Form 8-K - Current report

05 Septiembre 2024 - 4:17PM

Edgar (US Regulatory)

0000732712 false 0000732712 2024-09-05 2024-09-05 0000732712 vz:A0.875NotesDue2025Member 2024-09-05 2024-09-05 0000732712 vz:A3.250NotesDue2026Member 2024-09-05 2024-09-05 0000732712 vz:A1.375NotesDue2026Member 2024-09-05 2024-09-05 0000732712 vz:A0.875NotesDue2027Member 2024-09-05 2024-09-05 0000732712 vz:A1.375NotesDue2028Member 2024-09-05 2024-09-05 0000732712 vz:A1125NotesDue2028Member 2024-09-05 2024-09-05 0000732712 vz:A2350FixedRateNotesDue2028Member 2024-09-05 2024-09-05 0000732712 vz:A1.875NotesDue2029Member 2024-09-05 2024-09-05 0000732712 vz:A0375NotesDue2029Member 2024-09-05 2024-09-05 0000732712 vz:A1.250NotesDue2030Member 2024-09-05 2024-09-05 0000732712 vz:A1.875NotesDue2030Member 2024-09-05 2024-09-05 0000732712 vz:NotesDue20304250Member 2024-09-05 2024-09-05 0000732712 vz:A2.625NotesDue2031Member 2024-09-05 2024-09-05 0000732712 vz:A2.500NotesDue2031Member 2024-09-05 2024-09-05 0000732712 vz:A3000FixedRateNotesDue2031Member 2024-09-05 2024-09-05 0000732712 vz:A0.875NotesDue2032Member 2024-09-05 2024-09-05 0000732712 vz:A0750NotesDue2032Member 2024-09-05 2024-09-05 0000732712 vz:A3.500NotesDue2032Member 2024-09-05 2024-09-05 0000732712 vz:A1300NotesDue2033Member 2024-09-05 2024-09-05 0000732712 vz:NotesDue2034475Member 2024-09-05 2024-09-05 0000732712 vz:A4.750NotesDue2034Member 2024-09-05 2024-09-05 0000732712 vz:A3.125NotesDue2035Member 2024-09-05 2024-09-05 0000732712 vz:A1125NotesDue2035Member 2024-09-05 2024-09-05 0000732712 vz:A3.375NotesDue2036Member 2024-09-05 2024-09-05 0000732712 vz:A3.750NotesDue2036Member 2024-09-05 2024-09-05 0000732712 vz:A2.875NotesDue2038Member 2024-09-05 2024-09-05 0000732712 vz:A1875NotesDue2038Member 2024-09-05 2024-09-05 0000732712 vz:A1.500NotesDue2039Member 2024-09-05 2024-09-05 0000732712 vz:A3.500FixedRateNotesDue2039Member 2024-09-05 2024-09-05 0000732712 vz:A1850NotesDue2040Member 2024-09-05 2024-09-05 0000732712 vz:A3850FixedRateNotesDue2041Member 2024-09-05 2024-09-05 0000732712 exch:XNYS us-gaap:CommonStockMember 2024-09-05 2024-09-05 0000732712 exch:XNCM us-gaap:CommonStockMember 2024-09-05 2024-09-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 5, 2024

VERIZON COMMUNICATIONS INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

|

|

|

| 1-8606 |

|

23-2259884 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

1095 Avenue of the Americas

New York, New York |

|

10036 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (212) 395-1000

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☒ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of Each Class: |

|

Trading Symbol: |

|

Name of Each Exchange on Which Registered: |

| Common Stock, par value $0.10 |

|

VZ |

|

New York Stock Exchange |

| Common Stock, par value $0.10 |

|

VZ |

|

The Nasdaq Global Select Market |

| 0.875% Notes due 2025 |

|

VZ 25 |

|

New York Stock Exchange |

| 3.25% Notes due 2026 |

|

VZ 26 |

|

New York Stock Exchange |

| 1.375% Notes due 2026 |

|

VZ 26B |

|

New York Stock Exchange |

| 0.875% Notes due 2027 |

|

VZ 27E |

|

New York Stock Exchange |

| 1.375% Notes due 2028 |

|

VZ 28 |

|

New York Stock Exchange |

| 1.125% Notes due 2028 |

|

VZ 28A |

|

New York Stock Exchange |

| 2.350% Fixed Rate Notes due 2028 |

|

VZ 28C |

|

New York Stock Exchange |

| 1.875% Notes due 2029 |

|

VZ 29B |

|

New York Stock Exchange |

| 0.375% Notes due 2029 |

|

VZ 29D |

|

New York Stock Exchange |

| 1.250% Notes due 2030 |

|

VZ 30 |

|

New York Stock Exchange |

| 1.875% Notes due 2030 |

|

VZ 30A |

|

New York Stock Exchange |

| 4.250% Notes due 2030 |

|

VZ 30D |

|

New York Stock Exchange |

| 2.625% Notes due 2031 |

|

VZ 31 |

|

New York Stock Exchange |

| 2.500% Notes due 2031 |

|

VZ 31A |

|

New York Stock Exchange |

| 3.000% Fixed Rate Notes due 2031 |

|

VZ 31D |

|

New York Stock Exchange |

| 0.875% Notes due 2032 |

|

VZ 32 |

|

New York Stock Exchange |

| 0.750% Notes due 2032 |

|

VZ 32A |

|

New York Stock Exchange |

| 3.500% Notes due 2032 |

|

VZ 32B |

|

New York Stock Exchange |

| 1.300% Notes due 2033 |

|

VZ 33B |

|

New York Stock Exchange |

| 4.75% Notes due 2034 |

|

VZ 34 |

|

New York Stock Exchange |

| 4.750% Notes due 2034 |

|

VZ 34C |

|

New York Stock Exchange |

| 3.125% Notes due 2035 |

|

VZ 35 |

|

New York Stock Exchange |

| 1.125% Notes due 2035 |

|

VZ 35A |

|

New York Stock Exchange |

| 3.375% Notes due 2036 |

|

VZ 36A |

|

New York Stock Exchange |

| 3.750% Notes due 2036 |

|

VZ 36B |

|

New York Stock Exchange |

| 2.875% Notes due 2038 |

|

VZ 38B |

|

New York Stock Exchange |

| 1.875% Notes due 2038 |

|

VZ 38C |

|

New York Stock Exchange |

| 1.500% Notes due 2039 |

|

VZ 39C |

|

New York Stock Exchange |

| 3.50% Fixed Rate Notes due 2039 |

|

VZ 39D |

|

New York Stock Exchange |

| 1.850% Notes due 2040 |

|

VZ 40 |

|

New York Stock Exchange |

| 3.850% Fixed Rate Notes due 2041 |

|

VZ 41C |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

| Item 7.01 |

Regulation FD Disclosure. |

As previously disclosed, on September 4, 2024, Verizon Communications Inc., a Delaware corporation (“Verizon”), Frontier Communications Parent, Inc., a Delaware corporation (“Frontier”) and France Merger Sub Inc., a Delaware corporation and a wholly-owned subsidiary of Verizon (“Merger Sub”), entered into an Agreement and Plan of Merger (the “Merger Agreement”), pursuant to which, upon the terms and subject to the conditions set forth therein, among other things, Merger Sub will merge with and into Frontier, with Frontier surviving such merger as the surviving corporation (collectively with the other transactions contemplated by the Merger Agreement, the “Transactions”).

On September 5, 2024, Verizon hosted a webcast to discuss the Transactions and made available an investor presentation relating to the Transactions and, additionally, certain executives of Verizon attended the Citi 2024 Global TMT Conference (the “Citi Conference”) and discussed the Transactions. Also on September 5, 2024, Verizon sent an email regarding the Transactions to members of the media and a separate email regarding the Transactions to its employees.

