TIDMPEB

RNS Number : 7314L

Pebble Beach Systems Group PLC

10 September 2019

Pebble Beach Systems Group plc

Results for the half year ended 30 June 2019

Pebble Beach Systems Group plc, a leading global software

business specialising in solutions for playout automation and

content serving customers in the broadcast markets, is pleased to

announce its unaudited results for the half year ended 30 June

2019.

Financial Headlines

For the half year ended 30 June 2019

2019 2018

------------------------------------------- --------- ---------

Order Intake GBP5.2m GBP4.2m

Revenue GBP5.6m GBP3.7m

Gross Margin GBP4.2m GBP2.7m

75% 73%

Adjusted EBITDA* GBP2.0m GBP0.6m

% of Revenue 35% 15%

Adjusted earnings per share* 1.3p 0.2p

Net cash inflow from operating activities GBP0.8m GBP0.1m

Net Debt** GBP9.0m GBP9.4m

Headlines

-- Orders received in the period grew 23.6% to GBP5.2m (H1 2018: GBP4.2m)

-- Revenue up by 51% to GBP5.6m (H1 2018: GBP3.7m)

-- Adjusted EBITDA increased significantly in the period to GBP2.0m (2018: GBP0.6m)

-- Reported profit before tax GBP0.7m (2018: loss GBP0.9m)

-- Net debt further reduced as at 30 June 2019 GBP9.0m (31 December 2018: GBP9.4m)

*Adjusted EBITDA, a non-GAAP measure, is EBITDA before

non-recurring items and foreign exchange gains. Adjusted earnings

per share is calculated on the same basis after taking account of

related tax effects.

**Net debt at 31 December 2018 was GBP9.4m.

John Varney, Non-Executive Chairman of Pebble Beach Systems

Group plc, said:

"We are greatly encouraged with the results for the first half

of 2019. At the start of 2018, the Board put in place an aggressive

plan to turn around the Company. The work that was done during 2018

was both necessary and detailed but, as is normal in turnaround

situations, the numbers that we produced at the end of the year,

whilst encouraging, did not reflect the scale of the progress we

had made. It is therefore very pleasing indeed to be able to report

such an impressive set of results for the first half of 2019. These

are a huge testament to both the quality and hard work of the

people within the business. Whilst the first part of the turnaround

is complete, the marketplace in which we operate is fast moving and

competitive and whilst we have improved our reputation and our

market position, there is still a lot to do.

Looking into the second half of 2019 and beyond our focus is to

continue to build on the trading performance improvements delivered

in 2018 and capitalise on the opportunities presented by the

changes in the broadcast market."

- ends -

For further information please contact:

+44 (0) 75 55 59

36 02

John Varney, Non-Executive Chairman +44 (0) 1932 333

Peter Mayhead, Chief Executive 790

finnCap (Nomad and Broker)

Marc Milmo / Hannah Boros +44 (0) 207 220 0500

The Company is quoted on the LSE AIM market (PEB.L). More

information can be found at www.pebbleplc.com.

About Pebble Beach Systems

Pebble Beach Systems is a world leader in automation, channel in

a box, integrated and virtualised playout technology, with scalable

products designed for highly efficient multichannel transmission as

well as complex news and sports television. Installed in more than

70 countries and with proven systems ranging from single up to over

150 channels in operation, Pebble Beach Systems offers open,

flexible systems, which encompass ingest and playout automation,

and complex file-based workflows. The Company trades in the US as

Pebble Broadcast Systems.

Forward-looking statements

Certain statements in this announcement are forward-looking.

Although the Group believes that the expectations reflected in

these forward-looking statements are reasonable, it can give no

assurance that these expectations will prove to be correct. Because

these statements involve risks and uncertainties, actual results

may differ materially from those expressed or implied by these

forward-looking statements. The Group undertakes no obligation to

update any forward-looking statements whether as a result of new

information, future events or otherwise. Nothing in this

announcement should be construed as a profit forecast.

CHAIRMAN'S STATEMENT

In 2018, we embarked upon a strategic plan for the turnaround of

the Company. In delivering the first profit after tax for a half

year for continuing operations since 2014, we have demonstrated

that we have the ability, and management capability, to deliver

against this plan and to effect a successful turnaround.

We have a strong suite of automation, Channel in a Box and

content management solutions that are increasingly relevant in a

global broadcast sector that continues to go through significant

change as the approach to the consumption of content continues to

evolve. We are seeing excellent customer engagement and are very

encouraged by the growth in orders seen in the period. We also

recognise that the industry in which we are active will continue to

see advancements in content delivery and therefore with a stronger

platform now in place, a key part of our strategy will be to ensure

we have the technology and software solutions that satisfies the

needs of the broadcast industry.

I am pleased to report that trading in the first months of the

second half of 2019 have been strong and we are firmly on track to

meet management expectations. On behalf of the Board I would like

to thank the executive team and all our hard-working staff for

their diligence and efforts during the period.

John Varney

Non-Executive Chairman

CHIEF EXECUTIVE'S STATEMENT

I am delighted with the progress made by the Company in the

period. Having set out the agenda for growth during the course of

2018 and focussed the Company on its core strength of broadcast

playout solutions, the first six months of 2019 are very

encouraging and provide the Company with a very good platform from

which to fully capitalise on the market opportunity. The period saw

strong order and revenue growth as well as a return to a profit

before tax.

