Williams (NYSE: WMB) today announced its unaudited financial

results for the three months ended March 31, 2024.

Business continues to outperform; solid execution on

accretive acquisitions and organic growth driving immediate

returns

- GAAP net income of $631 million, or $0.52 per diluted share

(EPS)

- Adjusted net income of $719 million, or $0.59 per diluted share

(Adj. EPS) – up 5% vs. 1Q 2023

- Adjusted EBITDA of $1.934 billion – up $139 million or 8% vs.

1Q 2023

- Cash flow from operations (CFFO) of $1.234 billion

- Available funds from operations (AFFO) of $1.507 billion – up

$62 million or 4% vs. 1Q 2023

- Dividend coverage ratio of 2.60x (AFFO basis)

- Record contracted transmission capacity of 33.9 Bcf/d – up 4.3%

from 1Q 2023

- Strong 1Q performance driving expectations to top half of 2024

financial guidance range

Recent acquisitions and large roster of projects in execution

building long-term value

- Closed acquisition of 6 storage facilities with total capacity

of 115 Bcf across Louisiana and Mississippi, strategically located

to serve growing LNG exports and power generation demand

- Placed Transco's Carolina Market Link into service 1Q 2024

- Received FERC notice to proceed on Transco's Commonwealth

Energy Connector

- Commenced construction on Transco's Southside Reliability

Enhancement and Southeast Energy Connector

- First phase of Transco's Regional Energy Access continued to

deliver earnings with second phase on track to come online in 4Q

2024

- Received FERC certificate for Transco's Alabama Georgia

Connector and Texas to Louisiana Energy Pathway

- Pre-filed FERC application for Transco's ~1.6 Bcf/d Southeast

Supply Enhancement

- Continued execution of additional transmission, gathering &

processing and Deepwater Gulf of Mexico projects

CEO Perspective

Alan Armstrong, president and chief executive officer, made the

following comments:

“Our 8 percent higher Adjusted EBITDA was driven by the

continued outperformance of our transmission, storage and gathering

businesses, which delivered 13 percent higher Adjusted EBITDA

compared to the same period last year. Contracted transmission

capacity achieved another record in the first quarter and our

Transco projects recently placed into service contributed

additional fee-based revenues, as did our immediately accretive

acquisitions, including the Gulf Coast storage portfolio that we

closed in the quarter.

“Crisp execution by our teams in both integrating newly acquired

assets and building large-scale organic projects has us on track to

be in the top half of our original 2024 guidance range. As our

natural gas-focused strategy continues to gain momentum, we are

successfully executing a full slate of high return growth projects,

with new regulatory milestones reached on seven of our

FERC-regulated expansion projects so far this year and progressing

on a healthy backlog of expansion opportunities to serve

accelerating demand for natural gas.

Armstrong added, “Our track record of generating predictable,

growing earnings in all market cycles underscores the value of

Williams as a resilient, long-term investment with a strong

dividend. We’ve built a business positioned for the future, and

we’re leveraging our existing infrastructure and project

development capabilities to serve rising domestic and global

security needs, while lowering emissions and creating sustainable

value for our shareholders.”

Williams Summary Financial

Information

1Q

Amounts in millions, except ratios and

per-share amounts. Per share amounts are reported on a diluted

basis. Net income amounts are from continuing operations

attributable to The Williams Companies, Inc. available to common

stockholders.

2024

2023

GAAP Measures

Net Income

$

631

$

926

Net Income Per Share

$

0.52

$

0.76

Cash Flow From Operations

$

1,234

$

1,514

Non-GAAP Measures (1)

Adjusted EBITDA

$

1,934

$

1,795

Adjusted Net Income

$

719

$

684

Adjusted Earnings Per Share

$

0.59

$

0.56

Available Funds from Operations

$

1,507

$

1,445

Dividend Coverage Ratio

2.60x

2.65x

Other

Debt-to-Adjusted EBITDA at Quarter End

(2)

3.79x

3.57x

Capital Investments (Excluding

Acquisitions) (3) (4)

$

563

$

525

(1) Schedules reconciling Adjusted Net

Income, Adjusted EBITDA, Available Funds from Operations and

Dividend Coverage Ratio (non-GAAP measures) to the most comparable

GAAP measure are available at www.williams.com and as an attachment

to this news release.

(2) Does not represent leverage ratios

measured for WMB credit agreement compliance or leverage ratios as

calculated by the major credit ratings agencies. Debt is net of

cash on hand, and Adjusted EBITDA reflects the sum of the last four

quarters.

(3) Capital Investments include increases

to property, plant, and equipment (growth & maintenance

capital), purchases of and contributions to equity-method

investments and purchases of other long-term investments.

(4) First-quarter 2024 capital excludes

$1.851 billion for the acquisition of the Gulf Coast Storage

assets, which closed in January 2024. First-quarter 2023 capital

excludes $1.056 billion for the acquisition of MountainWest, which

closed in February 2023.

GAAP Measures

First-quarter 2024 net income decreased by $295 million compared

to the prior year reflecting an unfavorable change of $419 million

in net unrealized gains/losses on commodity derivatives, higher net

interest expense from recent debt issuances and retirements, as

well as higher operating costs, depreciation and interest expense

resulting from recent acquisitions. These unfavorable changes were

partially offset by a $211 million increase in service revenues

driven by acquisitions and expansion projects. The tax provision

decreased primarily due to lower pretax income.

First-quarter 2024 cash flow from operations decreased compared

to the prior year primarily due to unfavorable net changes in both

working capital and derivative collateral requirements.

Non-GAAP Measures

First-quarter 2024 Adjusted EBITDA increased by $139 million

over the prior year, driven by the previously described favorable

net contributions from acquisitions and expansion projects.

First-quarter 2024 Adjusted Net Income improved by $35 million

over the prior year, driven by the previously described impacts to

net income, adjusted primarily to remove the effects of net

unrealized gains/losses on commodity derivatives and the related

income tax effects.

First-quarter Available Funds From Operations (AFFO) increased

by $62 million compared to the prior year primarily due to the

change in operating results exclusive of non-cash items.

