Whitestone REIT (NYSE: WSR) (“Whitestone” or the “Company”) is

pleased to share the following CEO letter with shareholders:

At Whitestone, we are closing the year continuing to prove the

value of our differentiated strategy and ability to execute. The

value of our assets is steadily climbing as we show what a

portfolio of high-return shop space can deliver when properly

anchored to the community.

Our strong results continue to underscore that our strategy is

the right one. Our success is reflected not only in best-in-class

Total Shareholder Return over the last 3 years, but also in a

steadily increasing assessment of the value of our assets by

analysts and investors.

We have been deliberate and direct in communicating the key

components of our strategy:

- 75% of ABR coming from high-growth,

high-return optimally sized shop space

- Shorter leases, with an average

lease term of 4 years, allowing for quicker capture of

mark-to-market rents

- A dedicated leasing team trained to

leverage technology and utilize strong underwriting skills to

constantly evaluate and refresh tenants

The outside view of the value of our assets, as measured by

sell-side analyst Net Asset Value calculations has risen

dramatically over the past year, increasing 16% since the 3rd

quarter of 2023. This represents the 2nd highest increase within

the peer set as analysts reassess the value Whitestone has

delivered - and is capable of delivering in the future.

Achieving 10 consecutive quarters of leasing spreads in excess

of 17% is just one of the operational metrics bringing credibility

to our differentiated strategy.

The team at Whitestone views our strategy, our ability to drive

earnings growth and the external view of the value of our assets as

inexorably linked. We believe we have all the right ingredients to

drive the value of our assets higher, while appropriately aligning

external views to reflect both our intrinsic value and

forward-looking expectations.

Supporting our work is the feedback we have received from the

investment community. 2024 was an invaluable year of shareholder

engagement, and we have acted on many of the constructive

perspectives provided by shareholders. In our recent discussions,

we have heard support from many of you and appreciate your

confidence in the results we’re delivering and momentum we are

gaining.

Our financial and operational results underscore the meaningful

advancement we are making against our strategic objectives. Since

new management took over, Whitestone has been the best performing

shopping center REIT, with a total return of more than 60%,

significantly outpacing the peer average of 17%:

Fueling our progress is an exceptional and revamped team at

Whitestone dedicated to continuous improvement. From our

operations, leasing and asset recycling to corporate governance,

this mentality is being applied to every aspect of Whitestone.

The results of our approach are evident in our financial

and operational metrics:

Improving Operations: We drove occupancy to

94.1% in the third quarter of 2024, as we enter what is

historically Whitestone’s strongest quarter for leasing. We

achieved a combined overall positive leasing spread of 25.3% and

increased our Same Store NOI growth target to 3.75% - 4.75%, after

delivering year-to-date Same Store NOI growth of 4.9%. Not only are

we delivering top quartile Same Store NOI growth, we are utilizing

less capital as the majority of our centers are already correctly

configured with high-demand shop space.

Driving Earnings Growth: We reiterated our 2024

Core FFO per share estimate of $0.98 to $1.04, representing 11%

growth in 2024 versus 2023 (at the midpoint). We anticipate Same

Store NOI will continue to drive strong Core FFO per share growth

in 2025 and beyond and we are eager to provide investors with 2025

guidance early next year.

Increasing Returns: Growing earnings allows

Whitestone to significantly increase dividends while maintaining

our payout ratio, which is among the healthiest in the shopping

center sector. Whitestone recently declared dividends for the first

quarter of 2025, growing the dividend by 9% and reflecting the

Board’s confidence in Whitestone’s earnings growth trajectory. We

are laser focused on growing Core FFO per share and accompanying

that growth with an increasing dividend.

Ever Stronger Tenant Quality: Whitestone’s

performance during the pandemic was amongst the best within the

peer set, as measured by collections or by the change in Core FFO

per share from 2019 to 2020. Since that time, the leasing team has

relentlessly refreshed the tenant mix, driving the Bad Debt /

Revenue percentage down 50% from the 2019 level.

In evaluating businesses, we believe that strong underwriting

and leasing team skills are vital to driving strong Same Store NOI

growth, enhancing the credit quality of our portfolio and

supporting our ability to deliver results in any environment.

