Endeavour Silver Corp.

(“Endeavour” or the

“Company”) (NYSE: EXK; TSX: EDR)

announces its financial and operating results for the three and six

months ended June 30, 2024. All dollar amounts are in US dollars

(US$).

“During Q2 2024, the construction of the

Terronera project continued to make excellent progress, with

significant advance of the upper plant platform surface

infrastructure. Staying on track for Q4 2024 commissioning reflects

our team's planning, execution and dedication while ensuring

financial stability and operational momentum. We are in our last

big push before the finish line and remain focused on delivering

value to our stakeholders,” stated Dan Dickson, CEO of Endeavour

Silver.

Q2 2024 Highlights

- Production Tracking Towards Upper Range of

Guidance: 1,312,573 ounces (oz) of silver and 10,549 oz of

gold for 2.2 million oz silver equivalent (AgEq)(1).

- Strong Revenue from Higher Realized Prices:

$58.3 million from the sale of 1,217,569 oz of silver and 9,887 oz

of gold at average realized prices of $28.94 per oz silver and

$2,374 per oz gold.

- Mine Operating Cash Flow: $18.9 million in

mine operating cash flow before taxes(2), similar to Q2 2023.

- Adjusted Earnings: Recognized a loss of $1.0

million after excluding loss on derivative contracts, mark to

market deferred share units, unrealized foreign exchange, loss on

revaluation of cash settled DSUs and investments losses.

- Balance Sheet: Cash position of $68.1 million

and working capital(2) of $64.5 million. The Company raised gross

proceeds of $14.7 million through share issuances, primarily to

fund the activities at Terronera.

- Drawdown on Terronera Senior Secured Debt

Facility: During the quarter the Company completed first

drawdown of $60 million from the senior secured debt facility.

Subsequent to the reporting period end, the Company completed a

second draw of $15 million. An additional $45 million remains

committed and available for future drawdowns during the second half

of 2024.

- Construction Continues on Schedule at the Terronera

Mine: Overall project progress reached 64.5% completion,

with more than $204 million of the project’s budget spent to date.

Project commitments total $260 million, which is 96% of the $271

million capital budget, and remains on track for commissioning in

Q4 2024. See news release dated July 24, 2024 here.

