TIDMTST

RNS Number : 1322O

Touchstar PLC

28 May 2020

28 May 2020

Touchstar plc

Preliminary results for the year ended 31 December 2019

The Board of Touchstar plc ((AIM:TST) 'Touchstar', the 'Company'

or 'the Group'), suppliers of mobile data computing solutions and

managed services to a variety of industrial sectors, is pleased to

announce its final results for the year ended 31 December 2019.

Key Financials:

31 December 31 December

2019 2018

GBP7,119,000 GBP6,898,000 Increase 3.2%

* Revenue (including discontinued operations)

GBP(89,000) GBP(582,000) Reduction 85%

* 'Trading loss after tax before exceptional costs *

GBP1,200,000 GBP254,000 Increase 372%

* Order book at year end

Improvement

* Adjusted earnings per share (1.05)p (6.95)p 85%

GBP850,000 GBP296,000 Increase GBP554,000

* Net cash at year end

GBP412,000 GBP334,000

* Exceptional costs

GBP(501,000) GBP(916,000)

* Loss after tax

* Basic earnings per share (5.91)p (10.94)p

* Refer to note 6 for definition

Commenting today, Ian Martin, Chairman of Touchstar, said:

"Our achievements in 2019 - increasing the order book (at the

year-end by 372%), generating GBP554,000 of free cash, selling

Onboard (our loss-making airline business) and lowering the cost

base by over GBP500,000 - all had outcomes that brought benefits to

the longer term, and in this C-19 crisis they are vital factors

assisting us to survive and then prosper.

At the start of the C-19 event Touchstar plc was defensively

positioned with cash in the bank, no net debt, a lowered cost base,

a strong order book. We traded profitably in the first quarter of

2020, in what is historically a weak quarter for the Group.

That trend continued into April, our current expectation is the

momentum we had in place going into the crisis should enable a

favourable outcome at the half year.

How this ultimately plays out is candidly impossible to predict.

We are working tirelessly to navigate a path through the C-19

crisis. We are blessed with many positive factors which are

currently keeping us on track."

This announcement contains inside information as defined in

Article 7 of the Market Abuse Regulation No. 596/2014 and is

disclosed in accordance with the Company's obligations under

Article 17 of those Regulations.

For further information please contact:

Touchstar plc Ian Martin 0161 8745050

0161 874

Mark Hardy 5050

WH Ireland - Nominated Mike Coe/ Chris 0117 945

Adviser Savidge 3472

Information on Touchstar plc can be seen at:

www.touchstarplc.com

CHAIRMAN'S STATEMENT 2019

I hope everyone is all right in what are uncertain, strange and

troubling times for many people.

I am breaking with convention in this statement. I will cover

both the statutory reporting on the results for the year ended 31

December 2019 ("FY2019") and the impact of the current Covid C-19

("C-19") crisis on Touchstar.

Shareholders will probably be as interested in the shape of

Touchstar today as in the results for FY2019, in what is a

radically changed world - 2019 feels a long time ago.

Our achievements in 2019 - increasing the order book (at the

year-end by 372%), generating GBP554,000 of free cash, selling

Onboard (our loss-making airline business) and lowering the cost

base by over GBP500,000 - all had outcomes that brought benefits to

the longer term, and in this C-19 crisis they are vital factors

assisting us to survive and then prosper.

In outlining our response to the C -19 crisis I will not

speculate about the macro issues of this pandemic as I am not

qualified to do so, but I will focus on the actions we have taken

and summarise what we are expecting.

At Touchstar we are very determined to navigate through what are

very challenging times.

Financial Results 2019

The Group's results for FY2019 show a top line revenue growth of

3.2% to GBP7.1 million (FY 2018: GBP6.9 million). If one focuses on

continuing operations (that is excluding Onboard) the growth rate

was even more impressive at 7.2%, with revenue rising to GBP6.7

million (FY2018: GBP6.2 million).

Sales growth was driven by Touchstar's new products and services

as they became established. The year-end order book was up 372% to

GBP1.2 million compared with GBP0.25 million at the end of

2018.

Margins continued to rise to 53.9% (FY2018: 51.1%) reflecting a

continuation of the move to a more software and solution orientated

sale.

Improved margins, combined with the revenue growth, resulted in

the after-tax loss before exceptional costs being reduced by 85% to

GBP89,000 (FY2018: loss GBP582,000). The adjusted loss per share

was 1.05p (FY2018: loss 6.95p).

As of 31 December 2019, the Group had net cash of GBP850,000

(FY2018: GBP296,000).

I have often referenced the cash generative nature of our

business. In 2019 we generated GBP554,000 of free cash. This was

achieved even after a further GBP1.1 million was invested in new

product development and a sizeable cash outflow arising from

exceptional costs of GBP412,000 (FY2018: GBP334,000) associated

with the restructuring and the well-timed sale of our loss-making

airline business. We entered 2020 with a cost base lowered by

GBP571,000.

