FALSE000133691700013369172024-05-152024-05-150001336917us-gaap:CommonClassAMember2024-05-152024-05-150001336917us-gaap:CommonClassCMember2024-05-152024-05-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________________________________________

FORM 8-K

______________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 15, 2024

________________________________________________________________________________

UNDER ARMOUR, INC.

________________________________________________________________________________ | | | | | | | | | | | | | | |

Maryland | | 001-33202 | | 52-1990078 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| |

1020 Hull Street, Baltimore, Maryland | | 21230 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (410) 468-2512

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Class A Common Stock | UAA | New York Stock Exchange |

| Class C Common Stock | UA | New York Stock Exchange |

| (Title of each class) | (Trading Symbols) | (Name of each exchange on which registered) |

________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 2.02. Results of Operations and Financial Condition.

On May 16, 2024, Under Armour, Inc. (“Under Armour”, or the “Company”) issued a press release announcing its financial results for the fourth quarter and fiscal year ended March 31, 2024. A copy of Under Armour’s press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. Under Armour has scheduled a conference call for 8:30 a.m. ET on May 16, 2024 to discuss its financial results.

Item 2.05. Costs Associated with Exit or Disposal Activities

On May 15, 2024, the Company’s Board of Directors approved a restructuring plan designed to rebalance the Company’s cost base to further improve profitability and cash flow generation. In connection with the restructuring plan, the Company expects to incur total estimated pre-tax restructuring and related charges of approximately $70 million to $90 million during fiscal year 2025, primarily consisting of up to approximately:

•$50 million in cash-related charges, consisting of approximately $15 million in employee severance and benefits costs, and $35 million related to various transformational initiatives; and

•$40 million in non-cash charges consisting of approximately $7 million in employee severance and benefits costs and $33 million in facility, software and other asset-related charges and impairments.

This disclosure contains forward-looking statements within the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. All statements other than those that are purely historical are forward-looking statements, and include statements regarding anticipated charges and restructuring costs and the timing of these measures. These forward-looking statements are subject to risks, uncertainties, assumptions and changes in circumstances that may cause the estimated future impact of these restructuring charges and costs to differ materially from the forward-looking statements. These risks include the Company’s ability to successfully execute its restructuring plan, higher than anticipated costs in implementing the restructuring plan, management distraction from ongoing business activities, damage to the Company’s reputation and brand image and workforce attrition beyond planned restructuring related reductions. Additional information regarding other factors that could cause the Company’s results to differ can be found in the Company’s press release attached hereto as Exhibit 99.1, the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2024, and the Company’s subsequent filings with the U.S. Securities and Exchange Commission. The forward-looking statements contained in this disclosure reflect the Company’s views and assumptions only as of the date of this Current Report on Form 8-K. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which this disclosure is made or to reflect the occurrence of unanticipated events.

Item 8.01. Other Events.

On May 15, 2024, the Company’s Board of Directors authorized the Company to repurchase up to $500 million (exclusive of fees and commissions) of outstanding shares of its Class C common stock, $0.0003 1/3 par value per share (the “Class C Common Stock”), pursuant to a new share repurchase program. Under the share repurchase program, the Company may repurchase shares of Class C Common Stock through open market or privately negotiated transactions, block purchases, or other transactions, including accelerated share repurchase programs.

The share repurchase program will expire on May 31, 2027 and may be suspended or discontinued at any time. The share repurchase program does not obligate the Company to repurchase shares of Class C Common Stock and the timing and actual number of shares repurchased will depend on a variety of factors including price, market conditions, corporate and regulatory requirements and other investment opportunities. Information regarding share repurchases will be available in the Company’s periodic reports on Forms 10-Q and 10-K filed with the Securities and Exchange Commission as required by the applicable rules of the Securities Exchange Act of 1934, as amended.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. | | | | | | | | | | | |

Exhibit No. | | Exhibit |

| | Under Armour, Inc. press release announcing financial results for the fourth quarter and fiscal year ended March 31, 2024. |

| 101 | | XBRL Instance Document - The instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | UNDER ARMOUR, INC. |

| | | |

| Date: May 16, 2024 | | By: | | /s/ David E. Bergman |

| | | | David E. Bergman |

| | | | Chief Financial Officer |

Exhibit 99.1

UNDER ARMOUR REPORTS FOURTH QUARTER AND FULL-YEAR

FISCAL 2024 RESULTS; PROVIDES INITIAL FISCAL 2025 OUTLOOK

Company Also Announced a New $500 Million Share Repurchase Program

BALTIMORE, May 16, 2024 – Under Armour, Inc. (NYSE: UA, UAA) announced unaudited financial results for its fourth quarter and full-year fiscal 2024, which ended March 31, 2024. The company reports its financial performance following accounting principles generally accepted in the United States of America ("GAAP"). This press release refers to "currency neutral" and "adjusted" amounts, which are non-GAAP financial measures described below under the "Non-GAAP Financial Information" paragraph.

“Amid a challenging retail environment in fiscal 2024 that included high inventories and a consistent drumbeat of promotions – we demonstrated disciplined expense control and delivered results that were aligned with our previous outlook,” said Under Armour President and CEO Kevin Plank. “We also maintained a strong balance sheet, closing the year with a solid cash position and healthy inventory levels.”

Fourth Quarter Fiscal 2024 Review

•Revenue was down 5 percent to $1.3 billion (down 5 percent currency neutral).