Lastly, on September 5, 2024, Verizon’s Chief Executive Officer Hans Vestberg appeared on CNBC’s Squawk Box (the “Squawk Box Interview”) to discuss the Transactions.

Copies of the transcript of the webcast, the investor presentation, a transcript of the discussion at the Citi Conference related to the Transactions, the text of the email to members of the media, the text of the email to Verizon employees and the transcript of the Squawk Box Interview are attached as Exhibit 99.1, Exhibit 99.2, Exhibit 99.3, Exhibit 99.4, Exhibit 99.5, and Exhibit 99.6, respectively, to this Current Report on Form 8-K and the information contained therein is incorporated by reference into this Item 7.01.

Exhibit 99.1, Exhibit 99.2, Exhibit 99.3, Exhibit 99.4, Exhibit 99.5 and Exhibit 99.6 are being furnished, not filed, pursuant to this Item 7.01. Accordingly, such information will not be incorporated by reference into any filing filed by Verizon under the Securities Act or the Exchange Act, unless specifically identified therein as being incorporated by reference therein. The furnishing of the information in this Current Report on Form 8-K is not intended to, and does not, constitute a determination or admission by Verizon that such information is material or complete, or that investors should consider this information before making an investment decision with respect to any security of Verizon.

Forward-Looking Statements

In this report, we have made forward-looking statements. These statements are based on our estimates and assumptions and are subject to risks and uncertainties. Forward-looking statements include the information concerning our possible or assumed future results of operations. Forward-looking statements also include those preceded or followed by the words “anticipates,” “assumes,” “believes,” “estimates,” “expects,” “forecasts,” “hopes,” “intends,” “plans,” “targets” or similar expressions. For those statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. For a discussion of some of the risks and important factors that could affect such forward-looking statements, see our and Frontier’s most recent annual and quarterly reports and other filings filed with the SEC.

Factors which could have an adverse effect on our operations and future prospects include, but are not limited to, the following: risks relating to the Transactions, including in respect of the ability to obtain required regulatory approvals and the requisite company stockholder approval, and the satisfaction of other closing conditions on a timely basis or at all; unanticipated difficulties and/or expenditures relating to the Transactions and any related financing; uncertainties as to the timing of the completion of the Transactions; litigation relating to the Transactions; the impact of the Transactions on each company’s business operations (including the threatened or actual loss of subscribers, employees or suppliers); the inability to obtain, or delays in obtaining cost savings and synergies from the Transactions; incurrence of unexpected costs and expenses in connection with the Transactions; risks related to changes in the financial, equity and debt markets; and risks related to political, economic and market conditions. In addition, the risks to which Frontier’s business is subject, including those risks set forth in Part I, Item 1A of Frontier’s most recent Annual Report on Form 10-K and its periodic reports filed with the SEC, could adversely affect the Transactions and, following the completion of the Transactions, our operations and future prospects.

Important Additional Information and Where to Find It

In connection with the Transactions, Frontier intends to file with the SEC a proxy statement on Schedule 14A (the “Proxy Statement”), in preliminary and definitive form, the definitive version of which will be sent or provided to Frontier stockholders. Verizon or Frontier may also file other relevant documents with the SEC regarding the Transactions. This document is not a substitute for the Proxy Statement or any other document which Frontier may file with the SEC. Promptly after filing its definitive Proxy Statement with the SEC, Frontier will mail or provide the

definitive Proxy Statement and a proxy card to each Frontier stockholder entitled to vote at the meeting relating to the Transactions. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC (WHEN THEY ARE AVAILABLE), AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE TRANSACTIONS BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTIONS AND RELATED MATTERS. Investors and security holders may obtain free copies of the Proxy Statement and other documents that are filed or will be filed with the SEC by Frontier or Verizon (when they are available) through the website maintained by the SEC at www.sec.gov, Frontier’s investor relations website at investor.frontier.com or Verizon’s investor relations website at verizon.com/about/investors.

Participants in the Solicitation

Verizon may be deemed to be a “participant” in the solicitation of proxies from the stockholders of Frontier in connection with the Transactions. Additional information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, will be included in Frontier’s definitive Proxy Statement relating to the Transactions when it is filed by Frontier with the SEC. These documents (when available) may be obtained free of charge from the SEC’s website at www.sec.gov or Frontier’s website at investor.frontier.com.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

|

|

|

Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Webcast Transcript, dated as of September 5, 2024. |

|

|

| 99.2 |

|

Investor Presentation, dated as of September 5, 2024. |

|

|

| 99.3 |

|

Citi Conference Transcript, dated as of September 5, 2024. |

|

|

| 99.4 |

|

Text of Email to Media, dated as of September 5, 2024. |

|

|

| 99.5 |

|

Text of Email to Verizon Employees, dated as of September 5, 2024. |

|

|

| 99.6 |

|

Transcript of the Squawk Box Interview, as of September 5, 2024. |

|

|

| 104 |

|

Cover Page Interactive Data File (formatted as inline XBRL) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

| VERIZON COMMUNICATIONS INC. |

|

|

| By: |

|

/s/ William L. Horton, Jr. |

| Name: |

|

William L. Horton, Jr. |

| Title: |

|

Senior Vice President, Deputy General Counsel and Corporate Secretary |

Date: September 5, 2024

Exhibit 99.1

Event ID: 139328422003

Event Name: Verizon Communications

Inc to Acquire Frontier Communications Parent Inc Call

Event Date:

2024-09-05T12:00:00 UTC

P: Operator;;

C: Brady Connor;Verizon Communications Inc;Senior Vice President

C: Hans Vestberg;Verizon Communications Inc;Chairman of the Board, Chief Executive Officer

C: Anthony Skiadas;Verizon Communications Inc;Chief Financial Officer

C: Sowmyanarayan Sampath;Verizon Communications Inc;Executive Vice President and CEO of Verizon Consumer Group (VCG)

C: Joseph Russo;Verizon Communications Inc;Executive Vice President and President - Global Networks and Technology

P: John Hodulik;UBS;Analyst

P: Simon Flannery;Morgan

Stanley;Analyst

P: James Schneider;Goldman Sachs;Analyst

P:

Bryan Kraft;Deutsche Bank;Analyst

P: Frank Louthan;Raymond James;Analyst

P: Craig Moffett;MoffettNathanson;Analyst

P: Timothy

Horan;Oppenheimer;Analyst

Operator^ Good morning, and welcome to the Verizon conference call following the announcement of the acquisition of

Frontier Communications. (Operator Instructions) Today’s conference is being recorded. If you have any objections, you may disconnect at this time.

It is now my pleasure to turn the call over to your host, Mr. Brady Connor, Head of Investor Relations.

Brady Connor^ Good morning, everyone. Thank you for joining us on such short notice. I’m Brady Connor, Head of Investor Relations. I’m joined

today by our Chairman and Chief Executive Officer, Hans Vestberg; and our Chief Financial Officer, Tony Skiadas. We also have Sampath, Kyle, and Joe, the heads of our consumer, business, and network teams on the line with us that they can be in a

position to respond to your questions.

Before we begin, I’d like to draw your attention to our safe harbor statement, which can be found on slide 2

of the presentation. Information in this presentation contains statements about expected future events and financial results that are forward-looking and subject to risks and uncertainties. Discussions of factors that may affect future results are

contained in Verizon’s filings with the SEC, which are available on our Investor Relations website.

In connection with the proposed transaction that

we will discuss today, Verizon may be deemed to be a participant in the solicitation of Frontier stockholders. Information about our direct and indirect interest in the proposed transaction will be included in the proxy statement that Frontier will

file with the SEC and send to its stockholders.

With that, I’ll turn the call over to Hans.

