TIDMEWI

RNS Number : 0227C

Edinburgh Worldwide Inv Trust PLC

08 June 2023

RNS Announcement

Edinburgh Worldwide Investment Trust plc

Legal Entity Identifier: 213800JUA8RKIDDLH380

Regulated Information Classification: Interim Financial

Report

Results for the six months to 30 April 2023

The Company is invested in a diversified portfolio of companies

which individually offer significant long term growth potential and

typically have a market capitalisation of less than US$5bn at the

time of initial investment.

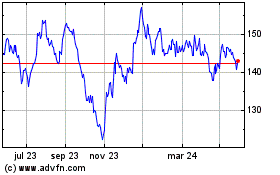

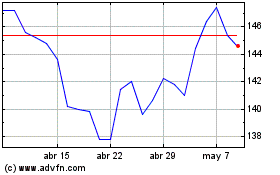

3/4 Over the six month period, the Company's net asset value per

share decreased by 7.5% while the comparative index(*) decreased by

1.5%. The share price fell by 13.6%. Over the five year period, the

Company's net asset value per share increased by 21.8% while the

comparative index* increased by 33.8%. The share price decreased by

4.8%. Invested gearing as at 30 April 2023 was 12.4%.

3/4 The market environment remains largely as it was six months

earlier: a dynamic post-pandemic adjustment period where companies

and stock markets are navigating inflationary and geopolitical

challenges. This is sculpting a new investment environment. One

where capital is less freely available, the hurdle rate for returns

is higher and the tolerance of uncertainty is markedly lower.

3/4 The notable contributors to absolute returns over the period

was led by Exact Sciences, a developer of non-invasive molecular

tests for early cancer detection. Alnylam Pharmaceuticals, a

developer of drugs focused on harnessing gene silencing technology,

was the largest detractor to absolute returns. 44 names in the

portfolio generated positive absolute returns in sterling terms

over the six months. Eight stocks fell more than 50%.

3/4 During the period, the Company bought back for treasury

2,865,382 shares. 16,334,054 shares were held in treasury as at 30

April 2023. As at close of business on 6 June 2023, the discount

was 18.8%.

3/4 The net revenue return per share was a negative 0.31p (six

months to 30 April 2022: negative 0.23p). No interim dividend is

being recommended.

3/4 As at 30 April 2023 the Company's investment in unlisted

companies was 20.9% of total assets (30 April 2022: 19.3%).

3/4 The Board and Managers remain confident that the holdings in

the portfolio represent a collection of some of the most exciting

and transformational long-term investment opportunities

available.

* Source: Baillie Gifford/Refinitiv and relevant underlying

index providers. See disclaimer at the end of this

announcement.

For a definition of terms see Glossary of Terms and Alternative

Performance Measures at the end of this announcement.

Past performance is not a guide to future performance.

Edinburgh Worldwide aims to achieve long term capital growth by

investing primarily in listed companies throughout the world. The

Company has total assets of GBP808.8 million (before deduction of

loans of GBP97million) as at 30 April 2023.

Edinburgh Worldwide is managed by Baillie Gifford, the Edinburgh

based fund management group with around GBP233 billion under

management and advice as at 7 June 2023.

Edinburgh Worldwide Investment Trust plc is a listed UK company.

The value of its shares and any income from them can fall as well

as rise and investors may not get back the amount invested. This is

because the share price is determined by the changing conditions in

the relevant stock markets in which the Company invests and by the

supply and demand for the Company's shares. Investment in

investment trusts should be regarded as medium to long-term. The

Company's risk could be increased by its investment in unlisted

investments. These assets may be more difficult to buy or sell, so

changes in their prices may be greater. The Company is listed on

the London Stock Exchange and is not authorised or regulated by the

Financial Conduct Authority. You can find up to date performance

information about Edinburgh Worldwide on the Edinburgh Worldwide

page of the Managers' website at edinburghworldwide.co.uk ++

++ Neither the contents of the Managers' website nor the

contents of any website accessible from hyperlinks on the Managers'

website (or any other website) is incorporated into, or forms part

of, this announcement.

7 June 2023

For further information please contact:

Anzelm Cydzik, Baillie Gifford & Co

Tel 0131 275 2000

Jonathan Atkins, Four Communications

Tel: 020 3103 9553 or 07872 495 396

The following is the unaudited Interim Financial Report for the

six months to 30 April 2023 which was approved by the Board on 7

June 2023.

Responsibility Statement

We confirm that to the best of our knowledge:

a) the condensed set of Financial Statements has been prepared

in accordance with FRS 104 'Interim Financial Reporting';

b) the Interim Management Report includes a fair review of the

information required by Disclosure Guidance and Transparency Rule

4.2.7R (indication of important events during the first six months,

their impact on the Financial Statements and a description of the

principal risks and uncertainties for the remaining six months of

the year); and

c) the Interim Financial Report includes a fair review of the

information required by Disclosure Guidance and Transparency Rule

4.2.8R (disclosure of related party transactions and changes

therein).

On behalf of the Board

Henry CT Strutt

Chairman

7 June 2023

Interim Management Report

Over the six months to 30 April 2023, the Company's net asset

value per share* decreased by 7.5%, which compares to a fall of

1.5% in the S&P Global Smaller Companies Index, total return in

sterling terms, over the same period. The share price over the six

months fell by 13.6% to 149.20p representing a discount of 18.4% to

the net asset value at 30 April 2023. This compares to a 12.7%

discount at the beginning of the period. The Company buys back its

own shares when the discount is substantial in absolute terms and

relative to its peers; 2,865,382 shares were bought back in the

period and are held in treasury.

Over the five-year period to 30 April 2023, the Company's net

asset value per share* increased by 21.8% while the comparative

index increased by 33.8%. The share price decreased by 4.8% over

this period.

The market environment remains largely as discussed in the 2022

Annual Report: a dynamic post-pandemic adjustment period where

companies and stock markets are navigating inflationary and

geopolitical challenges. This is sculpting a new investment

environment. One where capital is less freely available, the hurdle

rate for returns is higher and the tolerance of uncertainty is

markedly lower. The immediate manifestation of this is a shortening

of the time horizons of many investors, lulling them into a mindset

where the near-term resiliency of what they invest in is paramount

and the future is approached with a large dose of pessimism.

We are unashamedly long-term investors with our analytical radar

tuned towards high-potential early-stage growth opportunities. The

current myopic environment described above is not conducive to our

approach. We are accustomed to having a time horizon and investment

style that can be out of sync with broader equity markets. In many

ways, this seems an unavoidable aspect of contemporary equity

investing. As bruising as this can feel in the near term, it

ultimately creates the opportunity. It shapes the returns available

to those willing to postulate how industries might evolve and

actively seek out those companies driving that change.

For such companies, it's the fundamental path of progress that

ultimately matters most not the prevailing stock market narrative.

That progress naturally takes time to manifest but we remain

confident that the holdings in the portfolio represent a collection

of some of the most exciting and transformational long-term

investment opportunities available.

Some Reflections on Growth and Technology

We have frequently noted how innovation and the application of

technology is a structural force that largely sits outside of

conventional business cyclicality. But recent headlines on

technology sector job losses and retrenchment indicate that many

tech-led companies have not been immune from current pressures. In

some cases, the reasons for this cyclicality directly relate to end

product demand, but in many other areas we suspect it represents a

period of adaption to a new normal that we would ultimately expect

to see replicated more broadly across the economy.

That 'new normal' will likely favour efficiency in pursuing

business growth. In an era of zero-cost money, a surplus of labour

and an economic tailwind, the issue of productivity was primarily

addressed indirectly through the expansionary pursuit of scale:

grow bigger and operational leverage would ultimately drive

productivity. Direct investments in productivity tools to drive

unit economic efficiencies were generally less popular as they were

less likely to yield near-term expansionary growth. Furthermore,

they often carried a risk of disrupting an organisation as old

processes and workflows are ripped and replaced.