Strengthening Financial Profile: We have

reduced our leverage (measured as Net Debt / Pro Forma EBITDAre) to

7.2x, with an expected ratio range of 6.6x to 7.0x by the end of

2024. We have also been proactive in renewing our corporate credit

facility and minimizing near-term debt maturities. Most recently,

we shifted $20 million of our short-term variable rate debt to our

term loan debt due 2028 and locked it in at a more favorable rate

of 5.2%. These actions have led to a strengthened balance sheet and

the ability to fund future growth investments in line with our

strategic initiatives.

We are pleased with this progress, but what excites us most is

the runway ahead that we see for additional growth and value

creation.

Our portfolio optimization strategy is just hitting

stride.

Strong community connections and deep tenant relationships are

key to the success of Whitestone’s current centers and acquisition

strategy. We have excellent visibility into fast-growing

surrounding neighborhoods and dense areas that are

supply-constrained, in terms of retail development, to ensure that

our acquisitions are successful.

2024 brought the strongest environment we've seen in Texas and

Arizona in all the categories we serve, across all our size spaces

and mix of tenants of grocery, restaurants, health, wellness and

beauty, financial services, other services, education and

entertainment.

This year, we acquired Garden Oaks Shopping Center located in

the Houston MSA and Scottsdale Commons located in the Phoenix MSA.

Whitestone’s acquisition program has been funded with timely,

well-priced dispositions, is immediately accretive and directly

enhances our growth. Disposition cap rates have been more than 100

basis points below our day one acquisition cap rates. This means

that we are continuously improving our portfolio with higher

quality revenues and more valuable assets. The assets we acquire

generally have another 100 – 200 basis points of yield on cost

improvement within the first 2 years as we apply our strategic

operating model.

As we look ahead, we have all the right ingredients to find new

acquisitions, scale the platform and reduce the percentage of our

fixed costs while driving earnings growth.

Above all, we welcome and deeply value the perspectives

of our shareholders.

Shareholder engagement remains a top priority for the Board and

management, and we will continue regularly considering your views

as we make decisions about the future. Building and strengthening

our shareholder relations will remain a perpetual priority for

Whitestone.

Indeed, our recent Board refreshment with the additions of

Krissy Gathright and Don Miller is the result of an effective and

comprehensive refreshment process that took into account the views

of our shareholders. Krissy brings deep real estate experience at

both Board and executive levels, as well as significant B2C and

capital markets experience. Don brings decades of real estate

executive experience, including in acquisitions, asset management,

property management and leasing.

A word from our newest Trustees.

“I am energized by what I’ve seen so far in the Whitestone

boardroom. This is a company with phenomenal assets, a strong plan

in place, engaged trustees and significant growth potential.”

– Kristian M. Gathright

“Whitestone has shown its tremendous organic growth potential

over the last several years and has bolstered earnings with a

disciplined, opportunistic property acquisition strategy.

Simultaneously growing earnings and meaningfully reducing leverage

is an impressive accomplishment for any company and Whitestone

continues to display strong momentum.”

– Donald A. Miller, CFA

In all, we have an engaged independent Board that comprises

highly qualified trustees with significant leadership, governance,

investment, financial and operating experience across real estate,

REITs and public companies. Whitestone’s refreshed Board is

committed to acting in the best interests of all shareholders and

to enhancing the value of your investment.

We have strength and momentum heading into

2025.

With our leadership team and Board focused exclusively on

realizing Whitestone’s potential, we expect our underlying growth

engine to become more visible to investors and the inherent value

of our real estate platform to become clearer. We are excited to

further advance our strategic objectives and drive even greater

bottom line growth, fueled by strong organic performance and

disciplined external growth.

The Whitestone that enters 2025 possesses a high-quality

portfolio concentrated in fast growing sunbelt markets with a

diversified and granular tenant base, a disciplined and focused

team of operators with a proven record of curating centers to match

demand and a refreshed Board composed of independent and

experienced trustees focused on maximizing value for our

shareholders.

