TIDMHL.

RNS Number : 5911Q

Hargreaves Lansdown PLC

19 October 2023

Trading update

19 October 2023

Hargreaves Lansdown plc today issues a trading update in respect

of its first quarter ended 30 September 2023.

Highlights

-- Net new business of GBP0.6 billion in the period and closing

Assets under Administration ("AUA") of GBP134.8 billion.

-- Net new client growth of 8,000 in the period, taking us to

1,812,000 active clients, with client retention rate of 91.7%.

-- Revenue for the period of GBP183.8 million, up 13% (Q1 2023: GBP162.9m).

Dan Olley, Chief Executive Officer, commented:

"We continue to see net client growth and positive net new

business despite the macroeconomic backdrop and its on-going impact

on investor confidence and client behaviour.

Clients are looking to invest more in cash than risk-based

investments, from our Active Savings offer, giving easy access to a

range of banking partners, to Money Market Funds and short-dated

bonds. Combining this with informative and relevant content

provides our clients with a wide range of solutions to meet their

saving and investment needs."

Trading performance

-- Net new business of GBP0.6 billion in the quarter (Q1 2023:

GBP0.7bn), reflects moderated flows being seen across the market.

Active Savings continues to perform well and has been the key

driver of net flows as clients favour cash savings over risk based

investments.

-- Net client growth of 8,000 in the quarter (Q1 2023: 17,000)

primarily driven by net new clients in the SIPP and Active Savings

accounts. Client retention at 91.7% (FY2023: 92.2%) and asset

retention at 89.0% (FY2023: 90.4%) reflects the muted macroeconomic

backdrop and the need for various cohorts of clients to make cash

withdrawals.

-- Share dealing volumes averaged 634,000 per month in the

quarter (Q1 2023: 700,000) reflecting wider market trends.

-- Client cash balances were GBP12.4 billion at the end of the

quarter, 9.2% of total AUA, with heightened levels of cash

withdrawals and an increase in movement of cash into Active Savings

in July and August before stabilising in September.

-- Total revenue in the quarter of GBP183.8 million (Q1 2023:

GBP162.9m) with net interest margin growth more than offsetting the

revenue impact of the reduction in share dealing volumes.

Financial calendar

Our Annual General Meeting is scheduled to be held on 8 December

2023 and our interim results will be issued on 22 February

2024.

Contacts:

Investors Media

James Found, Head of Investor Danny Cox, Head of Communications

Relations +44(0)7989 672071

+44(0)7970 066634 Nick Cosgrove, Brunswick

0207 404 5959

Forward looking statements

This announcement contains forward-looking statements with

respect to the financial condition, results and business of the

Group. By their nature, forward-looking statements involve risk and

uncertainty because they relate to events, and depend on

circumstances, that will occur in the future. The Group's actual

results may differ materially from the results expressed or implied

in these forward-looking statements. Nothing in this announcement

should be construed as a profit forecast. This announcement is

unaudited. This statement should not be seen as a promotion or

solicitation to buy Hargreaves Lansdown plc shares. It should be

remembered that the value of shares can fall as well as rise and

therefore you could get back less than you invested.