–North America revenue decreased 10 percent to $772 million, and international revenue increased 7 percent to $561 million (up 6 percent currency neutral). In the international business, revenue increased 10 percent in EMEA (up 7 percent currency neutral), 1 percent in Asia-Pacific (up 5 percent currency neutral), and 20 percent in Latin America (up 12 percent currency neutral).

–Wholesale revenue decreased 7 percent to $850 million, and direct-to-consumer revenue was flat at $455 million. Owned and operated store revenue increased 7 percent and eCommerce revenue decreased 8 percent, representing 43 percent of the total direct-to-consumer business for the quarter.

–Apparel revenue decreased 1 percent to $877 million. Footwear revenue was down 11 percent to $338 million. Accessories revenue was down 7 percent to $89 million.

•Gross margin increased 170 basis points to 45.0 percent, driven primarily by supply chain benefits related to lower product and freight costs. This was partially offset by unfavorable foreign currency impacts and proactive inventory management actions, including increased promotional activities in our direct-to-consumer business.

•Selling, general & administrative expenses were up 5 percent to $603 million. Excluding a $58 million litigation reserve expense, adjusted selling, general & administrative expenses were down 5 percent to $546 million.

•Operating loss was $4 million. Adjusted operating income was $54 million.

•Net Income was $7 million. Adjusted net income was $49 million.

•Diluted earnings per share was $0.02. Adjusted diluted earnings per share was $0.11.

•Inventory was down 19 percent to $958 million.

•At the end of the quarter, Cash and Cash Equivalents were $859 million, and no borrowings were outstanding under the company's $1.1 billion revolving credit facility.

Full Year Fiscal 2024 Review

•Revenue was down 3 percent to $5.7 billion (down 4 percent currency neutral).

–North America revenue decreased 8 percent to $3.5 billion, and international revenue increased 8 percent to $2.2 billion (up 7 percent currency neutral). Within the international business, revenue increased 9 percent in EMEA (up 6 percent currency neutral), 6 percent in Asia-Pacific (up 9 percent currency neutral), and 8 percent in Latin America (down 1 percent currency neutral).

–Wholesale revenue decreased 7 percent to $3.2 billion, and direct-to-consumer revenue increased 3 percent to $2.3 billion due to a 5 percent increase in owned and operated store revenue and a 1 percent increase in eCommerce revenue, which represented 41 percent of the total direct-to-consumer business for the year.

–Apparel revenue decreased 2 percent to $3.8 billion, footwear revenue decreased 5 percent to $1.4 billion and accessories revenue declined 1 percent to $406 million.

•Gross margin increased 130 basis points to 46.1 percent, driven primarily by supply chain benefits related to lower freight and product costs. This was partially offset by proactive inventory management actions, including increased promotional activities in our direct-to-consumer business.

•Selling, general & administrative expenses were up 1 percent to $2.4 billion. Excluding an $80 million litigation reserve expense, adjusted selling, general & administrative expenses were down 2 percent to $2.3 billion.

•Operating income was $230 million. Excluding the company's litigation reserve expense, adjusted operating income was $310 million.

•Net Income was $232 million. Excluding a $50 million earn-out benefit in connection with the sale of the MyFitnessPal platform, the litigation reserve expense, and related tax impacts, adjusted net income was $245 million.

•Diluted earnings per share was $0.52. Adjusted diluted earnings per share was $0.54.

Fiscal 2025 Restructuring Plan

To strengthen and support the company's financial and operational efficiencies, Under Armour’s Board of Directors has approved a restructuring plan.

In conjunction with this plan, the company expects to incur total estimated pre-tax restructuring and related charges of approximately $70 to $90 million, including:

•Up to $50 million in cash-related charges, consisting of approximately $15 million in employee severance and benefits costs, and $35 million related to various transformational initiatives, and

•Up to $40 million in non-cash charges comprised of approximately $7 million in employee severance and benefits costs and $33 million in facility, software and other asset-related charges and impairments.

Fiscal 2025 Outlook

“Due to a confluence of factors, including lower wholesale channel demand and inconsistent execution across our business, we are seizing this critical moment to make proactive decisions to build a premium positioning for our brand, which will pressure our top and bottom line in the near term,” Plank continued, “Over the next 18 months, there is a significant opportunity to reconstitute Under Armour’s brand strength

through achieving more, by doing less and focusing on our core fundamentals: driving demand through better products and storytelling, running smarter plays like simplifying our operating model and elevating our consumer experience. In parallel, we’re focused on cost management and implementing the strategies necessary to grow our brand and improve shareholder value as we move forward.”

Key points related to Under Armour's fiscal 2025 outlook include:

•Revenue is expected to be down at a low-double-digit percentage rate. This includes an expected 15 to 17 percent decline in North America as the company works to meaningfully reset this business following years of heightened promotional activities, particularly in its DTC business and a low-single digit percent decline in its international business due to more conservative macro consumer trends and actions to protect the brand strength it has built.

•Gross margin is expected to be up 75 to 100 basis points compared to the prior year, driven by a material reduction in promotional and discounting activities in the company’s direct-to-consumer business and product costing benefits.

•Selling, general and administrative expenses are expected to be down 2 to 4 percent.

•Operating income is expected to be $50 to $70 million. Excluding the mid-point of anticipated restructuring charges, adjusted operating income is expected to be $130 to $150 million.