The momentum we are carrying into 2025 is a direct result of our

continuous improvement mentality, and it gives me great confidence

in the long-term value proposition of the new Whitestone REIT and

our ability to continue improving our portfolio, driving earnings

and growing free cash flow.

We are proud of all that we have achieved over the last year and

energized by the opportunities ahead as we move into 2025 with

great momentum. We look forward to providing you with a

comprehensive update on 2024 and our 2025 guidance in early

March.

Thank you for your continued trust in Whitestone, and Happy

Holidays!

– Dave Holeman, Whitestone CEO and

Trustee

Forward-Looking Statements

This release contains forward-looking statements within the

meaning of the federal securities laws, including discussion and

analysis of our financial condition and results of operations,

statements related to our expectations regarding the performance of

our business, and other matters. These forward-looking statements

are not historical facts but are the intent, belief or current

expectations of our management based on its knowledge and

understanding of our business and industry. Forward-looking

statements are typically identified by the use of terms such as

“may,” “will,” “should,” “potential,” “predicts,” “anticipates,”

“expects,” “intends,” “plans,” “believes,” “seeks,” “estimates” or

the negative of such terms and variations of these words and

similar expressions, although not all forward-looking statements

include these words. These statements are not guarantees of future

performance and are subject to risks, uncertainties and other

factors, some of which are beyond our control, are difficult to

predict and could cause actual results to differ materially from

those expressed or forecasted in the forward-looking

statements.

Factors that could cause actual results to differ materially

from any forward-looking statements made in this Report include:

the imposition of federal income taxes if we fail to qualify as a

real estate investment trust (“REIT”) in any taxable year or forego

an opportunity to ensure REIT status; uncertainties related to the

national economy and the real estate industry, both in general and

in our specific markets; legislative or regulatory changes,

including changes to laws governing REITs; adverse economic or real

estate developments or conditions in Texas or Arizona, Houston,

Dallas, and Phoenix in particular, including the potential impact

of public health emergencies on our tenants’ ability to pay their

rent, which could result in bad debt allowances or straight-line

rent reserve adjustments; increases in interest rates, including as

a result of inflation, which may increase our operating costs or

general and administrative expenses; our current geographic

concentration in the Houston, Dallas, and Phoenix metropolitan area

markets makes us susceptible to potential local economic downturns;

natural disasters, such as floods and hurricanes, which may

increase as a result of climate change may adversely affect our

returns and adversely impact our existing and prospective tenants;

increasing focus by stakeholders on environmental, social, and

governance matters; financial institution disruptions; availability

and terms of capital and financing, both to fund our operations and

to refinance our indebtedness as it matures; decreases in rental

rates or increases in vacancy rates; harm to our reputation,

ability to do business and results of operations as a result of

improper conduct by our employees, agents or business partners;

litigation risks; lease-up risks, including leasing risks arising

from exclusivity and consent provisions in leases with significant

tenants; our inability to renew tenant leases or obtain new tenant

leases upon the expiration of existing leases; risks related to

generative artificial intelligence tools and language models, along

with the potential interpretations and conclusions they might make

regarding our business and prospects, particularly concerning the

spread of misinformation; our inability to generate sufficient cash

flows due to market conditions, competition, uninsured losses,

changes in tax or other applicable laws; geopolitical conflicts,

such as the ongoing conflict between Russia and Ukraine, the

conflict in the Gaza Strip and unrest in the Middle East; the need

to fund tenant improvements or other capital expenditures out of

our operating cash flow; and the risk that we are unable to raise

capital for working capital, acquisitions or other uses on

attractive terms or at all the ultimate amount we will collect in

connection with the redemption of our equity investment in

Pillarstone Capital REIT Operating Partnership LP (“Pillarstone” or

“Pillarstone OP.”); and other factors detailed in the Company's

most recent Annual Report on Form 10-K, Quarterly Reports on Form

10-Q and other documents the Company files with the Securities and

Exchange Commission from time to time.

Non-GAAP Financial Measures

This release contains supplemental financial measures that are

not calculated pursuant to U.S. generally accepted accounting

principles (“GAAP”) including EBITDAre, FFO, Core FFO, NOI and net

debt. Following are explanations and reconciliations of these

metrics to their most comparable GAAP metric.