Hans Vestberg^ Thank you, Brady, and thank you, everyone, for joining us at the short notice. I’m going to start on slide 3. Today, we announced

that we have agreed to acquire Frontier Communications in an all-cash transaction valued at $20 billion. At closing, this acquisition will significantly expand Verizon’s fiber footprint, accelerating

our delivery of premium mobility and broadband services to current and new customers. It will also power Verizon’s intelligent Edge network for digital innovation like AI and IoT.

It’s important to note that everything we’re talking about today is 100% aligned with our core strategy to grow connections and value of customer

relationship at the highest return on investment, and is aligned to our three financial pillars: grow service revenue and expand EBITDA and free cash flow. We have been on a journey focused on executing on our strengths while leading the industry

and expanding options for both our consumers and business customers. Acquiring Frontier and its fiber assets is an important next step for us.

Verizon

has always been customer-first, and this announcement is about the customer. Connectivity is essentially in nearly every part of our lives and work and no one delivers better than Verizon. We offer more choice, flexibility and value, and we

continuously look for ways to provide the best product and network experience as we bolster our position as a provider of choice.

Let me take you through

why we’re confident Frontier brings strategic customer and financial benefits. To start, we’re expanding Verizon’s addressable market. We’ll be able to provide our award-winning fiber services to more consumers and small

businesses in more markets. We are also strengthening our position and product differentiation in mobility and home by uniting Frontier’s premium broadband offering with Verizon’s premium mobile offering. We were able to build deeper

relationship with our customers.

Verizon will also extend our premium offerings and experiences to Frontier’s customers as part of this transaction.

This means that those customers previously outside Verizon’s fiber footprint are expected to gain more choice and access to Verizon’s premium mobility, home internet, streaming, and connected home offerings at close.

Verizon is one of the original fiber players. This month marked the 20 years of Fios and no one does it better. Adding the Frontier network to our best-in-class Fios offering is a combination that can’t be beat. We already have a rapidly growing customer base in fixed wireless access. We have the best mobility

customer base in the industry. Now we’re adding size and scale to our best-in-class fiber offering.

Finally, the acquisition delivered substantial financial benefits. It is expected to be accretive to our revenue and adjusted EBITDA growth at close and to

deliver significant cost synergies and maintain our strong balance sheet and capital allocation priorities. We see tremendous opportunity with Frontier as part of our team. The nation’s best carrier is adding more size and scale to its fiber

portfolio to pair with our rapidly growing fixed wireless access customer base. With unparalleled strength in broadband and wireless, the best wireless network and the best customer base, we are differentiated from our competitors in a significant

way.

Moving to slide 4. You can see the combined coverage map with Verizon and Frontier together. Over the past

10 years, Frontier has transformed itself into a cutting-edge fiber network provider. It has invested $4.1 billion over approximately four years in upgrading its network and replacing antiquated copper lines. Today, Frontier derives more than

50% of its revenue from fiber products. It also maintains a Net Promoter Score six times higher than the closest cable competitor.

Frontier fiber meets

Verizon’s award-winning fiber standards. This means that, together, Verizon and Frontier have a combined 25 million fiber passings in 31 states and Washington, DC, with networks that can immediately be integrated after closing. You can see

on the slide that acquiring Frontier will give Verizon access to high-quality customer base in markets nationwide that are highly complementary with our Northeast and Mid-Atlantic focus.

In addition, Frontier intends to maintain its plan to build out 2.8 million passings and reach its goal of 10 million locations by 2026. As we look

to increase the reach of our products and services, Verizon is well positioned with stores throughout the Frontier territory. This means that in addition to offering our fiber services, we will also be able to sell and service our new customers

locally.

We have been strategically focused on our core mobility and broadband offerings. You can see that we’ve taken a number of steps to reach

this point, expanding and adapting the core of our business, mobility and broadband, through both inorganic and organic growth.

We have built a network

called the Verizon intelligent Edge network for wireless residential and business services to expand our network reach. We entered a value mobility market in a big way through our acquisition of TracFone in 2021. We have invested to improve our core

mobility business, and we innovated in broadband to deliver choice, flexibility, and value for our home and mobile customers. Upon close, we will have the capability to accelerate our premium broadband across the nation to 1 million more

customers, reinforcing our unique position in mobility and broadband.

Turning to slide 6. You can see on the left how fiber and fixed wireless access are

winning in the market. Fiber and fixed wireless access has added well over 100% of the industry’s net add growth over the last five quarters. With Frontier’s fiber added to our portfolio, we will be the only carrier that will have size and

scale in both fiber and fixed wireless access. Today, Verizon and Frontier have approximately 10 million fiber customers across 31 states and Washington, DC, with fiber network passing approximately 25 million premises and both companies

expect to increase their fiber penetration between now and closing.

Fiber clearly continues to outperform cable and drive better NPS; you can see that in

the statistics on the page. In addition, our fixed wireless access offering covers 60 million households, providing even more choice and connectivity for all customer segments. Between the best network, the best customer base, and scale in

fiber and fixed wireless access, we have the strongest, most differentiated offering among our competitors.

Moving now to slide 7. We have the opportunity to unite Frontier’s premium broadband offering with

Verizon’s premium mobile offering. This is a powerful and very strategic combination. Our team has demonstrated we can create value through mobile and home convergence in the Fios base. Frontier expands our fiber footprint in 22 new states to

benefit customers, allowing us to extend our offerings, choices, and experience to Frontier’s customers.

At the same time, we’re expanding our

addressable markets for customers that will benefit from exclusive value with our premium mobility, home internet, streaming, and connected home offerings. Altogether, this will grow and strengthen customer relationships and further improve our

competitive positions. It’s proven that joint mobile and fiber home customers show increased loyalty and have improved rate of churn by approximately 50% for postpaid mobility. After closing, we expect to drive improved subscriber economics in

Frontier’s broadband business and have an estimated 1 million joint subscriber opportunity.

Now I hand it to Tony to walk through the

transaction details and the financial highlights.

Anthony Skiadas^ Thanks, Hans, and good morning. Let’s go to slide 8. In terms of deal

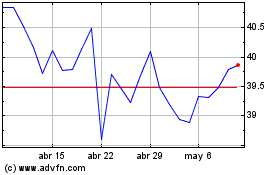

structure, we are acquiring Frontier for $38.50 per share in cash, representing an enterprise value of $20 billion. We expect to refinance Frontier’s existing debt and inherent its existing net operating tax losses. The acquisition is

expected to be accretive to revenue and adjusted EBITDA growth rates upon closing and accretive to EPS beginning in 2027. We see at least $500 million in run rate operating cost synergies expected to be realized by year three. The transaction

is expected to close in approximately 18 months and is subject to a Frontier shareholder vote, customary closing conditions, and regulatory approvals.

With respect to the balance sheet, we expect a modest increase in our net unsecured debt to adjusted EBITDA ratio of approximately 0.2 times to 0.3 times at

closing. Our capital allocation priorities have not changed. Today, we are announcing a significant investment in the business with the acquisition of Frontier. Yesterday, we increased the dividend for the 18th consecutive year, and we continue to

focus on paying down debt. Once we have satisfied the first three priorities, we said we would consider buybacks. As you saw in the release, we also reaffirmed our full-year guidance for 2024.

Now turning to slide 9. We see significant opportunities to realize synergies as part of this acquisition. We are confident in at least $500 million of

run rate operating cost synergies by year three. We expect to achieve these synergies from several sources, including network integration, third-party contract synergies and customer experience improvements, go-to-market savings on marketing and advertising as well as increased efficiencies, and savings from duplicative functions and other efficiencies in wholesale and small business groups. We also believe there

will be opportunity to generate revenue from mobile and home conversions, including cross-selling benefits.

