Dominion Lending Centres Inc. (TSX:DLCG) (“DLCG” or the

“Corporation”) is pleased to announce that it has entered into an

acquisition agreement (the “Acquisition Agreement”) with KayMaur

Holdings Ltd. (“KayMaur”) and certain minority holders to acquire

(the “Proposed Acquisition”) all of the issued and outstanding

non-voting series I class “B” preferred shares of the Corporation

(the “Preferred Shares”) in exchange for $137 million payable as

follows: 30,500,000 class “A” common shares (“Common Shares”)

(having a 20 day volume weighted average price of $4.00 per share)

and an aggregate cash payment of $15 million.

The Proposed Acquisition, if completed, would be

a related-party transaction for the purposes of Multilateral

Instrument 61-101 (“MI 61-101”) as Gary Mauris and Chris Kayat are

both officers and directors of the Corporation, indirectly own and

control KayMaur and also beneficially own, or exercise control or

direction over, directly or indirectly, more than 10% of the issued

and outstanding Common Shares of the Corporation. Upon completion

of the Proposed Acquisition, the Corporation intends to cancel the

Preferred Shares and amend the articles of incorporation to cancel

the Preferred Shares as a class and series of shares available for

issuance by the Corporation (the “Proposed Constating Document

Amendment”). The resolution to approve the Proposed Acquisition,

the special resolution to approve the Proposed Constating Document

Amendment, as well as a special resolution to increase the stated

capital of the Preferred Shares prior to completion of the Proposed

Acquisition (collectively, the “Transaction Resolutions”), will be

considered at a special meeting of holders of common shares of the

Corporation, anticipated to be held in the fourth quarter of 2024

(the "Meeting").

The Proposed Acquisition and the Proposed

Constating Document Amendment are subject to a number of

conditions, including approval by the Toronto Stock Exchange (the

“Exchange”). If such conditions are met, the Corporation

anticipates closing to occur at or near the end of 2024.

Trevor Bruno, Lead Independent Director

commented: “The Preferred Shares were created and issued in

connection with our reorganization at the end of 2020. The

Preferred Shares segregated the DLCG operations from the various

non-core assets and associated indebtedness related to the

Corporation’s legacy operations as an investment firm prior to the

reorganization. All non-core assets have been disposed of and all

associated indebtedness has been repaid, negating the original

purpose of the Preferred Shares. As such, the Corporation desires

to have simpler capital structure with one class of equity, the

Common Shares. We believe the Proposed Acquisition will enable

shareholders and market participants to better understand the

Corporation’s financial performance going forward, will better

align the Corporation’s financial reporting with other Canadian

public companies and will allow the Corporation to more effectively

manage its cash flow.”

Gary Mauris, co-founder of DLCG and Chairman of

the Corporation commented: “The creation of the Preferred Shares

were fundamental to Chris and I proceeding with the 2020

reorganization. However, since that time, the Corporation has

disposed of the non-core assets and retired all related debt.

Further, we have received considerable feedback from many market

participants that they found DLCG’s capital structure and financial

reporting to be overly complicated. While the Preferred Shares

served the Corporation well for a transitional period, we

understand that the time has come to simplify the Corporation’s

capital structure and have one class of Common Shares.”

The Proposed Acquisition, the

Acquisition Agreement and the Proposed Constating Document

Amendment

The highlights for the Proposed Acquisition, the

Acquisition Agreement and the Proposed Constating Document

Amendment (upon completion) are summarized as follows:

- The Corporation will acquire

26,774,054 Preferred Shares (being all of the Preferred Shares

issued and outstanding) in exchange for $137 million payable as

follows: 30,500,000 Common Shares (having a 20 day VWAP of $4.00

per share) and a cash payment of $15 million.

- Upon completion of the Proposed

Acquisition, the Preferred Shares shall be cancelled and the

articles of incorporation will be amended to cancel the Preferred

Shares as a class and series of shares available for issuance by

the Corporation.

- The Investor Rights Agreement

entered into between the Corporation and the holders of Preferred

Shares will be terminated upon closing of the Proposed

Acquisition.

- If the Proposed Acquisition is

completed, the Corporation will have 78,724,438 Common Shares and

Nil Preferred Shares outstanding, of which 47,233,265 Common Shares

(approximately 60% of the issued and outstanding Common Shares)

will be held by KayMaur.

- The Acquisition Agreement contains

additional representations, covenants and conditions customary for

a transaction of the nature of the Proposed Acquisition.

