U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

☐ Registration statement pursuant to Section 12 of the Securities Exchange Act of 1934

or

☒ Annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2022 Commission File Number 001-31722

New Gold Inc.

(Exact name of Registrant as specified in its charter)

| | | | | | | | |

British Columbia

(Province or other jurisdiction of incorporation or organization) | 1000

(Primary Standard Industrial Classification Code Number) | Not Applicable

(I.R.S. Employer

Identification Number) |

Suite 3320 Brookfield Place, 181 Bay Street

Toronto, Ontario, Canada M5J 2T3

(416) 324-6000

(Address and telephone number of Registrant’s principal executive offices)

| | |

CT Corporation System 28 Liberty Street, New York,NY 10005 (212) 894-8940

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class: | Trading Symbol(s): | Name of Each Exchange On Which Registered: |

| Common Shares, no par value | NGD | NYSE American |

Securities registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

For annual reports, indicate by check mark the information filed with this form:

☒Annual Information Form ☒Audited Annual Financial Statements

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

At December 31, 2022, the Registrant had outstanding 682,276,959, common shares without par value.

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days.

☒Yes ☐No

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

☒Yes ☐No

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule

12b-2 of the Exchange Act.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to

Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

DOCUMENTS INCORPORATED BY REFERENCE

The Annual Information Form (“AIF”) of New Gold Inc. (the “Registrant”, “New Gold” or the “Company”) for the fiscal year ended December 31, 2022 is filed as Exhibit 1 to this annual report on Form 40-F.

The audited consolidated financial statements of the Company for the years ended December 31, 2022 and 2021, including the related reports of independent registered public accounting firm, are filed as Exhibit 2 to this annual report on Form 40-F.

The Company’s management’s discussion and analysis (“MD&A”) for the year ended December 31, 2022 is filed as Exhibit 3 to this annual report on Form 40-F.

EXPLANATORY NOTE

The Company is a Canadian issuer eligible to file its annual report pursuant to Section 13 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), on Form 40-F. The Company is a “foreign private issuer” as defined in Rule 3b-4 under the Exchange Act. Accordingly, the Company’s equity securities are exempt from Sections 14(a), 14(b), 14(c), 14(f) and 16 of the Exchange Act pursuant to Rule 3a12-3 under the Exchange Act.

The Company is permitted, under a multi-jurisdictional disclosure system adopted by the United States, to prepare the documents incorporated by reference in this annual report on Form 40-F in accordance with Canadian disclosure requirements, which are different from those of the United States.

Disclosure regarding our mineral properties, including with respect to mineral reserve and mineral resource estimates included in this annual report on Form 40-F and the documents incorporated by reference herein, was prepared in accordance with Canadian National Instrument 43-101 — Standards of Disclosure for Mineral Projects (“NI 43-101”). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. NI 43-101 differs significantly from the disclosure requirements of the Commission generally applicable to U.S. companies. For example, the terms “mineral reserve”, “proven mineral reserve”, “probable mineral reserve”, “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in NI 43-101. These definitions differ from the definitions in the disclosure requirements promulgated by the Commission.

Accordingly, information contained in this annual report on Form 40-F and the documents incorporated by reference will not be comparable to similar information made public by U.S. companies reporting pursuant to Commission disclosure requirements.

Unless otherwise indicated, all dollar amounts are reported in U.S. dollars.

FORWARD LOOKING STATEMENTS

Certain information contained in this annual report on Form 40-F, including any information relating to New Gold’s future financial or operating performance are “forward looking”. All statements in this annual report on Form 40-F, other than statements of historical fact, which address events, results, outcomes or developments that New Gold expects to occur are “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and applicable Canadian Securities laws. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the use of forward-looking terminology such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “targeted”, “estimates”, “forecasts”, “intends”, “anticipates”, “projects”, “potential”, “believes” or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “should”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotation of such terms. Forward-looking statements in this annual report on Form 40-F include those under the headings “General Developments of the Business”, “Description of the Business” and “Mineral Properties” and include, among others, statements with respect to: guidance and expectations for production, operating expenses per gold equivalent ounce, total cash costs per equivalent ounce, all‐in sustaining costs per equivalent ounce and sustaining and growth capital expenditures on a consolidated and mine-by-mine basis, and the factors contributing to those expected results; mine life; Mineral Reserve and Mineral Resource estimates; grades expected to be mined and milled at the Company’s operations; planned activities and timing for 2023 and future years at the Rainy River Mine (as defined in Exhibit 1) and New Afton Mine (as defined in Exhibit 1), including planned development and exploration activities and related expenses; intended compliance with

