Dominion Lending Centres Inc. (TSX: DLCG) ("DLCG" or the

"Corporation") is pleased to announce it has completed the

acquisition (the "Acquisition") of all of the issued and

outstanding non-voting Series 1 Class B preferred shares of the

Corporation (the "Series 1 Preferred Shares") from one or more

companies controlled by Gary Mauris, one or more companies

controlled by Chris Kayat, and from certain other holders of Series

1 Preferred Shares in exchange for, in aggregate, 30,500,000 Class

A common shares ("Common Shares") (having a market price of

$122,000,000 based on a 20-day volume weighted average trading

price of $4.00 per Common Share at the time of announcement of the

Acquisition) and a cash payment of $15,000,000 (representing

approximately $1.78 per Series 1 Preferred Share), pursuant to a

purchase agreement dated October 2, 2024. Prior to the Acquisition,

various of the shareholders and the Corporation undertook certain

preliminary steps, including that the Corporation added to the

stated capital account of the Corporation maintained in respect of

the Series 1 Preferred Shares an aggregate amount of $15,000,000,

without any payment being made. Upon completion of the Acquisition,

the Corporation filed an amendment to the Corporation's articles of

amalgamation to cancel the Class B preferred shares as a class of

shares and the Series 1 Preferred Shares as a series of shares in

the capital of the Corporation authorized for issuance.

Gary Mauris, Chairman and Chief Executive

Officer commented: "We are pleased to announce that the Corporation

has acquired all of the Series 1 Preferred Shares and that the

Corporation now has only one class of voting common shares

outstanding. We believe that the time was right to simplify our

capital stack and our associated financial reporting in an effort

to showcase DLCG's financial performance. Chris and I each remain

committed to DLCG, as reflected by our ownership of 60% of the

Common Shares, and we are incredibly excited about the

opportunities ahead for DLCG."

Post-Closing Capital

Structure

Immediately prior to the completion of the

Acquisition, the Corporation had an aggregate of 48,224,438 Common

Shares and 26,774,054 Series 1 Preferred Shares issued and

outstanding. Upon completion of the Acquisition, the Corporation

has an aggregate of 78,724,438 Common Shares and Nil Series 1

Preferred Shares issued and outstanding.

Changes to Insider Share Ownership and

Early Warning Disclosure

Prior to the Acquisition, KayMaur Holdings Ltd.

("KayMaur") (2215 Coquitlam Ave., Port Coquitlam, BC, V3B 1J6), an

entity controlled by Gary Mauris and Chris Kayat, held an aggregate

of 25,432,674 Series 1 Preferred Shares (being approximately 95% of

the issued and outstanding Series 1 Preferred Shares) and

18,261,315 Common Shares (being approximately 38% of the issued and

outstanding Common Shares). Prior to the Acquisition, Belkorp

Industries Inc. ("Belkorp") (Suite 900, 1508 West Broadway,

Vancouver, BC, V6J 1W8), an entity of which Trevor Bruno is an

officer, held an aggregate of 14,657,798 Common Shares (being

approximately 30% of the issued and outstanding Common Shares).

On December 13, 2024, KayMaur completed a

reorganization (the "KayMaur Reorganization"), whereby all of the

Series 1 Preferred Shares and Common Shares held by KayMaur were

transferred to Mauris Family Investments Ltd. ("MaurisCo") (2215

Coquitlam Ave., Port Coquitlam, BC, V3B 1J6), a company controlled

by Gary Mauris, and 603908 B.C. Ltd. ("KayatCo") (2215 Coquitlam

Ave., Port Coquitlam, BC, V3B 1J6), a company controlled by Chris

Kayat and Kristy Kayat. Pursuant to the KayMaur Reorganization,

KayMaur disposed of an aggregate of 25,432,674 Series 1 Preferred

Shares and 18,261,315 Common Shares. Upon completion of the KayMaur

Reorganization and immediately prior to completion of the

Acquisition, KayMaur held Nil Common Shares (being 0% of the issued

and outstanding Common Shares) and Nil Series 1 Preferred Shares

(being 0% of the issued and outstanding Series 1 Preferred Shares),

MaurisCo held an aggregate of 9,493,758 Common Shares (being

approximately 20% of the issued and outstanding Common Shares) and

12,716,337 Series 1 Preferred Shares (being approximately 47.5% of

the issued and outstanding Series 1 Preferred Shares) and KayatCo

held an aggregate of 8,767,557 Common Shares (being approximately

18% of the issued and outstanding Common Shares) and 12,716,337

Series 1 Preferred Shares (being approximately 47.5% of the issued

and outstanding Series 1 Preferred Shares). Belkorp did not

participate in the KayMaur Reorganization.

Pursuant to the Acquisition, MaurisCo disposed

of an aggregate of 12,716,337 Series 1 Preferred Shares and KayatCo

disposed of an aggregate of 12,716,337 Series 1 Preferred Shares.

In connection with the Acquisition, MaurisCo received an aggregate

of 14,485,975 Common Shares (having a market value of $57,943,900

based on a 20-day volume weighted average trading price of $4.00

per Common Share at the time of announcement of the Acquisition)

and cash consideration of $7,124,250. KayatCo received an aggregate

of 14,485,975 Common Shares (having a market value of $57,943,900

based on a 20-day volume weighted average trading price of $4.00

per Common Share at the time of announcement of the Acquisition)

and cash consideration of $7,124,250. Belkorp did not acquire or

dispose of any Common Shares or Series 1 Preferred Shares pursuant

to the Acquisition and did not receive any consideration in

connection with the Acquisition.

