TIDMCCEP

RNS Number : 9603V

Coca-Cola European Partners plc

20 April 2021

Coca-Cola European Partners plc ("CCEP") is disclosing the

following unaudited pro forma condensed combined financial

information prepared in connection with proposed financings of the

Coca-Cola Amatil Limited (CCL) acquisition by CCEP.

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

In November 2020, CCEP and Coca-Cola Amatil Limited ("CCL")

entered into a binding Scheme Implementation Deed for the

acquisition of 69.2% of the entire existing issued share capital of

CCL, held by shareholders other than The Coca-Cola Company ("TCCC")

for A$12.75 per share in cash less the second half 2020 dividend of

A$0.18 per share declared by CCL on 18 February 2021 ("2H20

Dividend"), pursuant to a scheme of arrangement (the "Scheme"). CCL

is one of the largest bottlers and distributors of ready to drink

non-alcoholic and alcoholic beverages and coffee in the Asia

Pacific region and is the authorized bottler and distributor of

TCCC's beverage brands in Australia, New Zealand, Fiji, Indonesia,

Papua New Guinea and Samoa.

CCEP made a further, best and final, offer in February 2021 in

which it increased the Scheme consideration to A$13.50 per share in

cash less the 2H20 Dividend.

CCEP has also entered into a Co-operation and Sale Deed with

TCCC (the "Co-operation Agreement") which is conditional upon the

implementation of the Scheme. Under the Co-operation Agreement,

CCEP will acquire 10.8% of CCL shares from TCCC for A$9.57 per

share in cash less the 2H20 Dividend and can acquire the remaining

20% of CCL's shares held by TCCC for A$10.75 per share less the

2H20 Dividend, either in cash or a combination of cash and the

issue of CCEP shares at an agreed conversion ratio. In March 2021,

in accordance with the Co-operation Agreement, CCEP elected to

purchase the remaining 20% of CCL's shares held by TCCC for

cash.

The Scheme and the Co-operation Agreement are referred to herein

as the "Acquisition".

The Acquisition will be accounted for as a business combination

using the acquisition method of accounting in accordance with

International Financial Reporting Standards ("IFRS"). Accordingly,

CCL's assets to be acquired and liabilities to be assumed have been

adjusted based on preliminary estimates of fair value.

The following unaudited pro forma condensed combined financial

information and related notes (the "Pro Forma Financial

Information") is based on the historical consolidated financial

statements of CCEP and the historical financial statements of CCL

and has been prepared to reflect the Acquisition. The Acquisition

together with the related financing are together referred to as the

"Transaction." The pro forma adjustments related to the Transaction

include:

- The acquisition of 100% of CCL by CCEP;

- Reflecting the assets, liabilities, and non-controlling interests of

CCL at their preliminary estimated fair values;

- Proceeds and use of financings. Refer to Note 4 of the Pro Forma Financial

Information; and,

- The translation of CCL's financial information from Australian Dollars

("AUD" or A$) to Euros ("EUR" or EUR).

The Pro Forma Financial Information is derived from and should

be read in conjunction with the most recent historical financial

statements of CCEP and CCL. For both CCEP and CCL this is financial

information as at and for the year ended 31 December 2020. The

historical financial statements and related notes thereto of CCEP

are filed with the US Securities and Exchange Commission as part of

CCEP's Annual Report on Form 20-F for the year ended 31 December

2020. The historical financial statements and related notes thereto

of CCL can be found on CCL's website at

https://www.ccamatil.com/au/Investors/Financial-reporting and are

not incorporated by reference herein or form a part hereof.

The unaudited pro forma condensed combined income statement for

the year ended 31 December 2020 (the "Pro Forma Income Statement")

gives effect to the Acquisition as if it had occurred on 1 January

2020, while the unaudited pro forma condensed combined statement of

financial position at 31 December 2020 (the "Pro Forma Statement of

Financial Position") gives effect to the Acquisition as if it had

occurred on 31 December 2020.