In the last quarter of 2019 Jon Hall stepped down as a director

of the company. Jon had been with Touchstar for many years and I

would like to wish him all the best and thank him again for his

contribution.

Broadly, 2019 was a year of progress and we began the new year

with a record order book and feeling very optimistic for 2020.

Covid -19 Crisis (C-19)

At the start of the C-19 crisis Touchstar plc was defensively

positioned with cash in the bank, no net debt, a lowered cost base,

a strong order book. We traded profitably in the first quarter of

2020, in what is historically a weak quarter for the Group,

achieving revenue growth of 49% on continuing business compared to

Q1 2019, as the healthy order book flowed into revenue. The whole

Group worked flat out to complete orders, ship to clients and

invoice, so that orders could be turned into cash.

When the official UK lockdown began on the 23 March 2020, we

began work to ensure that Touchstar got through the crisis with its

workforce and business intact.

To this we are focussed upon three factors. First, looking after

our employees; second, to continue to support our existing

customers; and thirdly, cash.

History would suggest that even after the lifting of the

lockdown it will take at least 18 months for trading levels to

normalise. We therefore launched a series of self-help measures.

The self-help measures we have taken include reductions in staff

costs, property rentals and software development, as well as

utilising UK government schemes such as the Coronavirus Job

Retention Scheme, and taken the opportunity to delay the payment of

PAYE, NI and VAT.

Shareholders should note that all employees have made a large

collective sacrifice in this time of C-19 crisis by agreeing to

take substantially lower salaries for the duration of lockdown -

whether furloughed or working.

This shows how much we all believe in this business. It is that

spirit which gives me confidence and additional resolve to drive

forward and through this difficult time.

We made an application on 14th April through Barclays Bank to

participate in the UK Government's Coronavirus Business

Interruption Loan Scheme (CBILS), as yet we have not had a reply.

Even without this loan the balance sheet remains robust, we have no

net debt and cash in the bank of a similar level to just before the

C-19 crisis impacted the UK economy.

Touchstar serves sectors classified by the UK government as

"essential services". Revenues from these organisations comprised

70% of Group sales in 2019 and included NHS hospitals, care homes,

food factories, food distribution, schools, government buildings,

petrol forecourt deliveries, and oil and gas transportation and

throughout the crisis we have received new orders. To date we have

outperformed the roadmap we put in place as this crisis unfolded,

the short-term effect on Touchstar has been less severe than we had

planned to expect.

Trading in the first quarter was profitable. That trend

continued into April, our current expectation is the momentum we

had in place going into the crisis should enable a favourable

outcome at the half year.

How this ultimately plays out is candidly impossible to predict.

We are working tirelessly to navigate a path through the C-19

crisis. We are blessed with many positive factors which are

currently keeping us on track.

Take care, keep safe and I truly hope that my next communication

is in a happier time.

I Martin

Executive Chairman

28 May 2020

Consolidated income statement for the year ended 31 December

2019

2019 2018

GBP'000 GBP'000

------------ ------------- -------- ------------ ------------- ---------

Continuing Discontinued TOTAL Continuing Discontinued TOTAL

operations operations operations operations

Revenue 6,654 465 7,119 6,203 695 6,898

Cost of sales (3,207) (70) (3,277) (3,113) (257) (3,370)

------------------------- ------------ ------------- -------- ------------ ------------- ---------

Gross profit 3,447 395 3,842 3,090 438 3,528

Distribution costs (55) - (55) (63) (3) (66)

Administrative expenses (4,040) (551) (4,591) (3,752) (1,026) (4,778)

------------------------- ------------ ------------- -------- ------------ ------------- ---------

Operating (loss)/profit

before exceptional

items (451) 59 (392) (725) (257) (982)

Exceptional costs

included in admin

expenses (197) (215) (412) - (334) (334)

------------------------- ------------ ------------- -------- ------------ ------------- ---------

Operating loss (648) (156) (804) (725) (591) (1,316)

Finance costs (25) - (25) (4) - (4)

------------------------- ------------ ------------- -------- ------------ ------------- ---------

Loss before income

tax (673) (156) (829) (729) (591) (1,320)

Income tax credit 328 - 328 404 - 404

------------------------- ------------ ------------- -------- ------------ ------------- ---------

Loss for the year

attributable to

the owners of the

parent (345) (156) (501) (325) (591) (916)

------------------------- ------------ ------------- -------- ------------ ------------- ---------

(Loss)/earnings per ordinary share (pence) attributable to owners

of the parent during the year:

2019 2018

------------------------- ------------ ------------- -------- ------------ ------------- ---------

Basic (5.91)p (10.94)p

Adjusted (1.05)p (6.95)p

There is no other comprehensive income or expense in the current

year or prior year and consequently no statement of other

comprehensive income or expense has been presented.