EBITDAre: The National Association of Real Estate Investment

Trusts (“NAREIT”) defines EBITDAre as net income computed in

accordance with GAAP, plus interest expense, income tax expense,

depreciation and amortization and impairment write-downs of

depreciable property and of investments in unconsolidated

affiliates caused by a decrease in value of depreciable property in

the affiliate, plus or minus losses and gains on the disposition of

depreciable property, including losses/gains on change in control

and adjustments to reflect the entity’s share of EBITDAre of the

unconsolidated affiliates and consolidated affiliates with

non-controlling interests. We calculate EBITDAre in a manner

consistent with the NAREIT definition. Management believes that

EBITDAre represents a supplemental non-GAAP performance measure

that provides investors with a relevant basis for comparing REITs.

There can be no assurance the EBITDAre as presented by the Company

is comparable to similarly titled measures of other REITs. EBITDAre

should not be considered as an alternative to net income or other

measurements under GAAP as indicators of operating performance or

to cash flows from operating, investing or financing activities as

measures of liquidity. EBITDAre does not reflect working capital

changes, cash expenditures for capital improvements or principal

payments on indebtedness.

FFO: Funds From Operations: NAREIT defines FFO as net income

(loss) (calculated in accordance with GAAP), excluding depreciation

and amortization related to real estate, gains or losses from the

sale of certain real estate assets, gains and losses from change in

control, and impairment write-downs of certain real estate assets

and investments in entities when the impairment is directly

attributable to decreases in the value of depreciable real estate

held by the entity. We calculate FFO in a manner consistent with

the NAREIT definition and also include adjustments for our

unconsolidated real estate partnership.

Core Funds from Operations (“Core FFO”) is a non-GAAP measure.

From time to time, we report or provide guidance with respect

to “Core FFO” which removes the impact of certain

non-recurring and non-operating transactions or other items we do

not consider to be representative of our core operating results

including, without limitation, default interest on debt of real

estate partnership, extinguishment of debt cost, gains or losses

associated with litigation involving the Company that is not in the

normal course of business, and proxy contest costs.

Management uses FFO and Core FFO as a supplemental measure to

conduct and evaluate our business because there are certain

limitations associated with using GAAP net income alone as the

primary measure of our operating performance. Historical cost

accounting for real estate assets in accordance with GAAP

implicitly assumes that the value of real estate assets diminishes

predictably over time. Because real estate values instead have

historically risen or fallen with market conditions, management

believes that the presentation of operating results for real estate

companies that use historical cost accounting is insufficient by

itself. In addition, securities analysts, investors and other

interested parties use FFO as the primary metric for comparing

the relative performance of equity REITs. FFO and Core

FFO should not be considered as alternatives to net income or

other measurements under GAAP, as an indicator of our operating

performance or to cash flows from operating, investing or financing

activities as a measure of liquidity. FFO and Core FFO

do not reflect working capital changes, cash expenditures for

capital improvements or principal payments on indebtedness.

Although our calculation of FFO is consistent with that of NAREIT,

there can be no assurance that FFO and Core FFO presented by

us is comparable to similarly titled measures of other REITs.

NOI: Net Operating Income: Management believes that NOI is

a useful measure of our property operating performance. We define

NOI as operating revenues (rental and other revenues) less property

and related expenses (property operation and maintenance and real

estate taxes). Other REITs may use different methodologies for

calculating NOI and, accordingly, our NOI may not be comparable to

other REITs. Because NOI excludes general and administrative

expenses, depreciation and amortization, deficit in earnings of

real estate partnership, interest expense, interest, dividend and

other investment income, provision for income taxes, gain on sale

of properties, loss on disposal of assets, and

includes NOI of real estate partnership (pro rata) and net

income attributable to noncontrolling interest, it provides a

performance measure that, when compared year-over-year, reflects

the revenues and expenses directly associated with owning and

operating commercial real estate properties and the impact to

operations from trends in occupancy rates, rental rates and

operating costs, providing perspective not immediately apparent

from net income. We use NOI to evaluate our operating performance

since NOI allows us to evaluate the impact that factors such as

occupancy levels, lease structure, lease rates and tenant base have

on our results, margins and returns. In addition, management

believes that NOI provides useful information to the investment

community about our property and operating performance when

compared to other REITs since NOI is generally recognized as a

standard measure of property performance in the real estate

industry. However, NOI should not be viewed as a measure of our

overall financial performance since it does not reflect the level

of capital expenditure and leasing costs necessary to maintain the

operating performance of our properties, including general and

administrative expenses, depreciation and amortization, equity or

deficit in earnings of real estate partnership, interest expense,

interest, dividend and other investment income, provision for

income taxes, gain on sale of properties, and gain or loss on sale

or disposition of assets.