The Pro Forma Financial Information has not been prepared in

accordance with the requirements of Regulation S-X of the US

Securities Act of 1933, the Prospectus Regulation, or any generally

accepted accounting standards. Refer to Note 1 of the Pro Forma

Financial Information.

The Pro Forma Financial Information has been prepared in order

to illustrate the effects of the Acquisition on the financial

position and results of operations of CCEP. It is based on

information and assumptions that CCEP believes are reasonable,

including assumptions regarding the terms of the Acquisition. The

Pro Forma Financial Information has been prepared for illustrative

purposes only and because of its nature, addresses a hypothetical

situation. It does not intend to represent what CCEP's financial

position or results of operations actually would have been if the

Acquisition had been completed on the dates indicated, nor does it

intend to represent, predict or estimate the results of operations

for any future period or financial position at any future date. In

addition, it does not reflect ongoing cost savings that CCEP

expects to achieve as a result of the Acquisition or the costs

necessary to achieve these cost savings or synergies. As pro forma

information is prepared to illustrate retrospectively the effects

of transactions that will occur in the future, there are

limitations that are inherent to the nature of pro forma

information. As such, had the Acquisition taken place on the dates

assumed above, the actual effects would not necessarily have been

the same as those presented in the Pro Forma Financial

Information.

UNAUDITED PRO FORMA CONDENSED COMBINED INCOME STATEMENT

FOR THE YEARED 31 DECEMBER 2020

Transaction Accounting Adjustments

------------------------------------------------------------------------------

Intangible

Inventory Fixed asset asset Transaction

Adjusted fair value depreciation amortization and related Total Financing CCEP pro

(in EUR millions, Historical CCL adjustment adjustment adjustment costs acquisition Adjustments forma

except where specified) CCEP (Note 2) (Note 3(b)) (Note 3(b)) (Note 3(b)) (Note 3(b)) adjustments (Note 4) combined

----------------------- ---------- -------- ----------- ------------ ------------ ----------- ----------- ----------- --------

Revenue 10,606 2,929 - - - - - - 13,535

Cost of sales (6,871) (1,737) (29) (9) - - (38) - (8,646)

------------------------ ---------- -------- ----------- ------------ ------------ ----------- ----------- ----------- --------

Gross Profit 3,735 1,192 (29) (9) - - (38) - 4,889

Operating expenses (2,922) (1,022) - (2) (21) (92) (115) - (4,059)

------------------------ ---------- -------- ----------- ------------ ------------ ----------- ----------- ----------- --------

Operating profit 813 170 (29) (11) (21) (92) (153) - 830

Finance income 33 20 - - - - - - 53

Finance costs (144) (57) - - - (4) (4) (34) (239)

------------------------ --------

Total finance costs, net (111) (37) - - - (4) (4) (34) (186)

Non-operating items (7) (2) - - - - - - (9)

------------------------ ---------- -------- ----------- ------------ ------------ ----------- ----------- ----------- --------

Profit before taxes 695 131 (29) (11) (21) (96) (157) (34) 635

Taxes (197) (44) 8 3 6 28 45 10 (186)

------------------------ ---------- -------- ----------- ------------ ------------ ----------- ----------- ----------- --------

Profit after taxes 498 87 (21) (8) (15) (68) (112) (24) 449

Profit attributable to

shareholders 498 109 (21) (8) (15) (68) (112) (24) 471

Profit attributable to

non-controlling

interests - (22) - - - - - - (22)

------------------------ --------

Profit after taxes 498 87 (21) (8) (15) (68) (112) (24) 449

======================== ========== ======== =========== ============ ============ =========== =========== =========== ========

(per share information

in EUR)

Basic earnings per

share: 1.09 0.99

Diluted earnings per

share: 1.09 0.98

(share information in

millions)

Basic weighted average

number of shares 455 455

Diluted weighted average

number of shares 456 456

The accompanying notes are an integral part of this unaudited

pro forma condensed combined financial information.