Orders received in the period grew 23.6% to GBP5.2 million (H1

2018: GBP4.2 million). Revenue is up by 51% to GBP5.6 million (H1

2018: GBP3.7 million). Adjusted EBITDA for the business of GBP2.0

million (2018: GBP0.6 million). Reported profit for the period was

GBP0.7 million (2018: loss GBP0.9 million). Net debt further

reduced as at 30 June 2019 to GBP9.0 million (31 December 2018:

GBP9.4 million).

What we do: we support broadcasters around the world as they

adapt to compete with new entrants in the video media space by

providing solutions to support their transition from traditional

broadcast infrastructure to more flexible IP based technologies.

The majority of our customer base is made up of large, global

companies who are often the broadcaster of choice in the

territories that they operate. They have market positions that are

often dominant in their geographies and are thus very keen to

maintain their positions.

Our strategy: we will continue to develop and improve our

technology to ensure we have a competitive offering both today and

in the future. We do this by developing new products internally as

well as constantly monitoring what new startups are offering.

Mission Statement: we want to support broadcasters as they adapt

to compete with new entrants in the video media space by providing

solutions to support their transition from traditional broadcast

infrastructure to more flexible IP based technologies.

Sector: broadcasters are now investing into technology to allow

them to compete with the digital media companies that have

disrupted the industry. We are witnessing key media companies

breaking away from the likes of Netflix and looking for solutions

to compete in the digital media space. Our mission is clearly

aligned with this sector development and has led to a 71% increase

in the value of orders for investment into new systems for H1 2019

(GBP2.4 million) compared to H1 2018 (GBP1.4 million).

Financial Results

Pebble Beach Systems achieved H1 2019 revenue of GBP5.6 million

(2018: GBP3.7 million).

Management is confident it will achieve its forecasts for the

year as we head into H2 2019, with a backlog of orders of GBP5.2

million at 30 June 2019 (2018: GBP4.7 million) and a growing

pipeline.

Adjusted EBITDA was GBP2.0 million in H1 2019 (2018: GBP0.6

million) before the deduction of depreciation and amortisation

costs of GBP1.1 million.

In the first half, Central costs were GBP0.3 million (2018:

GBP0.2 million). Reported profit before tax was GBP0.7 million

(2018: loss GBP0.9 million).

The available Revolving Credit Facility (RCF) as at 30 June 2019

was GBP10.1 million (2018: GBP11.5 million) which had been fully

drawn down. Interest paid on the RCF was GBP0.2 million (2018:

GBP0.2 million). There is no overdraft facility (2018: GBP Nil). In

H1 2019 in accordance with the terms of the RCF GBP0.6 million was

paid down (2018: GBP Nil).

The Company continues to view investment in the development of

new products and services as key to future growth. In the first

half of 2019, Pebble Beach Systems capitalised GBP0.5 million of

development costs (2018: GBP0.4 million) and amortised GBP0.4

million (2018: GBP0.4 million).

Dividends

As in previous years, the Board is not declaring an interim

dividend.

Trading Outlook

The broadcast market continues to go through considerable

changes with evolving technologies. The industry as a whole will

benefit from higher spending from customers to invest in IP and

cloud orientated infrastructures.

The momentum in spending and investment within the industry has

been slow but is expected to grow and we are well positioned to

take advantage of this.

Our customers continue to show clear signs of loyalty towards

our world-class, specialist solutions and we are well-placed to

deliver the requirements for the evolving technologies of IP and

cloud orientated infrastructures.

Peter Mayhead

Chief Executive

For the six months ended 30 June 2019

FINANCIAL REVIEW

Divisions and Markets

For the half year ended 30 June 2019

Continuing Operations

2019 2018 Change

GBP'm GBP'm %

----------------------- ------------ ------------ -------

(Unaudited) (Unaudited)

Pebble Beach Systems 5.6 3.7 49.1%

-------

Total Revenue 5.6 3.7 49.1%

----------------------- ------------ ------------ -------

Pebble Beach Systems 2.3 0.8 207.1%

Central (0.3) (0.2) -79.4%

----------------------- ------------ ------------ -------

Total adjusted EBITDA 2.0 0.6 252.6%

Pebble Beach Systems has contributed GBP5.6 million of revenue

and GBP2.3 million of adjusted EBITDA in the six months to 30 June

2019.

Goodwill impairment

In accordance with the requirements of IAS 36 'Impairment of

assets', goodwill is required to be tested for impairment on an

annual basis, with reference to the value of the cash-generating

units ("CGU") in question. The carrying value of goodwill at 30

June 2019 is GBP3.2 million (2018: GBP3.2 million) and relates

solely to Pebble Beach Systems. There is significant headroom

between the carrying value and the value of the forecast discounted

cash flows.

Cash flows

The Group held cash and cash equivalents of GBP1.1 million at 30

June 2019 (2018: GBP1.3 million). Against this are set off debit

balances of GBP Nil (2018: GBP0.3 million). The table below

summarises the cash flows for the half year.