Before we open the call to Q&A, I’ll

turn it back to Hans for some final remarks.

Hans Vestberg^ Thanks, Tony. This is an exciting time for us at Verizon. Nobody manages a network like

we do, and nobody is better positioned to deliver the connectivity services consumers and businesses need in nearly every part of life and work. We power and empower where people live, work, and play, and this transaction is about providing

customers with more choice, flexibility, and value with the best products and network experience.

We’re confident that Frontier brings strategic customer and financial benefits, aligning with

Verizon’s customer-first focus. This transaction builds on hard work over many years from our incredible Verizon team. And we look forward to welcoming Frontier and their customers to the Verizon family.

With that, I hand it back to Brady for Q&A.

Anthony

Skiadas^ Brad, we’re ready to take the first question.

+++

q-and-a

Brady Connor^ (Operator Instructions) John Hodulik, UBS.

John Hodulik^ Congrats on the deal. Two questions, if I could. First, can you talk about any penetration upside you guys forecast in the fiber

region given the ability now to sell wireless bundles plus the distribution of the Verizon stores and the branding? So that’s number one. And then number two, you guys have sort of suggested this in the past, Sampath was talking about

yesterday, 400,000 to 500,000 homes passed per year in region with fiber. Any possibility that given the bigger platform and the bigger scale that you guys could go faster than you’re currently doing in region at this point?

Hans Vestberg^ Thank you, John. I will start and taking the second question, and then I will ask Sampath to answer the first question. Regarding the

400,000 to 500,000, that’s where the Fios footprint has been going on for quite a while, and that’s the plan for this year, as we said. We have to come back what we do in the future. But again, it’s a great asset. Wherever we deploy,

we have very high penetration share and a very good return on investment. So we will come back to that when we take our next steps with our broadband strategy.

Sampath?

Sowmyanarayan Sampath^ Thank you, Hans. In

markets where we have Fios today, our wireless share tends to be 400 to 500 basis points higher than when we don’t have Fios in this market. Over a period of time, once we close, we expect our wireless share in the Frontier markets to grow up

that level as we kind of bring our two bases together.

On fiber penetration, we will bring the power of the Verizon retail fleet to bear and our

distribution in the Frontier markets. And with that, you’re going to see higher penetration pretty soon once we close on the transaction.

Operator^ Simon Flannery, Morgan Stanley.

Simon

Flannery^ Hans, I wonder if you could answer the question why now. In the past, you’ve talked about a national broadband strategy, but it generally involves fiber in region and fixed wireless out of

region. Has there been any change in your perspective on the role of fixed wireless and it’s plays there? Or is it just your success in the convergence that has led you to make this move

here today? And then Tony, thanks for the synergy information. Could you get a little bit more specific on some of the big buckets within that $500 million number? And any cost to achieve on that as well?

Hans Vestberg^ Thank you, Simon. Now on the fixed wireless access, there is no change on our strategic view on that. It’s a great product, very high

NPS, very differentiated with self-install, and that we will continue with. And as we’ve said so many times before, Joe and the team and I have agreed that when we deploy the C-band, we put mobility as

the number one priority, and then fixed wireless access opportune comes along with it. And you will have seen through the years right now how great that has been both from the business side with Kyle, but also, of course, on the consumer side. And

that will continue to and create opportunities across because we want to create this optionality that we have with my home. We have different type of opportunities with fiber, different opportunities with fixed wireless access for different type of

customers. And then we have our streaming services on top of that.

On top of that, we have in-home offerings,

everything from insurance, et cetera. So it’s a way for us to continue to give more value to our customers. And that we’re going to apply in this case as well. So nothing changes in our strategy that we laid out a couple of years ago where

we built one network, try to get as many profitable connections on top of it, and then we have different access technologies for different types of customers in different moments. So that has not changed.

But a little bit changed is, of course, that we saw a build versus buy here. We could have continued to build with our fiber outside the ILEC, but the

economics of this deal and the time to market was, of course, very, very appealing for us. So that’s what it is and the team has done a great job. And of course, just as I said earlier today, when I talk to people, these assets were, of course,

Verizon’s. Some of them, at least from the beginning, my predecessor took the right decision to divest them. They were basically a copper-based asset by then. We needed to invest in other areas, which we did during that time. Now we’re

taking this asset back in a totally different shape with strong fiber footprint. So nothing changed in the strategy of fixed wireless access standard.

Tony?

Anthony Skiadas^ Yes, sure, Simon. So on the

synergies, a few points here. So we said in the prepared remarks that the deal is accretive to both revenue and EBITDA growth upon closing. And we also said it’s accretive to EPS and free cash flow in the first year (sic) [company

clarification: in 2027]. Obviously, there’s cost to achieve in year one.

In terms of the synergies, we said at least $500 million of OpEx

run rate synergies, and we’re very confident in the synergy goal. And obviously, we’ll push for more. In terms of the composition, roughly half of it is the network. If you think about access costs, if you think about transport,

that’s about half of it. And the other half is really around go-to-market. If you think about marketing, advertising and customer experience improvement. And

obviously, there’ll be some redundant costs as well. But that’s where we are at this point.

Simon Flannery^ Great. And then just one follow-up on BEAD.

Does anything change with Frontier’s BEAD strategy as a result of this?

Hans Vestberg^ No. Based on this, the only thing we can confirm that

— their plans to add 3 million passings in the next 1.5 year to ‘26, that we’ll continue, that we support it.

Operator^ Jim

Schneider, Goldman Sachs.

James Schneider^ I was wondering if you could comment first on, ultimately, once you have the combined footprint of

25 million fiber passings, what do you think is your ultimate ambition in terms of overall fiber front, how big can you make that footprint over the long term, say, by 2030?

And then separately, if you look forward and think about the balancing of your CapEx priorities between fixed wireless or overall wireless and fiber, would

you provide — basically lend any more weight to fiber investment relative to wireless on a go-forward basis?

Hans Vestberg^ Thank you for the question. As we estimate right now, we will have 30 million plus (sic) [company correction:

27 million to 28 million] passings when this closes, we estimated 18 months. And there on what’s going to happen after that, we will, of course, continue to be competed on fiber. But I have nothing to disclose right now.

We will do after that. But clearly, fiber has been important. Verizon was first to the market with the Fios product, which is doing the 20 years anniversary right now, which is just amazing. So we are very committed to that.

But we’re also very committed to fixed wireless access. That’s the whole sort of recipe for Verizon strategy. We will give choice to customers, and

we will have it. And we build the networks once. And on top of that, we now have owner’s economics on everything: mobility, fixed wireless access, and fiber. So that scale and distribution, nobody has. And that’s why we see this as fitting

in so well with our strategy.

Operator^ Sebastiano Petti, JPMorgan.

Sebastiano Petti^ Just wanted to follow up on the regulatory process. 18 months seems a little bit on the outside of how we have been thinking about it.

I mean, what are the long poles in the tent there as we should be thinking about that, and why perhaps 18 months relative to what we’ve seen in the past with TracFone and last time when you divested the Frontier was, I think, about a year or

so?

And then, anything to think about — Sampath, you talked about the market share increase being commensurate with your current fiber footprint. It

seems as though now fiber may have a larger part of your long-term convergence strategy. Help us think about what does that mean from a promotional intensity perspective or go to market? I mean, is it more about plugging in the fiber passing on the

Frontier base into, what, the Verizon flywheel? Or should we think about changes to your go-to-market strategy, as I think Hans in the past, you’ve talked about

putting one product versus together with another doesn’t necessarily mean you need to discount both for convergence to work. So any change on the longer-term conversion strategy or how you’re thinking about it would be great?

