Aura Minerals Provides an Update on the Aranzazu Project

06 Junio 2013 - 8:25AM

Marketwired Canada

Aura Minerals Inc. ("Aura Minerals" or the "Company") (TSX:ORA) announces an

update on the mine and plant expansion at its wholly-owned Aranzazu copper

project ("Aranzazu") in Zacatecas State, Mexico. All amounts are presented in

United States dollars unless otherwise noted.

On July 18, 2012, the Company released the results of the Preliminary Economic

Assessment ("PEA") for Aranzazu, prepared by AMC Mining Consultants (Canada)

Ltd. ("AMC"). The PEA evaluated a feed rate expansion at Aranzazu from the

current 2,600 tonnes per day ("tpd") to 4,000 tpd and 5,600 tpd, and recommended

an expansion to 4,000 tpd which it determined would result in a net present

value of $200 million to enable the Company to take the project forward. The PEA

also included an expected capital requirement of $107 million for the expansion

which included installation and commissioning of an arsenic control facility

using partial roasting technology (the "roaster") as the selected long-term

solution to decrease arsenic levels to coincide with the expansion.

The Company announces the following updates to the Aranzazu mine and mill expansion:

-- Basic engineering (65% completed to date) now fixes the feed rate

expansion of 4,500 tpd and anticipates completion of the expansion by

the second quarter of 2015. The engineering is expected to be completed

in August 2013 and includes the design for an upgrade to the fresh water

system, a redesign of the coarse ore stockpile feeders and a high

capacity tailings thickener to improve water recovery;

-- The expanded operation, with roaster capability, expected to have a

remaining life of 16 years and estimated life-of-mine cash costs per

payable pound of copper of $1.15 to $1.25;

-- The Company expects the estimated capital requirement of $113 million

(including a contingency of $12 million) is expected to be funded by a

combination of internally generated cash flows and external financing

and which is allocated amongst the following phases;

-- $41 million for mine development, which enables access to higher

grade ores and the phasing out of the open pit activities during

2014, and increases production to approximately 25 million pounds

per year;

-- $33 million for the roaster, which is expected to result in

substantially reduced arsenic-related treatment and refining charges

and penalties; and

-- $39 million for plant expansion (additional mill, paste-fill plant

and thickeners) which is expected to increase production to an

expected 35 million pounds of copper per year;

-- The roaster was selected and the purchase contract awarded in February

2013 with an estimated 46 week delivery time. The roaster is expected to

be operational in the second quarter of 2014; and

-- The deposit continues to remain open at depth and on strike therefore

allowing potential for further future expansion.

Jim Bannantine, the Company's President and Chief Executive Officer stated:

"Since the publication of the Preliminary Economic Assessment, Aura Minerals has

made excellent progress on the engineering and procurement for Aranzazu's

roaster and plant expansion and has advanced underground mine development and

expansion. Current priorities include procurement, installation and

commissioning of the roaster over the remainder of this year and early next year

and continued day by day development and expansion of underground mining.

Engineering and subsequent procurement for the plant expansion are expected to

allow for installation of additional equipment late next year after the

underground mine expansion reaches capacity to feed the expanded plant and the

roaster is up and running.

The Company expects each of these project elements, individually and as a group,

are expected to result in substantial reductions to the cash costs per payable

pound of copper over the life of the project and therefore contribute to

realizing a value of the Aranzazu asset greater than that stated in the PEA

because of the increase in capacity from 4,000 to 4,500 tpd."

Additional Project Commentary

Mineral Resource:

The measured, indicated and inferred mineral resources as of September 30, 2011,

and included in the PEA, have not been updated.

Mining:

The underground mine has been designed to facilitate the extraction of 4,500 tpd

through the application of transverse long hole open stoping, a low-cost bulk

mining technique suitable for the significant mineralized mining width and

strong continuity of Aranzazu resources. Paste backfill is integral to the

project to maximize both resource recovery and mining productivity. Modern

trackless mobile equipment will be used for the majority of mining activities.

An extensive underground development program that attains a minimum of 700

meters per month of advance is being executed to develop and maintain access to

adequate resources to sustain 4,500 tpd of production. Underground project

infrastructure include ventilation shafts and fans, a centralized pumping

station, a modern maintenance facility, electrical substations, fueling facility

and other ancillary installations.

