false

0000102037

0000102037

2024-11-19

2024-11-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current

Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 19, 2024

UNIVERSAL

CORPORATION

(Exact Name of Registrant as Specified in its

Charter)

Virginia

(State or Other Jurisdiction of Incorporation)

| 001-00652 |

|

54-0414210 |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| 9201 Forest Hill Avenue, Richmond, Virginia |

23235 |

| (Address of Principal Executive Offices) |

(Zip code) |

(804) 359-9311

(Registrant’s Telephone Number, Including

Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, no par value |

UVV |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth company |

¨ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

¨ |

| Item 3.01 |

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

As

previously disclosed in the Notification of Late Filing on Form 12b-25 filed by Universal Corporation (the “Company”)

with the U.S. Securities and Exchange Commission (the “SEC”) on November 12, 2024, the Company was unable to file its

Quarterly Report on Form 10-Q for the quarter ended September 30, 2024 (the “Form 10-Q”) on a timely basis

due to an ongoing internal investigation. As a result of the additional time

required to complete its internal investigation, the process of finalizing financial statements for the second quarter of fiscal year

2025 could not be completed on a timely basis.

On November 19, 2024, the

Company received a notice (the “NYSE Notice”) from the New York Stock Exchange (the “NYSE”) that, due to the delay

in the filing of the Form 10-Q, the Company is not in compliance with Section 802.01E of the NYSE Listed Company Manual, which

requires timely filing of all periodic reports with the SEC.

The NYSE Notice has no immediate

effect on the listing of the Company’s common stock on the NYSE. The NYSE Notice informed the Company that, under NYSE rules, the

Company has six months from November 18, 2024 to regain compliance with the NYSE listing standards by filing the Form 10-Q with

the SEC. If the Company fails to file the Form 10-Q within the six-month period, the NYSE may grant, in its sole discretion, an extension

of up to six additional months for the Company to regain compliance, depending on the specific circumstances. The NYSE Notice also noted

that the NYSE may nevertheless commence delisting proceedings at any time during the period that is available to the Company to complete

the filing if it deems that the circumstances warrant.

The Company is committed to completing

a deliberate, thorough investigation while diligently working to fulfill all reporting obligations and currently expects to file the Form 10-Q

within the six-month period granted by the NYSE Notice; however, there can be no assurance that the Form 10-Q will be filed within

such period.

| Item 7.01 |

Regulation FD Disclosure. |

As

required by Section 802.01E of the NYSE Listed Company Manual, the Company issued a press release on November 22, 2024 announcing

that it had received the NYSE Notice. A copy of the press release is furnished herewith as Exhibit 99.1 to this Current Report on

Form 8-K.

In

accordance with General Instruction B.2 of Form 8-K, the information in this Item 7.01 of this Current Report on Form 8-K, including

Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall either be deemed incorporated

by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by

specific references in such a filing.

CAUTIONARY

STATEMENTS REGARDING FORWARD-LOOKING INFORMATION

This

Form 8-K includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Among other things, these statements include statements

regarding expectations about the Company’s filing of its Form 10-Q for the quarter ended September 30, 2024. These forward-looking

statements are generally identified by the use of words such as we “expect,” “believe,” “anticipate,”

“could,” “should,” “may,” “plan,” “will,” “predict,” “estimate,”

and similar expressions or words of similar import. These forward-looking statements are based upon management’s current knowledge

and assumptions about future events and involve risks and uncertainties that could cause actual results, performance, or achievements

to be materially different from any anticipated results, prospects, performance, or achievements expressed or implied by such forward-looking

statements. Such risks and uncertainties include, but are not limited to, the uncertainty of the ultimate findings of the ongoing internal

investigation, as well as the timing of its completion and costs and expenses arising out of the ongoing internal investigation process

and its results; the impact of the ongoing internal investigation on us, our management and operations, including financial impact as

well as any litigation or regulatory action that may arise from the ongoing internal investigation; the impact of the internal investigation

on our conclusions regarding the effectiveness of our internal control over financial reporting and our disclosure controls and procedures;

our ability to regain compliance with the NYSE listing standards; success in pursuing strategic investments or acquisitions and integration

