Cameco Well Positioned to Self-manage its Financial Risks; 2019 Outlook Unchanged

01 Marzo 2019 - 4:16PM

Cameco (TSX: CCO; NYSE: CCJ) reaffirms its ability

to meet its financial obligations and self-manage risk, despite the

recent downgrade in its credit rating.

“We are disappointed by the ratings downgrade. Our 2018 results

and our outlook for 2019 are as expected, but the deliberate

decisions we have made to strengthen the company for the long-term

come with some near-term costs, which impact our credit metrics,”

said Grant Isaac, Cameco’s senior vice-president and CFO. “We have

done what we said we would do, and have been transparent and clear

about the near-term costs associated with our actions. While we

continue to navigate by our investment-grade rating, we will not

abandon our strategy in the interest of improving near-term

financial metrics at the expense of creating long-term value.”

Cameco has taken a number of deliberate actions to reduce supply

and streamline operations, which have allowed us to preserve the

value of our tier-one assets and build more than $1 billion dollars

of cash on our balance sheet. We expect these actions will also

allow the company to continue to generate positive cash flow in

2019, and will provide us with the option to retire the $500

million in debt maturing this year, or more aggressively reduce the

debt on our balance sheet if it makes sense to do so. There are

some near-term costs associated with our actions, like care and

maintenance costs, but we expect the benefit over the long term

will far outweigh those costs.

Cameco’s 2019 outlook remains unchanged and, as noted in our

annual management’s discussion and analysis, there are a number of

factors that could result in significant upside to that outlook.

Some of the more notable items are:

- The results of the investigation under the Section 232 Trade

Expansion Act in the US, and the potential impact on the uranium

market and uranium prices.

- A potential cost award from the Tax Court of Canada based on

the unequivocal win in our case with Canada Revenue Agency, where

we have applied for costs of $38 million.

- A potential award for damages from the TEPCO arbitration panel,

where we are seeking about $700 million US.

“Our strategy is designed to allow us to adjust to the dynamic

market we find ourselves in today, and to keep the company strong

and viable for the long term,” said Isaac. “Global population is on

the rise, and with the world’s need for safe, clean, reliable

baseload energy, we remain confident in the future of the nuclear

industry.”

Profile

Cameco is one of the world’s largest providers of uranium fuel.

Our competitive position is based on our controlling ownership of

the world’s largest high-grade reserves and low-cost operations.

Our uranium products are used to generate clean electricity in

nuclear power plants around the world. Our shares trade on the

Toronto and New York stock exchanges. Our head office is in

Saskatoon, Saskatchewan.

Caution Regarding Forward-Looking Information and

Statements

This news release includes statements and information about our

expectations for the future, which we refer to as forward-looking

information. Forward-looking information is based on our current

views, which can change significantly, and actual results and

events may be significantly different from what we currently

expect. Examples of forward-looking information in this news

release include: the statement reaffirming our ability to meet our

financial obligations and self-manage risk, despite the recent

downgrade in our credit rating; the statements regarding our

outlook for 2019 and the factors that could improve our actual

results; the statement that we will not abandon our strategy in

order to improve near-term financial metrics; the statements

regarding our cash flow in 2019; our ability to reduce debt; our

expectations regarding the long-term benefits of our actions; and

our views regarding population increase, future energy needs and

the future of the nuclear industry. Material risks that could

lead to different results include the risk that the recently

announced downgrade in our credit rating could have unexpected

implications for us, as well as all of the other material risks

referred to in our 2018 annual MD&A and our most recent annual

information form. In presenting the forward-looking information, we

have made material assumptions which may prove incorrect about the

recently announced downgrade in our credit rating not having any

significant adverse effect on us, in addition to the other material

assumptions referred to in our 2018 annual MD&A and our most

recent annual information form. Forward-looking information is

designed to help you understand management’s current views of our

near-term and longer-term prospects, and it may not be appropriate

for other purposes. We will not necessarily update this information

unless we are required to by securities laws.

| Investor inquiries: |

Rachelle Girard |

306-956-6403 |

| |

|

|

| Media inquiries: |

Carey Hyndman |

306-956-6317 |

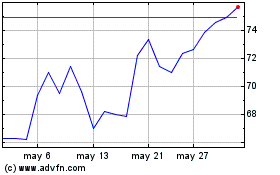

Cameco (TSX:CCO)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Cameco (TSX:CCO)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025