Hans Vestberg^ Let me start, and I will pass it over to Sampath to dig in a little bit to the

convergence. On the regulatory, I mean, we think this deal is great for the customers and the consumers that’s going to be addressed there. We’re going to have enhanced offerings. We’re going to bring the whole Verizon behind it with

the optionality. However, I mean, there is a process that has gone through. And of course, we have done it before. It’s going to be different states and other agencies that we’re going to do with.

So your guess is equally good as ours. We plan for this, as we communicate right now, 18 months. But of course, we will do everything to see that we can do

this faster.

On the convergence, the only thing I want to say before I hand it over to Sampath, we don’t have any change in how we view convergence.

We think it’s two great products that should not be discounted in order to sell them both, the wireless and broadband are essential today. What we can do is, of course, we can add a lot of scale on top of it and see that our customer gets that

benefit.

Sampath?

Sowmyanarayan Sampath^ Thank you,

Hans. When we do convergence the way Verizon likes it, it tends to be revenue and EBITDA accretive to us. A lot of that relies on the fact that we see a 50% reduction in mobility churn when we bring the two products together in front of the customer

and a 40% reduction in fiber churn when we do that. That translates into accretion, both on revenue and EBITDA, immediately.

The process for us is to

bring it into the Verizon flywheel. We had myPlan launch last year, which is a platform where we have the best connectivity products and then perks on top of that and other services that we add on top of that through digital, through our stores,

through our call centers. That is the flywheel that we’ve built, and the Frontier base post-closing will come right into that base, and we will drive increased penetration from what they have today.

Sebastiano^ Tony, a quick follow-up. Any, but I mean, I would imagine there’s probably some CapEx or

procurement savings as well from a synergy perspective. Any color there?

Anthony Skiadas^ Yes. There’s nothing in there from a CapEx

perspective at this point. So the $500 million is just literally OpEx synergies at this point.

Operator^ Bryan Kraft, Deutsche Bank.

Bryan Kraft^ I guess I just wanted to ask what this means from a broader strategy around fiber. And I don’t mean to ask the question in quite this

way, but I don’t know how else to do it, but could you envision additional acquisitions of fiber broadband operators? Is the goal here to continue to gain scale in this area?

And then secondly, for Tony, can you just give us a sense for what the integration and the cost to achieve might look like?

Hans Vestberg^ Thank you. On the first question, when it comes to our fiber footprint as we close this

one, I think the scale and the distribution we will have at that moment of close is going to be really good. And I think we’re going to be very satisfied with that asset. So right now, we’re, number one, focused on continuing to execute on

our day-to-day operations here and constantly improve the business we have, both in Verizon Business Group and in the Consumer Group. And then when we close this, I

think we’re going to be very happy with the assets we have, and we can address a totally bigger market, which is going to be good for a long-term sustainable growth of the overall company. So the short for it is, we’re happy with these

assets.

Anthony Skiadas^ And then, Brian, just on the integration cost, typically and historically, how we handle this is we’ll share the

integration costs and disclose them as we go, and that will be something we will provide transparency on as we get closer and closer to closing the deal.

Operator^ Frank Louthan, Raymond James.

Frank

Louthan^ Great. Just a follow-up on the last question. Given the synergies there, it seems a pretty good deal to pursue more of these types of acquisitions. From a balance sheet perspective, where would

you be comfortable if there were other assets for sale? And then secondly, on the integration, one of the challenges for these were systems. How much of those overall (sic) [company correction: systems] systems’ completely off? And how

challenging will it be to get back on your systems from those assets to put it back on?

Hans Vestberg^ Thank you. I will ask Joe to comment a little

bit on the systems. On the first one, you’re right. The economics of this deal is really good for us. I mean, as Tony said, accretive on growth of both EBITDA and revenue as we close. But also, we’re adding 0.2 to 0.3 of the leverage the

day of closing. And remember, we have time now to pay down debt until this is done.

So yes, it’s good there, but that doesn’t change sort of if

we’re going to do more M&A or not. We are happy with this right now, and this is a really good asset we have. I’ve said it so many times, we are sort of in the third phase here, after done a lot of changes in the company, the go-to-market, the structure, and then selling and buying assets. Now we add these to the current strategy. So I feel this is much more of an integration to the current core

strategy of the company. And I feel really good about the team’s work that they have been doing to come up to this decision.

Joe?

Joseph Russo^ Thanks, Hans. So as we look at the integration post close of systems, we, after 20 years of leading in Fios have some really

industry-leading customer experience metrics across how we operate the network, how we interface with customers, how we dispatch, et cetera. So our expectation is that we’ll leverage the power of the Verizon systems and processes post close to

bring to bear those benefits to customers in the Frontier footprint. That will take a little bit of time, but we expect to leverage the best of both what Frontier has done and what Verizon has done over the past 20 years on Fios.

Operator^ Craig Moffett, MoffettNathanson.

Craig Moffett^ I wonder if you could just talk about how this changes your strategy in wireless in the areas where you don’t have access to fiber.

And if you kind of envision a world where it seems like not just you, but also your wireless peers are moving toward more of a converged strategy. Does that kind of lead to a world where each of you has a relatively sort of small sets of islands

where you’re competitively advantaged, but that you are, therefore, competitively disadvantaged in other parts of the country?

Hans Vestberg^ I

wouldn’t describe this as small islands. We have a fantastic wireless footprint across the nation, number one with distribution. We are now adding to the fiber footprint and, of course, fixed wireless access, covering more than 60 million

homes right now. As I said before, our strategy with the C-Band deployment has always been mobility first and then adding on to fixed wireless access as an opportunity on the same equipment to get the best

owners economics. So we actually put the same radio base station, we have three business cases, which is very unique, and that’s why this is such a great business together with the fiber we’re now adding.

But maybe Sampath wants to add something to it. Sampath?

Sowmyanarayan Sampath^ By 2026, Craig, we’ll have 30 million (sic) [company correction: 27 million to 28 million]

homes of fiber that we pass. And right now, we are a little north of 60 million homes of FWA. So when you put those two footprints together, we’ll probably have one of the largest broadband footprints available in the space. And two is

both of those are owners economics, a.k.a., we control the underlying network ourselves. So when you put a converged solution together or a mobile plus home, one, we want it to be revenue and EBITDA accretive; two, we want to have owner’s

economics on both the networks. This basically puts us as the number one mobility player in the market and we’ll be amongst the top broadband players when the deal closes. So this puts us in a very strong position, together with FWA and the

fiber piece.

The last one is the value of myHome offering. We have a base offer with base connectivity. And on top of that, we are able to bring perks

and then some other services. It really builds the book of business with our customers and it deepens our relationship with our customers that helps with churn. When you put the two products together, as I said, you see a 50% reduction in mobility

churn and a 40% reduction in fiber churn. We have slightly smaller numbers, but similar numbers on the FWA side as well. So that makes for a really strong economics with a very large base of broadband that we offer.

Brady Connor^ Brad, we have time for one last question.

Operator^ Tim Horan, Oppenheimer.

Timothy Horan^ Can

you give us the number of total homes or POPs passed now with wireline infrastructure for both companies, both copper and fiber? And you’re basically on a 2.5 million fiber home build per year. I mean, post transaction, what would close

that to kind of go up or down?

Sowmyanarayan Sampath^ So Frontier is about 15 million based on what we understand today, and then

you add that to what we have in play, which is about 30 million.

Timothy Horan^ Got it. And what would cause the trajectory of builds to

change? I mean, would more subsidies accelerate or keep it at that pace? Or just any more color around that.

Sowmyanarayan Sampath^ Yes. So Frontier

said that they’re on pace to do 10 million. So they’re going to continue with their build plan. And obviously, as Hans mentioned earlier, we’re doing 400,000 to 500,000 on Fios, and we’ll come back to you with the next steps

on broadband real soon.

