false

0001643988

0001643988

2024-07-29

2024-07-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): July 29, 2024

Loop

Media, Inc.

(Exact

Name of Registrant as Specified in Charter)

| Nevada |

|

001-41508 |

|

47-3975872 |

| (State

or Other Jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

No.) |

2600 West Olive Avenue, Suite 54470

Burbank, CA |

|

91505 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (213) 436-2100

N/A

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered or to be registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, $0.0001 par value per share |

|

LPTV |

|

The

NYSE American, LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement

Amendment

to Loan Agreement

As

previously announced, effective as of July 29, 2022, Loop Media, Inc. (the “Company”) entered into a Loan and Security

Agreement (the “Loan Agreement”) with Industrial Funding Group, Inc. (the “Initial Lender”),

for a revolving loan credit facility for the principal sum of up to four million dollars ($4,000,000.00), and through the

exercise of an accordion feature, a total sum of up to ten million dollars ($10,000,000.00) (the “Loan”), evidenced

by a Revolving Loan Secured Promissory Note (the “Revolving Loan Note”), also effective as of July 29, 2022. In connection

with the Loan Agreement and the Revolving Loan Note, the Company also executed and delivered to the Initial Lender the

Loan Agreement Schedule dated as of July 29, 2022 (the “Loan Agreement Schedule”) and other Loan Documents, as defined

in the Loan Agreement. Shortly thereafter, the Initial Lender assigned the Loan Agreement, and the loan documents related thereto, to

GemCap Solutions, LLC (“GemCap” or “Senior Lender”). As previously disclosed, on October 27, 2022,

the Loan Agreement was amended by Amendment Number 1 to the Loan and Security Agreement and to the Loan Agreement Schedule to increase

the maximum availability and maximum credit of the loan from four million dollars ($4,000,000.00) to six million dollars ($6,000,000.00),

evidenced by an Amended and Restated Secured Promissory Note (Revolving Loans), also dated October 27, 2022.

Effective

July 29, 2024, the Company entered into Amendment Number 2 to the Loan and Security Agreement, the Loan Agreement Schedule, the Revolving

Loan Note and to the other Loan Documents (the “Loan Agreement Amendment No. 2”) to amend certain material terms,

including (i) to extend the maturity date of the Loan Agreement by one (1) year, from July 29, 2024, to July 29, 2025, and (ii)

to make Retail Media TV, Inc., the Company’s wholly-owned subsidiary, a co-borrower thereunder.

The

description of the Loan Agreement Amendment No. 2 is qualified in its entirety by reference to the full text of the Loan Agreement Amendment

No. 2, which is incorporated

by reference herein. A copy of the Loan Agreement Amendment No. 2 is included herein as Exhibit 10.1.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

The

information in Item 1.01 with respect to the Loan Agreement Amendment No. 2 is incorporated by reference into this Item 2.03.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by

the undersigned, hereunto duly authorized.

| Date:

August 1, 2024 |

LOOP

MEDIA, INC. |

| |

|

| |

By: |

/s/

Justis Kao |

| |

|

Justis

Kao, Chief Executive Officer |

Exhibit 10.1

AMENDMENT

NUMBER 2 TO THE LOAN AND SECURITY AGREEMENT, THE LOAN AGREEMENT SCHEDULE, THE REVOLVING LOAN NOTE AND TO THE OTHER LOAN DOCUMENTS

This

Amendment Number 2 to the Loan and Security Agreement, the Loan Agreement Schedule, the Revolving Loan Note and to the other Loan Documents

(“Amendment No. 2”) dated effective as of July 29, 2024 (the “Effective Date”) by and between LOOP

MEDIA, INC., a Nevada corporation with a principal place of business located at 2600 West Olive Avenue, Suite 5470, Burbank, CA 91505,

and RETAIL MEDIA TV, INC., a Nevada corporation with a principal place of business located at 2600 West Olive Avenue, Suite 5470, Burbank,

CA 91505, jointly and severally (the “Borrower”), and GEMCAP SOLUTIONS, LLC, a Delaware limited liability company

with offices at 9901 I.H. 10 West, Suite 800, San Antonio, TX 78230, as successor and assign to Industrial Funding Group, Inc. (together

with its successors and assigns, the “Lender”). The Borrower and the Lender are collectively referred to as the “Parties.”

RECITALS

A. Borrower

and Lender are parties to the Loan and Security Agreement dated as of July 29, 2022 (as amended, modified or supplements from time to

time, the “Loan Agreement”).

B. In

connection with the Loan Agreement, Borrower executed and delivered to Lender (i) the Loan Agreement Schedule dated as of July 29, 2022

(as amended, modified or supplemented from time to time, the “Loan Schedule”), (ii) the Amended and Restated Secured

Promissory Note (Revolving Loans), dated as of October 27, 2022 (as amended, modified or supplements from time to time, the “Revolving

Loan Note”) and (iii) other Loan Documents.