We sense that the broad premise of technology adaptation sitting

outside of conventional cyclicality still holds. But we would

concede that the dynamics of growth and business scaling are

adapting to the higher direct costs of expansion (e.g. higher

borrowing costs and wage inflation). Technology companies are among

the first to adjust to this, mainly because they were also the ones

at the forefront of pursuing expansionary- based scale.

We should not confuse this as being the end of a technology

cycle, far from it. As the focus shifts from the pursuit of scale

towards tools of efficiency, we think companies that offer or

exploit deep productivity- enhancing solutions will come to the

fore. You might argue that this has long been the case (e.g. the

rise of software tools since the 80s) but productivity growth in

most major developed market economies has been lacklustre for

several decades (1) . With looming huge improvements in intelligent

automation as discussed below, the prospects for meaningful

productivity gains look much brighter and we see the role of

automation shifting from the current model of assisting humans with

mundane tasks towards more value-added assistance or task

displacement.

You will have likely heard about some of the recent advances in

AI, particularly in the field of generative AI and local language

models through tools such as ChatGPT. While AI and machine learning

have been in their ascendency in recent years, their relevance has

primarily centred upon narrow probabilistic prediction - with the

accuracy of that prediction being most influenced by the intrinsic

data quality and manual labelling of data used to train a specific

algorithm.

Generative AI is focused on building novel content like art, an

essay, or lines of code. When challenged, a sophisticated

generative AI engine will draw upon the vast breadth of data it has

been exposed to, generate an approximate answer and then seek to

refine this through critical challenge. Such an iterative process

distances generative AI from the narrower predictive AI on several

fronts. Strikingly, it can make linkages between discrete

observations and deal with areas of ambiguity in what it observes.

Moreover, by mimicking mechanisms of natural conscious learning and

seeking resolution not statistical perfection, generative AI

outputs instinctively feel much more human-like, and it has proven

itself to be especially adept at mastering language and

dialogue.

At its core, generative AI advances are about delivering

context-relevant, digestible outputs that seek to answer real-world

queries. Its power can be pointed in many directions, whether

creating novel digital content at a hitherto unimaginable scale or

as a user-friendly distiller of complexity. The former could see it

garner a role in the production of software code or in-silico

screening of vast libraries of compounds for use in areas such as

drug discovery or battery technology. The latter uniquely positions

it to offer a scalable user interface that could ultimately perform

various functions such as knowledge search or fully automated

customer service. This is fundamentally different from most current

technology interfaces which are about delivering blunt and narrow

approximations.

What are the implications of all this? Our initial sense is that

these impressive but still nascent advances will lay new

foundations for how individuals and businesses engage with

technology. Much like the arrival of the internet 30 years ago, we

see generative AI as a horizontal technology tool that optically

lowers the entry barriers within a range of verticals/industries.

Traditionally, such a dynamic would be expected to favour nimble

disruptors and disadvantage stale incumbents. Yet to borrow further

from the experience of internet-based digitisation, while barriers

to entry were initially lowered, we suspect that barriers to scale

are likely to prove to be much harder to break down and will likely

be better determinants when filtering winners from losers within

this technology evolution.

While a clear advantage of generative AI is the ability to train

it on vast broad data sources, real-world commercial use cases of

this technology will likely have a requirement for domain-relevant

digital data with which to hone the algorithms. This proprietary

data likely exists within businesses that currently cater to their

respective end markets. Furthermore, many incumbents (or at least

those that remain/have emerged over the past few decades) are

digital native businesses - they are unlikely to be refuseniks when

experimenting with what AI offers. Taken together our initial view

is that for digitally savvy, forward-thinking businesses we suspect

that generative AI is more opportunity than a threat. For such

companies, this opportunity should be about making deeper

engagements with their customers and better leveraging the assets

they already have with the prize being to better their offering,

take share, and drive deep productivity savings. Given the

importance of this topic, we expect it to be a recurring theme in

our dialogue with holdings over the coming year.

Portfolio Update

Novocure disclosed encouraging clinical trial results for its

tumour-treating technology in lung cancer patients. Most

relevantly, Novocure's device appears to be synergistic with immune

checkpoint-blocking antibodies, a class of drugs that have emerged

as the primary therapeutic backbone in numerous cancer treatment

regimes. Exact Sciences received a boost when an aspiring

competitor in the colon cancer screening area revealed the

underwhelming performance of its blood-based test. This was further

bolstered through encouraging progress from Exact in bringing

forward its profitability and targets.

As at 30 April 2023 the Company's investment in unlisted

companies was 20.9% of total assets and the names held were

unchanged versus 31 October 2022. The end of the period saw both of

the portfolio's rocket companies begin test-flight campaigns on the

next generation of launch vehicles. SpaceX debuted its massive

Starship stack and Relativity Space its entirely 3D-printed

Terran-1 rocket. Both are following a rapidly iterative and

intentionally destructive development process in order to deliver

significant cost and capability improvements in the years ahead.

More recently, Astranis, the next-generation satellite company, has

launched its first MicroGEO platform into orbit over Alaska where

it will triple the available satellite bandwidth.

We remain broadly happy with how the portfolio companies are

navigating the current environment and have invested gearing of

12%. However, we have seen a handful of holdings experience large

negative price moves following company-specific challenges.

Trupanion's profitability has been hit as high levels of inflation

in veterinary bills have been hard to pass on via insurance premium

increases. Chegg's growth has been impacted by two years of

pandemic-impacted enrolment in the US college system. While we

expect this to ultimately wash through, the picture has been

further complicated by some college students experimenting with

generative AI tools for homework and coursework. Kroger, Ocado's

grocery partner in the US, announced that it is not planning to

open any additional Ocado-powered facilities in 2023 as it digests

the lessons from its initial warehouse deployments. With Kroger

currently engaged in a proposed merger with its competitor

Alberstons (a move that will give it a meaningful expansion in its

store base and national presence) we suspect commitments to

additional facilities will be pushed back until after the merger

completes.

We took a holding in Hashicorp, a provider of cloud

infrastructure automation and management tools. It designs

cloud-agnostic products which span the entire spectrum of cloud

infrastructure automation - from infrastructure provisioning to

networking, security, and application deployment - and make it easy

for companies to build in the cloud in a standardised and efficient

manner. It benefits from powerful secular trends, such as the

continued digital transformations of IT systems across industries

and the shift to a hybrid or a multi-cloud environment which are

inherently complex processes.

We added to the holdings in Novocure, Schrödinger, Progyny and

Appian as we felt the stock market was failing to keep pace with

the strategic progress these companies are demonstrating. We exited

four positions during the interim period including Galapagos,

Morphosys, Temenos and Oxford Instruments.

(1) Since 2005, US labour productivity has grown at a modest

1.4% per annum. In 2022 it dipped to -1.3%, its weakest since

1974.

* Net asset value after deducting borrowings at fair value.

Source: Baillie Gifford, Refinitive and relevant underlying

index providers. See disclaimer at the end of this

announcement.

The principal risks and uncertainties facing the Company are set

out below.

For a definition of terms see Glossary of Terms and Alternative

Performance Measures.

Total return information sourced from Refinitiv/Baillie Gifford

and relevant underlying index providers.

Past performance is not a guide to future performance.

Valuing Private Companies

We aim to hold our private company investments at 'fair value'

i.e., the price that would be paid in an open-market transaction.

Valuations are adjusted both during regular valuation cycles and on

an ad hoc basis in response to 'trigger events'. Our valuation

process ensures that private companies are valued in both a fair

and timely manner.

The valuation process is overseen by a valuations committee at

Baillie Gifford which takes advice from an independent third party

(S&P Global). The portfolio managers feed into the process, but

the valuations committee owns the process and the portfolio

managers only receive final valuation notifications once they have

been applied.

We revalue the private holdings on a three-month rolling cycle,

with one-third of the holdings reassessed each month. For

investment trusts, the prices are also reviewed twice per year by

the respective investment trust boards and are subject to the

scrutiny of external auditors in the annual audit process.