Same Store NOI: Management believes that Same Store NOI is a

useful measure of the Company’s property operating performance

because it includes only the properties that have been owned for

the entire period being compared, and that it is frequently used by

the investment community. Same Store NOI assists in eliminating

differences in NOI due to the acquisition or disposition of

properties during the period being presented, providing a more

consistent measure of the Company’s performance. The Company

defines Same Store NOI as operating revenues (rental and other

revenues, excluding straight-line rent adjustments, amortization of

above/below market rents, and lease termination fees) less property

and related expenses (property operation and maintenance and real

estate taxes), Non-Same Store NOI, and NOI of our investment in

Pillarstone OP (pro rata). We define “Non-Same Stores” as

properties that have been acquired since the beginning of the

period being compared and properties that have been sold, but not

classified as discontinued operations. Other REITs may use

different methodologies for calculating Same Store NOI, and

accordingly, the Company's Same Store NOI may not be comparable to

that of other REITs.

Net debt: We present net debt, which we define as total debt net

of insurance financing less cash plus our proportional share

of net debt of real estate partnership, and net debt to pro forma

EBITDAre, which we define as net debt divided by EBITDAre because

we believe they are helpful as supplemental measures in assessing

our ability to service our financing obligations and in evaluating

balance sheet leverage against that of other REITs. However, net

debt and net debt to pro forma EBITDAre should not be viewed as a

stand-alone measure of our overall liquidity and leverage. In

addition, our REITs may use different methodologies for calculating

net debt and net debt to pro forma EBITDAre, and accordingly our

net debt and net debt to pro forma EBITDAre may not be comparable

to that of other REITs.

|

Whitestone REIT and Subsidiaries |

|

RECONCILIATION OF NON-GAAP MEASURES |

|

Initial & Revised Full Year Guidance for

2024 |

|

(in thousands, except per share and per unit

data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q3 Revised Range Full Year

2024 (1) |

|

Projected Range Full Year 2024 |

|

|

Low |

|

High |

|

Low |

|

High |

|

FFO and Core FFO per diluted share and OP

unit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Whitestone REIT |

$ |

24,602 |

|

|

$ |

27,602 |

|

|

$ |

16,600 |

|

|

$ |

19,600 |

|

|

Adjustments to reconcile to FFO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization of real estate assets |

|

34,705 |

|

|

|

34,705 |

|

|

|

34,252 |

|

|

|

34,252 |

|

|

Depreciation and amortization of real estate assets of real estate

partnership (pro rata) |

|

133 |

|

|

|

133 |

|

|

|

133 |

|

|

|

133 |

|

|

Gain on sale of properties |

|

(10,212 |

) |

|

|

(10,212 |

) |

|

|

— |

|

|

|

— |

|

|

FFO |

$ |

49,228 |

|

|

$ |

52,228 |

|

|

$ |

50,985 |

|

|

|

53,985 |

|

|

Adjustments to reconcile to Core FFO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proxy contest costs |

|

1,757 |

|

|

|

1,757 |

|

|

|

— |

|

|

|

— |

|

|

Core FFO |

$ |

50,985 |

|

|

|

53,985 |

|

|

$ |

50,985 |

|

|

$ |

53,985 |

|

|

Denominator: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted shares |

|

51,262 |

|

|

|

51,262 |

|

|

|

51,262 |

|

|

|

51,262 |

|

|

OP Units |

|

695 |

|

|

|

695 |

|

|

|

695 |

|

|

|

695 |

|

|

Diluted share and OP Units |

|

51,957 |

|

|

|

51,957 |

|

|

|

51,957 |

|

|

|

51,957 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Whitestone REIT per diluted share |