Operating And Financial

Overview

|

Three Months Ended June 30 |

Q2 2024 Highlights |

Six Months Ended June 30 |

|

2024 |

2023 |

% Change |

|

2024 |

2023 |

% Change |

|

|

|

|

Production |

|

|

|

|

1,312,573 |

1,494,000 |

(12%) |

Silver ounces produced |

2,772,578 |

3,117,545 |

(11%) |

|

10,549 |

9,819 |

7% |

Gold ounces produced |

20,682 |

19,161 |

8% |

|

1,303,461 |

1,482,255 |

(12%) |

Payable silver ounces produced |

2,753,769 |

3,090,467 |

(11%) |

|

10,369 |

9,636 |

8% |

Payable gold ounces produced |

20,317 |

18,820 |

8% |

|

2,156,453 |

2,279,520 |

(5%) |

Silver equivalent ounces produced(1) |

4,427,130 |

4,650,425 |

(5%) |

|

13.43 |

13.52 |

(1%) |

Cash costs per silver ounce(2) |

13.30 |

12.27 |

8% |

|

20.48 |

18.54 |

10% |

Total production costs per ounce(2)) |

19.65 |

16.92 |

16% |

|

23.13 |

22.15 |

(5%) |

All-in sustaining costs per ounce (2) |

22.24 |

21.11 |

1% |

|

218,989 |

228,575 |

(4%) |

Processed tonnes |

440,783 |

439,648 |

0% |

|

140.36 |

131.79 |

7% |

Direct operating costs per tonne(2) |

137.65 |

126.28 |

9% |

|

192.68 |

169.59 |

14% |

Direct costs per tonne(2) |

187.19 |

169.54 |

10% |

|

|

|

|

Financial |

|

|

|

|

58.3 |

50.0 |

17% |

Revenue ($ millions) |

122.0 |

105.5 |

16% |

|

1,217,569 |

1,299,672 |

(6%) |

Silver ounces sold |

2,973,663 |

2,967,080 |

0% |

|

9,887 |

9,883 |

0% |

Gold ounces sold |

20,767 |

19,009 |

9% |

|

28.94 |

24.27 |

19% |

Realized silver price per ounce |

25.71 |

23.65 |

9% |

|

2,374 |

1,955 |

21% |

Realized gold price per ounce |

2,238 |

1,937 |

16% |

|

(14.0) |

(1.1) |

(1,229%) |

Net earnings (loss) ($ millions) |

(15.2) |

5.4 |

(381%) |

|

(1.0) |

1.6 |

(160%) |

Adjusted net earnings (loss) (2) ($ millions) |

(0.7) |

6.7 |

(110%) |

|

10.2 |

12.5 |

(19%) |

Mine operating earnings ($ millions) |

21.9 |

28.6 |

(24%) |

|

18.9 |

18.8 |

0% |

Mine operating cash flow before taxes ($ millions)(2) |

39.5 |

41.3 |

(4%) |

|

8.1 |

11.5 |

(30%) |

Operating cash flow before working capital changes(2) |

18.3 |

24.0 |

(24%) |

|

(2.3) |

11.4 |

(120%) |

EBITDA(2) ($ millions) |

11.3 |

30.8 |

(63%) |

|

11.9 |

14.4 |

(17%) |

Adjusted EBITDA(2) ($ millions) |

28.1 |

34.1 |

(18%) |

|

64.5 |

78.2 |

(18%) |

Working capital (2) ($ millions)(2) |

64.5 |

78.2 |

(18%) |

|

|

|

|

Shareholders |

|

|

|

|

(0.06) |

(0.01) |

(500%) |

Earnings (loss) per share – basic ($) |

(0.06) |

0.03 |

(300%) |

|

(0.00) |

0.01 |

(100%) |

Adjusted earnings (loss) per share – basic ($)(2) |

(0.00) |

0.04 |

(100%) |

|

0.03 |

0.06 |

(50%) |

Operating cash flow before working capital changes per

share(2) |

0.08 |

0.13 |

(38%) |

|

242,889,679 |

191,446,597 |

27% |

Weighted average shares outstanding |

235,201,630 |

190,867,192 |

23% |

|

|

|

|

|

|

|

|

(1) Silver equivalent (AgEq) is calculated using

an 80:1 silver:gold ratio.

(2) These are non-IFRS financial measures and

ratios. Further details on these non-IFRS financial measures and

ratios are provided at the end of this press release and in the

MD&A accompanying the Company’s financial statements, which can

be viewed on the Company’s website, on SEDAR+ at www.sedarplus.com

and on EDGAR at www.sec.gov.

Direct operating costs per tonne in Q2 2024

increased to $140.36, a 7% increase compared to $131.79 in Q2 2023.

The increase in the cost per tonne compared to the prior period was

driven by a strengthened Mexican peso contributing to higher

labour, power and consumables costs. In 2023, the Company faced

significant inflationary pressures, which have eased in 2024 but

still persist.

Consolidated cash costs per silver ounce, net of

by-product credits, in Q2 2024 decreased to $13.43 per silver

ounce, a 1% decrease compared with $13.52 per silver ounce in Q2

2023, driven by an increase in by-product gold sales, but largely

offset by an increase in direct operating costs per tonne as noted

above, and a decrease in silver ore grades.

All-In-Sustaining Costs (“AISC”) increased by 4%

on a per ounce basis compared to Q2 2023 due to the higher general

and administrative costs and higher share-based compensation,

partially offset by reduced sustaining capital expenditures.

For the six months ended June 30, 2024,

consolidated direct operating costs per tonne is above annual

guidance due to higher purchased material at Guanacevi and slightly

higher direct input costs than estimated. At Guanacevi purchased

material from local miners increased to 18% of throughput and

accounted for $5.0 million or $23.02 of consolidated direct

operating costs per tonne, In Q2, 2023, purchased material was $1.5

million or $6.38 of consolidated direct operating costs per tonne.

With higher precious metal prices, the availability and cost of the

purchased material have both increased. Per ounce guidance metrics

are impacted by metal price estimates, royalties, special mining

duties and normal variations in ore grades. The higher gold price

realized has offset increased input costs in calculating per ounce

guidance metrics. Management estimates costs per ounce metrics will

be near the lower end of the guidance range, while direct operating

costs per tonne will remain above guidance due to the higher metal

prices.

Management assumed $23 per oz silver price,

$1,840 per oz gold price and 17:1 Mexican peso to U.S. dollar

exchange rate in calculating its 2024 cost guidance.

The Company reported a net loss of $14.0 million

for the three-month period ended June 30, 2024 compared to a $1.0

million loss in Q2 2023. Excluding certain non-cash and

unusual items, and items that are subject to volatility which are

unrelated to the Company’s operation, adjusted loss was $1.0

million compared to adjusted earnings of $1.6 million in Q2

2023.

For the three months ended June 30, 2024,

revenue of $58.3 million, net of $0.4 million of smelting and

refining costs, increased by 17% compared to $50.0 million, net of

$0.9 million of smelting and refining costs, in Q2, 2023.

Gross sales of $58.7 million in Q2 2024 represented a 15% increase

over the gross sales of $50.9 million for the same period in 2023.

