TIDMWPHO

RNS Number : 0489O

Windar Photonics PLC

30 September 2019

30 September 2019

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Windar Photonics plc

("Windar", the "Company" or the "Group")

Unaudited interim report for the six months ended 30 June

2019

Windar Photonics plc (AIM:WPHO), the technology group that has

developed a cost efficient and innovative LiDAR wind sensor for use

on electricity generating wind turbines, is pleased to announce its

unaudited interim results for the six months ended 30 June

2019.

Highlights for the first six months of 2019:

-- Revenue of EUR0.7 million (H1 2018: EUR1.7 million) due to

the rescheduling of customer orders from H1 to H2 and decision to

terminate the Company's relationship with a Chinese distributer,

better positioning Windar for future OEM contracts

-- OEM discussions are progressing positively and Windar

anticipates receiving first orders for LiDAR roll-out within the

strategically important OEM market in the near future

-- Gross profit of EUR0.4 million (H1 2018: EUR0.8 million)

-- Gross margin for the period was consistent with prior period at 49.2% (H1 2018: 49.1%)

-- Operating costs increased to EUR1.5 million including

depreciation, amortisation and warrant costs (H1 2018: EUR1.1

million)

-- Net loss of EUR1.0 million (H1 2018: EUR0.3 million)

-- Cash held at the end of the period amounted to EUR0.3 million

(H1 2018: 0.3 million). In addition, the Company had restricted

cash of EUR0.4 million (H1 2018: EUR0.3 million)

Jørgen Korsgaard Jensen, Chief Executive Officer of the Company,

commented: "Although our results for the period have been affected

by some customer rescheduling and a decision to position ourselves

more strongly for OEM contracts currently under negotiation, we

currently expect to achieve a revenue for the full year 2019 equal

to or better than 2018. The traction we are experiencing with

customers is pleasing and we look forward to updating the market

regarding progress being made in relation to our OEM and IPP

strategies in the coming months."

For further information:

Windar Photonics plc Jørgen Korsgaard Jensen, CEO +4524234930

Cantor Fitzgerald Europe David Foreman (Corporate Finance)

Nominated Adviser and Broker Keith Dowsing (Sales) +44 (0)20 7894 7000

Elisabeth Cowell

Newgate Communications Adam Lloyd

Financial PR Tom Carnegie +44 (0)20 7680 6550

The person responsible for arranging the release of this

announcement on behalf of Windar is Jørgen Korsgaard Jensen.

About Windar:

Windar Photonics is a technology group that develops

cost-efficient and innovative Light Detection and Ranging ("LiDAR")

optimisation systems for use on electricity generating wind

turbines. LiDAR wind sensors in general are designed to remotely

measure wind speed and direction.

http://investor.windarphotonics.com

CHAIRMAN'S STATEMENT

The results for the first six months of 2019 were impacted by

two factors. Firstly, in relation to our retro-fit product,

WindEYE, we saw a number of contracted orders in Asia re-scheduled

for delivery in the second half of the financial year instead of

the first half of 2019. Secondly, the Company decided to terminate

one of its distributor relationships in China in order to better

position itself strategically in this world leading OEM market.

Certain provisions in the agreement with that distributer had the

potential to compromise major OEM agreements that the Group is

currently advancing.

While the results for the first half of 2019 appear

disappointing, these do not reflect the progress Windar is making

in terms of securing volume sales in the OEM market. Pleasingly,

the Company has expanded the number of OEM test projects underway

and has achieved final approvals from some major OEMs. We expect to

reach the important milestone of receiving first orders for LiDAR

roll-out within the strategically important OEM market in the near

future.

R&D remains an important part of our business and in the

first half of 2019 two major projects were completed. New

technology has been installed into our product offerings, enhancing

our value proposition for customers. Accordingly, both our future

OEM and retro-fit customers can now benefit from our wake

technology, which both detects wake scenarios and demonstrates

strategies for turbine optimisation in these scenarios. We have

also expanded our WindTimizer retro-fit plug'n'play solution for

yaw optimisation so that it handles analogue sensor interfaces.

This will significantly expand the market opportunities for our

retro-fit product in Asia and beyond.