The Company has elected to take the exemption under section 408

of the Companies Act 2006 not to present the parent Company income

statement. The loss for the Company is detailed in the Statement of

financial position and the Company statement of changes in

shareholders' equity.

Consolidated statement of changes in equity for the year ended

31 December 2019

Share Share premium Retained

capital account earnings Total equity

GBP'000 GBP'000 GBP'000 GBP'000

--------------------- ---------------------- -------------- ---------- -------------

At 1 January 2018 315 - 1,765 2,080

Share Issue 109 1,191 - 1,300

Cost of share issue - (72) - (72)

Loss for the year - - (916) (916)

At 31 December 2018 424 1,119 849 2,392

Loss for the year - - (501) (501)

At 31 December 2019 424 1,119 348 1,891

--------------------- ---------------------- -------------- ---------- -------------

Company statement of changes in equity for the year ended 31

December 2019

Share Share premium Retained

capital account earnings Total equity

GBP'000 GBP'000 GBP'000 GBP'000

--------------------- ---------------------- -------------- ---------- -------------

At 1 January 2018 315 - 773 1,088

Share Issue 109 1,191 - 1,300

Cost of share issue - (72) - (72)

Loss for the year - - (3,476) (3,476)

At 31 December 2018 424 1,119 (2,703) (1,160)

Loss for the year - - (2) (2)

--------------------- ---------------------- -------------- ---------- -------------

At 31 December 2019 424 1,119 (2,705) (1,162)

--------------------- ---------------------- -------------- ---------- -------------

Consolidated and Company statements of financial position as at

31 December 2019

Group Company

2019 2018 2019 2018

GBP'000 GBP'000 GBP'000 GBP'000

----------------------------- ------------------ ------------------- ---------------- -----------------

Non-current assets

Intangible assets 1,499 1,352 - -

Property, plant and

equipment 175 228 - -

Right-of-use assets 522 - - -

Deferred tax assets 111 157 - -

------------------------------ ------------------ ------------------- ---------------- -----------------

2,307 1,737 - -

----------------------------- ------------------ ------------------- ---------------- -----------------

Current assets

Inventories 891 1,210 - -

Trade and other receivables 1,317 1,928 1,189 706

Corporation tax receivable 344 487 - -

Cash and cash equivalents 3,143 2,112 - -

------------------------------ ------------------ ------------------- ---------------- -----------------

5,695 5,737 1,189 706

----------------------------- ------------------ ------------------- ---------------- -----------------

Total assets 8,002 7,474 1,189 706

------------------------------ ------------------ ------------------- ---------------- -----------------

Current liabilities

Trade and other payables 1,465 1,444 58 50

Contract liabilities 1,322 1,365 - -

Borrowings 2,293 1,816 2,293 1,816

Lease liabilities 171 - - -

5,251 4,625 2,351 1,866

----------------------------- ------------------ ------------------- ---------------- -----------------

Non-current liabilities

Deferred tax liabilities 234 269 - -

Contract liabilities 208 188 - -

Lease liabilities 418 - - -

----------------------------- ------------------ ------------------- ---------------- -----------------

860 457 - -

----------------------------- ------------------ ------------------- ---------------- -----------------

Total liabilities 6,111 5,082 2,351 1,866

------------------------------ ------------------ ------------------- ---------------- -----------------

Group Company

--------------------------- ----------------------------

2019 2018 2019 2018

GBP'000 GBP'000 GBP'000 GBP'000

Capital and reserves

attributable

to owners of the parent

Retained earnings at

31 December 2018/2017 849 1,856 (2,703) 773

Effect of IFRS 15 adjustment - (91) - -

Loss for the year (501) (916) (2) (3,476)

Retained earnings at

31 December 2019/2018 348 849 (2,705) (2,703)

Share capital 424 424 424 424

Share premium 1,119 1,119 1,119 1,119

------------------------------- --------------- ---------- ----------- ---------------

Total equity 1,891 2,392 (1,162) (1,160)

------------------------------- --------------- ---------- ----------- ---------------

Total equity and liabilities 8,002 7,474 1,189 706

------------------------------- --------------- ---------- ----------- ---------------

Consolidated and Company cash flow statement for the year ended

31 December 2019

Group Company

--------------------------------------- ---------------------- --------------------

2019 2018 2019 2018

GBP '000 GBP '000 GBP'000 GBP'000

--------------------------------------- ---------- ---------- --------- ---------

Cash flows from operating activities

Operating loss (804) (1,316) 4 (3,465)

Depreciation 264 70 - -

Amortisation 498 379 - -

Development expenditure impairment - 334 -

Development expenditure loss 29 - - -

on disposal

Gain on disposal of PPE (10)

Net effect of capitalised leases 68 - - -

Investment impairment - - - 3,474

Movement in:

Inventories 319 177 - -

Trade and other receivables 647 328 (483) (479)

Trade and other payables and

contract liabilities (36) 136 8 (75)