A 6% decrease in silver ounces sold during the period,

combined with a 19% increase in the realized silver price resulted

in an 11% increase in silver sales. Gold oz sold were in line with

comparative period, with a 21% increase in realized gold prices

resulting in a 22% increase in gold sales. During the period, the

Company sold 1,217,569 oz silver and 9,887 oz gold, for realized

prices of $28.94 and $2,374 per oz, respectively, compared to sales

of 1,299,672 oz silver and 9,883 oz gold, for realized prices of

$24.27 and $1,955 per oz, respectively, in the same period of 2023.

Silver and gold London spot prices averaged $28.68 and $2,337,

respectively, during the three months ended June 30, 2024.

The Company increased its finished goods metal

inventory to 268,020 oz and to 1,261 oz gold at June 30, 2024,

compared to 182,128 oz silver and 779 oz gold at March 31,

2024. The cost allocated to these finished goods was $6.1

million at June 30, 2024, compared to $4.0 million at March 31,

2024. As of June 30, 2024, the finished goods inventory fair market

value was $10.8 million, compared to $6.2 million at March 31,

2024.

Cost of sales for Q2 2024 was $48.0 million, an

increase of 28% over the cost of sales of $37.5 million for Q2

2023. The increase in the cost of sales compared to the prior

period was driven by a strengthened Mexican peso contributing to

higher labour, power and consumables costs. Throughout 2023, the

Company faced significant inflationary pressures, which have eased

in 2024 but still persist. Additionally, in Q2 2024 purchased

material from local miners increased to 18% of Guanacevi throughput

and accounted for $5.0 million of cost of sales, an increase of

$3.5 million compared to Q2 2023. The Company incurred

increased depreciation costs during Q2 2024 compared to the prior

period, due to lower reserve estimates at its’

operations.

The Company reported operating earnings of $1.7

million after exploration, evaluation and development costs of $4.3

million and general and administrative costs of $4.3 million.

Exploration and evaluation expenses were $4.3 million, in line with

$4.3 million incurred in the same period of 2023. General and

administrative expenses of $4.2 million were 80% higher compared to

the $2.4 million incurred for the same period of 2023; the $1.9

million increase is primarily attributable to the appreciation of

the Company’s share price and the revaluation of liability

recognized for cash settled deferred share units.

Finance costs, a foreign exchange loss, loss on

derivative contracts and investment and other income contributed to

a loss before income taxes of $11.3 million compared to $4.2

million earnings before taxes in Q2 2023.

The Company incurred a foreign exchange loss of

$4.0 million in Q2 2024 compared to a foreign exchange gain of $1.9

million in Q2 2023 due to a weakening of the Mexican peso at the

end of the reporting period, which decreased the US dollar value of

the Mexican peso denominated working capital surplus. As part of

the Debt Facility agreement, the Company entered into forward gold

sale contracts and Mexican Peso purchase contracts. The Company

recognized a $9.3 million loss on these derivative contracts due to

the increase in gold forward prices and the depreciation of the

Mexican peso in relation to the US dollar at June 30, 2024.

The complete financial statements and

management’s discussion & analysis can be viewed on the

Company’s website, on SEDAR at www.sedar.com and on EDGAR at

www.sec.gov. All shareholders can receive a hard copy of the

Company’s complete audited financial statements free of charge upon

request. To receive this material in hard copy, please contact

Allison Pettit, Director Investor Relations at 604-640-4804, toll

free at 1-877-685-9775 or by email

at apettit@edrsilver.com

Conference Call

Management will host a conference call to discuss the Company’s

Q2 2024 financial results today at 1:00pm Eastern time (EDT).

| Date: |

Thursday,

August 1, 2024 |

| |

|

| Time: |

10:00am Pacific (PDT) / 1:00pm Eastern (EDT) |

| |

|

| Telephone: |

Canada & US +1-844-763-8274 |

| |

International +1-647-484-8814 |

| |

|

| Replay: |

Canada/US Toll Free +1-855-669-9658 |

| |

International +1-412-317-0088 |

| |

Passcode is 3649166 |

| |

|

To access the replay using an international dial-in number,

please click here. The replay will also be available on the

Company’s website at www.edrsilver.com.

About Endeavour Silver –

Endeavour is a mid-tier precious metals company with a strong

commitment to sustainable and responsible mining practices. With

operations in Mexico and the development of the new cornerstone

mine in Jalisco state, the company aims to contribute positively to

the mining industry and the communities in which it operates. In

addition, Endeavour has a portfolio of exploration projects in

Mexico, Chile and the United States to facilitate its goal to

become a premier senior silver producer.

Contact Information Allison Pettit, Director

Investor Relations Tel: (877) 685 - 9775 Email:

apettit@edrsilver.com Website: www.edrsilver.com

Follow Endeavour Silver on Facebook, X,

Instagram and LinkedIn

Endnotes

1 Silver equivalent (AgEq)

AgEq is calculated using an 80:1 silver:gold ratio.