The Preferred Share Terms

The existing terms for the Preferred Shares are

as follows:

- The key economic provisions for the

Preferred Shares (being the dividend entitlements and liquidation

rights) are set out in the Preferred Share Terms and the key

governance provisions for the Preferred Shares are set out in the

Investor Rights Agreement (both of which are available for review

on SEDAR+ and filed on January 4, 2021 as part of the 2020

reorganization).

- The Preferred Share Terms define

the DLCG operations as the Corporation’s “Core Business” and the

Corporation’s “Non-Core Business” which includes the public company

operations and various legacy assets (which have since been

sold).

- Core Business Distributable Cash is

a defined term in the Preferred Share Terms as a proxy for 95% of

the distributable free cash flow of the Corporation and generally

includes cash flows from operating activities (excluding non-cash

working capital), cash flows from investing activities and cash

flow from financing activities attributable to the Core Business

for a given fiscal year.

- The Preferred Shares are entitled

to receive 40% of the Core Business Distributable Cash.

- On a liquidation of the Corporation

or the sale of the Core Business, the Preferred Shares are entitled

to 40% of the net proceeds on liquidation.

- The Preferred Shares are not

burdened by expenses incurred by the Corporation to operate as a

public company.

- The Preferred Shares have no

economic entitlements to the Non-Core Business.

- The holders of Preferred Shares are

entitled to nominate 40% of the Corporation’s directors.

- Certain corporate activities (such

as incurring more debt related to the Core Business or completing a

new Non-Core acquisition) require approval by the Preferred

Shareholders.

- The Preferred Shares are non-voting

and are not convertible into Common Shares.

Special Committee of Independent

Directors

The Board of Directors appointed a special

committee comprised entirely of independent directors (the “Special

Committee”) to review the Proposed Acquisition. The Special

Committee was comprised of Trevor Bruno (Chairman), Ron Gratton,

Dennis Sykora and Kingsley Ward. The Special Committee retained

Bennett Jones LLP to act as legal counsel. The Special Committee

supervised the appointment of Evans & Evans, Inc. (the

“Valuator”) and the preparation of the valuation of the subject

matter of the Proposed Transaction. Following receipt of the

valuation, the Special Committee met independently with the

Valuator to review the valuation and discuss with the Valuator.

Following such review, the Special Committee unanimously

recommended that the Board of Directors approve the Proposed

Acquisition.

Following receipt of the Special Committee's

recommendation, the Board of Directors unanimously approved the

Proposed Acquisition, the Acquisition Agreement and Proposed

Constating Document Amendment (with Messrs. Mauris and Kayat

abstaining) and resolved unanimously to recommend that shareholders

vote in favour of the Proposed Acquisition and the Proposed

Constating Document Amendment.

Related Party Matters – The Proposed

Acquisition

The Proposed Acquisition is subject to certain

approvals including the approval of the Exchange. Because the

KayMaur principals are related parties (within the meaning of MI

61-101) and, as such, the Proposed Acquisition is a related party

transaction (within the meaning of MI 61-101), and the Corporation

is required to obtain a formal valuation for, and minority approval

of, the Proposed Acquisition.

The Special Committee engaged the Valuator to

prepare an independent formal valuation of the subject matter of

the Proposed Acquisition and the property being exchanged in the

Proposed Acquisition. Completing such valuation also required that

the Valuator prepare a formal valuation of the Corporation as a

whole. The Valuator concluded that the fair market value of 100% of

the equity of DLCG was between $396.7 million and $441.5 million;

the fair market value of the Preferred Shares being acquired (on a

controlling, marketable basis assuming a full corporate sale) was

between $158.7 million and $176.6 million; and the fair market

value of the Preferred Shares being acquired, on a stand-alone

basis with no corporate acquisition control premium was between

$124.4 million and $137.4 million. Further, the Valuator concluded

that, using the fair market value of 100% of the equity of DLCG as

set out above, the value of the Common Shares being issued pursuant

to the Proposed Acquisition plus the $15.0 million cash payment was

valued at between $165.5 million and $182.5 million. The Valuator

concluded that, using the 30 day VWAP for the Common Shares as at

August 31, 2024, the value of the Common Shares being issued

pursuant to the Proposed Acquisition plus the $15.0 million cash

payment was valued at between $131.3 million and $137.3

million.

The formal valuation will be included in its

entirety in the Material Change Report to be filed by the

Corporation in respect of the Proposed Acquisition. Details of the

formal valuation also will be included in the management

information circular sent to shareholders in advance of the

Meeting. The fair market value figures above use the mid-point

value for the range of values determined by the Valuator.

There are no prior valuations in respect of the

Corporation that relate to the subject matter of the Proposed

Transaction or otherwise relevant to the Proposed Transaction that

have been made in the 24 months prior to the date hereof and the

existence of which is known, after reasonable inquiry, to the

Corporation or any director or senior officer of the

Corporation.