Beyond the regular cycle, the valuations committee also monitors

the portfolio for certain 'trigger events'. These may include:

changes in fundamentals; a takeover approach; an intention to carry

out an Initial Public Offering 'IPO'; or changes to the valuation

of comparable public companies. Any ad hoc change to the fair

valuation of any holding is implemented swiftly and reflected in

the next published net asset value. There is no delay.

The valuations committee also monitors relevant market indices

on a weekly basis and updates valuations in a manner consistent

with our external valuer's (S&P Global) most recent valuation

report where appropriate. When market volatility is particularly

pronounced the team undertakes these checks daily.

Recent market volatility has meant that recent pricing has moved

much more frequently than would have been the case with the

quarterly valuations cycle.

Edinburgh Worldwide Investment Trust*

------------------------------------------------- -----

Instruments valued 25

Quantum of individual (lines of stock) reviewed 65

Quantum of revaluations post review 51

Percentage of portfolio revalued 2+ times 100%

Percentage of portfolio revalued 3+ times 52%

------------------------------------------------- -----

* Data reflecting period 1 November 2022 to 30 April 2023 to

align with the Company's reporting period end.

A handful of companies have raised capital at an increased

valuation, reflecting exceptional performance. The average movement

in both valuation and share price for those which have decreased in

value is shown below.

Average Average

Movement Movement

in Investee in Investee

Company Company

Valuation Share Price

-------------------- ------------- -------------

Instruments valued 1.9% (1.4%)

-------------------- ------------- -------------

Data reflecting period 1 November 2022 - 30 April 2023 to align

with the Trust's half-year reporting period.

Share prices have decreased more than headline valuations which

have increased slightly on average, which is partially a result of

holding classes of stock with less preferential liquidation rights

and therefore less downside protection.

The share price movement reflects a probability weighted average

of both the regular valuation, which would be realised in an IPO,

and the downside protected valuation, which would normally be

triggered in the event of a corporate sale or liquidation.

The following chart quantifies the movements over the period

influencing the fair value of the private company investments at 30

April 2023.

Baillie Gifford Statement on Stewardship

Reclaiming Activism for Long-Term Investors

Baillie Gifford's over-arching ethos is that we are 'actual'

investors. We have a responsibility to behave as supportive and

constructively engaged long-term investors. We invest in companies

at different stages in their evolution, across vastly different

industries and geographies and we celebrate their uniqueness.

Consequently, we are wary of prescriptive policies and rules,

believing that these often run counter to thoughtful and beneficial

corporate stewardship. Our approach favours a small number of

simple principles which help shape our interactions with

companies.

Our Stewardship Principles

Prioritisation of Long-Term Value Creation

We encourage company management and their boards to be ambitious

and focus their investments on long-term value creation. We

understand that it is easy for businesses to be influenced by

short-sighted demands for profit maximisation but believe these

often lead to sub-optimal long-term outcomes. We regard it as our

responsibility to steer businesses away from destructive financial

engineering towards activities that create genuine economic value

over the long run. We are happy that our value will often be in

supporting management when others do not.

A Constructive and Purposeful Board

We believe that boards play a key role in supporting corporate

success and representing the interests of minority shareholders.

There is no fixed formula, but it is our expectation that boards

have the resources, cognitive diversity and information they need

to fulfil these responsibilities. We believe that a board works

best when there is strong independent representation able to

assist, advise and constructively test the thinking of

management.

Long-Term Focused Remuneration with Stretching Targets

We look for remuneration policies that are simple, transparent

and reward superior strategic and operational endeavour. We believe

incentive schemes can be important in driving behaviour, and we

encourage policies which create alignment with genuine long-term

shareholders. We are accepting of significant pay-outs to

executives if these are commensurate with outstanding long-run

value creation, but plans should not reward mediocre outcomes. We

think that performance hurdles should be skewed towards long-term

results and that remuneration plans should be subject to

shareholder approval.

Fair Treatment of Stakeholders

We believe it is in the long-term interests of all enterprises

to maintain strong relationships with all stakeholders - employees,

customers, suppliers, regulators and the communities they exist

within. We do not believe in one-size-fits all policies and

recognise that operating policies, governance and ownership

structures may need to vary according to circumstance. Nonetheless,

we believe the principles of fairness, transparency and respect

should be prioritised at all times.

Sustainable Business Practices

We believe an entity's long-term success is dependent on

maintaining its social licence to operate and look for holdings to

work within the spirit and not just the letter of the laws and

regulations that govern them. We expect all holdings to consider

how their actions impact society, both directly and indirectly, and

encourage the development of thoughtful environmental practices and

'net-zero' aligned climate strategies as a matter of priority.

Climate change, environmental impact, social inclusion, tax and

fair treatment of employees should be addressed at board level,

with appropriately stretching policies and targets focused on the

relevant material dimensions. Boards and senior management should

understand, regularly review and disclose information relevant to

such targets publicly, alongside plans for ongoing improvement.

Income Statement (unaudited)

For the six months ended For the six months ended For the year ended 31 October

30 April 2023 30 April 2022 2022 (audited)

--------------------- ---------------------------- ------------------------------ ---------------------------------

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- -------- -------- -------- -------- --------- --------- --------- ---------- ----------

Gains on sales of

investments - 322 322 - 42,613 42,613 - 66,140 66,140

Movements in

investment holding

gains - (59,741) (59,741) - (494,803) (494,803) - (594,419) (594,419)

Currency

gains/(losses) - 5,747 5,747 - (2,230) (2,230) - (6,070) (6,070)

Income from

investments and

interest receivable 612 - 612 490 - 490 986 - 986

Investment management

fee

(note 3) (563) (1,690) (2,253) (685) (2,054) (2,739) (1,277) (3,830) (5,107)

Other administrative

expenses (512) - (512) (521) - (521) (953) - (953)

--------------------- -------- -------- -------- -------- --------- --------- --------- ---------- ----------

Net return before

finance

costs and taxation (463) (55,362) (55,825) (716) (456,474) (457,190) (1,244) (538,179) (539,423)

--------------------- -------- -------- -------- -------- --------- --------- --------- ---------- ----------

Finance costs of

borrowings (720) (2,160) (2,880) (221) (662) (883) (675) (2,026) (2,701)

--------------------- -------- -------- -------- -------- --------- --------- --------- ---------- ----------

Net return before

taxation (1,183) (57,522) (58,705) (937) (457,136) (458,073) (1,919) (540,205) (542,124)

--------------------- -------- -------- -------- -------- --------- --------- --------- ---------- ----------

Tax (26) - (26) (23) - (23) (57) - (57)

--------------------- -------- -------- -------- -------- --------- --------- --------- ---------- ----------

Net return after

taxation (1,209) (57,522) (58,731) (960) (457,136) (458,096) (1,976) (540,205) (542,181)

--------------------- -------- -------- -------- -------- --------- --------- --------- ---------- ----------

Net return per

ordinary share

(note 4) (0.31p) (14.72p) (15.03p) (0.23p) (112.80p) (113.03p) (0.49p) (134.82p) (135.31p)

--------------------- -------- -------- -------- -------- --------- --------- --------- ---------- ----------

The total column of this Statement represents the profit and

loss account of the Company. The supplementary revenue and capital

columns are prepared under guidance published by the Association of

Investment Companies.

All revenue and capital items in this Statement derive from

continuing operations.

A Statement of Comprehensive Income is not required as the

Company does not have any other comprehensive income and the net

return after taxation is both the profit and comprehensive income

for the period.