2 Non-IFRS and Other Financial Measures

and Ratios

Certain non-IFRS and other non-financial

measures and ratios are included in this press release, including

cash costs per silver ounce, total production costs per ounce,

all-in costs per ounce, all-in sustaining cost (“AISC”) per ounce,

direct operating costs per tonne, direct costs per tonne, silver

co-product cash costs, gold co-product cash costs, realized silver

price per ounce, realized gold price per ounce, adjusted net

earnings (loss) adjusted net earnings (loss) per share, mine

operating cash flow before taxes, working capital, operating cash

flow before working capital adjustments, operating cash flow before

working capital changes per share, earnings before interest, taxes,

depreciation and amortization (“EBITDA”), adjusted EBITDA per share

and sustaining and growth capital.

Please see the June 30, 2024 MD&A for

explanations and discussion of these non-IFRS and other

non-financial measures and ratios. The Company believes that these

measures and ratios, in addition to conventional measures and

ratios prepared in accordance with International Financial

Reporting Standards (“IFRS”), provide management and investors an

improved ability to evaluate the underlying performance of the

Company. The non-IFRS and other non-financial measures and ratios

are intended to provide additional information and should not be

considered in isolation or as a substitute for measures or ratios

of performance prepared in accordance with IFRS. These measures and

ratios do not have any standardized meaning prescribed under IFRS,

and therefore may not be comparable to other issuers. Certain

additional disclosures for these non-IFRS measures have been

incorporated by reference and can be found in the section “Non-IFRS

Measures” in the June 30, 2024 MD&A available on SEDAR at

www.sedar.com.

Reconciliation of Working Capital

|

Expressed in thousands US dollars |

As at June 30, 2024 |

As at December 31, 2023 |

|

Current assets |

$127,506 |

$100,773 |

|

Current liabilities |

63,001 |

58,244 |

|

Working capital |

$64,505 |

$42,529 |

|

|

|

|

Reconciliation of Adjusted Net Earnings (Loss)

