Cactus, Inc. (NYSE: WHD) (“Cactus” or the “Company”) today

announced financial and operating results for the third quarter of

2024.

Third Quarter Highlights

- Revenue of $293.2 million and operating income of $76.8

million;

- Net income of $62.4 million and diluted earnings per Class A

share of $0.74;

- Adjusted net income(1) of $63.5 million and diluted earnings

per share, as adjusted(1) of $0.79;

- Net income margin of 21.3% and adjusted net income margin(1) of

21.7%;

- Adjusted EBITDA(2) and Adjusted EBITDA margin(2) of $100.4

million and 34.2%, respectively;

- Cash flow from operations of $85.3 million;

- Cash and cash equivalents of $303.4 million, with no bank debt

outstanding as of September 30, 2024; and

- In October 2024, the Board of Directors declared a quarterly

cash dividend of $0.13 per Class A share.

Financial Summary

Three Months Ended

September 30,

June 30,

September 30,

2024

2024

2023

(in thousands)

Revenues

$

293,181

$

290,389

$

287,870

Operating income(3)

$

76,792

$

79,819

$

87,603

Operating income margin

26.2

%

27.5

%

30.4

%

Net income

$

62,437

$

63,059

$

68,019

Net income margin

21.3

%

21.7

%

23.6

%

Adjusted net income(1)

$

63,479

$

65,192

$

63,804

Adjusted net income margin(1)

21.7

%

22.4

%

22.2

%

Adjusted EBITDA(2)

$

100,370

$

103,637

$

103,114

Adjusted EBITDA margin(2)

34.2

%

35.7

%

35.8

%

(1)

Adjusted net income, Adjusted net income

margin and diluted earnings per share, as adjusted are non-GAAP

financial measures. These figures assume Cactus, Inc. held all

units in its operating subsidiary at the beginning of the period.

Additional information regarding non-GAAP measures and the

reconciliation of GAAP to non-GAAP financial measures are in the

Supplemental Information tables.

(2)

Adjusted EBITDA and Adjusted EBITDA margin

are non-GAAP financial measures. See definition of these measures

and the reconciliation of GAAP to non-GAAP financial measures in

the Supplemental Information tables.

(3)

Operating income reflects certain expenses

related to the FlexSteel acquisition, including expenses related to

the remeasurement of the earn-out liability associated with the

FlexSteel acquisition and intangible amortization expenses related

to purchase price accounting. See the reconciliation of GAAP to

non-GAAP financial measures in the Supplemental Information tables

for further details.

Scott Bender, CEO and Chairman of the Board of Cactus,

commented, “Revenues in both segments surpassed our expectations

for the third quarter. I am particularly proud of our Spoolable

Technologies associates who have driven continued segment revenue

outperformance against softer year-to-date U.S. land activity

trends. In addition, we generated substantial free cash flow in the

third quarter with improved working capital performance, and

increased our cash balance by $57 million despite making the final

earn-out payment of $37 million to the sellers of FlexSteel.”

“In the fourth quarter of 2024, we anticipate that the U.S. land

rig count will remain stable from today's levels, with some

potential for reductions in customer activity late in the quarter

due to the holidays, weather, consolidations and the possibility of

some customer budget exhaustion. In Pressure Control, we achieved

high levels of sales per rig followed in the second and third

quarters and anticipate modest reversion in the fourth quarter. In

Spoolable Technologies, we expect a typical seasonal contraction in

the fourth quarter, partially offset by sustained international

activity.”

Mr. Bender concluded, “Although the outlook for U.S. land

drilling activity remains subdued, our business continues to

outperform, generating industry-leading returns and substantial

free cash flow. In the third quarter, we pursued a growth

opportunity and incurred non-routine Corporate expenses as a result

of this effort. We are no longer pursuing this specific

opportunity. Our leadership team remains substantial equity owners,

we will continue to be highly disciplined stewards of our capital

and resources, and we will continue to pursue opportunities that

enhance the Cactus value proposition and build long-term value for

our shareholders.”

Segment Performance

We report two business segments, Pressure Control and Spoolable

Technologies, and starting with the fourth quarter of 2023,

corporate and other expenses not directly attributable to either

segment are presented separately as Corporate and Other Expenses.

These expenses were previously included within the Pressure Control

segment. Prior periods presented have been recast to conform to the

new presentation.

