UNISYNC Reports Continued Improving Financial Performance in Q2 Fiscal 2024

16 Mayo 2024 - 7:30AM

Unisync Corp. (“Unisync") (TSX:"UNI")

(OTC:“USYNF”) announces its unaudited financial results for the

second quarter ended March 31, 2024 (“Q2 2024”). Unisync operates

through two business units: Unisync Group Limited (“UGL”) with

operations throughout Canada and the USA and 90% owned Peerless

Garments LP (“Peerless”), a domestic manufacturing operation based

in Winnipeg, Manitoba. UGL is a leading customer-focused provider

of corporate apparel, serving many leading Canadian and American

iconic brands. Peerless specializes in the production and

distribution of highly technical protective garments, including

military operational clothing and accessories for a broad spectrum

of Federal, Provincial and Municipal government departments and

agencies.

Results for Q2 2024 versus Q2

2023

Consolidated Revenues for Q2 2024 were $25.7

million, 10.4% lower than revenues experienced in the corresponding

quarter last year as its airline business returned to more normal

volumes following the 2023 post pandemic rebound. Peerless

generated revenues of $ 2.6 million in the current quarter down

marginally from the $2.7 million reported for Q2 2023.

Despite the lower level of revenues, the UGL

segment experienced a $0.8 million increase in gross profit to $4.4

million or 18.6% of segment revenue compared to $3.6 million or

13.8% of segment revenue in the same three-month period in the

prior year. The improved margins were related to customer price

increases combined with the impact of lower offshore container

delivery costs on the weighted average cost of product sold. In

addition, the consolidation of the Carleton Place, Ontario and the

Saint-Laurent, Quebec facilities into the more efficient Guelph and

Mississauga, Ontario facilities along with the discontinued use of

3PL locations, reduced fixed overhead costs.

The Peerless segment recorded gross profit of

$0.9 million or 35.1% of segment revenue against $0.7 million or

24.3% of segment revenue in the same quarter of the prior fiscal

year on a higher margin mix of product sales while discontinuing

the cost of using subcontractors to perform a portion of

manufacturing output.

At $3.7 million, consolidated general and

administrative expenses were down $0.6 million or 14.0% from the

three months ended March 31, 2023 due to overhead reductions

associated with the aforementioned consolidation of operations at

UGL. Second quarter general and administrative expenses included

employee severances of $0.2 million related to the consolidation

efforts.

Interest expense of $0.9 million in the current

quarter was unchanged from the same quarter of fiscal 2023 as an

increase in average debt outstanding was offset by lower cost

borrowing replacing previously availed high interest rate

shareholder loans.

The Company reported income before tax of $0.6

million in the quarter compared to a loss of $1.1 million in the

same quarter last year. Adjusted EBITDA in the current quarter was

$3.0 million before the aforenoted one-time severance costs, versus

$1.1 million for the corresponding three month period last

year.

Operating Performance

Outlook

With the last phase of staff reductions

associated with the centralization of operations at UGL completed

in February 2024, the full extent of the related estimated annual

savings of $2.5 million will continue to be positively reflected in

the Company’s financial results moving forward.

In addition, UGL continued to negotiate positive

pricing agreements with its offshore subcontractors and to relocate

certain offshore production to factories in other jurisdictions

that offer lower labour costs and/or are duty-free.

The cost of container shipments has stabilized

relative to the unprecedented levels reached during the pandemic,

although some increases are being experienced due to geopolitical

disruptions in the Middle East. UGL continues to reduce its order

delivery backlog and expects to continue to right-size the quantity

of uniform products held in its distribution centres for various

clients over the balance of the fiscal year.

We continue to also aggressively pursue a tenant

to lease out the resulting 40,000+ square feet of vacated space at

its Saint-Laurent facility or an outright sale of the 60,000 square

foot facility which, in either case, will further reduce UGL’s

direct overhead costs.

Business Outlook

There are a large number of managed uniform

programs totalling over $35 million in annual recurring business

scheduled to come to market in Canada during the balance of 2024

which UGL is actively pursuing. The Company also continues to place

an expanded emphasis on the US market where it continues to be in

advanced discussions with several major corporations with respect

to their image wear programs.

Although UGL is experiencing a slow start to Q3

orders in hand which will likely get reflected in lower revenues

during the first two months of the quarter, we expect the effects

on net income to be offset to a great extent by improved margins,

reduced headcount and operational efficiencies. UGL’s North

American airline accounts continue to experience steady demand,

having returned to pre-pandemic employee levels.

With $38.5 million in firm contracts and options

on hand as at March 31, 2024, the Peerless business segment has

sufficient firm orders on hand to maintain its current level of

revenues and profitability into fiscal 2025. Notwithstanding a

strong performance in Q2, some fabric delays are having an effect

on Peerless’ current production levels in the first half of the

current quarter pushing forecasted revenues to later in the fiscal

year.

More detailed information is contained in the

Company’s Consolidated Financial statements for the quarter ended

March 31, 2024 and Management Discussion and Analysis dated March

13, 2024 which may be accessed at www.sedarplus.com.

On Behalf of the Board of Directors

Douglas F GoodCEO

Investor relations

contact:Douglas F Good, Director & CEO Email:

dgood@unisyncgroup.com

Adjusted EBITDA.Adjusted EBITDA does not have a

standardized meaning prescribed by IFRS and is therefore unlikely

to be comparable to similar measures presented by other issuers and

should not be considered in isolation nor as a substitute for

financial information reported under IFRS. Unisync uses non-IFRS

measures, including Adjusted EBITDA, to provide shareholders with

supplemental measures of its operating performance. Unisync

believes adjusted EBITDA is a widely accepted indicator of an

entity’s ability to incur and service debt and commonly used by the

investing community to value businesses.

Forward Looking StatementsThis news release may

contain forward-looking statements that involve known and unknown

risk and uncertainties that may cause the Company’s actual results,

performance or achievements to be materially different from any

future results, performance or achievements expressed or implied in

these forward-looking statements. Any forward-looking statements

contained herein are made as of the date of this news release and

are expressly qualified in their entirety by this cautionary

statement. Except as required by law, the Company undertakes no

obligation to publicly update or revise any such forward-looking

statements to reflect any change in its expectations or in events,

conditions or circumstances on which any such forward-looking

statements may be based, or that may affect the likelihood that

actual results will differ from those set forth in the

forward-looking statements. Neither the TSX nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX) accepts responsibility for the adequacy or accuracy of this

release.

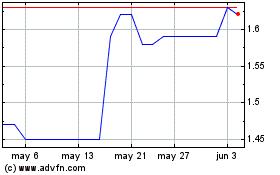

Unisync (TSX:UNI)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Unisync (TSX:UNI)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024