Business Segment Results & Form 10-Q

Williams' operations are comprised of the following reportable

segments: Transmission & Gulf of Mexico, Northeast G&P,

West and Gas & NGL Marketing Services, as well as Other. For

more information, see the company's first-quarter 2024 Form

10-Q.

First Quarter

Amounts in millions

Modified EBITDA

Adjusted EBITDA

1Q 2024

1Q 2023

Change

1Q 2024

1Q 2023

Change

Transmission & Gulf of Mexico

$

829

$

715

$

114

$

839

$

728

$

111

Northeast G&P

504

470

34

504

470

34

West

327

304

23

328

286

42

Gas & NGL Marketing Services

101

567

(466

)

189

231

(42

)

Other

76

74

2

74

80

(6

)

Total

$

1,837

$

2,130

$

(293

)

$

1,934

$

1,795

$

139

Note: Williams uses Modified EBITDA for

its segment reporting. Definitions of Modified EBITDA and Adjusted

EBITDA and schedules reconciling to net income are included in this

news release.

Transmission & Gulf of Mexico

First-quarter 2024 Modified and Adjusted EBITDA improved

compared to the prior year driven by favorable net contributions

from the Gulf Coast Storage and MountainWest acquisitions and the

Regional Energy Access expansion project. Modified EBITDA for both

periods was impacted by one-time acquisition costs, which are

excluded from Adjusted EBITDA.

Northeast G&P

First-quarter 2024 Modified and Adjusted EBITDA increased over

the prior year driven by higher rates and volumes at Susquehanna

Supply Hub, higher rates at Cardinal, and higher contribution from

our Aux Sable investment, partially offset by lower volumes at Ohio

Valley Midstream.

West

First-quarter 2024 Modified and Adjusted EBITDA increased

compared to the prior year benefiting from the DJ Basin

Acquisitions and improved commodity margins reflecting favorable

changes in shrink prices related to the absence of a short-term gas

price spike at Opal in 2023, partially offset by lower realized

gains on natural gas hedges. Modified EBITDA was also impacted by

the absence of a 2023 favorable contract settlement, which is

excluded from Adjusted EBITDA.

Gas & NGL Marketing Services

First-quarter 2024 Modified EBITDA decreased from the prior year

primarily reflecting lower commodity marketing margins and a $427

million net unfavorable change in unrealized gains/losses on

commodity derivatives, which is excluded from Adjusted EBITDA.

2024 Financial Guidance

After our strong first-quarter performance, Williams expects

Adjusted EBITDA at the top half of its 2024 guidance range of $6.8

billion and $7.1 billion. The company continues to expect 2024

growth capex between $1.45 billion and $1.75 billion and

maintenance capex between $1.1 billion and $1.3 billion, which

includes capital of $350 million for emissions reduction and

modernization initiatives. For 2025, the company continues to

expect Adjusted EBITDA between $7.2 billion and $7.6 billion with

growth capex between $1.65 billion and $1.95 billion and

maintenance capex between $750 million and $850 million, which

includes capital of $100 million based on midpoint for emissions

reduction and modernization initiatives. Williams continues to

anticipate a leverage ratio midpoint for 2024 of 3.85x and has

increased the dividend by 6.1% on an annualized basis to $1.90 in

2024 from $1.79 in 2023.

Williams' First-Quarter 2024 Materials to be Posted Shortly;

Q&A Webcast Scheduled for Tomorrow

Williams' first-quarter 2024 earnings presentation will be

posted at www.williams.com. The company's first-quarter 2024

earnings conference call and webcast with analysts and investors is

scheduled for Tuesday, May 7, at 9:30 a.m. Eastern Time (8:30 a.m.

Central Time). Participants who wish to join the call by phone must

register using the following link:

https://register.vevent.com/register/BI2af82b1f777e448892c40bafefdffe05

A webcast link to the conference call will be provided on

Williams' Investor Relations website. A replay of the webcast will

also be available on the website for at least 90 days following the

event.

About Williams

Williams (NYSE: WMB) is a trusted energy industry leader

committed to safely, reliably, and responsibly meeting growing

energy demand. We use our 33,000-mile pipeline infrastructure to

move a third of the nation’s natural gas to where it's needed most,

supplying the energy used to heat our homes, cook our food and

generate low-carbon electricity. For over a century, we’ve been

driven by a passion for doing things the right way. Today, our team

of problem solvers is leading the charge into the clean energy

future – by powering the global economy while delivering immediate

emissions reductions within our natural gas network and investing

in new energy technologies. Learn more at www.williams.com.

The Williams Companies,

Inc.

Consolidated Statement of

Income

(Unaudited)

Three Months Ended

March 31,

2024

2023

(Millions, except per-share

amounts)

Revenues:

Service revenues

$

1,905

$

1,694

Service revenues – commodity

consideration

30

36

Product sales

845

845

Net gain (loss) from commodity

derivatives

(9

)

506

Total revenues

2,771

3,081

Costs and expenses:

Product costs

526

553

Net processing commodity expenses

5

54

Operating and maintenance expenses

511

463

Depreciation and amortization expenses

548

506

Selling, general, and administrative

expenses

186

176

Other (income) expense – net

(17

)

(31

)

Total costs and expenses

1,759

1,721

Operating income (loss)

1,012

1,360

Equity earnings (losses)

137

147

Other investing income (loss) – net

24

8

Interest expense

(349

)

(294

)

Other income (expense) – net

31

20

Income (loss) before income taxes

855

1,241

Less: Provision (benefit) for income

taxes

193

284

Net income (loss)

662

957

Less: Net income (loss) attributable to

noncontrolling interests

30

30

Net income (loss) attributable to The

Williams Companies, Inc.

632

927

Less: Preferred stock dividends

1

1

Net income (loss) available to common

stockholders

$

631

$

926

Basic earnings (loss) per common

share:

Net income (loss) available to common

stockholders

$

.52

$

.76

Weighted-average shares (thousands)

1,218,155

1,219,465

Diluted earnings (loss) per common

share:

Net income (loss) available to common

stockholders

$

.52

$

.76

Weighted-average shares (thousands)

1,222,222

1,225,781

The Williams Companies,

Inc.