Pressure Control

Third quarter 2024 Pressure Control revenue decreased $2.1

million, or 1.1%, sequentially, primarily due to decreased sales of

wellhead and production related equipment resulting from lower

drilling and completions activity. Operating income decreased $3.1

million, or 5.6%, sequentially, on the lower volume, with margins

decreasing 130 basis points due to miscellaneous charges incurred

in the quarter, including reserves taken in connection with

customer bankruptcies and other litigation claims. Adjusted Segment

EBITDA decreased $3.3 million, or 5.1%, sequentially, with Adjusted

Segment EBITDA margins decreasing 140 basis points.

Spoolable Technologies

Third quarter 2024 Spoolable Technologies revenues increased

$4.4 million, or 4.3%, sequentially, due to increased customer

activity levels. Operating income increased $2.9 million, or 9.5%,

sequentially, primarily due to a lower expense booked as a result

of the remeasurement of the earn-out liability associated with the

FlexSteel acquisition, which was $0.1 million in the third quarter

compared to $2.9 million in the second quarter. Adjusted Segment

EBITDA increased $0.1 million, or 0.2%, sequentially, with Adjusted

Segment EBITDA margins decreasing 160 basis points due to higher

input costs.

Corporate and Other Expenses

Third quarter 2024 Corporate and Other expenses increased $2.8

million, or 46.9%, sequentially, primarily due to professional fees

associated with growth initiatives.

Liquidity, Capital Expenditures and Other

As of September 30, 2024, the Company had $303.4 million of cash

and cash equivalents, no bank debt outstanding, and $220.7 million

of availability on our revolving credit facility. Operating cash

flow was $85.3 million for the third quarter of 2024. During the

third quarter, the Company made dividend payments and associated

distributions of $10.4 million, and also settled the FlexSteel

earnout of $37.1 million.

Net capital expenditures were $10.0 million during the third

quarter of 2024. For the full year 2024, the Company has reduced

its expected net capital expenditures to a range of $32 million to

$37 million due to timing of planned investments.

As of September 30, 2024, Cactus had 66,655,755 shares of Class

A common stock outstanding (representing 83.8% of the total voting

power) and 12,927,927 shares of Class B common stock outstanding

(representing 16.2% of the total voting power).

Quarterly Dividend

The Board of Directors approved a quarterly cash dividend of

$0.13 per share of Class A common stock with payment to occur on

December 19, 2024 to holders of record of Class A common stock at

the close of business on December 2, 2024. A corresponding

distribution of up to $0.13 per CC Unit has also been approved for

holders of CC Units of Cactus Companies, LLC.

Conference Call Details

The Company will host a conference call to discuss financial and

operational results tomorrow, Thursday, October 31, 2024 at 9:00

a.m. Central Time (10:00 a.m. Eastern Time).

The call will be webcast on Cactus’ website at

www.CactusWHD.com. Please access the webcast for the call at least

10 minutes ahead of the start time to ensure a proper connection.

Analysts and institutional investors may click here to pre-register

for the conference call.

An archived webcast of the conference call will be available on

the Company’s website shortly after the end of the call.

About Cactus, Inc.

Cactus designs, manufactures, sells or rents a range of highly

engineered pressure control and spoolable pipe technologies. Its

products are sold and rented principally for onshore unconventional

oil and gas wells and are utilized during the drilling, completion

and production phases of its customers’ wells. In addition, it

provides field services for its products and rental items to assist

with the installation, maintenance and handling of the equipment.

Cactus operates service centers throughout North America and

Australia, while also providing equipment and services in select

international markets.

Cautionary Statement Concerning Forward-Looking

Statements

Certain statements contained in this press release and oral

statements made regarding the matters addressed in this release

constitute “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. These

forward-looking statements are subject to risks, uncertainties and

other factors, many of which are outside of Cactus’ control, that

could cause actual results to differ materially from the results

discussed in the forward-looking statements.

Forward-looking statements can be identified by the use of

forward-looking terminology including “may,” “believe,” “expect,”

“intend,” “anticipate,” “plan,” “should,” “estimate,” “continue,”

“potential,” “will,” “hope,” “opportunity,” or other similar words

and include the Company’s expectation of future performance

contained herein. These statements discuss future expectations,

contain projections of results of operations or of financial

condition, or state other “forward-looking” information. You are

cautioned not to place undue reliance on any forward-looking

statements, which can be affected by assumptions used or by risks

or uncertainties. Consequently, no forward-looking statements can

be guaranteed. When considering these forward-looking statements,

you should keep in mind the risk factors and other factors noted in

the Company’s Annual Report on Form 10-K, any Quarterly Reports on

Form 10-Q and the other documents that the Company files with the

Securities and Exchange Commission. The risk factors and other

factors noted therein could cause actual results to differ

materially from those contained in any forward-looking statement.