Balance Sheet (unaudited)

At 30 April At 31 October

2023 2022

(audited)

GBP'000 GBP'000

--------------------------------------- ----------- -------------

Fixed assets

Investments held at fair value through

profit or loss (note 6) 802,024 872,804

--------------------------------------- ----------- -------------

Current assets

Debtors 7,983 4,882

Cash and cash equivalents 10,349 11,131

--------------------------------------- ----------- -------------

18,332 16,013

--------------------------------------- ----------- -------------

Creditors

Amounts falling due within one year

(note 7) (108,591) (113,251)

--------------------------------------- ----------- -------------

Net current liabilities (90,259) (97,238)

--------------------------------------- ----------- -------------

Net assets 711,765 775,566

--------------------------------------- ----------- -------------

Capital and reserves

Share capital 4,058 4,058

Share premium account 499,723 499,723

Special reserve 35,220 35,220

Capital reserve 180,062 242,654

Revenue reserve (7,298) (6,089)

--------------------------------------- ----------- -------------

Shareholders' funds 711,765 775,566

--------------------------------------- ----------- -------------

Net asset value per ordinary share 182.78p 197.70p

--------------------------------------- ----------- -------------

Ordinary shares in issue (note 8) 389,419,641 392,285,023

--------------------------------------- ----------- -------------

Statement of Changes in Equity (unaudited)

For the six months ended 30 April 2023

Share

Share premium Special Capital Revenue Shareholders'

capital account reserve reserve* reserve funds

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- -------- -------- -------- --------- -------- -------------

Shareholders' funds at

1 November 2022 4,058 499,723 35,220 242,654 (6,089) 775,566

Ordinary shares bought

back (note 8) - - - (5,070) - (5,070)

Net return after taxation - - - (57,522) (1,209) (58,731)

-------------------------- -------- -------- -------- --------- -------- -------------

Shareholders' funds at

30 April 2023 4,058 499,723 35,220 180,062 (7,298) 711,765

-------------------------- -------- -------- -------- --------- -------- -------------

For the six months ended 30 April 2022

Share

Share premium Special Capital Revenue Shareholders'

capital account reserve reserve* reserve funds

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- -------- -------- -------- --------- -------- -------------

Shareholders' funds at

1 November 2021 4,052 497,999 35,220 808,197 (4,113) 1,341,355

Ordinary shares bought

back (note 8) 6 1,724 - (7,487) - (5,757)

Net return after taxation - - - (457,136) (960) (458,096)

-------------------------- -------- -------- -------- --------- -------- -------------

Shareholders' funds at

30 April 2022 4,058 499,723 35,220 343,574 (5,073) 877,502

-------------------------- -------- -------- -------- --------- -------- -------------

* The Capital Reserve as at 30 April 2023 includes investment

holding losses of GBP62,965,000 (30 April 2022 - gains of

GBP96,393,000)

Condensed Cash Flow Statement (unaudited)

Six months Six months

to to

30 April 30 April

2023 2022

GBP'000 GBP'000

-------------------------------------- ---------- ----------

Cash flows from operating activities

Net return before taxation (58,705) (458,073)

Net losses on investments 59,419 452,190

Currency (gains)/losses (5,747) 2,230

Finance costs of borrowings 2,880 883

Overseas withholding tax incurred (21) (20)

Changes in debtors and creditors (81) (589)

-------------------------------------- ---------- ----------

Cash from operations * (2,255) (3,379)

Interest paid (2,526) (827)

-------------------------------------- ---------- ----------

Net cash outflow from operating

activities (4,781) (4,206)

-------------------------------------- ---------- ----------

Net cash inflow/(outflow)from

investing activities 10,582 (18,380)

-------------------------------------- ---------- ----------

Financing

Ordinary shares bought back (5,503) (5,108)

Bank loans drawn down 198,589 135,346

Bank loans repaid (200,000) (135,346)

-------------------------------------- ---------- ----------

Net cash outflow from financing

activities (6,914) (5,108)

-------------------------------------- ---------- ----------

Decrease in cash and cash equivalents (1,113) (27,694)

Exchange movements 331 1,301

Cash and cash equivalents at

start of period 11,131 33,127

-------------------------------------- ---------- ----------

Cash and cash equivalents at

end of period 10,349 6,734

-------------------------------------- ---------- ----------

* Cash from operations includes dividends received in the period

of GBP382,000 (30 April 2022 - GBP503,000).

Cash and cash equivalents represent cash at bank and short term

money market deposits repayable on demand.

Performance of the Top 20 Holdings as at 30 April 2023

(unaudited)

Performance

Name Business Value Absolute Relative

Country GBP'000 % of total assets* % %

Designs, manufactures and

Space Exploration launches advanced rockets

Technologies (u) # and spacecraft USA 63,341 7.8 30.0 32.0

Drug developer focused on

harnessing gene silencing

Alylam Pharmaceuticals technology USA 57,250 7.1 49.2 51.5

Developer of commercial

PsiQuantum (u) # quantum computing USA 28,939 3.5 (26.2) (23.6)

Ophthalmic implants for

STAAR Surgical vision correction USA 28,218 3.5 23.3 25.1

Electronic bond trading

MarketAxess platform USA 26,775 3.3 21.6 23.4

Non-invasive molecular tests

Exact Sciences for early cancer detection USA 26,427 3.3 15.6 17.4

Manufacturer of medical

devices for cancer

Novocure treatment USA 25,554 3.2 (14.1) (12.8)

Zillow# US online real estate portal USA 23,305 2.9 19.8 23.0

Online grocery retailer and

Ocado technology provider UK 22,370 2.8 (44.6) (43.8)

Law enforcement equipment

Axon Enterprises and software provider USA 22,177 2.7 87.6 90.4

Antibody based drug

Genmab development Denmark 18,068 2.2 15.8 17.5

Small unmanned aircraft and

AeroVironment tactical missile systems USA 17,654 2.2 25.2 27.1

Oxford Nanopore Technologies Novel DNA sequencing

(p) technology UK 15,276 1.9 (25.1) (24.0)

Drug discovery ad simulation

Schrödinger software USA 12,640 1.6 18.7 20.5

Kingdee International Enterprise management

Software software provider China 12,409 1.5 (26.6) (25.5)

IP commercialisation focused

PureTech Health on healthcare UK 12,074 1.5 21.4 23.2

Chegg Online educational company USA 11,884 1.4 (27.4) (26.3)

Shine Technologies

(Illuminated Holdings) (u) Medical radioisotope

(#) production USA 11,404 1.4 (14.1) (13.3)

Enterprise financial

BlackLine software provider USA 10,584 1.3 (17.1) (15.9)

Opioid free analgesics

Pacira BioSciences developer USA 10,464 1.3 (39.2) (38.3)

456,813 56.5

================================================================== ======== ================== ======== ========

* Total assets before deduction of loans.

Absolute and relative performance has been calculated on a total

return basis over the period 1 November 2022 to 30 April 2023.

Absolute performance is in sterling terms; relative performance is

against S&P Global Small Cap Index (in sterling terms). Source:

Baillie Gifford/StatPro and relevant underlying index providers.

See disclaimer at the end of this announcement. Denotes private

company (unlisted) security.

(u) Denotes private company (unlisted) security

# More than one line of stock held. Holding information

represents the aggregate of all lines of stock.

Past performance is not a guide to future performance.

