Kootenay Silver Announces $4.0 Million Private Placement Financing of Units

09 Febrero 2022 - 6:40AM

Kootenay Silver Inc. (“

Kootenay” or the

“

Company”) (TSXV: KTN), is pleased to announce

that it has entered into an agreement with Research Capital

Corporation, as sole agent and sole bookrunner (, the

“

Agent”) in connection with a best efforts,

private placement of units of the Company (the

“

Units”) at a price of $0.16 per Unit (the

“

Offering Price”) for gross proceeds of up to

$4,000,000 (the “

Offering”).

Each Unit will be comprised of one common share

of the Company (a “Common Share”) and one Common

Share purchase warrant (a “Warrant”). Each Warrant

shall be exercisable to acquire one Common Share (a

“Warrant Share”) at a price of $0.22 per Warrant

Share for a period of 36 months from the closing of the

Offering.

The Agent will have an option (the

“Agent’s Option”) to offer for sale up to an

additional 15% of the number of Units sold in the Offering at the

Offering Price, which Agent’s Option is exercisable, in whole or in

part, at any time up to 48 hours prior to the closing of the

Offering.

The Company intends to use the net proceeds from

the Offering for working capital requirements and other general

corporate purposes.

The securities to be issued under the Offering

will be offered by way of private placement in each of the

provinces of Canada, and such other jurisdictions as may be

determined by the Company, in each case, pursuant to applicable

exemptions from the prospectus requirements under applicable

securities laws.

The Offering is scheduled to close on or about

the week of March 9, 2022, or such date as agreed upon between the

Company and the Agent (the “Closing”) and is

subject to certain conditions including, but not limited to, the

receipt of all necessary approvals including the approval of the

Exchange. The Units to be issued under the Offering will have a

hold period of four months and one day from Closing.

In connection with the Offering, the Agent will

receive an aggregate cash fee equal to 6.0% of the gross proceeds

from the Offering, including in respect of any exercise of the

Agent’s Option. In addition, the Company will grant the Agent, on

date of Closing, non-transferable compensation options (the

“Compensation Options”) equal to 6.0% of the total

number of Units sold under the Offering (including in respect of

any exercise of the Agent’s Option). Each Compensation Option will

entitle the holder thereof to purchase one Unit (a

“Compensation Option Unit”) at an exercise price

per Compensation Option Unit equal to the Offering Price for a

period of 36 months following the Closing.

The securities described herein have not been,

and will not be, registered under the United States Securities Act

of 1933, as amended (the “U.S. Securities Act”),

or any state securities laws, and accordingly, may not be offered

or sold within the United States except in compliance with the

registration requirements of the U.S. Securities Act and applicable

state securities requirements or pursuant to exemptions therefrom.

This press release does not constitute an offer to sell or a

solicitation to buy any securities in any jurisdiction.

About Kootenay Silver Inc.

Kootenay Silver Inc. is an exploration company

actively engaged in the discovery and development of mineral

projects in the Sierra Madre Region of Mexico and in British

Columbia, Canada. Supported by one of the largest junior portfolios

of silver assets in Mexico, Kootenay continues to provide its

shareholders with significant leverage to silver prices. The

Company remains focused on the expansion of its current silver

resources, new discoveries and the near-term economic development

of its priority silver projects located in prolific mining

districts in Sonora, State and Chihuahua, State, Mexico,

respectively.

For additional information, please

contact:

James McDonald, CEO and

President at 403-880-6016 Ken Berry,

Chairman at 604-601-5652; 1-888-601-5650 or visit:

www.kootenaysilver.com

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS:

The information in this news release has been

prepared as at February 7, 2022. Certain statements in this news

release, referred to herein as "forward-looking statements",

constitute "forward-looking statements" under the provisions of

Canadian provincial securities laws. These statements can be

identified by the use of words such as "expected", "may", "will" or

similar terms.

Forward-looking statements are necessarily based

upon a number of factors and assumptions that, while considered

reasonable by Kootenay as of the date of such statements, are

inherently subject to significant business, economic and

competitive uncertainties and contingencies. Many factors, known

and unknown, could cause actual results to be materially different

from those expressed or implied by such forward-looking statements.

Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date made.

Except as otherwise required by law, Kootenay expressly disclaims

any obligation or undertaking to release publicly any updates or

revisions to any such statements to reflect any change in

Kootenay's expectations or any change in events, conditions or

circumstances on which any such statement is based.

Cautionary Note to US

Investors: This news release includes Mineral Reserves and

Mineral Resources classification terms that comply with reporting

standards in Canada and the Mineral Reserves and the Mineral

Resources estimates are made in accordance with National Instrument

43-101 – Standards of Disclosure for Mineral Projects ("NI

43-101"). NI 43-101 is a rule developed by the Canadian Securities

Administrators that establishes standards for all public disclosure

an issuer makes of scientific and technical information concerning

mineral projects. These standards differ significantly from the

requirements adopted by the U.S. Securities and Exchange Commission

(the "SEC"). The SEC sets rules that are applicable to domestic

United States reporting companies. Consequently, Mineral Reserves

and Mineral Resources information included in this news release is

not comparable to similar information that would generally be

disclosed by domestic U.S. reporting companies subject to the

reporting and disclosure requirements of the SEC. Accordingly,

information concerning mineral deposits set forth herein may not be

comparable with information made public by companies that report in

accordance with U.S. standards.

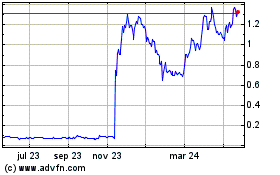

Kootenay Silver (TSXV:KTN)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

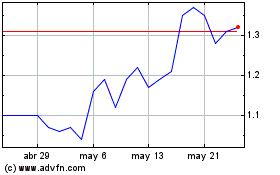

Kootenay Silver (TSXV:KTN)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025