C. Borrower

has requested that Lender amend the Loan Documents (i) to extend the Maturity Date by one (1) year, (ii) to make Retail Media TV, Inc.

a co-borrower thereunder, and (iii) to update each Borrower’s notice address and principal place of business, and Lender has agreed

to amend the Loan Documents (i) to extend the Maturity Date by one (1) year (ii) to make Retail Media TV, Inc. a co-borrower thereunder,

and (iii) to update each Borrower’s notice address and principal place of business, subject to the terms and conditions of this

Amendment No. 2.

D. In

consideration of Lender’s consent and accommodation, Borrower has agreed to pay all of Lender’s fees and costs including

Lender’s attorneys’ fees and costs in respect of the transactions regarding this Amendment No. 2.

E. Capitalized

terms used but not defined herein have the meanings set forth in the Loan Agreement.

NOW,

THEREFORE, in consideration of the foregoing, the mutual covenants and agreements herein contained and other good and valuable consideration,

Lender and Borrower mutually covenant, warrant and agree as follows:

1. Amendments.

Subject to Section 2 below, effective as of the date of this Amendment No. 2, the Loan Agreement, the Loan Agreement Schedule, the Revolving

Loan Note and the other Loan Documents, effective as of the date hereof, are amended as follows:

(a)

The Loan Agreement, the Loan Agreement Schedule, the Revolving Loan Note and the other Loan Documents are all hereby amended as follows:

Additional

Party. RETAIL MEDIA TV, INC., a Nevada corporation with a principal place of business located at 2600 West Olive Avenue, Suite

5470, Burbank, CA 91505 (“Retail Media”) is hereby executing this Amendment No. 2 for purposes of becoming a party

to the Loan Agreement, the Loan Agreement Schedule, the Revolving Loan Note and the other Loan Documents, as amended by this Amendment

No. 2. From and after the date of this Amendment No. 2, Retail Media shall be deemed to be a party to the Loan Agreement, the Loan Agreement

Schedule, the Revolving Loan Note and the other Loan Documents, and from and after the date of this Amendment No. 2, Retail Media and

LOOP MEDIA, INC., a Nevada corporation with a principal place of business located at 2600 West Olive Avenue, Suite 5470, Burbank, CA

91505 (“Loop Media”) shall be jointly and severally liable to Lender for all obligations under the Loan Agreement,

the Loan Agreement Schedule, the Revolving Loan Note and the other Loan Documents, as amended by this Amendment No. 2. From and after

the Second Amendment Effective Date, all references to Borrower in the Loan Agreement, the Loan Agreement Schedule, the Revolving Loan

Note and the other Loan Documents shall be to Retail Media and Loop Media, jointly and severally.

(b)

Section 1.78 of the Loan Agreement is hereby deleted and restated in its entirety as follows:

1.78 “Maturity

Date” shall mean the earlier of (i) July 29, 2025, and (ii) the date Lender may exercise any of its remedies pursuant to the

terms hereof.

(c)

Section 1 of the Loan Agreement is hereby amended by adding the following definition in the appropriate alphabetical order:

“Second

Amendment” means that certain Amendment Number 2 to the Loan and Security Agreement and to the Loan Agreement Schedule dated

effective as of the Second Amendment Effective Date, between Borrower and Lender.

“Second

Amendment Effective Date” means July 29, 2024.

(d) The

Loan Agreement is hereby amended by adding the following new Section 14.15:

14.15

Joint and Several Obligations. If more than one Person is a Borrower hereunder, the provisions of Section 12 of the Loan Agreement

Schedule shall apply.

(e) The Borrower’s notice information in Section 8 of the Loan Agreement Schedule is hereby deleted and restated in its entirety as follows:

If

to Borrower:

Loop

Media, Inc.

2600 West Olive Avenue

Suite 5470

Burbank, CA 91505

Attn:

Justis Kao

Email:

justis@loop.tv; legal@loop.tv; neil@loop.tv

(f) The Loan Agreement Schedule is hereby amended by adding the following new Section 12:

12. JOINT

AND SEVERAL OBLIGATIONS. If more than one Person is a Borrower hereunder, the following shall apply to each such Borrower:

(a) All

Obligations, covenants and liabilities of any Borrower under the Loan Documents shall be the joint and several Obligations, covenants

and liabilities of each Borrower. All representations and warranties of any Borrower hereunder shall be deemed made by each Borrower.

