This release includes business updates and unaudited financial

results for the three months ended March 31, 2024 ("Q1", "Q1 2024"

or the "Quarter") of Cool Company Ltd. ("CoolCo" or the "Company")

(NYSE:CLCO / CLCO.OL).

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240521645435/en/

Q1 Highlights and Subsequent Events

- Generated total operating revenues of $88.1 million in Q1,

compared to $97.1 million for the fourth quarter of 2023 ("Q4" or

"Q4 2023") primarily related to brief off-hire on the Kool Husky as

it transitioned to a new charter and a lower floating rate on

another vessel;

- Net income of $36.81 million in Q1, compared to $22.41 million

for Q4 with the increase primarily related to unrealized

mark-to-market gains on our interest rate swaps;

- Achieved average Time Charter Equivalent Earnings ("TCE")2 of

$77,200 per day for Q1, compared to $87,300 per day for Q4;

- Adjusted EBITDA2 of $58.5 million for Q1, compared to $69.4

million for Q4;

- Upsized the $520 million term loan facility by $200 million,

pushing out the first debt maturity to February 2027;

- Secured a 14-year charter with GAIL (India) Limited during Q2

2024 for one of the two state-of-the-art MEGA LNG carriers

currently under order at Hyundai-Samho (the "Newbuilds"), expected

to be delivered towards the end of 2024;

- Commenced drydock cycle with one vessel during Q2 2024, with a

further three vessels scheduled to follow in Q3 2024;

- Declared a quarterly dividend of $0.41 per share, payable to

shareholders of record on May 31, 2024.

Richard Tyrrell, CEO, commented:

“The first quarter was a transitional quarter for both the

market and CoolCo after the winter season in northern hemisphere

ended early and two of CoolCo’s vessels delivered into new

charters. While one of the vessels delivered into a higher rate

charter, the other was off-hire for a handful of days before

delivery and this, combined with lower rates on our single variable

rate contract reduced our overall fleet TCE to $77,200 per day.

Energy security concerns continue to support the price of LNG at

above $9/MMBTU, which is supportive of shipping as average cargo

values now exceed $30 million. Our next available vessels are well

spaced and do not come open before the second half of 2024, when

the market is anticipated to be in a seasonal upswing.

Additionally, following two atypically warm winters in the northern

hemisphere, during which China and India relied heavily upon

significant coal inventories, we expect to see longer voyage

distances in the second half of 2024 as greater volumes of LNG head

east.

Subsequent to the first quarter, CoolCo was pleased to announce

a long-term charter for one of its two state-of-the-art Newbuilds

and looks forward to securing employment for its second Newbuild.

The 14-year long-term charter takes CoolCo’s firm revenue backlog

to more than $1.2 billion and total revenue backlog including

extensions to almost $1.9 billion as of March 31, 2024, and

underscores the significant gap between the prevailing spot market

and the long-term employment prospects for the high-quality,

fuel-efficient LNG carriers."

Financial Highlights

The table below sets forth certain key financial information for

Q1 2024, Q4 2023 and Q1 2023.

(in thousands of $, except average daily

TCE)

Q1 2024

Q4 2023

Q1 2023

Time and voyage charter revenues

78,710

89,319

91,168

Total operating revenues

88,125

97,144

98,649

Operating income

44,097

55,051

52,022

Net income1

36,812

22,415

70,132

Adjusted EBITDA2

58,541

69,432

67,814

Average daily TCE2 (to the closest

$100)

77,200

87,300

83,700

LNG Market Review

The average Japan/Korea Marker gas price ("JKM") for the Quarter

was $9.43/MMBtu compared to $15.82/MMBtu for Q4 2023; with average

JKM for Q2 2024 at $9.96/MMBtu as of May 14, 2024. The Quarter

commenced with Dutch Title Transfer Facility gas price ("TTF") at

$10.31/MMBtu and quoted TFDE headline spot rates of $78,750 per

day. The Quarter concluded with TTF at $8.76/MMBtu and quoted TFDE

headline spot rates of $39,500 per day. The TFDE headline spot rate

has subsequently stabilized at around this level and is quoted at

$39,000 per day as of May 14, 2024.

