UNISYNC Reports Q1 Fiscal 2024 Financial Results

15 Febrero 2024 - 7:30AM

Unisync Corp. (“Unisync") (TSX:"UNI")

(OTC:“USYNF”) announces its financial results for the first quarter

ended December 31, 2023. Unisync operates through two business

units: Unisync Group Limited (“UGL”) with operations throughout

Canada and the USA and 90% owned Peerless Garments LP (“Peerless”),

a domestic manufacturing operation based in Winnipeg, Manitoba. UGL

is a leading customer-focused provider of corporate apparel,

serving many leading Canadian and American iconic brands. Peerless

specializes in the production and distribution of highly technical

protective garments, military operational clothing, and accessories

for a broad spectrum of Federal, Provincial and Municipal

government departments and agencies.

Results for

the quarter ended

December 31,

2023 versus the

quarter ended December

31, 2022

Consolidated revenue for the three months ended

December 31, 2023 of $23.0 million was within $0.6 million of the

normalized comparable revenue of $23.6 million for the three months

ended December 31, 2022. UGL segment revenue of $20.6 million in

the current quarter was below last year’s comparable quarter

revenue of $26.4 million mainly due to the December 2022 sale of

the non-core New Jersey division that contributed revenue of $5.3

million ($1.3 million of which was from the bulk sale of inventory

to the purchaser) in the corresponding quarter last year.

As a result of the loss of revenues from the

sale of the New Jersey division, the UGL segment experienced a

decrease in gross profit to $3.1 million or 15.0% of segment

revenue compared to $5.1 million or 19.2% of segment revenue in the

same quarter in the prior year.

Peerless maintained revenues consistent with the

same quarter last year, recording gross profit of $0.5 million or

20.9% of segment revenue against $0.4 million or 14.5% of segment

revenue in the same quarter of the prior fiscal year on a higher

margin mix of product sales.

At $3.7 million, consolidated general and

administrative expenses were down $0.7 million or 15.6% from the

three months ended December 31, 2022 due to the sale of the New

Jersey division last year and the overhead reductions associated

with the relocation of the Carleton Place, Ontario and the

Saint-Laurent, Quebec operations that began in September 2023.

Interest expense of $0.9 million in the current

quarter was up $0.2 million from the same quarter of fiscal 2023

due to greater borrowings required to finance operating losses

coming out of the pandemic years, restructuring costs and the

addition of imputed lease interest on the new Guelph distribution

facility.

The Company reported a net loss before tax of

$1.1 million in the quarter compared to net income of $0.7 million

in the same quarter last year. Net income in the first quarter last

year included a $0.4 million gain on the sale of the New Jersey

division. Adjusted EBITDA in the current quarter was $1.2 million

versus $2.1 million for the corresponding 3-month period last

year.

Business Outlook

During the first quarter UGL successfully

negotiated several positive contract pricing agreements, relocated

its offshore production from many factories with higher labour

costs and that were import duty subject, to those that offer lower

labour costs and/or are duty-free. In addition, UGL completed the

relocation and consolidation of a major portion of its Carleton

Place, Ontario and the Saint-Laurent, Quebec operations into its

more efficient Guelph and Mississauga, Ontario facilities. The

consolidation of distribution operations at its main Guelph

distribution facilities will yield UGL an estimated annual savings

of $2.5 million in direct and administrative labour costs on a net

reduction of about 20% in headcount. This restructuring took place

over the last six months and since the last phase of staff

reductions was not completed until February 2024, the full extent

of the related cost saving will not get reflected in our financial

results until the latter half of this fiscal year. The Company is

also in the process of sourcing a tenant to lease out the resulting

40,000+ square feet of vacated space at its Saint-Laurent facility

which will further reduce its direct and administrative overhead.

The Company believes these measures will significantly improve UGL

profitability in fiscal 2024.

UGL management continues to place strong focus

on the US market and is in advanced discussions with a number of US

major corporations with respect to their image wear programs

totaling over US$100 million annually in potential new business. As

well, UGL has been invited to bid on an extensive list of other

Canadian and US based major customers that are scheduled to come to

market during the 2024 calendar year.

With $38.5 million in firm contracts and options

on hand as at December 31, 2023, the Peerless business segment is

positioned to maintain its current level of revenues and

profitability over the balance of fiscal 2024.

More detailed information is contained in the

Company’s Consolidated Financial statements for the quarter ended

December 31, 2023 and Management Discussion and Analysis dated

February 13, 2024 which may be accessed at www.sedar.com.

On Behalf of the Board of Directors

Douglas F GoodCEO

Investor relations

contact:Douglas F Good, Director & CEO at 778-370-1725

Email: dgood@unisyncgroup.com

Adjusted EBITDAAdjusted EBITDA

does not have a standardized meaning prescribed by IFRS and is

therefore unlikely to be comparable to similar measures presented

by other issuers and should not be considered in isolation nor as a

substitute for financial information reported under IFRS. Unisync

uses non-IFRS measures, including Adjusted EBITDA, to provide

shareholders with supplemental measures of its operating

performance. Unisync believes adjusted EBITDA is a widely accepted

indicator of an entity’s ability to incur and service debt and

commonly used by the investing community to value businesses.

Forward Looking StatementsThis

news release may contain forward-looking statements that involve

known and unknown risk and uncertainties that may cause the

Company’s actual results, performance or achievements to be

materially different from any future results, performance or

achievements expressed or implied in these forward-looking

statements. Any forward-looking statements contained herein are

made as of the date of this news release and are expressly

qualified in their entirety by this cautionary statement. Except as

required by law, the Company undertakes no obligation to publicly

update or revise any such forward-looking statements to reflect any

change in its expectations or in events, conditions or

circumstances on which any such forward-looking statements may be

based, or that may affect the likelihood that actual results will

differ from those set forth in the forward-looking statements.

Neither the TSX nor its Regulation Services Provider (as that term

is defined in the policies of the TSX) accepts responsibility for

the adequacy or accuracy of this release.

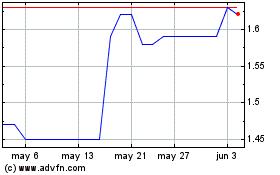

Unisync (TSX:UNI)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Unisync (TSX:UNI)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024