$ |

0.47 |

|

|

$ |

0.53 |

|

|

$ |

0.32 |

|

|

$ |

0.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FFO per diluted share and OP Unit |

$ |

0.95 |

|

|

$ |

1.01 |

|

|

$ |

0.98 |

|

|

$ |

1.04 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core FFO per diluted share and OP Unit |

$ |

0.98 |

|

|

$ |

1.04 |

|

|

$ |

0.98 |

|

|

$ |

1.04 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes a $10,212 gain on sale of properties and $1,757 in

proxy contest costs. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Whitestone REIT and Subsidiaries |

|

RECONCILIATION OF NON-GAAP MEASURES |

|

(continued) |

|

(in thousands) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

PROPERTY NET OPERATING INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Whitestone REIT |

|

$ |

7,624 |

|

|

$ |

2,486 |

|

|

$ |

19,556 |

|

|

$ |

17,639 |

|

|

General and administrative expenses |

|

|

4,878 |

|

|

|

5,392 |

|

|

|

17,610 |

|

|

|

15,651 |

|

|

Depreciation and amortization |

|

|

8,921 |

|

|

|

8,332 |

|

|

|

26,242 |

|

|

|

24,538 |

|

|

Deficit in earnings of real estate partnership (1) |

|

|

— |

|

|

|

375 |

|

|

|

28 |

|

|

|

1,627 |

|

|

Interest expense |

|

|

8,506 |

|

|

|

8,400 |

|

|

|

25,813 |

|

|

|

24,563 |

|

|

Interest, dividend and other investment income |

|

|

(3 |

) |

|

|

(11 |

) |

|

|

(15 |

) |

|

|

(49 |

) |

|

Provision for income taxes |

|

|

118 |

|

|

|

95 |

|

|

|

327 |

|

|

|

339 |

|

|

Gain on sale of properties |

|

|

(3,762 |

) |

|

|

(5 |

) |

|

|

(10,212 |

) |

|

|

(9,626 |

) |

|

Management fee, net of related expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

16 |

|

|

Loss on disposal of assets, net |

|

|

111 |

|

|

|

480 |

|

|

|

183 |

|

|

|

500 |

|

|

NOI of real estate partnership (pro rata)(1) |

|

|

— |

|

|

|

667 |

|

|

|

183 |

|

|

|

1,883 |

|

|

Net income attributable to noncontrolling interests |

|

|

99 |

|

|

|

35 |

|

|

|

257 |

|

|

|

248 |

|

|

NOI |

|

$ |

26,492 |

|

|

$ |

26,246 |

|

|

$ |

79,972 |

|

|

$ |

77,329 |

|

|

Non-Same Store NOI (2) |

|

|

(1,330 |

) |

|

|

(1,074 |

) |

|

|

(5,389 |

) |

|

|

(4,228 |

) |

|

NOI of real estate partnership (pro rata) (1) |

|

|

— |

|

|

|

(667 |

) |

|

|

(183 |

) |

|

|

(1,883 |

) |

|

NOI less Non-Same Store NOI and NOI of real estate

partnership (pro rata) |

|

|

25,162 |

|

|

|

24,505 |

|

|

|

74,400 |

|

|

|

71,218 |

|

|

Same Store straight-line rent adjustments |

|

|

(695 |

) |

|

|

(833 |

) |

|

|

(2,581 |

) |

|

|

(2,390 |

) |

|

Same Store amortization of above/below market rents |

|

|

(221 |

) |

|

|

(214 |

) |

|

|

(600 |

) |

|

|

(607 |

) |

|

Same Store lease termination fees |

|

|

(30 |

) |

|

|

(300 |

) |

|

|

(298 |

) |

|

|

(600 |

) |

|

Same Store NOI (3) |

|

$ |

24,216 |

|

|

$ |

23,158 |

|

|

$ |

70,921 |

|

|

$ |

67,621 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) We rely on reporting provided to us by our third-party partners