the framework and guidance issued by the TCFD (as defined in Exhibit 1); projected ramp-up of underground mining over the underground mine life at Rainy River with peak production from 2026 to 2028; planned average processing and throughput rates and anticipated mill feed at Rainy River and the timing associated therewith; expectations regarding the implementation of a batch processing approach to mill the underground material at Rainy River; anticipated production from the New Afton C-Zone and the timing thereof; the intended adjustment of the gravity circuit operation at New Afton in 2023 to focus on gold recovery; expectations regarding the management and mitigation of risk factors and the possible impacts on the Company; expected development activities for the New Afton C-Zone; and expected production, costs, economics, grade and other operating parameters of the Rainy River Mine and the New Afton Mine.

All forward-looking statements in this annual report on Form 40-F are based on the opinions and estimates of management as of the date such statements are made and are subject to important risk factors and uncertainties, many of which are beyond New Gold’s ability to control or predict. Certain material assumptions regarding such forward-looking statements are discussed in this annual report on Form 40-F, New Gold’s annual and quarterly MD&A and its Technical Reports (as defined in Exhibit 1) filed on SEDAR (www.sedar.com) and EDGAR (www.sec.gov). In addition to, and subject to, such assumptions discussed in more detail elsewhere, the forward-looking statements in this annual report Form 40-F are also subject to the following assumptions: (1) there being no significant disruptions affecting New Gold’s operations; (2) political and legal developments in jurisdictions where New Gold operates, or may in the future operate, being consistent with New Gold’s current expectations; (3) the accuracy of New Gold’s current Mineral Reserve and Mineral Resource estimates and the grade of gold, copper and silver expected to be mined; (4) the exchange rate between the Canadian dollar and U.S. dollar, and to a lesser extent the Mexican peso, and commodity prices being approximately consistent with current levels and expectations for the purposes of 2023 guidance and otherwise; (5) prices for diesel, natural gas, fuel oil, electricity and other key supplies being approximately consistent with current levels; (6) equipment, labour and material costs increasing on a basis consistent with New Gold’s current expectations; (7) arrangements with First Nations and other Indigenous groups in respect of the Rainy River Mine and New Afton Mine being consistent with New Gold’s current expectations; (8) all required permits, licenses and authorizations being obtained from the relevant governments and other relevant stakeholders within the expected timelines and the absence of material negative comments or obstacles during any applicable regulatory processes; (9) the results of the life of mine plans for the Rainy River Mine and the New Afton Mine being realized; (10) there being no material disruption to New Gold’s supply chains and workforce at either the Rainy River Mine or New Afton Mine due to cases of COVID-19 or otherwise that would interfere with New Gold’s anticipated course of action at its operations.