•Diluted earnings per share is expected to be between $0.02 and $0.05. Adjusted diluted earnings per share is expected to be between $0.18 and $0.21.

•Capital expenditures are expected to be between $200 to $220 million.

Share Buyback Program

The company also announced that its Board of Directors has authorized the repurchase of up to $500 million of Under Armour's outstanding Class C common stock. Repurchases under this program may be made over the next three years through various methods, including accelerated share repurchase, open market, or privately negotiated transactions.

Conference Call and Webcast

Under Armour will hold its fourth quarter fiscal 2024 conference call today at approximately 8:30 a.m. Eastern Time. The call will be webcast live at https://about.underarmour.com/investor-relations/financials and will be archived and available for replay about three hours after the live event.

Non-GAAP Financial Information

This press release refers to “currency-neutral” and "adjusted" results, as well as "adjusted" forward-looking estimates of the company's results for its 2025 fiscal year ending March 31, 2025. Management believes this information is helpful to investors in comparing the company’s results of operations period-over-period because it enhances visibility into its actual underlying results, excluding these impacts. Currency-neutral financial information is calculated to exclude changes in foreign currency exchange rates. References to adjusted financial measures exclude the effect of the company's litigation reserve expense, any gain or loss in connection with the sale of the MyFitnessPal platform, and the impact of the company's fiscal year 2025 restructuring plan and related charges and related tax effects. Management believes these adjustments are not core to the company’s operations. The reconciliation of non-GAAP amounts to the most directly comparable financial measure calculated according to GAAP is presented in supplemental financial information furnished with this release. All per-share amounts are reported on a diluted basis. These supplemental non-GAAP financial measures should not be considered in isolation. They should be

contemplated in addition to, and not as an alternative to, the company’s reported results prepared per GAAP. Additionally, the company’s non-GAAP financial information may not be comparable to similarly titled measures reported by other companies.

About Under Armour, Inc.

Under Armour, Inc., headquartered in Baltimore, Maryland, is a leading inventor, marketer, and distributor of branded athletic performance apparel, footwear, and accessories. Designed to empower human performance, Under Armour’s innovative products and experiences are engineered to make athletes better. For further information, please visit http://about.underarmour.com.

Forward-Looking Statements

Some of the statements contained in this press release constitute forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts, such as statements regarding our share repurchase program, our future financial condition or results of operations, our prospects and strategies for future growth, potential restructuring efforts, including the scope of these restructuring efforts and the amount of potential charges and costs, the timing of these measures and the anticipated benefits of our restructuring plans, expectations regarding promotional activities, freight, product cost pressures, and foreign currency impacts, the impact of global economic conditions and inflation on our results of operations, our liquidity and use of capital resources, the development and introduction of new products, the implementation of our marketing and branding strategies, the future benefits and opportunities from significant investments, and the impact of litigation or other proceedings. In many cases, you can identify forward-looking statements by terms such as “may,” “will,” “could,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “outlook,” “potential” or the negative of these terms or other comparable terminology. The forward-looking statements in this press release reflect our current views about future events. They are subject to risks, uncertainties, assumptions, and changes in circumstances that may cause events or our actual activities or results to differ significantly from those expressed in any forward-looking statement. Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future events, results, actions, activity levels, performance, or achievements. Readers are cautioned not to place undue reliance on these forward-looking statements. A number of important factors could cause actual results to differ materially from those indicated by these forward-looking statements, including, but not limited to: changes in general economic or market conditions, including increasing inflation, that could affect overall consumer spending or our industry; increased competition causing us to lose market share or reduce the prices of our products or to increase our marketing efforts significantly; fluctuations in the costs of raw materials and commodities we use in our products and our supply chain (including labor); our ability to successfully execute our long-term strategies; our ability to effectively drive operational efficiency in our business; changes to the financial health of our customers; our ability to effectively develop and launch new, innovative and updated products; our ability to accurately forecast consumer shopping and engagement preferences and consumer demand for our products and manage our inventory in response to changing demands; our ability to successfully execute any potential restructuring plans and realize their expected benefits; loss of key customers, suppliers or manufacturers; our ability to further expand our business globally and to drive brand awareness and consumer acceptance of our products in other countries; our ability to manage the increasingly complex operations of our global business; the impact of global events beyond our control, including military conflicts; the impact of global or regional public health emergencies on our industry and our business, financial condition and results of operations, including impacts on the global supply chain; our ability to successfully manage or realize expected results from significant transactions and investments; our ability to effectively market and maintain a positive brand

image; our ability to attract key talent and retain the services of our senior management and other key employees; our ability to effectively meet regulatory requirements and stakeholder expectations with respect to sustainability and social matters; the availability, integration and effective operation of information systems and other technology, as well as any potential interruption of such systems or technology; any disruptions, delays or deficiencies in the design, implementation or application of our global operating and financial reporting information technology system; our ability to access capital and financing required to manage our business on terms acceptable to us; our ability to accurately anticipate and respond to seasonal or quarterly fluctuations in our operating results; risks related to foreign currency exchange rate fluctuations; our ability to comply with existing trade and other regulations, and the potential impact of new trade, tariff and tax regulations on our profitability; risks related to data security or privacy breaches; and our potential exposure to and the financial impact of litigation and other proceedings. The forward-looking statements here reflect our views and assumptions only as of the date of this press release. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect unanticipated events.

