TIDMEUZ

RNS Number : 3437Q

Europa Metals Ltd

26 October 2021

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS NOT

FOR PUBLICATION, RELEASE OR DISTRIBUTION, DIRECTLY OR INDIRECTLY,

IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES, CANADA,

AUSTRALIA, NEW ZEALAND OR JAPAN OR IN OR INTO ANY OTHER

JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A BREACH OF ANY

APPLICABLE LAW OR REGULATION.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

ITSELF CONSTITUTE A PROSPECTUS OR OFFERING MEMORANDUM OR AN OFFER

FOR SALE OR SUBSCRIPTION IN RESPECT OF ANY SECURITIES IN THE

COMPANY. THIS ANNOUNCEMENT DOES NOT CONSTITUTE OR CONTAIN ANY

INVITATION, SOLICITATION, RECOMMATION, OFFER OR ADVICE TO ANY

PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE OR DISPOSE OF ANY

SECURITIES OF EUROPA METALS LTD IN ANY JURISDICTION WHERE TO DO SO

WOULD BREACH ANY APPLICABLE LAW OR REGULATION.

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY

THE COMPANY TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER

THE MARKET ABUSE REGULATION (EU) NO . 596/2014 AS IT FORMS PART OF

UK DOMESTIC LAW PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT

2018, AS AMED . UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO

BE IN THE PUBLIC DOMAIN .

26 October 2021

Europa Metals Ltd

("Europa Metals", the "Company" or the "Group") (AIM, AltX:

EUZ)

Result of Fundraising

Europa Metals, the European focused lead, zinc and silver

developer announces that, further to its announcement of 7.00 a.m.

(London time) today, it has successfully completed and closed the

Fundraising (a portion of which is conditional on Shareholder

approval, as set out below).

The Fundraising has raised, in aggregate, gross proceeds of

GBP1.5 million through the placing of 19,527,920 Placing Shares to

certain institutional and other investors and a subscription by

certain other investors directly with the Company of a further

10,472,080 Subscription Shares in each case at a price of 5 pence

per share (ZAR1.01).

The Fundraising is being conducted in two tranches with the

initial tranche of new Ordinary Shares being issued under the

Company's pre-existing share capital authorities and the second

tranche subject to shareholder approval at the Company's

forthcoming 2021 Annual General Meeting. The two tranches (subject

to passing of the requisite Resolutions in respect of the second

tranche) are being issued to subscribers to the Fundraising on a

pro rata basis.

The net proceeds of the Fundraising will be utilised to progress

the Company's refocused corporate and operational strategy and

applied towards:

-- Pursuing and assessing appropriate additional projects and

potential transaction opportunities : to support the Group's

corporate and strategic development as the Board seeks to create

shareholder value, via:

o Seeking a partial sale/earn-in/JV or similar third party

agreement for the Toral Project;

o Potential acquisitions with near term production/revenue or

value realisation point; or

o Potential low cost project acquisitions prospective in high

demand commodities such as copper, lithium, gold, iron or nickel in

regions including Europe, Australia, North America and select parts

of Asia, Africa and South America;

-- To further progress and de-risk the Toral Project : initially

pursuing further g eotechnical drilling to assess key areas for

future plant location and potential tailings storage facilities and

to compliment metallurgical and waste analysis work (impacting

future early years production profile) and ongoing environmental

impact assessment;

-- Optional deployment : to be used at the Board's discretion on

the assessment of potential acquisitions for corporate development

or further work including metallurgy and associated Toral Project

studies; and

-- General working capital : it is anticipated that the net

proceeds of the Fundraising will provide approximately 12 months of

additional working capital for the Group excluding any expenditure

in respect of potential transaction opportunities.

As noted above, the Fundraising comprises a placing and

subscription of new Ordinary Shares to be effected in two tranches.

Accordingly, the Company will issue 24,565,324 new Ordinary Shares

(the "First Fundraising Shares"), to raise gross proceeds of

approximately GBP1.23 million, to participants in the Placing and

Subscription under the Company's pre-existing share capital

authorities to allot equity securities granted at the Company's

annual general meeting held on 30 November 2020.

The Company intends to issue a further 5,434,676 new Ordinary

Shares (the "Second Fundraising Shares"), to raise gross proceeds

of approximately a further GBP270,000. The issue of the Second

Fundraising Shares is conditional, inter alia, upon the approval of

Shareholders at the Company's 2021 Annual General Meeting proposed

to be held on or around 30 November 2021, formal notice of which

will be notified to shareholders shortly. Subject to Shareholder

approval, the Second Fundraising Shares are expected to be admitted

to trading on AIM on or around 1 December 2021.

First Admission and Total Voting Rights

Application will be made to the London Stock Exchange for

admission of the 24,565,324 First Fundraising Shares to trading on

AIM and to the Johannesburg Stock Exchange for quotation on AltX.

It is expected that admission will become effective and dealings in

the First Fundraising Shares commence on AIM at 8.00 a.m. on 1

November 2021 (or such later date as may be agreed between the

Company and the Bookrunner, but no later than 29 January 2022).