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF FINANCIAL

POSITION

AS OF 31 DECEMBER 2020

Transaction Accounting Adjustments

---------- ---------- ---------------------------------------------------- ---------

Preliminary

purchase

consideration Transaction CCEP

Adjusted and and related Total Financing total pro

Historical CCL allocation costs acquisition Adjustments forma

(in EUR millions) CCEP (Note 2) (Note 3(a)) (Note 3(b)) adjustments (Note 4) combined

------------------ ---------- ---------- ------------- ----------- ----------- ----------- ---------

ASSETS:

Non-current:

Intangible assets 8,414 667 3,754 - 3,754 - 12,835

Goodwill 2,517 80 2,409 - 2,409 - 5,006

Property, plant and

equipment 3,860 1,206 94 - 94 - 5,160

Non-current

derivative assets 6 71 - - - - 77

Deferred tax assets 27 5 - - - - 32

Other non-current

assets 337 61 - - - - 398

------------------- ---------- ---------- ------------- ----------- ----------- ----------- ---------

Total non-current

assets 15,161 2,090 6,257 - 6,257 - 23,508

------------------- ---------- ---------- ------------- ----------- ----------- ----------- ---------

Current:

Current derivative

assets 40 13 - - - - 53

Current tax assets 19 6 - - - - 25

Inventories 681 356 29 - 29 - 1,066

Amount receivable

from related

parties 150 33 - - - - 183

Trade accounts

receivable 1,439 504 - - - - 1,943

Other current

assets 224 154 - - - - 378

Cash and cash

equivalents 1,523 630 (5,766) (96) (5,862) 5,221 1,512

------------------- ---------- ---------- ------------- ----------- ----------- ----------- ---------

Total current

assets 4,076 1,696 (5,737) (96) (5,833) 5,221 5,160

------------------- ------------- ----------- ----------- ----------- ---------

Total assets 19,237 3,786 520 (96) 424 5,221 28,668

=================== ========== ========== ============= =========== =========== =========== =========

LIABILITIES:

Non-current:

Borrowings, less

current portion 6,382 1,311 - - - 4,721 12,414

Employee benefit

liabilities 283 36 - - - - 319

Non-current

provisions 83 - - - - - 83

Non-current

derivative

liabilities 15 75 - - - - 90

Deferred tax

liabilities 2,134 143 1,215 - 1,215 - 3,492

Non-current tax

liabilities 131 - - - - - 131

Other non-current

liabilities 44 - - - - - 44

------------------- -----------

Total non-current

liabilities 9,072 1,565 1,215 - 1,215 4,721 16,573

------------------- ---------- ---------- ------------- ----------- ----------- ----------- ---------

Current:

Current portion of

borrowings 805 253 - - - 500 1,558

Current portion of

employee benefit

liabilities 13 51 - - - - 64

Current provisions 154 - - - - - 154

Current derivative

liabilities 62 40 - - - - 102

Current tax

liabilities 171 20 - - - - 191

Amounts payable to

related parties 181 87 - - - - 268

Trade and other

payables 2,754 763 - - - - 3,517

------------------- -----------

Total current

liabilities 4,140 1,214 - - - 500 5,854

------------------- ---------- ---------- ------------- ----------- ----------- ----------- ---------

Total liabilities 13,212 2,779 1,215 - 1,215 5,221 22,427

=================== ========== ========== ============= =========== =========== =========== =========

EQUITY

Share capital 5 1,179 (1,179) - (1,179) - 5

Share premium 192 - - - - - 192

Merger reserves 287 - - - - - 287

Other reserves (537) 121 (121) - (121) - (537)

Retained earnings 6,078 (490) 490 (96) 394 - 5,982

------------------- -----------

Equity attributable

to shareholders 6,025 810 (810) (96) (906) - 5,929

------------------- ---------- ---------- ------------- ----------- ----------- ----------- ---------

Non-controlling

interests - 197 115 - 115 - 312

Total equity 6,025 1,007 (695) (96) (791) - 6,241

=================== ========== ========== ============= =========== =========== =========== =========

The accompanying notes are an integral part of this unaudited

pro forma condensed combined financial information.