# # #

| | |

Under Armour Contacts: |

| Lance Allega |

| SVP, Investor Relations, Treasury and Corporate Development |

| (410) 246-6810 |

|

| Amanda Miller |

| SVP, Chief Communications Officer |

| (408) 219-0563 |

The Company revised its prior period financial statements for accounting corrections to the Company's Consolidated Statements of Operations primarily related to cost of goods sold and selling, general and administrative expenses, as well as corresponding impacts to the Company's other Consolidated Financial Statements. The impacts of these revisions were not material to the Company’s previously filed financial statements. These revisions relate to a number of immaterial corrections that were identified by management and when accumulated, required a correction to the Company's previously filed financial statements. Information presented in the tables below as of March 31, 2023, for the three months ended March 31, 2023 and for the year ended March 31, 2023 has been revised to reflect these corrections. See Note 1 to the Company’s Consolidated Financial Statements included in Part II, Item 8 of the Company’s Annual Report on Form 10-K for the year ended March 31, 2024, to be filed with the Securities and Exchange Commission. As a result of these corrections, the Company is currently assessing the nature of deficiencies in its internal control over financial reporting.

Under Armour, Inc.

For the Three Months and Year Ended March 31, 2024, and 2023

(Unaudited; in thousands, except per share amounts)

CONSOLIDATED STATEMENTS OF OPERATION | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | Year Ended March 31, |

| in '000s | 2024 | | % of Net

Revenues | | 2023 | | % of Net

Revenues | | 2024 | | % of Net

Revenues | | 2023 | | % of Net

Revenues |

| Net revenues | $ | 1,332,197 | | | 100.0 | % | | $ | 1,398,605 | | | 100.0 | % | | $ | 5,701,879 | | | 100.0 | % | | $ | 5,903,165 | | | 100.0 | % |

| Cost of goods sold | 732,601 | | | 55.0 | % | | 793,112 | | | 56.7 | % | | 3,071,626 | | | 53.9 | % | | 3,259,334 | | | 55.2 | % |

| Gross profit | 599,596 | | | 45.0 | % | | 605,493 | | | 43.3 | % | | 2,630,253 | | | 46.1 | % | | 2,643,831 | | | 44.8 | % |

| Selling, general and administrative expenses | 603,150 | | | 45.3 | % | | 575,931 | | | 41.2 | % | | 2,400,502 | | | 42.1 | % | | 2,380,245 | | | 40.3 | % |

| Income (loss) from operations | (3,554) | | | (0.3) | % | | 29,562 | | | 2.1 | % | | 229,751 | | | 4.0 | % | | 263,586 | | | 4.5 | % |

| Interest income (expense), net | 2,478 | | | 0.2 | % | | (1,651) | | | (0.1) | % | | 268 | | | — | % | | (12,826) | | | (0.2) | % |

| Other income (expense), net | (3,708) | | | (0.3) | % | | (10,204) | | | (0.7) | % | | 32,055 | | | 0.6 | % | | 17,096 | | | 0.3 | % |

| Income (loss) before income taxes | (4,784) | | | (0.4) | % | | 17,707 | | | 1.3 | % | | 262,074 | | | 4.6 | % | | 267,856 | | | 4.5 | % |

| Income tax expense (benefit) | (11,327) | | | (0.9) | % | | (153,171) | | | (11.0) | % | | 30,006 | | | 0.5 | % | | (108,645) | | | (1.8) | % |

| Income (loss) from equity method investments | 25 | | | — | % | | (308) | | | — | % | | (26) | | | — | % | | (2,042) | | | — | % |

| Net income (loss) | $ | 6,568 | | | 0.5 | % | | $ | 170,570 | | | 12.2 | % | | $ | 232,042 | | | 4.1 | % | | $ | 374,459 | | | 6.3 | % |

| | | | | | | | | | | | | | | |

| Basic net income (loss) per share of Class A, B and C common stock | $ | 0.02 | | | | | $ | 0.38 | | | | | $ | 0.53 | | | | | $ | 0.83 | | | |

| Diluted net income (loss) per share of Class A, B and C common stock | $ | 0.02 | | | | | $ | 0.38 | | | | | $ | 0.52 | | | | | $ | 0.81 | | | |

| Weighted average common shares outstanding Class A, B and C common stock | | | | | | | | |

| Basic | 435,582 | | | | | 444,052 | | | | | 440,324 | | | | | 451,426 | | | |

| Diluted | 447,385 | | | | | 454,652 | | | | | 451,011 | | | | | 461,509 | | | |

Under Armour, Inc.

