Whitestone REIT (NYSE: WSR) (“Whitestone” or the “Company”) today

announced that its Board of Trustees has declared a monthly cash

dividend of $0.045 per share on the Company's common shares and

operating partnership units for the first quarter of 2025. The

quarterly dividend amount of $0.135 per share represents a 9%

increase from the previous quarterly dividend amount.

Dave Holeman, Whitestone CEO, stated, “Ensuring our quarterly

dividends increase in line with our earnings growth remains a

priority for Whitestone. We reiterated our 2024 Core FFO per share

guidance forecast, which targets 11% year-over-year growth at the

midpoint. As we look to 2025, we intend to leverage our leadership

position and expertise in high-return shop space to continue

driving strong earnings growth. This increase is anticipated to

maintain a very healthy payout ratio of approximately 50% of Core

FFO as Whitestone extends its track record of simultaneously

growing earnings, increasing dividends levels and strengthening our

balance sheet through lower debt leverage.”

The first quarter dividend distribution for 2025 will be as

detailed below:

|

Month |

Record Date |

Payment Date |

Distribution perShare/Unit |

| January |

1/2/2025 |

1/14/2025 |

$0.045 |

| February |

2/3/2025 |

2/11/2025 |

$0.045 |

| March |

3/3/2025 |

3/11/2025 |

$0.045 |

| |

|

|

|

About Whitestone REIT

Whitestone REIT (NYSE: WSR) is a community-centered real

estate investment trust (REIT) that acquires, owns, operates,

and develops open-air, retail centers located in some of the

fastest growing markets in the country: Phoenix, Austin,

Dallas-Fort Worth, Houston and San Antonio.

Our centers are convenience focused: merchandised with a mix of

service-oriented tenants providing food (restaurants and grocers),

self-care (health and fitness), services (financial and logistics),

education and entertainment to the surrounding communities.

The Company believes its strong community connections and

deep tenant relationships are key to the success of its current

centers and its acquisition strategy. For additional

information, please visit the Company's investor relations

website.

Forward-Looking Statements

This Report contains forward-looking statements

within the meaning of the federal securities laws, including

discussion and analysis of our financial condition, pending

acquisitions and the impact of such acquisitions on our financial

condition and results of operations, anticipated capital

expenditures required to complete projects, amounts of anticipated

cash distributions to our shareholders in the future and other

matters. These forward-looking statements are not historical facts

but are the intent, belief or current expectations of our

management based on its knowledge and understanding of our business

and industry. Forward-looking statements are typically identified

by the use of terms such as “may,” “will,” “should,” “potential,”

“predicts,” “anticipates,” “expects,” “intends,” “plans,”

“believes,” “seeks,” “estimates” or the negative of such terms and

variations of these words and similar expressions, although not all

forward-looking statements include these words. These statements

are not guarantees of future performance and are subject to risks,

uncertainties and other factors, some of which are beyond our

control, are difficult to predict and could cause actual results to

differ materially from those expressed or forecasted in the

forward-looking statements.

Factors that could cause actual results to

differ materially from any forward-looking statements made in this

Report include: the imposition of federal income taxes if we fail

to qualify as a real estate investment trust (“REIT”) in any

taxable year or forego an opportunity to ensure REIT status;

uncertainties related to the national economy, the real estate

industry in general and in our specific markets; legislative or

regulatory changes, including changes to laws governing REITs;

adverse economic or real estate developments or conditions in Texas

or Arizona, Houston and Phoenix in particular, including the

potential impact of COVID-19 on our tenants’ ability to pay their

rent, which could result in bad debt allowances or straight-line

rent reserve adjustments; inflation and increases in interest

rates, operating costs or general and administrative expenses;

availability and terms of capital and financing, both to fund our

operations and to refinance our indebtedness as it matures;

decreases in rental rates or increases in vacancy rates; litigation

risks; lease-up risks, including leasing risks arising from

exclusivity and consent provisions in leases with significant

tenants; our inability to renew tenant leases or obtain new tenant

leases upon the expiration of existing leases; our inability to

generate sufficient cash flows due to market conditions,

competition, uninsured losses, changes in tax or other applicable

laws; geopolitical conflicts, such as the ongoing conflict between

Russia and Ukraine; the need to fund tenant improvements or other

capital expenditures out of operating cash flow; and the risk that

we are unable to raise capital for working capital, acquisitions or

other uses on attractive terms or at all and other factors detailed

in the Company's most recent Annual Report on Form 10-K, Quarterly

Reports on Form 10-Q and other documents the Company files with the

Securities and Exchange Commission from time to time.

Non-GAAP Financial Measures

This release contains supplemental financial measures that are

not calculated pursuant to U.S. generally accepted accounting

principles (“GAAP”) including EBITDAre, FFO, NOI and net debt.

Following are explanations and reconciliations of these metrics to

their most comparable GAAP metric.

FFO: Funds From Operations: The National Association of Real

Estate Investment Trusts (“NAREIT”) defines FFO as net income

(loss) (calculated in accordance with GAAP), excluding depreciation

and amortization related to real estate, gains or losses from the

sale of certain real estate assets, gains and losses from change in

control, and impairment write-downs of certain real estate assets

and investments in entities when the impairment is directly

attributable to decreases in the value of depreciable real estate

held by the entity. We calculate FFO in a manner consistent with

the NAREIT definition and also include adjustments for our

unconsolidated real estate partnership.

Core Funds from Operations (“Core FFO”) is a non-GAAP measure.

From time to time, we report or provide guidance with respect

to “Core FFO” which removes the impact of certain

non-recurring and non-operating transactions or other items we do

not consider to be representative of our core operating results

including, without limitation, default interest on debt of real

estate partnership, extinguishment of debt cost, gains or losses

associated with litigation involving the Company that is not in the

normal course of business, and proxy contest professional

fees.

Management uses FFO and Core FFO as a supplemental measure to

conduct and evaluate our business because there are certain

limitations associated with using GAAP net income (loss) alone as

the primary measure of our operating performance. Historical cost

accounting for real estate assets in accordance with GAAP

implicitly assumes that the value of real estate assets diminishes

predictably over time. Because real estate values instead have

historically risen or fallen with market conditions, management

believes that the presentation of operating results for real estate

companies that use historical cost accounting is insufficient by

itself. In addition, securities analysts, investors and other

interested parties use FFO and Core FFO as the primary metric

for comparing the relative performance of equity REITs.

FFO and Core FFO should not be considered as an alternative to

net income or other measurements under GAAP, as an indicator of our

operating performance or to cash flows from operating, investing or

financing activities as a measure of liquidity. FFO and Core

FFO do not reflect working capital changes, cash expenditures for

capital improvements or principal payments on indebtedness.

Although our calculation of FFO is consistent with that of

NAREIT, there can be no assurance that FFO and Core FFO

presented by us is comparable to similarly titled measures of other

REITs.

Investor and Media Contact:

David MordyDirector of Investor RelationsWhitestone REIT(713)

435-2219ir@whitestonereit.com

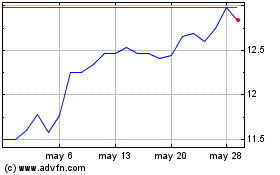

Whitestone REIT (NYSE:WSR)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Whitestone REIT (NYSE:WSR)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024