Most LNG has continued to trade within its basin of origin,

reducing the number of long-distance inter-basin voyages and

limiting the effect of the Panama and Suez Canal closures. While

demand for gas in Europe has dropped, the price of LNG is supported

by concerns over energy security and the potential for a further

decrease in gas from Russia whether in gas or liquid form. The high

value of the cargos delivered into Europe is supportive of LNG

shipping even though the distances involved are shorter.

The volatility of LNG markets is expected to increase as the

winter heating season approaches. Onshore storage in Europe could

fill up, resulting in more cargoes heading east and a return to

using LNG carriers for storage – both of which would be positive

for CoolCo’s vessels.

Operational Review

CoolCo's fleet continued to perform well with a Q1 fleet

utilization of 95% compared to 97% for Q4 2023, with the difference

primarily reflecting 51 off-hire days due to time lost between

charterhire as Kool Husky transitioned to its new charter in early

March. While there were no drydocks during Q1 2024, one drydock has

commenced in the second quarter, with a further three vessels

scheduled to start their drydocks during the third quarter of 2024.

The average cost of these drydocks is estimated to be at

approximately $6.5 million per vessel, plus up to 30 days off-hire.

One of the drydocks scheduled for the third quarter will also

include the upgrade of a vessel to LNGe specification through the

retrofit of a sub-cooler with high liquefaction capacity and other

performance enhancements at an estimated cost of an additional

$15.0 million and an additional 20 days off-hire.

Business Development

The chartering of one of CoolCo’s two Newbuilds sets a strong

precedent for the second Newbuild and CoolCo continues to be in

discussions with potential charterers regarding its employment.

CoolCo is also developing leads for its other two vessels

redelivering in the second half of 2024, both of which are

earmarked for an upgrade to LNGe specification during their

scheduled drydocks during the first half of 2025.

Financing and Liquidity

During the Quarter, the Company closed on the upsize of the

existing $520 million term loan facility maturing in May 2029 in

anticipation of the maturity of the two existing sale &

leaseback facilities (Kool Ice and Kool Kelvin) during the first

quarter of 2025. As previously disclosed, the $200 million upsize

will be available on a delayed drawdown basis, at our option.

As of March 31, 2024, CoolCo had cash and cash equivalents of

$105.8 million and total short and long-term debt, net of deferred

finance charges, amounting to $1,042.6 million. In addition, CoolCo

has approximately $49 million remaining undrawn capacity under its

Newbuild Vessel pre-delivery facility. Total Contractual Debt2

stood at $1,145.9 million, which is comprised of $475.8 million in

respect of the $570 million bank facility maturing in March 2027,

$461.9 million in respect of the $520 million term loan facility

maturing in May 2029, $168.2 million of sale and leaseback

financing in respect of the two vessels maturing in the first

quarter of 2025 (Kool Ice and Kool Kelvin) and $40.0 million in

respect of the Newbuilds' financing (Kool Tiger and Kool

Panther).

In February 2024, lender approval was obtained for an amendment

of financial covenants under the $570 million bank facility

including a relaxation of the minimum cash covenant and a reduction

in the minimum value clause. The new financial ratios include

minimum net worth, maximum net debt to total assets and a minimum

free cash restriction.

In March 2024, the Company and a group of lenders under the $520

million term loan facility maturing in May 2029, signed an

amendment for a $200 million upsize of this facility (on a delayed

drawdown basis) in anticipation of the maturity of the two existing

sale and leaseback facilities during the first quarter of 2025. The

amendment also includes a reduction in minimum free cash

restriction.

Overall, the Company’s interest rate on its debt is currently

fixed or hedged for approximately 80% of the notional amount of net

debt, adjusting for existing cash on hand.

Corporate and Other Matters

As of March 31, 2024, CoolCo had 53,702,846 shares issued and

outstanding. Of these, 31,254,390 shares (58.2%) were owned by EPS

Ventures Ltd ("EPS") and 22,448,456 (41.8%) were owned by other

public investors.

In line with the Company’s variable dividend policy, the Board

has declared a Q1 dividend of $0.41 per common share. The record

date is May 31, 2024 and the dividend will be distributed to

DTC-registered shareholders on or around June 10, 2024, while due

to the implementation of the Central Securities Depositories

Regulation in Norway, the dividend will be distributed to Euronext

VPS-registered shareholders on or around June 13, 2024.