LEI Number: 2138008ZCE93ZDSESG90

Revenue, clients and share dealing volumes

Key metrics 3 months 3 months 3 months 3 months 3 months

to 30 September to 30 June to 31 March to 31 December to 30 September

2023 2023 2023 2022 2022

Revenue (GBPm) 183.8 197.0 188.1 187.1 162.9

----------------- ------------ ------------- ---------------- -----------------

Net new clients 8,000 13,000 23,000 14,000 17,000

----------------- ------------ ------------- ---------------- -----------------

Total active

clients 1,812,000 1,804,000 1,791,000 1,768,000 1,754,000

----------------- ------------ ------------- ---------------- -----------------

Client Retention

Rate (%) 91.7 92.0 92.0 92.6 92.2

----------------- ------------ ------------- ---------------- -----------------

Asset Retention

Rate (%) 89.0 89.7 89.1 91.1 91.9

----------------- ------------ ------------- ---------------- -----------------

Share dealing

volumes per

month 634,000 685,000 770,000 627,000 700,000

----------------- ------------ ------------- ---------------- -----------------

Assets under administration

AUA (GBPbillion) 3 months 3 months 3 months 3 months 3 months

to 30 September to 30 June to 31 March to 31 December to 30 September

2023 2023 2023 2022 2022

Opening AUA 134.0 132.0 127.1 122.7 123.8

----------------- ------------ ------------- ---------------- -----------------

Net new business

- platform (0.1) 0.9 0.9 (0.1) -

----------------- ------------ ------------- ---------------- -----------------

Net new business

- Active

Savings 0.7 0.8 0.7 1.0 0.7

----------------- ------------ ------------- ---------------- -----------------

Total net

new business 0.6 1.7 1.6 0.9 0.7

----------------- ------------ ------------- ---------------- -----------------

Market movements

and other 0.2 0.3 3.3 3.5 (1.8)

----------------- ------------ ------------- ---------------- -----------------

Closing AUA 134.8 134.0 132.0 127.1 122.7

----------------- ------------ ------------- ---------------- -----------------

Closing As at 30 As at 30 As at 31 As at 31 As at 30

AUA (GBPbillion) September June 2023 March 2023 December September

2023 2022 2022

Funds 61.9 62.2 61.6 59.6 57.4

----------- ----------- ------------ ---------- -----------

Shares 51.9 50.8 49.8 47.1 45.2

----------- ----------- ------------ ---------- -----------

Cash 12.4 13.1 13.5 14.1 14.8

----------- ----------- ------------ ---------- -----------

HL Funds 8.7 8.7 8.6 8.3 7.8

----------- ----------- ------------ ---------- -----------

Active Savings 8.5 7.8 7.0 6.3 5.3

----------- ----------- ------------ ---------- -----------

Double count(1) (8.6) (8.6) (8.5) (8.3) (7.8)

----------- ----------- ------------ ---------- -----------

Total 134.8 134.0 132.0 127.1 122.7

----------- ----------- ------------ ---------- -----------

Average 3 months 3 months 3 months 3 months 3 months

AUA (GBPbillion) to 30 September to 30 June to 31 March to 31 December to 30 September

2023 2023 2023 2022 2022

Funds 62.6 62.1 61.8 59.2 59.8

----------------- ------------ ------------- ---------------- -----------------

Shares 52.2 50.4 50.1 47.3 47.5

----------------- ------------ ------------- ---------------- -----------------

Cash 12.5 13.4 13.6 14.3 14.8

----------------- ------------ ------------- ---------------- -----------------

HL Funds 8.8 8.7 8.6 8.2 8.1

----------------- ------------ ------------- ---------------- -----------------

Active Savings 8.3 7.5 6.8 6.0 5.1

----------------- ------------ ------------- ---------------- -----------------

Double count(1) (8.7) (8.6) (8.5) (8.1) (8.1)

----------------- ------------ ------------- ---------------- -----------------

Total 135.7 133.5 132.4 126.9 127.2

----------------- ------------ ------------- ---------------- -----------------

(1) All HL Funds are held in Vantage or the Portfolio Management

Service (PMS) and are included in the Funds category of the table

with the exception of a small balance held off platform by third

parties. To avoid double counting the amount held in Vantage or PMS

has been deducted.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBRBDGLSBDGXI

(END) Dow Jones Newswires

October 19, 2023 02:00 ET (06:00 GMT)

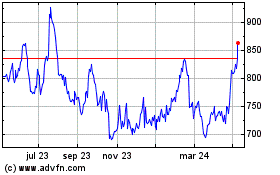

Hargreaves Lansdown (LSE:HL.)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

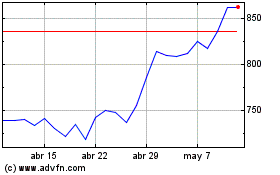

Hargreaves Lansdown (LSE:HL.)

Gráfica de Acción Histórica

De May 2023 a May 2024