Anthony Skiadas^ Yes. Perfect, Tim. Brad, that’s all the time we have today.

Brady Connor^ This concludes the conference call for today. Thank you for your participation and for using Verizon Conference Services. You may now

disconnect.

Forward-Looking Statements

In this

communication, we have made forward-looking statements. These statements are based on our estimates and assumptions and are subject to risks and uncertainties. Forward-looking statements include the information concerning our possible or assumed

future results of operations. Forward-looking statements also include those preceded or followed by the words “anticipates,” “assumes,” “believes,” “estimates,” “expects,” “forecasts,”

“hopes,” “intends,” “plans,” “targets” or similar expressions. For those statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation

Reform Act of 1995. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue

reliance on such forward-looking statements. For a discussion of some of the risks and important factors that could affect such forward-looking statements, see our and Frontier’s most recent annual and quarterly reports and other filings filed

with the SEC.

Factors which could have an adverse effect on our operations and future prospects include, but are not limited to, the following: risks

relating to the proposed transactions, including in respect of the ability to obtain required regulatory approvals and approval by Frontier’s stockholders, and the satisfaction of other closing conditions on a timely basis or at all;

unanticipated difficulties and/or expenditures relating to the proposed transactions and any related financing; uncertainties as to the timing of the completion of the proposed transactions; litigation relating to the proposed transactions; the

impact of the proposed transactions on each company’s business operations (including the threatened or actual loss of subscribers, employees or suppliers); the inability to obtain, or delays in obtaining cost savings and synergies from the

proposed transactions; incurrence of unexpected costs and expenses in connection with the proposed transactions; risks related to changes in the financial, equity and debt markets; and risks related to political, economic and market conditions. In

addition, the risks to which Frontier’s business is subject, including those risks set forth in Part I, Item 1A of Frontier’s most recent Annual Report on Form 10-K and its periodic reports filed

with the SEC, could adversely affect the proposed transactions and, following the completion of the proposed transactions, our operations and future prospects.

Important Additional Information and Where to Find It

In connection with the proposed transactions, Frontier intends to file with the SEC a proxy statement on Schedule 14A (the “Proxy Statement”) in

preliminary and definitive form, the definitive version of which will be sent or provided to Frontier stockholders. Verizon or Frontier may also file other documents with the SEC regarding the proposed transactions.

This document is not a substitute for the Proxy Statement or any other relevant document which Frontier may file with the SEC. Promptly after filing its

definitive Proxy Statement with the SEC, Frontier will mail or provide the definitive Proxy Statement and a proxy card to each Frontier stockholder entitled to vote at the meeting relating to the proposed transactions. INVESTORS AND SECURITY HOLDERS

ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC (WHEN THEY ARE AVAILABLE), AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BEFORE MAKING

ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE TRANSACTIONS BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTIONS AND RELATED MATTERS. Investors and security holders may obtain free copies of the Proxy Statement

and other documents that are filed or will be filed with the SEC by Frontier or Verizon (when they are available) through the website maintained by the SEC at www.sec.gov, Frontier’s investor relations website at investor.frontier.com or

Verizon’s investor relations website at verizon.com/about/investors.

Participants in the Solicitation

Verizon may be deemed to be a “participant” in the solicitation of proxies from the stockholders of Frontier in connection with the proposed

transactions. Additional information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, will be included in Frontier’s definitive Proxy Statement relating to the proposed

transactions when it is filed by Frontier with the SEC. These documents (when available) may be obtained free of charge from the SEC’s website at www.sec.gov or Frontier’s website at investor.frontier.com.

Verizon to acquire Frontier Expands

fiber network to accelerate offering of premium broadband and mobility services to more customers nationwide September 5, 2024 Exhibit 99.2

Forward-Looking Statements In this

communication, we have made forward-looking statements. These statements are based on our estimates and assumptions and are subject to risks and uncertainties. Forward-looking statements include the information concerning our possible or assumed

future results of operations. Forward-looking statements also include those preceded or followed by the words “anticipates,” “assumes,” “believes,” “estimates,” “expects,”

“forecasts,” “hopes,” “intends,” “plans,” “targets” or similar expressions. For those statements, we claim the protection of the safe harbor for forward-looking statements contained in the

Private Securities Litigation Reform Act of 1995. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are

cautioned not to place undue reliance on such forward-looking statements. For a discussion of some of the risks and important factors that could affect such forward-looking statements, see our and Frontier’s most recent annual and quarterly

reports and other filings filed with the SEC. Factors which could have an adverse effect on our operations and future prospects include, but are not limited to, the following: risks relating to the proposed transactions, including in respect of the

ability to obtain required regulatory approvals and approval by Frontier’s stockholders, and the satisfaction of other closing conditions on a timely basis or at all; unanticipated difficulties and/or expenditures relating to the proposed

transactions and any related financing; uncertainties as to the timing of the completion of the proposed transactions; litigation relating to the proposed transactions; the impact of the proposed transactions on each company’s business

operations (including the threatened or actual loss of subscribers, employees or suppliers); the inability to obtain, or delays in obtaining cost savings and synergies from the proposed transactions; incurrence of unexpected costs and expenses in

connection with the proposed transactions; risks related to changes in the financial, equity and debt markets; and risks related to political, economic and market conditions. In addition, the risks to which Frontier’s business is subject,

including those risks set forth in Part I, Item 1A of Frontier’s most recent Annual Report on Form 10-K and its periodic reports filed with the SEC, could adversely affect the proposed transactions and, following the completion of the proposed

transactions, our operations and future prospects. As required by SEC rules, we have provided a reconciliation of the non-GAAP financial measures included in this presentation to the most directly comparable GAAP measures in materials on our website

at www.verizon.com/about/investors.

Transaction will bring strategic,

customer and financial benefits + Expands addressable markets – accelerates offerings of premium broadband and mobility to more customers nationwide Furthers Verizon’s strength and product differentiation in mobility and home Extends

Verizon’s choices and experience to Frontier’s customers Enhances leading broadband footprint with superior scale and distribution

Frontier brings a complementary,

cutting-edge fiber network Verizon Frontier 25M fiber passings in About Frontier Planned fiber footprint of 10M homes by 2026 up from > 7M today Frontier’s NPS is 6x higher than the closest cable competitor(1) Verizon stores throughout

Frontier territory 2.2M fiber subscribers over 25 states(2) 50%+ of revenue and 65% of EBITDA from fiber(2) Fios experience: Immediate integration post-close with Verizon’s best-in-class offering + 31 states + D.C. = Note: figures in millions

Source: (1) Frontier second quarter 2024 results press release (2) Frontier second quarter 2024 results investor presentation

Acquisition of Frontier reinforces

Verizon’s unique position in mobility + broadband Verizon’s strategic focus is on core mobility and broadband offerings Network Reach Verizon Intelligent Network and One Fiber Value Segment Core Mobility mmWave, C-Band and CBRS spectrum

Core Broadband and Mobility Launch of 5G Home, myPlan, and myHome Today – Core Broadband + Accelerating Premium Broadband Nationwide TracFone acquisition

Fiber and FWA are winning by providing

customer choice Source: (1) Public disclosures from Verizon, AT&T, T-Mobile, Comcast, Charter, Altice, CenturyLink, FairPoint, and Frontier (2) Fiber 10x10 with SFP vs. DOCSIS 4.0 (ESD) (3) Marketable performance of DOCSIS 3.1 & XGSPON or

NGPON2 today (4) Federal Communications Commission data, Jan 2021, as analyzed by Nokia in 'DOCSIS 4.0 and PON compared,' 100-200Mbps tier comparative performance Verizon will be uniquely positioned in both Fiber and FWA taking all industry adds