For the Three Months and Year Ended March 31, 2024, and 2023

(Unaudited; in thousands)

NET REVENUES BY SEGMENT

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | Year Ended March 31, |

| in '000s | 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

| North America | $ | 771,870 | | | $ | 861,869 | | | (10.4) | % | | $ | 3,505,167 | | | $ | 3,820,522 | | | (8.3) | % |

| EMEA | 284,134 | | | 259,514 | | | 9.5 | % | | 1,081,915 | | | 992,624 | | | 9.0 | % |

| Asia-Pacific | 226,704 | | | 224,923 | | | 0.8 | % | | 873,019 | | | 825,338 | | | 5.8 | % |

| Latin America | 50,241 | | | 41,806 | | | 20.2 | % | | 229,481 | | | 213,215 | | | 7.6 | % |

Corporate Other (1) | (752) | | | 10,493 | | | (107.2) | % | | 12,297 | | | 51,466 | | | (76.1) | % |

| Total net revenues | $ | 1,332,197 | | | $ | 1,398,605 | | | (4.7) | % | | $ | 5,701,879 | | | $ | 5,903,165 | | | (3.4) | % |

NET REVENUES BY DISTRIBUTION CHANNEL | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | Year Ended March 31, |

| in '000s | 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

| Wholesale | $ | 849,805 | | | $ | 908,505 | | | (6.5) | % | | $ | 3,243,187 | | | $ | 3,468,126 | | | (6.5) | % |

| Direct-to-consumer | 454,690 | | | 453,853 | | | 0.2 | % | | 2,335,154 | | | 2,266,827 | | | 3.0 | % |

| Net Sales | 1,304,495 | | | 1,362,358 | | | (4.2) | % | | 5,578,341 | | | 5,734,953 | | | (2.7) | % |

| License revenues | 28,454 | | | 25,754 | | | 10.5 | % | | 111,241 | | | 116,746 | | | (4.7) | % |

| | | | | | | | | | | |

Corporate Other (1) | (752) | | | 10,493 | | | (107.2) | % | | 12,297 | | | 51,466 | | | (76.1) | % |

| Total net revenues | $ | 1,332,197 | | | $ | 1,398,605 | | | (4.7) | % | | $ | 5,701,879 | | | $ | 5,903,165 | | | (3.4) | % |

NET REVENUES BY PRODUCT CATEGORY | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | Year Ended March 31, |

| in '000s | 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

| Apparel | $ | 877,347 | | | $ | 888,920 | | | (1.3) | % | | $ | 3,789,016 | | | $ | 3,871,167 | | | (2.1) | % |

| Footwear | 337,738 | | | 377,740 | | | (10.6) | % | | 1,383,610 | | | 1,455,265 | | | (4.9) | % |

| Accessories | 89,410 | | | 95,698 | | | (6.6) | % | | 405,715 | | | 408,521 | | | (0.7) | % |

| Net Sales | 1,304,495 | | | 1,362,358 | | | (4.2) | % | | 5,578,341 | | | 5,734,953 | | | (2.7) | % |

| Licensing revenues | 28,454 | | | 25,754 | | | 10.5 | % | | 111,241 | | | 116,746 | | | (4.7) | % |

Corporate Other (1) | (752) | | | 10,493 | | | (107.2) | % | | 12,297 | | | 51,466 | | | (76.1) | % |

| Total net revenues | $ | 1,332,197 | | | $ | 1,398,605 | | | (4.7) | % | | $ | 5,701,879 | | | $ | 5,903,165 | | | (3.4) | % |

(1) Corporate Other primarily includes net revenues from foreign currency hedge gains and losses generated by entities within the Company’s operating segments but managed through the Company’s central foreign exchange risk management program, as well as subscription revenues from the Company's MapMyRun and MapMyRide platforms (collectively "MMR") and revenue from other digital business opportunities.

Under Armour, Inc.

For the Three Months and Year Ended March 31, 2024, and 2023

(Unaudited; in thousands)

INCOME (LOSS) FROM OPERATIONS BY SEGMENT | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | Year Ended March 31, |

| in '000s | 2024 | % of Net Revenues (1) | | 2023 | % of Net Revenues (1) | | 2024 | % of Net Revenues (1) | | 2023 | % of Net Revenues (1) |

| North America | $ | 139,841 | | 18.1 | % | | $ | 131,135 | | 15.2 | % | | $ | 677,882 | | 19.3 | % | | $ | 714,656 | | 18.7 | % |

| EMEA | 58,467 | | 20.6 | % | | 27,138 | | 10.5 | % | | 176,205 | | 16.3 | % | | 112,161 | | 11.3 | % |

| Asia-Pacific | 33,630 | | 14.8 | % | | 23,386 | | 10.4 | % | | 119,650 | | 13.7 | % | | 100,276 | | 12.1 | % |

| Latin America | 5,642 | | 11.2 | % | | 4,271 | | 10.2 | % | | 38,401 | | 16.7 | % | | 23,487 | | 11.0 | % |

Corporate Other (2) | (241,134) | | NM | | (156,368) | | NM | | (782,387) | | NM | | (686,994) | | NM |

| Income (loss) from operations | $ | (3,554) | | (0.3) | % | | $ | 29,562 | | 2.1 | % | | $ | 229,751 | | 4.0 | % | | $ | 263,586 | | 4.5 | % |

(1) The percentage of operating income (loss) is calculated based on total segment net revenues. The operating income (loss) percentage for Corporate Other is not presented as a meaningful metric (NM).

(2) Corporate Other primarily includes net revenues from foreign currency hedge gains and losses generated by entities within the Company’s operating segments but managed through the Company’s central foreign exchange risk management program, as well as subscription revenues from the Company's MapMyRun and MapMyRide platforms (collectively "MMR") and revenue from other digital business opportunities. Corporate Other also includes expenses related to the Company's central supporting functions.

Under Armour, Inc.