Importantly, and whilst it has taken longer than the Board

originally envisaged, we also expect to see deliveries through our

distribution agreement with Vestas in H2 2019. These deliveries

will strengthen the Group's revenue from the IPP retrofit

market.

Financial Overview

Overall, the Group realised a net loss of EUR1.0 million for the

period (H1 2018: EUR0.3 million loss) after depreciation,

amortisation and warrant costs of EUR0.14 million (H1 2018: EUR0.17

million).

Cash flow from operations produced a net outflow of EUR1.7

million for the period compared to a net outflow of EUR0.8 million

in H1 2018. The increased outflow during the period was primarily

driven by the operational results combined with an increase in

inventory of EUR0.4 million during the period, in anticipation of

an increase in orders for our retro-fit WindEYE product.

Trade receivables (net of impairment provision) increased to

EUR788k during the period, principally due to the timing of several

deliveries in the second quarter.

Outlook

Based upon current traction with our customers and our increased

product offering, the Directors believe the Group is well

positioned for substantial growth in the future. With our knowledge

at present, we expect to recoup the ground lost in the first half

and generate revenue for the full year 2019 equal to or better than

2018. Consequently, the net result in the second half of 2019 is

expected to show a substantial improvement to our H1 performance

and combined with an anticipated reduction of the inventory as at

30 June 2019, the Board are expect the Group will generate positive

operating cash flows in the second half of 2019 and an increase in

net cash available at the full financial year end.

Johan Blach Petersen

Chairman

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE

INCOME

FOR THE SIX MONTHSED 30 JUNE 2019

Six months Six months Year ended

ended ended 31 December

30 June 30 June 2018

2019 2018

(unaudited) (unaudited) (audited)

Note EUR EUR EUR

Revenue 730,597 1,671,587 3,499,867

Cost of goods sold (371,218) (850,433) (1,744,571)

Gross profit 359,379 821,155 1,755,296

Administrative expenses (1,451,745) (1,102,849) (2,391,798)

Impairment loss - - (39,182)

Other operating income 16,075 34,326 32,201

Loss from operations (1,076,291) (247,367) (643,483)

Finance expenses (53,081) (59,894) (269,925)

Loss before taxation (1,129,372) (307,261) (913,408)

Taxation 90,437 12,763 120,436

Loss for the period (1,038,935) (294,498) (792,972)

Other comprehensive income

Items that will or maybe reclassified

to profit or loss:

Exchange losses arising on

translation of foreign operations 5,094 (6,207) (2,125)

Total comprehensive loss for

the period (1,033,841) (300,705) (795,097)

============ ============ =========================

Loss per share for loss attributable

to the ordinary equity holders

of Windar Photonics plc

Basic and diluted, cents per

share 2 (2.3) (0.70) (1.8)

------------ ------------ -------------------------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE

2019

As at As at As at

30 June 30 June 31 December

2019 2018 2018

(unaudited) (unaudited) (audited)

Notes EUR EUR EUR

Assets

Non-current assets

Intangible assets 976,133 847,300 982,888

Property, plant & equipment 89,692 99,491 110,788

Deposits 43,796 47,448 46,285

Total non-current assets 1,109,621 994,238 1,139,961

-------------------------------- ------ ------------- -------------------- --------------------

Current assets

Inventory 3 1,088,878 654,500 726,999

Trade receivables 4 787,696 951,793 638,138

Other receivables 4 378,062 275,366 286,473

Prepayments 65,412 55,971 83,763

Restricted cash and cash

equivalents 368,000 312,864 518,138

Cash and cash equivalents 268,581 260,606 1,721,803

Total current assets 2,956,629 2,511,100 3,975,314

-------------------------------- ------ ------------- -------------------- --------------------

Total assets 4,066,250 3,505,338 5,115,275

-------------------------------- ------ ------------- -------------------- --------------------

Equity

Share capital 5 560,859 530,543 560,859

Share premium 12,558,434 10,281,073 12,558,434

Merger reserve 2,910,866 2,910,866 2,910,866

Foreign currency reserve (15,319) (25,797) (21,715)