List of Investments as at 30 April 2023 (unaudited)

Name Business Country Value % of total assets

------------------------------------ ----------------------------------- ------------ ------- -----------------

Space Exploration Technologies Designs, manufactures and launches

Series N Preferred (u) advanced rockets and spacecraft USA 36,303 4.5

Space Exploration Technologies Designs, manufactures and launches

Series J Preferred (u) advanced rockets and spacecraft USA 16,468 2.0

Space Exploration Technologies Designs, manufactures and launches

Series K Preferred (u) advanced rockets and spacecraft USA 7,507 0.9

Space Exploration Technologies Class Designs, manufactures and launches

A Common (u) advanced rockets and spacecraft USA 2,341 0.3

Space Exploration Technologies Class Designs, manufactures and launches

C Common (u) advanced rockets and spacecraft USA 722 0.1

------- -----------------

63,341 7.8

Drug developer focused on

harnessing gene silencing

Alnylam Pharmaceuticals technology USA 57,250 7.1

Developer of commercial quantum

PsiQuantum Series C Preferred (u) computing USA 16,391 2.0

Developer of commercial quantum

PsiQuantum Series D Preferred (u) computing USA 12,548 1.5

------- -----------------

28,939 3.5

Ophthalmic implants for vision

STAAR Surgical correction USA 28,218 3.5

MarketAxess Electronic bond trading platform USA 26,775 3.3

Non-invasive molecular tests for

Exact Sciences early cancer detection USA 26,427 3.3

Manufacturer of medical devices for

Novocure cancer treatment USA 25,554 3.2

Zillow Class C US online real estate portal USA 20,215 2.5

Zillow Class A US online real estate portal USA 3,090 0.4

23,305 2.9

Online grocery retailer and

Ocado technology provider UK 22,370 2.8

Law enforcement equipment and

Axon Enterprise software provider USA 22,177 2.7

Genmab Antibody based drug development Denmark 18,068 2.2

Small unmanned aircraft and

AeroVironment tactical missile systems USA 17,654 2.2

Oxford Nanopore Technologies Novel DNA sequencing technology UK 15,276 1.9

Drug discovery and simulation

Schrödinger software USA 12,640 1.6

Enterprise management software

Kingdee International Software provider China 12,409 1.5

IP commercialisation focused on

PureTech Health healthcare UK 12,074 1.5

Chegg Online educational company USA 11,884 1.4

Shine Technologies (Illuminated

Holdings) Series C-5 Preferred (u) Medical radioisotope production USA 10,608 1.3