Note 1. Basis of preparation

The Pro Forma Financial Information set forth herein is based

upon the historical financial statements of CCEP and CCL and has

been prepared to illustrate the effects of the Transaction as if it

had occurred on:

- 1 January 2020 in respect of the Pro Forma Income Statement; and,

- 31 December 2020 in respect of the Pro Forma Statement of Financial Position.

The Pro Forma Financial Information is presented for

illustrative purposes only and does not necessarily reflect the

results of operations or the financial position that actually would

have resulted had the Acquisition occurred at the dates indicated,

or project the results of operations or financial position for any

future dates or periods.

The Acquisition will be accounted for as a business combination

using the acquisition method of accounting in accordance with IFRS.

Accordingly, CCL's assets to be acquired and liabilities to be

assumed have been adjusted based on preliminary estimates of fair

value. Any excess of the purchase price over the fair value of

identified assets acquired and liabilities assumed will be

recognized as goodwill. The actual fair values will be determined

upon the consummation of the Acquisition and may vary from these

preliminary estimates.

The Pro Forma Financial Information does not reflect the cost of

any integration activities or benefits from the Acquisition,

including potential synergies that may be generated in future

periods.

The historical financial statements of CCEP are prepared in

accordance with IFRS and are presented in Euros. The historical

financial statements of CCL are prepared in accordance with

Australian Accounting Standards, which complies with IFRS and are

presented in Australian Dollars. The Pro Forma Financial

Information includes reclassifications and adjustments to conform

CCL's historical accounting presentation to CCEP's accounting

presentation, in each case for the relevant periods. The CCL income

statement has been translated from Australian Dollars to Euros

using the average monthly exchange rates for the periods of 0.6036.

The CCL balance sheet has been translated from Australian Dollars

to Euros using exchange rate at 31 December 2020 of 0.6184.

The estimated income tax impacts of the pre-tax adjustments that

are reflected in the Pro Forma Financial Information are calculated

using an estimated blended statutory rate of 29%, based upon the

annual period ending 31 December 2020. The blended statutory rate

and the effective tax rate of the combined group could be

significantly different depending on the post-transaction

activities and geographical mix of profit before tax.

Note 2: Adjustments to CCL's financial statements

The financial statements below illustrate the impact of

adjustments made to CCL's financial statements in order to present

them on a basis consistent with CCEP's accounting policies under EU

IFRS. These adjustments reflect CCEP's best estimates based upon

the information currently available to CCEP and could be subject to

change once more detailed information is obtained. The CCL

financial information has been adjusted to:

- Present CCL's financial information on a basis consistent with the accounting

policies adopted by CCEP; and

- Translate from Australian Dollars to Euros, which is the presentation

currency of CCEP.

U NAUDITED ADJUSTED CCL INCOME STATEMENT

FOR THE YEARED 31 DECEMBER 2020

Adjusted

Reclassifications CCL

Historical

CCL AUD (A$) Adjusted CCL EUR (EUR)

(in millions) AUD (A$) (Note 2(a)) AUD (A$) (Note 2(b))

--------------------------------------- ---------- ----------------- ------------ -------------

Revenue - 4,853 4,853 2,929

Trading revenue 4,762 (4,762) - -

Cost of sales - (2,877) (2,877) (1,737)

Cost of goods sold (2,862) 2,862 - -

Delivery (221) 221 - -

------------------------------------------- ---------- ----------------- ------------ -------------

Gross profit 1,679 297 1,976 1,192

Other revenues 39 (39) - -

Operating expenses (1,438) (256) (1,693) (1,022)

Operating profit 280 3 283 170

Finance income 33 - 33 20

Finance costs (95) - (95) (57)

------------------------------------------- ---------- ----------------- ------------ -------------