Consolidated Balance

Sheet

(Unaudited)

March 31,

December 31,

2024

2023

(Millions, except per-share

amounts)

ASSETS

Current assets:

Cash and cash equivalents

$

667

$

2,150

Trade accounts and other receivables (net

of allowance of $3 at March 31, 2024 and December 31, 2023)

1,355

1,655

Inventories

239

274

Derivative assets

173

239

Other current assets and deferred

charges

176

195

Total current assets

2,610

4,513

Investments

4,639

4,637

Property, plant and equipment

54,305

51,842

Accumulated depreciation and

amortization

(17,854

)

(17,531

)

Property, plant, and equipment – net

36,451

34,311

Intangible assets – net of accumulated

amortization

7,496

7,593

Regulatory assets, deferred charges, and

other

1,551

1,573

Total assets

$

52,747

$

52,627

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable

$

1,042

$

1,379

Derivative liabilities

75

105

Accrued and other current liabilities

1,077

1,284

Commercial paper

—

725

Long-term debt due within one year

2,787

2,337

Total current liabilities

4,981

5,830

Long-term debt

24,100

23,376

Deferred income tax liabilities

4,001

3,846

Regulatory liabilities, deferred income,

and other

4,735

4,684

Contingent liabilities and commitments

Equity:

Stockholders’ equity:

Preferred stock ($1 par value; 30 million

shares authorized at March 31, 2024 and December 31, 2023; 35,000

shares issued at March 31, 2024 and December 31, 2023)

35

35

Common stock ($1 par value; 1,470 million

shares authorized at March 31, 2024 and December 31, 2023; 1,258

million shares issued at March 31, 2024 and 1,256 million shares

issued at December 31, 2023)

1,258

1,256

Capital in excess of par value

24,564

24,578

Retained deficit

(12,238

)

(12,287

)

Accumulated other comprehensive income

(loss)

10

—

Treasury stock, at cost (39 million shares

at March 31, 2024 and December 31, 2023 of common stock)

(1,180

)

(1,180

)

Total stockholders’ equity

12,449

12,402

Noncontrolling interests in consolidated

subsidiaries

2,481

2,489

Total equity

14,930

14,891

Total liabilities and equity

$

52,747

$

52,627

The Williams Companies,

Inc.

Consolidated Statement of Cash

Flows

(Unaudited)

Three Months Ended

March 31,

2024

2023

(Millions)

OPERATING ACTIVITIES:

Net income (loss)

$

662

$

957

Adjustments to reconcile to net cash

provided (used) by operating activities:

Depreciation and amortization

548

506

Provision (benefit) for deferred income

taxes

152

283

Equity (earnings) losses

(137

)

(147

)

Distributions from equity-method

investees

188

208

Net unrealized (gain) loss from commodity

derivative instruments

92

(327

)

Inventory write-downs

4

18

Amortization of stock-based awards

24

17

Cash provided (used) by changes in current

assets and liabilities:

Accounts receivable

314

1,269

Inventories

34

27

Other current assets and deferred

charges

9

(4

)

Accounts payable

(309

)

(1,017

)

Accrued and other current liabilities

(218

)

(318

)

Changes in current and noncurrent

commodity derivative assets and liabilities

(68

)

82

Other, including changes in noncurrent

assets and liabilities

(61

)

(40

)

Net cash provided (used) by operating

activities

1,234

1,514

FINANCING ACTIVITIES:

Proceeds from (payments of) commercial

paper – net

(723

)

(352

)

Proceeds from long-term debt

2,099

1,502

Payments of long-term debt

(1,012

)

(7

)

Payments for debt issuance costs

(16

)

(8

)

Proceeds from issuance of common stock

5

3

Purchases of treasury stock

—

(74

)

Common dividends paid

(579

)

(546

)

Dividends and distributions paid to

noncontrolling interests

(64

)

(54

)

Contributions from noncontrolling

interests

26

3

Other – net

(17

)

(17

)

Net cash provided (used) by financing

activities

(281

)

450

INVESTING ACTIVITIES:

Property, plant, and equipment:

Capital expenditures (1)

(544

)

(545

)

Dispositions - net

5

(7

)

Purchases of businesses, net of cash

acquired

(1,851

)

(1,056

)

Purchases of and contributions to

equity-method investments

(52

)

(39

)

Other – net

6

8

Net cash provided (used) by investing

activities

(2,436

)

(1,639

)

Increase (decrease) in cash and cash

equivalents

(1,483

)

325

Cash and cash equivalents at beginning of

year

2,150

152

Cash and cash equivalents at end of

period

$

667

$

477

(1) Increases to property, plant, and

equipment

$

(509

)

$

(484

)

Changes in related accounts payable and

accrued liabilities

(35

)

(61

)

Capital expenditures

$

(544

)

$

(545

)

Transmission & Gulf of

Mexico

(UNAUDITED)

2023

2024

(Dollars in millions)

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

Year

1st Qtr

Regulated interstate natural gas

transportation, storage, and other revenues (1)

$

774

$

786

$

794

$

822

$

3,176

$

836

Gathering, processing, storage and

transportation revenues

100

104

114

100

418

137

Other fee revenues (1)

6

8

5

4

23

12

Commodity margins

10

8

7

8

33

9

Operating and administrative costs (1)

(254

)

(254

)

(257

)

(270

)

(1,035

)

(254

)

Other segment income (expenses) - net

(1)

26

31

36

26

119

43

Gain on sale of business

—

—

130

(1

)

129

—

Proportional Modified EBITDA of

equity-method investments

53

48

52

52

205

46

Modified EBITDA

715

731

881

741

3,068

829

Adjustments

13

17

(127

)

11

(86

)

10

Adjusted EBITDA

$

728

$

748

$

754

$

752

$

2,982

$

839

Statistics for Operated Assets

Natural Gas Transmission (2)

Transcontinental Gas Pipe Line

Avg. daily transportation volumes

(MMdth)

14.3

13.2

14.0

14.0

13.9

14.6

Avg. daily firm reserved capacity

(MMdth)

19.5

19.4

19.4

19.3

19.4

20.3

Northwest Pipeline LLC

Avg. daily transportation volumes

(MMdth)

3.1

2.3

2.3

2.8

2.6

3.1

Avg. daily firm reserved capacity

(MMdth)