Upon completion of the Acquisition and the

KayMaur Reorganization, MaurisCo owns an aggregate of 23,979,733

Common Shares (being approximately 30.5% of the issued and

outstanding Common Shares, representing an increase of

approximately 10.5%) and Nil Series 1 Preferred Shares (being 0% of

the issued and outstanding Series 1 Preferred Shares, representing

a decrease of approximately 47.5%). KayatCo owns an aggregate of

23,253,532 Common Shares (being approximately 29.5% of the issued

and outstanding Common Shares, representing an increase of

approximately 11.5%) and Nil Series 1 Preferred Shares (being 0% of

the issued and outstanding Series 1 Preferred Shares, representing

a decrease of approximately 47.5%). KayMaur owns Nil Common Shares

(being 0% of the issued and outstanding Common Shares, representing

a decrease of approximately 38%) and Nil Series 1 Preferred Shares

(being 0% of the issued and outstanding Series 1 Preferred Shares,

representing a decrease of approximately 95%). Belkorp owns an

aggregate of 14,657,798 Common Shares (being approximately 18.6% of

the issued and outstanding Common Shares, representing a decrease

of approximately 11%) and Nil Series 1 Preferred Shares (being 0%

of the issued and outstanding Series 1 Preferred Shares,

representing no change).

The KayMaur Reorganization and the Acquisition

occurred pursuant to private agreements; neither the KayMaur

Reorganization nor the Acquisition occurred through the facilities

of the Toronto Stock Exchange (the "TSX").

Early warning reports will be filed by KayMaur,

MaurisCo, KayatCo and Belkorp in accordance with applicable

Canadian securities laws and will be available under DLCG's SEDAR+

profile at www.sedarplus.ca or may be obtained directly from DLCG

by contacting James Bell at DLCG's office at Suite 1900, 350 – 7th

Avenue SW, Calgary, Alberta.

MaurisCo, KayatCo and Belkorp act independently

and each intends to hold their Common Shares for investment

purposes.

About Dominion Lending Centres

Inc.

Dominion Lending Centres Inc. is Canada's

leading network of mortgage professionals. DLCG operates through

Dominion Lending Centres Inc. and its three main subsidiaries, MCC

Mortgage Centre Canada Inc., MA Mortgage Architects Inc. and Newton

Connectivity Systems Inc., and has operations across Canada. DLCG's

extensive network includes over 8,500 agents and over 500

locations. Headquartered in British Columbia, DLCG was founded in

2006 by Gary Mauris and Chris Kayat.

DLCG can be found on X (Twitter), Facebook and

Instagram and LinkedIn @DLCGmortgage and on the web at

www.dlcg.ca.

Contact information for the Corporation is as

follows:

|

Eddy CocciolloPresident647-403-7320eddy@dlc.ca |

James BellEVP, Corporate and Chief Legal

Officer403-560-0821jbell@dlcg.ca |

|

|

|

The head office of the Corporation is located at

2215 Coquitlam Avenue, Port Coquitlam, BC, V3B 1J6.

Forward Looking Statements

This news release contains "forward-looking

statements" and "forward-looking information" within the meaning of

Canadian securities laws. All information that is not clearly

historical in nature may constitute forward-looking statements. In

some cases, forward-looking statements may be identified by the use

of terms such as "forecast", "projected", "assumption" and other

similar expressions or future or conditional terms such as

"anticipate", "believe", "could", "estimate", "expect", "intend",

"may", "plan", "predict", "project", "will", "would", and "should".

Forward-looking statements contained in this news release include

statements relating to the benefits to the Corporation of the

completion of the Acquisition and future intentions regarding

holdings of Common Shares.

Forward-looking statements contained in this

news release are based on certain factors and assumptions made by

management of DLCG based on their current expectations, estimates,

projections, assumptions and beliefs regarding their business and

DLCG does not provide any assurance that actual results will meet

management's expectations. While management considers these

assumptions to be reasonable based on information currently

available to them, they may prove to be incorrect. Such

forward-looking statements are not guarantees of future events or

performance and by their nature involve known and unknown risks,

uncertainties and other factors, including those risks described in

the Information Circular and DLCG's annual information form dated

March 19, 2024 (both of which are filed under DLCG's SEDAR+ profile

on www.sedarplus.ca), that may cause the actual results,

performance or achievements to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking statements. Although DLCG has attempted to

identify important factors that could cause actual actions, events

or results to differ materially from those described in

forward-looking statements, other factors may cause actions, events

or results to be different than anticipated, estimated or intended.

There can be no assurance that such statements will prove to be

accurate as actual results and future events could vary or differ

materially from those anticipated in such forward-looking

statements. Accordingly, readers should not place undue reliance on

forward-looking information. DLCG does not undertake to update any

forward-looking information, whether as a result of new information

or future events or otherwise, except as may be required by

applicable securities laws.

NEITHER THE TSX EXCHANGE NOR ITS REGULATION

SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE

TSX EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY

OF THIS RELEASE.

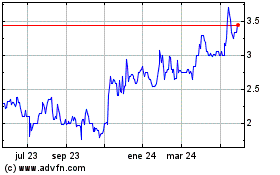

Dominion Lending Centres (TSX:DLCG)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

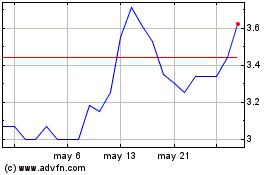

Dominion Lending Centres (TSX:DLCG)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025