---------------------------------------- ---------- ---------- --------- ---------

Cash generated from/(used in)

operations 975 108 (471) (545)

Interest paid (25) (4) (6) (4)

Corporation tax received/(paid) 481 290 - -

---------------------------------------- ---------- ---------- --------- ---------

Net cash generated from/(used

in) operating activities 1,431 394 (477) (549)

---------------------------------------- ---------- ---------- --------- ---------

Cash flows from investing activities

Purchase of intangible assets (674) (929) - -

Purchase of property, plant

and equipment (26) (61) - -

Proceeds from sale of property, 10 - - -

plant & equipment

--------------------------------------- ---------- ---------- --------- ---------

Net cash used in investing activities (690) (990) - -

---------------------------------------- ---------- ---------- --------- ---------

Cash flows from financing activities

Proceeds from issue of shares - 1,300 - 1,300

Costs of issue of shares - (72) - (72)

Principal elements of lease (187) -

payments

--------------------------------------- ---------- ---------- --------- ---------

Net cash generated from financing

activities (187) 1,228 - 1,228

---------------------------------------- ---------- ---------- --------- ---------

Net increase/(decrease) in cash

and cash equivalents 554 632 (477) 679

Cash and cash equivalents at

start of the year 296 (336) (1,816) (2,495)

---------------------------------------- ---------- ---------- --------- ---------

Cash and cash equivalents at

end of the year 850 296 (2,293) (1,816)

---------------------------------------- ---------- ---------- --------- ---------

1 General information

Touchstar plc (the 'Company') and its subsidiaries (together

'the Group') design and build rugged mobile computing devices and

develop software solutions used in a wide variety of field-based

delivery, logistics and service applications. The Company is a

public company limited by share capital incorporated and domiciled

in the United Kingdom. The Company has its listing on the

Alternative Investment Market. The address of its registered office

is 1 George Square, Glasgow, G2 1AL.

2 Basis of preparation

The preliminary results for the year ended 31 December 2019 have

been prepared in accordance with the accounting policies set out in

the annual report and the accounts for the year ended 31 December

2018.

The Group Financial Statements have been prepared in accordance

with the International Financial Reporting Standards ('IFRS') as

adopted by the European Union, IFRS IC interpretations and the

Companies Act 2006 applicable to companies reporting under IFRSs

and the AIM Rules for Companies. The Group Financial Statements

have been prepared under the historical cost convention.

While the financial information included in this preliminary

announcement has been computed in accordance with IFRS, this

announcement does not itself contain sufficient information to

comply with IFRS. The accounting policies used in preparation of

this preliminary announcement have remained unchanged from those

set out in the Group's 2018 statutory financial statements other

than those described below. They are also consistent with those in

the Group's statutory financial statements for the year ended 31

December 2019 which have yet to be published. The preliminary

results for the year ended 31 December 2019 were approved by the

Board of Directors on 27 May 2020.

The financial information set out in this preliminary

announcement does not constitute the Group's statutory financial

statements for the year ended 31 December 2019 but is derived from

those financial statements which were approved by the Board of

Directors on 27 May 2020. The Auditors have reported on the Group's

statutory financial statements and their report was (i) unqualified

(ii) did include a material uncertainty in relation to going

concern without qualifying their report and (iii) did not contain a

statement under section 498(2) or 498(3) Companies Act 2006. The

statutory financial statements for the year ended 31 December 2019

have not yet been delivered to the Registrar of Companies and will

be delivered following the Company's Annual General Meeting.

The comparative figures are derived from the Group's statutory

financial statements for the year ended 31 December 2018 which

carried an unqualified audit report, did not contain a statement

under section 498(2) or 498(3) Companies Act 2006 and have been

filed with the Registrar of Companies.

Changes in accounting policy

New and amended Standards and Interpretations adopted by the

Group and Company

In these financial statements, the Group has changed its

accounting policies in the following areas:

-- Lease recognition

The Group has adopted the following IFRSs in these financial

statements:

-- IFRS 16 Leases

Effective 1 January 2019, IFRS 16 Leases has replaced IAS 17

Leases and IFRIC 4 Determining Whether an Arrangement Contains a

Lease. The standard eliminates the classification of leases as

either operating or finance leases and introduces a single

accounting model. Lessees are required to recognise a right-of-use

asset and related lease liability for their operating leases and

show depreciation of leased assets and interest on lease

liabilities separately in their income statement. IFRS 16 requires

the Company to recognise substantially all of its operating leases

on the balance sheet with options to exclude leases where the lease

term is 12 months or less, or where the underlying asset is of low

value. See note 11 for additional information.

Non - GAAP financial measures

For the purposes of the annual report and financial statements,

the Group uses alternative non-Generally Accepted Accounting

Practice ('non-GAAP') financial measures which are not defined

within IFRS. The Directors use the measures in order to assess the

underlying operational performance of the Group and as such, these

measures are important and should be considered alongside the IFRS

measures.