3.8

3.8

3.8

3.8

3.8

3.8

MountainWest (3)

Avg. daily transportation volumes

(MMdth)

4.2

3.2

3.8

4.2

3.9

4.3

Avg. daily firm reserved capacity

(MMdth)

7.8

7.5

7.5

7.9

7.7

8.4

Gulfstream - Non-consolidated

Avg. daily transportation volumes

(MMdth)

1.0

1.2

1.4

1.1

1.2

1.0

Avg. daily firm reserved capacity

(MMdth)

1.4

1.4

1.4

1.4

1.4

1.4

Gathering, Processing, and Crude Oil

Transportation

Consolidated (4)

Gathering volumes (Bcf/d)

0.28

0.23

0.27

0.27

0.26

0.25

Plant inlet natural gas volumes

(Bcf/d)

0.43

0.40

0.46

0.46

0.44

0.45

NGL production (Mbbls/d)

28

24

28

26

27

28

NGL equity sales (Mbbls/d)

7

5

6

5

6

5

Crude oil transportation volumes

(Mbbls/d)

119

111

134

130

123

118

Non-consolidated (5)

Gathering volumes (Bcf/d)

0.36

0.30

0.36

0.33

0.34

0.27

Plant inlet natural gas volumes

(Bcf/d)

0.36

0.30

0.36

0.33

0.34

0.27

NGL production (Mbbls/d)

28

21

30

28

27

15

NGL equity sales (Mbbls/d)

8

3

8

7

7

3

(1) Excludes certain amounts associated

with revenues and operating costs for tracked or reimbursable

charges.

(2) Tbtu converted to MMdth at one

trillion British thermal units = one million dekatherms.

(3) Includes 100% of the volumes

associated with the MountainWest Acquisition transmission assets

after the purchase on February 14, 2023, including 100% of the

volumes associated with the operated equity-method investment White

River Hub, LLC. Average volumes were calculated over the period

owned.

(4) Excludes volumes associated with

equity-method investments that are not consolidated in our

results.

(5) Includes 100% of the volumes

associated with operated equity-method investments, including

Discovery Producer Services.

Northeast G&P

(UNAUDITED)

2023

2024

(Dollars in millions)

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

Year

1st Qtr

Gathering, processing, transportation, and

fractionation revenues

$

391

$

431

$

417

$

411

$

1,650

$

411

Other fee revenues (1)

32

27

27

28

114

34

Commodity margins

5

(1

)

7

1

12

11

Operating and administrative costs (1)

(101

)

(101

)

(115

)

(107

)

(424

)

(108

)

Other segment income (expenses) - net

—

—

(1

)

(9

)

(10

)

(1

)

Proportional Modified EBITDA of

equity-method investments

143

159

119

153

574

157

Modified EBITDA

470

515

454

477

1,916

504

Adjustments

—

—

31

8

39

—

Adjusted EBITDA

$

470

$

515

$

485

$

485

$

1,955

$

504

Statistics for Operated Assets

Gathering and Processing

Consolidated (2)

Gathering volumes (Bcf/d)

4.42

4.61

4.41

4.37

4.45

4.33

Plant inlet natural gas volumes

(Bcf/d)

1.92

1.79

1.93

1.93

1.89

1.76

NGL production (Mbbls/d)

144

135

144

133

139

133

NGL equity sales (Mbbls/d)

1

1

—

1

1

1

Non-consolidated (3)

Gathering volumes (Bcf/d)

6.97

7.03

6.83

6.85

6.92

6.79

Plant inlet natural gas volumes

(Bcf/d)

0.77

0.93

0.99

1.01

0.93

0.98

NGL production (Mbbls/d)

54

64

71

69

65

72

NGL equity sales (Mbbls/d)

4

5

4

4

4

3

(1) Excludes certain amounts associated

with revenues and operating costs for reimbursable charges.

(2) Includes volumes associated with

Susquehanna Supply Hub, the Northeast JV, and Utica Supply Hub, all

of which are consolidated.

(3) Includes 100% of the volumes

associated with operated equity-method investments, including the

Laurel Mountain Midstream partnership and Blue Racer Midstream

which we operate effective January 1, 2024; and the Bradford Supply

Hub and the Marcellus South Supply Hub within the Appalachia

Midstream Services partnership.

West

(UNAUDITED)

2023

2024

(Dollars in millions)

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

Year

1st Qtr

Net gathering, processing, transportation,

storage, and fractionation revenues

$

382

$

373

$

371

$

397

$

1,523

$

421

Other fee revenues (1)

5

7

4

8

24

8

Commodity margins

(24

)

18

21

19

34

12

Operating and administrative costs (1)

(115

)

(122

)

(122

)

(144

)

(503

)

(139

)

Other segment income (expenses) - net

23

(7

)

(4

)

(14

)

(2

)

—

Proportional Modified EBITDA of

equity-method investments

33

43

45

41

162

25

Modified EBITDA

304

312

315

307

1,238

327

Adjustments

(18

)

—

—

16

(2

)

1

Adjusted EBITDA

$

286

$

312

$

315

$

323

$

1,236

$

328

Statistics for Operated Assets

Gathering and Processing

Consolidated (2) (4)

Gathering volumes (Bcf/d) (3)

5.47

5.51

5.60

6.03

6.02

5.75

Plant inlet natural gas volumes

(Bcf/d)

0.92

1.06

1.12

1.63

1.54

1.52

NGL production (Mbbls/d)

25

40

61

99

91

87

NGL equity sales (Mbbls/d)

6

16

22

14

14

6

Non-consolidated (5)

Gathering volumes (Bcf/d)

0.32

0.33

0.33

—

—

—

Plant inlet natural gas volumes

(Bcf/d)

0.32

0.32

0.32

—

—

—

NGL production (Mbbls/d)

37

38

38

—

—

—

NGL and Crude Oil Transportation volumes

(Mbbls/d) (6)

161

217

244

250

218

220

(1) Excludes certain amounts associated

with revenues and operating costs for reimbursable charges.

(2) Excludes volumes associated with

equity-method investments that are not consolidated in our

results.

(3) Includes 100% of the volumes

associated with the Cureton Acquisition gathering assets after the

purchase on November 30, 2023. Average volumes were calculated over

the period owned.

