UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-8

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

GOOD

GAMING, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

37-1902603 |

(State

or other Jurisdiction

of Incorporation or Organization) |

|

(IRS

Employer

Identification

No.) |

415

McFarlan Road, Suite 108

Kennett

Square, PA |

|

19348 |

| (Address of Principal Executive

Offices) |

|

(zip code) |

2022

STOCK INCENTIVE PLAN

(Full

title of the plans)

David

Dorwart

415

McFarlan Road, Suite 108

Kennett

Square, PA 19348

(844)

419-7445

(Name,

address, including zip code, and telephone number,

including area code, of agent for service)

With

a copy to:

Gregory

Sichenzia

Arthur

Marcus |

| Sichenzia

Ross Ference LLP |

| 1185

Avenue of the Americas, 31st Floor |

| New

York, NY 10036 |

| Tel:

(212) 930-9700 |

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| |

Non-accelerated

filer |

☐ |

Smaller

reporting company |

☒ |

| |

Emerging

growth company |

☐ |

|

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION

OF REGISTRATION FEE

| Title

Of Securities To Be Registered(1) |

|

Amount

To

Be

Registered |

|

|

Proposed

Maximum

Offering

Price

Per Share(2) |

|

|

Proposed

Maximum

Aggregate

Offering

Price |

|

|

Amount

Of

Registration

Fee |

|

| Common

Stock, par value $0.001 per share(1) |

|

|

30,000,000 |

|

|

$ |

0.045 |

|

|

$ |

1,350,000 |

|

|

$ |

125.15 |

|

| |

(1) |

Represents

Common Stock, $0.001 par value (the “Common Stock”) issuable under the 2022 Stock Incentive Plan. |

| |

|

|

| |

(2) |

Estimated

solely for the purpose of calculating the registration fee in accordance with Rule 457(c) and (h) of the Securities Act on the basis

of the last reported sale price of a share of common stock, par value $0.001 per share on the OTC Markets on May 31, 2022,

which date is within one business day prior to filing this Registration Statement. |

EXPLANATORY

NOTE

This

Registration Statement on Form S-8 (this “Registration Statement”) is being filed by the Good Gaming, Inc., a Nevada

corporation (the “Company”) relating to 30,000,000 shares of common stock, $0.001 par value per share (the “Common

Stock”), issuable under the Good Gaming, Inc. 2022 Equity Incentive Plan (the “Plan”). 20,637,547 of the

Common Stock are reserved for future grants and 9,362,453 are being offered by Selling Stockholders as listed.

This

Registration Statement also includes a prospectus (the “Reoffer Prospectus”) prepared in accordance with General Instruction

C of Form S-8 and in accordance with the requirements of Part I of Form S-3. This Reoffer Prospectus may be used for the reoffer and

resale of shares of Common Stock on a continuous or delayed basis that may be deemed to be “restricted securities” and/or

“control securities” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”),

and the rules and regulations promulgated thereunder, that are issuable to certain of our executive officers, employees, consultants

and directors identified in the Reoffer Prospectus. The number of shares of Common Stock included in the Reoffer Prospectus represents

shares of Common Stock issuable to the Selling Securityholders pursuant to equity awards, including stock options and restricted stock

grants, granted to the Selling Securityholders and does not necessarily represent a present intention to sell any or all such shares

of Common Stock.

As

specified in General Instruction C of Form S-8, until such time as we meet the registrant requirements for use of Form S-3, the number

of shares of Common Stock to be offered by means of this reoffer prospectus, by each of the selling security holders, and any other person

with whom he or she is acting in concert for the purpose of selling our shares of Common Stock, may not exceed, during any three month

period, the amount specified in Rule 144(e) of the Securities Act.

PART

I

INFORMATION

REQUIRED IN THE SECTION 10(a) PROSPECTUS

| Item 1. |

Plan Information.* |

| |

|

| Item 2. |

Registrant Information and Employee Plan Annual

Information.* |

*

The documents containing the information specified in this Part I of Form S-8 (plan information and registration information and employee

plan annual information) will be sent or given to employees as specified by the Securities and Exchange Commission (the “Commission”)

pursuant to Rule 428(b)(1) of the Securities Act. Such documents are not required to be and are not filed with the Commission either

as part of this registration statement (this “Registration Statement”) or as prospectuses or prospectus supplements

pursuant to Rule 424. These documents and the documents incorporated by reference in this Registration Statement pursuant to Item 3 of

Part II hereof, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act. The Registrant

will provide a written statement to participants advising them of the availability without charge, upon written or oral request, of the

documents incorporated by reference in Item 3 of Part II hereof and including the statement in the preceding sentence. The written statement

to all participants will indicate the availability without charge, upon written or oral request, of other documents required to be delivered

pursuant to Rule 428(b), and will include the address and telephone number to which the request is to be directed.

REOFFER

PROSPECTUS

Good

Gaming, Inc.

2022

STOCK INCENTIVE PLAN

Up

to 30,000,000 Shares of Common Stock

Issuable

under certain awards granted under

The

Good Gaming, Inc. 2022 Stock Incentive Plan

This

reoffer prospectus relates to the public resale, from time to time, of an aggregate of 30,000,000 shares (the “Shares”)

of our common stock, $0.001 par value per share (the “Common Stock”) by certain security holders identified herein

in the section entitled “Selling Securityholders”. Such shares may be acquired in connection with common underlying

Options issued pursuant to the Good Gaming, Inc. 2022 Stock Incentive Plan. You should read this prospectus carefully before you invest

in our Common Stock.

Such

resales shall take place on the OTC Markets, or such other stock market or exchange on which our Common Stock may be listed or quoted,

in negotiated transactions or otherwise, at market prices prevailing at the time of the sale or at prices otherwise negotiated (see “Plan

of Distribution” starting on page 5 of this prospectus). We will receive no part of the proceeds from sales made under this

reoffer prospectus. The Selling Securityholders will bear all sales commissions and similar expenses. Any other expenses incurred by

us in connection with the registration and offering and not borne by the Selling Securityholders will be borne by us.

This

reoffer prospectus has been prepared for the purposes of registering our shares of Common Stock under the Securities Act to allow for

future sales by Selling Securityholders on a continuous or delayed basis to the public without restriction, provided that the amount

of shares of Common Stock to be offered or resold under this Reoffer Prospectus by each Selling Securityholder or other person with whom

he or she is acting in concert for the purpose of selling shares of Common Stock, may not exceed, during any three-month period, the

amount specified in Rule 144(e) under the Securities Act. We have not entered into any underwriting arrangements in connection with the

sale of the shares covered by this reoffer prospectus. The Selling Securityholders identified in this reoffer prospectus, or their pledgees,

donees, transferees or other successors-in-interest, may offer the shares covered by this reoffer prospectus from time to time through

public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated

prices.