Cactus disclaims any duty to update and does not intend to update

any forward-looking statements, all of which are expressly

qualified by the statements in this section, to reflect events or

circumstances after the date of this press release.

Cactus, Inc.

Condensed Consolidated

Statements of Income

(unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

(in thousands, except per

share data)

Revenues

Pressure Control

$

185,099

$

182,484

$

547,319

$

576,273

Spoolable Technologies

108,155

105,386

310,966

245,821

Corporate and other(1)

(73

)

—

(592

)

—

Total revenues

293,181

287,870

857,693

822,094

Operating income (loss)

Pressure Control

52,537

54,822

159,881

180,881

Spoolable Technologies

32,907

39,773

79,341

34,004

Total segment operating income

85,444

94,595

239,222

214,885

Corporate and other expenses

(8,652

)

(6,992

)

(20,061

)

(29,072

)

Total operating income

76,792

87,603

219,161

185,813

Interest income (expense), net

2,062

(1,372

)

4,156

(6,298

)

Other income, net

—

266

—

3,804

Income before income taxes

78,854

86,497

223,317

183,319

Income tax expense

16,417

18,478

48,006

30,553

Net income

$

62,437

$

68,019

$

175,311

$

152,766

Less: net income attributable to

non-controlling interest

12,510

15,439

36,591

32,542

Net income attributable to Cactus,

Inc.

$

49,927

$

52,580

$

138,720

$

120,224

Earnings per Class A share - basic

$

0.75

$

0.81

$

2.10

$

1.87

Earnings per Class A share -

diluted(2)

$

0.74

$

0.80

$

2.09

$

1.82

Weighted average shares outstanding -

basic

66,563

64,879

66,030

64,399

Weighted average shares outstanding -

diluted(2)

80,190

65,486

79,777

79,632

(1)

Represents the elimination of

inter-segment revenue for sales from our Pressure Control segment

to our Spoolable Technologies segment.

(2)

Dilution for the three and nine months

ended September 30, 2024 and for the nine months ended September

30, 2023 includes an additional $12.9 million, $37.8 million and

$33.6 million, respectively, of pre-tax income attributable to

non-controlling interest adjusted for a corporate effective tax

rate of 26.0% and 13.0 million, 13.5 million and 14.8 million

weighted average shares of Class B common stock outstanding,

respectively, plus the effect of dilutive securities. Dilution for

the three months ended September 30, 2023 excludes 14.6 million

shares of Class B common stock as the effect would be

antidilutive.

Cactus, Inc.

Condensed Consolidated Balance

Sheets

(unaudited)

September 30,

December 31,

2024

2023

(in thousands)

Assets

Current assets

Cash and cash equivalents

$

303,376

$

133,792

Accounts receivable, net

196,874

205,381

Inventories

219,799

205,625

Prepaid expenses and other current

assets

10,152

11,380

Total current assets

730,201

556,178

Property and equipment, net

344,183

345,502

Operating lease right-of-use assets,

net

23,589

23,496

Intangible assets, net

167,988

179,978

Goodwill

203,028

203,028

Deferred tax asset, net

203,778

204,852

Other noncurrent assets

8,956

9,527

Total assets

$

1,681,723

$

1,522,561

Liabilities and Equity

Current liabilities

Accounts payable

$

74,897

$

71,841

Accrued expenses and other current

liabilities

79,347

50,654

Earn-out liability

—

20,810

Current portion of liability related to

tax receivable agreement

25,485

20,855

Finance lease obligations, current

portion

7,121

7,280

Operating lease liabilities, current

portion

4,451

4,220

Total current liabilities

191,301

175,660

Deferred tax liability, net

3,160

3,589

Liability related to tax receivable

agreement, net of current portion

241,542

250,069

Finance lease obligations, net of current

portion

10,620

9,352

Operating lease liabilities, net of

current portion

19,414

19,121

Other noncurrent liabilities

3,406

—

Total liabilities

469,443

457,791

Equity

1,212,280

1,064,770

Total liabilities and equity

$

1,681,723

$

1,522,561

Cactus, Inc.

