TIDMANIC

RNS Number : 3724T

Agronomics Limited

22 July 2022

22nd July 2022

Agronomics Limited

("Agronomics" or the "Company")

Net Asset Value calculation to 30 June 2022

Agronomics Limited (AIM:ANIC), the leading listed company

focused on the field of cellular agriculture, announces that its

unaudited Net Asset Valuation ("NAV") calculation as at closing on

30 June 2022 was 15.27 pence per share, including uninvested cash

of GBP51.5 million. Net Assets stand at GBP148 million, including

investments of GBP98 million.

The share price of 16 pence at the 30 June 2022 close represents

a premium of 5.75% to the NAV per share. The average premium to NAV

per share over the last 12-month period was 62.22%. Under IFRS, the

Company's unquoted investments are carried at cost or the most

recent priced funding round.

Richard Reed, Chairman of Agronomics, commented: -

"Agronomics has continued its investment activity in cellular

agriculture this quarter, as well as having formed a new company,

Liberation Labs Holdings Inc. - a contract manufacturer for food

technology precision fermentation.

We already have what we believe are sector leaders in cultivated

meat and seafood production, where cell culture is the best suited

technology to produce industrial quantities of meat at a much

greater efficiency when compared with conventional agriculture. We

will continue to support these cell culture companies but, moving

forward, we intend to further increase our exposure in precision

fermentation and its enabling technologies given the near-term

commercial opportunities, coupled with limited technology

risks.

Whilst global venture funding aggregated across all areas has

experienced a 23% decline quarter on quarter in Q2 2022, reflecting

the slow-down given volatile market conditions, cellular

agriculture as a sector remains promising because of the

significant ESG tailwinds, intrinsic excitement and near-term

uplifts, all of which will benefit the Agronomics portfolio."

The Company newsletter for Q2 2022 (Q4 for the financial

reporting year), can be found here .

Financing

During the financial year ended 30 June 2022, the Company

successfully completed a funding round in December 2021, raising

gross proceeds of GBP31,824,684 and issuing 138,368,193 new

Ordinary Shares. Following share issue commissions and professional

fees, net cash proceeds of approximately GBP31 million were

retained by the Company. During the 3-month period to 30 June 2022,

184,712 new Ordinary Shares were issued following the exercise of

warrants. In total, 800,343 Ordinary Shares have been issued

following the exercise of warrants, raising gross proceeds of

GBP0.231 million. These funds, together with existing cash

resources, will be utilised to provide backing for opportunities

within the field of cellular agriculture, both by supporting

existing companies, as well as identifying new opportunities in

which to invest.

Investment review

On 4 May 2022, the Company announced that cultivated leather

company VitroLabs, Inc. completed a successful Series A financing

round, and has now raised a total of US$ 46 million. Agronomics led

the Series A financing, with a US$ 7 million investment completed

in September 2021.

On 6 May 2022, the Company completed a US$ 2 million investment

into Chinese cultivated meat company CellX Limited, subscribing for

857,363 preferred shares. Following this, the existing SAFE

investment converted to 230,681 preferred shares, resulting in an

unrealised gain on the original investment of US$ 0.5 million.

On 20 June 2022, Agronomics completed a US$ 0.6 million founders

round investment into Liberation Labs Holdings, Inc. ("Liberation

Labs"). Agronomics and CPT Capital LLP have come together with

Liberation Labs' co-founders Mark Warner, CEO, and Etan Bendheim,

CBO, to address the pressing need for modern full-scale precision

fermentation facilities.

Unaudited to

30 June 2022

GBP

Current Assets

Investments 98,040,773

Uninvested cash 51,482,501

Trade and other receivables 31,260

Current Liabilities

Trade and other creditors (1,574,555)

--------------

Net Assets 147,979,979

Capital and Reserves

Share capital 947

Share premium 131,916,054

Retained earnings 16,062,978

--------------

Net assets 147,979,979

Shares in Issue 969,269,715*

Net Asset Value per 15.27 pence

share

* The stated Shares in Issue figure is lower than the last

reported figure stated by the Company on 25 April 2022 given a

timing issue due to shares being issued in the secondary purchase

in Geltor, Inc, announced 21(st) February 2022.

The quoted investments within the portfolio are valued under

IFRS at bid price.

Portfolio Details

Investments as at 30 June 2022 Value (GBP) % of Total Portfolio

Cellular agriculture holdings 97,718,648 99.67%

Legacy holdings 322,125 0.33%

Total 98,040,773 100%

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No. 596/2014, as

it forms part of UK Domestic Law by virtue of the European Union

(Withdrawal) Act 2018. Upon the publication of this announcement,

this inside information is now considered to be in the public

domain.

For further information please contact:

Agronomics Beaumont Canaccord Genuity Cenkos Peterhouse Capital TB Cardew

Limited Cornish Limited Limited Securities Plc Limited

The Company Nomad Joint Broker Joint Broker Joint Broker Public Relations

====================== ==================== ====================== ====================== ====================

Richard Reed Roland Cornish Andrew Potts Giles Balleny Lucy Williams Ed Orlebar

Denham Eke James Biddle Harry Rees Michael Johnson Charles Goodfellow Alistair Walker

Alex Aylen (Head of

Equities)

====================== ==================== ====================== ====================== ====================

+44 (0) 1624 +44 (0) 20 7930 0777

639396 +44 (0) 7738 724 630

info@agronomics. agronomics@tbcardew.

im +44 (0) 207 628 3396 +44 (0) 207 523 8000 +44 (0) 207 397 8900 +44 (0) 207 469 0936 com

====================== ==================== ====================== ====================== ====================

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUASRRUBUBUUR

(END) Dow Jones Newswires

July 22, 2022 02:00 ET (06:00 GMT)

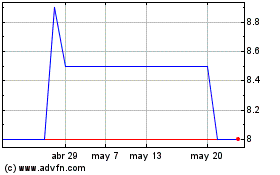

Agronomics (AQSE:ANIC.GB)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Agronomics (AQSE:ANIC.GB)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025