UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE

ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

November 21, 2024

Commission File No. 0001-34184

SILVERCORP

METALS INC.

(Translation of registrant’s name into English)

Suite 1750 - 1066 West Hastings

Street

Vancouver, BC Canada V6E 3X1

(Address of principal executive office)

[Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F]

Form 20-F [ ] Form

40-F [ X ]

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

|

| Dated:

November 21, 2024 |

SILVERCORP METALS INC. |

| |

|

| |

/s/

Jonathan Hoyles |

| |

Jonathan

Hoyles |

| |

General

Counsel and Corporate Secretary |

EXHIBIT INDEX

| |

|

| EXHIBIT |

DESCRIPTION OF EXHIBIT |

Exhibit 99.1

SILVERCORP ANNOUNCES PRICING OF US$130 MILLION

CONVERTIBLE SENIOR NOTES OFFERING

Trading Symbol: TSX: SVM

NYSE AMERICAN:

SVM

VANCOUVER, BC, Nov. 21, 2024 /CNW/ - Silvercorp Metals

Inc. ("Silvercorp" or the "Company") (TSX: SVM) (NYSE American: SVM) today announced that it has priced its previously

announced private placement offering of US$130,000,000 aggregate principal amount of 4.75% convertible senior notes due 2029 (the "Notes"

and the "Offering"). The Company also granted the initial purchasers of the Notes an option to purchase up to an additional

US$20,000,000 aggregate principal amount of Notes, exercisable in whole or in part at any time until 20 days after the closing of

the Offering.

The Notes will be senior unsecured obligations of

the Company. The Notes will accrue interest payable semi-annually in arrears at a rate of 4.75% per annum and will mature on December

15, 2029, unless earlier repurchased, redeemed or converted. The initial conversion rate of the Notes is 216.0761 common shares of the

Company ("Common Shares") per $1,000 principal amount of Notes, or an initial conversion price of approximately US$4.63 (equivalent

to approximately C$6.48) per Common Share. The initial conversion price of the Notes represents a premium of approximately 30% over the

last reported sale price of the Company's Common Shares on November 20, 2024, which was US$3.56 per share as reported on the NYSE

American LLC.

The Notes will be convertible at the option of holders,

prior to the close of business on the business day immediately preceding September 15, 2029, only under certain circumstances and during

certain periods, and thereafter, at any time until the close of business on the second scheduled trading day immediately preceding the

maturity date. Upon conversion, the Notes may be settled, at the Company's election, in cash, Common Shares or a combination thereof.

The Notes will not be redeemable at the Company's option prior to December 20, 2027, except upon the occurrence of certain tax law changes.

On or after December 20, 2027 and on or prior to the 51st scheduled trading day immediately preceding the maturity date, the Notes will

be redeemable at the Company's option if the last reported sale price of the Company's Common Shares has been at least 130% of the conversion

price then in effect for at least 20 trading days (whether or not consecutive) during any 30 consecutive trading day period (including

the last trading day of such period) ending on, and including, the trading day immediately preceding the date on which the Company provides

notice of redemption at a redemption price equal to 100% of the principal amount of the Notes to be redeemed, plus accrued and unpaid

interest to, but excluding, the redemption date.

The Offering is expected to close on or about November

25, 2024, subject to customary closing conditions.

The Company estimates that the net proceeds from the

sale of the Notes, after deducting initial purchaser discounts but before deducting the other estimated expenses of the offering, will

be approximately US$124.2 million (or approximately US$143.5 million if the initial purchasers exercise their option to purchase additional

Notes in full). The Company intends to use the net proceeds from the Offering (including any net proceeds from the sale of any additional

Notes that may be sold should the initial purchasers exercise their option to purchase additional Notes) for the construction of copper-gold

mining projects outside of China, for the exploration and development of other projects and for working capital.

The Notes are being offered on a private placement

basis and are not being offered by way of a prospectus in Canada. The Notes and the distribution of Common Shares issuable upon conversion

of the Notes have not been, and will not be, registered under the U.S. Securities Act of 1933, as amended (the "Securities Act"),

or any state securities laws and may not be offered or sold in the United States except pursuant to an exemption from, or in a transaction

not subject to, the registration requirements of the Securities Act and the rules promulgated thereunder and applicable state securities

laws.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy the Notes or any other securities and shall not constitute an offer, solicitation or sale

in the United States or in any other jurisdiction in which such an offer, solicitation or sale would be unlawful prior to the registration

and qualification under the securities laws of such state or jurisdiction. The Offering may be made only by means of an offering memorandum.