As of March 31, 2024, and March 31, 2023

(Unaudited; in thousands)

CONSOLIDATED BALANCE SHEETS | | | | | | | | | | | | | | |

| in '000s | | March 31, 2024 | | March 31, 2023 |

| Assets | | | | |

| Current assets | | | | |

| Cash and cash equivalents | | $ | 858,691 | | | $ | 710,929 | |

| Accounts receivable, net | | 757,339 | | | 758,564 | |

| Inventories | | 958,495 | | | 1,185,657 | |

| Prepaid expenses and other current assets, net | | 289,157 | | | 293,334 | |

| Total current assets | | 2,863,682 | | | 2,948,484 | |

| Property and equipment, net | | 664,503 | | | 644,834 | |

| Operating lease right-of-use assets | | 434,699 | | | 489,306 | |

| Goodwill | | 478,302 | | | 481,992 | |

| Intangible assets, net | | 7,000 | | | 8,940 | |

| Deferred income taxes | | 221,033 | | | 186,908 | |

| Other long-term assets | | 91,515 | | | 67,089 | |

| Total assets | | $ | 4,760,734 | | | $ | 4,827,553 | |

| Liabilities and Stockholders’ Equity | | | | |

| Current maturities of long-term debt | | $ | 80,919 | | | $ | — | |

| Accounts payable | | 483,731 | | | 648,486 | |

| Accrued expenses | | 287,853 | | | 366,530 | |

| Customer refund liabilities | | 139,283 | | | 160,533 | |

| Operating lease liabilities | | 139,331 | | | 140,990 | |

| Other current liabilities | | 34,344 | | | 42,744 | |

| Total current liabilities | | 1,165,461 | | | 1,359,283 | |

| Long-term debt, net of current maturities | | 594,873 | | | 674,478 | |

| Operating lease liabilities, non-current | | 627,665 | | | 705,713 | |

| Other long-term liabilities | | 219,449 | | | 121,932 | |

| Total liabilities | | 2,607,448 | | | 2,861,406 | |

| Total stockholders’ equity | | 2,153,286 | | | 1,966,147 | |

| Total liabilities and stockholders’ equity | | $ | 4,760,734 | | | $ | 4,827,553 | |

Under Armour, Inc.

For the Years Ended March 31, 2024 and 2023

(Unaudited; in thousands)

CONSOLIDATED STATEMENTS OF CASH FLOWS | | | | | | | | | | | |

| | Year Ended March 31, |

| in '000s | 2024 | | 2023 |

| Cash flows from operating activities | | | |

| Net income (loss) | $ | 232,042 | | | $ | 374,459 | |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities | | | |

| Depreciation and amortization | 142,590 | | | 135,456 | |

| Unrealized foreign currency exchange rate (gain) loss | 16,080 | | | (8,463) | |

| | | |

| Loss on disposal of property and equipment | 1,623 | | | 2,616 | |

| Non-cash restructuring and impairment charges | 6,179 | | | 1,959 | |

| Amortization of bond premium and debt issuance costs | 2,034 | | | 2,192 | |

| Stock-based compensation | 42,998 | | | 36,811 | |

| Deferred income taxes | (23,693) | | | (153,143) | |

| Changes in reserves and allowances | 13,612 | | | 11,696 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (3,906) | | | (60,910) | |

| Inventories | 216,484 | | | (368,992) | |

| Prepaid expenses and other assets | (29,060) | | | (37,907) | |

| Other non-current assets | 34,920 | | | (60,944) | |

| Accounts payable | (197,887) | | | 76,280 | |

| Accrued expenses and other liabilities | (18,267) | | | (9,388) | |

| Customer refund liability | (21,427) | | | 851 | |

| Income taxes payable and receivable | (60,352) | | | 17,541 | |

| Net cash provided by (used in) operating activities | 353,970 | | | (39,886) | |

| Cash flows from investing activities | | | |

| Purchases of property and equipment | (150,333) | | | (158,066) | |

| | | |

| Sale of MyFitnessPal platform | 45,000 | | | 35,000 | |

| Net cash provided by (used in) investing activities | (105,333) | | | (123,066) | |

| Cash flows from financing activities | | | |

| | | |

| | | |

| Common shares repurchased | (75,000) | | | (125,000) | |

| Employee taxes paid for shares withheld for income taxes | (6,163) | | | (5,151) | |

| Proceeds from exercise of stock options and other stock issuances | 3,193 | | | 3,776 | |

| Payments of debt financing costs | (720) | | | — | |

| Net cash provided by (used in) financing activities | (78,690) | | | (126,375) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (19,775) | | | (5,315) | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | 150,172 | | | (294,642) | |

| Cash, cash equivalents and restricted cash | | | |

| Beginning of period | 726,745 | | | 1,021,387 | |

| End of period | $ | 876,917 | | | $ | 726,745 | |

Under Armour, Inc.

For the Three Months and Year Ended March 31, 2024

(Unaudited)

The table below presents the reconciliation of net revenue growth (decline) calculated according to GAAP to currency-neutral net revenue, a non-GAAP measure. See "Non-GAAP Financial Information" above for further information regarding the Company's use of non-GAAP financial measures.