Accumulated loss (14,297,994) (12,765,726) (13,287,757)

Total equity 1,716,846 930,959 2,720,687

-------------------------------- ------ ------------- -------------------- --------------------

Non-current liabilities

Warranty provisions 78,461 74,659 78,422

Loans 6 1,193,867 1,080,485 1,135,744

-------------------------------- ------ ------------- -------------------- --------------------

Total non-current liabilities 1,272,328 1,155,144 1,214,166

-------------------------------- ------ ------------- -------------------- --------------------

Current liabilities

Trade and other payables 7 523,745 815,532 492,822

Other liabilities 7 376,930 386,477 588,456

Invoice discounting 7 143,532 205,717 10,735

Deferred revenue 7 27,473 6,709 83,169

Loans 7 5,396 4,800 5,240

-------------------------------- ------ ------------- -------------------- --------------------

Total current liabilities 1,077,076 1,419,235 1,180,422

-------------------------------- ------ ------------- -------------------- --------------------

Total liabilities 2,349,404 2,574,379 2,394,588

-------------------------------- ------ ------------- -------------------- --------------------

Total equity and liabilities 4,066,250 3,505,338 5,115,275

-------------------------------- ------ ------------- -------------------- --------------------

CONSOLIDATED CASH FLOW STATEMENT FOR THE SIX MONTHSED

30 JUNE 2019

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2019 2018 2018

(unaudited) (unaudited) (audited)

EUR EUR EUR

Loss for the period before

tax (1,129,372) (307,261) (913,408)

Adjustments for:

Finance expenses 53,081 59,894 269,925

Amortisation 89,417 104,061 189,557

Depreciation 21,164 20,141 64,078

Received tax credit - - 66,095

Foreign exchange difference 5,094 (6,207) (84,759)

Warrants expense 30,000 50,000 26,443

---------------------------------------- -------------- -------------- ---------------

(930,616) (79,372) (382,069)

Movements in working capital

Changes in inventory (361,880) 85,110 12,611

Changes in receivables (150,633) (616,459) (285,731)

Changes in trade payables 30,376 (229,984) (552,147)

Changes in deferred revenue (55,696) (7) 76,453

Changes in warranty provision 39 (74) 6,218

Changes in other payables

and provision (190,529) 77,017 263,442

Cash flow (used in) operations (1,658,939) (763,769) (861,223)

---------------------------------------- -------------- -------------- ---------------

Investing activities

Payments for intangible assets (79,497) (170,084) (415,456)

Grants received - 78,172 108,779

Payments for tangible assets - - (68,125)

Cash flow (used in) investing

activities (79,497) (91,912) (374,802)

---------------------------------------- -------------- -------------- ---------------

Financing activities

Proceeds from issue of share

capital - - 2,500,877

Costs associated with the

issue of share capital - - (193,199)

(Reduction) / proceeds from

invoice discounting (2,158) 84,508 (110,474)

(Decrease)/ increase restricted

cash balances 282,935 (78,172) (283,446)

Repayment of loans (2,732) (3,727) (4,579)

Foreign exchange rate gains/(losses) - 22,886 -

Interest (paid) 7,200 (22,377) (66,537)

Cash flow from financing activities 285,245 3,118 1,842,642

---------------------------------------- -------------- -------------- ---------------

Net (decrease)/increase in

cash and cash equivalents (1,453,191) (852,563) 606,617

Exchange differences (31) (3,334) (1,317)

Cash and cash equivalents at

the beginning of the period 1,721,803 1,116,503 1,116,503

Cash and cash equivalents at

the end of the period 268,581 260,606 1,721,803

---------------------------------------- -------------- -------------- ---------------

INTERIM CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE SIX

MONTHS

ED 30 JUNE 2019

Share Share Merger Foreign Accumulated Total

Capital Premium reserve currency Losses

reserve

EUR EUR EUR EUR EUR EUR

--------------------- --------- ------------------- ---------- ---------- ------------- ------------