The following non-GAAP measure referred to in the Chairman's

statement relates to trading loss or profit.

'Trading loss after tax before exceptional costs' is separately

disclosed, being defined as loss or profit after tax adjusted to

exclude exceptional costs such as development expenditure

impairment, goodwill impairment and restructuring costs. These

exceptional costs relate to items which the management believe do

not accurately reflect the underlying trading performance of the

business in the period. The Directors believe that the trading loss

or profit is an important measure of the underlying performance of

the Group.

Going concern

These financial statements have been prepared on a going concern

basis, which assumes that the Group will be able to meet its

liabilities when they fall due. As at 31 December 2019, a total of

GBPNil was drawn down from the GBP300,000 on demand overdraft

facility (GBPnil in May 2020).

The Group benefits from a supportive bank who have provided the

borrowing facility since 2005. In assessing the Group's ability to

continue as a going concern, the Board has reviewed the Group's

cash flow and profit forecasts against this facility. The impact of

potential risks and related sensitivities to the forecasts were

considered in assessing the likelihood of additional facilities

being required, whilst identifying what mitigating actions are

available to the Group to avoid additional facilities and the

potential withdrawal of the facility by the bank (as it is

repayable upon demand). Specifically, a range of assumptions

underpin the profit and cash flow forecasts for the period to June

2021, including:

-- growth of the sales pipeline in 2020 and 2021 in the context of the COVID-19 pandemic; and

-- mitigation of the potential impact of not achieving the growth by implementing cost savings

Failure to achieve one or more of the above would result in

lower EBITDA with a consequent negative impact on cash generation.

The COVID-19 pandemic has reduced the Group's revenue in the short

term but the directors expect a return to trend in 2021. If the

Group's forecast is not achieved, there is a risk that the Group

will require additional facilities that it has not secured or the

bank withdraws the existing facility. Without the support of the

bank, the Group and Parent Company would be unable to meet their

liabilities as they fall due.

Given the timing and execution risks associated with achieving

the forecast and therefore remaining within the facility, the

directors have concluded that it is necessary to draw attention to

this as a material uncertainty which may cast significant doubt

about the Group's and the Parent Company's ability to continue as a

going concern in the basis of preparation to the financial

statements. The directors have confirmed that, after due

consideration, they have a reasonable expectation that the Company

and the Group have adequate resources to continue in operational

existence for the foreseeable future. For this reason, they

continue to adopt the going concern basis in preparing the

financial statements.

The Company as a lessee

The Company assesses whether a contract is or contains a lease,

at inception of a contract. The Company recognises a right-of-use

asset and a corresponding lease liability with respect to all lease

agreements in which it is the lessee, except for short-term leases

(defined as leases with a lease term of 12 months or less) and

leases of low value assets. For these leases, the Company

recognises the lease payments as an operating expense on a

straight-line basis over the term of the lease unless another

systematic basis is more representative of the time pattern in

which economic benefits from the leased asset are consumed.

The lease liability is initially measured at the present value

of the lease payments that are not paid at the commencement date,

discounted by using the rate implicit in the lease. If this rate

cannot be readily determined, the Company uses its incremental

borrowing rate based on the rate provided by the Group's bankers,

Barclays.

The lease liability is included in 'Creditors' on the Statement

of Financial Position.

The lease liability is subsequently measured by increasing the

carrying amount to reflect interest on the lease liability (using

the effective interest method) and by reducing the carrying amount

to reflect the lease payments made.

The right-of-use assets comprise the initial measurement of the

corresponding lease liability, lease payments made at or before the

commencement day and any initial direct costs. They are

subsequently measured at cost less accumulated depreciation and

impairment losses.

Right-of-use assets are depreciated over the shorter period of

lease term and useful life of the underlying asset. If a lease

transfers ownership of the underlying asset or the cost of the

right-of-use asset reflects that the Company expects to exercise a

purchase option, the related right-of-use asset is depreciated over

the useful life of the underlying asset. The depreciation starts at

the commencement date of the lease.

The right-of-use assets are included in the 'Intangible Assets',

'Tangible Fixed Assets' and 'Investment Property' lines, as

applicable, in the Statement of Financial Position.

The Company applies IAS 36 to determine whether a right-of-use

asset is impaired and accounts for any identified impairment loss

in accordance with that standard.

As a practical expedient, IFRS 16 permits a lessee not to

separate non-lease components, and instead account for any lease

and associated non-lease components as a single arrangement. The

Company has used this practical expedient.

3 Critical accounting estimates and judgements

The Group and Company makes estimates and assumptions concerning

the future. The resulting accounting estimates will, by definition,

seldom equal the related actual results. The estimates and

assumptions that have a significant risk of causing a material

adjustment to the carrying amounts of assets and liabilities within

the next financial year are discussed below.

