Endeavour Silver Forecasts Steady Silver Production in 2014

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Jan 22, 2014) -

Endeavour Silver Corp. (TSX:EDR)(NYSE:EXK) released today its

improved cash and debt positions at year-end (all currency in US$)

and the Company's consolidated operating guidance for 2014 for its

three underground, silver-gold mines in Mexico, the Guanaceví Mine

in Durango State and the Bolañitos and El Cubo Mines in Guanajuato

State.

Production Outlook

Endeavour plans to hold its silver production relatively steady

in the range of 6.5-6.9 million ounces (oz) compared to the 6.8

million oz silver it produced in 2013. Gold production is expected

to be in the 65,000-69,000 oz range and silver equivalent

production is anticipated to be 10.4-11.0 million oz (at a

silver:gold ratio of 60:1) as shown in the table below.

|

Mine |

Ag Prod. (M oz) |

Au Prod. (K oz) |

Ag Eq. Prod. (K oz) |

Tonnes/Day (tpd) |

|

|

|

|

|

|

|

Guanaceví |

2.6-2.7 |

7.0-8.0 |

3.0-3.2 |

1,200-1,300 |

|

Bolañitos |

2.2-2.4 |

36.0-38.0 |

4.4-4.7 |

1,450-1,600 |

| El

Cubo |

1.7-1.8 |

22.0-23.0 |

3.0-3.1 |

1,200-1,550 |

|

|

|

|

|

|

|

Total |

6.5-6.9 |

65.0-69.0 |

10.4-11.0 |

3,850-4,450 |

Bradford Cooke, CEO of Endeavour, commented, "After delivering

tremendous production growth in 2013, we plan to hold production

relatively steady for 2014, hone the operations and position the

Company for a turnaround in metal prices later this year. Our

capital budget is significantly reduced this year which will help

boost free cash-flow."

"Our focus this year will be on further refining our operating

and financial performance through initiatives to improve

productivity, reduce operating costs and enhance cash-flow at all

three mines, as well as completing the operational turn-around at

El Cubo. We have resumed exploration around the mines in order to

replace depleted reserves and expand resources, but green-fields

exploration will be minimized to drilling our emerging new, high

grade discovery at the San Sebastián property."

The main opportunity to expand production in 2014 is at El Cubo,

where the plant is currently operating at 1,200 tpd but has a

capacity of 1,550 tpd. Management plans a steady ramp-up of plant

throughput during the year as mine development opens up the new

Villalpando-Asunción deposit for increased production. The main

area of reduced production in 2014 is at Bolañitos where the plant

is operating at its 1,600 tpd capacity and management has elected

not to continue extra mine production for processing at the El Cubo

plant as it did in 2013.

Bolañitos and El Cubo are both producing silver-gold

concentrates for sale under one year contracts to smelters because

their attractive terms offer lower costs and higher profit margins

compared to producing doré bars from the El Cubo leach plant at the

current low metal prices.

At El Cubo, production will continue primarily from the Dolores,

Villalpando, San Nicolas and Santa Cecilia veins as well as the

emerging new Villalpando- Asunción deposit. At Guanaceví,

production will continue primarily from the Porvenir Norte,

Porvenir Cuatro and Santa Cruz veins. Underground development of

the new Milache discovery is awaiting permitting for development to

start in 2014 and production to start in 2015. At Bolañitos,

production will continue primarily from the Daniela, Karina, Lana

and Bolañitos veins and mine development will open up the La Luz-

Asunción deposit.

Operating Costs

Consolidated by-product cash costs of silver production (net of

gold credits) are expected to be in the $9-$10 range in 2014,

largely due to the lower gold price and reduced gold production.

Consolidated co-product cash costs of silver and gold production

are anticipated to be around $13-14 and $800-850 per oz

respectively.

All-in by-product sustaining costs of production (including

sustaining capex, exploration and G&A costs) are forecasted to

be approximately $19 per oz of silver produced and all-in

co-product sustaining costs of production are predicted to be

approximately $19 per oz silver and $1,166 per oz gold. Direct

operating costs are estimated to be in the $95 per tonne range.

Capital Budget

Endeavour plans to invest $43.9 million on capital projects in

2014, including $34.6 million on mine development, infrastructure,

equipment and exploration plus $9.3 million on plant upgrades,

infrastructure, equipment and plant and exploration buildings.