Following First Admission, the total number of Ordinary Shares

in the capital of the Company in issue will be 73,695,973 with

voting rights. This figure may be used by Shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the Company's share capital pursuant to the Company's

Constitution.

Second Admission and Total Voting Rights

Second Admission, comprising the Second Fundraising Shares,

being 5,434,676 new Ordinary Shares, is conditional upon, amongst

other things, the passing of the Resolutions at the Company's

forthcoming 2021 Annual General Meeting.

Application will be made to the London Stock Exchange for

admission of the 5,434,676 Second Fundraising Shares to trading on

AIM and to the Johannesburg Stock Exchange for quotation on AltX.

It is expected that admission will become effective and dealings in

the Second Fundraising Shares commence on AIM at 8.00 a.m. on or

around 1 December 2021 (or such later date as may be agreed between

the Company and the Bookrunner, but no later than 29 January

2022).

Following Second Admission, the total number of Ordinary Shares

in the capital of the Company in issue will be 79,130,649 with

voting rights. This figure may be used by Shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the Company's share capital pursuant to the Company's

Constitution.

The Fundraising Shares will be issued fully paid and will rank

pari passu in all respects with the Company's existing Ordinary

Shares.

Notice of 2021 Annual General Meeting

The Company will make a further announcement in due course with

respect to the publication of the formal notice of its 2021 Annual

General Meeting with regards to seeking Shareholder approval for,

inter alia, the proposed issue of the Second Fundraising Shares and

replenishment of the Company's share capital authorities. Once

posted, the Notice will also be made available on the Company's

website at: www.europametals.com.

Related Party Transaction

Pursuant to the abovementioned Fundraising, Deutsche Balaton

Aktiengesellshaft ("DBA") is investing GBP328,604, via the

Subscription, for 6,572,080 new Ordinary Shares. DBA is currently

an existing substantial shareholder of the Company and,

accordingly, is considered to be a related party under the AIM

Rules for Companies (the "AIM Rules"). The participation of DBA in

the Fundraising is therefore deemed to constitute a related party

transaction pursuant to Rule 13 of the AIM Rules. Accordingly, the

independent Directors of Europa Metals, being Myles Campion,

Laurence Read, Daniel Smith and Evan Kirby consider, having

consulted with Strand Hanson Limited, the Company's Nominated

Adviser, that the terms of DBA's participation in the Fundraising

are fair and reasonable insofar as the Company's Shareholders are

concerned.

Laurence Read, CEO of Europa Metals, commented :

"Today's GBP1.5m (gross) Fundraising introduces new investors to

Europa Metal's shareholder register, a number of which have

experience within the natural resources sector. With the support of

the Company's Shareholders, our refocused strategy going forwards

is to seek to generate value via a potential transaction(s) to

augment our asset portfolio whilst continuing to further de-risk

and progress our Toral Project. We believe today's Fundraising

provides a stable platform for Europa Metals as we seek to build on

our operational success over the course of the last twelve months

.

"The Board will seek to secure and take advantage of attractive

opportunities in what is currently a very exciting resources

market. With our existing Toral lead, zinc and silver project

already significantly progressed, we possess 100% of an excellent,

high margin asset, located in the EU and governed by relevant world

class ESG regulations, that, subject to funding, can be fast

tracked into potential future production. With increasing interest

in zinc as a next generation battery metal we plan to assess and

potentially introduce other, value accretive project opportunities

into the Company's portfolio with a view to replicating our model

of cost effectively and efficiently advancing such projects along

the value chain."

Capitalised terms used but not otherwise defined in this

announcement shall have the meanings ascribed to such terms in the

Company's announcement made at 7.00 a.m. on 26 October 2021, unless

the context requires otherwise.

For further information on the Company, please visit www.europametals.com or contact:

Europa Metals Ltd

Dan Smith, Non-Executive Director and Company Secretary

(Australia)

T: +61 417 978 955

Laurence Read, CEO (UK)

T: +44 (0)20 3289 9923

Linkedin: Europa Metals ltd

Twitter: @ltdeuropa

Vox: Europametals

WH Ireland Limited (Joint Broker and Bookrunner)

Harry Ansell/Katy Mitchell/Sarah Mather

T: +44 (0)20 7 220 1666

Strand Hanson Limited (Nominated Adviser)

Rory Murphy/Matthew Chandler

T: +44 (0)20 7409 3494

Turner Pope Investments (TPI) Limited (Joint Broker)

Andy Thacker/James Pope

T: +44 (0)20 3657 0050

Sasfin Capital Proprietary Limited (a member of the Sasfin

group)

Sharon Owens

T (direct): +27 11 809 7762

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCPPGPCUUPGGQQ

(END) Dow Jones Newswires

October 26, 2021 12:43 ET (16:43 GMT)

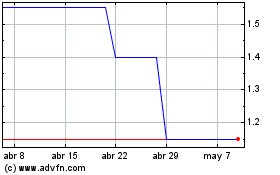

Europa Metals (LSE:EUZ)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Europa Metals (LSE:EUZ)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024