Each Borrower shall, without duplication, make payment upon the maturity of the Obligations by acceleration or otherwise, and such obligation

and liability on the part of any Borrower shall in no way be affected by the failure of Lender to pursue or preserve its rights against

any other Borrower or the release by Lender of any Collateral now or thereafter acquired from any other Borrower.

(b) Each

Borrower expressly waives any and all rights of subrogation, reimbursement, indemnity, exoneration, contribution or any other claim which

such Borrower may now or hereafter have against any other Borrower or against any Guarantor or other Person directly or contingently

liable for the Obligations until all Obligations have been indefeasibly paid in full as determined by Lender.

(c) Lender

is hereby authorized, without notice or demand and without affecting the liability of any Borrower, at any time and from time to time,

to (i) renew, extend or otherwise increase the time for payment of the Obligations; (ii) with the written agreement of any Borrower,

change the terms relating to the Obligations or otherwise modify, amend or change the terms of any Note or other agreement, document

or instrument now or hereafter executed by any Borrower; (iii) accept partial payments of the Obligations; (iv) take and hold any Collateral

for the payment of the Obligations or for the payment of any guaranties of the Obligations and exchange, enforce, waive and release any

such Collateral; (v) apply any such Collateral and direct the order or manner of sale thereof as Lender, in its sole discretion, may

determine; and (vi) settle, release, compromise, collect or otherwise liquidate the Obligations and any Collateral therefor in any manner,

all guarantor and surety defenses being hereby waived by each Borrower. Except as specifically provided in the Loan Agreement, Lender

shall have the exclusive right to determine the time and manner of application of any payments or credits, whether received from any

Borrower or any other source, and such determination shall be binding on all Borrowers. All such payments and credits may be applied,

reversed and reapplied, in whole or in part, to any of the Obligations that Lender shall determine, in its sole discretion, without affecting

the validity or enforceability of the Obligations of any Borrower.

(d)

Each Borrower hereby agrees that its obligations hereunder shall be unconditional, irrespective

of (i) the absence of any attempt to collect the Obligations from any obligor or other action to enforce the same; (ii) the waiver or

consent by Lender with respect to any provision of any instrument evidencing the Obligations, or any part thereof, or any other agreement

heretofore, now or hereafter executed by a Borrower and delivered to Lender; (iii) failure by Lender to take any steps to perfect and

maintain its security interest in, or to preserve its rights to, any security or collateral for the Obligations; (iv) the institution

of any proceeding under the Bankruptcy Code, or any similar proceeding, by or against a Borrower or Lender’s election in any such

proceeding of the application of Section 1111(b)(2) of the Bankruptcy Code (or any similar law); (v) any borrowing or grant of a security

interest by a Borrower as debtor-in-possession, under Section 364 of the Bankruptcy Code; (vi) the disallowance, under Section 502 of

the Bankruptcy Code, of all or any portion of Lender’s claim(s) for repayment of any of the Obligations; or (vii) any other circumstance

other than payment in full of the Obligations which might otherwise constitute a legal or equitable discharge or defense of a guarantor

or surety, including, without limitation, any failure by Lender to bring suit against any Person that might otherwise result in a discharge

of such Borrower’s obligations and liabilities under the Loan Documents pursuant to Chapter 43 of the Texas Civil Practice &

Remedies Code or any other similar applicable law.

(e)

Each Borrower represents and warrants to Lender that (i) each Borrower has one or more common

or affiliated shareholders, directors and officers, (ii) the businesses and corporate activities of each Borrower are closely related

to, and substantially benefit, the business and corporate activities of the other, and (iii) each Borrower will receive a substantial

economic benefit from entering into the transactions evidenced by the Loan Documents and will receive a substantial economic benefit

from the Loans, whether or not such amount is used directly by such Borrower, and (iv) the Loans made pursuant to the Loan Documents

are for the exclusive and indivisible benefit of the Borrowers.

(f)

Notwithstanding any provisions of this Loan Agreement Schedule to the contrary, it is intended

that the joint and several nature of the liability of the Borrowers for the Obligations and the Liens granted by the Borrowers to secure

the Obligations, not constitute a Fraudulent Conveyance (as defined below). Consequently, Lender and each Borrower agree that if the

liability of any individual Borrower for the Obligations, or any Liens granted by such Borrower securing the Obligations would, but for

the application of this sentence, constitute a Fraudulent Conveyance, the liability of such Borrower and the Liens securing such liability

shall be valid and enforceable only to the maximum extent that would not cause such liability or such Lien to constitute a Fraudulent

Conveyance, and the liability of such Borrower and this Loan Agreement Schedule shall automatically be deemed to have been amended accordingly.

For purposes hereof, the term “Fraudulent Conveyance” means a fraudulent conveyance under Section 548 of the Bankruptcy

Code or a fraudulent conveyance or fraudulent transfer under the applicable provisions of any fraudulent conveyance or fraudulent transfer

law or similar law of any state, nation or other governmental unit, as in effect from time to time.

