Non-Standard Finance PLC Update on Scheme, Delisting & Directorate Change (6596D)

23 Junio 2023 - 1:00AM

UK Regulatory

TIDMNSF

RNS Number : 6596D

Non-Standard Finance PLC

23 June 2023

Non-Standard Finance plc

('Non-Standard Finance', 'NSF' or the 'Company')

Update on scheme of arrangement ('Scheme'), Delisting and

Directorate Change

23 June 2023: NSF announces that the Scheme was sanctioned

yesterday by the Court. As previously announced, the Scheme is part

of a broader transaction to restore the Group's balance sheet, fund

the partial payment of redress claims under the Scheme and return

Everyday Loans (branch-based lending) to profitable trading.

The sole remaining condition to the effectiveness of the Scheme

is the funding of the Scheme Fund through the proceeds of either

the Proposed Recapitalisation or the Alternative Transaction, both

of which have been described in previous announcements. Following

significant additional work to test the viability of the Proposed

Recapitalisation without the participation of Alchemy, the Group's

largest shareholder, i n the equity raise under the Proposed

Recapitalisation , the Board of NSF has regretfully concluded that

the Proposed Recapitalisation is not capable of implementation.

As a consequence, in order to ensure that the Scheme becomes

effective, the Board has made the decision that the Alternative

Transaction should be implemented instead of the Proposed

Recapitalisation. As a reminder to Shareholders, the Alternative

Transaction will involve the transfer of the Group's business to

the secured lenders in exchange for the release of a portion of

their secured debt and the provision of a new lending facility.

Part of the proceeds from this new lending facility would be used

to fund the Scheme Fund and cover the costs of the Scheme.

While the Alternative Transaction will secure the future of the

Everyday Loans business and allow it to pursue its growth plans

providing an invaluable service for its customers, it will

unfortunately result in no recovery for NSF's shareholders. The

Board expects the Alternative Transaction to be implemented by the

end of June 2023 or in early July 2023.

The most likely outcome for Non-Standard Finance plc, as the

ultimate parent company of the Group, is an orderly winddown

following implementation of the Alternative Transaction. To

facilitate this process, Non-Standard Finance plc intends to take

steps to cancel the listing of its ordinary shares (the "Shares")

on the standard segment of the Official List of the FCA and cancel

the admission to trading of the Shares on the Main Market for

listed securities of the London Stock Exchange (the "Delisting").

Formal notice of any Delisting, including the proposed date of any

Delisting, will be set out in a separate announcement in due

course.

In light of the above, independent non-executive director Niall

Booker has decided not to stand for re-election as an independent

non-executive director, or to stand for election as non-executive

chairman, at the Company's 2023 Annual General Meeting (the "AGM")

which is to be held at 1 p.m. (London time) today. Niall will stand

down from the Board following the AGM.

Jono Gillespie, Group Chief Executive, said:

"We are pleased that the Scheme has been sanctioned by the

Court, which is a critical milestone in restoring the Everyday

Loans business to financial health. While we are very disappointed

that it has not been possible to carry out the equity raise as

planned, we are grateful that - with support from our secured

lenders - we prepared a fall-back transaction for this exact

eventuality. We will now take steps to implement that fall-back

transaction, which will allow the Group to grow and develop the

Everyday Loans business, continue to provide much needed funding

solutions for customers, and protect the position of the Group's

employees."

Unless otherwise defined, capitalised terms within this

announcement shall have the same meaning as those contained within

NSF's announcement dated 17 March 2023.

This announcement contains inside information as stipulated

under the Market Abuse Regulations (EU) No. 596/2014 as it forms

part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018. The person responsible for arranging the

release of this announcement on behalf of Non-Standard Finance plc

is Sarah Day, Chief ESG Officer and Group Company Secretary.

For more information:

Non-Standard Finance plc

Jono Gillespie, Group Chief

Executive Officer

Sarah Day, Chief ESG Officer

and Company

Secretary +44 203 869 9020

Cenkos Securities plc

Nicholas Wells

Ben Jeynes

Callum Davidson +44 207 397 8900

H/Advisors Maitland +44 207 379 5151

Neil Bennett +44 7900 000777

Finlay Donaldson +44 7341 788066

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFSTRDIFFIV

(END) Dow Jones Newswires

June 23, 2023 02:00 ET (06:00 GMT)

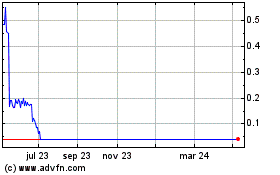

Non-standard Finance (LSE:NSF)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Non-standard Finance (LSE:NSF)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024