for financial information regarding the Company's investment in

Pillarstone OP. Because Pillarstone OP financial statements for the

three and nine months ended September 30, 2024 and 2023 have not

been made available to us, we have estimated deficit in earnings

and pro rata share of NOI of real estate partnership based on the

information available to us at the time of this Report. As of

September 30, 2024, our ownership in Pillarstone OP no longer

represents a majority interest. On January 25, 2024, we exercised

our notice of redemption for substantially all of our investment in

Pillarstone OP. |

|

(2) We define “Non-Same Store” as properties that have been

acquired since the beginning of the period being compared and

properties that have been sold, but not classified as discontinued

operations. For purpose of comparing the three months ended

September 30, 2024 to the three months ended September 30, 2023,

Non- Same Store includes properties owned before July 1, 2023, and

not sold before September 30, 2024, but not included in

discontinued operations. For purposes of comparing the nine months

ended September 30, 2024 to the nine months ended September 30,

2023, Non-Same Store includes properties acquired between January

1, 2023 and September 30, 2024 and properties sold between January

1, 2023 and September 30, 2024, but not included in discontinued

operations. |

|

(3) We define “Same Store” as properties that have been owned

during the entire period being compared. For purpose of comparing

the three months ended September 30, 2024 to the three months ended

September 30, 2023, Same Store includes properties owned before

July 1, 2023 and not sold before September 30, 2024. For purposes

of comparing the nine months ended September 30, 2024 to the nine

months ended September 30, 2023, Same Store includes properties

owned before January 1, 2023 and not sold before September 30,

2024. Straight line rent adjustments, above/below market rents, and

lease termination fees are excluded. |

|

|

|

Whitestone REIT and Subsidiaries |

|

RECONCILIATION OF NON-GAAP MEASURES |

|

(continued) |

|

(in thousands) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND

AMORTIZATION FOR REAL ESTATE (EBITDAre) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Whitestone REIT |

|

$ |

7,624 |

|

|

$ |

2,486 |

|

|

$ |

19,556 |

|

|

$ |

17,639 |

|

|

Depreciation and amortization |

|

|

8,921 |

|

|

|

8,332 |

|

|

|

26,242 |

|

|

|

24,538 |

|

|

Interest expense |

|

|

8,506 |

|

|

|

8,400 |

|

|

|

25,813 |

|

|

|

24,563 |

|

|

Provision for income taxes |

|

|

118 |

|

|

|

95 |

|

|

|

327 |

|

|

|

339 |

|

|

Net income attributable to noncontrolling interests |

|

|

99 |

|

|

|

35 |

|

|

|

257 |

|

|

|

248 |

|

|

Deficit in earnings of real estate partnership (1) |

|

|

— |

|

|

|

375 |

|

|

|

28 |

|

|

|

1,627 |

|

|

EBITDAre adjustments for real estate partnership (1) |

|

|

— |

|

|

|

223 |

|

|

|

136 |

|

|

|

169 |

|

|

Gain on sale of properties |

|

|

(3,762 |

) |

|

|

(5 |

) |

|

|

(10,212 |

) |

|

|

(9,626 |

) |

|

Loss on disposal of assets |

|

|

111 |

|

|

|

480 |

|

|

|

183 |

|

|

|

500 |

|

|

EBITDAre |

|

$ |

21,617 |

|

|

$ |

20,421 |

|

|

$ |

62,330 |

|

|

$ |

59,997 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) We rely on reporting provided to us by our third-party partners

for financial information regarding the Company's investment in

Pillarstone OP. Because Pillarstone OP financial statements for the

three and nine months ended September 30, 2024 and 2023 have not

been made available to us, we have estimated deficit in earnings in

Pillarstone OP no longer represents a majority interest. On January

25, 2024, we exercised our notice of redemption for substantially

all of our investment in Pillarstone OP. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