Shine Technologies (Illuminated

Holdings) Series D-1 Preferred (u) Medical radioisotope production USA 796 0.1

------- -----------------

11,404 1.4

Enterprise financial software

BlackLine provider USA 10,584 1.3

Pacira BioSciences Opioid free analgesics developer USA 10,464 1.3

Astranis SpaceTechnologies Series C Communication satellite

Preferred (u) manufacturing and operation USA 9,547 1.2

Astranis Space Technologies Series C Communication satellite

Preferred (u) manufacturing and operation USA 796 0.1

------- -----------------

10,343 1.3

Online freelancing and recruitment

Upwork services platform USA 9,928 1.2

Cloud based software for social

Sprout Social media management USA 9,624 1.2

Freelance services marketplace for

Fiverr businesses Israel 9,399 1.2

ShockWave Medical Medical devices manufacturer USA 9,357 1.2

Appian Enterprise software developer USA 9,170 1.1

Chinese bio-pharmaceutical

development and distribution

Zai Lab HK Line company China 8,515 1.1

Reaction Engines (u) Advanced heat exchange company UK 8,351 1.0

IPG Photonics High-power fibre lasers USA 8,260 1.0

Fertility benefits management

Progyny company USA 8,234 1.0

Relativity Space Series D Preferred 3D printing and aerospace launch

(u) company USA 5,093 0.6

Relativity Space Series E Preferred 3D printing and aerospace launch

(u) company USA 3,066 0.4

------- -----------------

8,159 1.0

Cloud based accounting software for

Xero small and medium-sized enterprises New Zealand 8,087 1.0

Video game platform and software

Epic Games (u) developer USA 7,411 0.9

Adaptimmune Therapeutics ADR Cell therapies for cancer treatment UK 7,138 0.9

Online healthcare resource and

interactive

Doximity platform developer USA 7,036 0.9

TransMedics Medical device company USA 6,714 0.8

Ceres Power Holding Developer of fuel cells UK 6,600 0.8

Echodyne Corp. Series C-1 Preferred Metamaterial radar sensors and

(u) software USA 6,103 0.8

Snyk Series F Preferred (u) Security software UK 4,005 0.5

Snyk Ordinary Shares (u) Security software UK 2,390 0.3

------- -----------------

6,395 0.8

Teladoc Telemedicine services provider USA 6,274 0.8

Livestock breeding and technology

Genus services UK 6,238 0.8

Affinity based diagnostic reagents

Avacta Group and therapeutics UK 6,218 0.8

LiveRamp Marketing technology company USA 6,200 0.8

Software development tools and

JFrog management Israel 6,108 0.8

CyberArk Software Cyber security solutions provider Israel 5,707 0.7

Lightning Labs Series B Preferred Lightning software that enables

(u) users to send and receive money USA 5,458 0.7

Cloud-computing infrastructure

HashiCorp provider USA 5,273 0.7

Trupanion Pet health insurance provider USA 5,162 0.6

Solid-state batteries for electric

QuantumScape vehicles USA 5,086 0.6

Measurement and calibration

Renishaw equipment UK 5,070 0.6

Industrial and pharmaceutical

Codexis enzyme developer USA 4,980 0.6

Antibody design and development

AbCellera Biologics company Canada 4,956 0.6

Manufacturer of gas and flow

Sensirion Holding sensors Switzerland 4,874 0.6

Enterprise sales management

Zuora software USA 4,837 0.6

Video compression and image

Ambarella processing semiconductors USA 4,812 0.6

Manufacturer of insulin pumps for

Tandem Diabetes Care diabetic patients USA 4,671 0.6

BillionToOne Series C Preferred (u) Pre-natal diagnostics USA 4,125 0.5

BillionToOne Promissory Note (u) Pre-natal diagnostics USA 398 0.0

------- -----------------

4,523 0.5

M3 Online medical database Japan 4,403 0.5

Rightmove UK online property portal UK 3,962 0.5

Splunk Data diagnostics USA 3,769 0.5

MonotaRO Online business supplies Japan 3,765 0.5

Peptide based drug discovery

PeptiDream platform Japan 3,696 0.5

DNA Script Series C Preferred (u) Synthetic DNA fabricator France 3,392 0.4

Critical event management software

Everbridge provider USA 3,103 0.4

Intellectual property

IP Group commercialisation UK 3,076 0.4

KSQ Therapeutics Series C Preferred Biotechnology target identification

(u) company USA 3,072 0.4

Cloud based accounting software for

freee K.K. small and medium-sized enterprises Japan 2,967 0.4

Beam Therapeutics Biotechnology company USA 2,843 0.3

Akili Interactive Digital medicine company USA 2,827 0.3

Hydrogen energy solutions

ITM Power manufacturer UK 2,724 0.3

Twist Bioscience Biotechnology company USA 2,708 0.3

Online platform for restaurant

InfoMart supplies Japan 2,634 0.3

Biotechnology company focused on

next generation protein

Sutro Biopharma therapeutics USA 2,538 0.3

Designs and manufactures power

American Superconductor systems and superconducting wire USA 2,462 0.3

LendingTree Online consumer finance marketplace USA 2,217 0.3

Discovery and development of novel

materials for mass market

Ilika applications UK 2,179 0.3

Expensify Expense management software USA 2,160 0.3

Victrex High-performance thermo-plastics UK 2,130 0.3

Quanterix Ultra-sensitive protein analysers USA 2,107 0.3

Digital watermarking technology

Digimarc provider USA 2,097 0.3

Specialised processor chips for

Graphcore Series D2 Preferred (u) machine learning applications UK 1,518 0.2

Specialised processor chips for

Graphcore Series E Preferred (u) machine learning applications UK 484 0.1

------- -----------------

2,002 0.3

New Horizon Health Cancer screening company China 1,996 0.2

Chinook Therapeutics Immunotherapy drug development USA 1,861 0.2

Chinook Therapeutics CVR Line Immunotherapy drug development USA 0 0.0

1,861 0.2

Stratasys 3D printer manufacturer USA 1,652 0.2

Therapies for gastrointestinal

Cosmo Pharmaceuticals diseases Italy 1,608 0.2

Rational drug design and

C4X Discovery Holdings optimisation UK 1,607 0.2

C4X Discovery Warrants Software to aid drug design UK - 0.0

1,607 0.2

Huya ADR A live game streaming platform China 1,606 0.2

Cloud based virtual banking

Q2 Holdings solutions provider USA 1,599 0.2

Licenses IP to the semiconductor

CEVA industry USA 1,516 0.2

Cardlytics Digital advertising platform USA 1,366 0.1

Online marketplace for buying

EverQuote insurance USA 1,280 0.1

Online furniture and homeware

Wayfair retailer USA 1,119 0.1

Commerce platform for small and

BASE medium-sized enterprises Japan 1,117 0.1

Cloud-based healthcare software

Tabula Rasa HealthCare developer USA 1,027 0.1

Messaging tools for business and

LivePerson customer interactions USA 909 0.1

Nanomedicine company focused on

Nanobiotix ADR cancer radiotherapy France 896 0.1

Next generation chemotherapy

NuCana SPN ADR developer UK 828 0.1

Analytics and data collection

technology for sports teams and

Catapult Group International athletes Australia 741 0.1

Voice and video platform technology

Agora ADR provider China 680 0.1

Genetic engineering for cell based

Cellectis therapies France 367 0.1

Genetic engineering for cell based

Cellectis ADR therapies France 127 <0.1

------- -----------------

494 0.1

Satellite powered data collection

Spire Global and analysis company USA 478 0.1

Biotechnology company focused on

Adicet Bio (formerly resTORbio) age related disorders USA 409 0.1

Biotechnology tools focused on cell

Phenomex characterisation USA 230 <0.1

Angelalign Technology Medical devices manufacturer China 88 <0.1

4D Pharma Microbiome biology therapeutics UK 0 0.0

4D Pharma Warrants Microbiome biology therapeutics UK 0 0.0

------- -----------------

0 0.0

Mines, processes and manufactures

China Lumena New Materials (S) natural thenardite products China 0 0.0

------------------------------------ ----------------------------------- ------------- ------- -----------------

Total investments 802,024 99.2

---------------------------------------------------------------------------------------- ------- -----------------

Net liquid assets 6,741 0.8

---------------------------------------------------------------------------------------- ------- -----------------

Total assets 808,765 100.0

---------------------------------------------------------------------------------------- ------- -----------------

* Total assets before deduction of loans.

(u) Denotes unlisted security.

(P) Denotes security where majority of holding was previously

held in the portfolio as an unlisted security.

(S) Denotes suspended security.

Listed equities Unlisted Net liquid Total assets

% securities assets %

# %

%

---------------- -------------------------- --------------- -------------- --------------------

30 April 2023 78.3 20.9 0.8 100.0

---------------- -------------------------- --------------- -------------- --------------------

31 October 2022 79.2 20.1 0.7 100.0

---------------- -------------------------- --------------- -------------- --------------------

Figures represent percentage of total assets.

# Includes holdings in ordinary shares and preference

shares.

Distribution of Total Assets* (unaudited)

Portfolio Weightings (relative to comparative

Industry Analysis at 30 April 2023 % of total assets * index ) %

------------------------------------------------ ------------------- -----------------------------------------------

Biotechnology 20.4 16.8

Aerospace and Defence 14.6 13.3

Software 14.0 9.9

Healthcare Equipment and Supplies 9.1 6.8

Healthcare Technology 4.2 3.9

Technology Hardware, Storage and Peripherals 4.0 3.4

Capital Markets 3.7 0.8

Life Sciences Tools and Services 3.6 2.6

Electronic Equipment, Instruments and Components 3.1 0.6

Electrical Equipment 3.0 1.4

Pharmaceuticals 2.9 1.0

Real Estate Management and Development 2.8 1.1

Professional Services 2.7 0.7

Food and Staples Retailing 2.7 1.5

Healthcare Providers and Services 1.8 -0.2

Diversified Consumer Services 1.3 0.6

Semiconductors and Semiconductor Equipment 0.8 -1.8

Interactive Media and Services 0.6 0.0

Auto Components 0.5 -0.9

Insurance 0.5 -2.3

Trading Companies and Distributors 0.5 -1.0

Consumer Finance 0.3 -0.4

Chemicals 0.3 -3.0

Entertainment 0.2 -0.6

Specialty Retail 0.2 -2.3

Media 0.2 -1.3

IT Services 0.1 -1.2

Net Liquid Assets 0.8 0.8

* Total assets before deduction of loans.

S&P Global Small Cap Index. Weightings exclude industries

where the Company has no exposure. See disclaimer at the end of

this announcement.

Geographical Analysis 30 April 2023 31 October

2022

% %

---------------------------------------- -------------- -----------

North America 72.1 71.7

USA 71.5 70.6

Canada 0.6 1.1

----------------------- ------------------------------- -----------

Europe 20.6 21.5

United Kingdom 14.3 13.5

Eurozone 3.0 1.8

Developed Europe (non

euro) 3.3 6.2

----------------------- ------------------------------- -----------

Asia 5.4 5.0

Japan 3.1 2.3

China 2.3 2.7

----------------------- ------------------------------- -----------

Australasia 1.1 1.1

Australia 0.1 0.1

New Zealand 1.0 1.0

----------------------- ------------------------------- -----------

Net Liquid Assets 0.8 0.7

---------------------------------------- -------------- -----------

Total Assets 100.0 100.0

---------------------------------------- -------------- -----------

Sectoral Analysis 30 April 2023 31 October 2022

% %

----------------------- ------------- ---------------

Communication Services 3.8 2.9

Consumer Discretionary 4.9 6.3

Financials 4.6 4.3

Healthcare 42.2 43.2

Industrials 21.0 17.7

Information Technology 22.4 24.7

Materials 0.3 0.2

----------------------- ------------- ---------------

Net Liquid Assets 0.8 0.7

----------------------- ------------- ---------------

Total Assets 100.0 100.0

----------------------- ------------- ---------------

Notes to the Financial Statements (unaudited)

1. The condensed Financial Statements for the six months to 30

April 2023 comprise the statements set out above together with the

related notes below. They have been prepared in accordance with FRS

104 'Interim Financial Reporting' and the AIC's Statement of

Recommended Practice issued in October 2019 and updated in July

2022 with consequential amendments. They have not been audited or

reviewed by the Auditor pursuant to the Auditing Practices Board

Guidance on 'Review of Interim Financial Information'. The

Financial Statements for the six months to 30 April 2023 have been

prepared on the basis of the same accounting policies as set out in

the Company's Annual Report and Financial Statements at 31 October

2022.

Going Concern

The Directors have considered the nature of the Company's

principal risks and uncertainties, as set out on the inside front

cover. In addition, the Company's investment objective and policy,

assets and liabilities, and projected income and expenditure,

together with the dividend policy have been taken into

consideration and it is the Directors' opinion that the Company has

adequate resources to continue in operational existence for the

foreseeable future. The Board has, in particular, considered the

ongoing impact of geopolitical and macroeconomic challenges. The

Company's assets, the majority of which are investments in quoted

securities which are readily realisable, exceed its liabilities

significantly.

All borrowings require the prior approval of the Board. Gearing

levels and compliance with borrowing covenants are reviewed by the

Board on a regular basis. The Company has continued to comply with

the investment trust status requirements of section 1158 of the

Corporation Tax Act 2010 and the Investment Trust (Approved

Company) (Tax) Regulations 2011. Accordingly, the Directors

consider it appropriate to adopt the going concern basis of

accounting in preparing these Financial Statements and confirm that

they are not aware of any material uncertainties which may affect

the Company's ability to continue to do so over a period of at

least twelve months from the date of approval of these Financial

Statements.

2. The financial information contained within this Interim

Financial Report does not constitute statutory accounts as defined

in sections 434 to 436 of the Companies Act 2006. The financial

information for the year ended 31 October 2022 has been extracted

from the statutory accounts which have been filed with the

Registrar of Companies. The Auditor's Report on those accounts was

not qualified, did not include a reference to any matters to which

the Auditor drew attention by way of emphasis without qualifying

the report, and did not contain a statement under sections 498(2)

or (3) of the Companies Act 2006.

