false000169237600016923762024-08-012024-08-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 01, 2024 |

Velocity Financial, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39183 |

46-0659719 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

2945 Townsgate Road, Suite 110 |

|

Westlake Village, California |

|

91361 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (818) 532-3700 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, par value $0.01 per share |

|

VEL |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

We posted to our Investor Relations website, www.velfinance.com, management's second quarter 2024 earnings presentation. A copy of the presentation is furnished as Exhibit 99 and is incorporated herein by reference.

The information provided in this Form 8-K, including Exhibit 99, is intended to be furnished and shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act or the Securities Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Velocity Financial, Inc. |

|

|

|

|

Date: |

August 2, 2024 |

By: |

/s/ Roland T. Kelly |

|

|

|

Roland T. Kelly

Chief Legal Officer and General Counsel |

2Q24 Results Presentation August 1, 2024 Exhibit 99

Forward-looking statements Some of the statements contained in this presentation may constitute forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, projections, plans and strategies, positioning, anticipated events or trends, and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as "may," "will," "should," "expects," "intends," "plans," "anticipates," "believes," "estimates," "predicts," or "potential" or the negative of these words and phrases. You can also identify forward-looking statements by discussions of strategy, plans, or intentions. The forward-looking statements contained in this presentation reflect our current views about future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause actual results to differ significantly from those expressed or contemplated in any forward-looking statement. While forward-looking statements reflect our good faith projections, assumptions and expectations, they are not guarantees of future results. Furthermore, we disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, data or methods, future events or other changes, except as required by applicable law. Factors that could cause our results to differ materially include but are not limited to: (1) the continued course and severity of COVID-19 variants and subvariants and their direct and indirect impacts (2) general economic conditions and real estate market conditions, such as a possible recession, (3) regulatory and/or legislative changes, (4) our customers' continued interest in loans and doing business with us, (5) market conditions and investor interest in our contemplated securitizations and (6) changes in federal government fiscal and monetary policies and (7) the continued conflict in Ukraine and Israel. For a further discussion of these and other factors that could cause future results to differ materially from those expressed or contemplated in any forward-looking statements, see the section titled ''Risk Factors" previously disclosed in our Form 10-Q filed with the SEC on May 14, 2020, as well as other cautionary statements we make in our current and periodic filings with the SEC. Such filings are available publicly on our Investor Relations web page at www.velfinance.com.

2Q24 Highlights Production& �Loan Portfolio Earnings Financing & �Capital Net income of $14.7 million, up 21.3% from $12.2 million for 2Q23. Diluted EPS of $0.42 per share, up $0.06 from $0.36 for 2Q23 Core net income(1) of $15.9 million, up 23.1% from $12.9 million for 2Q23. Core diluted EPS(1) of $0.45, up from $0.38 per share for 2Q23 Portfolio net interest margin (NIM) of 3.54% up 30 bps from 3.24% for 2Q23 Loan production of $422.2 million in UPB, an 11.5% and 63.2% increase from 1Q24 and 2Q23, respectively Total loan portfolio of $4.5 billion in UPB, an increase of 20.4% from June 30, 2023 Nonperforming Loans (NPL) were 10.5% of HFI loans, up slightly from 10.1% and 10.0% as of March 31, 2024, and June 30, 2023, respectively 2Q24 realized gains of $1.0 million, or 101.3%, of NPL UPB resolved Completed the VCC 2024-2 & 2024-3 securitizations totaling $286.2 million and $204.6 million, respectively, of securities issued Resulted in a $0.06 per share EPS reduction from additional issuance expenses from a second securitization during the quarter Century Health & Housing Capital, LLC acquired $3.6 million in Mortgage Servicing Rights (MSRs) related to $227.6 million in UPB of commercial GNMA mortgages Liquidity(2) of $83.8 million and total available warehouse line capacity was $646.5 million as of June 30, 2024 (1) “Core net income” is a non-GAAP measure which excludes non-recurring, non-operating, and/or unusual activities from GAAP net income. (2) Liquidity includes unrestricted cash and cash equivalents of $47.4 million and available liquidity in unfinanced loans of $36.4 million.

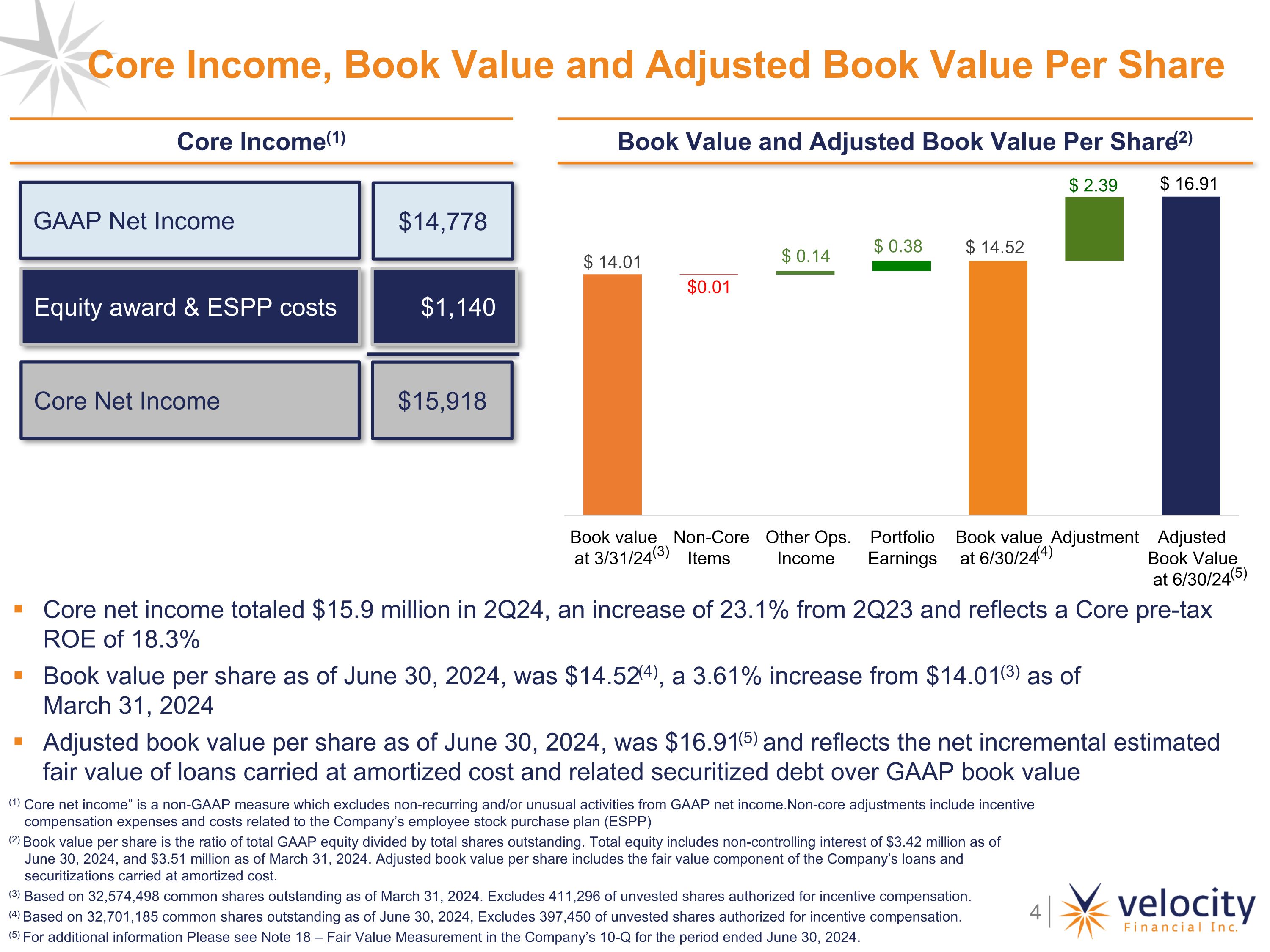

Book Value and Adjusted Book Value Per Share(2) Core net income totaled $15.9 million in 2Q24, an increase of 23.1% from 2Q23 and reflects a Core pre-tax ROE of 18.3% Book value per share as of June 30, 2024, was $14.52(4), a 3.61% increase from $14.01(3) as of �March 31, 2024 Adjusted book value per share as of June 30, 2024, was $16.91(5) and reflects the net incremental estimated fair value of loans carried at amortized cost and related securitized debt over GAAP book value Core Income, Book Value and Adjusted Book Value Per Share Core Income(1) Equity award & ESPP costs $1,140 (1) Core net income” is a non-GAAP measure which excludes non-recurring and/or unusual activities from GAAP net income. Non-core adjustments include incentive compensation expenses and costs related to the Company’s employee stock purchase plan (ESPP) (2) Book value per share is the ratio of total GAAP equity divided by total shares outstanding. Total equity includes non-controlling interest of $3.42 million as of �June 30, 2024, and $3.51 million as of March 31, 2024. Adjusted book value per share includes the fair value component of the Company’s loans and securitizations carried at amortized cost. (3) Based on 32,574,498 common shares outstanding as of March 31, 2024. Excludes 411,296 of unvested shares authorized for incentive compensation. (4) Based on 32,701,185 common shares outstanding as of June 30, 2024, Excludes 397,450 of unvested shares authorized for incentive compensation. (5) For additional information Please see Note 18 – Fair Value Measurement in the Company’s 10-Q for the period ended June 30, 2024. (3) (4) Core Net Income $15,918 GAAP Net Income $14,778 (5)