of new businesses and the impact of these new businesses on future results; product purchased not meeting quality and quantity requirements;

our reliance on a few large customers; our ability to maintain effective information technology systems and safeguard confidential information;

anticipated levels of demand for and supply of our products and services; costs incurred in providing these products and services including

increased transportation costs and delays attributed to global supply chain challenges; timing of shipments to customers; higher inflation

rates; changes in market structure; government regulation and other stakeholder expectations; economic and political conditions in the

countries in which we and our customers operate, including the ongoing impacts from international conflicts; product taxation; industry

consolidation and evolution; changes in exchange rates and interest rates; impacts of regulation and litigation on its customers; industry-specific

risks related to its plant-based ingredient businesses; exposure to certain regulatory and financial risks related to climate change;

changes in estimates and assumptions underlying our critical accounting policies; the promulgation and adoption of new accounting standards,

new government regulations and interpretation of existing standards and regulations; and general economic, political, market, and weather

conditions. Actual results, therefore, could vary from those expected. Please also refer to such other factors as discussed in Part I, Item

1A. “Risk Factors” of Universal’s Annual Report on Form 10-K for the fiscal year ended March 31, 2024 and

related disclosures in other filings, which have been filed with the U.S. Securities and Exchange Commission and are available on the

SEC’s website at www.sec.gov. All risk factors and uncertainties described herein and therein should be considered in evaluating

forward-looking statements, and all of the forward-looking statements are expressly qualified by the cautionary statements contained or

referred to herein and therein. Universal cautions investors not to place undue reliance on any forward-looking statements as these statements

speak only as of the date when made, and it undertakes no obligation to update any forward-looking statements made, except as required

by law.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

UNIVERSAL CORPORATION |

| |

|

| Date: November 22, 2024 |

By: |

/s/ Catherine H. Claiborne |

| |

|

Catherine H. Claiborne |

| |

|

Vice President, General Counsel, and Secretary |

Exhibit 99.1

P.O. Box 25099

~ Richmond, VA 23260 ~ Phone: (804) 359-9311 ~ Fax: (804) 254-3584

P R E S S R E L E A S E

| CONTACT: |

Universal Corporation Investor

Relations |

RELEASE: |

4:15 p.m. ET |

| |

Phone: (804) 359-9311 |

|

|

| |

Fax: (804)

254-3584 |

|

|

| |

Email:

investor@universalleaf.com |

|

|

Universal Corporation Receives NYSE Notice

Regarding Filing of Form 10-Q for the Fiscal Quarter Ended September 30, 2024

Richmond, VA / November 22, 2024 / PRNEWSWIRE

Universal Corporation (NYSE:UVV) (“Universal”

or the “Company”), a global business-to-business agriproducts company, today announced that, as expected, on November 19,

2024, it received a notice (the “NYSE Notice”) from the New York Stock Exchange (the “NYSE”) that the Company

is not in compliance with Section 802.01E of the NYSE Listed Company Manual as a result of its failure to timely file its Quarterly

Report on Form 10-Q for the fiscal quarter ended September 30, 2024 (the “Form 10-Q”) with the U.S. Securities

and Exchange Commission (the “SEC”) prior to November 18, 2024, the end of the extension period provided by Rule 12b-25

under the Securities Exchange Act of 1934, as amended.

The NYSE Notice has no immediate effect on the

listing of the Company’s common stock on the NYSE. The NYSE Notice informed the Company that, under NYSE rules, the Company has

six months from November 18, 2024, to regain compliance with the NYSE listing standards by filing the Form 10-Q with the SEC.

If the Company fails to file the Form 10-Q within the six-month period, the NYSE may grant, in its sole discretion, an extension

of up to six additional months for the Company to regain compliance, depending on the specific circumstances. The NYSE Notice also noted

that the NYSE may nevertheless, in its own discretion, commence delisting proceedings at any time during such period.

As previously disclosed in the Company’s

Notification of Late Filing on Form 12b-25, filed on November 12, 2024 (the “Form 12b-25”) with the SEC, the

Company was unable to file the Form 10-Q on a timely basis due to an ongoing internal investigation. As a result of the additional

time required to complete its internal investigation, the process of finalizing financial statements for the second quarter of fiscal

year 2025 could not be completed on a timely basis.