3. Baillie Gifford & Co Limited, a wholly owned subsidiary

of Baillie Gifford & Co, has been appointed by the Company as

its Alternative Investment Fund Manager and Company Secretary. The

investment management function has been delegated to Baillie

Gifford & Co. Dealing activity and transaction reporting have

been further sub-delegated to Baillie Gifford Overseas Limited and

Baillie Gifford Asia (Hong Kong) Limited. The management agreement

is terminable on not less than three months' notice. The annual

management fee is 0.75% on the first GBP50 million of net assets,

0.65% on the next GBP200 million of net assets and 0.55% on the

remaining net assets.

4. Net return per ordinary share

Six months Six months Year to

to 30 April to 30 April 31 October

2023 2022 2022

(audited)

GBP'000 GBP'000 GBP'000

------------------------------------ ------------ ------------ -----------

Net return per ordinary share

Revenue return after taxation (1,209) (960) (1,976)

Capital return after taxation (57,522) (457,136) (540,205)

------------------------------------ ------------ ------------ -----------

Total net return (58,731) (458,096) (542,181)

------------------------------------ ------------ ------------ -----------

Weighted average number of ordinary

shares in issue 390,711,773 405,267,892 400,679,723

------------------------------------ ------------ ------------ -----------

5. Dividend

No interim dividend has been declared.

6. Fair Value Hierarchy

The Company's investments are financial assets held at fair

value through profit or loss. The fair value hierarchy used to

analyse the basis on which the fair values of financial instruments

held at fair value through the profit or loss account are measured

is described below. Fair value measurements are categorised on the

basis of the lowest (that is the least reliable or least

independently observable) level input that is significant to the

fair value measurement.

Level 1 - using unadjusted quoted prices for identical

instruments in an active market;

Level 2 - using inputs, other than quoted prices included within

Level 1, that are directly or indirectly observable (based on

market data); and

Level 3 - using inputs that are unobservable (for which market

data is unavailable).

An analysis of the Company's financial assets based on the fair

value hierarchy described above is shown below.

Investments held at fair value through profit or loss

Level Level Level

1 2 3 Total

As at 30 April 2023 GBP'000 GBP'000 GBP'000 GBP'000

---------------------- -------- -------- -------- --------

Listed equities 633,131 - - 633,131

Unlisted ordinary

shares - - 21,215 21,215

Unlisted preference

shares* - - 147,280 147,280

Unlisted promissory

note - - 398 398

---------------------- -------- -------- -------- --------

Total financial asset

investments 633,131 - 168,893 802,024

---------------------- -------- -------- -------- --------

Level Level Level

As at 31 October 1 2 3 Total

2022 (audited) GBP'000 GBP'000 GBP'000 GBP'000

-------------------- -------- -------- -------- --------

Listed equities 696,135 - - 696,135

Unlisted ordinary

shares - - 22,456 22,456

Unlisted preference

shares* - - 153,779 153,779

Unlisted promissory

note - - 434 434

-------------------- -------- -------- -------- --------

Total financial

asset investments 696,135 - 176,669 872,804

-------------------- -------- -------- -------- --------

* The investments in preference shares are not classified as

equity holdings as they include liquidation preference rights that

determine the repayment (or multiple thereof) of the original

investment in the event for a liquidation event such as a

take-over

There have been no transfers between levels of the fair value

hierarchy during the period. The fair value of listed investments

is either bid price or, depending on the convention of the exchange

on which the investment is listed, last traded price. Listed

investments are categorised as Level 1 if they are valued using

unadjusted quoted prices for identical instruments in an active

market and as Level 2 if they do not meet all these criteria but

are, nonetheless, valued using market data. Unlisted investments

are valued at fair value by the Directors following a detailed

review and appropriate challenge of the valuations proposed by the

Managers. The Managers' unlisted investment policy applies

methodologies consistent with the International Private Equity and

Venture Capital Valuation guidelines ('IPEV'). The principal

methodologies can be categorised as follows: (a) market approach

(price of recent investment, multiples, industry valuation

benchmarks and available market prices); (b) income approach

(discounted cash flows); and (c) replacement cost approach (net

assets). The Company's holdings in unlisted investments are

categorised as Level 3 as unobservable data is a significant input

to their fair value measurements.

7. Bank Loans

At 30 April 2023 creditors falling due within one year include

borrowings of GBP97,000,000 (31 October 2022 - GBP103,827,000)

drawn down under a five year GBP100 million multi-currency

revolving credit facility with The Royal Bank of Scotland

International Limited which expires on 9 June 2026.

At 30 April 2023 the drawings were EUR10,600,000, US$77,150,000

and GBP26,308,000 (31 October 2022 - EUR10,600,000, US$77,150,000

and GBP27,720,000) drawn down under the GBP100 million

multi-currency revolving credit facility.

At 30 April 2023 there were no drawings under the GBP25 million

or GBP36 million multi-currency revolving credit facilities with

National Australia Bank Limited with expiry dates of 29 June 2023

and 30 September 2024 respectively (31 October 2022 - nil).

The fair value of the bank loans at 30 April 2023 was

GBP97,000,000 (31 October 2022 - GBP103,827,000).

8. Share Capital

30 April 30 April 31 October 31 October

2023 2023 2022 2022

Number GBP'000 Number GBP'000

------------------------ ----------- -------- ----------- ----------

Allotted, called up and

fully paid ordinary

shares of 1p each 389,419,641 3,894 392,285,023 3,923

Treasury shares of 1p

each 16,334,054 164 13,468,672 135

------------------------ ----------- -------- ----------- ----------

405,753,695 4,058 405,753,695 4,058

------------------------ ----------- -------- ----------- ----------

The Company has authority to allot shares under section 551 of

the Companies Act 2006. The Board has authorised use of this

authority to issue new shares at a premium to net asset value in

order to enhance the net asset value per share for existing

shareholders and improve the liquidity of the Company's shares. In

the six months to 30 April 2023, no shares were issued (in the six

months to 30 April 2022 - 550,000 shares with a nominal value of

GBP6,000, representing 0.1% of the issued share capital at 31

October 2021 raising net proceeds of GBP1,730,000).

Over the period from 30 April 2023 to 6 June 2023 the Company

issued no further shares.

The Company also has authority to buy back shares. In the six

months to 30 April 2023, 2,865,382 shares with a nominal value of

GBP29,000 were bought back at a total cost of GBP5,070,000 and held

in treasury (in the six months to 30 April 2022- 3,525,695 shares

were bought back and held in treasury). At 30 April 2023 the

Company had authority to buy back a further 58,628,524 ordinary

shares.

Over the period from 30 April 2023 to 6 June 2023, no further

shares have been bought back by the Company.

9. Transaction Costs

During the period the Company incurred transaction costs on

purchases of investments of GBP8,000 (30 April 2022 - GBP29,000; 31

October 2022 - GBP155,000) and transaction costs on sales of

GBP3,000 (30 April 2022- GBP4,000; 31 October 2022 -

GBP25,000).

10. Related Party Transactions

There have been no transactions with related parties during the

first six months of the current financial year that have materially

affected the financial position or the performance of the Company

during that period and there have been no changes in the related

party transactions described in the last Annual Report and

Financial Statements that could have had such an effect on the

Company during that period.

None of the views expressed in this document should be construed

as advice to buy or sell a particular investment.

Principal Risks and Uncertainties

The principal risks facing the Company are financial risk,

investment strategy risk, climate and governance risk, discount

risk, regulatory risk, custody and depositary risk, small company

risk, private company (unlisted) investments risk, operational

risk, leverage risk, political and associated economic risk, cyber

security risk and emerging risks. An explanation of these risks and

how they are managed is set out on pages 9 and 10 of the Company's

Annual Report and Financial Statements for the year to 31 October

2022 which is available on the Company's website:

edinburghworldwide.co.uk. The principal risks and uncertainties

have not changed since the date of the Annual Report.