and Adjusted Net Earnings (Loss) Per Share

|

Expressed in thousands US dollars |

Three Months Ended June 30 |

Six Months Ended June 30 |

|

(except for share numbers and per share amounts) |

2024 |

2023 |

2024 |

2023 |

|

Net earnings (loss) for the period per financial statements |

($14,007) |

($1,054) |

($15,201) |

$5,402 |

|

Unrealized foreign exchange (Gain) loss |

2,196 |

519 |

2,332 |

1,614 |

|

(Gain) loss on derivatives |

9,253 |

- |

9,253 |

- |

|

Change in fair value of investments |

425 |

3,150 |

1,286 |

53 |

|

Change in fair value of cash settled DSUs |

1,159 |

(994) |

1,624 |

(341) |

|

Adjusted net earnings (loss) |

($974) |

$1,621 |

($706) |

$6,728 |

|

Basic weighted average share outstanding |

242,889,679 |

191,446,597 |

235,201,630 |

190,867,192 |

|

Adjusted net earnings (loss) per share |

($0.00) |

$0.01 |

($0.00) |

$0.04 |

| |

|

|

|

|

Reconciliation of Mine Operating Cash Flow

Before Taxes

|

Expressed in thousands US dollars |

Three Months Ended June 30 |

Six Months Ended June 30 |

|

|

2024 |

2023 |

2024 |

2023 |

|

Mine operating earnings per financial statements |

$10,196 |

$12,542 |

$21,852 |

$28,567 |

|

Share-based compensation |

74 |

(294) |

153 |

(162) |

|

Depreciation |

8,639 |

6,596 |

17,516 |

12,849 |

|

Mine operating cash flow before taxes |

$18,909 |

$18,844 |

$39,521 |

$41,254 |

|

|

|

|

|

|

Reconciliation of Operating Cash Flow Before

Working Capital Changes and Operating Cash Flow Before Working

Capital Changes Per Share

|

Expressed in thousands US dollars |

Three Months Ended June 30 |

Six Months Ended June 30 |

|

(except for per share amounts) |

2024 |

2023 |

2024 |

2023 |

|

Cash from (used in) operating activities per financial

statements |

$12,367 |

$4,853 |

$16,950 |

$4,452 |

|

Net changes in non-cash working capital per financial

statements |

4,301 |

(6,606) |

(1,350) |

(19,508) |

|

Operating cash flow before working capital changes |

$8,066 |

$11,459 |

$18,300 |

$23,960 |

|

Basic weighted average shares outstanding |

242,889,679 |

191,446,597 |

235,201,630 |

190,867,192 |

|

Operating cash flow before working capital changes per share |

$0.03 |

$0.06 |

$0.08 |

$0.13 |

| |

|

|

|

|

Reconciliation of EBITDA and Adjusted EBITDA

|

Expressed in thousands US dollars |

Three Months Ended June 30 |

Six Months Ended June 30 |

|

|

2024 |

2023 |

2024 |

2023 |

|

Net earnings (loss) for the period per financial statements |

($14,007) |

($1,054) |

($15,201) |

$5,402 |

|

Depreciation – cost of sales |

8,639 |

6,596 |

17,516 |

12,849 |

|

Depreciation – exploration, evaluation and development |

188 |

317 |

347 |

595 |

|

Depreciation – general & administration |

106 |

54 |

205 |

116 |

|

Finance costs |

103 |

229 |

238 |

488 |

|

Current income tax expense |

2,878 |

4,442 |

8,545 |

8,887 |

|

Deferred income tax expense (recovery) |

(163) |

766 |

(396) |

2,442 |

|

EBITDA |

($2,256) |

$11,350 |

$11,254 |

$30,779 |

|

Share based compensation |

1,162 |

416 |

2,332 |

2,041 |

|

Unrealized foreign exchange (gain) loss |

2,196 |

519 |

2,332 |

1,614 |

|

(Gain) loss on derivatives |

9,253 |

- |

9,253 |

- |

|

Change in fair value of investments |

425 |

3,150 |

1,286 |

53 |

|

Change in fair value of cash settled DSUs |

1,159 |

(994) |

1,624 |

(341) |

|

Adjusted EBITDA |

$11,939 |

$14,441 |

$28,081 |

$34,146 |

|

Basic weighted average shares outstanding |

242,889,679 |

191,446,597 |

235,201,630 |

190,867,192 |

|

Adjusted EBITDA per share |

$0.05 |

$0.08 |

$0.12 |

$0.18 |

|

|

|

|

|

|

Reconciliation of Cash Cost Per Silver Ounce,

Total Production Costs Per Ounce, Direct Operating Costs Per Tonne,

Direct Costs Per Tonne

|

Expressed in thousands US dollars |

Three Months Ended June 30 |

Six Months Ended June 30 |

|

|

Guanaceví |

Bolañitos |

Total |

Guanaceví |

Bolañitos |

Total |

|

Direct production costs per financial statements |

$23,001 |

$10,702 |

$33,703 |

14,878 |

10,600 |

$25,478 |

|

'Purchase of the third-party material |

(5,043) |

- |

(5,043) |

(1,457) |

- |

(1,457) |

|

Smelting and refining costs included in net revenue |

- |

447 |

447 |

- |

795 |

795 |

|

Opening finished goods |

(2,314) |

(651) |

(2,965) |

(4,848) |

(1,063) |

(5,911) |

|

Closing finished goods |

4,038 |

557 |

4,595 |

10,257 |

962 |

11,219 |

|

Direct operating costs |

19,682 |

11,055 |

30,737 |

18,830 |

11,294 |

30,124 |

|

'Purchase of third-party material |

5,043 |

- |

5,043 |

1,457 |

- |

1,457 |

|

Royalties |

5,556 |

92 |