Outlook

In the near term, the spot LNG carrier market is likely to

remain substantially detached from prospects for either multi-year

secondhand employment or very long-term charters for newbuilds.

Charterer comfort levels have been buoyed by two consecutive mild

winters in the northern hemisphere and delays to commissioning and

startup of very late-stage liquefaction facilities, resulting in

both an enlarged pool of vessels available for short-term

employment and an increased willingness of charterers to rely upon

the availability of such temporary tonnage. As evidenced by the

dislocation between the spot market and longer-term charter

markets, current prevailing spot rates are more indicative of a

market in a holding pattern than a longer-term call on overall

market direction.

As anticipated, the imposition of a carbon pricing scheme and

increasingly stringent environmental regulations are increasingly

disadvantaging older steam turbine vessels in mainstream LNG

trades. As such, that portion of the fleet, representing

approximately 30% of the global LNG carriers, is experiencing both

increased idleness and reduced charter rates relative to more

modern, fuel-efficient vessels. Additionally, as has been seen in

other shipping sectors in recent years, an increasing number of

older steam turbine vessels have begun transitioning out of

mainstream trades via sales to owners based primarily in Asia. This

phenomenon has served as a dampener on anticipated scrapping levels

for those older, less efficient ships, but nevertheless removes

them from direct competition for primary business in a way that is

likely to be sticky.

Moving beyond the short-term, liquefaction projects that have

already reached FID (“Final Investment Decision”) remain set to

increase the total volume of LNG on the water by more than 50% in

the years ahead, with a particularly heavy concentration for

commissioning in 2025, for which charterers will need to secure

tonnage. Even against the backdrop of a sizable orderbook and

relatively limited scrapping of older steam turbine vessels, the

charter market is positioned to tighten considerably as these new

volumes come online. Furthermore, even a typical winter season has

the potential to absorb significant incremental tonnage. In that

scenario, the prospect of being short transportation capacity is

likely to reorient charterers away from their recent complacency in

the spot market and back towards the risk-averse, energy security

focus they have historically been willing to pay a premium for in

the multi-year charter market.

1 Net income for Q1 2024 includes a

mark-to market gain on interest rate swaps amounting to $11.3

million, of which $8.1 million was unrealized gain.

2 Refer to 'Appendix A' - Non-GAAP

financial measures and definitions, for definitions of these

measures and a reconciliation to the nearest GAAP measure.

Forward Looking Statements

This press release and any other written or oral statements made

by us in connection with this press release include forward-looking

statements within the meaning of Section 21E of the Securities

Exchange Act of 1934. All statements, other than statements of

historical facts, that address activities and events that will,

should, could, are expected to or may occur in the future are

forward-looking statements. These forward-looking statements are

made under the "safe harbor" provisions of the U.S. Private

Securities Litigation Reform Act of 1995. You can identify these

forward-looking statements by words or phrases such as “believe,”

“anticipate,” “intend,” “estimate,” “forecast,” “project,” “plan,”

“potential,” “will,” “may,” “should,” “expect,” “could,” “would,”

“predict,” “propose,” “continue,” or the negative of these terms

and similar expressions are intended to identify such

forward-looking statements. These forward-looking statements

include statements relating to our outlook, industry trends and

expected impact, expected results and performance, expectations on

chartering and charter rates, expected drydockings including the

timing and duration, and impact of performance enhancements on our

vessels, timeline for delivery of newbuilds, dividends, expected

growth in LNG supply and the attractiveness of LNG, expected

industry and business trends including expected trends in LNG

demand and market trends and potential future drivers of demand and

market volatility, expected trends in LNG shipping capacity

including timing for newbuilds, LNG vessel supply and demand

(including expected seasonal upswings), factors impacting supply

and demand of vessels, regulatory updates such as IMO CII rules,

rates and expected trends in charter and spot rates, backlog,

contracting, utilization, LNG vessel newbuild order-book and

underlying market fundamentals and expectation that fundamentals

may support vessel orders and the continuity of a healthy charter

rate environment, seasonality and volatility statements, under “LNG

Market Review” and “Outlook” and other non-historical matters.

