Patagonia Gold Reports Drilling Results From the Monte Leon Target, Santa Cruz, Argentina

01 Marzo 2023 - 6:00AM

Patagonia Gold Corp. (“Patagonia” or the “Company”) (TSXV: PGDC) is

pleased to announce new gold and silver analytical results in

exploration drill samples from the Monte Leon (“MLN”) target near

its Cap Oeste (“Capo”) mine in the Santa Cruz province of southern

Argentina.

Highlights

- On November 16, 2022, the Company

announced an exploration agreement with a private arm’s-length

company for a 20,000 meter, two-phase, core drilling program at MLN

(see news release on www.patagoniagold.com).

- MLN is located on a major, NNW-SSE

structural trend that extends beyond MLN to the east-southeast and

to the north-northwest to the Capo mineral system.

- To date, a total of 1,760 meters in

five, HQ-sized core holes were completed in this phase of drilling

(see Figure 1 below). Results from 973 meters in 5 core holes are

reported in this news release (through MLN-874-D ).

- Anomalous gold and silver

mineralization, greater than 0.5 grams per tonne (“g/t”) gold

(“Au”), was intersected in five new core holes. Au values up to

72.4 g/t and silver (“Ag”) values up to 1,473 g/t were reported

from hole MLN 873D (see Table 1).

Mr. Christopher van Tienhoven, CEO of Patagonia,

commented “We have had MLN as one of our priority exploration

targets for this year. Prior Company drilling defined near surface

oxidized mineralization in late 2020 and 2021. We are pleased with

the analytical results thus far and are designing additional

drilling to help define the depth and lateral extension of the new

gold and silver mineralization.”

Historical Work

Prior to this new program of core drilling at

MLN, the Company identified gold mineralization in oxidized and

brecciated structures at MLN, with 104 trenches and 21 core holes

(see December 29, 2020 news release on www.patagoniagold.com). In

addition, Patagonia Gold Plc (the AIM-listed predecessor to the

Company), drilled 75 reverse circulation and 21 core holes in the

general area surrounding the recent MLN drilling in 2011 and 2015.

The location of the historic work in noted in Figure 1. In

addition, 43.9 line-kilometers (‘’km”) of ground-based, induced

polarization and resistivity (pole-dipole IP-Res) surveying was

completed in 2021, and more than 800 line-km of ground

magnetics.

Figure 1. Location of MLN and Capo in the

El Tranquilo concession black

Note: new drilling labelled in yellow font with azimuth and

inclination direction noted from each drill collar. See inset map

for MLN and Capo location reference in the El Tranquilo concession

block.

Current Activities

In 2021 and 2022, the Company identified near

surface gold and silver mineralization with geologic mapping and

sampling and rotary air blast (“RAB”) drilling. Coupled with the

historical data, this new work led to the new drill program.

Composited Au and Ag analyses from the new core samples are shown

in Table 1.

Table 1. Analytical Results (composited)

from MLN Core Drilling

|

Drill Hole Data |

Mineralization |

|

Number |

Azimuth (degrees) |

Inclination (degrees) |

Depth (m) |

From (m) |

To (m) |

Length (m) |

Au |

Ag |

|

(g/t) |

(g/t) |

|

MLN-860A-D |

240 |

-50 |

143 |

102.9 |

103.85 |

0.95 |

1.11 |

1.0 |

|

|

|

|

|

130.4 |

135.85 |

5.45 |

1.20 |

2.2 |

|

MLN-871A-D |

240 |

-50 |

185 |

62 |

63.9 |

1.9 |

49.50 |

11.0 |

|

|

|

|

|

110.87 |

111.65 |

0.78 |

4.88 |

126.0 |

|

|

|

|

|

115.75 |

116.25 |

0.5 |

9.92 |

12.0 |

|

MLN-872-D |

240 |

-50 |

218 |

85.22 |

93 |

7.78 |

0.98 |

5.8 |

|

Incl. |

|

|

|

89 |

89.83 |

0.83 |

3.02 |

28.0 |

|

|

|

|

|

162.28 |

163.1 |

0.82 |

27.10 |

403.0 |

|

MLN-873-D |

240 |

-50 |

137 |

59 |

72.97 |

13.97 |

1.74 |

12.2 |

|

Incl. |

|

|

|

61.3 |

62 |

0.7 |

5.51 |

7.0 |

|

Incl. |

|

|

|

70.55 |

71 |

0.45 |

10.40 |

126.0 |

|

|

|

|

|

77.73 |

80.3 |

2.57 |

15.95 |

326.6 |

|

Incl. |

|

|

|

78.42 |

78.97 |

0.55 |

72.40 |

1473.0 |

|

|

|

|

|

92.7 |

93.2 |

0.5 |

7.92 |

15.0 |

|

|

|

|

|

120.6 |

127.1 |

6.5 |

3.36 |

130.0 |

|

Incl. |

|

|

|

125.5 |

126.4 |

0.9 |

20.00 |

584.0 |

|

MLN-874-D |

240 |

-50 |

240 |

112.4 |

113 |

0.6 |

1.43 |

6.0 |

|

|

|

|

|

158.15 |

158.75 |

0.6 |

3.28 |

167.0 |

Notes to Table 1.