(4) Volumes associated with the Rocky

Mountain Midstream (RMM) assets for 4th Qtr 2023 and Year 2023 are

presented entirely in the Consolidated section. We acquired the

remaining 50 percent of RMM on November 30, 2023.

(5) Includes 100% of the volumes

associated with operated equity-method investment RMM through 3rd

Qtr 2023.

(6) Includes 100% of the volumes

associated with Overland Pass Pipeline Company (an operated

equity-method investment), RMM (see Note 4 above) as well as

volumes for our consolidated Bluestem pipeline.

Gas & NGL Marketing

Services

(UNAUDITED)

2023

2024

(Dollars in millions)

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

Year

1st Qtr

Commodity margins

$

265

$

(2

)

$

38

$

88

$

389

$

236

Other fee revenues

1

—

—

—

1

—

Net unrealized gain (loss) from derivative

instruments

333

94

24

208

659

(95

)

Operating and administrative costs

(32

)

(24

)

(19

)

(24

)

(99

)

(40

)

Modified EBITDA

567

68

43

272

950

101

Adjustments

(336

)

(84

)

(27

)

(203

)

(650

)

88

Adjusted EBITDA

$

231

$

(16

)

$

16

$

69

$

300

$

189

Statistics

Product Sales Volumes

Natural Gas (Bcf/d)

7.24

6.56

7.31

7.11

7.05

7.53

NGLs (Mbbls/d)

234

239

245

173

223

170

Other

(UNAUDITED)

2023

2024

(Dollars in millions)

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

Year

1st Qtr

Service revenues

$

3

$

5

$

4

$

4

$

16

$

4

Net realized product sales

120

97

127

145

489

113

Net unrealized gain (loss) from derivative

instruments

(6

)

(11

)

(1

)

19

1

3

Operating and administrative costs

(48

)

(54

)

(58

)

(65

)

(225

)

(51

)

Other segment income (expenses) - net

5

5

10

8

28

7

Net gain from Energy Transfer litigation

judgment

—

—

—

534

534

—

Proportional Modified EBITDA of

equity-method investments

—

(1

)

(1

)

—

(2

)

—

Modified EBITDA

74

41

81

645

841

76

Adjustments

6

11

1

(553

)

(535

)

(2

)

Adjusted EBITDA

$

80

$

52

$

82

$

92

$

306

$

74

Statistics

Net Product Sales Volumes

Natural Gas (Bcf/d)

0.26

0.29

0.31

0.30

0.29

0.28

NGLs (Mbbls/d)

3

6

9

10

7

8

Crude Oil (Mbbls/d)

1

3

5

7

4

5

Capital Expenditures and

Investments

(UNAUDITED)

2023

2024

(Dollars in millions)

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr*

Year*

1st Qtr

Capital expenditures:

Transmission & Gulf of Mexico

$

205

$

263

$

382

$

404

$

1,254

$

310

Northeast G&P

99

74

115

71

359

71

West

169

197

141

121

628

120

Other

72

76

52

75

275

43

Total (1)

$

545

$

610

$

690

$

671

$

2,516

$

544

Purchases of and contributions to

equity-method investments:

Transmission & Gulf of Mexico

$

8

$

18

$

6

$

9

$

41

$

27

Northeast G&P

31

12

4

52

99

25

West

—

—

1

—

1

—

Other

—

—

—

—

—

—

Total

$

39

$

30

$

11

$

61

$

141

$

52

Summary:

Transmission & Gulf of Mexico

$

213

$

281

$

388

$

413

$

1,295

$

337

Northeast G&P

130

86

119

123

458

96

West

169

197

142

121

629

120

Other

72

76

52

75

275

43

Total

$

584

$

640

$

701

$

732

$

2,657

$

596

Capital investments:

Increases to property, plant, and

equipment

$

484

$

684

$

792

$

604

$

2,564

$

509

Purchases of businesses, net of cash

acquired

1,056

(3

)

(29

)

544

1,568

1,851

Purchases of and contributions to

equity-method investments

39

30

11

61

141

52

Purchases of other long-term

investments

2

1

2

1

6

2

Total

$

1,581

$

712

$

776

$

1,210

$

4,279

$

2,414

(1) Increases to property, plant, and

equipment

$

484

$

684

$

792

$

604

$

2,564

$

509

Changes in related accounts payable and

accrued liabilities

61

(74

)

(102

)

67

(48

)

35

Capital expenditures

$

545

$

610

$

690

$

671

$

2,516

$

544

Contributions from noncontrolling

interests

$

3

$

15

$

—

$

—

$

18

$

26

Contributions in aid of construction

$

11

$

7

$

2

$

8

$

28

$

10

Proceeds from sale of business

$

—

$

—

$

348

$

(2

)

$

346

$

—

* Certain amounts for the fourth quarter

of 2023 were revised to agree to final reported amounts.

Non-GAAP Measures

This news release and accompanying materials may include certain

financial measures – adjusted EBITDA, adjusted income (“earnings”),

adjusted earnings per share, available funds from operations and

dividend coverage ratio – that are non-GAAP financial measures as

defined under the rules of the SEC.

Our segment performance measure, modified EBITDA, is defined as

net income (loss) before income (loss) from discontinued

operations, income tax expense, interest expense, equity earnings

from equity-method investments, other net investing income,

impairments of equity investments and goodwill, depreciation and

amortization expense, and accretion expense associated with asset

retirement obligations for nonregulated operations. We also add our

proportional ownership share (based on ownership interest) of

modified EBITDA of equity-method investments.

Adjusted EBITDA further excludes items of income or loss that we

characterize as unrepresentative of our ongoing operations. Such

items are excluded from net income to determine adjusted income and

adjusted earnings per share. Management believes this measure

provides investors meaningful insight into results from ongoing

operations.

Available funds from operations (AFFO) is defined as net income

(loss) excluding the effect of certain noncash items, reduced by

distributions from equity-method investees, net distributions to

noncontrolling interests, and preferred dividends. AFFO may also be

adjusted to exclude certain items that we characterize as

unrepresentative of our ongoing operations.