5,648 |

5,679 |

70 |

5,749 |

|

Special mining duty(1) |

129 |

637 |

766 |

1,224 |

209 |

1,433 |

|

Direct costs |

30,410 |

11,784 |

42,194 |

27,190 |

11,573 |

38,763 |

|

By-product gold sales |

(8,622) |

(14,852) |

(23,474) |

(8,469) |

(10,853) |

(19,322) |

|

Opening gold inventory fair market value |

871 |

851 |

1,722 |

2,500 |

995 |

3,495 |

|

Closing gold inventory fair market value |

(2,187) |

(751) |

(2,938) |

(1,629) |

(1,268) |

(2,897) |

|

Cash costs net of by-product |

20,472 |

(2,968) |

17,504 |

19,592 |

447 |

20,039 |

|

Depreciation |

5,965 |

2,674 |

8,639 |

3,381 |

3,215 |

6,596 |

|

Share-based compensation |

60 |

14 |

74 |

(147) |

(147) |

(294) |

|

Opening finished goods depreciation |

(771) |

(219) |

(990) |

(1,115) |

(355) |

(1,470) |

|

Closing finished goods depreciation |

1,326 |

144 |

1,470 |

2,318 |

288 |

2,606 |

|

Total production costs |

$27,052 |

($355) |

$26,697 |

$24,029 |

$3,448 |

$27,477 |

|

|

Three Months Ended June 30, 2024 |

Three Months Ended June 30, 2023 |

|

|

Guanaceví |

Bolañitos |

Total |

Guanaceví |

Bolañitos |

Total |

|

Throughput tonnes |

112,897 |

106,092 |

218,989 |

116,908 |

111,667 |

228,575 |

|

Payable silver ounces |

1,192,165 |

111,296 |

1,303,461 |

1,348,366 |

133,889 |

1,482,255 |

|

|

|

|

|

|

|

|

|

Cash costs per silver ounce |

$17.17 |

($26.67) |

$13.43 |

$14.53 |

$3.34 |

$13.52 |

|

Total production costs per ounce |

$22.69 |

($3.19) |

$20.48 |

$17.82 |

$25.75 |

$18.54 |

|

Direct operating costs per tonne |

$174.34 |

$104.20 |

$140.36 |

$161.07 |

$101.14 |

$131.79 |

|

Direct costs per tonne |

$269.36 |

$111.07 |

$192.68 |

$232.58 |

$103.64 |

$169.59 |

|

Expressed in thousands US dollars |

Six Months Ended June 30, 2024 |

Six Months Ended June 30, 2023 |

|

|

Guanaceví |

Bolañitos |

Total |

Guanaceví |

Bolañitos |

Total |

|

Direct production costs per financial statements |

$49,887 |

$20,521 |

$70,408 |

$33,023 |

$18,971 |

$51,994 |

|

'Purchase of the third-party material |

(5,043) |

- |

(5,043) |

(1,457) |

- |

(1,457) |

|

Smelting and refining costs included in net revenue |

- |

940 |

940 |

- |

1,451 |

1,451 |

|

Opening finished goods |

(7,137) |

(699) |

(7,836) |

(4,953) |

(245) |

(5,198) |

|

Closing finished goods |

4,038 |

557 |

4,595 |

10,257 |

962 |

11,219 |

|

Direct operating costs |

39,353 |

21,319 |

60,672 |

34,378 |

21,139 |

55,517 |

|

'Purchase of third-party material |

5,043 |

- |

5,043 |

1,457 |

- |

1,457 |

|

Royalties |

11,888 |

168 |

12,056 |

12,150 |

134 |

12,284 |

|

Special mining duty(1) |

1,650 |

697 |

2,347 |

2,494 |

294 |

2,788 |

|

Direct costs |

60,326 |

22,184 |

82,510 |

52,971 |

21,567 |

74,538 |

|

By-product gold sales |

(19,353) |

(27,117) |

(46,470) |

(16,902) |

(19,917) |

(36,819) |

|

Opening gold inventory fair market value |

2,909 |

619 |

3,528 |

2,740 |

354 |

3,094 |

|

Closing gold inventory fair market value |

(2,187) |

(751) |

(2,938) |

(1,629) |

(1,268) |

(2,897) |

|

Cash costs net of by-product |

41,695 |

(5,065) |

36,630 |

37,180 |

736 |

37,916 |

|

Depreciation |

11,780 |

5,736 |

17,516 |

6,855 |

5,994 |

12,849 |

|

Share-based compensation |

122 |

31 |

153 |

(81) |

(81) |

(162) |

|

Opening finished goods depreciation |

(1,459) |

(197) |

(1,656) |

(862) |

(60) |

(922) |

|

Closing finished goods depreciation |

1,326 |

144 |

1,470 |

2,318 |

288 |

2,606 |

|

Total production costs |

$53,464 |

$649 |

$54,113 |

$45,410 |

$6,877 |

$52,287 |

|

|

Six Months Ended June 30, 2024 |

Six Months Ended June 30, 2023 |

|

|

Guanaceví |

Bolañitos |

Total |

Guanaceví |

Bolañitos |

Total |

|

Throughput tonnes |

227,901 |

212,882 |

440,783 |

219,283 |

220,365 |

439,648 |

|

Payable silver ounces |

2,523,900 |

229,869 |

2,753,769 |

2,783,970 |

306,497 |

3,090,467 |

|

|

|

|

|

|

|

|

|

Cash costs per silver ounce |

$16.52 |

($22.03) |

$13.30 |

$13.36 |

$2.40 |

$12.27 |

|

Total production costs per ounce |

$21.18 |

$2.82 |

$19.65 |

$16.31 |

$22.44 |

$16.92 |

|

Direct operating costs per tonne |

$172.68 |

$100.14 |

$137.65 |

$156.77 |

$95.93 |

$126.28 |

|

Direct costs per tonne |

$264.70 |

$104.21 |

$187.19 |

$241.56 |

$97.87 |

$169.54 |

|

|

|

|

|

|

|

|

Reconciliation of All-In Costs Per Ounce and

AISC per ounce

|

Expressed in thousands US dollars

|

Three Months Ended June 30, 2024 |

Three Months Ended June 30, 2023 |

|

|

Guanaceví |

Bolañitos |

Total |

Guanaceví |

Bolañitos |