- “Incl.” means including.

- Samples were collected from

HQ-diameter core.

- Mineralized intervals are down-hole

lengths. True widths are not yet known.

- 0.5 g/t Au minimum grade was used

in compositing and no more than 2 consecutive grades less than 0.5

g/t Au were used in compositing.

- Grades were not capped.

- All analyses were performed by Alex

Stewart International, a certified, independent analytical services

provider, in their Mendoza, Argentina facilities using fire

assaying for Au and four-acid digestion, ICP-MS for Ag.

- Assays for 5 drill holes are pending.

- For QA/QC purposes, a total of 39 blanks, 80 Certified

Reference Material standards were inserted into the primary, drill

sample stream by Company personnel at a ratio of one QA/QC sample

to 9 primary samples. All QA/QC results were within acceptable

limits.

- There has been insufficient exploration to define a mineral

resource at this time and it is uncertain if further exploration

will result in the target being delineated as a mineral

resource.

Drilling thus far has confirmed the main 12.75

km long structural corridor on strike with the Capo mine. Within

the corridor at MLN, two prominent, near vertical, NNW-SSE

structural trends have been recognized that are believed to control

the widest zones of gold and silver mineralization defined to-date.

Other precious metal occurrences occur in narrower, sheeted

structures sub-parallel to the two main trend (see Figure 2).

MLN mineralization is believed to be

intermediate sulfidation, epithermal in character, hosted within a

near-vertical oxidized and sulfidic breccia. The breccia is

pipe-like and appears to be 1.5 km by 0.3 km (NNW-SSE) in dimension

and near vertically oriented.

Figure 2. MLN Geologic and Mineralization

Cross Section Looking Northwest

Qualified Person’s Statement

Donald J. Birak, an independent geologist and

Registered Member of SME and Fellow of AusIMM and a qualified

person as defined by NI 43-101, supervised the preparation of the

scientific and technical information that forms the basis for this

news release and has reviewed and approved the scientific and

technical disclosure herein. The Qualified Person visited the MLN

property in November 2022 and viewed the historic drill sites, new

RAB drilling then underway, and the surface geology and

mineralization exposed in a shallow pit, as well as Company core

sample preparation activities from other drilling. The Qualified

Person has not validated the historic trenching and drilling nor

any historic QA/QC.

About Patagonia Gold

Patagonia Gold Corp. is a South America focused,

publicly traded mining company listed on the TSX Venture Exchange.

The Company seeks to grow shareholder value through exploration and

development of gold and silver projects in the Patagonia region of

Argentina. The Company is primarily focused on the Calcatreu

project in Rio Negro and the development of the Cap-Oeste

underground project. Patagonia, indirectly through its subsidiaries

or under option agreements, has mineral rights to over 430

properties in several provinces of Argentina and Chile and is one

of the largest landholders in the province of Santa Cruz,

Argentina.

FORWARD-LOOKING STATEMENTS

This news release contains certain

forward-looking statements, including, but not limited to,

statements with respect to, among other things, plans related to

additional drilling and the results of such drilling; the belief

that the exploration results herein present viable exploration

targets for the Company to evaluate with additional drilling; and

the anticipated growth in shareholder value. Wherever possible,

words such as “may”, “will”, “should”, “could”, “expect”, “plan”,

“intend”, “anticipate”, “believe”, “estimate”, “predict” or

“potential” or the negative or other variations of these words, or

similar words or phrases, have been used to identify these

forward-looking statements. These statements reflect management’s

current beliefs and are based on information currently available to

management as at the date hereof.

Forward-looking statements involve significant

risk, uncertainties and assumptions. Many factors could cause

actual results, performance or achievements to differ materially

from the results discussed or implied in the forward-looking

statements. These factors should be considered carefully, and

readers should not place undue reliance on the forward-looking

statements. Although the forward-looking statements contained in

this news release are based upon what management believes to be

reasonable assumptions, the Company cannot assure readers that

actual results will be consistent with these forward-looking

statements. These forward-looking statements are made as of the

date of this news release, and the Company assumes no obligation to

update or revise them to reflect new events or circumstances,

except as required by law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/b6a90560-5bca-45d6-8f51-ce54f43a1cc8https://www.globenewswire.com/NewsRoom/AttachmentNg/a15f9d4d-9655-4f99-bfcf-5cf9c5ee8d3f

Christopher van Tienhoven, Chief Executive Officer

Patagonia Gold Corp

T: +54 11 5278 6950

E: cvantienhoven@patagoniagold.com

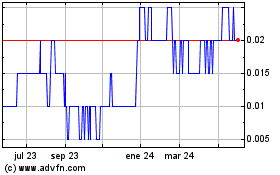

Patagonia Gold (TSXV:PGDC)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

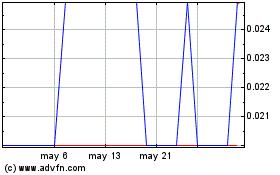

Patagonia Gold (TSXV:PGDC)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025