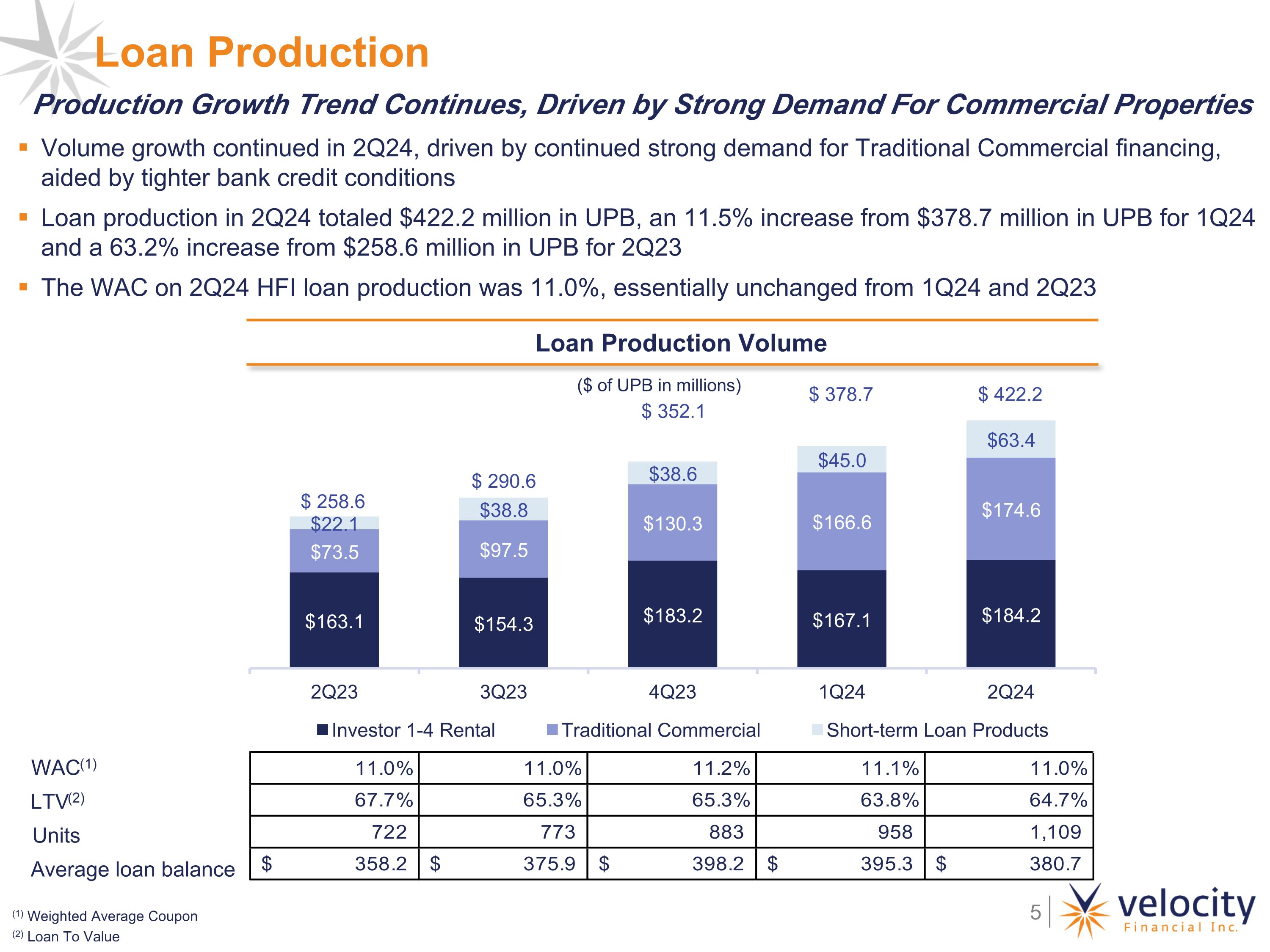

Loan Production Volume growth continued in 2Q24, driven by continued strong demand for Traditional Commercial financing, aided by tighter bank credit conditions Loan production in 2Q24 totaled $422.2 million in UPB, an 11.5% increase from $378.7 million in UPB for 1Q24 and a 63.2% increase from $258.6 million in UPB for 2Q23 The WAC on 2Q24 HFI loan production was 11.0%, essentially unchanged from 1Q24 and 2Q23 Loan Production Volume ($ of UPB in millions) Production Growth Trend Continues, Driven by Strong Demand For Commercial Properties Units Average loan balance (1) Weighted Average Coupon (2) Loan To Value WAC(1) LTV(2)