This news release is accompanied by a reconciliation of these

non-GAAP financial measures to their nearest GAAP financial

measures. Management uses these financial measures because they are

accepted financial indicators used by investors to compare company

performance. In addition, management believes that these measures

provide investors an enhanced perspective of the operating

performance of assets and the cash that the business is

generating.

Neither adjusted EBITDA, adjusted income, nor available funds

from operations are intended to represent cash flows for the

period, nor are they presented as an alternative to net income or

cash flow from operations. They should not be considered in

isolation or as substitutes for a measure of performance prepared

in accordance with United States generally accepted accounting

principles.

Reconciliation of Income (Loss) from

Continuing Operations Attributable to The Williams Companies, Inc.

to Non-GAAP Adjusted Income

(UNAUDITED)

2023

2024

(Dollars in millions, except per-share

amounts)

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

Year

1st Qtr

Income (loss) from continuing

operations attributable to The Williams Companies, Inc. available

to common stockholders

$

926

$

547

$

654

$

1,146

$

3,273

$

631

Income (loss) from continuing

operations - diluted earnings (loss) per common share (1)

$

.76

$

.45

$

.54

$

.94

$

2.68

$

.52

Adjustments:

Transmission &

Gulf of Mexico

MountainWest acquisition and

transition-related costs

$

13

$

17

$

3

$

9

$

42

$

—

Gulf Coast Storage acquisition and

transition-related costs*

—

—

—

1

1

10

Gain on sale of business

—

—

(130

)

1

(129

)

—

Total Transmission & Gulf of Mexico

adjustments

13

17

(127

)

11

(86

)

10

Northeast

G&P

Accrual for loss contingency

—

—

—

10

10

—

Our share of accrual for loss contingency

at Aux Sable Liquid Products LP

—

—

31

(2

)

29

—

Total Northeast G&P adjustments

—

—

31

8

39

—

West

Cureton acquisition and transition-related

costs*

—

—

—

6

6

1

Gain from contract settlement

(18

)

—

—

—

(18

)

—

Impairment of assets held for sale

—

—

—

10

10

—

Total West adjustments

(18

)

—

—

16

(2

)

1

Gas & NGL

Marketing Services

Impact of volatility on NGL linefill

transactions*

(3

)

10

(3

)

5

9

(6

)

Net unrealized (gain) loss from derivative

instruments

(333

)

(94

)

(24

)

(208

)

(659

)

94

Total Gas & NGL Marketing Services

adjustments

(336

)

(84

)

(27

)

(203

)

(650

)

88

Other

Net unrealized (gain) loss from derivative

instruments

6

11

1

(19

)

(1

)

(2

)

Net gain from Energy Transfer litigation

judgment

—

—

—

(534

)

(534

)

—

Total Other adjustments

6

11

1

(553

)

(535

)

(2

)

Adjustments included in Modified

EBITDA

(335

)

(56

)

(122

)

(721

)

(1,234

)

97

Adjustments below

Modified EBITDA

Gain on remeasurement of RMM

investment

—

—

—

(30

)

(30

)

—

Imputed interest expense on deferred

consideration obligations*

—

—

—

—

—

12

Amortization of intangible assets from

Sequent acquisition

15

14

15

15

59

7

15

14

15

(15

)

29

19

Total adjustments

(320

)

(42

)

(107

)

(736

)

(1,205

)

116

Less tax effect for above items

78

10

25

178

291

(28

)

Adjustments for tax-related items (2)

—

—

(25

)

—

(25

)

—

Adjusted income from continuing

operations available to common stockholders

$

684

$

515

$

547

$

588

$

2,334

$

719

Adjusted income from continuing

operations - diluted earnings per common share (1)

$

.56

$

.42

$

.45

$

.48

$

1.91

$

.59

Weighted-average shares - diluted

(thousands)

1,225,781

1,219,915

1,220,073

1,221,894

1,221,616

1,222,222

(1) The sum of earnings per share for the

quarters may not equal the total earnings per share for the year

due to changes in the weighted-average number of common shares

outstanding.

(2) The third quarter of 2023 includes an

adjustment associated with a decrease in our estimated deferred

state income tax rate.

*Amounts for the 2024 periods are included

in Additional adjustments on the Reconciliation of Cash Flow from

Operating Activities to Non-GAAP Available Funds from Operations

(AFFO).

Reconciliation of "Net Income (Loss)"

to “Modified EBITDA” and Non-GAAP “Adjusted EBITDA”

(UNAUDITED)

2023

2024

(Dollars in millions)

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

Year

1st Qtr

Net income (loss)

$

957

$

494

$

684

$

1,168

$

3,303

$

662

Provision (benefit) for income taxes

284

175

176

370

1,005

193

Interest expense

294

306

314

322

1,236

349

Equity (earnings) losses

(147

)

(160

)

(127

)

(155

)

(589

)

(137

)

Other investing (income) loss - net

(8

)

(13

)

(24

)

(63

)

(108

)

(24

)

Proportional Modified EBITDA of

equity-method investments

229

249

215

246

939

228

Depreciation and amortization expenses

506

515

521

529

2,071

548

Accretion expense associated with asset

retirement obligations for nonregulated operations

15

14

14

16

59

18

(Income) loss from discontinued

operations, net of tax

—

87

1

9

97

—

Modified EBITDA

$

2,130

$

1,667

$

1,774

$

2,442

$

8,013

$

1,837

Transmission & Gulf of Mexico

$

715

$

731

$

881

$

741

$

3,068

$

829

Northeast G&P

470

515

454

477

1,916

504

West

304

312

315

307

1,238

327

Gas & NGL Marketing Services

567

68

43

272

950

101

Other

74

41

81

645

841

76

Total Modified EBITDA

$

2,130

$

1,667

$

1,774

$

2,442

$

8,013

$

1,837

Adjustments (1):

Transmission & Gulf of Mexico

$

13

$

17

$

(127

)

$

11

$

(86

)

$

10

Northeast G&P

—

—

31

8

39

—

West

(18

)

—

—

16

(2

)

1

Gas & NGL Marketing Services

(336

)

(84

)

(27

)

(203

)

(650

)

88

Other

6

11

1

(553

)

(535

)

(2

)

Total Adjustments

$

(335

)

$

(56

)

$

(122

)

$

(721

)

$

(1,234

)

$

97

Adjusted EBITDA:

Transmission & Gulf of Mexico

$

728

$

748

$

754

$

752

$

2,982

$

839

Northeast G&P

470

515

485

485

1,955

504

West

286

312

315

323

1,236

328

Gas & NGL Marketing Services

231

(16

)

16

69

300

189

Other

80

52

82

92

306

74

Total Adjusted EBITDA

$

1,795

$

1,611

$

1,652

$

1,721

$

6,779

$

1,934

(1) Adjustments by segment are detailed in

the "Reconciliation of Income (Loss) from Continuing Operations

Attributable to The Williams Companies, Inc. to Non-GAAP Adjusted

Income," which is also included in these materials.