CURRENCY-NEUTRAL NET REVENUE GROWTH (DECLINE) RECONCILIATION | | | | | | | | | | | |

| Three Months Ended March 31, 2024 | | Year Ended March 31, 2024 |

| Total Net Revenue | | | |

| Net revenue growth - GAAP | (4.7) | % | | (3.4) | % |

| Foreign exchange impact | (0.2) | % | | (0.2) | % |

| Currency neutral net revenue growth - Non-GAAP | (4.9) | % | | (3.6) | % |

| | | |

| North America | | | |

| Net revenue growth - GAAP | (10.4) | % | | (8.3) | % |

| Foreign exchange impact | (0.1) | % | | 0.3 | % |

| Currency neutral net revenue growth - Non-GAAP | (10.5) | % | | (8.0) | % |

| | | |

| EMEA | | | |

| Net revenue growth - GAAP | 9.5 | % | | 9.0 | % |

| Foreign exchange impact | (2.4) | % | | (3.3) | % |

| Currency neutral net revenue growth - Non-GAAP | 7.1 | % | | 5.7 | % |

| | | |

| Asia-Pacific | | | |

| Net revenue growth - GAAP | 0.8 | % | | 5.8 | % |

| Foreign exchange impact | 3.7 | % | | 3.5 | % |

| Currency neutral net revenue growth - Non-GAAP | 4.5 | % | | 9.3 | % |

| | | |

| Latin America | | | |

| Net revenue growth - GAAP | 20.2 | % | | 7.6 | % |

| Foreign exchange impact | (8.7) | % | | (8.6) | % |

| Currency neutral net revenue growth - Non-GAAP | 11.5 | % | | (1.0) | % |

| | | |

| Total International | | | |

| Net revenue growth - GAAP | 6.6 | % | | 7.5 | % |

| Foreign exchange impact | (0.3) | % | | (1.0) | % |

| Currency neutral net revenue growth - Non-GAAP | 6.3 | % | | 6.5 | % |

Under Armour, Inc.

For the Three Months and Year Ended March 31, 2024

(Unaudited; in thousands, except per share amounts)

The tables below present the reconciliation of the Company's condensed consolidated statement of operations presented in accordance with GAAP to certain adjusted non-GAAP financial measures discussed in this press release. See "Non-GAAP Financial Information" above for further information regarding the Company's use of non-GAAP financial measures.

ADJUSTED SELLING GENERAL AND ADMINISTRATIVE EXPENSES

| | | | | | | | | | | |

| in '000s | Three months ended March 31, 2024 | | Year ended March 31, 2024 |

| GAAP selling, general and administrative expenses | $ | 603,150 | | | $ | 2,400,502 | |

| Add: Impact of litigation reserve | (57,500) | | | (80,000) | |

| Adjusted selling, general and administrative expenses | $ | 545,650 | | | $ | 2,320,502 | |

ADJUSTED OPERATING INCOME (LOSS) RECONCILIATION

| | | | | | | | | | | |

| in '000s | Three months ended March 31, 2024 | | Year ended March 31, 2024 |

| GAAP income from operations | $ | (3,554) | | | $ | 229,751 | |

| Add: Impact of litigation reserve | 57,500 | | | 80,000 | |

| Adjusted income from operations | $ | 53,946 | | | $ | 309,751 | |

ADJUSTED NET INCOME (LOSS) RECONCILIATION

| | | | | | | | | | | |

| in '000s | Three months ended March 31, 2024 | | Year ended March 31, 2024 |

| GAAP net income | $ | 6,568 | | | $ | 232,042 | |

| Add: Impact of litigation reserve | 57,500 | | | 80,000 | |

| Add: Impact of earn-out recorded in connection with the sale of the MyFitnessPal platform | — | | | (50,000) | |

| Add: Impact of commission expense in connection with the sale of the MyFitnessPal platform | — | | | 700 | |

| Add: Impact of provision for income taxes | (14,910) | | | (17,913) | |

| Adjusted net income | $ | 49,158 | | | $ | 244,829 | |

ADJUSTED DILUTED EARNINGS (LOSS) PER SHARE RECONCILIATION | | | | | | | | | | | |

| Three months ended March 31, 2024 | | Year ended March 31, 2024 |

| GAAP diluted net income per share | $ | 0.02 | | | $ | 0.52 | |

| Add: Impact of litigation reserve | 0.13 | | | 0.18 | |

| Add: Impact of earn-out recorded in connection with the sale of the MyFitnessPal platform | — | | | (0.11) | |

| Add: Impact of commission expense in connection with the sale of the MyFitnessPal platform | — | | | — | |

| Add: Impact of provision for income taxes | (0.04) | | | (0.05) | |

| Adjusted diluted net income per share | $ | 0.11 | | | $ | 0.54 | |

Under Armour, Inc.

Outlook for the Year Ended March 31, 2025

(Unaudited; in millions, except per share amounts)

The tables below present the reconciliation of the Company's fiscal 2025 outlook presented in accordance with GAAP to certain adjusted non-GAAP financial measures discussed in this press release. See "Non-GAAP Financial Information" above for further information regarding the Company's use of non-GAAP financial measures.

ADJUSTED OPERATING INCOME RECONCILIATION

| | | | | | | | | | | | | | | | | |

| (in millions) | | | | Year Ending March 31, 2025 |

| | | | | Low end of estimate | | High end of estimate |

| GAAP income from operations | | | | | $ | 50 | | | $ | 70 | |

Add: Impact of restructuring and related impairment (1) | | | | | 80 | | | 80 | |

| Adjusted income from operations | | | | | $ | 130 | | | $ | 150 | |

ADJUSTED DILUTED (LOSS) EARNINGS PER SHARE RECONCILIATION

| | | | | | | | | | | | | | | | | |

| | | | Year Ending March 31, 2025 |

| | | | | Low end of estimate | | High end of estimate |

| GAAP diluted net income per share | | | | | $ | 0.02 | | | $ | 0.05 | |

Add: Impact of restructuring and related impairment, net of tax (1) | | | | | 0.16 | | | 0.16 | |

| Adjusted diluted net income per share | | | | | $ | 0.18 | | | $ | 0.21 | |

(1) The estimated impact of the restructuring plan presented above assumes the mid-point of the Company's estimated range of restructuring and related charges, which is $70-$90 million.