Forward-looking statements are necessarily based on estimates and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors that may cause actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking statements. Such factors include, without limitation: price volatility in the spot and forward markets for metals and other commodities; discrepancies between actual and estimated production, between actual and estimated costs, between actual and estimated Mineral Reserves and Mineral Resources and between actual and estimated metallurgical recoveries; equipment malfunction, failure or unavailability; accidents; risks related to early production at the Rainy River Mine, including failure of equipment, machinery, the process circuit or other processes to perform as designed or intended; the speculative nature of mineral exploration and development, including the risks of obtaining and maintaining the validity and enforceability of the necessary licenses and permits and complying with the permitting requirements of each jurisdiction in which New Gold operates, including, but not limited to: uncertainties and unanticipated delays associated with obtaining and maintaining necessary licenses, permits and authorizations and complying with permitting requirements,; changes in project parameters as plans continue to be refined; changing costs, timelines and development schedules as it relates to construction; the Company not being able to complete its construction projects at the Rainy River Mine or the New Afton Mine on the anticipated timeline or at all; volatility in the market price of the Company’s securities; changes in national and local government legislation in the countries in which New Gold does or may in the future carry on business; compliance with public company disclosure obligations; controls, regulations and political or economic developments in the countries in which New Gold does or may in the future carry on business; the Company’s dependence on the Rainy River Mine and New Afton Mine; the Company not being able to complete its exploration drilling programs on the anticipated timeline or at all; inadequate water management and stewardship; disruptions to the Company’s workforce at either the Rainy River Mine or the New Afton Mine, or both, due to cases of COVID-19 or otherwise); the responses of the relevant governments to any disease, epidemic or pandemic outbreak, including the COVID-19 outbreak, not being sufficient to contain the impact of such outbreak; disruptions to the Company’s supply chain and workforce due to any disease, epidemic or pandemic outbreak, including the COVID-19 outbreak; an economic recession or downturn as a result of any disease, epidemic or pandemic outbreak, including the COVID-19 outbreak, that materially adversely affects the

Company’s operations or liquidity position; there being further shutdowns at the Rainy River Mine or New Afton Mine; significant capital requirements and the availability and management of capital resources; additional funding requirements; diminishing quantities or grades of Mineral Reserves and Mineral Resources; actual results of current exploration or reclamation activities; uncertainties inherent to mining economic studies including the Technical Reports for the Rainy River Mine and New Afton Mine; impairment; unexpected delays and costs inherent to consulting and accommodating rights of First Nations and other indigenous groups; climate change, environmental risks and hazards and the Company’s response thereto; tailings dam and structure failures; ability to obtain and maintain sufficient insurance; actual results of current exploration or reclamation activities; fluctuations in the international currency markets and in the rates of exchange of the currencies of Canada, the United States and, to a lesser extent, Mexico; global economic and financial conditions and any global or local natural events that may impede the economy or New Gold’s ability to carry on business in the normal course; inflation; compliance with debt obligations and maintaining sufficient liquidity; taxation; fluctuation in treatment and refining charges; transportation and processing of unrefined products; rising costs or availability of labour, supplies, fuel and equipment; adequate infrastructure; relationships with communities, governments and other stakeholders; geotechnical instability and conditions; labour disputes; the uncertainties inherent in current and future legal challenges to which New Gold is or may become a party; defective title to mineral claims or property or contests over claims to mineral properties; competition; loss of, or inability to attract, key employees; use of derivative products and hedging transactions; reliance on third-party contractors; counterparty risk and the performance of third party service providers; investment risks and uncertainty relating to the value of equity investments in public companies held by the Company from time to time; the adequacy of internal and disclosure controls; conflicts of interest; the lack of certainty with respect to foreign operations and legal systems, which may not be immune from the influence of political pressure, corruption or other factors that are inconsistent with the rule of law; the successful acquisitions and integration of business arrangements and realizing the intended benefits therefrom; and information systems security threats. In addition, there are risks and hazards associated with the business of mineral exploration, development, construction, operation and mining, including environmental events and hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins, flooding or drought and gold bullion losses (and, in each case, the risk of inadequate insurance or inability to obtain insurance to cover these risks) as well as “Risk Factors” included in this annual report on Form 40-F and in New Gold’s disclosure documents incorporated by reference herein. Forward-looking statements are not guarantees of future performance, and actual results and future events could materially differ from those anticipated in such statements. All of the forward-looking statements contained in this annual report on Form 40-F or in documents incorporated by reference herein are qualified by these cautionary statements. New Gold expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, events or otherwise, except in accordance with applicable securities laws.