Reconciliation of Cash Flow from

Operating Activities to Non-GAAP Available Funds from Operations

(AFFO)

(UNAUDITED)

2023

2024

(Dollars in millions, except coverage

ratios)

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr**

Year**

1st Qtr

Net cash provided (used) by operating

activities

$

1,514

$

1,377

$

1,234

$

1,813

$

5,938

$

1,234

Exclude: Cash (provided) used by changes

in:

Accounts receivable

(1,269

)

(154

)

128

206

(1,089

)

(314

)

Inventories, including write-downs

(45

)

(19

)

7

14

(43

)

(38

)

Other current assets and deferred

charges

4

(28

)

29

(65

)

(60

)

(9

)

Accounts payable

1,017

203

(148

)

(63

)

1,009

309

Accrued and other current liabilities

318

(246

)

42

(95

)

19

218

Changes in current and noncurrent

commodity derivative assets and liabilities

(82

)

(37

)

(53

)

(28

)

(200

)

68

Other, including changes in noncurrent

assets and liabilities

40

47

53

106

246

61

Preferred dividends paid

(1

)

—

(1

)

(1

)

(3

)

(1

)

Dividends and distributions paid to

noncontrolling interests

(54

)

(58

)

(62

)

(39

)

(213

)

(64

)

Contributions from noncontrolling

interests

3

15

—

—

18

26

Adjustment to exclude litigation-related

charges in discontinued operations

—

115

1

9

125

—

Adjustment to exclude net gain from Energy

Transfer litigation judgment

—

—

—

(534

)

(534

)

—

Additional Adjustments *

—

—

—

—

—

17

Available funds from operations

$

1,445

$

1,215

$

1,230

$

1,323

$

5,213

$

1,507

Common dividends paid

$

546

$

545

$

544

$

544

$

2,179

$

579

Coverage ratio:

Available funds from operations divided by

Common dividends paid

2.65

2.23

2.26

2.43

2.39

2.60

* See detail on Reconciliation of Income

(Loss) from Continuing Operations Attributable to The Williams

Companies, Inc. to Non-GAAP Adjusted Income.

** Certain amounts for the fourth quarter

of 2023 were revised to agree to final reported amounts, with no

impact to previously reported AFFO for that period.

Reconciliation of Net Income (Loss)

from Continuing Operations to Modified EBITDA, Non-GAAP Adjusted

EBITDA and Cash Flow from Operating Activities to Non-GAAP

Available Funds from Operations (AFFO)

2024 Guidance

2025 Guidance

(Dollars in millions, except per-share

amounts and coverage ratio)

Low

Mid

High

Low

Mid

High

Net income (loss) from continuing

operations

$

2,094

$

2,219

$

2,344

$

2,373

$

2,523

$

2,673

Provision (benefit) for income taxes

670

695

720

735

785

835

Interest expense

1,380

1,390

Equity (earnings) losses

(535

)

(610

)

Proportional Modified EBITDA of

equity-method investments

895

990

Depreciation and amortization expenses and

accretion for asset retirement obligations associated with

nonregulated operations

2,270

2,325

Other

(6

)

(8

)

Modified EBITDA

$

6,768

$

6,918

$

7,068

$

7,195

$

7,395

$

7,595

EBITDA Adjustments

32

5

Adjusted EBITDA

$

6,800

$

6,950

$

7,100

$

7,200

$

7,400

$

7,600

Net income (loss) from continuing

operations

$

2,094

$

2,219

$

2,344

$

2,373

$

2,523

$

2,673

Less: Net income (loss) attributable to

noncontrolling interests and preferred dividends

115

115

Net income (loss) from continuing

operations attributable to The Williams Companies, Inc. available

to common stockholders

$

1,979

$

2,104

$

2,229

$

2,258

$

2,408

$

2,558

Adjustments:

Adjustments included in Modified EBITDA

(1)

32

5

Adjustments below Modified EBITDA (2)

29

18

Allocation of adjustments to

noncontrolling interests

—

—

Total adjustments

61

23

Less tax effect for above items

(15

)

(6

)

Adjusted income from continuing operations

available to common stockholders

$

2,025

$

2,150

$

2,275

$

2,275

$

2,425

$

2,575

Adjusted income from continuing

operations - diluted earnings per common share

$

1.65

$

1.76

$

1.86

$

1.85

$

1.97

$

2.10

Weighted-average shares - diluted

(millions)

1,224

1,228

Available Funds from Operations

(AFFO):

Net cash provided by operating activities

(net of changes in working capital, changes in current and

noncurrent derivative assets and liabilities, and changes in other,

including changes in noncurrent assets and liabilities)

$

5,125

$

5,250

$

5,375

$

5,295

$

5,445

$

5,595

Preferred dividends paid

(3

)

(3

)

Dividends and distributions paid to

noncontrolling interests

(215

)

(235

)

Contributions from noncontrolling

interests

18

18

Available funds from operations

(AFFO)

$

4,925

$

5,050

$

5,175

$

5,075

$

5,225

$

5,375

AFFO per common share

$

4.02

$

4.13

$

4.23

$

4.13

$

4.25

$

4.38

Common dividends paid

$

2,320

5%-7% Dividend growth

Coverage Ratio (AFFO/Common dividends

paid)

2.12x

2.18x

2.23x

~2.12x

(1) Adjustments reflect transaction and

transition costs of acquisitions

(2) Adjustments reflect amortization of

intangible assets from Sequent acquisition

Forward-Looking Statements

The reports, filings, and other public announcements of The

Williams Companies, Inc. (Williams) may contain or incorporate by

reference statements that do not directly or exclusively relate to

historical facts. Such statements are “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as

amended (Securities Act), and Section 21E of the Securities

Exchange Act of 1934, as amended (Exchange Act). These

forward-looking statements relate to anticipated financial

performance, management’s plans and objectives for future

operations, business prospects, outcomes of regulatory proceedings,

market conditions, and other matters. We make these forward-looking

statements in reliance on the safe harbor protections provided

under the Private Securities Litigation Reform Act of 1995.