Investing

in our Common Stock involves risks. See “Risk Factors” beginning on page 3 of this reoffer prospectus. These are speculative

securities.

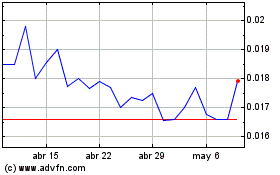

Our

Common Stock is quoted on the OTC Markets under the symbol “GMER” and the last reported sale price of our Common Stock on

May 31, 2022 was $0.04500 per share.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED

IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The

date of this prospectus is May 18, 2022

GOOD

GAMING, INC.

TABLE

OF CONTENTS

Except

where the context otherwise requires, the terms, “Good Gaming”, “we,” “us,” “our” or

“the Company,” refer to the business of Good Gaming, Inc., a Nevada corporation and its subsidiaries.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents and information incorporated by reference in this prospectus include “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act and Section 21E of the Securities

and Exchange Act of 1934, as amended, or the Exchange Act. Forward-looking statements reflect our current view about future events. When

used in this prospectus, the words “anticipate,” “believe,” “estimate,” “expect,” “future,”

“intend,” “plan,” or the negative of these terms and similar expressions, as they relate to us or our management,

identify forward-looking statements. Such statements, include, but are not limited to, statements contained in this prospectus relating

to our business strategy, our future operating results and liquidity and capital resources outlook. Forward-looking statements are based

on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward–looking

statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to

predict. Our actual results may differ materially from those contemplated by the forward-looking statements. They are neither statements

of historical fact nor guarantees of assurance of future performance. We caution you therefore against relying on any of these forward-looking

statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include,

without limitation, our ability to raise capital to fund continuing operations; our ability to protect our intellectual property rights;

the impact of any infringement actions or other litigation brought against us; competition from other providers and products; our ability

to develop and commercialize products and services; changes in government regulation; our ability to complete capital raising transactions;

and other factors (including the risks contained in the section of this prospectus entitled “Risk Factors”) relating to our

industry, our operations and results of operations. Actual results may differ significantly from those anticipated, believed, estimated,

expected, intended or planned.

Factors

or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of

them. We cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including

the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements.

We

use our registered trademark, “Good Gaming”, in this prospectus. This prospectus also includes trademarks, tradenames and

service marks that are the property of other organizations. Solely for convenience, trademarks and tradenames referred to in this prospectus

appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert,

to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and

tradenames.

PROSPECTUS

SUMMARY

The

Commission allows us to ‘‘incorporate by reference’’ certain information that we file with the Commission, which

means that we can disclose important information to you by referring you to those documents. The information incorporated by reference

is considered to be part of this prospectus, and information that we file later with the Commission will update automatically, supplement

and/or supersede the information disclosed in this prospectus. Any statement contained in a document incorporated or deemed to be incorporated

by reference in this prospectus shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement

contained in this prospectus or in any other document that also is or is deemed to be incorporated by reference in this prospectus modifies

or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded,

to constitute a part of this prospectus. You should read the following summary together with the more detailed information regarding

our company, our Common Stock and our financial statements and notes to those statements appearing elsewhere in this prospectus or incorporated

herein by reference.

Our

Company

The

Company was incorporated on November 3, 2008 under the laws of the State of Nevada, to engage in certain business services. Our goal,

at the time, was to become a leading tournament gaming provider as well as an online destination, targeting over 250 million esports

players and participants worldwide that want to compete at the high school or college level. We are a developmental stage business, have

generated limited revenues to date and have a history of operating losses.

The

Good Gaming platform was established in early 2014 by its founding members who recognized the need that millions of gamers worldwide

desired to play games at competitive levels. The founders recognized that there was no structure or organization on a large scale for

amateur gamers while professional esports was quickly establishing itself.

Good

Gaming effectively built the business infrastructure for the rapidly growing esports industry, similar to the high school and college

athletic industry. Good Gaming was designed to be the gateway for amateur esports athletes to compete at the semi-professional level,

improve their gaming skills, and interact with veteran gamers globally in a destination site and social networking framework.

Good

Gaming differs from the professional level of the esports industry by focusing on more than 250 million gamers that fall below the professional

level but are above the casual level, classified as “amateurs.” Good Gaming distinguishes itself from its direct and indirect

competitors by being the first company to offer multi-game, multi-console services at the amateur esports level. The Company was not

exclusive to any particular hardware or software vendor.

On

May 4, 2016, the Company announced that it had completed its first closed public beta testing of their 2.0 tournament platform to determine

the functionality, speed, ease of use, and accuracy of the system and are preparing to enter into full-blown production.

For

the year ended December 31, 2021, the Company had net income of $338,408. At December 31, 2021, the Company had an accumulated deficit

of $7,638,959 and a working capital surplus of $2,111,655 . The Company anticipates that it will continue to generate operating losses

and use cash in operations through the foreseeable future.

Our

corporate name is Good Gaming, Inc. for both legal and commercial purposes. We are a Nevada corporation. Our executive offices are located

at 415 McFarlan Rd, Suite 108, Kennett Square, PA 19501, and our telephone number is (844) 419-7445. We maintain a corporate website

www.good-gaming.com. The information on our website is not part of this prospectus. We have included our website address as a factual

reference and do not intend it to be active link to our website.

The

Offering

| Outstanding

Common Stock: |

|

103,526,044

shares of our Common Stock are outstanding as of January 31, 2022. |

| |

|

|

| Common Stock Offered: |

|

Up to 30,000,000 shares

of Common Stock for sale by the selling securityholders (which include our executive officers and directors) for their own account

pursuant to the Plan. |

| |

|

|

| Selling Securityholders: |

|

The selling securityholders

are set forth in the section entitled “Selling Securityholders” of this reoffer prospectus on page 3. The amount of securities

to be offered or resold by means of the reoffer prospectus by the designated selling securityholders may not exceed, during any three

month period, the amount specified in Rule 144(e). |

| |

|

|

| Use of proceeds: |

|

We will not receive any

proceeds from the sale of our Common Stock by thehe selling securityholders. We would, however, receive proceeds upon the exercisse

of the stock options by those who receive options under the Plan and exercise such options for cash. Any cash proceeds will be used

by us for general corporate purposes. |

| |

|

|

| Risk Factors: |

|

The securities offered

hereby involve a high degree of risk. See “Risk Factors”.” |

| |

|

|

| Nasdaq Capital Market

trading symbol: |

|

GMER |

RISK

FACTORS

An

investment in shares of our Common Stock is highly speculative and involves a high degree of risk. We face a variety of risks that may

affect our operations or financial results and many of those risks are driven by factors that we cannot control or predict. Before investing

in our Common Stock, you should carefully consider the risks below and set forth under the caption “Risk Factors” in our

Company’s Registration Statement on Form S-1 (File No. 333-182573), filed with the filed with the Securities and Exchange Commission

(the “SEC”) on February 14, 2013, which are incorporated by reference herein, and subsequent reports filed with the SEC,

together with the financial and other information contained or incorporated by reference in this prospectus. If any of these risks actually

occurs, our business, prospects, financial condition and results of operations could be materially adversely affected. In that case,

the trading price of our Common Stock would likely decline and you may lose all or a part of your investment. Only those investors who

can bear the risk of loss of their entire investment should invest in our Common Stock.