Total finance costs, net (62) - (62) (37)

Non-operating items - (3) (3) (2)

------------------------------------------- ---------- ----------------- ------------ -------------

Profit before tax 218 - 218 131

------------------------------------------- ---------- ----------------- ------------ -------------

Taxes - (73) (73) (44)

Income tax expense (73) 73 - -

------------------------------------------- ---------- ----------------- ------------ -------------

Profit after tax 145 - 145 87

------------------------------------------- ---------- ----------------- ------------ -------------

Profit attributable to shareholders - 180 180 109

Attributable to shareholders of

Coca-Cola Amatil Limited 180 (180) - -

Profit attributable to non-controlling

interests (35) - (35) (22)

------------------------------------------- ---------- ----------------- ------------ -------------

Profit after tax 145 - 145 87

------------------------------------------- ---------- ----------------- ------------ -------------

UNAUDITED ADJUSTED CCL BALANCE SHEET

AS OF 31 DECEMBER 2020

Adjusted

Reclassifications CCL

Historical Adjusted

CCL AUD (A$) CCL EUR (EUR)

(Note

(in millions) AUD (A$) (Note 2(a)) AUD (A$) 2(b))

------------------------------- ---------- ----------------- ---------- -----------

ASSETS:

Non-current:

Intangible assets 1,208 (130) 1,078 667

Goodwill - 130 130 80

Investments 61 (61) - -

Defined benefit superannuation

plans 7 (7) - -

Property, plant and equipment 1,519 432 1,951 1,206

Right of use assets 432 (432) - -

Non-current derivative

assets - 115 115 71

Derivatives 115 (115) - -

Deferred tax assets 8 - 8 5

Other non-current assets - 99 99 61

Other receivables 1 (1) - -

Prepayments 18 (18) - -

Loans receivable interest

bearing 12 (12) - -

------------------------------- ---------- ----------------- ---------- -----------

Total non-current assets 3,381 - 3,381 2,090

Current:

Current derivative assets - 22 22 13

Derivatives 22 (22) - -

Other financial assets

at amortised cost 37 (37) - -

Current tax assets 10 - 10 6

Inventories 576 - 576 356

Amount receivable from

related parties - 53 53 33

Trade accounts receivable - 815 815 504

Trade and other receivables 964 (964) - -

Other current assets - 249 249 154

Other financial assets 30 (30) - -

Prepayments 86 (86) - -

Cash and cash equivalents - 1,018 1,018 630

Cash assets 1,018 (1,018) - -

------------------------------- ---------- ----------------- ---------- -----------

Total current assets 2,743 - 2,743 1,696

------------------------------- ---------- ----------------- ---------- -----------

Total assets 6,124 - 6,124 3,786

=============================== ========== ================= ========== ===========

UNAUDITED ADJUSTED CCL BALANCE SHEET

AS OF 31 DECEMBER 2020

Adjusted

Reclassifications CCL

Historical Adjusted

CCL AUD (A$) CCL EUR (EUR)

(Note

(in millions) AUD (A$) (Note 2(a)) AUD (A$) 2(b))

------------------------------------ ---------- ----------------- ---------- -----------

LIABILITIES

Non-current

Borrowings, less current

portion - 2,120 2,120 1,311

Borrowings 1,693 (1,693) - -

Lease liabilities 427 (427) - -

Employee benefit liabilities - 59 59 36

Employee benefits provisions 11 (11) - -

Defined benefit superannuation

plans 48 (48) - -

Non-current derivative liabilities - 122 122 75

Derivatives 122 (122) - -

Deferred tax liabilities 231 - 231 143

---------- ----------------- ---------- -----------

Total non-current liabilities 2,532 - 2,532 1,565

Current:

