KMID leverages Kayne Anderson Rudnick’s

expertise in quality-focused equity strategies

Virtus Investment Partners, Inc. (NYSE: VRTS) has expanded its

offerings of distinctive, actively managed exchange-traded funds

with the introduction of the Virtus KAR Mid-Cap ETF, (NYSE: KMID),

the first ETF strategy managed by Kayne Anderson Rudnick (KAR).

The Virtus KAR Mid-Cap ETF is an actively managed, concentrated

portfolio consisting of 25-35 high-quality mid-cap stocks, selected

using KAR’s disciplined and rigorous business-analyst approach to

fundamental research, and looking to own these businesses for the

long run. KMID aims to generate attractive risk-adjusted long-term

returns by offering investments in businesses with sustainable

competitive advantages that can maintain above-average growth and

are better positioned to exceed consensus growth expectations.

“We consider mid-caps to be in the equity ‘sweet spot’ between

faster-growing small caps and less-volatile large caps,

representing an attractive investment opportunity,” said KAR’s Jon

Christensen, CFA, portfolio manager and senior research analyst,

who manages KMID with Craig Stone, co-chief investment officer and

portfolio manager. “Investors whose portfolios do not have

dedicated exposure to mid-cap equities may be missing out on the

growth potential of this compelling segment.”

Virtus’ multi-manager ETF platform, Virtus ETF Solutions, now

offers 19 actively managed and index-based ETFs across multiple

asset classes. These include the Virtus Terranova U.S. Quality

Momentum ETF (JOET) as well as ETFs managed by other Virtus

affiliates, Duff & Phelps Investment Management Co., Newfleet

Asset Management, Seix Investment Advisors, and Stone Harbor

Investment Partners.

“We are excited to launch the first ETF managed by Kayne, which

has been delivering high-quality investment strategies for 40

years,” said William J. Smalley, executive managing director,

Virtus ETF Solutions. “KAR is extending to investors its well-known

active management capabilities in a transparent and tax-efficient

structure that adds value to their stock selection process by

selecting what they consider to be quality mid-sized businesses

with strong growth prospects.”

About Kayne Anderson Rudnick

Kayne Anderson Rudnick, an affiliate of Virtus Investment

Partners, is an investment management and wealth advisory firm

founded in 1984 by John Anderson (a Forbes 400 billionaire and the

benefactor of UCLA’s Anderson School of Management). Based in Los

Angeles, the firm has $69.8 billion in assets under management as

of September 30, 2024. The company manages assets for corporations,

endowments, foundations, public entities, and high net worth

individuals. With 40 years of experience, the firm is known for its

commitment to high quality in its business practices, investment

strategies and wealth solutions.

About Virtus ETF Solutions

Virtus ETF Solutions is an ETF sponsor that offers actively

managed and index-based investment capabilities across multiple

asset classes, seeking to deliver a family of complementary ETFs

that provide investors access to differentiated investment

capabilities from select managers.

About Virtus Investment Partners, Inc.

Virtus Investment Partners (NYSE: VRTS) is a distinctive

partnership of boutique investment managers singularly committed to

the long-term success of individual and institutional investors. We

provide investment management products and services from our

affiliated managers, each with a distinct investment style and

autonomous investment process, as well as select subadvisers.

Investment solutions are available across multiple disciplines and

product types to meet a wide array of investor needs. Additional

information about our firm, investment partners, and strategies is

available at virtus.com.

Risk Considerations

Exchange-Traded Funds (ETF): The value of an ETF may be

more volatile than the underlying portfolio of securities it is

designed to track. The costs to the portfolio of owning shares of

an ETF may exceed the cost of investing directly in the underlying

securities. Equity Securities: The market price of equity

securities may be adversely affected by financial market, industry,

or issuer-specific events. Focus on a particular style or on small,

medium, or large-sized companies may enhance that risk. Limited

Number of Investments: Because the portfolio has a limited

number of securities, it may be more susceptible to factors

adversely affecting its securities than a portfolio with a greater

number of securities. Non-Diversified: The portfolio is not

diversified and may be more susceptible to factors negatively

impacting its holdings to the extent the portfolio invests more of

its assets in the securities of fewer issuers than would a

diversified portfolio. Market Price/NAV: At the time of

purchase and/or sale, an investor’s shares may have a market price

that is above or below the fund’s NAV, which may increase the

investor’s risk of loss. Market Volatility: The value of the

securities in the portfolio may go up or down in response to the

prospects of individual companies and/or general economic

conditions. Local, regional, or global events such as war,

terrorism, pandemic, or recession could impact the portfolio,

including hampering the ability of the portfolio’s manager(s) to

invest its assets as intended.

Prospectus: For additional information on risks, please

see the fund’s prospectus.

The Russell Midcap® Index is a market

capitalization-weighted index of medium-capitalization stocks of

U.S. companies. The index is calculated on a total return basis

with dividends reinvested. The S&P 500® Index is a

free-float market capitalization-weighted index of 500 of the

largest U.S. companies. The Russell 2000® Index is a market

capitalization-weighted index of the 2,000 smallest companies in

the Russell Universe, which comprises the 3,000 largest U.S.

companies. The indexes are calculated on a total return basis with

dividends reinvested. The indexes are unmanaged, their returns do

not reflect any fees, expenses, or sales charges, and they are not

available for direct investment.

Please consider the investment objectives, risks, charges,

and expenses of the fund carefully before investing. The prospectus

contains this and other information about the fund. Contact us at

1-800-243-4361 or visit virtus.com for a copy of the fund's

prospectus. Read the prospectus carefully before you invest or send

money.

Mutual funds distributed by VP Distributors, LLC, member

FINRA and subsidiary of Virtus Investment Partners, Inc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241016681465/en/

Media Relations Ryan Graham (862) 777-4274

rgraham@jconnelly.com

Josh Silvia (860) 503-1327 josh.silvia@virtus.com

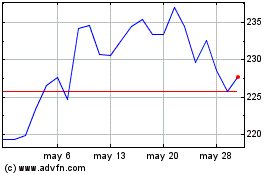

Virtus Investment Partners (NYSE:VRTS)

Gráfica de Acción Histórica

De Mar 2025 a Abr 2025

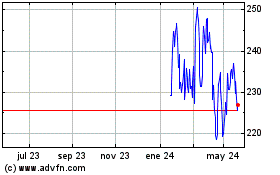

Virtus Investment Partners (NYSE:VRTS)

Gráfica de Acción Histórica

De Abr 2024 a Abr 2025