>100% of Industry Net Add Growth Last 5 Quarters(1) ~10 million fiber subscribers and +3.8 million FWA between Verizon and Frontier today Expanding network for myHome and winning Fios offering Fiber outperforms cable and drives better NPS 8-10x

more download capacity(2) 30x faster upload speeds(3) 50% lower latency levels(4) ~60 million customers have access to Verizon’s FWA offering Cable FWA Fiber DSL 0 2022 2023 2024 YTD

Verizon mobile + home in 22 new states

will benefit customers Expands Verizon’s fiber footprint Grows and strengthens customer relationships Extends Verizon’s offerings, choices and experience to Frontier’s customers Expands our addressable markets for core mobility,

streaming, connected home, B2B and SMB Delivers customer savings and services with premium mobility, home internet, streaming and connected home offerings Combines Frontier’s broadband offering with Verizon’s industry-leading mobile

offering Joint Mobile + Fiber Home customers show increased loyalty Expected to drive improved subscriber economics in broadband business 1M Est. joint subscriber opportunity ~50% postpaid mobility churn improvement (1) Estimated Verizon wireless

subscriptions in Frontier’s footprint Proven track record of creating value through mobile & home convergence in the Fios base (1)

Structure and Terms All-cash

consideration to Frontier Communications’ shareholders of $38.50 per share $38.50 per share price implies $20 billion of enterprise value Existing debt at Frontier Communications is expected to be refinanced by Verizon Inheritance of existing

Frontier NOLs Expected Financial Impact Accretive to revenue and adjusted EBITDA growth rates upon closing Accretive to EPS beginning in 2027 At least $500M of run-rate operating cost synergies by year 3 Closing Conditions Subject to Frontier

shareholder vote, customary regulatory approvals and other customary closing conditions Expected closing in ~18 months Capital Allocation Verizon will maintain its capital allocation priorities – led by prudent investment in the business, a

commitment to maintaining an industry-leading dividend and continued de-leveraging Modest increase of pro forma net unsecured leverage of ~0.2x-0.3x at closing Transaction overview and financial highlights

Significant synergy opportunity and

financial benefits Network integration, 3rd party contract synergies and customer experience improvements Go-to-market savings, including marketing and advertising and increased efficiencies Mobile & home cross-sell benefits Savings from

duplicative functions and other efficiencies in the wholesale and small business groups At least $500M Opportunity to generate revenue synergies from mobile + home convergence benefits Run-Rate Operating Cost Synergies by Year 3

Transaction will bring strategic,

customer and financial benefits + Expands addressable markets – accelerates offerings of premium broadband and mobility to more customers nationwide Furthers Verizon’s strength and product differentiation in mobility and home Extends

Verizon’s choices and experience to Frontier’s customers Enhances leading broadband footprint with superior scale and distribution

Q&A

Important Additional Information

and Where to Find It In connection with the proposed transactions, Frontier intends to file with the SEC a proxy statement on Schedule 14A (the “Proxy Statement”) in preliminary and definitive form, the definitive version of which will

be sent or provided to Frontier stockholders. Verizon or Frontier may also file other documents with the SEC regarding the proposed transactions. This document is not a substitute for the Proxy Statement or any other relevant document which Frontier

may file with the SEC. Promptly after filing its definitive Proxy Statement with the SEC, Frontier will mail or provide the definitive Proxy Statement and a proxy card to each Frontier stockholder entitled to vote at the meeting relating to the

proposed transactions. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC (WHEN THEY ARE AVAILABLE), AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE

DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE TRANSACTIONS BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTIONS AND RELATED MATTERS. Investors and security

holders may obtain free copies of the Proxy Statement and other documents that are filed or will be filed with the SEC by Frontier or Verizon (when they are available) through the website maintained by the SEC at www.sec.gov, Frontier’s

investor relations website at investor.frontier.com or Verizon’s investor relations website at verizon.com/about/investors. Participants in the Solicitation Verizon may be deemed to be a “participant” in the solicitation of proxies

from the stockholders of Frontier in connection with the proposed transactions. Additional information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, will be included in

Frontier’s definitive Proxy Statement relating to the proposed transactions when it is filed by Frontier with the SEC. These documents (when available) may be obtained free of charge from the SEC’s website at www.sec.gov or

Frontier’s website at investor.frontier.com.

Exhibit 99.3

Event ID: 140142774759

Event Name: Verizon Communications Inc

at Citi Global TMT Conference

Event Date: 2024-09-05T13:10:00 UTC

C: Joseph Russo;Verizon Communications Inc;Executive Vice President and President - Global Networks and Technology

C: Sowmyanarayan Sampath;Verizon Communications Inc;Executive Vice President and CEO of Verizon Consumer Group (VCG)

P: Michael Rollins;Citi;Analyst

Michael Rollins^ Welcome

back to Citi’s Global TMT Conference. A couple of things to mention. This session is for Citi clients only and disclosures are available at the back of the room near the AV desk. We’re excited to be joined by Verizon today, a day in which

you have some news to share with us. And so thank you so much for being here and being a part of the conference.

From Verizon, I’d like to welcome

Sampath, CEO of the Verizon Consumer Group; Joe Russo, Executive Vice President and President of Global Networks and Technology. Sampath and Joe, thank you so much for being here.

Joseph Russo^ Thank you for having us.

Sowmyanarayan

Sampath^ Thanks for having us.

+++ q-and-a

Michael Rollins^ So the news of the day is Verizon’s announced the acquisition of Frontier. So maybe the first question, I’d like to ask for

both of your perspectives on is can you share with us the broader vision that Verizon is using to engage with the acquisition and think about how the assets for Verizon are going to continue to evolve over time as well as the operating strategy?

Sowmyanarayan Sampath^ Definitely. Before that, the Safe Harbor, I’ll point everyone to the Verizon Investor Relations section, where we have a

Safe Harbor. I’ll ask you all to read it, and this conversation is covered by that Safe Harbor.

So I’ll get started on our overall vision.

Look, our vision — it’s — our fundamental strategy is around bringing broad — premium broadband and premium mobility to American customers. That’s been our fundamentals. Those are the two tailwinds we are running. Those are

the big secular trends we are building on is mobility and broadband. This is doubling down in that.

So this basically expands the fiber footprint,

7 million on homes, now 10 million by 2026. So basically, by the end of 2026, we will have (sic) [company clarification: close to] 30 million homes of the best fiber on earth. So that’s step one.

Then on top of that, you complement that with fixed wireless access, 60 million homes will have access to fixed wireless access. The combination of that is we’ll be able to bring

high-quality broadband to a large portion of America.

Then on top of that, you overlay our mobility network, we are the number one mobility network. And

when you combine the two things, you get incredible value both for customers and for us. To give you a sense, when you bring wireless and fiber together, we see a 50% reduction in mobility churn. And then we also see a 40% reduction in fiber churn

as well that comes with it. So incredibly strong value in this.

The last one is for our Frontier customers, we’ll be able to give them access to our

myHome and myPlan offerings. That’s a really — it’s a differentiated world-class platform where we have connectivity. We have perks that you can’t buy from anywhere else, non-connected

services, then access to our loyalty program. So we’ll be able to bring that.

And what we see is a 400 to 500 basis point higher wireless share in

markets where we have fiber. So once we close on the transaction with Frontier and once we integrate, we’ll be able to see those levels of share gain in the Frontier markets as well.

Joseph Russo^ I think you nailed it.

Michael

Rollins^ So thinking about the strategy then. So 30 million fiber homes, where does Verizon see the need for that fiber passings number to go over a 5, 10-year period? And are there other

opportunities either within this transaction or with other things that Verizon can do to continue to expand upon the opportunity?