Current portion of borrowings - 409 409 253

Borrowings 336 (336) - -

Lease liabilities 73 (73) - -

Current portion of employee

benefit liabilities - 82 82 51

Employee benefits provisions 82 (82) - -

Current derivative liabilities - 65 65 40

Derivatives 65 (65) - -

Current tax liabilities 33 - 33 20

Amounts payable to related

parties - 141 141 87

Trade and other payables 1,295 (60) 1,235 763

Other financial liabilities 81 (81) - -

------------------------------------ ---------- ----------------- ---------- -----------

Total current liabilities 1,965 - 1,965 1,214

------------------------------------ ---------- ----------------- ---------- -----------

Total liabilities 4,497 - 4,497 2,779

==================================== ========== ================= ========== ===========

EQUITY

Share capital 1,919 (13) 1,906 1,179

Treasury shares (13) 13 - -

Other reserves - 194 194 121

Reserves 194 (194) - -

Retained earnings - (792) (792) (490)

Accumulated losses (792) 792 - -

------------------------------------ ---------- ----------------- ---------- -----------

Equity attributable to shareholders 1,308 - 1,308 810

Non-controlling interests 319 - 319 197

------------------------------------

Total equity 1,627 - 1,627 1,007

==================================== ========== ================= ========== ===========

(a) Preliminary pro forma classification adjustments have been

made to CCL's income statement and balance sheet in order to

present them on a basis consistent with CCEP. These adjustments

have not changed CCL's profit for the year, total assets or total

liabilities. These adjustments reflect CCEP's best estimates based

upon information currently available to CCEP and could be subject

to change once more detailed information is obtained.

(b) The CCL income statement has been translated from Australian

Dollars to Euros using the average monthly exchange rates for the

periods of 0.6036. The CCL balance sheet has been translated from

Australian Dollars to Euros using exchange rate at 31 December 2020

of 0.6184.

Note 3: Transaction accounting adjustments - acquisition

(a) Preliminary purchase consideration and allocation

The Acquisition is reflected in the Pro Forma Financial

Information as being accounted for under the acquisition method in

accordance with IFRS 3 - Business Combinations. Under this method

the CCL assets acquired and liabilities assumed have been recorded

on preliminary estimates of fair value. The final fair values will

be determined upon the consummation of the Acquisition and may vary

materially from these preliminary estimates.

The estimated purchase consideration, estimated fair values and

residual goodwill are as follows:

Description

(in EUR millions, except where specified) Amount

--------

Consideration to public shareholders pursuant

to the Scheme (in AUD) 6,673

Consideration to TCCC (in AUD) 2,265

----------------------------------------------- --------

Total purchase consideration (in AUD) 8,938

----------------------------------------------- --------

Total purchase consideration (in EUR) 5,766

Allocation of purchase consideration:

Net working capital (excluding inventory) 126

Inventory 385

Intangible assets 4,421

Property, Plant, and Equipment 1,300

Other non-current assets 132

Other non-current liabilities (1,422)

Fair value of noncontrolling interests (312)

Deferred taxes, net (1,353)

--------

Residual goodwill 2,489

Less CCL's historical goodwill (80)

----------------------------------------------- --------

Goodwill adjustment 2,409

----------------------------------------------- --------

The preliminary allocation has been made based on limited access

to information. CCEP will not have sufficient information to make

final allocations until after the completion of the

Acquisition.

The final determination of the accounting for the Acquisition is

anticipated to be completed as soon as practicable after the

completion of the Acquisition. CCEP anticipates that the valuations

of the assets acquired and liabilities assumed in the Acquisition

will include, but not be limited to, inventory, property, plant and

equipment, intangible assets and borrowings. The valuations will

consist of physical appraisals, discounted cash flow analyses or

other appropriate valuation techniques to determine the fair value

of the assets acquired and liabilities assumed.

The final consideration and amounts allocated to assets acquired

and liabilities assumed in the Acquisition could differ materially

from the preliminary amounts presented in the Pro Forma Financial

Information. A decrease in the fair value of assets acquired or an

increase in the fair value of liabilities assumed in the

Acquisition from those preliminary valuations presented in the Pro

Forma Financial Information would result in an increase in the

amount of goodwill that will result from the Acquisition. In

addition, if the value of the assets acquired is higher than the

preliminary indication, it may result in higher amortization and

depreciation expense than is presented in the Pro Forma Financial

Information.