(a) Development expenditure

The Group recognises costs incurred on development projects as

an intangible asset which satisfies the requirements of IAS 38. The

calculation of the costs incurred includes the percentage of time

spent by certain employees on the development project. The decision

whether to capitalise and how to determine the period of economic

benefit of a development project requires an assessment of the

commercial viability of the project and the prospect of selling the

project to new or existing customers.

(b) Impairment of intangibles

Judgement is required in the impairment of assets, notably

intangible software development costs. Recoverable amounts are

based on a calculation of expected future cash flows, which require

assumptions and estimates of future performance to be made. Cash

flows are discounted to their present value using pre-tax discount

rates based on the Directors market assessment of risks specific to

the asset.

4 Exceptional costs 2019 2018

GBP '000 GBP '000

--------------------------------------------- ---------- ----------

Restructuring expenses:

Redundancy costs 229 -

Onerous lease costs 154 -

Development expenditure impairment (note 7) 29 334

--------------------------------------------- ---------- ----------

412 334

--------------------------------------------- ---------- ----------

5.1 Income tax credit

2019 2018

GBP '000 GBP '000

--------------------------------------- ---------- ----------

Corporation tax

Current tax (326) (468)

Deferred tax 12 101

Adjustments in respect of prior years (13) (37)

--------------------------------------- ---------- ----------

Total tax credit (327) (404)

--------------------------------------- ---------- ----------

Corporation tax is calculated at 19% (2018: 19%) of the

estimated assessable profit for the year. This is the weighted

average tax rate applicable for the year.

5.2 Factors affecting the tax credit for the year

The tax credit for the year is different (2018: different) from

the standard rate of corporation tax in the UK of 19% (2018: 19%).

The differences are explained below :

2018 2018

GBP '000 GBP '000

--------------------------------------------------------------------------------- ---------- ----------

Loss before income tax (829) (1,320)

--------------------------------------------------------------------------------- ---------- ----------

Multiplied by the standard rate of corporation tax in the UK of 19% (2018: 19%) (158) (251)

Effects of:

Items not deductible for tax purposes 3 68

Enhanced research and development deduction (248) (368)

Adjustments in respect of prior years (13) (37)

Losses surrendered through R&D tax credit 100 150

Capital allowances claimed in year (in excess of)/ less than depreciation (11) 20

Adjustment to deferred tax arising from changes in tax rate - 14

Total tax credit for the year (327) (404)

--------------------------------------------------------------------------------- ---------- ----------

Factors affecting the future tax charge

The Chancellor's budget of March 2016 announced that corporation

tax rates will ultimately fall to 17% on 1 April 2020.

Consequently, deferred taxation has been calculated with reference

to this ultimate tax rate of 17%. The Directors do not expect

timing differences arising in the intervening period, when higher

taxation rates apply, to have a significant effect on the Group's

future tax charge.

In March 2020, the budget announced the intention to cancel the

future reduction in corporation tax rate from 19% to 17%. This

announcement does not constitute substantive enactment and

therefore deferred taxes at the balance sheet date continue to be

measured at the enacted tax rate of 17%. However, the corporation

tax rate will now remain at 19% after 1 April 2020.

6 (Losses)/earnings per share

2019 2018

---------- --------- ---------

Basic (5.91)p (10.94)p

Adjusted (1.05)p (6.95)p

---------- --------- ---------

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares in issue during the year. The calculation

of adjusted earnings per share excludes exceptional costs of

GBP412,000 (2018: GBP334,000).

Reconciliations of the earnings and weighted average number of

shares used in the calculation are set out below:

2019 2018

Earnings Weighted average number of Earnings Weighted average number of

GBP'000 shares (in thousands) GBP'000 shares (in thousands)

------------------------------- --------- ------------------------------ --------- -------------------------------

Basic EPS

Loss attributable to owners of

the parent (501) 8,374 (916) 8,374

Exceptional costs (note 4) 412 334

------------------------------- --------- ------------------------------ --------- -------------------------------

Adjusted EPS

(Loss)/earnings attributable

to owners of the parent

before exceptional items (89) 8,374 (582) 8,374

------------------------------- --------- ------------------------------ --------- -------------------------------

The Group does not operate a share option scheme and as a result diluted earnings per share

are not presented.

Non - GAAP financial measures

For the purposes of the annual report and financial statements, the Group uses alternative

non-Generally Accepted Accounting Practice ('non-GAAP') financial measures which are not defined

within IFRS. The Directors use the measures in order to assess the underlying operational

performance of the Group and as such, these measures are important and should be considered

alongside the IFRS measures.

The following non-GAAP measure referred to in the Chairman's statement relates to trading

loss or profit.

'Trading loss or profit' is separately disclosed, being defined as loss or profit after tax

adjusted to exclude exceptional costs such as development expenditure impairment, goodwill

impairment and restructuring costs. These exceptional costs relate to items which the management

believe do not accurately reflect the underlying trading performance of the business in the

period. The Directors believe that the trading loss or profit is an important measure of the

underlying performance of the Group.