Condensed Consolidated

Statements of Cash Flows

(unaudited)

Nine Months Ended September

30,

2024

2023

(in thousands)

Cash flows from operating

activities

Net income

$

175,311

$

152,766

Reconciliation of net income to net cash

provided by operating activities

Depreciation and amortization

45,124

50,180

Deferred financing cost amortization

840

4,187

Stock-based compensation

15,943

13,526

Provision for expected credit losses

378

2,153

Inventory obsolescence

2,738

3,569

Gain on disposal of assets

(824

)

(1,999

)

Deferred income taxes

12,606

10,723

Change in fair value of earn-out

liability

16,318

12,932

Gain from revaluation of liability related

to tax receivable agreement

—

(3,683

)

Changes in operating assets and

liabilities:

Accounts receivable

8,324

(12,637

)

Inventories

(16,781

)

45,377

Prepaid expenses and other assets

1,065

(7,321

)

Accounts payable

2,871

2,733

Accrued expenses and other liabilities

32,050

2,986

Payments pursuant to tax receivable

agreement

(15,277

)

(26,890

)

Payment of earn-out liability

(31,168

)

—

Net cash provided by operating

activities

249,518

248,602

Cash flows from investing

activities

Acquisition of a business, net of cash and

cash equivalents acquired

—

(616,189

)

Capital expenditures and other

(27,042

)

(33,400

)

Proceeds from sales of assets

2,991

4,347

Net cash used in investing activities

(24,051

)

(645,242

)

Cash flows from financing

activities

Proceeds from the issuance of long-term

debt

—

155,000

Repayments of borrowings of long-term

debt

—

(155,000

)

Net proceeds from the issuance of Class A

common stock

—

169,878

Payments of deferred financing costs

—

(6,857

)

Payment of contingent consideration

(5,960

)

—

Payments on finance leases

(5,881

)

(5,579

)

Dividends paid to Class A common stock

shareholders

(24,821

)

(22,266

)

Distributions to members

(10,444

)

(13,926

)

Repurchases of shares

(9,321

)

(4,599

)

Net cash (used in) provided by financing

activities

(56,427

)

116,651

Effect of exchange rate changes on cash

and cash equivalents

544

(800

)

Net increase (decrease) in cash and cash

equivalents

169,584

(280,789

)

Cash and cash equivalents

Beginning of period

133,792

344,527

End of period

$

303,376

$

63,738

Cactus, Inc. – Supplemental Information

Reconciliation of GAAP to non-GAAP Financial Measures

Adjusted net income, diluted earnings per share, as adjusted and

adjusted net income margin (unaudited)

Adjusted net income, diluted earnings per share, as adjusted and

adjusted net income margin are not measures of net income as

determined by GAAP but they are supplemental non-GAAP financial

measures that are used by management and external users of the

Company’s consolidated financial statements. Cactus defines

adjusted net income as net income assuming Cactus, Inc. held all

units in its operating subsidiary at the beginning of the period,

with the resulting additional income tax expense related to the

incremental income attributable to Cactus, Inc. Adjusted net income

also includes certain other adjustments described below. Cactus

defines diluted earnings per share, as adjusted as Adjusted net

income divided by weighted average shares outstanding, as adjusted.

Cactus defines Adjusted net income margin as Adjusted net income

divided by total revenue. The Company believes this supplemental

information is useful for evaluating performance period over

period.

Three Months Ended

September 30,

June 30,

September 30,

2024

2024

2023

(in thousands, except per

share data)

Net income

$

62,437

$

63,059

$

68,019

Adjustments:

Revaluation gain on TRA liability(1)

—

—

(266

)

Transaction related expenses(2)

2,793

—

1,084

Intangible amortization expense(3)

3,997

3,997

3,997

Remeasurement (gain) loss on earn-out

liability(4)

138

2,876

(5,091

)

Income tax expense differential(5)

(5,886

)

(4,740

)

(3,939

)

Adjusted net income

$

63,479

$

65,192

$

63,804

Diluted earnings per share, as

adjusted

$

0.79

$

0.81

$

0.80

Weighted average shares outstanding, as

adjusted(6)

80,190

79,994

80,037

Revenue

$

293,181

$

290,389

$

287,870

Net income margin

21.3

%

21.7

%

23.6

%

Adjusted net income margin

21.7

%

22.4

%

22.2

%

(1)

Represents non-cash adjustments for the

revaluation of the liability related to the TRA.

(2)

Reflects fees and expenses recorded in

connection with the FlexSteel acquisition and related financing

during 2023 and growth initiatives during 2024.

(3)

Reflects amortization expense associated

with the step-up in intangible value due to purchase price

accounting.