2019 2018

GBP'million GBP'million

------------------------------------------- ------------- ----------------

Cash generated from operating activities 0.8 0.1

Net cash used in investing activities (0.4) (0.3)

Net cash used in financing activities (0.6) -

Effects of foreign exchange - -

------------------------------------------- ------------- ----------------

Net decrease in cash and cash equivalents (0.2) (0.2)

Cash and cash equivalents at 1 January 1.3 1.2

------------------------------------------- ------------- ----------------

Cash and cash equivalents at 30 June 1.1 1.0

------------------------------------------- ------------- ----------------

As at 30 June 2019 net debt was GBP9.0 million (cash GBP1.1

million and bank debt of GBP10.1 million). At the end of August

2019, net debt had reduced to GBP8.9 million. The Group was using

all GBP10.1 million of its available facilities in June 2019.

A marginally positive net increase in cash and cash equivalents

is forecast for the second half of 2019. Scheduled debt repayments

of GBP275,000 were made in March and June 2019. Further repayments

of GBP275,000 are due in September and December 2019.

Foreign exchange

The principal exchange rates used by the Group in translating

overseas profits and net assets into sterling are set out in the

table below.

Period Period

Average Average end end

rate rate rate rate

Rate compared to GBP sterling 2019 2018 2019 2018

------------------------------ ------- ------- ------ ------

US dollar 1.294 1.376 1.273 1.320

------------------------------ ------- ------- ------ ------

Risk management

The Board regularly reviews the full range of business risks

facing the Group. The approach adopted is to identify, evaluate and

manage the likely impact of risk on the Group's business

objectives. Where the risks are unavoidable, they are managed

through business controls and where appropriate through insurance

and treasury activities.

The Group has a programme of regular risk assessment, which

incorporates internal control reviews of both a financial and

non-financial nature. A process of continuous review has been in

place throughout the year at an operating company level to consider

the risk environment and the effectiveness of controls. The results

of reviews, initiatives and progress on implementing control

improvements are regularly reported to the Board.

CONSOLIDATED INCOME STATEMENT

for the six months ended 30 June 2019

6 months 6 months Year ended

to 30 June to 30 June 31 December

2019 2018 2018

(Unaudited) (Unaudited) (Audited)

Notes GBP'000 GBP'000 GBP'000

Revenue 4 5,587 3,748 9,174

Cost of sales (1,377) (1,028) (2,515)

------------ ------------ -------------

Gross profit 4,210 2,720 6,659

Sales and marketing expenses (1,052) (1,196) (2,163)

Research and development expenses (717) (600) (1,222)

Administrative expenses (1,030) (830) (1,759)

Foreign exchange gains 24 26 28

Other expenses (511) (871) (1,723)

Operating profit/(loss) 5 924 (751) (180)

--------------------------------------------- ------ ------------ ------------ -------------

Operating profit is analysed as:

Adjusted EBITDA 1,969 559 2,470

Non-recurring items - (167) (304)

Exchange gains credited to the income

statement 24 26 28

--------------------------------------------- ------ ------------ ------------ -------------

Earnings before interest, tax, depreciation

and amortisation (EBITDA) 1,993 418 2,194

--------------------------------------------- ------ ------------ ------------ -------------

Depreciation (126) (65) (127)

Amortisation and impairment of acquired

intangibles (511) (704) (1419)

Amortisation of capitalised development

costs (432) (400) (828)

Finance costs (210) (152) (296)

Finance income 1 3 4

Profit/(loss) before tax 715 (900) (472)

Tax 6 68 117 253

------------ ------------ -------------

Profit/(loss) for the period being

profit/(loss) attributable to owners

of the parent 783 (783) (219)

Net result from discontinued operations 16 56 195

------------ ------------ -------------

Net result for the period 799 (727) (24)

Earnings per share from continuing

and

discontinued operations attributable

to the owners of

the parent during the period

Basic earnings/(loss) per share

From continuing operations 7 0.6p (0.6)p (0.2)p

From discontinued operations 0.0p 0.0p 0.2p

------------ ------------ -------------

From earnings/(loss) for the period 0.6p (0.6)p 0.0p

--------------------------------------------- ------ ------------ ------------ -------------

Diluted earnings/(loss) per share

From continuing operations 7 0.6p (0.6)p (0.2)p

From discontinued operations 0.0p 0.0p 0.2p

------------ ------------ -------------

From earnings/(loss) for the period 0.6p (0.6)p 0.0p

--------------------------------------------- ------ ------------ ------------ -------------

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the six months ended 30 June 2019

6 months 6 months Year ended

to 30 June to 30 June 31 December

2019 2018 2018

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

------------------------------------------------------ ------------ ------------ -------------

Profit/(Loss) for the financial year 799 (727) (24)

Other comprehensive income - items that

may be reclassified subsequently to profit

or loss:

Exchange differences on translation of

overseas operations

- continuing operations (3) (18) (58)

- discontinued operations - 3 2

Total profit/(loss) for the period attributable

to owners of the parent 796 (742) (80)

------------------------------------------------------ ------------ ------------ -------------

CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY

for the half year ended 30 June 2019

Capital

Ordinary Share redemption Merger Translation Accumulated

shares premium reserve reserve reserve losses Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