DISCLOSURE CONTROLS AND PROCEDURES

The Company’s President and Chief Executive Officer and Chief Financial Officer have evaluated the effectiveness of the Company’s disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act) as of December 31, 2022. Based on the evaluation, the Chief Executive Officer and Chief Financial Officer concluded that, as of December 31, 2022 the Company’s disclosure controls and procedures were effective to provide assurance that the information required to be disclosed by the Company in reports it files or submits under the Exchange Act, is recorded, processed, summarized and reported on a timely basis in accordance with applicable time periods specified by the Commission rules and forms and to ensure that information required to be disclosed by the Company in reports that it files or submits under the Exchange Act is accumulated and communicated to the Company’s management, including its principal executive and financial officers, or persons performing similar functions, as appropriate, to allow timely decisions regarding required disclosure.

MANAGEMENT’S ANNUAL REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

The Company’s management, including the President and Chief Executive Officer and the Chief Financial Officer, is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is defined in Rule 13a-15(f) and Rule 15d-15(f) promulgated under the Exchange Act as a process designed by, or under the supervision of, a company’s principal executive and principal financial officers and effected by the Company’s board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. The Company’s internal control over financial reporting includes those policies and procedures that:

•pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the Company;

•provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and directors of the Company; and

•provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s assets that could have a material effect on the financial statements.

The Company’s management, under the supervision of the President and Chief Executive Officer and the Chief Financial Officer, assessed the effectiveness of the Company’s internal control over financial reporting as defined in Rule 13a-15(f) and Rule 15d-15(f) under the Exchange Act as of December 31, 2022. In making this assessment, it used the criteria set forth in the Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). Based on this assessment, management has concluded that, as of December 31, 2022, the Company’s internal control over financial reporting is effective based on those criteria. There are no material weaknesses that have been identified by management.

The effectiveness of the Company’s internal control over financial reporting as of December 31, 2022 has been audited by Deloitte LLP, the Company’s independent registered public accounting firm. As stated in their report immediately preceding the Company’s audited consolidated financial statements for the years ended December 31, 2022 and 2021, filed as Exhibit 2 to this annual report on Form 40-F, Deloitte LLP expressed an unqualified opinion on the effectiveness of the Company’s internal control over financial reporting.

ATTESTATION REPORT OF THE REGISTERED PUBLIC ACCOUNTING FIRM

The report immediately precedes the Company’s audited consolidated financial statements for the years ended December 31, 2022 and 2021, which are filed as Exhibit 2 to this annual report on Form 40-F.

CHANGES IN INTERNAL CONTROL OVER FINANCIAL REPORTING

During the fiscal year ended December 31, 2022, there were no changes in the Company’s internal control over financial reporting that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

LIMITATIONS ON DISCLOSURE CONTROLS AND PROCEDURES AND INTERNAL CONTROL OVER FINANCIAL REPORTING

The Company’s management, including the President and Chief Executive Officer and the Chief Financial Officer, believes that any disclosure controls and procedures or internal control over financial reporting, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, they cannot provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been prevented or detected. These inherent limitations include the realities that judgments in decision making can be faulty and breakdowns can occur because of simple error or mistake. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or by unauthorized override control. The design of any system of controls also is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Accordingly, because of the inherent limitations in a cost effective control system, misstatements due to error or fraud may occur and not be detected.

AUDIT COMMITTEE IDENTIFICATION AND FINANCIAL EXPERT

The Company has an Audit Committee established by its board of directors for the purpose of overseeing the accounting and financial reporting processes of the Company and audits of the financial statements of the Company, in accordance with Section 3(a)(58)(A) of the Exchange Act. The members of the Audit Committee are Marilyn Schonberner (Chair), Geoffrey Chater and Margaret Mulligan. Each of Ms. Schonberner, Mr. Chater and Ms. Mulligan is “independent” as that term is defined under the rules of the NYSE American.