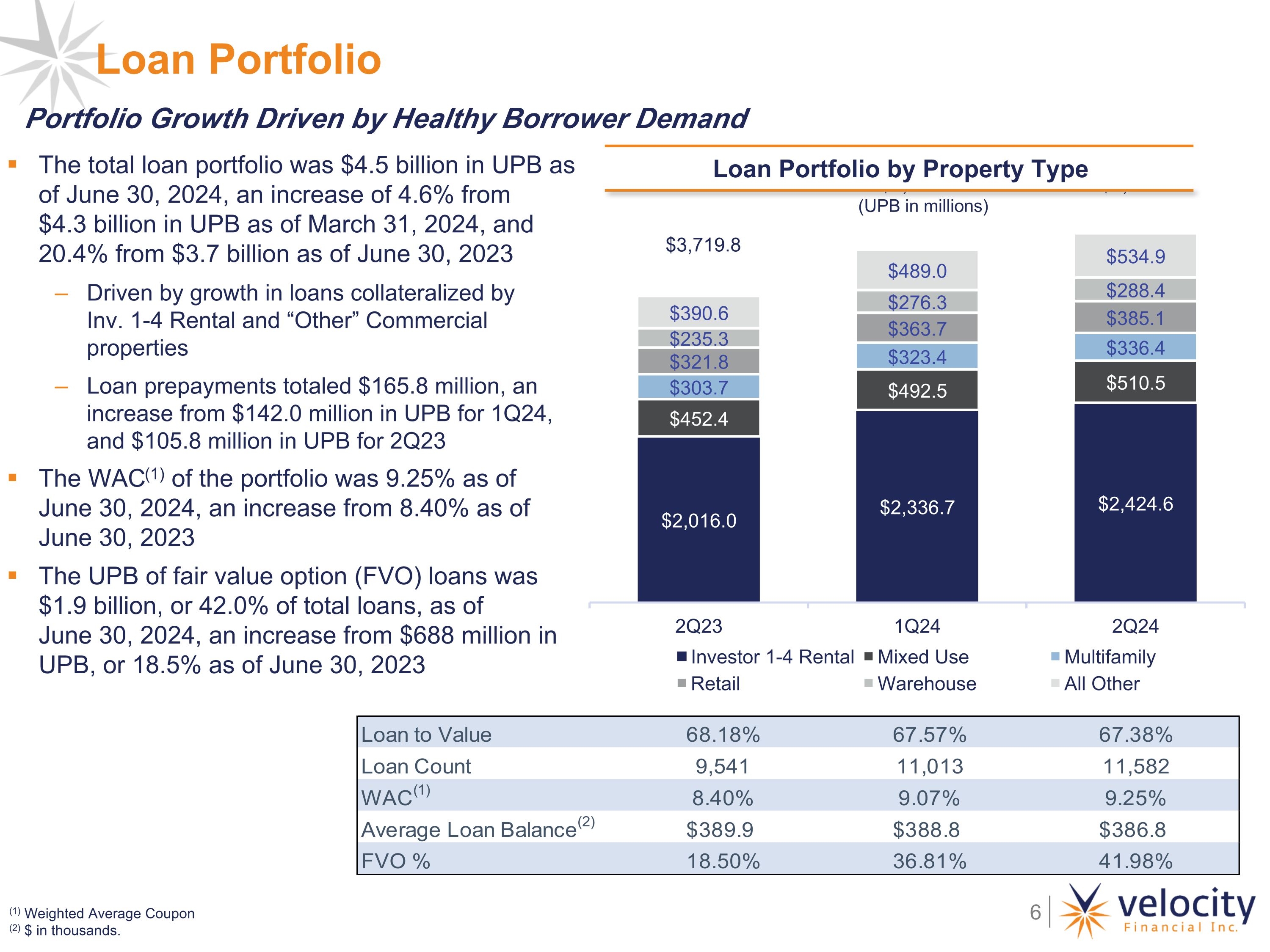

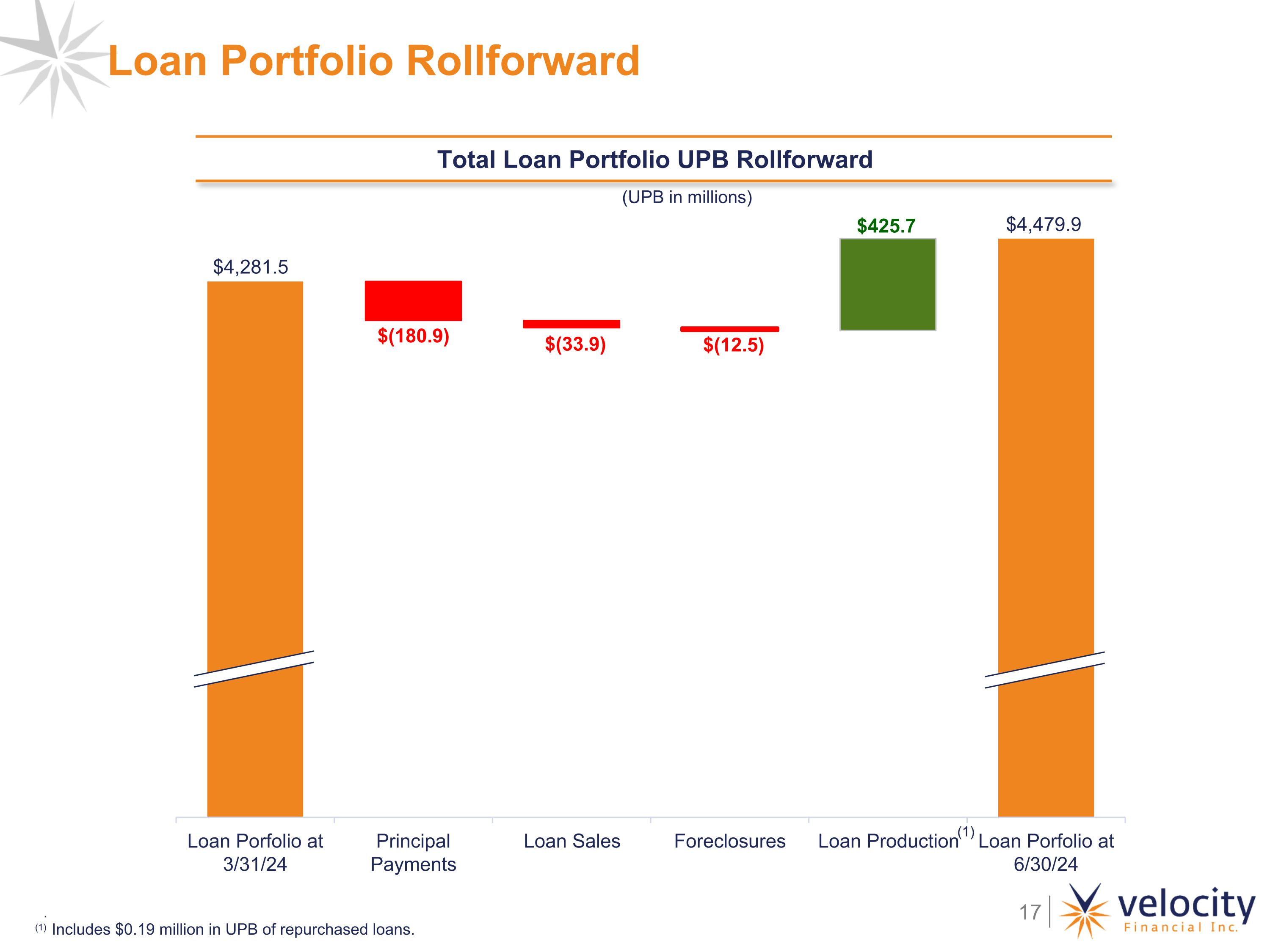

Loan Portfolio by Property Type The total loan portfolio was $4.5 billion in UPB as of June 30, 2024, an increase of 4.6% from �$4.3 billion in UPB as of March 31, 2024, and 20.4% from $3.7 billion as of June 30, 2023 Driven by growth in loans collateralized by �Inv. 1-4 Rental and “Other” Commercial properties Loan prepayments totaled $165.8 million, an increase from $142.0 million in UPB for 1Q24, and $105.8 million in UPB for 2Q23 The WAC(1) of the portfolio was 9.25% as of �June 30, 2024, an increase from 8.40% as of �June 30, 2023 The UPB of fair value option (FVO) loans was $1.9 billion, or 42.0% of total loans, as of �June 30, 2024, an increase from $688 million in UPB, or 18.5% as of June 30, 2023 Loan Portfolio (UPB in millions) (1) Weighted Average Coupon (2) $ in thousands. Portfolio Growth Driven by Healthy Borrower Demand

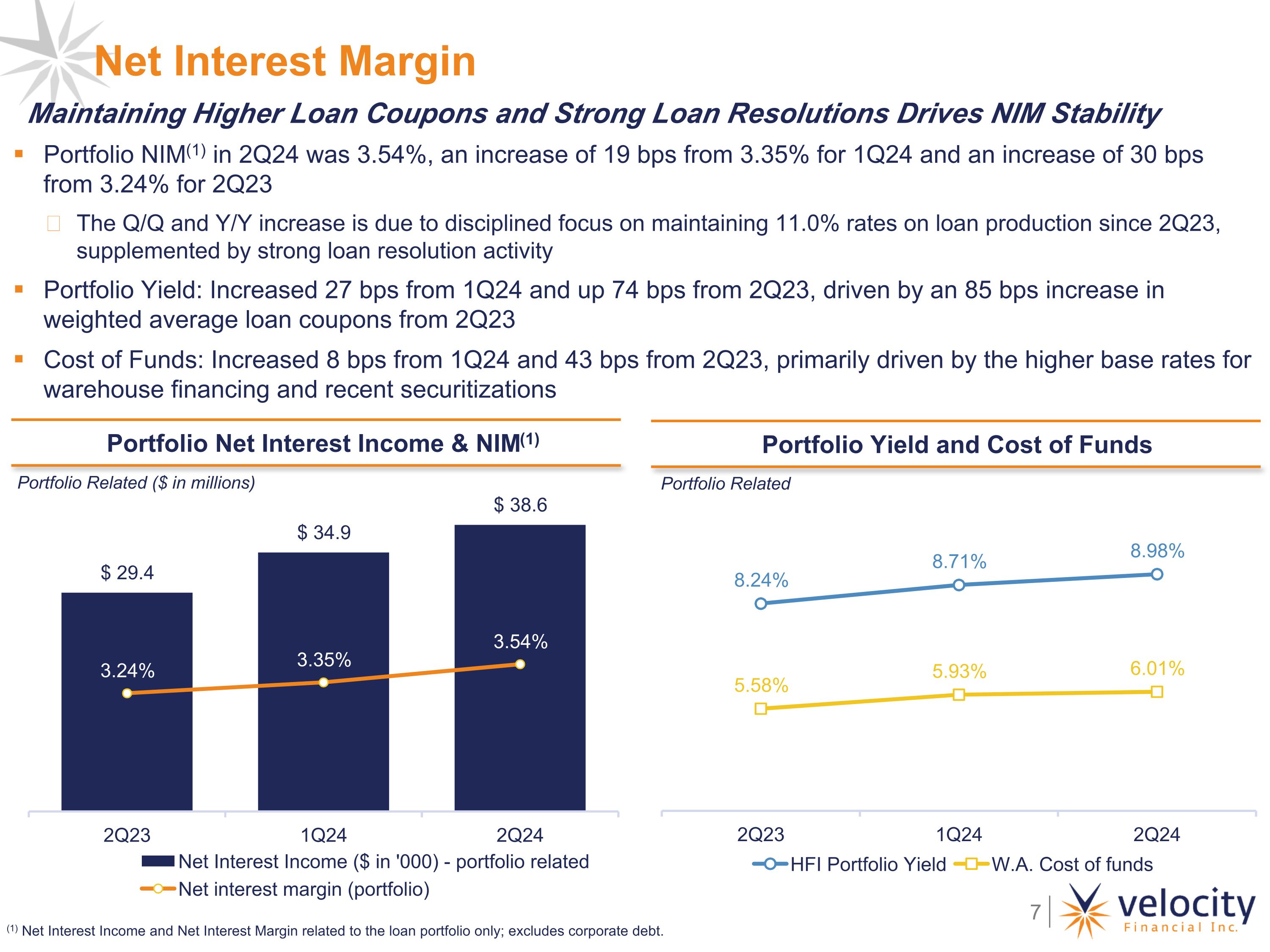

Portfolio Net Interest Income & NIM(1) Portfolio Yield and Cost of Funds Portfolio Related Portfolio NIM(1) in 2Q24 was 3.54%, an increase of 19 bps from 3.35% for 1Q24 and an increase of 30 bps from 3.24% for 2Q23 The Q/Q and Y/Y increase is due to disciplined focus on maintaining 11.0% rates on loan production since 2Q23, supplemented by strong loan resolution activity Portfolio Yield: Increased 27 bps from 1Q24 and up 74 bps from 2Q23, driven by an 85 bps increase in weighted average loan coupons from 2Q23 Cost of Funds: Increased 8 bps from 1Q24 and 43 bps from 2Q23, primarily driven by the higher base rates for warehouse financing and recent securitizations Net Interest Margin (1) Net Interest Income and Net Interest Margin related to the loan portfolio only; excludes corporate debt. Portfolio Related ($ in millions) Maintaining Higher Loan Coupons and Strong Loan Resolutions Drives NIM Stability