----------------------------- --------- --------- ------------- ---------- ------------- ------------ ---------

At 1 January 2019 3,115 6,800 617 29,778 (195) (46,260) (6,145)

----------------------------- --------- --------- ------------- ---------- ------------- ------------ ---------

Adjustment on adoption

of IFRS 16 - - - - - (203) (203)

----------------------------- --------- --------- ------------- ---------- ------------- ------------ ---------

Retained profit for

the period - - - - - 799 799

Exchange differences

on translation of

overseas operations - - - - (3) - (3)

----------------------------- --------- --------- ------------- ---------- ------------- ------------ ---------

Total comprehensive

income/expense for

the period - - - - (3) 799 796

----------------------------- --------- --------- ------------- ---------- ------------- ------------ ---------

At 30 June 2019 (Unaudited) 3,115 6,800 617 29,778 (198) (45,664) (5,552)

----------------------------- --------- --------- ------------- ---------- ------------- ------------ ---------

At 1 January 2018 3,115 6,800 617 29,778 (139) (46,236) (6,065)

----------------------------- --------- --------- ------------- ---------- ------------- ------------ ---------

Retained loss for

the period - - - - - (727) (727)

Exchange differences

on translation of

overseas operations - - - - (15) - (15)

----------------------------- --------- --------- ------------- ---------- ------------- ------------ ---------

Total comprehensive

income/expense for

the period - - - - (15) (727) (742)

----------------------------- --------- --------- ------------- ---------- ------------- ------------ ---------

At 30 June 2018 (Unaudited) 3,115 6,800 617 29,778 (154) (46,963) (6,807)

----------------------------- --------- --------- ------------- ---------- ------------- ------------ ---------

At 1 January 2018 3,115 6,800 617 29,778 (139) (46,236) (6,065)

----------------------------- --------- --------- ------------- ---------- ------------- ------------ ---------

Retained loss for

the year - - - - - (24) (24)

Exchange differences

on translation of

overseas operations - - - - (56) - (56)

----------------------------- --------- --------- ------------- ---------- ------------- ------------ ---------

Total comprehensive

income/expense for

the period - - - - (56) (24) (80)

----------------------------- --------- --------- ------------- ---------- ------------- ------------ ---------

At 31 December 2018

(Audited) 3,115 6,800 617 29,778 (195) (46,260) (6,145)

----------------------------- --------- --------- ------------- ---------- ------------- ------------ ---------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

as at 30 June 2019

30 June 30 June 31 December

2019 2018 2018

(Unaudited) (Unaudited) (Audited)

Notes GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Intangible assets 4,937 6,202 5,422

Property, plant and equipment 1,253 232 232

Deferred tax assets 3 - 3

------------ ------------ ------------

6,193 6,434 5,657

------------ ------------ ------------

Current assets

Inventories 238 220 210

Trade and other receivables 2,972 2,774 2,391

Current tax assets - 18 12

Cash and cash equivalents 1,083 1,275 1,269

------------ ------------ ------------

4,293 4,287 3,882

Liabilities

Current liabilities

Financial liabilities - borrowings 1,310 1,288 1,100

Contract liabilities 1,883 2,522 2,323

Trade and other payables 2,488 2,124 1,964

Provisions for other liabilities

and charges 167 400 367

------------ ------------ ------------

5,848 6,334 5,754

------------ ------------ ------------

Net current liabilities (1,555) (2,047) (1,872)

------------ ------------ ------------

Non-current liabilities

Financial liabilities - borrowings 8,790 10,500 9,550

Other Non-current liabilities 1,107 - -

Deferred tax liabilities 293 527 380

Provisions for other liabilities - 167 -

and charges

------------ ------------ ------------

10,190 11,194 9,930

------------ ------------ ------------

Net liabilities (5,552) (6,807) (6,145)

--------------------------------------------- ------------ ------------ ------------

Equity attributable to owners of

the parent

Ordinary shares 3,115 3,115 3,115

Share premium account 6,800 6,800 6,800

Capital redemption reserve 617 617 617

Merger reserve 29,778 29,778 29,778

Translation reserve (198) (154) (195)

Retained earnings (45,664) (46,963) (46,260)

------------ ------------ ------------

Total equity (5,552) (6,807) (6,145)

--------------------------------------------- ------------ ------------ ------------

CONSOLIDATED STATEMENT OF CASH FLOWS

for the half year ended 30 June 2019

6 months 6 months Year ended

to 30 June to 30 June 31 December

2019 2018 2018

(Unaudited) (Unaudited) (Audited)

Notes GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Cash generated from operations 8 1,063 291 2,039

Interest paid (210) (152) (295)

Taxation paid (13) (13) (25)

------------ ------------ -------------

Net cash from operating activities 840 126 1,719

------------ ------------ -------------

Cash flows from investing activities

Interest received 1 3 4

Proceeds from sale of property, plant

and equipment - - 3

Purchase of property, plant and equipment (19) (19) (88)

Expenditure on capitalised development

costs (458) (364) (728)

Net cash (used in)/generated from investing

activities (476) (380) (809)

------------ ------------ -------------

Cash flows from financing activities

Net cash used in repayment of financing

activities (550) - (850)