Material handling from the underground workings to the concentrator is

accomplished by a modern fleet of haulage trucks via an extensive ramp system

connected to two existing surface portals. Primary crushing will continue to be

performed on surface.

The Company expects the planned underground infrastructure and mining method

support a potential increase in production to 4,500 tpd and the incremental

investment in fixed plant and mobile equipment has been included in the capital

expenditure schedule above. It is expected that the economy of scale realized by

the expansion of the mine and processing plant will yield a decrease in the cash

cost per payable pound of copper produced of between $0.75 and $1.00 per pound

of payable copper.

Processing:

The expansion of the processing plant to 4,500 tpd capacity will include an

additional 13' x 18' primary ball mill and two 130 m3 and eight 5 m3 tank

flotation cells. This will provide not only sufficient additional rougher

flotation capacity but also allow for the total reconfiguration of the cleaner

circuit to further optimize final concentrate quality. Additional crushing

capacity will be achieved by more fully utilizing the available runtime of the

existing equipment so the expansion to 4,500 tpd is capital efficient. The

installation of the additional equipment can also be carried out with minimal

disruption to current production.

A new tailings thickener and the paste backfill plant is also expected to

improve the recovery of water from tailings. The existing tailings storage

facility offers short-term capacity, while the majority of the tailings from the

expanded production scenario will be stored in a new facility to be developed to

the east of the current operation. It is anticipated that 40% of tailings will

be delivered to the underground mine as paste backfill.

Roaster:

Arsenic reduction in the copper concentrate will be achieved using partial

roasting technology. The roaster was selected and the contract awarded to

Technip on February 26, 2013 with an expected 46 week delivery period. Pilot

tests conducted using high arsenic content concentrate from Aranzazu showed a

decrease of arsenic content by 85%. The expected arsenic content in the treated

concentrate once the roaster has been commissioned is 0.3% and the roaster

package includes a performance guarantee of a maximum of 0.5%. It is expected

that the roaster will decrease arsenic related charges and penalties by up to

$1.00 per payable pound of copper produced. The roaster has been presented to

SEMARNAT, the Mexican Environmental Authority, and SEMARNAT has authorized the

roaster as a modification to the existing operating license.

About the Aranzazu Mine

The Aranzazu mine is located within the Municipality of Concepcion del Oro in

the north eastern region of the State of Zacatecas, Mexico, and covers

approximately 11,380 hectares, including the historical, past producing El Cobre

area. The property can be accessed by paved highway from both the city of

Zacatecas located 250 kilometres to the southwest and from the city of Saltillo

located 112 kilometres to the northeast. Both Zacatecas and Saltillo are

serviced by daily domestic and international flights.

National Instrument 43-101 Compliance

Unless otherwise indicated, Aura Minerals has prepared the technical information

in this press release ("Technical Information") based on information contained

in the PEA technical report titled "Preliminary Economic Assessment of the

Expansion of the Aranzazu Mine, Zacatecas, Mexico" dated August 31, 2012 and the

Company's news release dated July 18, 2012 (collectively the "Disclosure

Documents") available under the Company's profile on SEDAR at www.sedar.com.

Each Disclosure Document was prepared by or under the supervision of a qualified

person (a "Qualified Person") as defined in National Instrument 43-101 Standards

of Disclosure for Mineral Projects. Readers are encouraged to review the full

text of the Disclosure Documents which qualifies the Technical Information. The

Disclosure Documents are each intended to be read as a whole, and sections

should not be read or relied upon out of context. The Technical Information is

subject to the assumptions and qualifications contained in the Disclosure

Documents.

The PEA was prepared under the direction of AMC by independent industry

professionals, all Qualified Persons under NI 43-101. The Qualified Person for

Aura Minerals is Bruce Butcher, P. Eng., Vice President, Technical Services, who

has reviewed and approved this press release. The updates in this press release

do not materially change the overall results or conclusions of the PEA.

The PEA is preliminary in nature. It includes inferred mineral resources that

are considered too speculative geologically to have the economic considerations

applied to them that would enable them to be categorized as mineral reserves.