About Silvercorp

Silvercorp Metals Inc. is a Canadian mining company

producing silver, gold, lead and zinc from the Ying Mining District and the GC Mine in China. Silvercorp's additional assets include

the development-stage Curipamba copper-gold project, containing the El Domo deposit, and the exploration-stage Condor project in Ecuador.

For further information

Silvercorp Metals Inc.

Lon Shaver

President

Phone: (604) 669-9397

Toll Free: 1 (888) 224-1881

Email: investor@silvercorp.ca

Cautionary statement on forward-looking information

Certain statements in this release constitute "forward-looking

statements" or "forward-looking information" within the meaning of applicable securities laws. Such statements and information

involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the

Company, its projects, or industry results, to be materially different from any future results, performance or achievements expressed

or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as "may",

"would", "could", "will", "intend", "expect", "believe", "plan",

"anticipate", "estimate", "scheduled", "forecast", "predict" and other similar terminology,

or state that certain actions, events or results "may", "could", "would", "might" or "will"

be taken, occur or be achieved. These statements reflect the Company's current expectations regarding future events, performance and results

and speak only as of the date of this release. Such statements include without limitation, the completion of the Offering and the expected

use of proceeds therefrom.

Forward-looking statements and information involve

significant risks and uncertainties, should not be read as guarantees of future performance or results and will not necessarily be accurate

indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the

results discussed in the forward- looking statements or information, including, but not limited to, risks related to the Company's ability

to consummate the Offering; the fact that the Company's management will have broad discretion in the use of the proceeds from the Offering;

fluctuating commodity prices; recent market events and condition; estimation of mineral resources, mineral reserves and mineralization

and metal recovery; interpretations and assumptions of mineral resource and mineral reserve estimates; exploration and development programs;

climate change; economic factors affecting the Company; timing, estimated amount, capital and operating expenditures and economic returns

of future production; integration of future acquisitions into existing operations; permits and licences for mining and exploration in

China; title to properties; non-controlling interest shareholders; acquisition of commercially mineable mineral rights; financing; competition;

operations and political conditions; regulatory environment in China; regulatory environment and political climate in Bolivia and Ecuador;

integration and operations of Adventus; environmental risks; natural disasters; dependence on management and key personnel; foreign exchange

rate fluctuations; insurance; risks and hazards of mining operations; conflicts of interest; internal control over financial reporting

as per the requirements of the Sarbanes-Oxley Act; outcome of current or future litigation or regulatory actions; bringing actions and

enforcing judgments under U.S. securities laws; cyber-security risks; public health crises; the Company's investment in New Pacific Metals

Corp. and Tincorp Metals Inc.; and the other risk factors described in the Company's Annual Information Form and other filings with

Canadian and U.S. regulators on www.sedarplus.ca and www.sec.gov.

Although the forward-looking statements contained

in this release are based upon what management of the Company believes are reasonable assumptions, there can be no assurance that actual

results will be consistent with these forward- looking statements. These forward-looking statements are made as of the date of this release

and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the Company does not

assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring

after the date of this release.

View original content to download multimedia:https://www.prnewswire.com/news-releases/silvercorp-announces-pricing-of-us130-million-convertible-senior-notes-offering-302312544.html

SOURCE Silvercorp Metals Inc

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/21/c6732.html

%CIK: 0001340677

CO: Silvercorp Metals Inc

CNW 03:01e 21-NOV-24

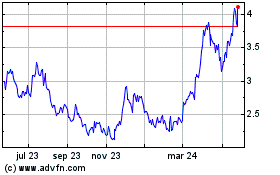

Silvercorp Metals (AMEX:SVM)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

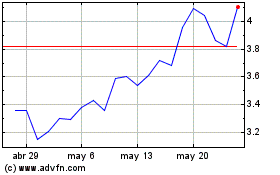

Silvercorp Metals (AMEX:SVM)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024