2. Effectiveness.

The effectiveness of this Amendment No. 2 is conditioned upon and subject to the receipt by the Lender of each of the following on

or before the dates set forth below:

(a) A

copy of this Amendment No. 2 duly executed by Borrower and delivered to Lender by e-mail on or before the Effective Date with the original

of this Amendment No. 2 duly executed by Borrower and delivered to Lender on or before three (3) Business Days following the Effective

Date;

(b)

A copy of an officer certificate duly executed by Retail Media and delivered to Lender by e-mail

on or before the Effective Date with the original of such officer’s certificate duly executed Retail Media and delivered to Lender

on or before three (3) Business Days following the Effective Date;

(c) A

copy of IRS tax forms, ACH Agreements, and other agreements duly executed by Retail Media and delivered to Lender as may be reasonably

requested by Lender;

(d) A

copy of UCC-3 Financing Statements to amend Borrower’s address duly recorded with the Nevada Secretary of State; and

(e) Receipt

by Lender on or before the Effective Date, of all costs of Lender (including Lender’s attorneys’ fees and expenses) in respect

of the transactions relating to this Amendment No. 2.

3. Miscellaneous.

Except as herein expressly amended by this Amendment No. 2, all of the terms and provisions of the Loan Agreement, the Loan Agreement

Schedule, the Revolving Loan Note and the other Loan Documents shall continue in full force and effect, and the Loan Agreement, the Loan

Agreement Schedule, the Revolving Loan Note and the other Loan Documents as amended by this Amendment No. 2 are hereby ratified and confirmed

by Borrower. The Borrower acknowledges to Lender that (a) no offsets, counterclaims or defenses exist as of the date of this Amendment

No. 2 with respect to any of the Loan Documents and the Obligations, and no Event of Default is in existence as of the date of this Amendment

No. 2, and (b) by a resolution, all members and Managers of Borrower unanimously approved this Amendment No. 2 and the transactions contemplated

thereby. The foregoing is without prejudice to Lender’s rights under the Loan Agreement and the other Loan Documents referred to

therein, including, without limitation, applicable law, all of which rights are hereby expressly reserved. In addition to the representations,

warranties and covenants set forth in the Loan Agreement, the Borrower represents, warrants and covenants to Lender that prior to execution,

they have been given the opportunity to have this Amendment No. 2 to be reviewed by legal counsel. This Amendment No. 2 may be executed

in counterparts and by facsimile or other electronic signatures, each of which when so executed, shall be deemed an original, but all

of which shall constitute but one and the same instrument.

[SIGNATURE

PAGE FOLLOWS]

IN

WITNESS WHEREOF, this Amendment No. 2 has been duly executed as of the day and year first above written.

| BORROWER: |

|

| |

|

|

| LOOP

MEDIA, INC. |

|

| |

|

|

| By: |

/s/

Neil Watanabe |

|

| Name: |

Neil

Watanabe |

|

| Title: |

Chief

Financial Officer |

|

| |

|

|

| RETAIL

MEDIA TV, INC. |

|

| |

|

|

| By: |

/s/

Neil Watanabe |

|

| Name: |

Neil

Watanabe |

|

| Title: |

Treasurer |

|

| |

|

|

| LENDER: |

|

| |

|

|

| GEMCAP

SOLUTIONS, LLC |

|

| |

|

|

| By: |

/s/

David Ellis |

|

| |

David

Ellis, Co-President |

|

[SIGNATURE

PAGE - AMENDMENT NUMBER 2 TO THE LOAN AND SECURITY AGREEMENT, THE LOAN AGREEMENT SCHEDULE, THE REVOLVING LOAN NOTE AND TO THE OTHER LOAN

DOCUMENTS]

v3.24.2.u1

Cover

|

Jul. 29, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 29, 2024

|

| Entity File Number |

001-41508

|

| Entity Registrant Name |

Loop

Media, Inc.

|

| Entity Central Index Key |

0001643988

|

| Entity Tax Identification Number |

47-3975872

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

2600 West Olive Avenue

|

| Entity Address, Address Line Two |

Suite 54470

|

| Entity Address, City or Town |

Burbank

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

91505

|

| City Area Code |

(213)

|

| Local Phone Number |

436-2100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

stock, $0.0001 par value per share

|

| Trading Symbol |

LPTV

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

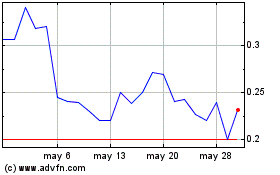

Loop Media (AMEX:LPTV)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Loop Media (AMEX:LPTV)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024