At 1 January 2018 530,543 10,281,073 2,910,866 (19,590) (12,521,228) 1,181,664

Share option and

warrant costs - - - - 50,000 50,000

--------- ------------------- ---------- ---------- ------------- ------------

Transaction with

owners - - - - 50,000 50,000

--------- ------------------- ---------- ---------- ------------- ------------

Comprehensive loss

for the period - - - - (294,498) (294,498)

Other comprehensive

loss - - - (6,207) - (6,207)

Total comprehensive

income - - - (6,207) (294,498) (300,705)

At 30 June 2018 530,543 10,281,073 2,910,866 (25,797) (12,765,726) 930,959

New shares issued 30,316 2,470,560 - - - 2,500,876

Costs associated

with capital raise - (193,199) - - - (193,199)

Share option and

warrant costs - - - - 26,443 26,443

--------- ------------------- ---------- ---------- ------------- ------------

Transaction with

owners 30,316 2,277,361 - - 26,443 2,334,120

--------- ------------------- ---------- ---------- ------------- ------------

Comprehensive loss

for the period - - - - (548,474 (548,474)

Other comprehensive

income - - - 4,082 - 4,082

Total comprehensive

income - - - 4,082 (548,474) (544,392)

At 31 December 2018 560,859 12,558,434 2,910,866 (21,715) (13,287,757) 2,720,687

Share option and

warrant costs - - - - 30,000 30,000

--------- ------------------- ---------- ---------- ------------- ------------

Transaction with

owners - - - - 30,000 30,000

--------- ------------------- ---------- ---------- ------------- ------------

Comprehensive loss

for the period - - - - (1,038,935) (1,038,935)

Other comprehensive

Income - - - 5,094 - 5,094

Total comprehensive

income - - - 5,094 (1,038,935) (1,033,841)

At 30 June 2019 560,859 12,558,434 2,910,866 (16,621) (14,296,692) 1,716,846

1. BASIS OF PREPARATION

The financial information for the six months ended 30 June 2019

and 30 June 2018 does not constitute the Groups statutory financial

statements for those periods with the meaning of Section 434(3) of

the Companies Act 2006 and has neither been audited or reviewed

pursuant to guidance issued by the Auditing Practices Board. The

annual financial statements of Windar Photonics plc are prepared in

accordance with International Financial Reporting Standards as

endorsed by the European Union ("IFRS"). The principal accounting

policies used in preparing the Interim financial statements are

those that the Group expects to apply in its financial statements

for the year ended 31 December 2019 and are unchanged from those

disclosed in the Group's Annual Report for the year ended 31

December 2018, except for the adoption of IFRS 16. The comparative

financial information for the year ended 31 December 2018 included

within this report does not constitute the full statutory accounts

for that period. The statutory Annual Report and Financial

Statements for 2018 have been filed with the Registrar of

Companies. The Independent Auditor's Report on the Annual Report

and Financial Statements for 2018 was unqualified, but included a

reference to the material uncertainty related to going concern in

respect of the timing of future revenues without qualifying their

report and did not contain a statement under section 498(2)-498(3)

of the Companies Act 2006. After making enquiries, the directors

have a reasonable expectation that the Group has adequate resources

to continue operating for the next 12 months. Accordingly, they

continue to adopt the going concern basis in preparing the half

yearly condensed consolidated financial statements. This interim

report was approved by the directors.

2. Loss per share

The loss and weighted average number of ordinary shares used in

the calculation of basic loss per share are as follows:

Six months Six months Year ended

ended ended 31 December

30 June 30 June 2018

2019 2018

EUR EUR EUR

Loss for the period (1,038,935) (294,498) (792,972)

------------- ------------ -------------

Weighted average number of ordinary

shares for the purpose of basic

earnings per share 44,508,369 41,808,369 43,002,600

Basic loss and diluted, cents per

share (2.3) (0.70) (1.8)

------------- ------------ -------------

There is no dilutive effect of the warrants as the dilution

would reduce the loss per share.