Voting Support Agreements

In connection with the Proposed Acquisition,

each of the Corporation’s directors (except for Messrs. Mauris and

Kayat), as well as Belkorp Industries Inc., has entered into

irrevocable voting and support agreements pursuant to which they

have agreed to vote their Common Shares in favour of the Proposed

Acquisition at the Meeting, subject to certain customary

exceptions.

The Common Shares subject to voting and support

agreements represent approximately 32% of outstanding Common Shares

(and approximately 52% of the outstanding Common Shares eligible to

vote on the resolution to approve the Proposed Acquisition after

excluding the Common Shares owned by KayMaur).

Lender Approval

The Corporation has entered into a consent and

waiver agreement with its lender relating to the Proposed

Acquisition, whereby the lender has consented to the Proposed

Acquisition subject to the Corporation providing evidence of

certain approvals and filed documents.

Cautionary Note Regarding

Forward-looking Information

Certain statements in this document constitute

forward-looking information under applicable securities

legislation. Forward-looking information typically contains

statements with words such as "anticipate," "believe," "estimate,"

"will," "expect," "plan," "intend," or similar words suggesting

future outcomes or an outlook. Forward-looking information in this

document includes, but is not limited to: the anticipated

completion of the Proposed Acquisition and the Proposed Constating

Document Amendment; the anticipated benefits of the simplification

of our corporate structure resulting from the Proposed Acquisition;

the approval of Proposed Acquisition by the Corporation's senior

lender and the anticipated closing date of the Proposed Acquisition

and the Proposed Constating Document Amendment. Such

forward-looking information is based on a number of assumptions

which may prove to be incorrect. Assumptions have been made with

respect to the following matters, in addition to any other

assumptions identified in this news release: the conditions to

complete the Proposed Acquisition and the Proposed Constating

Document Amendment will be satisfied and the transactions will be

completed as anticipated; and the Corporation's senior lender will

approve the Proposed Acquisition on terms and conditions acceptable

to the Corporation.

Such forward-looking information is necessarily

based on many estimates and assumptions, including material

estimates and assumptions, related to the factors identified below

that, while considered reasonable by the Corporation as at the date

hereof considering management’s experience and perception of

current conditions and expected developments, are inherently

subject to significant business, economic and competitive

uncertainties and contingencies. Known and unknown factors could

cause actual results to differ materially from those projected in

the forward-looking statements. Such factors include, but are not

limited to changes in taxes and other risks and uncertainties

described elsewhere in this document and in our other filings with

Canadian securities authorities. Many of these uncertainties and

contingencies can affect our actual results and could cause actual

results to differ materially from those expressed or implied in any

forward-looking statements made by, or on behalf of, us. Readers

are cautioned that forward-looking statements are not guarantees of

future performance. All forward-looking statements made in this

press release are qualified by these cautionary statements. The

foregoing list of risks is not exhaustive. For more information

relating to risks, see the risk factors identified in our Annual

Report. The forward-looking information contained in this document

is made as of the date hereof and, except as required by applicable

securities laws, we undertake no obligation to update publicly or

revise any forward-looking statements or information, whether

because of new information, future events or otherwise.

About Dominion Lending Centres

Inc.

Dominion Lending Centres Inc. is Canada’s

leading network of mortgage professionals. DLCG operates through

Dominion Lending Centres Inc. and its three main subsidiaries, MCC

Mortgage Centre Canada Inc., MA Mortgage Architects Inc. and Newton

Connectivity Systems Inc., and has operations across Canada. DLCG

extensive network includes over 8,000 agents and over 520

locations. Headquartered in British Columbia, DLC was founded in

2006 by Gary Mauris and Chris Kayat.

DLCG can be found on X (Twitter), Facebook and

Instagram and LinkedIn @DLCGmortgage and on the web at

www.dlcg.ca.

Contact information for the Corporation is as

follows:

|

Eddy CocciolloPresident647-403-7320eddy@dlc.ca |

James BellEVP, Corporate and Chief Legal

Officer403-560-0821jbell@dlcg.ca |

|

|

|

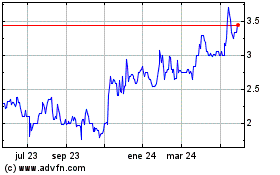

Dominion Lending Centres (TSX:DLCG)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

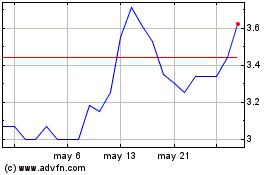

Dominion Lending Centres (TSX:DLCG)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025