Cameco Responds to Announcement by Kazatomprom

07 Abril 2020 - 2:15PM

Cameco (TSX: CCO; NYSE: CCJ) responded to the

announcement issued today by JSC National Atomic Company

“Kazatomprom” (Kazatomprom) that it is reducing operational

activities across all of its uranium mines for an expected period

of three months due to the risks posed by the Coronavirus

(COVID-19) pandemic. According to Kazatomprom, this decision will

result in a lower level of wellfield development activity and, as a

result, an estimated reduction of up to 17.5% in total planned

uranium production in Kazakhstan for 2020. In 2019, Kazakhstan

accounted for more than 42% of the world’s uranium production.

The reduction in activity will impact production from Joint

Venture Inkai LLP (JV Inkai), a uranium operation jointly owned by

Cameco (40%) and Kazatomprom (60%). Based on information provided

by JV Inkai, Cameco’s preliminary assessment of the effects of

Kazatomprom’s decision is a reduction in Inkai’s 2020 production of

up to 12%, which translates into a reduction in Cameco’s 2020

purchases from JV Inkai of up to 600,000 pounds of U3O8. Prior to

this announcement, Cameco had expected to purchase 4.9 million

pounds of U3O8 in 2020. Cameco will be in discussions with

Kazatomprom and JV Inkai to determine the impact of Kazatomprom’s

decision on output from the operation and Cameco’s purchases.

The decision to temporarily decrease operational activity at JV

Inkai is an unplanned event that may lead to variability in the

2020 outlook we provided in our Annual MD&A; however, it is too

soon to quantify what the impact might be on the market. We will

continue to assess the situation and will provide an update when we

can better ascertain what the implications of this decision and

other impacts on our business related to COVID-19 might be for this

year’s outlook.

The Inkai operation is an in-situ recovery uranium mine in

southern Kazakhstan that is owned and operated by JV Inkai, which

in turn is currently owned by Cameco (40%) and Kazatomprom (60%).

As a result of Cameco’s minority ownership interest in the joint

venture, we account for JV Inkai on an equity basis.

Profile

Cameco is one of the largest global providers of the uranium

fuel needed to energize a clean-air world. Our competitive position

is based on our controlling ownership of the world’s largest

high-grade reserves and low-cost operations. Utilities around the

world rely on our nuclear fuel products to generate power in safe,

reliable, carbon-free nuclear reactors. Our shares trade on the

Toronto and New York stock exchanges. Our head office is in

Saskatoon, Saskatchewan.

Caution Regarding Forward-Looking Information and

Statements

This news release includes statements and information about our

expectations for the future, which we refer to as forward-looking

information. Forward-looking information is based on our current

views, which can change significantly, and actual results and

events may be significantly different from what we currently

expect.

Examples of forward-looking information in this news release

include Kazatomprom’s intention to reduce operational activities

across all of its uranium mines for an expected period of three

months; Kazatomprom’s expectation of a lower level of wellfield

development activity resulting in an estimated reduction of up to

17.5% in planned uranium production in Kazakhstan for 2020; our

preliminary assessment that production from JV Inkai will be

reduced by up to 12%, resulting in a reduction in Cameco’s 2020

purchases from Inkai of up to 600,000 pounds of U3O8; and the

potential for variability in our 2020 outlook and our expectations

regarding updating our 2020 outlook.

Material risks that could lead to different results include the

possibility that Kazatomprom may not in fact reduce its operational

activities or wellfield development activity to the extent stated

for any reason, or that the period of reduced operational

activities will differ from the expected three month period; the

risk that the reduction in wellfield development activity will

result in a greater than estimated reduction in planned uranium

production in Kazakhstan for 2020; the possibility that production

from JV Inkai and the corresponding reduction in Cameco’s 2020

purchases from Inkai may differ significantly from our preliminary

assessment; the risk that these developments could have a

materially adverse impact on our 2020 outlook; and the risk that we

may be unable to assess and report on the impact of these

developments on our 2020 outlook in a timely manner.

In presenting this forward-looking information, we have made

assumptions which may prove incorrect, including assumptions

regarding: the extent of Kazatomprom’s reduction of operational

activities and wellfield development activity; the period of

reduced operational activities; the impact of the reduction in

wellfield development activity on planned uranium production in

Kazakhstan for 2020; the impact of a reduction in production on

Cameco’s 2020 purchases from Inkai; and that we will be able to

assess, quantify and provide an update regarding any implications

of those developments on our 2020 outlook in a timely

manner.

Forward-looking information is designed to help you understand

management’s current views of our near-term and longer-term

prospects, and it may not be appropriate for other purposes. We

will not necessarily update this information unless we are required

to by securities laws.

|

Investor inquiries: |

Rachelle

Girard |

306-956-6403 |

| |

|

|

| Media inquiries: |

Jeff Hryhoriw |

306-385-5221 |

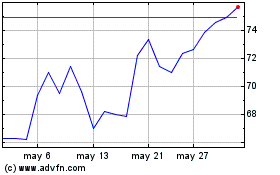

Cameco (TSX:CCO)

Gráfica de Acción Histórica

De Feb 2025 a Mar 2025

Cameco (TSX:CCO)

Gráfica de Acción Histórica

De Mar 2024 a Mar 2025