Total |

|

Cash costs net of by-product |

$20,472 |

($2,968) |

$17,504 |

$19,592 |

$447 |

$20,039 |

|

Operations share-based compensation |

60 |

14 |

74 |

(147) |

(147) |

(294) |

|

Corporate general and administrative |

2,263 |

910 |

3,173 |

1,228 |

477 |

1,705 |

|

Corporate share-based compensation |

684 |

277 |

961 |

430 |

169 |

599 |

|

Reclamation - amortization/accretion |

101 |

73 |

174 |

79 |

66 |

145 |

|

Mine site expensed exploration |

341 |

335 |

676 |

327 |

350 |

677 |

|

Equipment loan payments |

78 |

67 |

145 |

245 |

489 |

734 |

|

Capital expenditures sustaining |

5,245 |

2,199 |

7,444 |

6,300 |

2,920 |

9,220 |

|

All-In-Sustaining Costs |

$29,244 |

$907 |

$30,151 |

$28,054 |

$4,771 |

$32,825 |

|

Growth exploration, evaluation and development |

|

|

3,299 |

|

|

3,253 |

|

Growth capital expenditures |

|

|

48,367 |

|

|

14,644 |

|

All-In-Costs |

|

|

$81,817 |

|

|

$50,722 |

|

|

Three Months Ended June 30, 2024 |

Three Months Ended June 30, 2023 |

|

|

Guanaceví |

Bolañitos |

Total |

Guanaceví |

Bolañitos |

Total |

|

Throughput tonnes |

112,898 |

106,092 |

218,990 |

116,908 |

111,667 |

228,575 |

|

Payable silver ounces |

1,192,165 |

111,296 |

1,303,461 |

1,348,366 |

133,889 |

1,482,255 |

|

Silver equivalent production (ounces) |

1,535,148 |

621,257 |

2,156,405 |

1,663,223 |

616,297 |

2,279,520 |

|

|

|

|

|

|

|

|

|

All-in Sustaining cost per ounce |

$24.53 |

$8.15 |

$23.13 |

$20.81 |

$35.64 |

$22.15 |

|

Expressed in thousands US dollars |

Six Months Ended June 30, 2024 |

Six Months Ended June 30, 2023 |

|

|

Guanaceví |

Bolañitos |

Total |

Guanaceví |

Bolañitos |

Total |

|

Cash costs net of by-product |

$41,695 |

($5,065) |

$36,630 |

$37,180 |

$736 |

$37,916 |

|

Operations share-based compensation |

122 |

31 |

153 |

(81) |

(81) |

(162) |

|

Corporate general and administrative |

4,467 |

1,711 |

6,178 |

3,844 |

1,355 |

5,199 |

|

Corporate share-based compensation |

1,374 |

527 |

1,901 |

1,449 |

511 |

1,960 |

|

Reclamation - amortization/accretion |

203 |

150 |

353 |

158 |

128 |

286 |

|

Mine site expensed exploration |

463 |

649 |

1,112 |

706 |

663 |

1,369 |

|

Equipment loan payments |

206 |

287 |

493 |

490 |

976 |

1,466 |

|

Capital expenditures sustaining |

9,961 |

4,465 |

14,426 |

11,990 |

5,221 |

17,211 |

|

All-In-Sustaining Costs |

$58,491 |

$2,755 |

$61,246 |

$55,736 |

$9,509 |

$65,245 |

|

Growth exploration, evaluation and development |

|

|

6,823 |

|

|

6,316 |

|

Growth capital expenditures |

|

|

86,272 |

|

|

27,370 |

|

All-In-Costs |

|

|

$154,341 |

|

|

$98,931 |

|

|

Six Months Ended June 30, 2024 |

Six Months Ended June 30, 2023 |

|

|

Guanaceví |

Bolañitos |

Total |

Guanaceví |

Bolañitos |

Total |

|

Throughput tonnes |

227,902 |

212,882 |

440,784 |

219,283 |

220,365 |

439,648 |

|

Payable silver ounces |

2,523,900 |

229,869 |

2,753,769 |

2,783,970 |

306,497 |

3,090,467 |

|

Silver equivalent production (ounces) |

3,200,810 |

1,226,320 |

4,427,130 |

3,438,187 |

1,212,238 |

4,650,425 |

|

|

|

|

|

|

|

|

|

All-in Sustaining cost per ounce |

$23.17 |

$11.98 |

$22.24 |

$20.02 |

$31.03 |

$21.11 |

|

|

|

|

|

|

|

|

Reconciliation of Sustaining Capital and Growth

Capital

|

Expressed in thousands US dollars |

Three Months Ended June 30 |

Six Months Ended June 30 |

|

|

2024 |

2023 |

2024 |

2023 |

|

Capital expenditures sustaining |

$7,444 |

$9,220 |

$14,426 |

$17,211 |

|

Growth capital expenditures |

48,367 |

14,644 |

86,272 |

27,370 |

|

Property, plant and equipment expenditures per Consolidated

Statement of Cash Flows |

$55,829 |

$23,864 |

$100,716 |

$44,581 |

|

Expressed in thousands US dollars |

Three Months Ended June 30 |

Six Months Ended June 30 |

|

|

2024 |

2023 |

2024 |

2023 |

|

Mine site expensed exploration |

$676 |

$677 |

$1,112 |

$1,369 |

|

Growth exploration, evaluation and development |

2,187 |

3,253 |

6,823 |

6,316 |

|

Total exploration, evaluation and development |

3,975 |

3,930 |

7,935 |

7,685 |

|

Exploration, evaluation and development depreciation |

188 |

317 |

347 |

595 |

|

Exploration, evaluation and development share-based

compensation |

127 |

112 |

278 |

243 |

|

Exploration, evaluation and development expense |

$4,290 |

$4,359 |

$8,560 |

$8,523 |

| |

|

|

|

|

Reconciliation of Realized Silver Price Per

Ounce and Realized Gold Price Per Ounce

|

Expressed in thousands US dollars |

Three Months Ended June 30 |