The forward-looking statements in this document are based upon

management’s current expectations, estimates and projections. These

statements involve significant risks, uncertainties, contingencies

and factors that are difficult or impossible to predict and are

beyond our control, and that may cause our actual results,

performance or achievements to be materially different from those

expressed or implied by the forward-looking statements. Numerous

factors could cause our actual results, level of activity,

performance or achievements to differ materially from the results,

level of activity, performance or achievements expressed or implied

by these forward-looking statements including:

- general economic, political and business conditions, including

sanctions and other measures;

- general LNG market conditions, including fluctuations in

charter hire rates and vessel values;

- changes in demand in the LNG shipping industry, including the

market for our vessels;

- changes in the supply of LNG vessels;

- our ability to successfully employ our vessels;

- changes in our operating expenses, including fuel or cooling

down prices and lay-up costs when vessels are not on charter,

drydocking and insurance costs;

- compliance with, and our liabilities under, governmental, tax,

environmental and safety laws and regulations;

- changes in governmental regulation, tax and trade matters and

actions taken by regulatory authorities;

- potential disruption of shipping routes and demand due to

accidents, piracy or political events and/or instability, including

the ongoing conflicts in the Middle East;

- vessel breakdowns and instances of loss of hire;

- vessel underperformance and related warranty claims;

- our expectations regarding the availability of vessel

acquisitions;

- our ability to procure or have access to financing and

refinancing;

- continued borrowing availability under our credit facilities

and compliance with the financial covenants therein;

- fluctuations in foreign currency exchange and interest

rates;

- potential conflicts of interest involving our significant

shareholders;

- our ability to pay dividends;

- information system failures, cyber incidents or breaches in

security;

- adjustments in our ship management business and related costs;

and

- other risks indicated in the risk factors included in CoolCo’s

Annual Report on Form 20-F for the year ended December 31, 2023 and

other filings with the U.S. Securities and Exchange

Commission.

The foregoing factors that could cause our actual results to

differ materially from those contemplated in any forward-looking

statement included in this report should not be construed as

exhaustive. Moreover, we operate in a very competitive and rapidly

changing environment. New risks and uncertainties emerge from time

to time, and it is not possible for us to predict all risks and

uncertainties that could have an impact on the forward-looking

statements contained in this press release. The results, events and

circumstances reflected in the forward-looking statements may not

be achieved or occur, and actual results, events or circumstances

could differ materially from those described in the forward-looking

statements.

As a result, you are cautioned not to place undue reliance on

any forward-looking statements which speak only as of the date of

this press release. The Company undertakes no obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise unless

required by law.

Responsibility Statement

We confirm that, to the best of our knowledge, the interim

unaudited condensed consolidated financial statements for the three

months ended March 31, 2024, which have been prepared in accordance

with accounting principles generally accepted in the United States

(US GAAP) give a true and fair view of the Company’s consolidated

assets, liabilities, financial position and results of operations.

To the best of our knowledge, the financial report for the three

months ended March 31, 2024 includes a fair review of important

events that have occurred during the period and their impact on the

interim unaudited condensed consolidated financial statements, the

principal risks and uncertainties, and major related party

transactions.

May 22, 2024 Cool Company Ltd. London, UK

Questions should be directed to: c/o Cool Company Ltd - +1(441)

295 2244

Richard Tyrrell (Chief Executive Officer

& Director)

Cyril Ducau (Chairman of the Board)

John Boots (Chief Financial Officer)

Antoine Bonnier (Director)

Joanna Huipei Zhou (Director)

Sami Iskander (Director)

Neil Glass (Director)

Peter Anker (Director)

Cool Company Ltd

Unaudited Condensed Consolidated

Statement of Operations

(in thousands of $)

Jan-March 2024

Oct-Dec 2023

Jan-March 2023

Time and voyage charter revenues

78,710

89,319

91,168

Vessel and other management fee

revenues

4,923

3,308

3,376

Amortization of intangible assets and

liabilities - charter agreements, net

4,492

4,517

4,105

Total operating revenues

88,125

97,144

98,649

Vessel operating expenses

(17,594

)

(16,804

)

(18,588

)

Voyage, charter hire and commission

expenses, net

(1,439

)

(1,019

)

(1,499

)

