coach purchased the Stuart Weitzman

footwear brand.

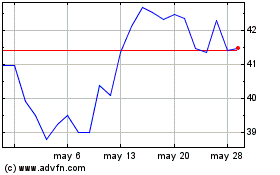

But the Kate Spade brand has struggled. Sales at Kate Spade

stores open at least a year fell 6% in the three months that ended

June 29, and the brand's margins contracted on higher discounting.

That prompted Tapestry to lower earnings guidance for the year,

which sent its stock plunging 22% in a single day. The shares have

fallen by more than half during the past year.

In an interview, Mr. Zeitlin said the company was committed to

its multibrand strategy, but needed to work on execution. "There

has been a gap between strategy and delivery," he said.

Tapestry's other two brands, Coach and the much smaller Stuart

Weitzman, have performed better. Sales at Coach stores open at

least a year rose 2% in the latest quarter.

But some analysts question the portfolio, saying it isn't built

on strong brands. "Tapestry's strategy is flawed," said Randal

Konik, an analyst at Jefferies. "The Coach brand is stagnating" and

the "Kate Spade brand is a big problem."

Mr. Zeitlin, who will remain board chairman, said he wasn't

planning any management changes at Kate Spade or elsewhere in the

company. He said the board plans to begin a search for a permanent

CEO at some point in the future. The company also said board member

Susan Kropf, a former Avon executive, has been named lead

independent director.

Tapestry said Wednesday it is maintaining its recently lowered

fiscal 2020 financial outlook and continues to expect to return

about $700 million to shareholders through its dividend and

repurchase programs.

Coach, Kate Spade and Stuart Weitzman have battled a challenging

retail environment, especially for designers with significant

exposure to department stores, where traffic has declined.

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com

(END) Dow Jones Newswires

September 05, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

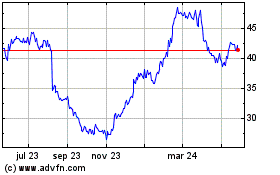

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024