Patagonia Gold Announces Increase to Loan Facility and Extension of Its Maturity Date

06 Diciembre 2024 - 4:00PM

Patagonia Gold Corp. (“Patagonia” or the

“Company”) (TSXV: PGDC) is pleased to announce it has entered into

an agreement with Cantomi Capital Ltd. (“Cantomi”) to increase the

maximum aggregate amount of the Cantomi Loan (as defined below) to

US$40 million and to extend its maturity.

The original loan facility, which Cantomi

provided in February 2019 for US$15 million, and with a maturity

date of December 31, 2025, was subsequently amended and further

increased to US$40 million with a maturity date of December 31,

2026 (as amended, the “Cantomi Loan”). The agreement amending the

Cantomi Loan provides that the maximum aggregate amount of the

Cantomi Loan is increased to US$40 million. The funds from the

increased Cantomi Loan will be utilised primarily to make

downpayments for long lead items for the development of the

Calcatreu project until financing is secured and in addition for

general working capital purposes.

Other than the amendment to increase the maximum

amount of the Cantomi Loan and its maturity date, all other terms

of the Cantomi Loan remain unchanged.

About Patagonia Gold

Patagonia Gold Corp. is a South America focused,

publicly traded, mining company listed on the TSX Venture Exchange.

The Company seeks to grow shareholder value through exploration and

development of gold and silver projects in the Patagonia region of

Argentina. The Company is primarily focused on the Calcatreu

project in Rio Negro and the development of the Cap-Oeste

underground project. Patagonia, indirectly through its subsidiaries

or under option agreements, has mineral rights to over 430

properties in several provinces of Argentina and is one of the

largest landholders in the province of Santa Cruz, Argentina.

For more information, please

contact:

Christopher van Tienhoven, Chief Executive

OfficerPatagonia Gold CorpT: +54 11 5278 6950E:

cvantienhoven@patagoniagold.com

FORWARD-LOOKING STATEMENTS

This news release contains certain

forward-looking statements, including, but not limited to,

statements with respect to the use of the funds from the increase

of the Cantomi Loan, the extension of its maturity date,

advancement and development of gold and silver projects in the

Patagonia region of Argentina and the anticipated growth in

shareholder value. Wherever possible, words such as “may”, “will”,

“should”, “could”, “expect”, “plan”, “intend”, “anticipate”,

“believe”, “estimate”, “predict” or “potential” or the negative or

other variations of these words, or similar words or phrases, have

been used to identify these forward-looking statements. These

statements reflect management’s current beliefs and are based on

information currently available to management as at the date

hereof.

Forward-looking statements involve significant

risk, uncertainties and assumptions. Many factors could cause

actual results, performance or achievements to differ materially

from the results discussed or implied in the forward-looking

statements. These factors should be considered carefully and

readers should not place undue reliance on the forward-looking

statements. Although the forward-looking statements contained in

this news release are based upon what management believes to be

reasonable assumptions, the Company cannot assure readers that

actual results will be consistent with these forward-looking

statements. These forward- looking statements are made as of the

date of this news release, and the Company assumes no obligation to

update or revise them to reflect new events or circumstances,

except as required by law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

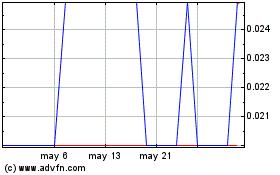

Patagonia Gold (TSXV:PGDC)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

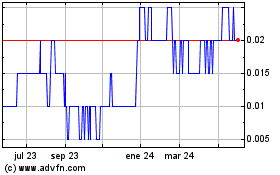

Patagonia Gold (TSXV:PGDC)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024