Form SC 13D/A - General Statement of Acquisition of Beneficial Ownership: [Amend]

15 Julio 2024 - 8:45PM

Edgar (US Regulatory)

United States

Securities and Exchange Commission

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 4)*

Maxeon Solar

Technologies, Ltd.

(Name of Issuer)

Ordinary Shares

(Title of Class of Securities)

Y58473102

(CUSIP Number)

Marine Delaitre

General Counsel – Gas, Renewables &

Power

TOTALENERGIES SE

2, place Jean Millier

La Défense 6

92400 Courbevoie

France

00-331-4135-2834

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

July 11, 2024

(Date of Event which Requires Filing of this

Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of § §

240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box.¨

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7 for other parties to whom

copies are to be sent.

| * | The remainder of this cover page shall be filled

out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment

containing information which would alter disclosures provided in a prior cover page. |

The information

required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities

Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all

other provisions of the Act (however, see the Notes).

| 1 |

Names of Reporting Persons

TotalEnergies SE

|

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨

|

| 3 |

SEC Use Only |

| 4 |

Source of Funds (See Instructions)

OO

|

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

Citizenship or Place of Organization

France

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7 |

Sole Voting Power

0

|

| 8 |

Shared Voting Power

24,027,461

|

| 9 |

Sole Dispositive Power

0

|

| 10 |

Shared Dispositive Power

24,027,461

|

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person 24,027,461 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes

Certain Shares

¨

|

| 13 |

Percent of Class Represented by Amount in Row

(11)

5.5 per cent.12

|

| 14 |

Type of Reporting Person

CO

|

| |

|

|

|

| 1 | Percentage calculated based on (i) a denominator comprised of (a) 420,921,574 ordinary shares, no par value (the

"Ordinary Shares"), of Maxeon Solar Technologies, Ltd. (the "Issuer") issued and outstanding as of July

12, 2024,

according to information provided by the Issuer to the Reporting Persons as of the date hereof (the "Outstanding Share Count"),

plus (b) the "Issuable Shares" as defined under (ii)(b) immediately below, and (ii) a numerator based on (a) 8,000,931 Ordinary

Shares held by the above Reporting Person plus (b) 16,026,530 Ordinary Shares (the "Issuable Shares") that would be issuable

upon the conversion of the Issuer's Adjustable-Rate Convertible Second Lien Senior Secured Notes due 2028 (the "Notes")

issued to the above Reporting Person's wholly-owned subsidiary on July 5, 2024, pursuant to that certain indenture dated as of June 20,

2024 (the "Indenture"), by and among the Issuer, the guarantors party thereto, Deutsche Bank Trust Company Americas,

as trustee, DB Trustees (Hong Kong) Limited, as collateral trustee and, solely with respect to the Philippine collateral, RCBC Trust Corporation,

at the applicable conversion rate and conversion adjustment for the Conversion Consideration (as defined in the Indenture) as if the Notes

were converted as of July 5, 2024. The number of Issuable Shares depends upon the conversion formula set forth in the Indenture, and the

actual number of Issuable Shares issuable on any given date is a fluctuating figure that may ultimately be a larger number or smaller

number on the actual date of conversion. |

|

2 |

It is expected, subject to the satisfaction of certain conditions, including receipt of required regulatory approvals, that investors unrelated to the above Reporting Person will acquire a significant percentage of the beneficial ownership of the Issuer's outstanding Ordinary Shares following consummation of certain transactions disclosed by the Issuer in a Form 6-K on May 30, 2024 and another Form 6-K on June 17, 2024. It is also expected that the Outstanding Share Count will continue to increase due to continued conversions of the Notes into Ordinary Shares by certain holders of the Notes pursuant to the Indenture. Once the foregoing transactions and conversions are consummated, it is expected that the beneficial ownership of the above Reporting Person may be substantially diluted in the near future. At the time any such dilution is publicly disclosed or otherwise provided to the above Reporting Person by the Issuer, this Schedule 13D is expected to be amended accordingly. |

| 1 |

Names of Reporting Persons

TotalEnergies Gaz & Electricité Holdings

SAS

|

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨

|

| 3 |

SEC Use Only |

| 4 |

Source of Funds (See Instructions)

OO

|

| 5 |

Check

if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

Citizenship or Place of Organization

France

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7 |

Sole Voting Power

0

|

| 8 |

Shared Voting Power

8,000,931

|

| 9 |

Sole Dispositive Power

0

|

| 10 |

Shared Dispositive Power

8,000,931

|

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person 8,000,931 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes

Certain Shares

¨

|

| 13 |

Percent of Class Represented by Amount in Row

(11)

1.9 per cent.3

|

| 14 |

Type of Reporting Person

CO

|

| |

|

|

|

| 3 | Percentage calculated based on a denominator comprised solely of the Outstanding Share Count. |

| 1 |

Names of Reporting Persons

TotalEnergies Solar INTL SAS

|

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ¨ (b) ¨

|

| 3 |

SEC Use Only |

| 4 |

Source of Funds (See Instructions)

OO

|

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

Citizenship or Place of Organization

France

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7 |

Sole Voting Power

0

|

| 8 |

Shared Voting Power

8,000,931

|

| 9 |

Sole Dispositive Power

0

|

| 10 |

Shared Dispositive Power

8,000,931

|

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person 8,000,931 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes

Certain Shares

¨

|

| 13 |

Percent of Class Represented by Amount in Row

(11)

