Exxon Pledges to Cut Methane Emissions 15% by 2020

23 Mayo 2018 - 1:02PM

Noticias Dow Jones

By Rebecca Elliott and Sarah Kent

Exxon Mobil Corp. plans to reduce methane emissions 15% by 2020,

the latest in a series of pledges by major oil companies to

voluntarily curtail releases of the potent greenhouse gas.

The Texas-based company also said it intends to cut flaring, or

burning of natural gas, by 25% over the same period. Those efforts

likely will be concentrated in West Africa. Both reduction targets

are compared with 2016 levels.

Exxon's move Wednesday, a week before its annual meeting May 30,

comes as pressure from investors mounts on big oil companies to not

only disclose climate-related business risks, but also take action

to reduce emissions linked to global warming.

Companies have also come under fire from activists for flaring

natural gas, which can increase air pollution, during oil and gas

production.

"We have a longstanding commitment to improve efficiency and

mitigate greenhouse gas emissions," said Exxon Chief Executive

Darren Woods in a statement. "Today's announcement builds on that

commitment and will help further drive improvements in our

business."

BP PLC said in April that it will keep its emissions flat out to

2025 even as it grows. The company set a target to cut 3.5 million

tons of greenhouse-gas emissions from its operations over the

period, focusing on reducing methane emissions as a key part of

this. Royal Dutch Shell PLC last year announced a plan to halve the

company's carbon footprint -- including emissions caused by drivers

who burn Shell fuel -- by 2050.

Much of the pressure to address climate change has come from

shareholders. Last year, a group of investors with roughly $30

trillion under management launched a five-year effort to push the

world's biggest corporate polluters to reduce emissions and improve

transparency and governance around climate.

At Shell's annual meeting Tuesday, investors with nearly $8

trillion under management called on the company to go beyond its

already ambitious plans to curb emissions and set firm targets.

Exxon and Chevron Corp. are also expected to face questions on the

subject at their annual meetings next week.

"Investors are not going to let go," said Mindy Lubber, CEO and

president of Ceres, a Boston-based nonprofit group that works with

investors to promote sustainable business practices. "The level of

effort going in is exponentially more substantial than last year or

the year before."

Companies have invested heavily in natural gas in recent years,

touting the fuel as a greener alternative to coal, which emits far

more carbon dioxide when converted to electricity. However, that

does not account for methane, which is the primary component of

natural gas and often leaks into the atmosphere as the resource is

extracted and transported.

The Environmental Defense Fund, a nonprofit environmental

advocacy group that has been working to highlight methane and

flaring issues, said it supported Exxon's plan to cut emissions,

but called for "greater ambition."

"In a carbon-constrained world, oil and gas industry leaders

should seek to virtually eliminate emissions of this highly-potent

greenhouse gas," said Matt Watson, EDF's associate vice president

for climate and energy, in a statement.

Write to Rebecca Elliott at rebecca.elliott@wsj.com and Sarah

Kent at sarah.kent@wsj.com

(END) Dow Jones Newswires

May 23, 2018 13:47 ET (17:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

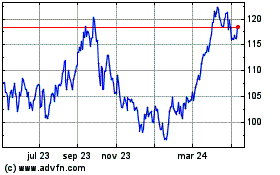

Exxon Mobil (NYSE:XOM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

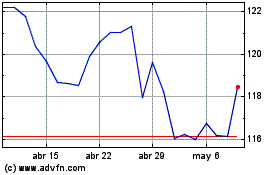

Exxon Mobil (NYSE:XOM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024