There is no certainty that the PEA will be realized. Mineral resources that are

not mineral reserves do not have demonstrated economic viability.

Cautionary Note

This news release contains certain "forward-looking information" and

"forward-looking statements", as defined in applicable securities laws

(collectively, "forward-looking statements"). All statements other than

statements of historical fact are forward-looking statements. Forward-looking

statements relate to future events or future performance and reflect the

Company's current estimates, predictions, expectations or beliefs regarding

future events and include, without limitation, statements with respect to: the

planned Aranzazu mine and mill expansion, including the cost, timing and results

thereof; projected mine performance and economics; project internal cash flows;

external financing; the amount of mineral reserves and mineral resources; the

amount of future production over any period; the amount of waste tonnes mined;

the amount of mining and haulage costs; cash costs; operating costs; strip

ratios and mining rates; expected grades and ounces of metals and minerals;

expected processing recoveries; expected time frames; prices of metals and

minerals; mine life; and gold hedge programs. Often, but not always,

forward-looking statements may be identified by the use of words such as

"expects", "anticipates", "plans", "projects", "estimates", "assumes",

"intends", "strategy", "goals", "objectives" or variations thereof or stating

that certain actions, events or results "may", "could", "would", "might" or

"will" be taken, occur or be achieved, or the negative of any of these terms and

similar expressions.

Forward-looking statements are necessarily based upon a number of estimates and

assumptions that, while considered reasonable by the Company, are inherently

subject to significant business, economic and competitive uncertainties and

contingencies. Forward-looking statements in this news release are based upon,

without limitation, the following estimates and assumptions: the availability of

financing on acceptable terms; the presence of and continuity of metals at the

Company's Mines at modeled grades; the capacities of various machinery and

equipment; the results or performance of the proposed expansion of Aranzazu, the

availability of personnel, machinery and equipment at estimated prices; exchange

rates; metals and minerals sales prices; appropriate discount rates; tax rates

and royalty rates applicable to the mining operations; cash costs; anticipated

mining losses and dilution; metals recovery rates, reasonable contingency

requirements; and receipt of regulatory approvals on acceptable terms.

Known and unknown risks, uncertainties and other factors, many of which are

beyond the Company's ability to predict or control could cause actual results to

differ materially from those contained in the forward-looking statements.

Specific reference is made to the PEA and the most recent Annual Information

Form on file with certain Canadian provincial securities regulatory authorities

for a discussion of some of the factors underlying forward-looking statements,

which include, without limitation, gold and copper or certain other commodity

price volatility, changes in debt and equity markets, the uncertainties involved

in interpreting geological data, increases in costs, environmental compliance

and changes in environmental legislation and regulation, interest rate and

exchange rate fluctuations, general economic conditions and other risks involved

in the mineral exploration and development industry. Readers are cautioned that

the foregoing list of factors is not exhaustive of the factors that may affect

the forward-looking statements.

All forward-looking statements herein are qualified by this cautionary

statement. Accordingly, readers should not place undue reliance on

forward-looking statements. The Company undertakes no obligation to update

publicly or otherwise revise any forward-looking statements whether as a result

of new information or future events or otherwise, except as may be required by

law. If the Company does update one or more forward-looking statements, no

inference should be drawn that it will make additional updates with respect to

those or other forward-looking statements.

FOR FURTHER INFORMATION PLEASE CONTACT:

Aura Minerals Inc.

Alex Penha

Vice President, Corporate Development

(416) 509-0583 or (416) 649-1033

(416) 649-1044 (FAX)

info@auraminerals.com

www.auraminerals.com

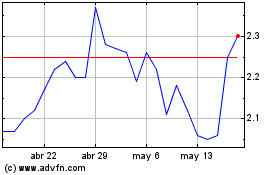

Arizona Metals (TSX:AMC)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

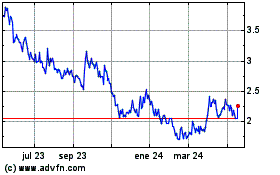

Arizona Metals (TSX:AMC)

Gráfica de Acción Histórica

De May 2023 a May 2024