7 Intangible assets

Group

------------------------ ----------------------------------------------

Goodwill Development expenditure Total

GBP'000 GBP'000 GBP'000

------------------------ --------- ------------------------ ---------

Cost

At 1 January 2018 9,904 3,558 13,462

Additions - 929 929

Disposals - (352) (352)

At 31 December 2018 9,904 4,135 14,039

Additions - 674 674

At 31 December 2019 9,904 4,809 14,713

------------------------ --------- ------------------------ ---------

Accumulated amortisation

At 1 January 2018 9,904 2,422 12,326

Amortisation charge - 379 379

Impairment 334 334

Eliminated on disposal - (352) (352)

------------------------ --------- ------------------------ ---------

At 31 December 2018 9,904 2,783 12,687

Amortisation charge - 498 498

Impairment - 29 29

At 31 December 2019 9,904 3,310 13,214

------------------------ --------- ------------------------ ---------

Net book value

At 1 January 2018 - 1,136 1,136

------------------------ --------- ------------------------ ---------

At 31 December 2018 - 1,352 1,352

------------------------ --------- ------------------------ ---------

At 31 December 2019 - 1,499 1,499

------------------------ --------- ------------------------ ---------

Amortisation of GBP498,000 (2017: GBP379,000) is included within

administrative expenses in the income statement.

Development expenditure

The calculation of the costs incurred includes the percentage of

time spent by certain employees on the development project. The

decision whether to capitalise and how to determine the period of

economic benefit of a development project requires an assessment of

the commercial viability of the project and the prospect of selling

the project to new or existing customers.

Management determined budgeted sales growth based on historic

performance and its expectations of market development via each

product set's underlying pipeline

A review of each of the product sets did not result in any

impairment.

Development expenditure has been capitalised on an ongoing basis

and therefore has a remaining useful economic life ranging from 0

to 5 years.

8 IFRS 16 Right of use assets

Premises Motor vehicles Total

GBP'000 GBP'000 GBP'000

--------------------------------------- --------- --------------- -------------------------------

Cost

At 1 January 2019 - - -

Impact of change in accounting policy 579 148 727

At 1 January 2019 (adjusted balance) 579 148 727

Additions - 64 64

At 31 December 2019 579 212 791

--------------------------------------- --------- --------------- -------------------------------

Accumulated depreciation

At 1 January 2019 - - -

Charge for the year 80 105 185

Impairment 61 23 84

At 31 December 2019 141 128 269

--------------------------------------- --------- --------------- -------------------------------

Net book value

At 31 December 2018 - - -

--------------------------------------- --------- --------------- -------------------------------

At 31 December 2019 438 84 522

--------------------------------------- --------- --------------- -------------------------------

Depreciation expenditure of GBP185,000 (2018: GBPNil) is

included within administrative expenses in the income

statement.

9 Leases

The note provides information for leases where the group is a

lessee.

i) Amounts recognised in the balance sheet

The balance sheet shows the following amounts relating to

leases:

2019 1 January

GBP'000 2019

GBP'000 *

--------------------- ---- --------- -----------

Right-of-use assets

Buildings 438 579

Vehicles 84 148

--------------------------- --------- -----------

522 727

-------------------------- --------- -----------

Lease Liabilities

Current 171 176

Non-current 418 529

--------------------------- --------- -----------

589 705

-------------------------- --------- -----------

*In the previous year, the group only recognised lease assets

and lease liabilities in relation to leases that were classified as

'finance leases' under IAS 17 'Leases'.

Under IFRS 16 the assets are now presented in property, plant

and equipment and the liabilities as part of the group's

borrowings. For adjustments recognised on adoption of IFRS 16 on 1

January 2019 see note 11.

ii) Amounts recognised in the statement of profit or loss

The statement of profit or loss shows the following amounts

relating to leases:

2019 2018

GBP'000 GBP'000 *

------------------------------------ --------- -----------

Depreciation charge of right-of-use

assets

Buildings 74 -

Vehicles 111 -

------------------------------------ --------- -----------

185 -

------------------------------------ --------- -----------

Interest expense (included 19 -

in finance cost)

Expense relating to short-term 23 -

leases (included in administrative

expenses)

------------------------------------ --------- -----------

10 Discontinued operation

The Onboard business was sold on 6 November 2019 and is reported

in the current period as a discontinued operation. Financial

information relating to the discontinued operation for the period

to the date of disposal is set out below and on the face of the

Income Statement.