September 30, |

|

September 30, |

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Debt/EBITDAre Ratio |

|

|

|

|

|

|

|

|

|

|

|

|

|

Outstanding debt, net of insurance financing |

|

$ |

633,437 |

|

|

$ |

632,353 |

|

|

$ |

633,437 |

|

|

$ |

632,353 |

|

|

Less: Cash |

|

|

(2,534 |

) |

|

|

(2,976 |

) |

|

|

(2,534 |

) |

|

|

(2,976 |

) |

|

Less: Deposit due to real estate partnership debt default |

|

|

(13,633 |

) |

|

|

— |

|

|

|

(13,633 |

) |

|

|

— |

|

|

Add: Proportional share of net debt of unconsolidated real estate

partnership (1) |

|

|

— |

|

|

|

8,685 |

|

|

|

— |

|

|

|

8,685 |

|

|

Total Net Debt |

|

$ |

617,270 |

|

|

$ |

638,062 |

|

|

$ |

617,270 |

|

|

$ |

638,062 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDAre |

|

$ |

21,617 |

|

|

$ |

20,421 |

|

|

$ |

62,330 |

|

|

$ |

59,997 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Effect of partial period acquisitions and dispositions |

|

$ |

(172 |

) |

|

$ |

— |

|

|

$ |

(1,004 |

) |

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro forma EBITDAre |

|

$ |

21,445 |

|

|

$ |

20,421 |

|

|

$ |

61,326 |

|

|

$ |

59,997 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annualized pro forma EBITDAre |

|

$ |

85,780 |

|

|

$ |

81,684 |

|

|

$ |

81,768 |

|

|

$ |

79,996 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratio of debt to pro forma EBITDAre |

|

|

7.2 |

|

|

|

7.8 |

|

|

|

7.5 |

|

|

|

8.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) We rely on

reporting provided to us by our third-party partners for financial

information regarding the Company's investment in Pillarstone OP.

Because Pillarstone OP financial statements as of September 30,

2023 have not been made available to us, we have estimated

proportional share of net debt based on the information available

to us at the time of this Report |

| |

|

Whitestone REIT and Subsidiaries |

|

RECONCILIATION OF NON-GAAP MEASURES |

|

Initial Full Year Guidance for 2024 |

|

(in thousands) |

| |

|

|

|

|

|

|

|

Projected Range Fourth Quarter 2024 |

|

|

|

Low |

|

High |

|

EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND

AMORTIZATION FOR REAL ESTATE (EBITDAre) |

|

|

|

|

|

|

|

Net income attributable to Whitestone REIT |

|

$ |

6,161 |

|

|

$ |

5,311 |

|

|

Depreciation and amortization |

|

|

8,746 |

|

|

|

8,746 |

|

|

Interest expense |

|

|

8,013 |

|

|

|

8,013 |

|

|

Provision for income taxes |

|

|

134 |

|

|

|

134 |

|

|

Net income attributable to noncontrolling interests |

|

|

86 |

|

|

|

86 |

|

|

EBITDAre |

|

$ |

23,140 |

|

|

$ |

22,290 |

|

|

Annualized EBITDAre |

|

$ |

92,560 |

|

|

$ |

89,160 |

|

| |

|

|

|

|

|

Outstanding debt, net of insurance financing |

|

|

616,290 |

|

|

|

624,290 |

|

|

Less: Cash |

|

|

(3,000 |

) |

|

|

(3,000 |

) |

|

Total net debt |

|

$ |

613,290 |

|

|

$ |

621,290 |

|

| |

|

|

|

|

|

Ratio of Net Debt to EBITDAre |

|

|

6.6 |

|

|

|

7.0 |

|

| |

|

|

|

|

Investor and Media Contact:David MordyDirector

of Investor RelationsWhitestone REIT(713)

435-2219ir@whitestonereit.com

Photos accompanying this announcement are available

at:https://www.globenewswire.com/NewsRoom/AttachmentNg/44b02079-eb33-4402-b0c9-b74d959d4c96https://www.globenewswire.com/NewsRoom/AttachmentNg/d05da196-c1ad-434a-9595-93fc19a8df0fhttps://www.globenewswire.com/NewsRoom/AttachmentNg/df89da10-e8d8-4524-9aca-db78d05b1f26

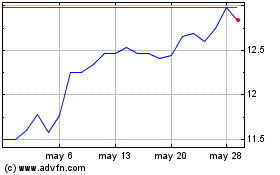

Whitestone REIT (NYSE:WSR)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Whitestone REIT (NYSE:WSR)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024