The Company has budgeted US$20.9 million at El Cubo, $9.9

million at Bolañitos, $11.7 million at Guanaceví and $1.4 million

for general capital, all of which should be covered by the

Company's anticipated 2014 cash-flow.

Exploration Expenditures

In 2013, Endeavour plans to spend $11.9 million on exploration.

A total of 54,000 metres of drilling in about 120 holes are

budgeted to test multiple exploration targets in addition to the

underground mine exploration drilling.

The Company will focus on brownfields exploration around the

three operating mines in order to replenish reserves and grow

resources and mine-lives, as well as expanding and permitting the

emerging new high grade silver-gold discovery in the Terronera vein

on the San Sebastián property in Jalisco State.

Endeavour will also continue evaluating M&A opportunities in

order to identify and possibly acquire a fourth operating mine

while market valuations are low.

Cash Position

Thanks to Endeavour's strong operating performance in the second

half of 2013, the Company was able to significantly add to its cash

position and reduce its revolving bank line of credit balance by

year-end. Net debt improved by about $19 million in the last six

months of 2013, from cash of approximately $22 million and debt of

$39 million at June 30, 2013 to cash of approximately $35 million

and debt of $33 million at December 31, 2013 (all $ figures

unaudited).

Endeavour is on track to deliver another strong year of

production in 2014, notwithstanding the lower metal prices, due to

the Company's philosophy of continuous improvement. With an

improved balance sheet, Endeavour is well positioned financially to

execute its business plan in 2014.

About Endeavour Silver - Endeavour is a mid-tier silver mining

company focused on growing its profits, production, reserves and

resources in Mexico. Since start-up in 2004, Endeavour has posted

nine consecutive years of accretive growth of its silver mining

operations. The organic expansion programs now underway at

Endeavour's three silver-gold mines in Mexico combined with its

strategic acquisition and exploration programs should help

facilitate Endeavour's goal to become a premier senior silver

producer.

Cautionary Note Regarding Forward-Looking

Statements

This news release contains "forward-looking statements"

within the meaning of the United States private securities

litigation reform act of 1995 and "forward-looking information"

within the meaning of applicable Canadian securities legislation.

Such forward-looking statements and information herein include but

are not limited to statements regarding Endeavour's anticipated

performance in 2014 and the timing and results of exploration drill

programs. The Company does not intend to, and does not assume any

obligation to update such forward-looking statements or

information, other than as required by applicable law.

Forward-looking statements or information involve known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of

Endeavour and its operations to be materially different from those

expressed or implied by such statements. Such factors include,

among others, changes in national and local governments,

legislation, taxation, controls, regulations and political or

economic developments in Canada and Mexico; operating or technical

difficulties in mineral exploration, development and mining

activities; risks and hazards of mineral exploration, development

and mining; the speculative nature of mineral exploration and

development, risks in obtaining necessary licenses and permits, and

challenges to the Company's title to properties; as well as those

factors described in the section "risk factors" contained in the

Company's most recent form 40F/Annual Information Form filed with

the S.E.C. and Canadian securities regulatory authorities.

Forward-looking statements are based on assumptions

management believes to be reasonable, including but not limited to:

the continued operation of the Company's mining operations, no

material adverse change in the market price of commodities, mining

operations will operate and the mining products will be completed

in accordance with management's expectations and achieve their

stated production outcomes, and such other assumptions and factors

as set out herein. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking statements or

information, there may be other factors that cause results to be

materially different from those anticipated, described, estimated,

assessed or intended. There can be no assurance that any

forward-looking statements or information will prove to be accurate

as actual results and future events could differ materially from

those anticipated in such statements or information. Accordingly,

readers should not place undue reliance on forward-looking

statements or information.

Endeavour Silver Corp.Meghan BrownDirector Investor

RelationsToll free: (877) 685-9775 or (604) 640-4804(604)

685-9744mbrown@edrsilver.comwww.edrsilver.com

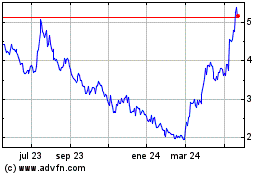

Endeavour Silver (TSX:EDR)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

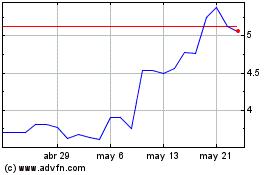

Endeavour Silver (TSX:EDR)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024