USE

OF PROCEEDS

The

shares which may be sold under this reoffer prospectus will be sold for the respective accounts of each of the Selling Securityholders

listed herein (which includes our executive officers and directors). Accordingly, we will not realize any proceeds from the sale of the

shares of our Common Stock. We will receive proceeds from the exercise of the options; however, no assurance can be given as to when

or if any or all of the options will be exercised. If any options are exercised, the proceeds derived therefrom will be used for working

capital and general corporate purposes. All expenses of the registration of the shares will be paid by us. See “Selling Securityholders”

and “Plan of Distribution.”

DETERMINATION

OF OFFERING PRICE

The

Selling Securityholders will determine at what price they may sell the offered shares of Common Stock, and such sales may be made at

prevailing market prices or at privately negotiated prices. See “Plan of Distribution” below for more information.

SELLING

SECURITYHOLDERS

We

are registering for resale the shares covered by this prospectus to permit the Selling Securityholders identified below and their pledgees,

donees, transferees and other successors-in-interest that receive their securities from a Selling Securityholder as a gift, partnership

distribution or other non-sale related transfer after the date of this prospectus to resell the shares when and as they deem appropriate.

The Selling Securityholders acquired, or may acquire, these shares from us pursuant to the Plan. The shares may not be sold or otherwise

transferred by the Selling Securityholders unless and until the applicable awards vest and are exercised, as applicable, in accordance

with the terms and conditions of the Plan.

The

following table sets forth:

| |

● |

the name of

each Selling Securityholder; |

| |

● |

the position(s), office

or other material relationship with our company and its predecessors or affiliates, over the last three years of each Selling Securityholder; |

| |

● |

the

number and percentage of shares of our Common Stock that each Selling Securityholder beneficially owned as of May 15, 2022,

prior to the offering for resale of the shares under this prospectus; |

| |

● |

the number of shares of

our Common Stock that may be offered for resale for the account of each Selling Securityholder under this prospectus; and |

| |

● |

the number and percentage

of shares of our Common Stock to be beneficially owned by each Selling Securityholder after the offering of the resale shares (assuming

all of the offered resale shares are sold by such Selling Securityholder). |

Information

with respect to beneficial ownership is based upon information obtained from the Selling Securityholders. Because the Selling Securityholders

may offer all or part of the shares of Common Stock, which they own pursuant to the offering contemplated by this reoffer prospectus,

and because its offering is not being underwritten on a firm commitment basis, no estimate can be given as to the amount of shares that

will be held upon termination of this offering.

The

number of shares in the column ‘‘Number of Shares Being Offered’’ represents all of the shares of our Common

Stock that each Selling Securityholder may offer under this prospectus. We do not know how long the Selling Securityholders will hold

the shares before selling them or how many shares they will sell. The shares of our Common Stock offered by this prospectus may be offered

from time to time by the Selling Securityholders listed below. We cannot assure you that any of the Selling Securityholders will offer

for sale or sell any or all of the shares of Common Stock offered by them by this prospectus.