Net cash used in financing activities (550) - (850)

------------ ------------ -------------

Net (decrease)/increase in cash and

cash equivalents (186) (254) 60

Effect of foreign exchange rate changes - (8) (40)

------------ ------------ -------------

Cash and cash equivalents and overdrafts

at 1 January 1,269 1,249 1,249

Cash and cash equivalents and overdrafts

at period end 1,083 987 1,269

------------ ------------ -------------

Net debt comprises:

Cash and cash equivalents and overdrafts 1,083 987 1,269

Borrowings (10,100) (11,500) (10,650)

------------ ------------ -------------

Net debt at period end (9,017) (10,513) (9,381)

--------------------------------------------- ------ ------------ ------------ -------------

The cash and cash equivalents and overdrafts balance comprise

credit balances of GBP1,083,000 (2018: GBP1,275,000) which have

been set off against debit balances of GBP Nil (2018:

GBP288,000).

NOTES TO THE FINANCIAL STATEMENTS

for the half year ended 30 June 2019

1. GENERAL INFORMATION

The Pebble Beach Systems Group is a leading global software

business specialising in solutions for playout automation and

content, serving customers in the broadcast markets.

The Company is a public limited company and is quoted on the

Alternative Investment Market (AIM) of the London Stock Exchange.

The Company is incorporated and domiciled in the UK. The address of

its registered office is 12 Horizon Business Village, 1 Brooklands

Road, Weybridge, Surrey, KT13 0TJ.

The registered number of the Company is 04082188.

This half year results announcement was approved at close of

business on 9 September 2019.

2. BASIS OF PREPARATION

The Group financial statements have been prepared on a going

concern basis in accordance with International Financial Reporting

Standards as adopted by the European Union (IFRS), IFRIC

interpretations and the Company Act 2006 applicable to companies

reporting under IFRS.

The preparation of financial statements in conformity with IFRS

requires the use of certain critical accounting estimates. It also

requires management to exercise judgment in the process of applying

the Group's accounting policies. The areas involving a higher

degree of judgment or complexity, or areas where assumptions and

estimates are significant to the Group financial statements are

disclosed in note 4 of the Group financial statements.

During the current reporting period IFRS 16 Leases became

effective. The Group has adopted the modified retrospective

approach to implementation. Accordingly, comparative periods have

not been restated.

From 1 January 2019, at inception of a contract, the Group

assesses whether it is, or contains, a lease. A contract is, or

contains, a lease if it conveys the right to control the use of an

identified asset for a time in exchange for consideration. A

contract conveys the right to control the use of an asset, if the

Group receives substantially all of the economic benefits from its

use over time and controls how it is used.

At inception or on reassessment of a contract that contains a

lease component, the Group allocates the consideration in the

contract to each lease component based on their relative

stand-alone prices.

For contracts entered into before 1 January 2019, the Group

determined whether the arrangement was or contained a lease using

the same assessment.

The Group recognises a right-of-use asset and a lease liability

at the lease commencement date. The right of-of-use asset is

initially measured at cost. Cost comprises the initial amount of

the lease liability, adjusted for any lease payments made at or

before the commencement date, plus any initial direct costs

incurred and an estimate of costs to dismantle and remove the

underlying asset or the site on which it is located, less any lease

incentives received.

The right-of-use asset is subsequently depreciated using the

straight-line method from the commencement date to the earlier of

the end of its useful life or the end of the lease term. Useful

life is determined on the same basis as other property and

equipment.

The lease liability is initially measured at the present value

of the lease payments that are not paid at the commencement date,

discounted using the interest rate implicit in the lease, or if

that cannot be determined, the Group's incremental borrowing rate.

Generally, the Group uses its incremental borrowing rate as the

discount rate. The lease liability is measured at amortised cost

using the effective interest method.

The Group has elected not to recognise right-of-use assets and

lease liabilities for leases that have a term of 12 months or less.

The Group recognises the payments associated with these leases as

an expense on a straight-line basis over the lease term.

Under the previous policy none of the Group's leases were

classified as finance leases. Payments made under operating leases

were recognised in profit or loss on a straight-line basis over the

term of the lease. Lease incentives received were recognised as an

integral part of the total lease expense, over the term of the

lease.

The cumulative impact of the adoption of IFRS 16 has been

accounted for as an adjustment to equity. For leases classified as

operating leases in 2018 the Group did not recognise related assets

or liabilities, and instead charged the cost to the income

statement on a straight-line basis over the period of the lease and

disclosed its total commitment in the notes to the financial

statements. Instead of recognising an operating expense for its

operating lease payments, the Group has recognised GBP21,000

interest on its lease liabilities and GBP67,000 amortisation on its

right of use assets. Adjusted EBITDA has increased by GBP84,000

resulting from the reclassification of operating lease cost. It has

not had a material effect on the Group's income or net assets.

In addition, standards or amendments issued but not yet

effective are not expected to have a material impact on the net

assets of the Group.

The financial information contained in these condensed financial

statements has been computed in accordance with IFRS. However, this

announcement, due to its condensed nature, does not itself contain

sufficient information to comply with IFRS.

Going Concern

The directors are required to make an assessment of the Group's

ability to continue to trade as a going concern.