Administrative expenses

(6,059

)

(5,372

)

(6,643

)

Depreciation and amortization

(18,936

)

(18,898

)

(19,897

)

Total operating expenses

(44,028

)

(42,093

)

(46,627

)

Operating income

44,097

55,051

52,022

Other non-operating income

—

—

42,528

Financial income/(expense):

Interest income

1,705

1,743

1,517

Interest expense

(19,678

)

(20,463

)

(19,485

)

Gains /(losses) on derivative

instruments

11,301

(13,115

)

(6,001

)

Other financial items, net

(480

)

(426

)

(393

)

Financial expenses, net

(7,152

)

(32,261

)

(24,362

)

Income before income taxes and

non-controlling interests

36,945

22,790

70,188

Income taxes, net

(133

)

(375

)

(56

)

Net income

36,812

22,415

70,132

Net income attributable to non-controlling

interests

(238

)

(351

)

(1,287

)

Net income attributable to the Owners

of Cool Company Ltd

36,574

22,064

68,845

Net income attributable to:

Owners of Cool Company Ltd

36,574

22,064

68,845

Non-controlling interests

238

351

1,287

Net income

36,812

22,415

70,132

Cool Company Ltd

Unaudited Condensed Consolidated

Balance Sheet

At March 31,

At December 31,

(in thousands of $, except number of

shares)

2024

2023

(Audited)

ASSETS

Current assets

Cash and cash equivalents

105,818

133,496

Restricted cash and short-term

deposits

3,242

3,350

Intangible assets, net

413

825

Trade receivable and other current

assets

15,323

12,923

Inventories

309

3,659

Total current assets

125,105

154,253

Non-current assets

Restricted cash

463

492

Intangible assets, net

9,066

9,438

Newbuildings

205,223

181,904

Vessels and equipment, net

1,687,656

1,700,063

Other non-current assets

18,438

10,793

Total assets

2,045,951

2,056,943

LIABILITIES AND EQUITY

Current liabilities

Current portion of long-term debt and

short-term debt

185,013

194,413

Trade payable and other current

liabilities

95,272

98,917

Total current liabilities

280,285

293,330

Non-current liabilities

Long-term debt

857,597

866,671

Other non-current liabilities

86,055

90,362

Total liabilities

1,223,937

1,250,363

Equity

Owners' equity includes 53,702,846 (2023:

53,702,846) common shares of $1.00 each, issued and outstanding

751,186

735,990

Non-controlling interests

70,828

70,590

Total equity

822,014

806,580

Total liabilities and equity

2,045,951

2,056,943

Cool Company Ltd

Unaudited Condensed Consolidated

Statement of Cash Flows

(in thousands of $)

Jan-March 2024

Jan-March 2023

Operating activities

Net income

36,812

70,132

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization expenses

18,936

19,897

Amortization of intangible assets and

liabilities arising from charter agreements, net

(4,492

)

(4,105

)

Amortization of deferred charges and fair

value adjustments

881

1,539

Gain on sale of vessel

—

(42,528

)

Drydocking expenditure

(1,494

)

(884

)

Compensation cost related to share-based

payment

640

589

Change in fair value of derivative

instruments

(8,145

)

(7,557

)

Changes in assets and liabilities:

Trade accounts receivable

699

(378

)

Inventories

3,350

172

Other current and other non-current

assets

(3,533

)

2,692

Amounts (due to)/ from related parties

(216

)

(1,626

)

Trade accounts payable

3,057

12,334

Accrued expenses

(3,154

)

1,766

Other current and non-current

liabilities

(4,780

)

4,908

Net cash provided by operating

activities

38,561

56,951

Investing activities

Additions to vessels and equipment

(2,571

)

(798

)

Additions to newbuildings

(22,300

)

—

Additions to intangible assets

(132

)

—

Proceeds from sale of vessel

—

184,300

Net cash provided by investing

activities

(25,003

)

183,502

Financing activities

Repayments of short-term and long-term

debt

(19,355

)

(107,490

)

Cash dividends paid

(22,018

)

(21,475

)

Net cash used in financing

activities

(41,373

)

(128,965

)

Net (decrease)/ increase in cash, cash

equivalents and restricted cash

(27,815

)