| |

|

Number

of Shares

Beneficially Owned

Prior to Offering (1) |

|

|

Number

of

Shares

Being

Offered |

|

|

Number

of Shares Beneficially Owned

After Offering (2) |

|

| Securityholders |

|

Number |

|

|

Percent

(%) |

|

|

Number |

|

|

Number |

|

|

Percent

(%) |

|

| David Dorwart |

|

|

5,943,958 |

|

|

|

5.74 |

% |

|

|

4,943,985 |

|

|

|

1,000,000 |

|

|

|

* |

% |

| Domenic Fontana |

|

|

1,562,720 |

|

|

|

* |

% |

|

|

1,062,720 |

|

|

|

500,000 |

|

|

|

* |

% |

| Jordan Axt |

|

|

1,562,720 |

|

|

|

* |

% |

|

|

1,062,720 |

|

|

|

500,000 |

|

|

|

* |

% |

| John D Hilzendager |

|

|

1,562,720 |

|

|

|

* |

% |

|

|

1,062,720 |

|

|

|

500,000 |

|

|

|

* |

% |

| Marjorie Greenhalgh |

|

|

818,690 |

|

|

|

* |

% |

|

|

618,690 |

|

|

|

200,000 |

|

|

|

* |

% |

| Samuel Schwieters |

|

|

144,003 |

|

|

|

* |

% |

|

|

119,003 |

|

|

|

25,000 |

|

|

|

* |

% |

| Eric Brown |

|

|

1,239,115 |

|

|

|

* |

% |

|

|

492,615 |

|

|

|

746,500 |

|

|

|

* |

% |

| Kevin LaPierre |

|

|

2,287,185 |

|

|

|

* |

% |

|

|

2,287,185 |

|

|

|

0 |

|

|

|

* |

% |

| Brian Young |

|

|

2,287,185 |

|

|

|

* |

% |

|

|

2,287,185 |

|

|

|

0 |

|

|

|

* |

% |

| Brandon Young |

|

|

2,287,185 |

|

|

|

* |

% |

|

|

2,287,185 |

|

|

|

0 |

|

|

|

* |

|

| Byron Young |

|

|

2,287,185 |

|

|

|

* |

% |

|

|

2,287,185 |

|

|

|

0 |

|

|

|

* |

|

| Suleman Bhmani |

|

|

2,287,185 |

|

|

|

* |

% |

|

|

2,287,185 |

|

|

|

0 |

|

|

|

* |

|

| David Sterling |

|

|

793,658 |

|

|

|

* |

% |

|

|

793,658 |

|

|

|

0 |

|

|

|

* |

|

| Adam Walthen |

|

|

793,658 |

|

|

|

* |

% |

|

|

793,658 |

|

|

|

0 |

|

|

|

* |

|

| Stephen Alexander |

|

|

492,615 |

|

|

|

* |

% |

|

|

492,615 |

|

|

|

0 |

|

|

|

* |

|

| Shawn Khoja |

|

|

492,615 |

|

|

|

* |

% |

|

|

492,615 |

|

|

|

0 |

|

|

|

* |

|

| Leslie Rowe |

|

|

492,615 |

|

|

|

* |

% |

|

|

492,615 |

|

|

|

0 |

|

|

|

* |

|

| Scott Jeffery |

|

|

618,690 |

|

|

|

* |

% |

|

|

618,690 |

|

|

|

0 |

|

|

|

* |

|

| Lynn Martin |

|

|

618,690 |

|

|

|

* |

% |

|

|

618,690 |

|

|

|

0 |

|

|

|

* |

|

| Colby Jones |

|

|

492,615 |

|

|

|

* |

% |

|

|

492,615 |

|

|

|

0 |

|

|

|

* |

|

| Paula Sprabary |

|

|

119,003 |

|

|

|

* |

% |

|

|

119,003 |

|

|

|

0 |

|

|

|

* |

|

| Kate Kazanjian |

|

|

119,003 |

|

|

|

* |

% |

|

|

119,003 |

|

|

|

0 |

|

|

|

* |

|

| Lee Schafer |

|

|

119,003 |

|

|

|

* |

% |

|

|

119,003 |

|

|

|

0 |

|

|

|

* |

|

| Chelsea Boylan |

|

|

119,003 |

|

|

|

* |

% |

|

|

119,003 |

|

|

|

0 |

|

|

|

* |

|

| Alex Dorwart |

|

|

119,003 |

|

|

|

* |

% |

|

|

119,003 |

|

|

|

0 |

|

|

|

* |

|

| Ariel Weaver |

|

|

119,003 |

|

|

|

* |

% |

|

|

119,003 |

|

|

|

0 |

|

|

|

* |

|

| Divya Pandey |

|

|

63,960 |

|

|

|

* |

% |

|

|

63,960 |

|

|

|

0 |

|

|

|

* |

|

| Byron Alston |

|

|

63,960 |

|

|

|

* |

% |

|

|

63,960 |

|

|

|

0 |

|

|

|

* |

|

| Connor Gulch |

|

|

63,960 |

|

|

|

* |

% |

|

|

63,960 |

|

|

|

0 |

|

|

|

* |

|

| Aaron Benedict |

|

|

63,960 |

|

|

|

* |

% |

|

|

63,960 |

|

|

|

0 |

|

|

|

* |

|

| Vicki McIntosh |

|

|

63,960 |

|

|

|

* |

% |

|

|

63,960 |

|

|

|

0 |

|

|

|

* |

|

| Certain Non-Affiliates employees(12) |

|

|

|

|

|

|

* |

% |

|

|

|

|

|

|

|

|

|

|

* |

% |

*less

than 1%

| (1) |

Beneficial

ownership information in this table is based upon information supplied by officers, directors and employees. Unless otherwise indicated

in the footnotes to this table and subject to community property laws where applicable, we believe that each of the stockholders

named in this table has sole voting and dispositive power with respect to the shares indicated as beneficially owned.. |

| (2) |

Because the selling stockholders

may sell all or some portion of the shares of common stock beneficially owned by them, only an estimate (assuming the selling stockholder

sells all of the shares offered hereby) can be given as to the number of shares that will be beneficially owned by the selling stockholders

after this offering. In addition, the selling stockholders may have sold, transferred or otherwise disposed of, or may sell, transfer

or otherwise dispose of, at any time or from time to time since the dates on which they provided the information regarding their

beneficially ownership, some or all of the shares of common stock set forth opposite their names in the table above in transactions

exempt from the registration requirements of the Securities Act. |

PLAN

OF DISTRIBUTION

We

are registering the Shares covered by this prospectus to permit the Selling Securityholders to conduct public secondary trading of these

Shares from time to time after the date of this prospectus. We will not receive any of the proceeds of the sale of the Shares offered

by this prospectus. The aggregate proceeds to the Selling Securityholders from the sale of the Shares will be the purchase price of the

Shares less any discounts and commissions. We will not pay any brokers’ or underwriters’ discounts and commissions in connection

with the registration and sale of the Shares covered by this prospectus. The Selling Securityholders reserve the right to accept and,

together with their respective agents, to reject, any proposed purchases of Shares to be made directly or through agents.

The

Shares offered by this prospectus may be sold from time to time to purchasers:

| |

● |

directly

by the Selling Securityholders, or |

| |

|

|

| |

● |

through

underwriters, broker-dealers or agents, who may receive compensation in the form of discounts, commissions or agent’s commissions

from the Selling Securityholders or the purchasers of the Shares. |

Any

underwriters, broker-dealers or agents who participate in the sale or distribution of the Shares may be deemed to be “underwriters”

within the meaning of the Securities Act. As a result, any discounts, commissions or concessions received by any such broker-dealer or

agents who are deemed to be underwriters will be deemed to be underwriting discounts and commissions under the Securities Act. Underwriters

are subject to the prospectus delivery requirements of the Securities Act and may be subject to certain statutory liabilities under the

Securities Act and the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We will make copies of this

prospectus available to the Selling Securityholders for the purpose of satisfying the prospectus delivery requirements of the Securities

Act. To our knowledge, there are currently no plans, arrangements or understandings between the Selling Securityholders and any underwriter,

broker-dealer or agent regarding the sale of the Shares by the Selling Securityholders.

The

Shares may be sold in one or more transactions at:

| |

● |

prevailing

market prices at the time of sale; |

| |

● |

prices

related to such prevailing market prices; |

| |

● |

varying

prices determined at the time of sale; or |

These

sales may be effected in one or more transactions:

| |

● |

on

the OTC Markets or any other stock exchange on which the Common Stock may be listed at the time of sale; |

| |

● |

in

the over-the-counter market; |

| |

● |

in

transactions otherwise than on such exchanges or services or in the over-the-counter market; |

| |

● |

any

other method permitted by applicable law; or |

| |

● |

through

any combination of the foregoing. |

These

transactions may include block transactions or crosses. Crosses are transactions in which the same broker acts as an agent on both sides

of the trade.

At

the time a particular offering of the Shares is made, a prospectus supplement, if required, will be distributed, which will set forth

the name of the Selling Securityholders, the aggregate amount of Shares being offered and the terms of the offering, including, to the

extent required, (1) the name or names of any underwriters, broker-dealers or agents, (2) any discounts, commissions and other terms

constituting compensation from the Selling Securityholders and (3) any discounts, commissions or concessions allowed or reallowed to

be paid to broker-dealers.

The

Selling Securityholders will act independently of us in making decisions with respect to the timing, manner, and size of each resale

or other transfer. There can be no assurance that the Selling Securityholders will sell any or all of the Shares under this prospectus.