At 30 June 2019 net debt was GBP9.0 million (2018: GBP10.5

million) comprising net cash of GBP1.1 million (2018: GBP1.0

million) and bank debt of GBP10.1 million (2018: GBP11.5

million).

We maintain a good relationship with our bank. The current loan

agreement secures the facility until 30 November 2020 with banking

covenants and a repayment schedule in place.

In order to assess the appropriateness of preparing the

financial statements on a going concern basis, management have

prepared detailed projections of expected cash flows. These

projections include the continuing impact of cost reductions

implemented in past years, and margin improvement strategies and

sales growth in the future.

As part of the review, the Board considered sensitivities with

regards to the timing of revenue growth coming from the transition

in the broadcast industry from SDI to IP platforms. It looked at

sensitivities regarding gross margin and sales growth. Finally, it

considered sensitivities regarding the cost reductions.

The Board have concluded that the primary risk is one of ongoing

trading and therefore the Group and hence the Company remains a

going concern.

The Group has prepared forecasts which indicate that it is able

to meet its ongoing banking covenants and debt reduction

schedule.

We have a strong order book and pipeline which underpin our

third and fourth quarter revenue.

The Board remains confident about the future prospects for the

Group and have concluded that it is appropriate to prepare the

Group interim financial statements on a going concern basis.

3. ACCOUNTING POLICIES

Except as described above, the accounting policies applied are

consistent with those of the annual report and financial statements

for the year ended 31 December 2018, as described in those annual

report and financial statements.

Exceptional items are disclosed and described separately in the

financial statements where it is necessary to do so to provide

further understanding of the financial performance of the Group.

They are material items of income or expense that have been shown

separately due to the significance of their nature or amount.

Taxes on income in the half year periods are accrued using the

tax rate that would be applicable to expected total annual earnings

on a country by country basis.

4. SEGMENTAL REPORTING

The Group's internal organisational and management structure and

its system of internal financial reporting to the Board of

Directors comprise of Pebble Beach Systems Limited and Central

costs. The chief operating decision-maker has been identified as

the Board.

The Board reviews the Group's internal financial reporting in

order to assess performance and allocate resources. Management have

therefore determined that the operating segments for the Group will

be based on these reports.

The Pebble Beach Systems Limited business is responsible for the

sales and marketing of all Group software products and

services.

The table below shows the analysis of Group external revenue and

operating profit from continuing operations by business

segment.

Pebble Central Total

Beach Systems

GBP'000 GBP'000 GBP'000

----------------------------------------------- --------------- -------- --------

6 months to 30 June 2019 (Unaudited)

Total revenue 5,587 - 5,587

--------------- -------- --------

Adjusted EBITDA 2,328 (359) 1,969

Depreciation (126) - (126)

Amortisation and impairment of acquired

intangibles (511) - (511)

Amortisation of capitalised development

costs (432) - (432)

Non-recurring items - - -

Exchange (losses)/gains 20 4 24

Finance costs (25) (185) (210)

Finance income 1 - 1

Profit/(loss) before taxation 1,255 (540) 715

Taxation 70 (2) 68

Profit/(loss) for the period being

attributable to owners of the parent 1,325 (542) 783

----------------------------------------------- --------------- -------- --------

6 months to 30 June 2018 (Unaudited)

Total revenue 3,748 - 3,748

Adjusted EBITDA 758 (199) 559

Depreciation (65) - (65)

Amortisation and impairment of acquired

intangibles (704) - (704)

Amortisation of capitalised development

costs (400) - (400)

Non-recurring items (167) - (167)

Exchange (losses)/gains 26 - 26

Finance costs - (152) (152)

Finance income 2 1 3

Loss before taxation (550) (350) (900)

Taxation 117 - 117

Loss for the period being attributable

to owners of the parent (433) (350) (783)

----------------------------------------------- --------------- -------- --------

Year to 31 December 2018 (Audited)

Total revenue 9,174 - 9,174

--------------- -------- --------

Adjusted EBITDA 2,867 (397) 2,470

Depreciation (127) - (127)

Amortisation of acquired intangibles (1,419) - (1,419)

Amortisation of capitalised development

costs (828) - (828)

Non-recurring items (3,858) 3,554 (304)

Exchange (losses)/gains 46 (18) 28

Finance costs - (296) (296)

Finance income 3 1 4

Intercompany finance income/(costs) 118 (118) -

(Loss)/profit before taxation (3,198) 2,726 (472)

Taxation 254 (1) 253

Profit/(loss) for the year being attributable

to owners of the parent (2,944) 2,725 (219)

----------------------------------------------- --------------- -------- --------

GBP3.5 million intercompany debt between Pebble Beach Systems

Ltd and Pebble Beach Systems Group Plc was waived in December

2018.

Geographic external revenue analysis

The revenue analysis in the table below is based on the

geographical location of the customer for continuing operations of

the business.