111,488

Cash, cash equivalents and restricted

cash at beginning of period

137,338

133,077

Cash, cash equivalents and restricted

cash at end of period

109,523

244,565

Cool Company Ltd

Unaudited Condensed Consolidated

Statement of Changes in Equity

For the three months ended

March 31, 2024

(in thousands of $, except number of

shares)

Number of common

shares

Owners’ Share Capital

Additional Paid-in

Capital(1)

Retained Earnings

Owners' Equity

Non- controlling

Interests

Total Equity

Consolidated balance at December 31,

2023

53,702,846

53,703

509,327

172,960

735,990

70,590

806,580

Net income for the period

—

—

—

36,574

36,574

238

36,812

Share based payments contribution

—

—

640

—

640

—

640

Dividends

—

—

—

(22,018

)

(22,018

)

—

(22,018

)

Consolidated balance at

March 31, 2024

53,702,846

53,703

509,967

187,516

751,186

70,828

822,014

(1) Additional paid-in capital refers to

the amount of capital contributed or paid-in over and above the par

value of the Company's issued share capital.

For the three months ended

March 31, 2023

(in thousands of $, except number of

shares)

Number of common

shares

Owners’ Share Capital

Additional Paid-in

Capital(1)

Retained Earnings

Owners' Equity

Non- controlling

Interests

Total Equity

Consolidated balance at December 31,

2022

53,688,462

53,688

507,127

85,742

646,557

68,956

715,513

Net income for the period

—

—

—

68,845

68,845

1,287

70,132

Share based payments contribution

—

—

589

—

589

—

589

Dividends

—

—

—

(21,475

)

(21,475

)

—

(21,475

)

Consolidated balance at

March 31, 2023

53,688,462

53,688

507,716

133,112

694,516

70,243

764,759

(1) Additional paid-in capital refers to

the amount of capital contributed or paid-in over and above the par

value of the Company's issued share capital.

Appendix A - Non-GAAP Financial Measures and Definitions

Non-GAAP Financial Metrics Arising from How Management Monitors

the Business

In addition to disclosing financial results in accordance with

U.S. generally accepted accounting principles (US GAAP), this

earnings release and the associated investor presentation and

discussion contain references to the non-GAAP financial measures

which are included in the table below. We believe these non-GAAP

financial measures provide investors with useful supplemental

information about the financial performance of our business, enable

comparison of financial results between periods where certain items

may vary independent of business performance, and allow for greater

transparency with respect to key metrics used by management in

operating our business and measuring our performance. These

non-GAAP financial measures should not be considered a substitute

for, or superior to, financial measures calculated in accordance

with US GAAP, and the financial results calculated in accordance

with US GAAP. Non-GAAP measures are not uniformly defined by all

companies, and may not be comparable with similar titles, measures

and disclosures used by other companies. The reconciliations from

these results should be carefully evaluated.

Non-GAAP measure

Closest equivalent US GAAP

measure

Adjustments to reconcile to

primary financial statements prepared under US GAAP

Rationale for

adjustments

Performance Measures

Adjusted EBITDA

Net income

+/- Other non-operating income

+/- Net financial expense, representing:

Interest income, Interest expense, Gains/(Losses) on derivative

instruments and Other financial items, net

+/- Income taxes, net

+ Depreciation and amortization

- Amortization of intangible assets and

liabilities - charter agreements, net

Increases the comparability of total

business performance from period to period and against the

performance of other companies by removing the impact of other

non-operating income, depreciation, amortization of intangible

assets and liabilities -charter agreements, net, financing and tax

items.

Average daily TCE

Time and voyage charter revenues

- Voyage, charter hire and commission

expenses, net

The above total is then divided by

calendar days less scheduled off-hire days.

Measure of the average daily net revenue

performance of a vessel.

Standard shipping industry performance

measure used primarily to compare period-to-period changes in the

vessel’s net revenue performance despite changes in the mix of

charter types (i.e. spot charters, time charters and bareboat

charters) under which the vessel may be employed between the

periods.

Assists management in making decisions

regarding the deployment and utilization of its fleet and in

evaluating financial performance.