Further, we cannot assure you that the Selling Securityholders will not transfer, distribute, devise or gift the Shares by other means

not described in this prospectus. In addition, any Shares covered by this prospectus that qualify for sale under Rule 144 of the Securities

Act may be sold under Rule 144 rather than under this prospectus. The Shares may be sold in some states only through registered or licensed

brokers or dealers. In addition, in some states the Shares may not be sold unless they have been registered or qualified for sale or

an exemption from registration or qualification is available and complied with.

The

Selling Securityholders and any other person participating in the sale of the Shares will be subject to the Exchange Act. The Exchange

Act rules include, without limitation, Regulation M, which may limit the timing of purchases and sales of any of the Shares by the Selling

Securityholders and any other person. In addition, Regulation M may restrict the ability of any person engaged in the distribution of

the Shares to engage in market-making activities with respect to the particular Shares being distributed. This may affect the marketability

of the Shares and the ability of any person or entity to engage in market-making activities with respect to the Shares.

The

Selling Securityholders may indemnify any broker or underwriter that participates in transactions involving the sale of the Shares against

certain liabilities, including liabilities arising under the Securities Act.

LEGAL

MATTERS

The

validity of the issuance of the securities offered by this prospectus will be passed upon for us by Sichenzia Ross Ference LLP, New York,

New York. Sichenzia Ross Ference LLP or certain members or employees of Sichenzia Ross Ference LLP have been issued common stock of the

Company.

EXPERTS

The

financial statements of the Company appearing elsewhere in this prospectus have been included herein in reliance upon the report of Victor

Mokuolu, CPA PLLC an independent registered public accounting firm, appearing elsewhere herein, and upon the authority of Victor Mokuolu,

CPA PLLC experts in accounting and auditing.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

The

following documents filed with the SEC are hereby incorporated by reference in this prospectus:

| |

a) |

The description

of the Company’s common stock, par value $0.001 per share (the “Common Stock”), which is contained in the Company’s

Registration Statement on Form S-1 (File No. 333-182573), filed with the SEC on February 14, 2013, including any amendment or report

filed for the purpose of updating such description. |

| |

b) |

The Registrant’s

Annual Report filed on Form 10-K for the period ended December 31, 2021, filed with the SEC on April 15, 2022; |

| |

c) |

The Registrant’s

Quarterly report on Form 10-Q for the Period ended September 30, filed with the SEC on November 15, 2021; |

| |

d) |

The Registrant’s

Current Reports filed with the SEC on December 14, 2021, January 7, 2022, January 14, 2022, February 1, 2022 and the amendment to

such filed on February 11, 2022, and March 10, 2022; |

| |

e) |

The Company’s Registration

on Form 8-A (File No. 000-53949) filed with the SEC on April 20, 2010, including any amendment or report filed for the purpose of

updating such description; and |

| |

f) |

All other reports and documents

subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act (other than Current Reports

furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits furnished on such form that relate to such items) on or after the

date of this Registration Statement and prior to the filing of a post-effective amendment to this Registration Statement which indicates

that all securities offered have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated

by reference herein and to be a part of this Registration Statement from the date of the filing of such reports and documents. Any

statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or

superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any subsequently filed

document that also is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so

modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement. |

Notwithstanding

the forgoing, information furnished under Items 2.02 and 7.01 of any Current Report on Form 8-K, including the related exhibits, is not

incorporated by reference in this Registration Statement.

DISCLOSURE

OF COMMISSION POSITION ON INDEMNIFICATION

FOR

SECURITIES ACT LIABILITIES

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling the

registrant, the registrant has been informed that in the opinion of the Commission such indemnification is against public policy as expressed

in the Securities Act and is therefore unenforceable.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and other reports, proxy statements and other information with the SEC. Our SEC filings are available to the public

over the Internet at the SEC’s website at http://www.sec.gov. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and

Current Reports on Form 8-K, including any amendments to those reports, and other information that we file with or furnish to the SEC

pursuant to Section 13(a) or 15(d) of the Exchange Act can also be accessed free of charge by linking directly from our website at the

https://www.good-gaming.com/. These filings will be available as soon as reasonably practicable after we electronically file such material

with, or furnish it to, the SEC. Information contained on our website is not part of this prospectus.

The

Registrant hereby undertakes to provide without charge to each person, including any beneficial owner, to whom a copy of this prospectus

is delivered, upon written or oral request of any such person, a copy of any and all of the information that has been incorporated by

reference in this prospectus but not delivered with the prospectus other than the exhibits to those documents, unless the exhibits are

specifically incorporated by reference into the information that this prospectus incorporates. Requests for documents should be directed

to Good Gaming, Inc. Attention: Investor Relations: 415 McFarlan Rd, Suite 108, Kennett Square, PA 19501, (844) 419-7445.

Good

Gaming, Inc.

UP

TO 30,000,000 SHARES OF COMMON STOCK

REOFFER

PROSPECTUS

May

18, 2022

PART

II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

| Item 3. |

Incorporation of Documents by

Reference. |

The

following documents filed with the Commission by Good Gaming, Inc. (the “Company”), pursuant to the Securities Act and the

Securities Exchange Act of 1934, as amended (the “Exchange Act”)are hereby incorporated by reference in this Registration

Statement:

(1)

The Registrant’s Annual Report on Form 10-K for the year ended December 31, 2021, filed with the Commission on April 15, 2022;

(2)

The Company’s Registration on Form 8-A (File No. 000-53949) filed with the SEC on April 20, 2010; and

(3)

The description of the Company’s common stock, par value $0.001 per share (the “Common Stock”), which is contained

in the Company’s Registration Statement on Form S-1 (File No. 333-182573), filed with the SEC on February 14, 2013, including any

amendment or report filed for the purpose of updating such description.

All

documents subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act and, to the extent

specifically designated therein, Current Reports on Form 8-K filed by the Registrant with the Commission that are identified in such

forms as being incorporated into this Registration Statement and prior to the filing of a post-effective amendment to this Registration

Statement indicating that all of the securities offered hereby have been sold or which deregisters all securities then remaining unsold,

shall be deemed to be incorporated by reference into this Registration Statement and to be part hereof from the date of filing such documents.

Any

statement contained in a document incorporated or deemed to be incorporated by reference in this Registration Statement shall be deemed

to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained in this Registration

Statement (or in any other subsequently filed document which also is incorporated or deemed to be incorporated by reference herein),

modifies or supersedes such statement. Any statement contained in this Registration Statement shall be deemed to be modified or superseded

to the extent that a statement contained in a subsequently filed document that is or is deemed to be incorporated by reference in this

Registration Statement modifies or supersedes such prior statement. Any such statement so modified or superseded shall not be deemed,

except as so modified or superseded, to constitute a part of this Registration Statement.

| Item 4. |

Description of Securities. |

Not

applicable

| Item 5. |

Interests of Named Experts and

Counsel. |

Not

applicable

| Item 6. |

Indemnification of Directors

and Officers. |

Under

the Articles of Incorporation and Bylaws of the Company, we may indemnify an officer or director who is made a party to any proceeding,

including a lawsuit, because of his position, if he acted in good faith and in a manner, he reasonably believed to be in our best interest.