Sowmyanarayan

Sampath^ We also have a very large fixed wireless access business. We are committed to getting to 4 million to 5 million customers. It’s available roughly around 60 million homes. Then when we get to 4 million to

5 million in the next quarter — this quarter and coming quarter, we’ll come back and talk about how we expand that footprint. So together with the 30 million homes the fiber and the FWA, we have a really competitive broadband

footprint in large.

And look, in footprint, we continue to add 400,000 to 500,000 OFS every single year. There’s definitely more opportunity to grow

in that space because we’ve gotten better at managing costs deploying faster, but also the benefits from mobility convergence that we typically haven’t had before.

Joseph Russo^ I’ll just add. So if you think about post close, the combined entity will pass around 45 million homes in total, right? So as

Sampath said, we’ll get to around 30 million shortly after close. But as we continue to see our costs improve, technology improve, ARPU improve, penetration improve, the opportunity beyond those, we’ll see how far it takes us.

Michael Rollins^ Frontier has been talking about in the past, they divided their market expansions in waves. So they had this like Wave 3 opportunities

they’ve been contemplating, which they said was on top of the 10 million target, at least another 1 million to 2 million. As part of this, is there a contemplation to accelerate and engage, for example, with that Wave 3

opportunity?

Joseph Russo^ Yeah. So I would say it’s a little early to say at this point. We’ll have to get into that really more post close what the Wave 3 looks like. But we’re also

looking inside our own footprint at what’s next. And as Sampath said, once we hit the 4 million to 5 million fixed wireless access, we’ve committed to come back and saying, what’s our broadband aspirations in both fiber and

fixed wireless access. So stay tuned over the next couple of months for that.

Michael Rollins^ There’s a debate on fixed wireless that

it’s only using up excess capacity. And over time, as the mobile business grows, it continues to eat into that. So fixed wireless is more of a temporal opportunity and fiber is the long-term opportunity. How do you react? And what’s

Verizon’s perspective on that, especially in terms of the durability of your fixed wireless?

Joseph Russo^ First, let me start and just talk

about, by the way, the 20-year Verizon Fios guy, right? So — but for a fiber builder, I love fixed wireless access for a whole bunch of reasons.

First and foremost, our customers love the product. It’s easy to install, great value, provides great reliability and performance. That’s why

we’re selling so much of it, Sampath and Kyle. That being said, it took us 20 years in our ILEC footprint to build out 18 million homes. It’s taken me three years to cover 60 million homes.

So it gives us this great opportunity to serve customers that are in all sorts of areas of this country. Somewhere fiber may reach them someday or today,

somewhere it doesn’t. So giving customers choice, to me, is a key aspect of fixed wireless access.

And I don’t see that as a short-term thing.

I don’t think every customer in the long term is going to want exactly the same kind of throughputs, products, installations. There’s all sorts of value in both fiber as a premium product and in fixed wireless access as a premium product

in a different way.

So we’ll continue to invest in our mid-band rollout. That will give us more addressable

fixed wireless access over the next couple of years, and we’ll see where the technology takes us. I mean the thing I also love about fixed wireless access, comparing it to the days with DSL, is there’s so much investment still happening in

the technology of the radio access network.

So I am absolutely looking forward to increasing our bits per hertz, increasing the way we can do beam

forming and shaping, all of these kind of things give me more and more confidence in the long-term viability of fixed wireless access.

Michael

Rollins^ On the operating side, you mentioned a 50% reduction in mobile churn and 40% reduction in fiber churn. Churn rates for the industry are already, at least for mobile, postpaid phones are fairly low. So can you unpack a little bit more

about what you’re seeing in terms of that stickiness of customer? And does this implicitly mean there’s an almost doubling lifetime value for a customer on these models?

Sowmyanarayan Sampath^ There is a significant increase in lifetime value when the two come together.

And one of the ways we think about convergence is a little different from how convergence played out in Europe.

In Europe, a lot of the convergence was supply led because everyone had access to each other’s network, and it was race to the bottom for the large part.

For us, the way we do conversion, it’s revenue accretive and it’s EBITDA accretive largely driven on the back of churn as well as the ability to sell more services to the family or the home to do that piece.

We — in many cases, we don’t even do a single bill. We offer an affiliate discount on each other’s bill between mobility and home to get to the

right place. So I think there’s a huge increase in lifetime value of a joint customer, and I think it’s only going to keep getting better.

And

lastly, look, we’ll also bring the power of Verizon distribution. In the Northeast, just about 1,000 stores just started selling Fios in the Northeast. Historically not done that, and now we have an opportunity to sell that. Similar, once the

Frontier deal closes, we’ll be able to bring Verizon distribution to bear to a Fios network as well.

Michael Rollins^ In terms of integration,

so the $500 million of cost savings opportunity, can you unpack that a little bit more in terms of the timing and drivers? And as you divested a lot of what’s in Frontier in the past, how would you rate the difficulty or complexity of this

upcoming integration process?

Sowmyanarayan Sampath^ We may know a little bit about the network. I’ll ask Joe to comment on that. But if you

think about it, we think there’s a $0.5 billion of run rate synergies only on the cost side. And roughly, we think about it, half of it is on the network, half of it is on the

go-to-market and G&A piece. So it’s pretty straightforward. We think it’s going to take two to three years to get to the full run rate savings.

And at the end of the day, this deal is accretive for us on EBITDA and revenue growth rates from the first time we close. And then after the first year where

we have a little extra cost to make the synergies happen, it will be accretive to EPS and free cash flow as well. So it’s a very rich deal for us in terms of synergies, and we have a clear path to going and extracting the piece. Last is we know

these assets.

And Joe, maybe comments on that.

Joseph

Russo^ Yes. And to your question, integrations always take care. But this is a business we know. Not only because at one point, we used to operate many parts of Frontier, but we’ve run an ILEC business since beginning of Verizon. So

we’re very familiar with all aspects of what they do.

Their network is very similar to ours. We think there’s a lot of opportunity to integrate

our intelligent edge network into their access network. But generally, we see this as a really great opportunity to bring together the power of the Verizon network with all of the great work they’ve done to fiberize their footprint as well.

Michael Rollins^ And you mentioned the difference in convergence maybe between here and Europe. When you look at convergence and the benefits

you’ve had from bundling in and the overlap, how much of the benefit that you see in the churn, in the market share for mobile penetration?

How much of that’s been intentional where Verizon has actually driven the outcome from a marketing

perspective versus complementary where, just because Verizon has the brand, for example, in the Northeast and you had the Fios in the Northeast, that it just created the advantage that you see?

Sowmyanarayan Sampath^ I’m going to take that answer with FWA and fiber a little differently. In FWA, we were very determined to get that value from

day one. Hence, 75% of our FWA base overlaps with our mobility base. We were very intentional about it. We put programs to make it happen.

We had

incentives in the field. And more importantly, the value prop for the customer made perfect sense to do that piece. We had — they had access to our perks. They had access to our nonconnectivity services on top of it. It makes sense.

On Fios, it’s only a 40% overlap roughly between the two. So we are just getting started on that journey, and we are being a lot more intentional on how

we bring our Fios customers and our mobility customers on the same platform. And that’s why you see on the stores, we just started selling Fios through an assisted sale in our Verizon stores in the Northeast and

Mid-Atlantic area.

So I think it’s a little bit of tale of two cities. But overall, the thesis remains

really strong for us. And once we close on the Frontier transaction, we would have learned a lot more both on fiber and FWA and bring that to the Frontier base immediately.

Michael Rollins^ And how do you contemplate, we talked about the benefits of churn and share, but the dilution and risk to ARPU, whether it’s on a

relationship basis or on a service basis?

Sowmyanarayan Sampath^ If you look at the discounts we offer both, they’re quite minimal between

— when you put a customer on both of them, we offer pretty minimal discounts. On the scheme of things, it’s not a big thing.

But what happens