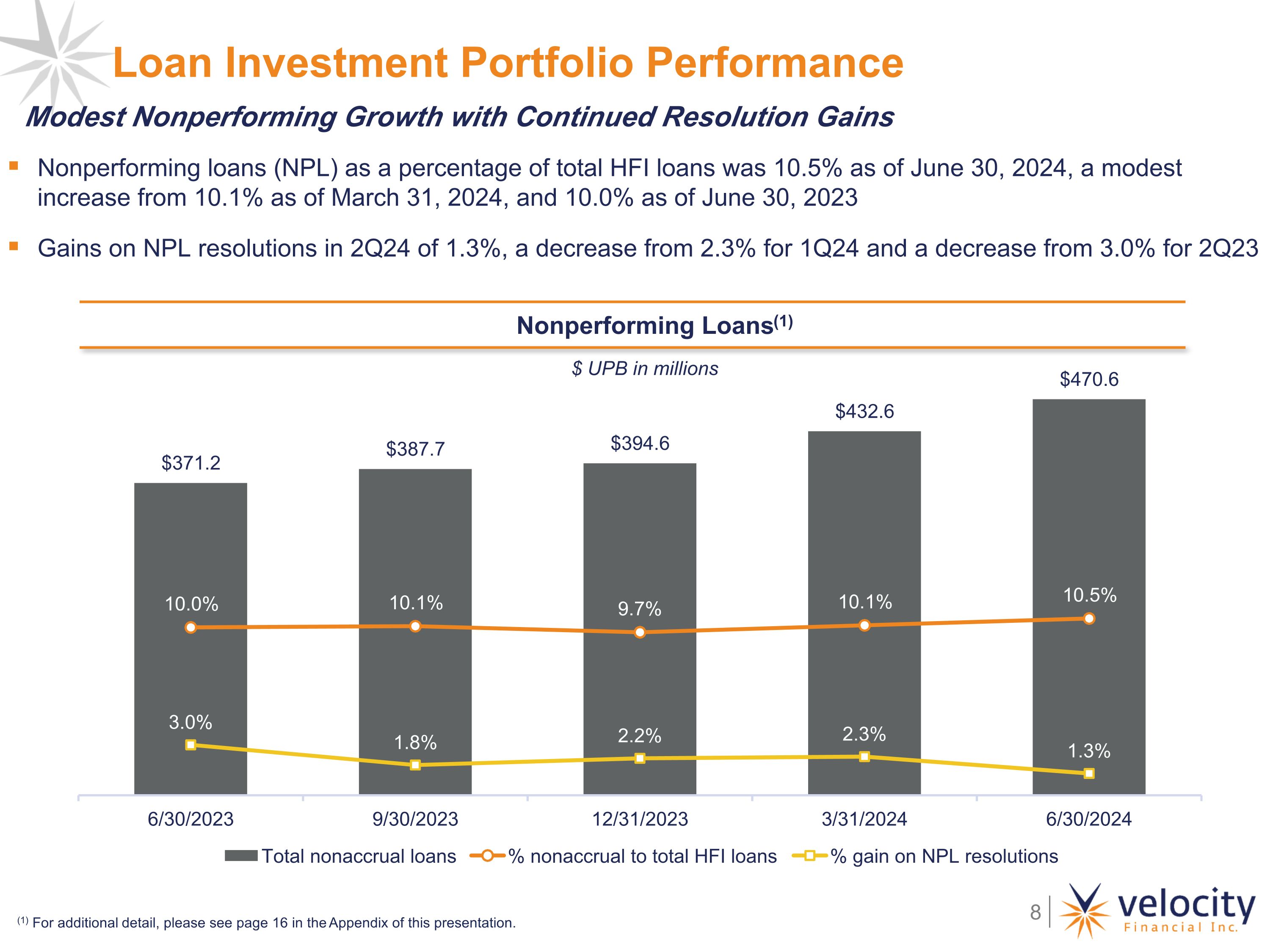

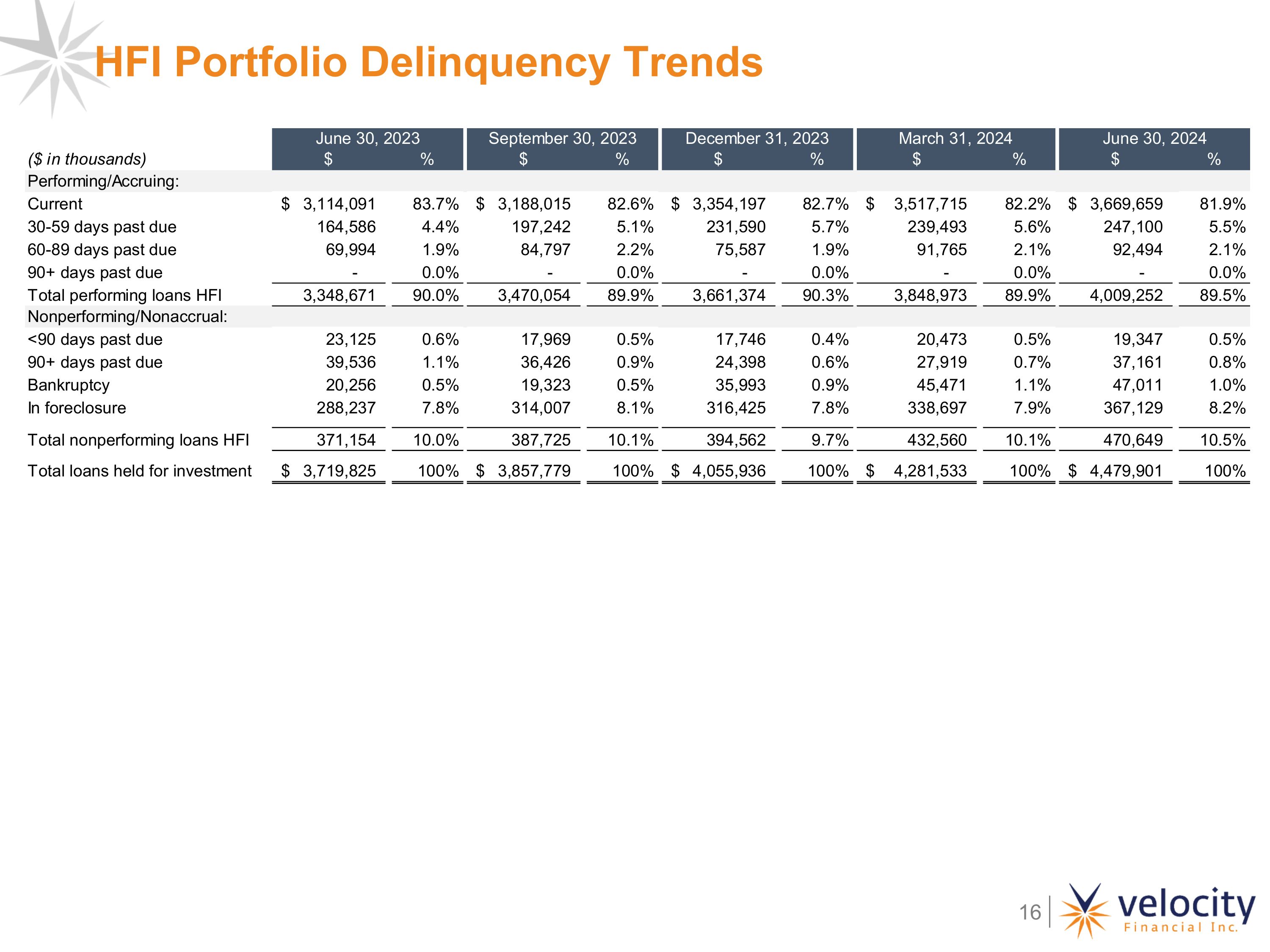

Nonperforming Loans(1) Nonperforming loans (NPL) as a percentage of total HFI loans was 10.5% as of June 30, 2024, a modest increase from 10.1% as of March 31, 2024, and 10.0% as of June 30, 2023 Gains on NPL resolutions in 2Q24 of 1.3%, a decrease from 2.3% for 1Q24 and a decrease from 3.0% for 2Q23 $ UPB in millions Loan Investment Portfolio Performance (1) For additional detail, please see page 16 in the Appendix of this presentation. Modest Nonperforming Growth with Continued Resolution Gains