We may advance expenses incurred in defending a proceeding. To the extent that the officer or director is successful on the merits in

a proceeding as to which he is to be indemnified, we must indemnify him against all expenses incurred, including attorney’s fees.

With respect to a derivative action, indemnity may be made only for expenses actually and reasonably incurred in defending the proceeding,

and if the officer or director is judged liable, only by a court order. The indemnification is intended to be to the fullest extent permitted

by the laws of the State of Nevada.

| Item 7. |

Exemption from Registration Claimed. |

Not

applicable.

The

following exhibits are filed as part of this Registration Statement:

(a)

The registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)

To include any prospectus required by Section 10(a)(3) of the Securities Act.

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume

and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration

Fee” table in the effective registration statement.

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or

any material change to such information in the registration statement.

provided,

however, that paragraphs (a)(1)(i) and (a)(1)(ii) herein do not apply if the information required to be included in a post-effective

amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section

13 or Section 15(d) of the Exchange Act (15 U.S.C. 78m or 78o(d)) that are incorporated by reference in the registration statement.

(2)

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be

a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(b)

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of

the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing

of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in

the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering

of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c)

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons

of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities

and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred

or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is

asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless

in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the

question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final

adjudication of such issue.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe it

meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the

undersigned, thereunto duly authorized, in the City of Kenneth Square, Pennsylvania on the 20th day of November,

2022.

| |

GOOD

GAMING, INC. |

| |

|

|

| |

By: |

/s/

David B. Dorwart |

| |

|

David Dorwart |

| |

|

Chief Executive Officer |

POWER

OF ATTORNEY

KNOW

ALL MEN BY THESE PRESENTS, that each person whose signature appears below hereby constitutes and appoints David Dorwart his true

and lawful attorney-in-fact and agent, each acting alone, with full power of substitution and resubstitution, for him and in his

name, place and stead, in any and all capacities, to sign any and all amendments (including any post-effective amendments) to the

Registration Statement, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the

Securities and Exchange Commission, granting unto said attorneys-in-fact and agents full power and authority to do and perform each

and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he

might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents or any of them, or their

substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following person in

the capacities indicated and on the date indicated below.

| Signatures |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

David Dorwart |

|

|

|

November

20, 2023 |

| David Dorwart |

|

Chairman

of the Board and Chief Executive Officer |

|

|

| |

|

|

|

|

| /s/

Domenic Fontana |

|

|

|

November

20, 2023 |

| Domenic Fontana |

|

Chief Financial

Officer and Director |

|

|

| |

|

|

|

|

| /s/

Jordan Axl |

|

|

|

November

20, 2023 |

| Jordan Axt |

|

Chief Marketing

Officer and Director |

|

|

Exhibit 4.1

Exhibit

5.1

May

31, 2022

Good

Gaming, Inc.

415

McFarlan Road, Suite 108

Kennett

Square, PA 19348

| |

Re: |

Good

Gaming, Inc. Registration

Statement on Form S-8 |

Gentlemen:

We

have acted as counsel to Good Gaming, Inc., a Nevada corporation (the “Company”), in connection with the preparation

and filing of a Registration Statement on Form S-8 (the “Registration Statement”) pertaining to the registration by

the Company under the Securities Act of 1933, as amended (the “Securities Act”), of 30,000,000 shares (the “Shares”)

of the Company’s common stock, $0.001 par value per share (“Common Stock”), pursuant to the Good Gaming, Inc.

2022 Stock Incentive Plan (the “Plan”).

In

our capacity as counsel to the Company in connection with the matters referred to above, we have examined copies of the following: (i)

the Articles of Incorporation of the Company (the “Certificate”), (ii) the By-laws of the Company currently in effect

(the “By-laws”), and records of certain of the Company’s corporate proceedings as reflected in its minute books,

(iii) the Plan, (iv) a specimen certificate representing the Common Stock and (v) the Registration Statement, in the form it is to be

filed with the Securities and Exchange Commission (the “Commission”) on the date hereof. We have also examined such

other documents, papers, authorities and statutes as we have deemed necessary to form the basis of the opinions hereinafter set forth.

In

our examination, we have assumed the legal capacity of all natural persons, the genuineness of all signatures, the authenticity of all

documents submitted to us as originals, the conformity to original documents of all documents submitted to us as certified or copies,

and the authenticity of the originals of such documents. As to certain facts material to this opinion, we have relied upon oral or written

statements and representations of officers and other representatives of the Company and certificates of public officials, and such other

documents and information as we have deemed necessary or appropriate to enable us to render the opinions expressed below. We have not

undertaken any independent investigation to determine the accuracy of any such facts.

We

have also assumed that the Company will cause certificates representing Shares issued in the future to be properly executed and delivered

and will conform to the specimen certificate examined by us evidencing the Common Stock or, if the Shares are issued in book-entry form,

an appropriate account statement evidencing the Shares credited to the recipient’s account maintained with the Company’s

transfer agent will be issued by said transfer agent, and that the Company will take all other actions appropriate for the due and proper

issuance of such Shares. We have assumed for purposes of this opinion that the Company will receive adequate consideration (not less

than par value thereof) for all Shares issued under the Plan. We express no opinion regarding any Shares reacquired by the Company after

initial issuance.

Based

upon and subject to the qualifications, assumptions and limitations stated in this letter, it is our opinion that the Shares issuable

by the Company, under and in accordance with all of the provisions of the Plan, have been duly authorized and will be validly issued,

fully paid and non-assessable.

We

hereby consent to the filing of this opinion as Exhibit 5.1 to the Registration Statement. In giving this consent, we do not admit that

we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the

Commission promulgated thereunder.

We

hereby consent to the filing of this opinion with the Commission in connection with the Registration Statement in accordance with the

requirements of Item 601(b)(5) of Regulation S-K under the Securities Act. In giving such consent, we do not hereby admit that we are

in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission.

This opinion letter is limited to the specific legal matters expressly set forth herein and is limited to present statutes, regulations

and administrative and judicial interpretations. We assume no obligation to revise or supplement this opinion in the event of future

changes in such laws or regulations.

| |

Very truly yours,

|

| |

/s/Sichenzia

Ross Ference, LLP |

| |

Sichenzia

Ross Ference LLP |

Exhibit

10.1

GOOD

GAMING, INC.