3. Inventory

As at

As at As at 31 December

30 June 30 June 2018

2019 2018

EUR EUR EUR

Raw materials 544,439 297,347 364,090

Work in progress 446,440 333,004 311,420

Finished goods 97,999 24,149 51,489

Inventory 1,088,878 654,500 726,999

------------------ ------------ ---------- -------------

4. Trade and other receivables

As at

As at As at 31 December

30 June 30 June 2018

2019 2018

EUR EUR EUR

--------------------------------------- ---------- ------------ -------------

Trade receivables 835,2606 (999,428)3 685,679

Less; provision for impairment

of trade receivables (47,564) (47,635) (47,541)

--------------------------------------- ---------- ------------ -------------

Trade receivables - net 787,696 951,793 638,138

Total financial assets other than

cash and cash equivalents classified

at amortised costs 787,696 951,793 638,138

--------------------------------------- ---------- ------------ -------------

Tax receivables 210,723 78,932 120,209

Other receivables 167,339 196,502 166,264

Total other receivables 378,062 275,434 286,473

Total trade and other receivables 1,165,758 1,227,227 924,611

--------------------------------------- ---------- ------------ -------------

Classified as follows:

Current Portion 1,165,758 1,227,227 924,611

--------------------------------------- ---------- ------------ -------------

5. Share capital

Number of shares EUR

Shares as 30 June 2018 41,808,369 530,543

Issue of shares for cash 2,700,000 30,316

Shares at 31 December 2017 and

31 December 2018 44,508,369 560,859

Shares at 30 June 2019 44,508,369 560,859

----------------------------------- ----------- --------

At 30 June 2019, the share capital comprises 44,508,369 shares

of 1 pence each.

6. Borrowings

The carrying value and fair value of Group's borrowings are as

follows:

Six months Six months Year ended

ended ended 31 December

30 June 30 June 2018

2019 2018

EUR EUR EUR

Growth Fund (including accrued

interest) 1,185,764 1,066,765 1,124,914

Nordea Ejendomme 8,103 13,720 10,830

Total financial assets other than

cash and cash equivalents classified

as loans and receivables 1,193,867 1,080,485 1,135,744

--------------------------------------- ----------- ----------- -------------

The Growth Fund borrowing from the Danish public institution,

Vækstfonden, bears interest at a rate of 12 per cent. The borrowing

is a bullet loan with maturity in June 2020. The Group may at any

point in time either repay the loan in part or in full or initiate

an annuity repayment scheme over four years. If an annuity

repayment scheme is initiated, the interest rate will be reduced to

8 per cent in the repayment period.

The loan from Nordea Ejendomme is in respect of amounts included

in the fitting out of the offices in Denmark. The loan is repayable

over the 6 years and matures I November 2021 and carries a fixed

interest rate of 6 per cent.

Both loans are denominated in Danish Kroner.

7. Trade and other payables

As at As at

As at 30 June 31 December

30 June 2019 2018 2018

EUR EUR EUR

Invoice discounting 143,532 205,717 10,735

Trade payables 523,746 815,532 492,822

Other payables and accruals 376,930 386,477 588,456

Current portion of Nordea

Ejendomme loan 5,396 4,800 5,240

Total financial liabilities,

excluding 'non-current'

loans and borrowings classified

as financial liabilities

measured at amortised cost 1,049,604 1,412,526 1,097,253

---------------------------------- --------------- ------------ -------------

Deferred revenue 27,473 6,709 83,169

---------------------------------- --------------- ------------ -------------

Total trade and other payables 1,077,076 1,419,235 1,182,422

---------------------------------- --------------- ------------ -------------

Classified as follows:

Current Portion 1,077,076 1,419,235 1,182,422

---------------------------------- --------------- ------------ -------------

There is no material difference between the net book value and

the fair values of current trade and other payables due to their

short-term nature.

8. Availability of Interim Report

Copies of the Interim Report will not be sent to shareholders

but will be available from the Group's website

www.investor.windarphotonics.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR BCGDCRUDBGCC

(END) Dow Jones Newswires

September 30, 2019 02:02 ET (06:02 GMT)

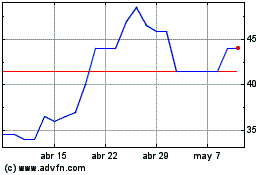

Windar Photonics (LSE:WPHO)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Windar Photonics (LSE:WPHO)

Gráfica de Acción Histórica

De May 2023 a May 2024