All statements, other than statements of historical facts,

included in this report that address activities, events, or

developments that we expect, believe, or anticipate will exist or

may occur in the future, are forward-looking statements.

Forward-looking statements can be identified by various forms of

words such as “anticipates,” “believes,” “seeks,” “could,” “may,”

“should,” “continues,” “estimates,” “expects,” “forecasts,”

“intends,” “might,” “goals,” “objectives,” “targets,” “planned,”

“potential,” “projects,” “scheduled,” “will,” “assumes,”

“guidance,” “outlook,” “in-service date,” or other similar

expressions. These forward-looking statements are based on

management’s beliefs and assumptions and on information currently

available to management and include, among others, statements

regarding:

- Levels of dividends to Williams stockholders;

- Future credit ratings of Williams and its affiliates;

- Amounts and nature of future capital expenditures;

- Expansion and growth of our business and operations;

- Expected in-service dates for capital projects;

- Financial condition and liquidity;

- Business strategy;

- Cash flow from operations or results of operations;

- Seasonality of certain business components;

- Natural gas, natural gas liquids, and crude oil prices, supply,

and demand;

- Demand for our services.

Forward-looking statements are based on numerous assumptions,

uncertainties, and risks that could cause future events or results

to be materially different from those stated or implied in this

report. Many of the factors that will determine these results are

beyond our ability to control or predict. Specific factors that

could cause actual results to differ from results contemplated by

the forward-looking statements include, among others, the

following:

- Availability of supplies, market demand, and volatility of

prices;

- Development and rate of adoption of alternative energy

sources;

- The impact of existing and future laws and regulations, the

regulatory environment, environmental matters, and litigation, as

well as our ability and the ability of other energy companies with

whom we conduct or seek to conduct business, to obtain necessary

permits and approvals, and our ability to achieve favorable rate

proceeding outcomes;

- Our exposure to the credit risk of our customers and

counterparties;

- Our ability to acquire new businesses and assets and

successfully integrate those operations and assets into existing

businesses as well as successfully expand our facilities, and

consummate asset sales on acceptable terms;

- Whether we are able to successfully identify, evaluate, and

timely execute our capital projects and investment

opportunities;

- The strength and financial resources of our competitors and the

effects of competition;

- The amount of cash distributions from and capital requirements

of our investments and joint ventures in which we participate;

- Whether we will be able to effectively execute our financing

plan;

- Increasing scrutiny and changing expectations from stakeholders

with respect to our environmental, social, and governance

practices;

- The physical and financial risks associated with climate

change;

- The impacts of operational and developmental hazards and

unforeseen interruptions;

- The risks resulting from outbreaks or other public health

crises;

- Risks associated with weather and natural phenomena, including

climate conditions and physical damage to our facilities;

- Acts of terrorism, cybersecurity incidents, and related

disruptions;

- Our costs and funding obligations for defined benefit pension

plans and other postretirement benefit plans;

- Changes in maintenance and construction costs, as well as our

ability to obtain sufficient construction-related inputs, including

skilled labor;

- Inflation, interest rates, and general economic conditions

(including future disruptions and volatility in the global credit

markets and the impact of these events on customers and

suppliers);

- Risks related to financing, including restrictions stemming

from debt agreements, future changes in credit ratings as

determined by nationally recognized credit rating agencies, and the

availability and cost of capital;

- The ability of the members of the Organization of Petroleum

Exporting Countries and other oil exporting nations to agree to and

maintain oil price and production controls and the impact on

domestic production;

- Changes in the current geopolitical situation, including the

Russian invasion of Ukraine and conflicts in the Middle East,

including between Israel and Hamas and conflicts involving Iran and

its proxy forces;

- Changes in U.S. governmental administration and policies;

- Whether we are able to pay current and expected levels of

dividends;

- Additional risks described in our filings with the Securities

and Exchange Commission (SEC).

Given the uncertainties and risk factors that could cause our

actual results to differ materially from those contained in any

forward-looking statement, we caution investors not to unduly rely

on our forward-looking statements. We disclaim any obligations to,

and do not intend to, update the above list or announce publicly

the result of any revisions to any of the forward-looking

statements to reflect future events or developments.

In addition to causing our actual results to differ, the factors

listed above and referred to below may cause our intentions to

change from those statements of intention set forth in this report.

Such changes in our intentions may also cause our results to

differ. We may change our intentions, at any time and without

notice, based upon changes in such factors, our assumptions, or

otherwise.

Because forward-looking statements involve risks and

uncertainties, we caution that there are important factors, in

addition to those listed above, that may cause actual results to

differ materially from those contained in the forward-looking

statements. For a detailed discussion of those factors, see Part I,

Item 1A. Risk Factors in our Annual Report on Form 10-K for the

year ended December 31, 2023, as filed with the SEC on February 21,

2024, and as may be supplemented by disclosures in Part II, Item

1A. Risk Factors in subsequent Quarterly Reports on Form 10-Q.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240506608318/en/

MEDIA CONTACT: media@williams.com (800) 945-8723

INVESTOR CONTACTS: Danilo Juvane (918) 573-5075 Caroline

Sardella (918) 230-9992

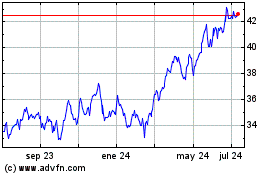

Williams Companies (NYSE:WMB)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

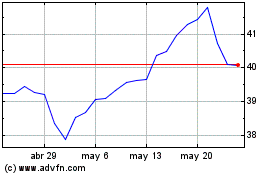

Williams Companies (NYSE:WMB)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024