2022

STOCK INCENTIVE PLAN

1.

Purpose of the Plan.

This

2022 Stock Incentive Plan (the “Plan”) is intended as an incentive, to retain in the employ of and as directors, officers,

consultants, advisors and employees to Good Gaming, Inc., a Nevada corporation (the “Company”), and any Subsidiary

of the Company, within the meaning of Section 424(f) of the United States Internal Revenue Code of 1986, as amended (the “Code”),

persons of training, experience and ability, to attract new directors, officers, consultants, advisors and employees whose services are

considered valuable, to encourage the sense of proprietorship and to stimulate the active interest of such persons in the development

and financial success of the Company and its Subsidiaries.

It

is further intended that certain options granted pursuant to the Plan shall constitute incentive stock options within the meaning of

Section 422 of the Code (the “Incentive Options”) while certain other options granted pursuant to the Plan shall be

nonqualified stock options (the “Nonqualified Options”). Incentive Options and Nonqualified Options are hereinafter

referred to collectively as “Options.”

The

Company intends that the Plan meet the requirements of Rule 16b-3 (“Rule 16b-3”) promulgated under the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), and that transactions of the type specified in subparagraphs

(c) to (f) inclusive of Rule 16b-3 by officers and directors of the Company pursuant to the Plan will be exempt from the operation of

Section 16(b) of the Exchange Act. Further, the Plan is intended to satisfy the performance-based compensation exception to the limitation

on the Company’s tax deductions imposed by Section 162(m) of the Code, as recently amended, with respect to those Options for which

qualification for such exception is intended. In all cases, the terms, provisions, conditions and limitations of the Plan shall be construed

and interpreted consistent with the Company’s intent as stated in this Section 1.

2.

Administration of the Plan.

The

authority to manage the operation of and administer the Plan shall be vested in the Board of Directors of the Company (the “Board”)

or a Committee (the “Committee”) consisting of two or more directors who are (i) “Independent Directors”

(as such term is defined under the rules of the OTCQX U.S. Stock Market), (ii) “Non-Employee Directors” (as such term is

defined in Rule 16b-3) and (iii) “Outside Directors” (as such term is defined in Section 162(m) of the Code), which shall

serve at the pleasure of the Board. The Committee, subject to Sections 3, 5 and 6 hereof, shall have full power and authority to designate

recipients of Options and restricted stock (“Restricted Stock”), and to determine the terms and conditions of the

respective Option and Restricted Stock agreements (which need not be identical) and to interpret the provisions and supervise the administration

of the Plan. The Committee shall have the authority, without limitation, to designate which Options granted under the Plan shall be Incentive

Options and which shall be Nonqualified Options. To the extent any Option does not qualify as an Incentive Option, it shall constitute

a separate Nonqualified Option.

Subject

to the provisions of the Plan, the Committee shall interpret the Plan and all Options and Restricted Stock (the “Securities”)

granted under the Plan, shall make such rules as it deems necessary for the proper administration of the Plan, shall make all other determinations

necessary or advisable for the administration of the Plan and shall correct any defects or supply any omission or reconcile any inconsistency

in the Plan or in any Securities granted under the Plan in the manner and to the extent that the Committee deems desirable to carry into

effect the Plan or any Securities. The act or determination of a majority of the Committee shall be the act or determination of the Committee

and any decision reduced to writing and signed by all of the members of the Committee shall be fully effective as if it had been made

by a majority of the Committee at a meeting duly held for such purpose. Subject to the provisions of the Plan, any action taken or determination

made by the Committee pursuant to this and the other Sections of the Plan shall be conclusive on all parties.

In

the event that for any reason the Committee is unable to act or if the Committee at the time of any grant, award or other acquisition

under the Plan does not consist of two or more Non-Employee Directors, or if there shall be no such Committee, or if the Board otherwise

determines to administer the Plan, then the Plan shall be administered by the Board, and references herein to the Committee (except in

the proviso to this sentence) shall be deemed to be references to the Board, and any such grant, award or other acquisition may be approved

or ratified in any other manner contemplated by subparagraph (d) of Rule 16b-3; provided, however, that grants to the Company’s

Chief Executive Officer or to any of the Company’s other four most highly compensated officers that are intended to qualify as

performance-based compensation under Section 162(m) of the Code may only be granted by the Committee.

If

the Board, at any time, consists of only one member or only employee directors, such sole director may take all actions granted to the

Committee hereunder. For avoidance of doubt until a committee is designed by the Board, the Board shall administer the Plan and unless

such Committee has been designated any references to Committee herein shall be to the Board.

3.

Designation of Optionees and Grantees.

The

persons eligible for participation in the Plan as recipients of Options (the “Optionees”) or Restricted Stock (the

“Grantees” and together with Optionees, the “Participants”) shall include directors, officers and

employees of, and consultants and advisors to, the Company or any Subsidiary; provided that Incentive Options may only be granted to

employees of the Company and any Subsidiary. In selecting Participants, and in determining the number of shares to be covered by each

Option or award of Restricted Stock granted to Participants, the Committee may consider any factors it deems relevant, including, without

limitation, the office or position held by the Participant or the Participant’s relationship to the Company, the Participant’s

degree of responsibility for and contribution to the growth and success of the Company or any Subsidiary, the Participant’s length

of service, promotions and potential. A Participant who has been granted an Option or Restricted Stock hereunder may be granted an additional

Option or Options, or Restricted Stock if the Committee shall so determine.

4.

Stock Reserved for the Plan.

Subject

to adjustment as provided in Section 8 hereof, a total of 30,000,000 shares of the Company’s common stock, par value $0.001 per

share (the “Common Stock”), shall be subject to the Plan. The shares of Common Stock subject to the Plan shall consist

of unissued shares, treasury shares or previously issued shares held by any Subsidiary of the Company, and such number of shares of Common

Stock shall be and is hereby reserved for such purpose. Any of such shares of Common Stock that may remain unissued and that are not

subject to outstanding Options at the termination of the Plan shall cease to be reserved for the purposes of the Plan, but until termination

of the Plan the Company shall at all times reserve a sufficient number of shares of Common Stock to meet the requirements of the Plan.

Should any Securities expire or be canceled prior to its exercise, satisfaction of conditions or vesting in full, as applicable, or should

the number of shares of Common Stock to be delivered upon the exercise or vesting in full of an Option or award of Restricted Stock be

reduced for any reason, the shares of Common Stock theretofore subject to such Option or Restricted Stock, as applicable, may be subject

to future Options or Restricted Stock under the Plan, except where such reissuance is inconsistent with the provisions of Section 162(m)

of the Code where qualification as performance-based compensation under Section 162(m) of the Code is intended.

5.

Terms and Conditions of Options.