(i) Consideration

The total cash consideration was translated from AUD to Euro

using the 31 March 2021 exchange rate of 0.64516. The actual

purchase consideration will be determined upon completion of the

Acquisition.

(ii) Inventory

The preliminary estimates of the fair value of inventory

acquired is based on key assumptions and have been developed using

publicly disclosed information for other acquisitions in the

industry, CCEP's historical experience, data that were available in

the public domain and CCEP's due diligence review of the business

of CCL. These estimates will be finalized following completion of

the Acquisition and additional values, if any, assigned to

inventory.

The fair value of CCL inventory on hand has been estimated as

EUR356 million, representing a fair value uplift related to

finished goods inventory from their historical costs of EUR29

million which is expected to be recognized within cost of sales

within the first year following the close of the transaction.

This adjustment has been tax affected using a blended statutory

rate of 29% for the Pro Forma Income Statement.

(iii) Intangible assets

The preliminary estimates of the intangible assets acquired are

based on key assumptions and have been developed using publicly

disclosed information for other acquisitions in the industry,

CCEP's historical experience, data that were available in the

public domain and CCEP's due diligence review of the business of

CCL. These estimates will be finalized following completion of the

Acquisition and additional values, if any, assigned to CCL customer

relationships or other identifiable intangible assets acquired.

The fair value and weighted average estimated useful life of

identifiable intangible assets are estimated as follows:

Description

(in EUR millions) Fair value Weighted-average estimated useful life Annual amortization

----------- --------------------------------------- --------------------

Distribution rights, brand names and

trademarks 3,902 Indefinite -

Other acquired identifiable intangible

assets 436 20 22

-----------

Total acquired identifiable intangible

assets (excluding software and other

intangibles) 4,338 22

--------------------

Less CCL's book value of intangible

assets (excluding software and other

intangibles) (584)

-----------

Adjustment to intangible assets, net 3,754

===========

Based on the estimated fair values of identified intangible

assets and the weighted average useful lives, the following

adjustment to amortization expense (recognized within

administrative expense) and associated income tax adjustments have

been included in the Pro Forma Income Statement:

Description

Year ended

31 December

(in EUR millions) 2020

-------------

Amortization of identified intangible assets 22

Less: CCL's intangible amortization per 31 December 2020 accounts

(excluding software and other intangibles) (1)

-------------

Adjustment to amortization expense 21

=============

These adjustments have been tax affected using a blended

statutory rate of 29% for the Pro Forma Income Statement.

(iv) Property, plant and equipment

The preliminary estimates of the property, plant and equipment

assets acquired are based on key assumptions and have been

developed using publicly disclosed information for other

acquisitions in the industry, CCEP's historical experience, data

that were available in the public domain and CCEP's due diligence

review of the business of CCL. These estimates will be finalized

following completion of the Acquisition and additional values, if

any, will be quantified.

The fair value and weighted average estimated remaining useful

life of property, plant and equipment, excluding right of use

assets, have been estimated as EUR1.03 billion (representing a fair

value uplift of EUR94 million) and 7 years, respectively.

Based on the estimated fair values of property, plant and

equipment, excluding right of use assets, and the weighted average

remaining useful lives, an adjustment of EUR11 million has been

recorded as an increase to depreciation expense.

These adjustments have been tax affected using a blended

statutory rate of 29% for the Pro Forma Income Statement.

(v) Non-controlling interests

The fair value of the non-controlling interest assumed

represents the value recognized in CCL's 31 December 2020

consolidated balance sheet of EUR197 million increased by a fair

value adjustment of EUR115 million to EUR312 million. This fair

value adjustment represents the estimated enterprise value at the

acquisition date that is attributable to non-controlling interests,

inclusive of the associated deferred tax impact.