1.9 per cent.4

|

| 14 |

Type of Reporting Person

CO

|

| |

|

|

|

| 4 | Percentage calculated based on a denominator comprised solely of the Outstanding Share Count. |

| 1 |

Names of Reporting Persons

TotalEnergies Marketing Services SAS

|

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ¨ (b) ¨

|

| 3 |

SEC Use Only |

| 4 |

Source of Funds (See Instructions)

OO

|

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

Citizenship or Place of Organization

France

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7 |

Sole Voting Power

0

|

| 8 |

Shared Voting Power

16,026,530

|

| 9 |

Sole Dispositive Power

0

|

| 10 |

Shared Dispositive Power

16,026,530

|

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person 16,026,530 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes

Certain Shares

¨

|

| 13 |

Percent of Class Represented by Amount in Row

(11)

3.7 per cent.5

|

| 14 |

Type of Reporting Person

CO

|

| |

|

|

|

| 5 | Percentage calculated based on (i) a denominator comprised of the Outstanding Share Count plus the Issuable

Shares and (ii) a numerator comprised solely of the Issuable Shares. |

Explanatory Note

This Amendment No. 4 (this "Amendment

No. 4") to Schedule 13D amends the Schedule 13D of the Reporting Persons that was initially filed on September 8, 2020 (the "Initial

Filing") with the SEC, as amended by Amendment No. 1 to Schedule 13D filed with the SEC on November 1, 2022 ("Amendment

No. 1"), by Amendment No. 2 to Schedule 13D filed with the SEC on May 23, 2023 ("Amendment No. 2") and by Amendment

No. 3 to Schedule 13D filed with the SEC on July 9, 2024 ("Amendment No. 3," and together with the Initial Filing, Amendment

No. 1, Amendment No. 2 and Amendment No. 3, the "Amended Filing"), relating to the Ordinary Shares of the Issuer. Information

reported in the Amended Filing remains in effect except to the extent that it is amended, restated or superseded by information contained

in this Amendment No. 4 (together with the Amended Filing, the "Schedule 13D"). Capitalized terms used but not defined

in this Amendment No. 4 have the respective meanings set forth in the Amended Filing.

This Amendment No. 4 is being filed to report

the decrease in the percentage of Ordinary Shares of the Issuer beneficially owned by the Reporting Persons since the previous reporting

date on account of an increase in the Outstanding Share Count from the Amended Filing as a result of conversions of the Notes into Ordinary

Shares by certain holders of the Notes pursuant to the Indenture.

In furtherance thereof, it amends and restates

portions of Items 2 and 5 of the Amended Filing. Except as set forth herein, there are no changes to the Schedule 13D.

Item 2. Identity and Background.

This Amendment No. 4 amends and restates Items 2(d)

and 2(e) of the Amended Filing as set forth below:

During the last five years, none of the Reporting

Persons nor, to the best of the Reporting Persons' knowledge, any of their respective directors or executive officers (i) have been convicted

in any criminal proceeding (excluding traffic violations or similar misdemeanors) or (ii) were parties to a civil proceeding of a judicial

or administrative body of competent jurisdiction and as a result of such proceeding were or are subject to a judgment, decree or final

order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any

violation with respect to such laws.

Item 5. Interest in Securities of

the Issuer.

This Amendment No. 4 amends and restates Items

5(a), 5(b) and 5(e) of the Amended Filing as set forth below:

(a) and (b) The information set forth in rows

7 through 13 (and related footnotes) of each of the cover pages for each Reporting Person of this Amendment No. 4 is incorporated herein

by reference into this Item 5.

(e) As

of the date hereof, the following Reporting Persons ceased to beneficially own more than five percent of the Ordinary Shares. This Amendment

No. 4 constitutes an exit filing for such Reporting Persons:

| (1) | TotalEnergies Gaz & Electricité Holdings SAS, a French société par actions simplifiée, |

| (2) | TotalEnergies Solar INTL SAS, a French société par actions simplifiée, and |

| (3) | TotalEnergies Marketing Services SAS, a French société par actions simplifiée. |

SIGNATURES

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: July 15, 2024

| TOTALENERGIES SE |

|

| |

|

| By: |

/s/ Marine Delaitre |

|

| Name: |

Marine Delaitre |

|

| Title: |

Duly Authorized Representative |

|

| TOTALENERGIES GAZ & ELECTRICITÉ HOLDINGS SAS |

|

| |

|

| By: |

/s/ Laurent Wolffsheim |

|

| Name: |

Laurent Wolffsheim |

|

| Title: |

President |

|

| TOTALENERGIES SOLAR INTL SAS |

|

| |

|

| By: |

/s/ Vincent Stoquart |

|

| Name: |

Vincent Stoquart |

|

| Title: |

President |

|

| TOTALENERGIES MARKETING SERVICES SAS |

|

| |

|

| By: |

/s/ Denis Toulouse |

|

| Name: |

Denis Toulouse |

|

| Title: |

Finance Director |

|

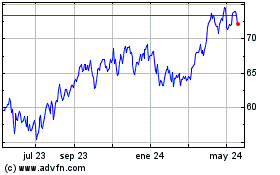

TotalEnergies (NYSE:TTE)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

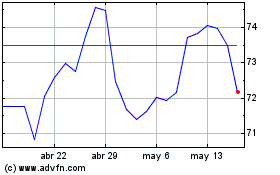

TotalEnergies (NYSE:TTE)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024