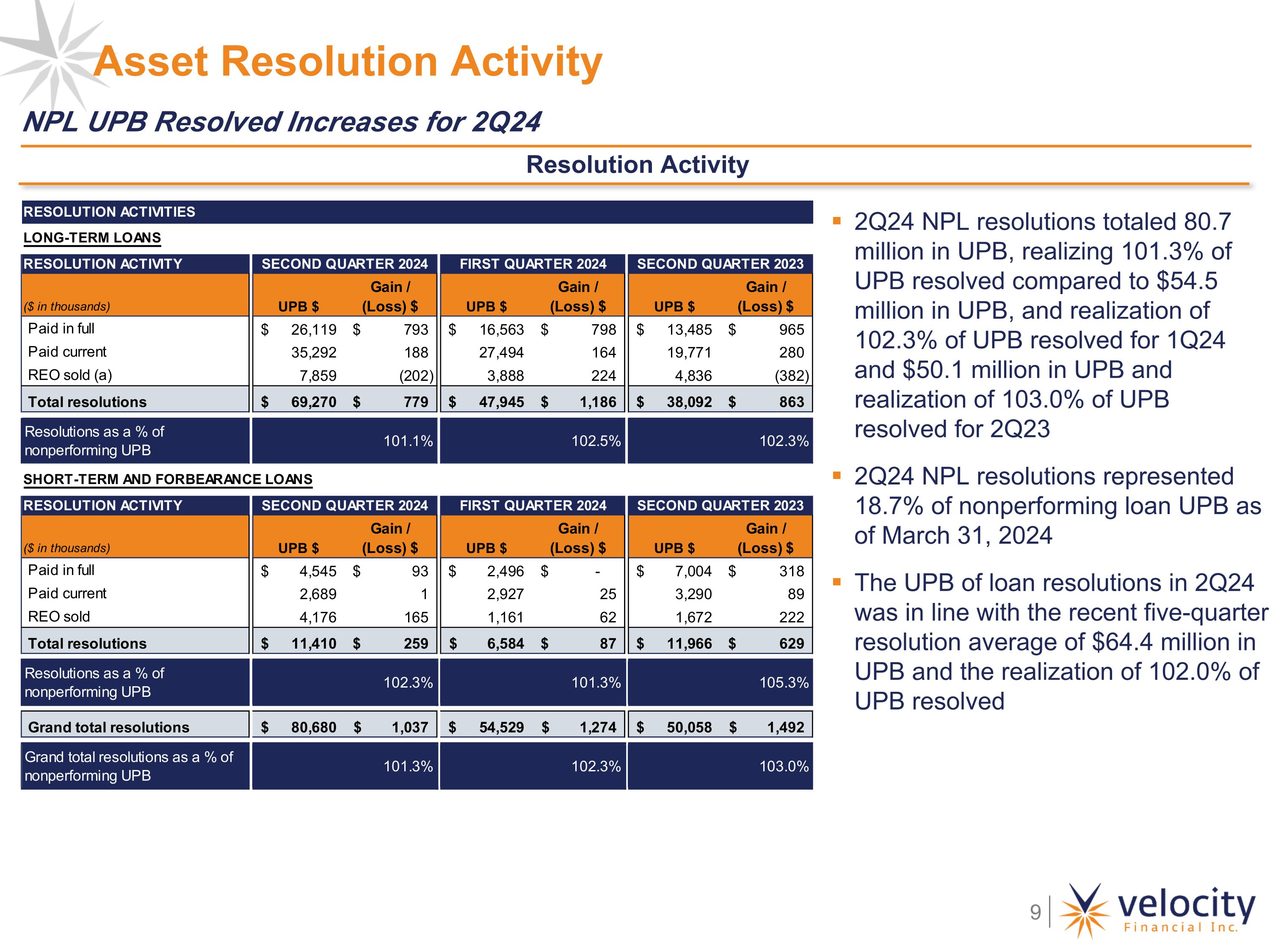

Asset Resolution Activity Resolution Activity 2Q24 NPL resolutions totaled 80.7 million in UPB, realizing 101.3% of UPB resolved compared to $54.5 million in UPB, and realization of 102.3% of UPB resolved for 1Q24 and $50.1 million in UPB and realization of 103.0% of UPB resolved for 2Q23 2Q24 NPL resolutions represented 18.7% of nonperforming loan UPB as of March 31, 2024 The UPB of loan resolutions in 2Q24 was in line with the recent five-quarter resolution average of $64.4 million in UPB and the realization of 102.0% of UPB resolved NPL UPB Resolved Increases for 2Q24

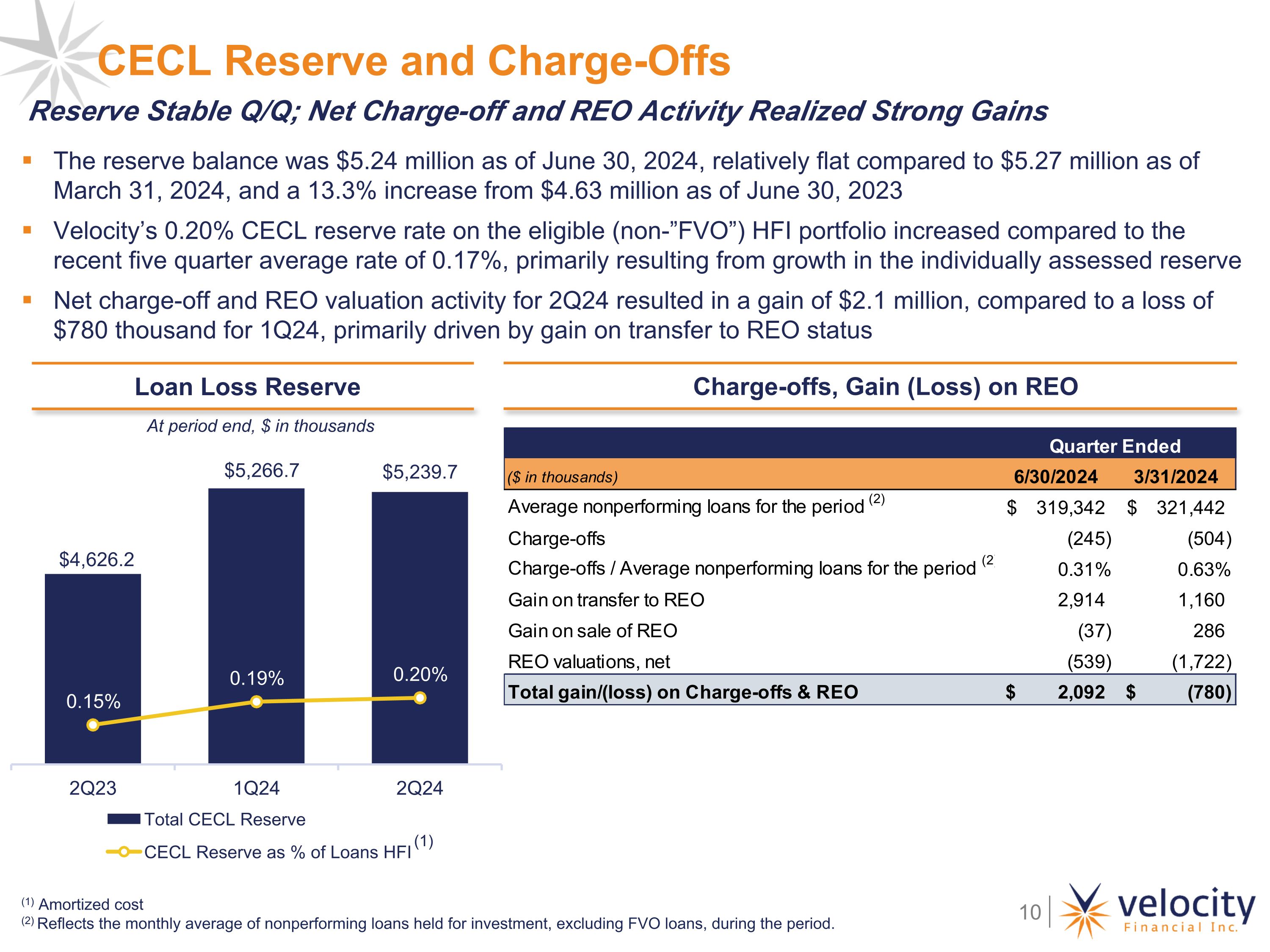

The reserve balance was $5.24 million as of June 30, 2024, relatively flat compared to $5.27 million as of �March 31, 2024, and a 13.3% increase from $4.63 million as of June 30, 2023 Velocity’s 0.20% CECL reserve rate on the eligible (non-”FVO”) HFI portfolio increased compared to the recent five quarter average rate of 0.17%, primarily resulting from growth in the individually assessed reserve Net charge-off and REO valuation activity for 2Q24 resulted in a gain of $2.1 million, compared to a loss of $780 thousand for 1Q24, primarily driven by gain on transfer to REO status CECL Reserve and Charge-Offs Loan Loss Reserve Reserve Stable Q/Q; Net Charge-off and REO Activity Realized Strong Gains Charge-offs, Gain (Loss) on REO (1) Amortized cost (2) Reflects the monthly average of nonperforming loans held for investment, excluding FVO loans, during the period. At period end, $ in thousands (1)