Six Months Ended June 30 |

|

|

2024 |

2023 |

2024 |

2023 |

|

Gross silver sales |

$35,234 |

$31,543 |

$76,456 |

$70,163 |

|

Silver ounces sold |

1,217,569 |

1,299,672 |

2,973,663 |

2,967,080 |

|

Realized silver price per ounces |

$28.94 |

$24.27 |

$25.71 |

$23.65 |

|

Expressed in thousands US dollars |

Three Months Ended June 30 |

Six Months Ended June 30 |

|

|

2024 |

2023 |

2024 |

2023 |

|

Gross gold sales |

$23,474 |

$19,322 |

$46,470 |

$36,819 |

|

Gold ounces sold |

9,887 |

9,883 |

20,767 |

19,009 |

|

Realized gold price per ounces |

$2,374 |

$1,955 |

$2,238 |

$1,937 |

|

|

|

|

|

|

Cautionary Note Regarding Forward-Looking

Statements

This news release contains “forward-looking

statements” within the meaning of the United States private

securities litigation reform act of 1995 and “forward-looking

information” within the meaning of applicable Canadian securities

legislation. Such forward-looking statements and information herein

include but are not limited to statements regarding the development

and financing of the Terronera Project including: anticipated

timing of the project; the Company’s ability to further drawdown on

the Debt Facility, estimated project economics, Terronera’s

forecasted operations, costs and expenditures, and the timing and

results of various related activities, Endeavour’s

anticipated performance in 2024 including changes in mining

operations and forecasts of production levels, anticipated

production costs and all-in sustaining costs and the timing and

results of various activities. The Company does not intend to and

does not assume any obligation to update such forward-looking

statements or information, other than as required by applicable

law.

Forward-looking statements or information

involve known and unknown risks, uncertainties and other factors

that may cause the actual results, level of activity, production

levels, performance or achievements of Endeavour and its operations

to be materially different from those expressed or implied by such

statements. Such factors include but are not limited changes in

production and costs guidance; the ongoing effects of inflation and

supply chain issues on mine economics; national and local

governments, legislation, taxation, controls, regulations and

political or economic developments in Canada and Mexico; financial

risks due to precious metals prices; operating or technical

difficulties in mineral exploration, development and mining

activities; risks and hazards of mineral exploration, development

and mining; the speculative nature of mineral exploration and

development; risks in obtaining necessary licenses and permits;

satisfaction of conditions precedent to drawdown under the Debt

Facility; the ongoing effects of inflation and supply chain issues

on the Terronera Project economics; fluctuations in the prices of

silver and gold, fluctuations in the currency markets (particularly

the Mexican peso, Chilean peso, Canadian dollar and U.S. dollar);

and challenges to the Company’s title to properties; as well as

those factors described in the section “risk factors” contained in

the Company’s most recent form 40F/Annual Information Form filed

with the S.E.C. and Canadian securities regulatory authorities.

Forward-looking statements are based on

assumptions management believes to be reasonable, including but not

limited to: the continued operation of the Company’s mining

operations, no material adverse change in the market price of

commodities, forecasted mine economics as of 2024, mining

operations will operate and the mining products will be completed

in accordance with management’s expectations and achieve their

stated production outcomes, the Company’s ability to further

drawdown on the Debt Facility, and such other assumptions and

factors as set out herein. Although the Company has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

statements or information, there may be other factors that cause

results to be materially different from those anticipated,

described, estimated, assessed or intended. There can be no

assurance that any forward-looking statements or information will

prove to be accurate as actual results and future events could

differ materially from those anticipated in such statements or

information. Accordingly, readers should not place undue reliance

on forward-looking statements or information.

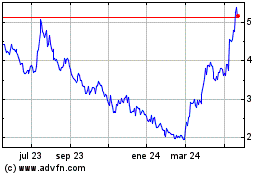

Endeavour Silver (TSX:EDR)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

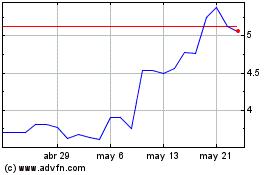

Endeavour Silver (TSX:EDR)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025