(4)

Represents non-cash adjustments for the

remeasurement of the earn-out liability associated with the

FlexSteel acquisition.

(5)

Represents the increase or decrease in tax

expense as though Cactus, Inc. owned 100% of its operating

subsidiary at the beginning of the period, calculated as the

difference in tax expense recorded during each period and what

would have been recorded, adjusted for pre-tax items listed above,

based on a corporate effective tax rate of 26.0% on income before

income taxes.

(6)

Reflects 66.6, 66.1, and 64.9 million

weighted average shares of basic Class A common stock outstanding

and 13.0, 13.4 and 14.6 million additional shares for the three

months ended September 30, 2024, June 30, 2024, and September 30,

2023, respectively, as if the weighted average shares of Class B

common stock were exchanged and cancelled for Class A common stock

at the beginning of the period, plus the effect of dilutive

securities.

Cactus, Inc. – Supplemental Information

Reconciliation of GAAP to non-GAAP Financial Measures

EBITDA, Adjusted EBITDA and Adjusted EBITDA margin

(unaudited)

EBITDA, Adjusted EBITDA and Adjusted EBITDA margin are not

measures of net income as determined by GAAP but are supplemental

non-GAAP financial measures that are used by management and

external users of the Company’s consolidated financial statements,

such as industry analysts, investors, lenders and rating agencies.

Cactus defines EBITDA as net income excluding net interest, income

tax and depreciation and amortization. Cactus defines Adjusted

EBITDA as EBITDA excluding the other items outlined below.

Cactus management believes EBITDA and Adjusted EBITDA are useful

because they allow management to more effectively evaluate the

Company’s operating performance and compare the results of its

operations from period to period without regard to financing

methods or capital structure, or other items that impact

comparability of financial results from period to period. EBITDA

and Adjusted EBITDA should not be considered as alternatives to, or

more meaningful than, net income or any other measure as determined

in accordance with GAAP. The Company’s computations of EBITDA and

Adjusted EBITDA may not be comparable to other similarly titled

measures of other companies. Cactus defines Adjusted EBITDA margin

as Adjusted EBITDA divided by total revenue. Cactus presents this

supplemental information because it believes it provides useful

information regarding the factors and trends affecting the

Company’s business.

Three Months Ended

Nine Months Ended

September 30,

June 30,

September 30,

September 30,

2024

2024

2023

2024

2023

(in thousands)

Net income

$

62,437

$

63,059

$

68,019

$

175,311

$

152,766

Interest (income) expense, net

(2,062

)

(1,405

)

1,372

(4,156

)

6,298

Income tax expense

16,417

18,165

18,478

48,006

30,553

Depreciation and amortization

15,077

15,001

15,156

45,124

50,180

EBITDA

91,869

94,820

103,025

264,285

239,797

Revaluation gain on TRA liability(1)

—

—

(266

)

—

(3,683

)

Transaction related expenses(2)

2,793

—

1,084

2,793

11,856

Remeasurement (gain) loss on earn-out

liability(3)

138

2,876

(5,091

)

16,318

12,932

Inventory step-up expense(4)

—

—

—

—

23,516

Stock-based compensation

5,570

5,941

4,362

15,943

13,526

Adjusted EBITDA

$

100,370

$

103,637

$

103,114

$

299,339

$

297,944

Revenue

$

293,181

$

290,389

$

287,870

$

857,693

$

822,094

Net income margin

21.3

%

21.7

%

23.6

%

20.4

%

18.6

%

Adjusted EBITDA margin

34.2

%

35.7

%

35.8

%

34.9

%

36.2

%

(1)

Represents non-cash adjustments for the

revaluation of the liability related to the TRA.

(2)

Reflects fees and expenses recorded in

connection with the FlexSteel acquisition and related

financing.

(3)

Represents non-cash adjustments for the

remeasurement of the earn-out liability associated with the

FlexSteel acquisition.

(4)

Represents amortization of the FlexSteel

inventory step-up adjustment due to purchase price accounting.

Cactus, Inc. – Supplemental Information

Reconciliation of GAAP to non-GAAP Financial Measures

Adjusted Segment EBITDA and Adjusted Segment EBITDA margin

(unaudited)

Adjusted Segment EBITDA and Adjusted Segment EBITDA margin are

not measures of net income as determined by GAAP but are

supplemental non-GAAP financial measures that are used by

management and external users of the Company’s consolidated

financial statements, such as industry analysts, investors, lenders

and rating agencies. Cactus defines Adjusted Segment EBITDA as

segment operating income excluding depreciation and amortization

and the other items outlined below, in each case, that are

attributable to the segment.