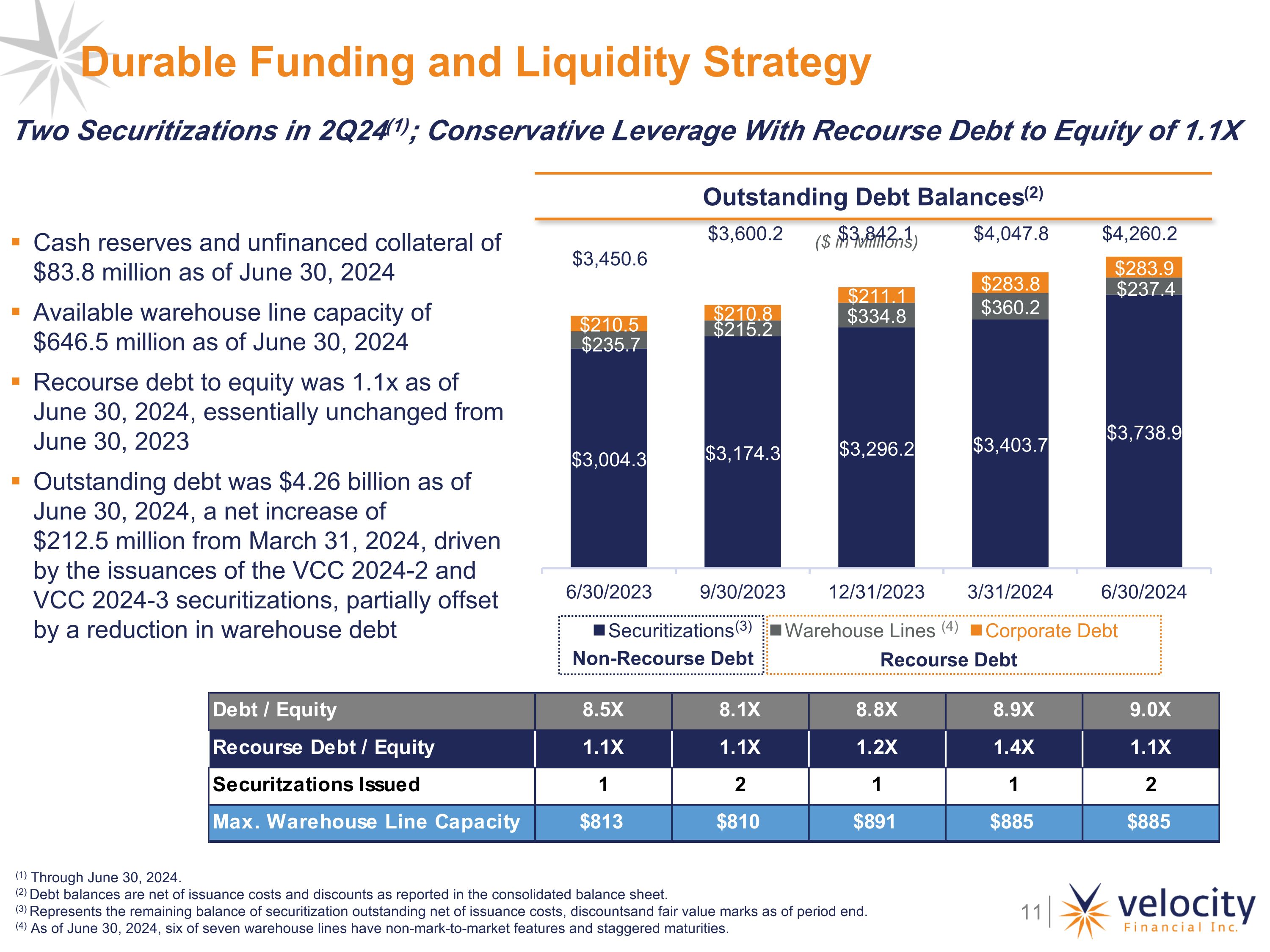

Durable Funding and Liquidity Strategy Two Securitizations in 2Q24(1); Conservative Leverage With Recourse Debt to Equity of 1.1X Outstanding Debt Balances(2) ($ in Millions) (1) Through June 30, 2024. (2) Debt balances are net of issuance costs and discounts as reported in the consolidated balance sheet. (3) Represents the remaining balance of securitization outstanding net of issuance costs, discounts and fair value marks as of period end. (4) As of June 30, 2024, six of seven warehouse lines have non-mark-to-market features and staggered maturities. Non-Recourse Debt Recourse Debt (3) Cash reserves and unfinanced collateral of �$83.8 million as of June 30, 2024 Available warehouse line capacity of $646.5 million as of June 30, 2024 Recourse debt to equity was 1.1x as of �June 30, 2024, essentially unchanged from June 30, 2023 Outstanding debt was $4.26 billion as of �June 30, 2024, a net increase of �$212.5 million from March 31, 2024, driven by the issuances of the VCC 2024-2 and VCC 2024-3 securitizations, partially offset by a reduction in warehouse debt (4) (5)

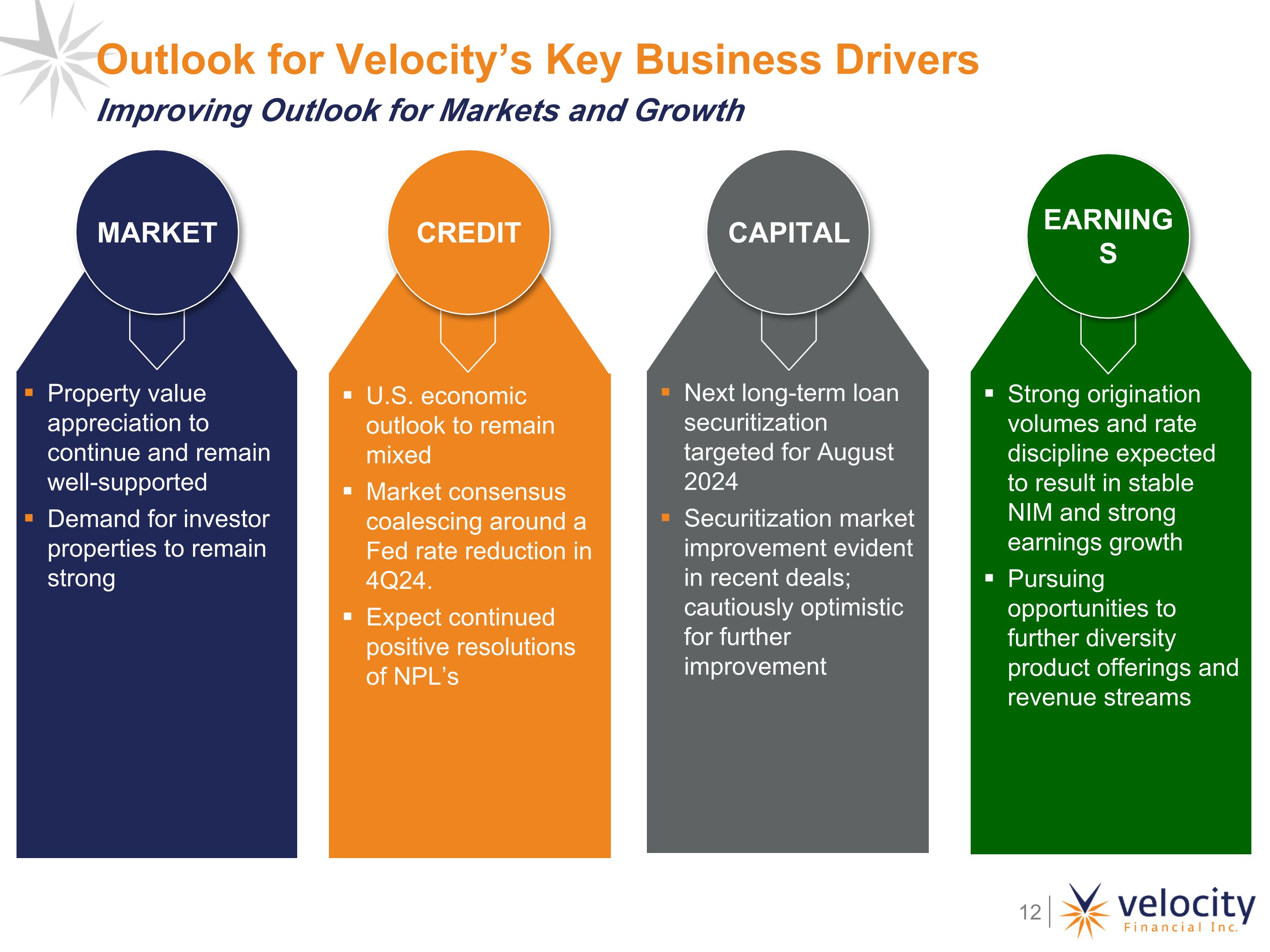

U.S. economic outlook to remain mixed Market consensus coalescing around a Fed rate reduction in 4Q24. Expect continued positive resolutions of NPL’s Property value appreciation to continue and remain well-supported Demand for investor properties to remain strong Outlook for Velocity’s Key Business Drivers MARKET CREDIT CAPITAL Next long-term loan securitization targeted for August 2024 Securitization market improvement evident in recent deals; cautiously optimistic for further improvement Improving Outlook for Markets and Growth Strong origination volumes and rate discipline expected to result in stable NIM and strong earnings growth Pursuing opportunities to further diversity product offerings and revenue streams EARNINGS