Under Armour, Inc.

(Unaudited; in thousands)

The Company revised its prior period financial statements for accounting corrections to the Company's Consolidated Statements of Operations primarily related to cost of goods sold and selling, general and administrative expenses, as well as corresponding impacts to the Company's other Consolidated Financial Statements. The impact of these revisions was not material to the Company’s previously filed financial statements. See Note 1 to the Company’s Consolidated Financial Statements included in Part II, Item 8 of the Company’s Annual Report on Form 10-K for the year ended March 31, 2024, to be filed with the Securities and Exchange Commission. The Company has elected to present certain revised quarterly financial information for fiscal 2024 and fiscal 2023 to reflect these corrections in the tables below.

SELECTED FISCAL 2024 and 2023 STATEMENTS OF OPERATIONS DATA

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, 2023 | | Three Months Ended

September 30, 2023 | | Three Months Ended

December 31, 2023 | | Three Months Ended

March 31, 2024 | | Fiscal 2024 | | % of Net Revenues |

| | | | |

| Net revenues | $ | 1,316,965 | | | $ | 1,566,674 | | | $ | 1,486,043 | | | $ | 1,332,197 | | | $ | 5,701,879 | | | 100.0 | % |

| Cost of goods sold | 704,792 | | | 816,615 | | | 817,618 | | | 732,601 | | | 3,071,626 | | | 53.9 | % |

| Gross profit | 612,173 | | | 750,059 | | | 668,425 | | | 599,596 | | | 2,630,253 | | | 46.1 | % |

| Selling, general and administrative expenses | 589,072 | | | 607,023 | | | 601,257 | | | 603,150 | | | 2,400,502 | | | 42.1 | % |

| | | | | | | | | | | |

| Income (loss) from operations | 23,101 | | | 143,036 | | | 67,168 | | | (3,554) | | | 229,751 | | | 4.0 | % |

| Interest income (expense), net | (1,626) | | | (373) | | | (211) | | | 2,478 | | | 268 | | | — | % |

| Other income (expense), net | (6,060) | | | (6,104) | | | 47,927 | | | (3,708) | | | 32,055 | | | 0.6 | % |

| Income (loss) before income taxes | $ | 15,415 | | | $ | 136,559 | | | $ | 114,884 | | | $ | (4,784) | | | $ | 262,074 | | | 4.6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, 2022 | | Three Months Ended

September 30, 2022 | | Three Months Ended

December 31, 2022 | | Three Months Ended

March 31, 2023 | | Fiscal 2023 | | % of Net Revenues |

|

| Net revenues | $ | 1,348,777 | | | $ | 1,574,296 | | | $ | 1,581,487 | | | $ | 1,398,605 | | | $ | 5,903,165 | | | 100.0 | % |

| Cost of goods sold | 720,860 | | | 860,799 | | | 884,563 | | | 793,112 | | | 3,259,334 | | | 55.2 | % |

| Gross profit | 627,917 | | | 713,497 | | | 696,924 | | | 605,493 | | | 2,643,831 | | | 44.8 | % |

| Selling, general and administrative expenses | 599,286 | | | 597,595 | | | 607,433 | | | 575,931 | | | 2,380,245 | | | 40.3 | % |

| | | | | | | | | | | |

| Income (loss) from operations | 28,631 | | | 115,902 | | | 89,491 | | | 29,562 | | | 263,586 | | | 4.5 | % |

| Interest income (expense), net | (6,005) | | | (3,555) | | | (1,615) | | | (1,651) | | | (12,826) | | | (0.2) | % |

| Other income (expense), net | (14,241) | | | (5,771) | | | 47,312 | | | (10,204) | | | 17,096 | | | 0.3 | % |

| Income (loss) before income taxes | $ | 8,385 | | | $ | 106,576 | | | $ | 135,188 | | | $ | 17,707 | | | $ | 267,856 | | | 4.5 | % |

Under Armour, Inc.

As of March 31, 2024, and 2023

COMPANY-OWNED & OPERATED DOOR COUNT | | | | | | | | | | | | | | |

| | March 31, |

| | 2024 | | 2023 |

| Factory House | | 183 | | 176 |

| Brand House | | 17 | | 18 |

| North America total doors | | 200 | | 194 |

| | | | |

| Factory House | | 173 | | 165 |

| Brand House | | 67 | | 80 |

| International total doors | | 240 | | 245 |

| | | | |

| Factory House | | 356 | | 341 |

| Brand House | | 84 | | 98 |

| Total doors | | 440 | | 439 |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassCMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

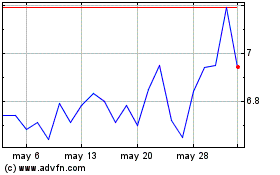

Under Armour (NYSE:UAA)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Under Armour (NYSE:UAA)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024