The board of directors has determined that each of Marilyn Schonberner, Geoffrey Chater and Margaret Mulligan is an “Audit Committee Financial Expert” as that term is defined under Section 407 of the Sarbanes-Oxley Act of 2002 and paragraph (8) of General Instruction B of Form 40-F.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

A description of New Gold’s pre-approval policies and procedures and information about fees billed to New Gold for professional services rendered by its principal accountant, Deloitte LLP (Toronto, Canada, PCAOB ID No. 1208) are included under the headings “Pre-Approval Policies and Procedures” and “Auditors and External Auditor Service Fees (by category)” on pages 68 and 69 of New Gold’s AIF for the fiscal year ended December 31, 2022, filed as Exhibit 1 to this annual report on Form 40-F.

CODE OF ETHICS

In connection with a comprehensive review of the Company’s corporate governance policies, on August 13, 2008, the board of directors of the Company (the “Board”) approved the adoption of a code of business conduct and ethics (“Code”). The Code has been reviewed and updated annually since its adoption, with the most recent review by the Board on November 2, 2022. The Code is applicable to all directors, officers and employees of the Company, including its President and Chief Executive Officer, Chief Financial Officer and principal accounting officer. The Code was adopted to, among other things, update and clarify the duties, obligations and responsibilities that are imposed upon the persons subject to its provisions. A copy of the amended Code is filed as Exhibit 4 to this annual report on Form 40-F. Additionally, on July 8, 2008, the Board approved the adoption of a whistleblower policy (“Whistleblower Policy”). The Whistleblower Policy has been reviewed and ratified or updated annually since its adoption, with the most recent review by the Board on November 2, 2022. The Whistleblower Policy outlines the principles and commitments that the Company has made with respect to the treatment of complaints by its personnel. Copies of the Code and the Whistleblower Policy are available on the Company’s website at www.newgold.com.

There were no waivers of the Code in the past fiscal year.

OFF-BALANCE SHEET ARRANGEMENTS

The Company has no off-balance sheet arrangements that have, or are reasonably likely to have, a current or future material effect on the Company’s financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

CONTRACTUAL AND OTHER OBLIGATIONS

The information provided under the heading “Financial Risk Management – (b) Liquidity risk” on page 42 of the MD&A for the year ended December 31, 2022 filed as Exhibit 3 to this annual report on Form 40-F, is incorporated by reference herein.

NYSE AMERICAN CORPORATE GOVERNANCE

The Company’s common shares are listed on the NYSE American. Section 110 of the NYSE American company guide permits NYSE American to consider the laws, customs and practices of foreign issuers in relaxing certain NYSE American listing criteria, and to grant exemptions from NYSE American listing criteria based on these considerations. A company seeking relief under these provisions is required to provide written certification from independent local counsel that the non-complying practice is not prohibited by home country law. A description of the significant ways in which the Company’s governance practices differ from those followed by domestic companies pursuant to NYSE American standards is contained on the Company’s website at www.newgold.com.

UNDERTAKINGS

The Company undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

CONSENT TO SERVICE OF PROCESS

The Company has filed with the Commission a written consent to service of process and power of attorney on Form F-X and amendments thereto. Any change to the name or address of the Company’s agent for service shall be communicated promptly to the Commission by amendment to the Form F-X referencing the file number of the Company.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereto duly authorized.

NEW GOLD INC.

By: /s/ Robert Chausse

Name: Robert Chausse

Title: Executive Vice President and Chief Financial Officer

Date: February 24, 2023

EXHIBIT INDEX

The following documents are being filed with the Commission as exhibits to this annual report on Form 40-F.

| | | | | |

| Exhibit | |

| 1. | |

| 2. | |

| 3. | |

| 4. | |

| 5. | |

| 6. | |

| 7. | |

| 8. | |

| 9. | |

| 10. | |

| 11. | |

| 12. | |

| 101. | Interactive Data File (formatted as Inline XBRL) |

| 104. | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

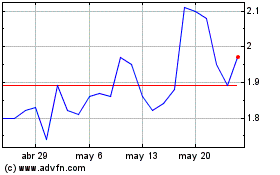

New Gold (AMEX:NGD)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

New Gold (AMEX:NGD)

Gráfica de Acción Histórica

De May 2023 a May 2024