6 months 6 months Year ended

to 30 June to 30 June 31 December

2018

2019 (Unaudited) 2018

(Unaudited) (Audited)

Total Total Total

GBP'000 GBP'000 GBP'000

---------------- ------------- ------------- -------------

By market

UK & Europe 2,807 1,589 4,820

North America 222 251 585

Latin America 683 242 513

Middle East 1,720 1,608 2,931

Asia / Pacific 155 58 325

5,587 3,748 9,174

---------------- ------------- ------------- -------------

Net assets

The table below summarises the net assets of the Group by

division. Balance sheet reporting is disclosed by the divisional

assets and liabilities of the Group as this is consistent with the

presentation of internal information provided to the Executive

Management Board and the Board of Directors.

6 months 6 months Year ended

to 30 June to 30 June 31 December

2019 2018 2018

Total Total Total

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

---------------------- ------------ ------------ -------------

By division:

Pebble Beach Systems 4,935 6,360 5,308

Central (10,487) (13,167) (11,453)

(5,552) (6,807) (6,145)

---------------------- ------------ ------------ -------------

5. OPERATING PROFIT

The following items have been included in arriving at the

operating profit for the continuing business:

6 months 6 months Year ended

to 30 June to 30 June 31 December

2019 2018 2018

Total Total Total

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

----------------------------------------------------------- ------------ ------------ -------------

Depreciation of property, plant and equipment 126 65 127

Amortisation of acquired intangibles 511 704 1,419

Operating lease rentals - 84 167

Exchange (gains)/ losses (credited)/charged

to profit and loss (24) (26) (28)

Research and development expenditure

in the year which includes: 717 1,222 1222

* Amortisation of capitalised development costs 432 400 828

----------------------------------------------------------- ------------ ------------ -------------

Non-recurring items

The following items are excluded from management's assessment of

profit because by their nature they could distort the Group's

underlying quality of earnings. They are excluded to reflect

performance in a consistent manner and are in line with how the

business is managed and measured on a day-to-day basis:

6 months 6 months Year ended

to 30 June to 30 June 31 December

2019 2018 2018

Total Total Total

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

-------------------------------------- ------------- ------------ -------------

Rationalisation and Redundancy costs - 167 358

Provision for former executive debt - - (54)

- 167 304

---------------------------------------------------- ------------ -------------

6. INCOME TAX EXPENSE

6 months 6 months Year ended

to 30 June to 30 June 31 December

2019 2018 2018

Total Total Total

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

--------------------------------------- ------------ ------------ -------------

Current tax

UK corporation tax - - 27

Foreign Tax - current year 19 3 -

Adjustments in respect of prior years - - (11)

--------------------------------------- ------------ ------------ -------------

Total current tax 19 3 16

--------------------------------------- ------------ ------------ -------------

Deferred tax

UK corporation tax - (120) (269)

Total deferred tax (87) (120) (269)

--------------------------------------- ------------ ------------ -------------

Total taxation (68) (117) (253)

--------------------------------------- ------------ ------------ -------------

Changes to the UK corporation tax rates were substantively

enacted on 7 September 2016. These include reductions to the main

rate to reduce the rate to 17 per cent from 1 April 2020. Deferred

tax has been provided for at the rate of 17 per cent (2018: 17 per

cent).

7. EARNINGS PER ORDINARY SHARE

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the year.

For diluted earnings per share the weighted average number of

ordinary shares in issue is adjusted to assume conversion of all

dilutive potential ordinary shares. The dilutive shares are those

share options granted to employees where the exercise price is less

than the average market price of the Company's ordinary shares

during the year.

Reconciliations of the earnings and weighted average number of

shares used in the calculations are set out below.

Year ended 31 December

6 months to 30 June 2019 2018

(Unaudited) (Audited)

Weighted Weighted

average Earnings average Earnings

number per number per

Earnings of shares share Earnings of shares share

GBP'000 '000s pence GBP'000 '000s pence

----------------------------- --------- ------------ ---------- --------- ------------ ----------

Basic earnings per share

Profit/(loss) attributable

to continuing operations 783 0.6p (219) (0.2)p

Profit attributable

to discontinued operations 16 0.0p 195 0.2p

----------------------------- --------- ------------ ---------- --------- ------------ ----------

Basic earnings/(loss)

per share 799 124,477 0.6p (24) 124,477 0.0p

----------------------------- --------- ------------ ---------- --------- ------------ ----------

Diluted earnings per

share

Profit/(loss) attributable

to continuing operations 783 0.6p (219) (0.2)p

----------------------------- --------- ------------ ---------- --------- ------------ ----------

Profit attributable

to discontinued operations 16 0.0p 195 0.2p

----------------------------- --------- ------------ ---------- --------- ------------ ----------

Diluted earnings/(loss)

per share 799 124,577 0.6p (24) 124,477 0.0p

----------------------------- --------- ------------ ---------- --------- ------------ ----------

6 months to 30 June 2018

(Unaudited)

Weighted

average Earnings

number per

Earnings of shares share

GBP'000 '000s pence

----------------------------- --------- ------------ ----------

Basic loss per share

Loss attributable to

continuing operations (783) (0.6)p

Profit attributable

to discontinued operations 56 0.0p

----------------------------- --------- ------------ ----------

Basic loss per share (727) 124,477 (0.6)p

----------------------------- --------- ------------ ----------

Diluted loss per share

Loss attributable to

continuing operations (783) (0.6)p

Profit attributable

to discontinued operations 56 0.0p

----------------------------- --------- ------------ ----------

Diluted loss per share (727) 124,477 (0.6)p

----------------------------- --------- ------------ ----------

Potential ordinary shares were non-dilutive in the prior periods

because they would decrease the loss per share from continuing

operations. Accordingly, there was no difference between basic and

diluted EPS.