Options

granted under the Plan shall be subject to the following conditions and shall contain such additional terms and conditions, not inconsistent

with the terms of the Plan, as the Committee shall deem desirable:

(a)

Option Price. The purchase price of each share of Common Stock purchasable under an Incentive Option shall be determined by the

Committee at the time of grant, but shall not be less than 100% of the Fair Market Value (as defined below) of such share of Common Stock

on the date the Option is granted; provided, however, that with respect to an Optionee who, at the time such Incentive

Option is granted, owns (within the meaning of Section 424(d) of the Code) more than 10% of the total combined voting power of all classes

of stock of the Company or of any Subsidiary, the purchase price per share of Common Stock shall be at least 110% of the Fair Market

Value per share of Common Stock on the date of grant. Note that David B. Dorwart, the Company’s Chief Executive Officer, owns more

than 10% of the total combined voting power of all classes of stock of the Company or of any Subsidiary and thus shall pay at least 110%

of the Fair Market Value per share of Common Stock he acquires pursuant to this Plan. The purchase price of each share of Common Stock

purchasable under a Nonqualified Option shall not be less than 100% of the Fair Market Value of such share of Common Stock on the date

the Option is granted. The exercise price for each Option shall be subject to adjustment as provided in Section 8 below. “Fair

Market Value” means the closing price on the final trading day immediately prior to the grant date of the Common Stock on the

OTCQX U.S. or other principal securities exchange or OTCQB on which shares of Common Stock are listed (if the shares of Common Stock

are so listed), or, if not so listed, the mean between the closing bid and asked prices of publicly traded shares of Common Stock in

the over the counter market, or, if such bid and asked prices shall not be available, as reported by any nationally recognized quotation

service selected by the Company, or as determined by the Committee in a manner consistent with the provisions of the Code. Anything in

this Section 5(a) to the contrary notwithstanding, in no event shall the purchase price of a share of Common Stock be less than the minimum

price permitted under the rules and policies of any national securities exchange on which the shares of Common Stock are listed.

(b)

Option Term. The term of each Option shall be fixed by the Committee, but no Option shall be exercisable more than ten years after

the date such Option is granted and in the case of an Incentive Option granted to an Optionee who, at the time such Incentive Option

is granted, owns (within the meaning of Section 424(d) of the Code) more than 10% of the total combined voting power of all classes of

stock of the Company or of any Subsidiary, no such Incentive Option shall be exercisable more than five years after the date such Incentive

Option is granted.

(c)

Exercisability. Subject to Section 5(j) hereof, Options shall be exercisable at such time or times and subject to such terms and

conditions as shall be determined by the Committee at the time of grant; provided, however, that in the absence of any

Option vesting periods designated by the Committee at the time of grant, Options shall vest and become exercisable as to one-third of

the total number of shares subject to the Option on each of the first, second and third anniversaries of the date of grant; and provided

further that no Options shall be exercisable until such time as any vesting limitation required by Section 16 of the Exchange Act, and

related rules, shall be satisfied if such limitation shall be required for continued validity of the exemption provided under Rule 16b-3(d)(3).

Upon

the occurrence of a “Change in Control” (as hereinafter defined), the Committee may accelerate the vesting and exercisability

of outstanding Options, in whole or in part, as determined by the Committee in its sole discretion. In its sole discretion, the Committee

may also determine that, upon the occurrence of a Change in Control, each outstanding Option shall terminate within a specified number

of days after notice to the Optionee thereunder, and each such Optionee shall receive, with respect to each share of Common Stock subject

to such Option, an amount equal to the excess of the Fair Market Value of such shares immediately prior to such Change in Control over

the exercise price per share of such Option; such amount shall be payable in cash, in one or more kinds of property (including the property,

if any, payable in the transaction) or a combination thereof, as the Committee shall determine in its sole discretion.

For

purposes of the Plan, unless otherwise defined in an employment agreement between the Company and the relevant Optionee, a Change in

Control shall be deemed to have occurred if:

(i)

a tender offer (or series of related offers) shall be made and consummated for the ownership of 50% or more of the outstanding voting

securities of the Company, unless as a result of such tender offer more than 50% of the outstanding voting securities of the surviving

or resulting corporation shall be owned in the aggregate by the stockholders of the Company (as of the time immediately prior to the

commencement of such offer), any employee benefit plan of the Company or its Subsidiaries, and their affiliates;

(ii)

the Company shall be merged or consolidated with another corporation, unless as a result of such merger or consolidation more than 50%

of the outstanding voting securities of the surviving or resulting corporation shall be owned in the aggregate by the stockholders of

the Company (as of the time immediately prior to such transaction), any employee benefit plan of the Company or its Subsidiaries, and

their affiliates;

(iii)

the Company shall sell substantially all of its assets to another corporation that is not wholly owned by the Company, unless as a result

of such sale more than 50% of such assets shall be owned in the aggregate by the stockholders of the Company (as of the time immediately

prior to such transaction), any employee benefit plan of the Company or its Subsidiaries and their affiliates; or

(iv)

a Person (as defined below) shall acquire 50% or more of the outstanding voting securities of the Company (whether directly, indirectly,

beneficially or of record), unless as a result of such acquisition more than 50% of the outstanding voting securities of the surviving

or resulting corporation shall be owned in the aggregate by the stockholders of the Company (as of the time immediately prior to the

first acquisition of such securities by such Person), any employee benefit plan of the Company or its Subsidiaries, and their affiliates.

Notwithstanding

the foregoing, if Change of Control is defined in an employment agreement between the Company and the relevant Optionee, then, with respect

to such Optionee, Change of Control shall have the meaning ascribed to it in such employment agreement.

For

purposes of this Section 5(c), ownership of voting securities shall take into account and shall include ownership as determined by applying

the provisions of Rule 13d-3(d)(I)(i) (as in effect on the date hereof) under the Exchange Act. In addition, for such purposes, “Person”

shall have the meaning given in Section 3(a)(9) of the Exchange Act, as modified and used in Sections 13(d) and 14(d) thereof; provided,

however, that a Person shall not include (A) the Company or any of its Subsidiaries; (B) a trustee or other fiduciary holding

securities under an employee benefit plan of the Company or any of its Subsidiaries; (C) an underwriter temporarily holding securities

pursuant to an offering of such securities; or (D) a corporation owned, directly or indirectly, by the stockholders of the Company in

substantially the same proportion as their ownership of stock of the Company.

(d)

Method of Exercise. Options to the extent then exercisable may be exercised in whole or in part at any time during the option

period, by giving written notice to the Company specifying the number of shares of Common Stock to be purchased, accompanied by payment

in full of the purchase price, in cash, or by check or such other instrument as may be acceptable to the Committee. As determined by