Glossary of Terms and Alternative Performance Measures

('APM')

An alternative performance measure is a financial measure of

historical or future financial performance, financial position, or

cash flows, other than a financial measure defined or specified in

the applicable financial reporting framework.

Total Assets

This is the Company's definition of Adjusted Total Assets, being

the total value of assets held less all liabilities (other than

liabilities in the form of borrowings).

Net Asset Value ('NAV')

Also described as shareholders' funds, net asset value is the

value of total assets less liabilities (including borrowings). Net

asset value can be calculated on the basis of borrowings stated at

book value and fair value. An explanation of each basis is provided

below. The net asset value per share is calculated by dividing this

amount by the number of ordinary shares in issue excluding any

shares held in treasury.

Net Asset Value (Borrowings at Book Value)

Borrowings are valued at nominal book value (book cost).

Net Asset Value (Borrowings at Fair Value) (APM)

Borrowings are valued at an estimate of their market worth.

Net Asset Value (Reconciliation of NAV at Book Value to NAV at

Fair Value)

30 April 2023 31 October 2022

=================================== ============== ================

Net Asset Value per ordinary share

(borrowings at book value) 182.78p 197.70p

----------------------------------- -------------- ----------------

Shareholders' funds (borrowings at GBP711,765,000 GBP755,566,000

book value)

Add: book value of borrowings GBP97,000,000 GBP103,827,000

Less: fair value of borrowings GBP97,000,000 (GBP103,827,000)

----------------------------------- -------------- ----------------

Shareholders' funds (borrowings at GBP711,765,000 GBP775,566,000

fair value)

----------------------------------- -------------- ----------------

Number of shares in issue 389,419,641 392,285,023

----------------------------------- -------------- ----------------

Net Asset Value per ordinary share

(borrowings at fair value) 182.78p 197.70p

----------------------------------- -------------- ----------------

Net Asset Value (Reconciliation of NAV at Book Value to NAV at

Fair Value)

At 30 April 2023 and 31 October 2022 all borrowings are in the

form of short term floating rate borrowings and their fair value is

considered equal to their book value, hence there is no difference

in the net asset value at book value and fair value.

Net Liquid Assets

Net liquid assets comprise current assets less current

liabilities, excluding borrowings.

Discount/Premium (APM)

As stockmarkets and share prices vary, an investment trust's

share price is rarely the same as its net asset value. When the

share price is lower than the net asset value per share it is said

to be trading at a discount. The size of the discount is calculated

by subtracting the share price from the net asset value per share

and is usually expressed as a percentage of the net asset value per

share. If the share price is higher than the net asset value per

share, this situation is called a premium.

30 April 31 October

2023 2022

--------------------------------- -------- ----------

Net Asset Value per share (a) 182.78p 197.70p

Share price (b) 149.20p 172.60p

--------------------------- ---- -------- ----------

Discount ((b)-(a)) ÷ (a) (18.4%) (12.7%)

--------------------------------- -------- ----------

Total Return (APM)

The total return is the return to shareholders after reinvesting

the dividend on the date that the share price goes ex-dividend. The

Company does not pay a dividend, therefore, the one year total

returns for the share price and NAV per share at book and fair

value are the same as the percentage movements in the share price

and NAV per share at book and fair value.

Ongoing Charges (APM)

The total recurring expenses (excluding the Company's cost of

dealing in investments and borrowing costs) incurred by the Company

as a percentage of the average net asset value (with debt at fair

value). The ongoing charges are calculated on the basis prescribed

by the Association of Investment Companies.

Gearing (APM)

At its simplest, gearing is borrowing. Just like any other

public company, an investment trust can borrow money to invest in

additional investments for its portfolio. The effect of the

borrowing on the shareholders' assets is called 'gearing'. If the

Company's assets grow, the shareholders' assets grow

proportionately more because the debt remains the same. But if the

value of the Company's assets falls, the situation is reversed.

Gearing can therefore enhance performance in rising markets but can

adversely impact performance in falling markets.

Invested gearing is the Company's borrowings at book value less

cash and cash equivalents (as adjusted for investment and share buy

back/issuance transactions awaiting settlement) expressed as a

percentage of shareholders' funds.

30 April 31 October

2023 2022

-------------------------------------------- --------------- ---------------

Borrowings (at book value) GBP97,000,000 GBP103,827,000

Less: cash and cash equivalents (GBP10,349,000) (GBP11,131,000)

Less: sales for subsequent settlement (GBP7,627,000) (GBP4,598,000)

Add: purchases for subsequent settlement GBP8,971,000 GBP6,719,000

Add: buy backs awaiting settlement - GBP433,000

-------------------------------------------- --------------- ---------------

Adjusted borrowings (a) GBP87,995,000 GBP95,250,000

------------------------------------ ------ --------------- ---------------

Shareholders' funds (b) GBP711,765,000 GBP775,566,000

------------------------------------ ------ --------------- ---------------

Invested gearing: (a) as a percentage

of (b) 12% 12%

-------------------------------------------- --------------- ---------------

Potential gearing is the Company's borrowings expressed as a

percentage of shareholders' funds.

30 April 2023 31 October 2022

--------------------------------------- ---- -------------- ---------------

Borrowings (at book value) (a) GBP97,000,000 GBP103,827,000

Shareholders' funds (b) GBP711,765,000 (GBP11,131,000)

--------------------------------------- ---- -------------- ---------------

Potential gearing: (a) as a percentage

of (b) 14% 13%

--------------------------------------------- -------------- ---------------

Leverage (APM)

For the purposes of the Alternative Investment Fund Managers

Directive, leverage is any method which increases the Company's

exposure, including the borrowing of cash and the use of

derivatives. It is expressed as a ratio between the Company's

exposure and its net asset value and can be calculated on a gross

and a commitment method. Under the gross method, exposure

represents the sum of the Company's positions after the deduction

of sterling cash balances, without taking into account any hedging

and netting arrangements. Under the commitment method, exposure is

calculated without the deduction of sterling cash balances and

after certain hedging and netting positions are offset against each

other.

Active Share (APM)

Active share, a measure of how actively a portfolio is managed,

is the percentage of the portfolio that differs from its

comparative index. It is calculated by deducting from 100 the

percentage of the portfolio that overlaps with the comparative

index. An active share of 100 indicates no overlap with the index

and an active share of zero indicates a portfolio that tracks the

index.

Treasury Shares

The Company has the authority to make market purchases of its

ordinary shares for retention as treasury shares for future

reissue, resale, transfer, or for cancellation. Treasury shares do

not receive distributions and the Company is not entitled to

exercise the voting rights attaching to them.

Private (Unlisted) Company

An unlisted or private company means a company whose shares are

not available to the general public for trading and are not listed

on a stock exchange.

Third Party Data Provider Disclaimer

No third party data provider ('Provider') makes any warranty,

express or implied, as to the accuracy, completeness or timeliness

of the data contained herewith nor as to the results to be obtained

by recipients of the data. No Provider shall in any way be liable

to any recipient of the data for any inaccuracies, errors or

omissions in the index data included in this document, regardless

of cause, or for any damages (whether direct or indirect) resulting

therefrom.

No Provider has any obligation to update, modify or amend the

data or to otherwise notify a recipient thereof in the event that

any matter stated herein changes or subsequently becomes

inaccurate.

Without limiting the foregoing, no Provider shall have any

liability whatsoever to you, whether in contract (including under

an indemnity), in tort (including negligence), under a warranty,

under statute or otherwise, in respect of any loss or damage

suffered by you as a result of or in connection with any opinions,

recommendations, forecasts, judgements, or any other conclusions,

or any course of action determined, by you or any third party,

whether or not based on the content, information or materials

contained herein.

S&P Index

The S&P Global Small Cap Index ('Index') is a product of

S&P Dow Jones Indices LLC, a division of S&P Global, or its

affiliates ('SPDJI'). Standard & Poor's(R) and S&P(R) are

registered trademarks of Standard & Poor's Financial Services

LLC, a division of S&P Global ('S&P'); Dow Jones(R) is a