Perseus Mining Limited: Activities Report for March 2014 Quarter

29 Abril 2014 - 12:30AM

Marketwired Canada

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

Perseus Mining Limited ("Perseus" or the "Company") (TSX:PRU)(ASX:PRU) reports

on its activities for the three month period ended 31 March 2014 (the

"Quarter"). An executive summary is provided below, however the full report is

available for download from www.perseusmining.com, www.asx.com.au and

www.sedar.com.

Full details of activities in the March Quarter, including reconciled production

and all-in site cash costs, will be included in the Company's March 2014

Quarterly Activities Report that is scheduled to be released to the market on 29

April 2014.

Operations - Edikan Gold Mine ("EGM"), Ghana

-- The trend of improved operating performance at Perseus's EGM continued

during the Quarter as indicated by increases in the run time of the SAG

mill (88%) and gold recovery (86% in March 2014);

-- 43,787ozs of gold were produced, reflecting an expected short term

decrease in the head grade and quantity of ore processed during the

Quarter;

-- The EGM's all-in site cost (including production, royalties, development

and sustaining capital) was reduced during the Quarter but given the

expected reduction in gold production, unit costs increased slightly to

US$1,286/oz;

-- 43,873ozs of gold were sold during the Quarter at an average sales price

of US$1,294/oz;

-- A fire occurred in the cyclone cluster in the processing plant during

routine maintenance following the end of the Quarter. Processing of ore

was interrupted for seven days while repairs to fire damage were

completed.

-- The seven day shutdown of gold production due to the fire has

contributed materially to a change to gold production and subsequently

cost guidance for the six months ending 30 June 2014 ("the June Half

Year"):

----------------------------------------------------------------------------

Six Months to Twelve Months to

Parameter Units 30 June 2014 30 June 2014

----------------------------------------------------------------------------

Gold Production Ounces 89,000 - 99,000 183,200-193,200

All-In Site Cash

Costs US$/oz 1,150 - 1,300 1,200 - 1,300

----------------------------------------------------------------------------

This represents a decrease in forecast gold production of approximately 10% and

an increase in all-in site unit costs of approximately 7%.

Development - Sissingue Gold Project ("Sissingue"), Cote d'Ivoire

-- The Ivorian Government granted Perseus a two year extension to the date

for completion of the Sissingue development;

-- A new Mining Code introduced by the Ivorian Government provides a sound

framework for obtaining fiscal stability for mining projects in the

country;

-- Work has started on optimising the Sissingue process route and

development plan.

Exploration - Ghana and Cote d'Ivoire

-- Significant drill intercepts from the Bele Central prospect at the

Mahale Project in Cote d'Ivoire;

-- Ground geophysics survey commenced on the Bele prospect and 2,094 metres

of auger drilling completed 7 kilometres north-east of Bele.

Corporate

-- Available cash and bullion of $47.6 million as at 31 March 2014

(excluding $49.7 million in escrow and VAT receivable);

-- A placement of about 68.7 million ordinary shares, representing 15% of

the Company's existing capital to raise approximately $32 million was

successfully completed on 17 February 2014.

Program for the June 2014 Quarter

Edikan Gold Mine

-- Produce gold at a total all-in site cash cost that is in line with

amended Half Year guidance;

-- Continue to fine tune plant metallurgical performance and maximise SAG

mill throughput;

-- Continue training of operating and maintenance staff; and

-- Continue to implement business improvement initiatives across all

departments of the EGM.

Sissingue Gold Mine Development Project

-- Review of project cost structure and development options; and

-- Review project economics and financing alternatives.

-- Continue exploration for Mineral Resources on Mahale exploration licence

and the Sissingue exploitation permit.

Jeffrey A Quartermaine

Managing Director and Chief Executive Officer

Caution Regarding Forward Looking Information: This report contains

forward-looking information which is based on the assumptions, estimates,

analysis and opinions of management made in light of its experience and its

perception of trends, current conditions and expected developments, as well as

other factors that management of the Company believes to be relevant and

reasonable in the circumstances at the date that such statements are made, but

which may prove to be incorrect. Assumptions have been made by the Company

regarding, among other things: the price of gold, continuing commercial

production at the Edikan Gold Mine without any major disruption, development of

a mine at Tengrela, the receipt of required governmental approvals, the accuracy

of capital and operating cost estimates, the ability of the Company to operate

in a safe, efficient and effective manner and the ability of the Company to

obtain financing as and when required and on reasonable terms. Readers are

cautioned that the foregoing list is not exhaustive of all factors and

assumptions which may have been used by the Company. Although management

believes that the assumptions made by the Company and the expectations

represented by such information are reasonable, there can be no assurance that

the forward-looking information will prove to be accurate. Forward-looking

information involves known and unknown risks, uncertainties, and other factors

which may cause the actual results, performance or achievements of the Company

to be materially different from any anticipated future results, performance or

achievements expressed or implied by such forward-looking information. Such

factors include, among others, the actual market price of gold, the actual

results of current exploration, the actual results of future exploration,

changes in project parameters as plans continue to be evaluated, as well as

those factors disclosed in the Company's publicly filed documents. The Company

believes that the assumptions and expectations reflected in the forward-looking

information are reasonable. Assumptions have been made regarding, among other

things, the Company's ability to carry on its exploration and development

activities, the timely receipt of required approvals, the price of gold, the

ability of the Company to operate in a safe, efficient and effective manner and

the ability of the Company to obtain financing as and when required and on

reasonable terms. Readers should not place undue reliance on forward-looking

information. Perseus does not undertake to update any forward-looking

information, except in accordance with applicable securities laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

To discuss any aspect of this announcement, please contact:

Managing Director: Jeff Quartermaine

Telephone +61 8 6144 1700

Email jeff.quartermaine@perseusmining.com (Perth)

Investor Relations: Nathan Ryan

Telephone +61 (0) 420 582 887

Email nathan.ryan@nwrcommunications.com.au (Melbourne)

Perseus Mining (TSX:PRU)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

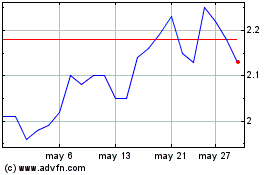

Perseus Mining (TSX:PRU)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024