Cactus management believes Adjusted Segment EBITDA is useful

because it allows management to more effectively evaluate the

Company’s segment operating performance and compare the results of

its segment operations from period to period without regard to

financing methods or capital structure, or other items that impact

comparability of financial results from period to period. Adjusted

Segment EBITDA should not be considered as an alternative to, or

more meaningful than, net income or any other measure as determined

in accordance with GAAP. The Company’s computations of Adjusted

Segment EBITDA may not be comparable to other similarly titled

measures of other companies. Cactus defines Adjusted Segment EBITDA

margin as Adjusted Segment EBITDA divided by total segment revenue.

Cactus presents this supplemental information because it believes

it provides useful information regarding the factors and trends

affecting the Company’s business.

Three Months Ended

Nine Months Ended

September 30,

June 30,

September 30,

September 30,

2024

2024

2023

2024

2023

(in thousands)

Pressure Control

Revenue

$

185,099

$

187,192

$

182,484

$

547,319

$

576,273

Operating income

52,537

55,669

54,822

159,881

180,881

Depreciation and amortization expense

6,592

6,662

6,868

20,065

23,987

Stock-based compensation

2,837

2,978

1,491

7,963

5,185

Adjusted Segment EBITDA

$

61,966

$

65,309

$

63,181

$

187,909

$

210,053

Operating income margin

28.4

%

29.7

%

30.0

%

29.2

%

31.4

%

Adjusted Segment EBITDA margin

33.5

%

34.9

%

34.6

%

34.3

%

36.5

%

Spoolable Technologies

Revenue

$

108,155

$

103,716

$

105,386

$

310,966

$

245,821

Operating income

32,907

30,041

39,773

79,341

34,004

Other non-operating income

—

—

—

—

121

Depreciation and amortization expense

8,485

8,339

8,288

25,059

26,193

Stock-based compensation

1,015

1,200

716

3,089

2,703

Remeasurement (gain) loss on earn-out

liability(1)

138

2,876

(5,091

)

16,318

12,932

Inventory step-up expense(2)

—

—

—

—

23,516

Adjusted Segment EBITDA

$

42,545

$

42,456

$

43,686

$

123,807

$

99,469

Operating income margin

30.4

%

29.0

%

37.7

%

25.5

%

13.8

%

Adjusted Segment EBITDA margin

39.3

%

40.9

%

41.5

%

39.8

%

40.5

%

Corporate and Other

Revenue(3)

$

(73

)

$

(519

)

$

—

$

(592

)

$

—

Corporate and other expenses

(8,652

)

(5,891

)

(6,992

)

(20,061

)

(29,072

)

Stock-based compensation

1,718

1,763

2,155

4,891

5,638

Transaction related expenses(4)

2,793

—

1,084

2,793

11,856

Adjusted Corporate EBITDA

$

(4,141

)

$

(4,128

)

$

(3,753

)

$

(12,377

)

$

(11,578

)

Total revenue

$

293,181

$

290,389

$

287,870

$

857,693

$

822,094

Total operating income

$

76,792

$

79,819

$

87,603

$

219,161

$

185,813

Total operating income margin

26.2

%

27.5

%

30.4

%

25.6

%

22.6

%

Total Adjusted EBITDA

$

100,370

$

103,637

$

103,114

$

299,339

$

297,944

Total Adjusted EBITDA margin

34.2

%

35.7

%

35.8

%

34.9

%

36.2

%

(1)

Represents non-cash adjustments for the

remeasurement of the earn-out liability associated with the

FlexSteel acquisition.

(2)

Represents amortization of the FlexSteel

inventory step-up adjustment due to purchase price accounting.

(3)

Represents the elimination of

inter-segment revenue for sales from our Pressure Control segment

to our Spoolable Technologies segment.

(4)

Reflects fees and expenses recorded in

connection with the FlexSteel acquisition and related financing and

growth initiatives during 2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030945388/en/

Cactus, Inc. Alan Boyd, 713-904-4669 Director of

Corporate Development and Investor Relations IR@CactusWHD.com

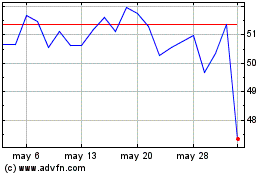

Cactus (NYSE:WHD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Cactus (NYSE:WHD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024