Appendix

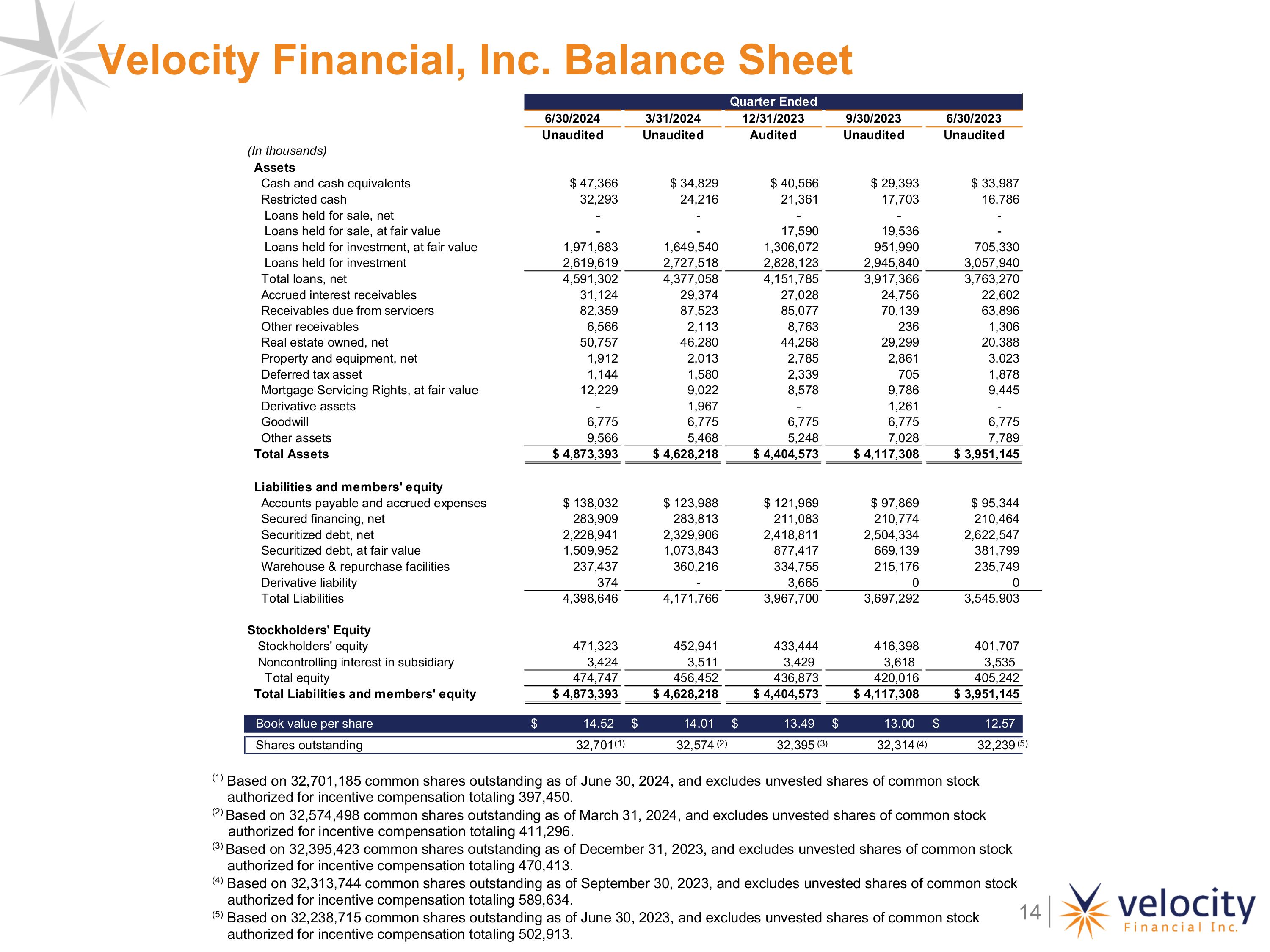

Velocity Financial, Inc. Balance Sheet

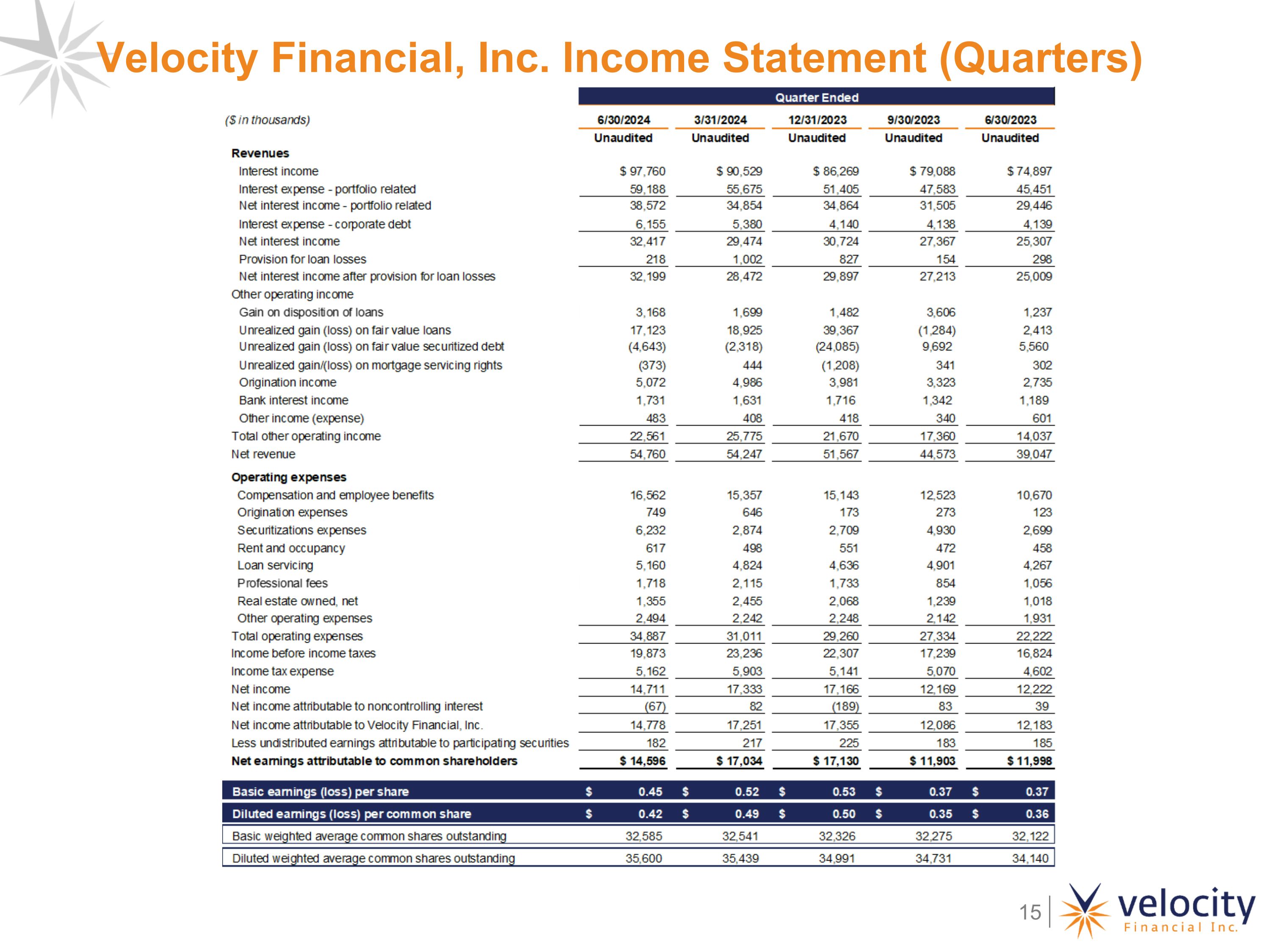

Velocity Financial, Inc. Income Statement (Quarters)

