UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2024

Commission File Number: 001-40253

Zhihu Inc.

(Registrant’s Name)

18 Xueqing Road

Haidian District, Beijing

100083

People’s Republic

of China

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Zhihu Inc. |

| |

|

|

|

| |

By |

: |

/s/ Han Wang |

| |

Name |

: |

Han Wang |

| |

Title |

: |

Chief Financial Officer |

Date: July 23, 2024

Exhibit 99.1

Hong

Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement,

make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising

from or in reliance upon the whole or any part of the contents of this announcement.

This

announcement has been prepared pursuant to, and in order to comply with, the Listing Rules and the Codes, and does not constitute

an invitation or offer to acquire, purchase or subscribe for securities of the Company nor shall there be any sale, purchase or subscription

for securities of the Company in any jurisdiction in which such offer, solicitation or sale would be unlawful absent the filing of a

registration statement or the availability of an applicable exemption from registration or other waiver.

Zhihu

Inc.

(A

company controlled through weighted voting rights and incorporated in the Cayman Islands with limited liability)

(NYSE:

ZH; HKEX: 2390)

ANNOUNCEMENT

PURSUANT

TO RULE 3.8 OF THE TAKEOVERS CODE

This

announcement is made by Zhihu Inc. (the “Company”) pursuant to Rule 3.8 of The Hong Kong Code on Takeovers and

Mergers.

Reference

is made to the announcement of the Company dated July 19, 2024 in relation to, among other things, the Offer (the “3.5

Announcement”). Unless otherwise defined herein, capitalized terms used herein shall have the same meanings as those defined

in the 3.5 Announcement.

UPDATE

ON THE NUMBER OF RELEVANT SECURITIES OF THE COMPANY

The

Board wishes to announce that on July 22, 2024, 165 options granted under the 2012 Plan have been cancelled pursuant to the 2012

Plan and 127,689 restricted share units granted under the 2022 Plan have been cancelled pursuant to the 2022 Plan. In addition, on July 22, 2024, 3,573 Bulk Issuance Shares (as defined below) in the form of ADSs were used to settle the exercise or vesting

of awards granted under the 2012 Plan and the 2022 Plan.

Details

of all classes of relevant securities (as defined in Note 4 to Rule 22 of the Takeovers Code) issued by the Company and the numbers

of such securities in issue as at the date of this announcement are as follows:

| (i) | a

total of 294,635,959 Shares issued and outstanding, which comprised 277,242,293 Class A

Ordinary Shares and 17,393,666 Class B Ordinary Shares issued and outstanding. This

total number of issued and outstanding Shares excludes the Class A Ordinary Shares issued

to the depositary for bulk issuance of ADSs reserved for future issuances upon the exercise

or vesting of awards granted under the 2012 Plan and the 2022 Plan (“Bulk Issuance

Shares”), which amounted to 331,992 Class A Ordinary Shares; |

| (ii) | a total of 1,809,547 outstanding options

entitling the holders to acquire an aggregate of 1,809,547 Class A Ordinary Shares under

the 2012 Plan; |

| (iii) | a total of 249,741 outstanding restricted

shares entitling the holders to acquire an aggregate of 249,741 Class A Ordinary Shares

under the 2012 Plan; and |

| (iv) | a total of 17,049,956 outstanding restricted

share units entitling the holders to acquire an aggregate of 17,049,956 Class A Ordinary

Shares under the 2022 Plan. |

As

at the date of this announcement, save as disclosed above, the Company has no other outstanding options, derivatives, warrants or securities

which are convertible or exchangeable into Shares and the Company has no other relevant securities (as defined in Note 4 to Rule 22

of the Takeovers Code).

DEALING

DISCLOSURE

The

associates (as defined in Note 4 to Rule 22 of the Takeovers Code) of the Company are hereby reminded to disclose their dealings

in the relevant securities (as defined in Note 4 to Rule 22 of the Takeovers Code) of the Company under Rule 22 of the Takeovers

Code during the Offer Period.

In

accordance with Rule 3.8 of the Takeovers Code, reproduced below is the full text of Note 11 to Rule 22 of the Takeovers Code:

“Responsibilities

of stockbrokers, banks and other intermediaries

Stockbrokers,

banks and others who deal in relevant securities on behalf of clients have a general duty to ensure, so far as they are able, that those

clients are aware of the disclosure obligations attaching to associates of an offeror or the offeree company and other persons under

Rule 22 and that those clients are willing to comply with them. Principal traders and dealers who deal directly with investors should,

in appropriate cases, likewise draw attention to the relevant Rules. However, this does not apply when the total value of dealings (excluding

stamp duty and commission) in any relevant security undertaken for a client during any 7 day period is less than $1 million.

This

dispensation does not alter the obligation of principals, associates and other persons themselves to initiate disclosure of their own

dealings, whatever total value is involved.

Intermediaries

are expected to co-operate with the Executive in its dealings enquiries. Therefore, those who deal in relevant securities should appreciate

that stockbrokers and other intermediaries will supply the Executive with relevant information as to those dealings, including identities

of clients, as part of that co-operation.”

WARNING:

The Offer is conditional upon the satisfaction of the Condition as described in this announcement in all aspects. Accordingly, the Offer

may or may not become unconditional. Shareholders and/or potential investors of the Company should therefore exercise caution when dealing

in the securities of the Company. Persons who are in doubt as to the action they should take should consult their licensed securities

dealers or registered institutions in securities, bank managers, solicitors, professional accountants or other professional advisers.

| |

By order of the board |

| |

Zhihu Inc. |

| |

Yuan Zhou |

| |

Chairman |

Hong

Kong, July 23, 2024

As

at the date of this announcement, the board of Directors comprises Mr. Yuan Zhou as an executive Director, Mr. Dahai Li, Mr. Zhaohui

Li, and Mr. Bing Yu as non-executive Directors, and Mr. Hanhui Sam Sun, Ms. Hope Ni, and Mr. Derek Chen as independent

non-executive Directors.

The

Directors jointly and severally accept full responsibility for the accuracy of the information contained in this announcement and confirm,

having made all reasonable enquiries, that to the best of their knowledge, opinions expressed in this announcement have been arrived

at after due and careful consideration and there are no other facts not contained in this announcement, the omission of which would make

any statement in this announcement misleading.

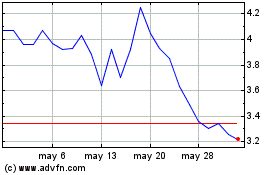

Zhihu (NYSE:ZH)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Zhihu (NYSE:ZH)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024