-- M O R E --

Universal Corporation

Page 2

The Company is committed to completing a deliberate,

thorough investigation while diligently working to fulfill all reporting obligations and currently expects to file the Form 10-Q

within the six-month period granted by the NYSE Notice; however, there can be no assurance that the Form 10-Q will be filed within

such period.

About Universal Corporation

Universal Corporation (NYSE: UVV) is a global

agricultural company with over 100 years of experience supplying products and innovative solutions to meet our customers’ evolving

needs and precise specifications. Through our diverse network of farmers and partners across more than 30 countries on five continents,

we are a trusted provider of high-quality, traceable products. We leverage our extensive supply chain expertise, global reach, integrated

processing capabilities, and commitment to sustainability to provide a range of products and services designed to drive efficiency and

deliver value to our customers. For more information, visit www.universalcorp.com.

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING

INFORMATION

This release includes “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. Among other things, these statements include statements regarding expectations about the Company’s filing of

its Form 10-Q for the quarter ended September 30, 2024. These forward-looking statements are generally identified by the use

of words such as we “expect,” “believe,” “anticipate,” “could,” “should,”

“may,” “plan,” “will,” “predict,” “estimate,” and similar expressions or words

of similar import. These forward-looking statements are based upon management’s current knowledge and assumptions about future events

and involve risks and uncertainties that could cause actual results, performance, or achievements to be materially different from any

anticipated results, prospects, performance, or achievements expressed or implied by such forward-looking statements. Such risks and uncertainties

include, but are not limited to, the uncertainty of the ultimate findings of the ongoing internal investigation, as well as the timing

of its completion and costs and expenses arising out of the ongoing internal investigation process and its results; the impact of the

ongoing internal investigation on us, our management and operations, including financial impact as well as any litigation or regulatory

action that may arise from the ongoing internal investigation; the impact of the internal investigation on our conclusions regarding the

effectiveness of our internal control over financial reporting and our disclosure controls and procedures; our ability to regain compliance

with NYSE listing requirements; success in pursuing strategic investments or acquisitions and integration of new businesses and the impact

of these new businesses on future results; product purchased not meeting quality and quantity requirements; our reliance on a few large

customers; our ability to maintain effective information technology systems and safeguard confidential information; anticipated levels

of demand for and supply of our products and services; costs incurred in providing these products and services including increased transportation

costs and delays attributed to global supply chain challenges; timing of shipments to customers; higher inflation rates; changes in market

structure; government regulation and other stakeholder expectations; economic and political conditions in the countries in which we and

our customers operate, including the ongoing impacts from international conflicts; product taxation; industry consolidation and evolution;

changes in exchange rates and interest rates; impacts of regulation and litigation on its customers; industry-specific risks related to

its plant-based ingredient businesses; exposure to certain regulatory and financial risks related to climate change; changes in estimates

and assumptions underlying our critical accounting policies; the promulgation and adoption of new accounting standards, new government

regulations and interpretation of existing standards and regulations; and general economic, political, market, and weather conditions.

Actual results, therefore, could vary from those expected. Please also refer to such other factors as discussed in Part I, Item

1A. “Risk Factors” of Universal’s Annual Report on Form 10-K for the fiscal year ended March 31, 2024, and

related disclosures in other filings which have been filed with the U.S. Securities and Exchange Commission and are available on the SEC’s

website at www.sec.gov. All risk factors and uncertainties described herein and therein should be considered in evaluating forward-looking

statements, and all of the forward-looking statements are expressly qualified by the cautionary statements contained or referred to herein

and therein. Universal cautions investors not to place undue reliance on any forward-looking statements as these statements speak only

as of the date when made, and it undertakes no obligation to update any forward-looking statements made, except as required by law.

###

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

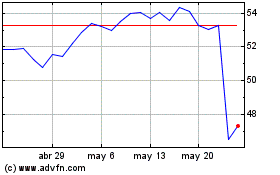

Universal (NYSE:UVV)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Universal (NYSE:UVV)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024