Adjusted earnings

The directors believe that adjusted EBITDA, adjusted profit

before tax, adjusted earnings and adjusted earnings per share

provide additional useful information on underlying trends to

shareholders. These measures are used by management for internal

performance analysis and incentive compensation arrangements. The

term "adjusted" is not a defined term used under IFRS and may not

therefore be comparable with similarly titled profit measurements

reported by other companies. The principal adjustments are made in

respect of the amortisation of acquired intangibles and capitalised

development costs, non-recurring items and exchange gains or losses

charged to the income statement and their related tax effects.

The reconciliation between reported and underlying earnings and

basic earnings per share is shown below:

6 months 6 months Year ended

to 30 June to 30 June 31 December

2019 2018 2018

Total Total Total

(Unaudited) (Unaudited) (Audited)

Earnings Earnings Earnings

GBP'000 Pence GBP'000 Pence GBP'000 Pence

------------------------------------------ -------- ------ -------- ------- -------- -------

Reported earnings/(loss) per share

- continuing operations 783 0.6p (783) (0.6)p (219) (0.2)p

Depreciation 105 0.1p 54 0.0p 105 0.1p

Amortisation of acquired intangibles

after tax 424 0.3p 584 0.4p 1,178 0.9p

Amortisation of capitalised development

costs 359 0.3p 332 0.3p 687 0.6p

Non-recurring items after tax - - 135 0.1p 245 0.2p

Exchange losses/(gains) (19) 0.0p (21) 0.0p (23) 0.0p

-------- ------ -------- ------- -------- -------

Adjusted earnings per share - continuing

operations 1,652 1.3p 301 0.2p 1,973 1.6p

------------------------------------------ -------- ------ -------- ------- -------- -------

8. CASH FLOW GENERATED FROM OPERATING ACTIVITIES

Reconciliation of loss before taxation to net cash flows from

operating activities.

6 months 6 months Year ended

to 30 June to 30 June 31 December

2019 2018 2018

Total Total Total

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

----------------------------------------------- ------------ ------------ -------------

Profit/(loss) before tax - continuing

operations 715 (900) (472)

Profit before tax - discontinued operations 16 56 184

----------------------------------------------- ------------ ------------ -------------

Total profit/(loss) before tax 731 (844) (288)

Depreciation of property, plant and equipment 126 65 127

Loss on disposal of property, plant and

equipment - - 10

Amortisation and impairment of development

costs 432 400 828

Amortisation and impairment of acquired

intangibles 511 703 1,419

Finance income (1) (3) (4)

Finance costs 210 152 295

Decrease/(increase) in inventories (28) 5 15

Decrease/(increase) in trade and other

receivables (581) 955 848

Decrease in trade and other payables (137) (942) (811)

Decrease in provisions (200) (200) (400)

----------------------------------------------- ------------ ------------ -------------

Net cash generated from operating activities 1,063 291 2,039

----------------------------------------------- ------------ ------------ -------------

9. NET FUNDS

Reconciliation of change in cash and cash equivalents to

movement in net cash:

Net cash and Other borrowings Total net

cash equivalents GBP'000 cash

GBP'000 GBP'000

------------------------------------------- ------------------ ----------------- ----------

At 1 January 2019 1,269 (10,650) (9,381)

Cash flow for the period before financing 364 - 364

Movement in borrowings in the period (550) 550 -

Exchange rate adjustments - - -

------------------------------------------- ------------------ ----------------- ----------

Cash and cash equivalents at 30 June

2019 (Unaudited) 1,083 (10,100) (9,017)

------------------------------------------- ------------------ ----------------- ----------

At 1 January 2018 1,249 (11,500) (10,251)

Cash flow for the period before financing (254) - (254)

Movement in borrowings in the period - - -

Exchange rate adjustments (8) - (8)

------------------------------------------- ------------------ ----------------- ----------

Cash and cash equivalents at 30 June

2018 (Unaudited) 987 (11,500) (10,513)

------------------------------------------- ------------------ ----------------- ----------

At 1 January 2018 1,249 (11,500) (10,251)

Cash flow for the year before financing 910 - 910

Movement in borrowings in the year (850) 850 -

Exchange rate adjustments (40) - (40)

------------------------------------------- ------------------ ----------------- ----------

Cash and cash equivalents at 31 December

2018 (Audited) 1,269 (10,650) (9,381)

------------------------------------------- ------------------ ----------------- ----------

Ends

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR BRGDCGSGBGCC

(END) Dow Jones Newswires

September 10, 2019 02:01 ET (06:01 GMT)

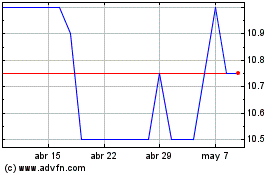

Pebble Beach Systems (LSE:PEB)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Pebble Beach Systems (LSE:PEB)

Gráfica de Acción Histórica

De May 2023 a May 2024