2019 2018

GBP '000 GBP '000

------------------------------------------------------------------------------------------- ---------- ----------

Net cash inflow from operating activities (174) (472)

Net cash inflow/(outflow) from investing activities (2019 includes an inflow of GBP10,000

from the sale of the division) 10 (271)

Net increase in cash generated by the subsidiary (164) (743)

------------------------------------------------------------------------------------------- ---------- ----------

Details of the sale of the subsidiary:

2019

GBP '000

----------------------------------------------- ----------

Consideration received or receivable:

Cash 10

Fair value of liabilities disposed of 75

Total disposal consideration 85

Carrying amount of net assets sold -

----------------------------------------------- ----------

Gain on sale 85

----------------------------------------------- ----------

Earnings per share:

31 December 2019 31 December 2018

GBP '000 GBP '000

------------------------------------------------------------------------------ ------------------ ------------------

From continuing operations attributable to the ordinary equity holders of the

company (4.07) (3.89)

From discontinued operation (1.84) (7.05)

Total basic earnings per share attributable to the ordinary equity

holders of the company (5.91) (10.94)

------------------------------------------------------------------------------ ------------------ ------------------

11 Changes in accounting policies

This note explains the impact of the adoption of IFRS 16

'Leases' on the group's financial statements.

As indicated in note 9 above, the group has adopted IFRS 16

'Leases' retrospectively from 1

January 2019, but has not restated comparatives for the 2018

reporting period, as permitted under the

specific transition provisions in the standard. The

reclassifications and the adjustments arising from

the new leasing rules are therefore recognised in the opening

balance sheet on 1 January 2019.

On adoption of IFRS 16, the group recognised lease liabilities

in relation to leases which had

previously been classified as 'operating leases' under the

principles of IAS 17 'Leases'. These

liabilities were measured at the present value of the remaining

lease payments, discounted using the

lessee's incremental borrowing rate as of 1 January 2019. The

weighted average lessee's incremental

borrowing rate applied to the lease liabilities on 1 January

2019 was 3.5%.

For leases previously classified as finance leases the entity

recognised the carrying amount of the

lease asset and lease liability immediately before transition as

the carrying amount of the right of use

asset and the lease liability at the date of initial

application. The measurement principles of IFRS 16

are only applied after that date.

(i) Practical expedients applied

In applying IFRS 16 for the first time, the group has used the

following practical expedients permitted by the standard:

-- applying a single discount rate to a portfolio of leases with

reasonably similar characteristics;

-- accounting for operating leases with a remaining lease term

of less than 12 months as at 1

January 2019 as short-term leases;

-- excluding initial direct costs for the measurement of the

right-of-use asset at the date of initial

application; and

-- using hindsight in determining the lease term where the

contract contains options to extend or

terminate the lease.

The group has also elected not to reassess whether a contract

is, or contains a lease at the date of

initial application. Instead, for contracts entered into before

the transition date the group relied on its

assessment made applying IAS 17 and Interpretation 4 Determining

whether an Arrangement contains

a Lease .

(ii) Measurement of lease liabilities

2019

GBP '000

--------------------------------------------------------------------------------------------- ----------

Operating lease commitments disclosed as at 31 December 2018 896

Discounted using the lessee's incremental borrowing rate at the date of initial application (69)

(Less): short-term leases not recognised as a liability (58)

Lease incentives and prepaid rent relating to commitments formerly classified as operating

leases (64)

Lease liability recognised as at 1 January 2019 705

Of which are:

Current lease liabilities 176

Non-current lease liabilities 529

----------

(iii) Measurement of right-of-use assets

The associated right-of-use assets for property leases were

measured on a retrospective basis as if the

new rules had always been applied. Other right-of use assets

were measured at the amount equal to

the lease liability, adjusted by the amount of any prepaid or

accrued lease payments relating to that

lease recognised in the balance sheet as at 31 December

2018.

(iv) Adjustments recognised in the balance sheet on 1 January

2019

The change in accounting policy affected the following items in

the balance sheet on

1 January 2019:

-- right-of-use assets - increase by GBP727,000

-- lease liabilities - increase by GBP705,000

-- prepayments - decrease by GBP22,000

The net impact on retained earnings at 1 January 2019 was

GBPnil.

12 Post balance sheet events

COVID-19

The outbreak of COVID-19 creates a new and highly unpredictable

challenge and constitutes a non-adjusting post balance sheet event.

We have tested our business continuity plans which have been

successfully activated. The investment in technology over recent

years has resulted in the business being well placed to continue

delivering services to our clients with minimal disruption.

Management do not consider it possible to quantify the true impact

of COVID-19 on the business at this time but remain confident that

the business can adjust to the challenges it presents.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR BLGDUDBDDGGR

(END) Dow Jones Newswires

May 28, 2020 02:00 ET (06:00 GMT)

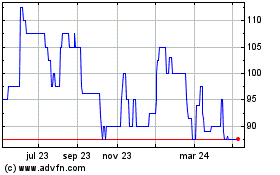

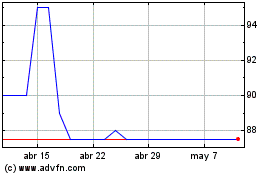

Touchstar (LSE:TST)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Touchstar (LSE:TST)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024