AIP Realty Trust Announces Extension of Non-Brokered Offering

27 Mayo 2024 - 6:00AM

AIP Realty Trust (the “

Trust” or

“

AIP”) (TSXV: AIP.U) today announces that it has

received approval from the TSX Venture Exchange (the

“

TSXV”) to extend the price reservation on its

non-brokered private placement (the “

Financing”),

for which the Trust announced the closing of a first tranche on

April 19, 2024, by an additional 30 days until June 27, 2024. The

Trust intends to close a second tranche as well as any additional

tranches thereafter, on or before June 27, 2024.

The Financing consists of the issuance of up to

6,000,000 Preferred Units – Series B Convertible (each, a

“Preferred Unit”), at a price of US$0.50 per

Preferred Unit for aggregate gross proceeds of up to US$3,000,000.

An aggregate of 1,100,000 Preferred Units for aggregate gross

proceeds of US$550,000 have been issued under the first tranche.

The terms and conditions of the Preferred Units are available on

the Trust’s SEDAR+ profile at www.sedarplus.com.

The Trust intends to use the proceeds of the

Private Placement for working capital and general corporate

purposes.

Completion of the Financing, including a second

or other tranches of the Financing remains subject to approval from

the TSX Venture Exchange (the “TSXV”).

About AIP Realty Trust

AIP Realty Trust is a real estate investment

trust with a growing portfolio of AllTrades branded Serviced

Industrial Business Suites (“SIBS”) light

industrial flex facilities focused on small businesses and the

trades and services sectors in the U.S. These properties appeal to

a diverse range of small space users, such as contractors, skilled

trades, suppliers, repair services, last-mile providers, small

businesses and assembly and distribution firms. They typically

offer attractive fundamentals including low tenant turnover, stable

cash flow and low capex intensity, as well as significant growth

opportunities. With an initial focus on the Dallas-Fort Worth

market, AIP plans to roll out this innovative property offering

nationally. AIP holds the exclusive rights to finance the

development of and to purchase all the completed and leased

properties built across North America by its development and

property management partner, AllTrades Industrial Properties, Inc.

For more information, please visit www.aiprealtytrust.com.

For further information from the Trust,

contact:Leslie WulfExecutive Chairman(214)

679-5263les.wulf@aiprealtytrust.com

Or

Greg VorwallerChief Executive Officer(778)

918-8262Greg.vorwaller@aiprealtytrust.com

Cautionary Statement on

Forward-Looking Information

This press release contains statements which

constitute “forward-looking information” within the meaning of

applicable securities laws, including statements regarding the

plans, intentions, beliefs and current expectations of AIP Realty

Trust with respect to future business activities and operating

performance. Forward-looking information is often identified by the

words “may”, “would”, “could”, “should”, “will”, “intend”, “plan”,

“anticipate”, “believe”, “estimate”, “expect” or similar

expressions and includes information regarding, the closing of any

subsequent tranche of the Financing, the ability to obtain

regulatory and unitholder approvals and other factors. When or if

used in this news release, the words “anticipate”, “believe”,

“estimate”, “expect”, “target, “plan”, “forecast”, “may”,

“schedule” and similar words or expressions identify

forward-looking statements or information. These forward-looking

statements or information may relate to proposed financing

activity, proposed acquisitions, regulatory or government

requirements or approvals, the reliability of third-party

information and other factors or information. Such statements

represent the Trust’s current views with respect to future events

and are necessarily based upon a number of assumptions and

estimates that, while considered reasonable by the Trust, are

inherently subject to significant business, economic, competitive,

political and social risks, contingencies and uncertainties. Many

factors, both known and unknown, could cause results, performance

or achievements to be materially different from the results,

performance or achievements that are or may be expressed or implied

by such forward- looking statements. The Trust does not intend, and

do not assume any obligation, to update these forward-looking

statements or information to reflect changes in assumptions or

changes in circumstances or any other events affecting such

statements and information other than as required by applicable

laws, rules and regulations.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

This news release is not an offer of securities

for sale in the United States. The securities may not be offered or

sold in the United States absent registration or an exemption from

registration under U.S. Securities Act of 1933, as amended (the

“U.S. Securities Act”). The Trust has not registered and will not

register the securities under the U.S. Securities Act. The Trust

does not intend to engage in a public offering of their securities

in the United States.

Source: AIP Realty Trust

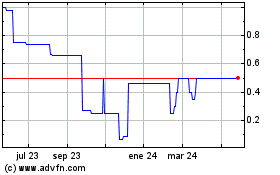

AIP Realty (TSXV:AIP.U)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

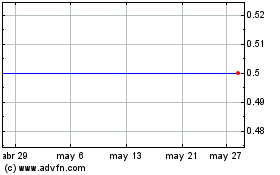

AIP Realty (TSXV:AIP.U)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024