Liquidity measures

Total Contractual Debt

Total debt (current and non-current), net

of deferred finance charges

+ VIE Consolidation and fair value

adjustments upon acquisition

+ Deferred Finance Charges

We consolidate two lessor VIEs for our

sale and leaseback facilities (for the vessels Ice and Kelvin).

This means that on consolidation, our contractual debt is

eliminated and replaced with the Lessor VIEs’ debt.

Contractual debt represents our actual

debt obligations under our various financing arrangements before

consolidating the Lessor VIEs.

The measure enables investors and users of

our financial statements to assess our liquidity and the split of

our debt (current and non-current) based on our underlying

contractual obligations.

Total Company Cash

CoolCo cash based on GAAP measures:

+ Cash and cash equivalents

+ Restricted cash and short-term deposits

(current and non-current)

- VIE restricted cash and short-term

deposits (current and non-current)

We consolidate two lessor VIEs for our

sale and leaseback facilities. This means that on consolidation, we

include restricted cash held by the lessor VIEs.

Total Company Cash represents our cash and

cash equivalents and restricted cash and short-term deposits

(current and non-current) before consolidating the lessor VIEs.

Management believes that this measure

enables investors and users of our financial statements to assess

our liquidity and aids comparability with our competitors.

Reconciliations - Performance

Measures

Adjusted EBITDA

(in thousands of $)

Jan-March 2024

Oct-Dec 2023

Jan-March 2023

Net income

36,812

22,415

70,132

Other non-operating income

—

—

(42,528

)

Interest income

(1,705

)

(1,743

)

(1,517

)

Interest expense

19,678

20,463

19,485

(Gains)/Losses on derivative

instruments

(11,301

)

13,115

6,001

Other financial items, net

480

426

393

Income taxes, net

133

375

56

Depreciation and amortization

18,936

18,898

19,897

Amortization of intangible assets and

liabilities - charter agreements, net

(4,492

)

(4,517

)

(4,105

)

Adjusted EBITDA

58,541

69,432

67,814

Average daily TCE

(in thousands of $, except number of days

and average daily TCE)

Jan-March 2024

Oct-Dec 2023

Jan-March 2023

Time and voyage charter revenues

78,710

89,319

91,168

Voyage, charter hire and commission

expenses, net

(1,439

)

(1,019

)

(1,499

)

77,271

88,300

89,669

Calendar days less scheduled off-hire

days

1,001

1,012

1,071

Average daily TCE (to the closest

$100)

$ 77,200

$ 87,300

$ 83,700

Reconciliations - Liquidity

measures

Total Contractual Debt

(in thousands of $)

At March 31, 2024

At December 31,

2023

Total debt (current and non-current) net

of deferred finance charges

1,042,610

1,061,084

Add: VIE consolidation and fair value

adjustments

98,184

97,245

Add: Deferred finance charges

5,083

5,563

Total Contractual Debt

1,145,877

1,163,892

Total Company Cash

(in thousands of $)

At March 31, 2024

At December 31,

2023

Cash and cash equivalents

105,818

133,496

Restricted cash and short-term

deposits

3,705

3,842

Less: VIE restricted cash

(3,242

)

(3,350

)

Total Company Cash

106,281

133,988

Other definitions

Contracted Revenue Backlog

Contracted revenue backlog is defined as the contracted daily

charter rate for each vessel multiplied by the number of scheduled

hire days for the remaining contract term. Contracted revenue

backlog is not intended to represent adjusted EBITDA or future

cashflows that will be generated from these contracts. This measure

should be seen as a supplement to and not a substitute for our US

GAAP measures of performance.

This information is subject to the disclosure requirements in

Regulation EU 596/2014 (MAR) article 19 number 3 and section 5-12

of the Norwegian Securities Trading Act.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240521645435/en/

c/o Cool Company Ltd - +44 207 659 1111 / IR@coolcoltd.com

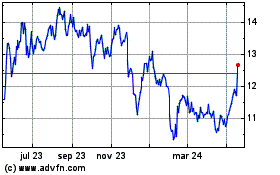

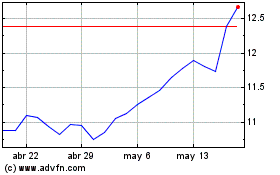

Cool (NYSE:CLCO)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Cool (NYSE:CLCO)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024