(vi) Deferred tax liabilities

The total net deferred tax liability is estimated to be EUR1.35

billion, or a net increase of EUR1.21 billion. The net increase

results from fair value adjustments related to intangible assets

and property, plant and equipment discussed above.

(b) Transaction and related costs

Reflects the accrual of non-recurring costs of EUR96 million

related to the Acquisition, including, among others, fees paid for

financial advisors, legal services, professional accounting

services, and temporary financing related to the transaction. These

costs are not reflected in the historical consolidated balance

sheets of CCEP and CCL, but are reflected in the Pro Forma

Statement of Financial Position, as a decrease to cash and cash

equivalents and a corresponding decrease to retained earnings, and

in the Pro Forma Income Statement for the year ended 31 December

2020, within operating expenses and finance costs as they will be

expensed by CCEP and CCL as incurred. These costs are not expected

to be incurred in any period beyond 12 months from the closing date

of the Acquisition.

The adjustment to the Pro Forma Income Statement has been tax

affected using a blended statutory rate of 29% for the Pro Forma

Income Statement.

Note 4: Transaction related adjustments - financing

CCEP intends to borrow approximately EUR5.2 billion to fund the

Acquisition. For purposes of this unaudited pro forma condensed

combined financial information, CCEP has assumed that the new CCEP

financing will consist of 4.7 billion Euro equivalent aggregate

principal of Senior Notes, being a mix of Euro and USD denominated

borrowings, and EUR500 million of short term financing of

commercial paper. The USD denominated borrowings will be swapped

into Euros using cross currency swaps. For the purposes hereof, the

new funds raised are assumed to be used for the Acquisition and

costs and expenses of the Acquisition. The amount and type of

financing could be different from that presented in these pro forma

condensed combined financial statements.

Description

(in EUR millions) Amount

Proceeds from commercial paper program 500

-------

Pro forma adjustment to current

portion of borrowings 500

Proceeds from senior notes 4,745

Less capitalised issuance costs (24)

-------

Pro forma adjustment to non-current

portion of borrowings 4,721

Total borrowings 5,240

Weighted average interest rate 0.60%

-------

Pro forma annual interest expense 31

Pro forma annual amortization of

debt issuance costs 3

-------

Pro forma adjustment to finance

costs 34

=======

CONTACTS

Company Secretariat Investor Relations Media Relations

Clare Wardle Sarah Willett Shanna Wendt

T +44 20 7355 8406 +44 7970 145 218 T +44 7976 595 168

ABOUT CCEP

Coca-Cola European Partners plc is a leading consumer goods

company in Western Europe, making, selling & distributing an

extensive range of non-alcoholic ready to drink beverages & is

the world's largest Coca-Cola bottler based on revenue. Coca-Cola

European Partners serves a consumer population of over 300 million

across Western Europe, including Andorra, Belgium, continental

France, Germany, Great Britain, Iceland, Luxembourg, Monaco, the

Netherlands, Norway, Portugal, Spain & Sweden. The Company is

listed on Euronext Amsterdam, the New York Stock Exchange, London

Stock Exchange & on the Spanish Stock Exchanges, trading under

the symbol CCEP. For more information about CCEP, please visit

www.cocacolaep.com & follow CCEP on Twitter at @CocaColaEP.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGPUBGCUPGPGB

(END) Dow Jones Newswires

April 20, 2021 03:10 ET (07:10 GMT)

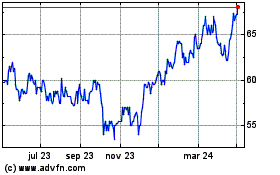

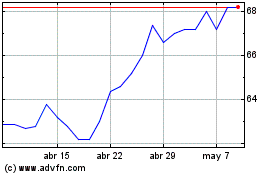

Coca-cola Europacific Pa... (LSE:CCEP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Coca-cola Europacific Pa... (LSE:CCEP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024