HFI Portfolio Delinquency Trends

Loan Portfolio Rollforward Total Loan Portfolio UPB Rollforward (UPB in millions) . (1) Includes $0.19 million in UPB of repurchased loans. (1)

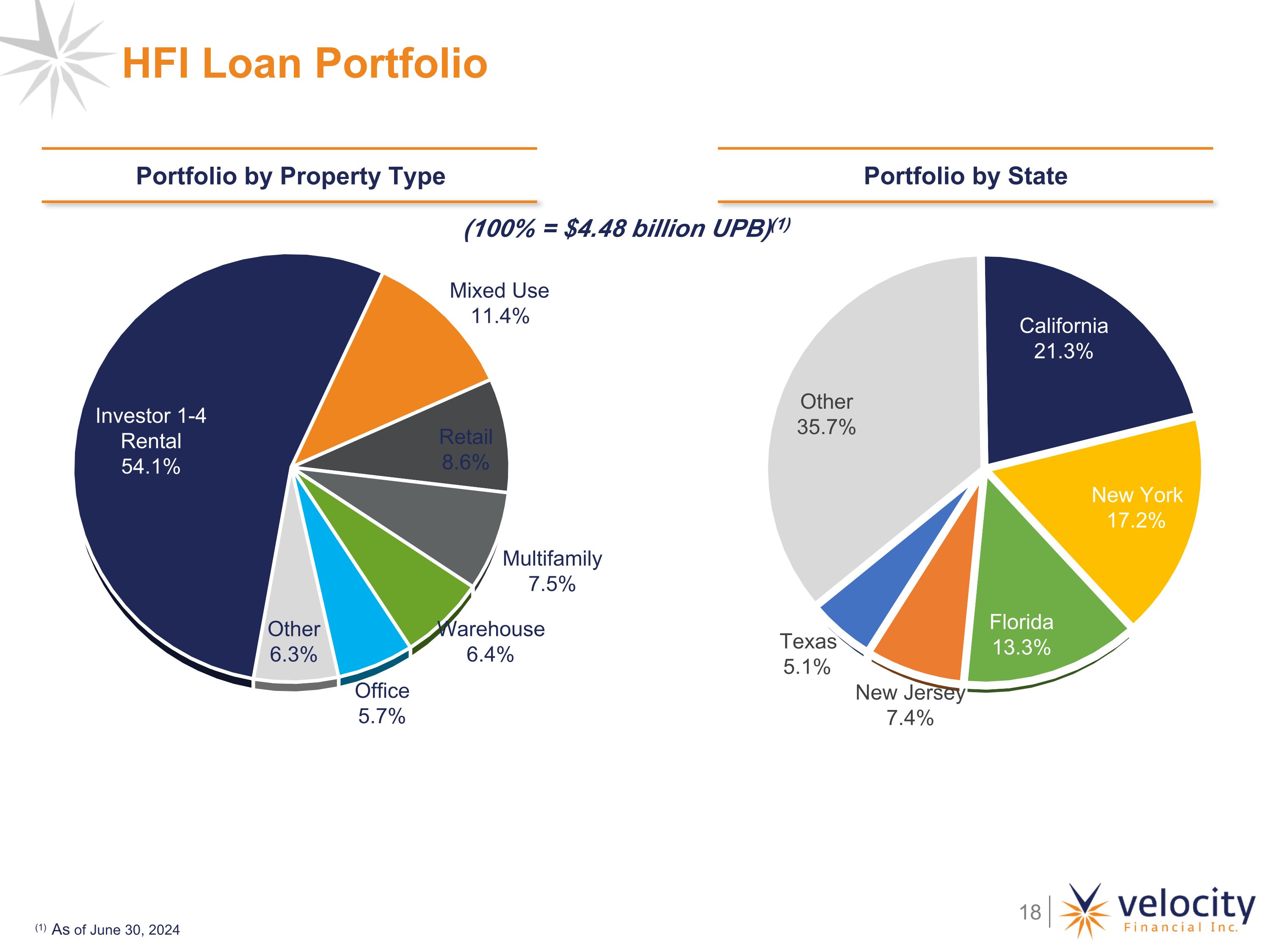

HFI Loan Portfolio Portfolio by Property Type (100% = $4.48 billion UPB)(1) (1) As of June 30, 2024 Portfolio by State

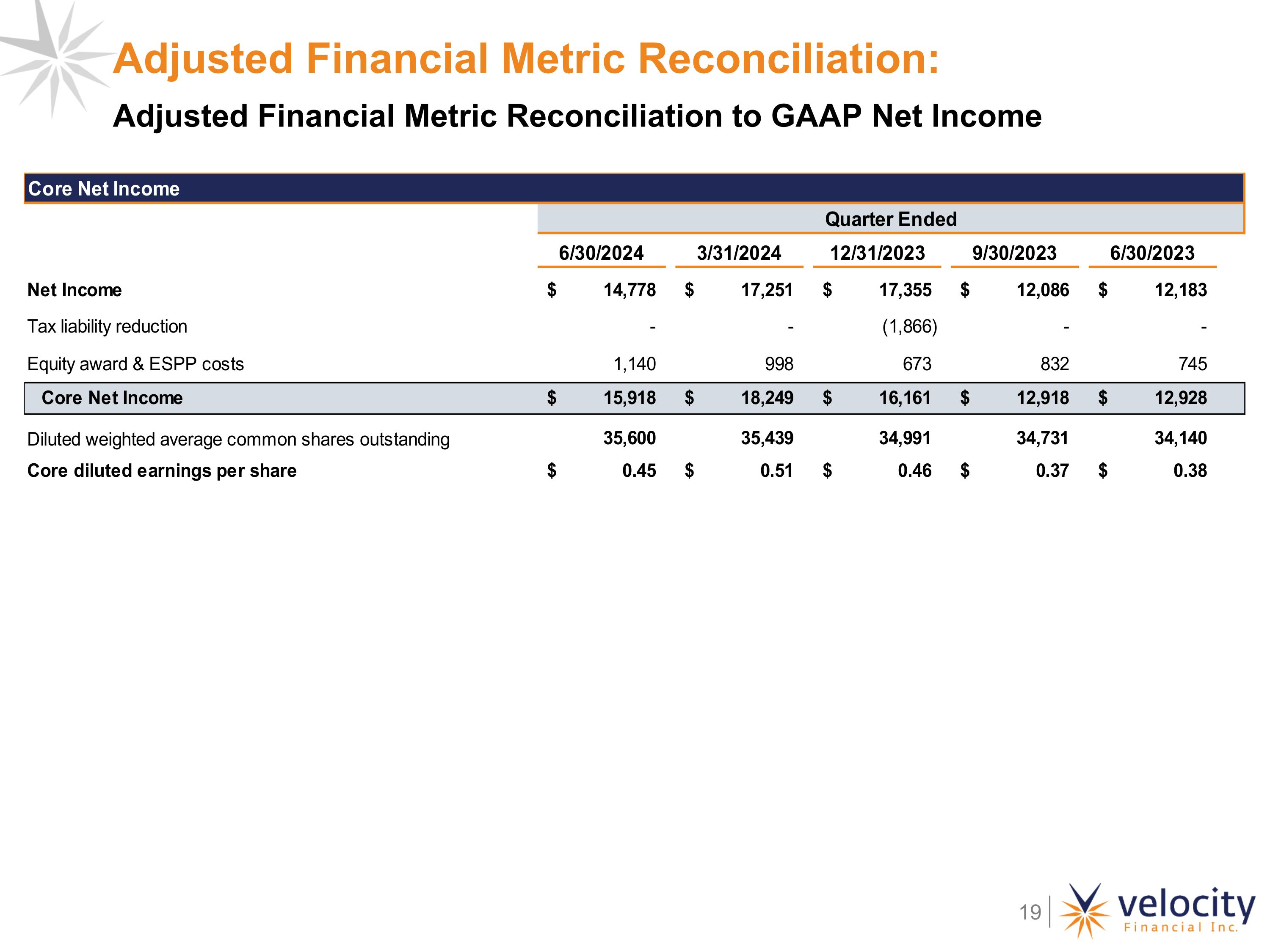

Adjusted Financial Metric Reconciliation: Adjusted Financial Metric Reconciliation to GAAP Net Income

v3.24.2.u1

Document And Entity Information

|

Aug. 01, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 01, 2024

|

| Entity Registrant Name |

Velocity Financial, Inc.

|

| Entity Central Index Key |

0001692376

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-39183

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

46-0659719

|

| Entity Address, Address Line One |

2945 Townsgate Road, Suite 110

|

| Entity Address, City or Town |

Westlake Village

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

91361

|

| City Area Code |

(818)

|

| Local Phone Number |

532-3700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.01 per share

|

| Trading Symbol |

VEL

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Velocity Financial (NYSE:VEL)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Velocity Financial (NYSE:VEL)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025