UNISYNC Reports Q3 Fiscal 2023 Results

15 Agosto 2023 - 7:10AM

Unisync Corp. ("Unisync") (TSX:"UNI")

(OTC:"USYNF") announces its financial results for the third quarter

ended June 30, 2023 of its 2023 fiscal year (“Q3 2023”). Unisync

operates through two business units: Unisync Group Limited (“UGL”)

with operations throughout Canada and the USA and 90% owned

Peerless Garments LP (“Peerless”), a domestic manufacturing

operation based in Winnipeg, Manitoba. UGL is a leading

customer-focused provider of corporate apparel, serving many

leading Canadian and American iconic brands. Peerless specializes

in the production and distribution of highly technical protective

garments, including military operational clothing and accessories

for a broad spectrum of Federal, Provincial and Municipal

government departments and agencies.

Results for Q3 2023 versus Q3

2022Revenue for Q3 2023 of $25.4 million rose by $0.7

million or 3% from Q3 2022, due to a $0.9 million revenue

improvement in the UGL segment less a $0.4 million revenue decrease

in the Peerless segment and less a $0.2 million decrease in

intersegment revenue eliminations. UGL segment revenue of $22.7

million increased by 4% over the same period in the prior year on

an improvement in sales to the segment’s airline accounts. The

increase in sales to the Company’s airline accounts was caused by

the continued post-pandemic rebound in the airline industry where

staffing levels have surged above pre-pandemic levels. The revenue

decrease in the Peerless segment in the current quarter was due to

lower uniform product sales to the Department of National Defence

(“DND”) on account of delays in the exercise of contract options

and the lack of new contract orders.

Gross profit for Q3 2023 of $1.9 million was

down $2.6 million from the third quarter of fiscal 2022 and the

gross profit margin declined to 7.4% of revenue from 18.1%. The UGL

segment experienced a decline in gross profit to $1.3 million or 6%

of segment revenue compared to $3.9 million or 18% of segment

revenue in the same quarter in the prior year because of a $1.8

million revaluation of the weighted average cost of inventory in

the current period to adjust for the sharp drop in offshore

container delivery costs since the peak experienced in June 2022,

the absorption of higher outbound courier costs to deliver product

to customers and costs associated with the startup of the new

Guelph satellite 40,000 sq. ft. distribution facility which opened

in July. Despite the decrease in Peerless segment revenue, gross

profit of $0.6 million in that segment was unchanged from the prior

year due to the higher margin mix of product sales.

At $4.0 million, total general and

administrative expenses for Q3 2023 were down $0.4 million or 9%

from Q3 2022 on a reduction in senior management and customer

service staff levels from the same period in the prior period.

Interest expense of $0.8 million in the current

quarter was up $0.4 million from the same quarter of fiscal 2022

due to higher interest costs combined with the need for greater

short-term borrowings to finance the growth in inventory and

receivable levels.

The Company reported a net loss before tax of

$3.0 million in the quarter compared to a net loss of $0.5 million

in the same quarter last year. Adjusted EBITDA, before the $1.8

million non-cash inventory revaluation in the quarter, was $1.0

million versus $1.2 million for the corresponding 3 month period

last year.

More detailed information is contained in the

Company’s Consolidated Financial Statements for the quarter ended

June 30, 2023 and Management Discussion and Analysis dated August

10, 2023 which may be accessed at www.sedar.com.

Business OutlookThe Company’s

North American airline accounts continue to experience strong

demand and, although volumes are down from the unprecedented

volumes experienced in the first half of fiscal 2023 due to a

massive ramp-up in employee counts, ongoing orders have returned to

pre-pandemic levels. The Company expects that this will continue to

result in strong uniform sales to its airline accounts throughout

the remainder of fiscal 2023 and thereafter. The lead time for

offshore ocean shipments continues to improve, and the costs of

container shipments have stabilized at pre-pandemic levels

following the inflated levels experienced during the pandemic and

into early fiscal 2023. New product orders are at an all-time high

as evidenced by the increase in deferred revenue to $21.3 million

at June 30, 2023 compared to $16.7 million as at September 30, 2022

and $5.0 million as at September 30, 2021. Approximately 60% of the

deferred revenue at the end of Q3 2023 represents deposits on

custom garment production in process, with the balance representing

customer deposits at full selling prices covering slow moving

inventory awaiting a disposition decision.

The Company continues to place strong focus on

the US market. UGL is in advanced discussions with a number of

major corporations with respect to their image wear programs

totaling close to US$100 million annually in potential new

business. Additionally, UGL has been added as an approved supplier

to an extensive list of major customers that are also scheduled to

come to market during the 2023 and into 2024 calendar years.

The Peerless business segment is positioned to

maintain its current level of revenues and profitability over the

balance of fiscal 2023 although there has been a significant

slowdown in new opportunities emanating from the DND.

Our primary strategy has been concentrated to

date on building an infrastructure of strong management and

advanced systems and a referenceable base of iconic clients to fuel

future growth and profitability. As we move out of this platform

building phase, management and your board are committed to

achieving continued future growth and the development of an

improved level of profitability to enhance shareholder value.

On Behalf of the Board of Directors

Douglas F GoodCEO

Investor relations contact:Douglas

F Good, CEO at 778-370-1725 Email: dgood@unisyncgroup.com

Forward-Looking Statements

This news release may contain forward-looking

statements that involve known and unknown risk and uncertainties

that may cause the Company’s actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied in these

forward-looking statements. Any forward-looking statements

contained herein are made as of the date of this news release and

are expressly qualified in their entirety by this cautionary

statement. Except as required by law, the Company undertakes no

obligation to publicly update or revise any such forward-looking

statements to reflect any change in its expectations or in events,

conditions, or circumstances on which any such forward-looking

statements may be based, or that may affect the likelihood that

actual results will differ from those set forth in the

forward-looking statements. Neither the TSX nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX) accepts responsibility for the adequacy or accuracy of this

release.

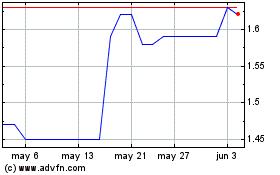

Unisync (TSX:UNI)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Unisync (TSX:UNI)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024