TIDMASC

RNS Number : 5967N

ASOS PLC

26 September 2023

26 September 2023

ASOS plc (the "Company")

Global Online Fashion Destination

Trading statement for the period ended 3 September 2023

Reducing inventory, improving profitability and generating

cash

Summary unaudited financial results

Period to 3 September 2023 53 weeks to 3 September

(P4) 2023 (FY23)

CCY change CCY change

(adjusted Reported (adjusted Reported change

& like-for-like) CCY(1) change & like-for-like) CCY(1)

GBPm (1,2,3,4) change (1,2,3,4) change

------------------- -------- ----------- ------------------- -------- ------------------

UK total

sales (16%) (13%) (13%) (13%) (12%) (12%)

EU total

sales (7%) (4%) (4%) (4%) (3%) (1%)

US total

sales (19%) (16%) (19%) (14%) (13%) (6%)

ROW total

sales (28%) (25%) (26%) (16%) (30%) (29%)

----------- ------------------- -------- ------------------

Total group

revenue(5) (15%) (12%) (12%) (11%) (11%) (10%)

------------------- -------- ----------- ------------------- -------- ------------------

Strategic update and post close trading update

The Company has continued to execute on its Driving Change

agenda. The following progress was made during the period:

-- Adjusted H2 EBIT (6) up more than 100% year-on-year ("YoY")

and H2 cashflow improving by c.GBP140m despite double-digit revenue

decline, reflecting material improvements to core profitability and

strong inventory management.

-- Sales declined 15% YoY in P4, in-line with guidance, with a

stronger start to the period followed by weaker performance in July

and August amidst a deterioration in the UK clothing market (7)

.

-- Despite the decline in sales, P4 will be another profitable

quarter. c.GBP300m of profit improvement and cost savings have now

been realised, in-line with the FY23 target set under the Driving

Change agenda, driving order profitability (8) up more than 35%

YoY.

-- Adjusted gross margin(9) up c.150bps YoY in H2 (vs. guidance

up c.200bps), driven primarily by lower freight and duty costs,

partially offset by tactical investment in promotional activity to

prioritise stock reduction in a challenging trading

environment.

-- As such, inventory down c.30% YoY, ahead of guidance,

supporting the transition to the new commercial model in FY24 and

beyond.

-- Pivot to faster stock model on track with c.500 Test &

React options launched on c.2-week lead times, with c.60% of each

product launch selling through in seven days and stock turning c.3x

faster than average.

-- EBIT is expected around the bottom of the guided GBP40m to

GBP60m range, with free cash inflow in H2 now expected to be

c.GBP60m excluding refinancing costs(10) (previously GBP150m),

principally as a result of timing effects that will reverse in

September and October. All other guidance remains unchanged.

-- Cash and undrawn facilities totalling c.GBP430m at year-end,

providing substantial liquidity following the refinancing and

equity raise announced in May 2023.

José Antonio Ramos Calamonte, Chief Executive Officer, said:

"ASOS has delivered on the Driving Change agenda and as a

consequence is a leaner and more resilient business twelve months

after its launch. We have reduced our stock balance by c.30%,

significantly improved the core profitability of the business and

generated cash against a very challenging market backdrop. We

continue to focus on bringing the best fashion and the most

engaging proposition to our customers as we make progress on our

journey to sustainably profitable and cash generative growth."

CEO review

In our P3 trading statement I explained the challenging position

we were in as we entered FY23: we had more stock than we'd like,

our buying processes were too deep and too slow, we lacked

profitability and we had tension in our balance sheet with

earnings-based covenants on our debt. To address these issues, we

refinanced our balance sheet and rebuilt the leadership team. I

also explained that we had begun to pivot to a new commercial model

that puts speed at the heart of everything we do, bringing the most

relevant and exciting fashion to our customers and making our

operations more profitable and more cash generative.

Since then, we have continued to make progress: inventory is now

down ahead of guidance, by c.30% YoY, order profitability is up

over 35% as a result of targeted action to manage our least

profitable customers. Most pleasingly, new product operating under

our refreshed commercial model is performing well and our Test

& React pilot has produced extremely positive results that we

will scale up over the coming months.

At our H1 results in May, we reiterated our priorities for H2,

focused around reducing inventory and improving our core

profitability, and provided guidance for revenue growth, gross

margin, EBIT, inventory and cash for the balance of the year. We

have successfully reduced inventory more than planned while

delivering sales and profit broadly in-line, but cash generation in

the period has lagged, predominantly as a result of timing.

Across many of our markets (but most notably the UK), the hot

weather drove a strong June and a wet July and August produced a

weaker sales result. While the stronger than expected June and

weaker than expected July and August broadly netted out to deliver

sales and EBIT in-line with guidance, the phasing of sales impacted

year-end cashflow. This is due to the immediate reduction in the

cash inflow from our sales and the delayed reduction in the cash

outflow on our costs, best illustrated by the simplified chart

below. We typically receive cash from our sales gross of returns

and sales tax immediately. However, the cash outflow from sales

tax, returns and variable costs associated with those sales

predominantly impact the following two months. As a result,

cashflow was negatively impacted by c.GBP60m as weaker July and

August gross sales coincided with higher sales costs from strong

June trading. This impact will reverse during September and

October.

*For illustrative purposes only. Sales and their associated

variable costs impact the P&L concurrently. In contrast, the

impact of lost gross sales on cashflow is immediate while the

resulting lower variable costs lag.

Progress towards our new commercial model

There are two key stages to our new commercial model -

converting our current stock into cash and then turning our stock

faster on an ongoing basis to make our business model more cash

generative. Over the last year (starting with our GBP130m stock

write-down) we focused the business on selling excess stock and

improving the way we buy stock - buying less on faster lead times

with more flexibility. To achieve this, we have rewritten our

commercial model to focus on speed - this means a better customer

proposition, less inventory risk, higher margins and greater cash

generation.

Despite the difficult trading environment, we have reduced

inventory by c.30% during FY23 which has required higher levels of

discounting in the short-term as well as reducing our intake, which

as I previously shared, has resulted in reduced width and newness,

negatively impacting revenue. This elevated level of discounting is

likely to persist through FY24, and notably through P1, as we seek

to clear last year's Autumn/Winter stock, which is now among our

oldest inventory. We remain on track to return stock to pre-COVID

levels by the end of FY24 (reducing stock below GBP600m), which

will importantly continue to drive down our net debt.

Our newest, high fashion product is selling very well, with a

50% increase in 4-week sell-through since the start of the year.

However, due to our reduced stock intake and seasonally low newness

in July and August, new stock is a low proportion of sales and the

strong performance on new product has therefore not been enough to

offset the challenging discount season for clearance product. In

September, the proportion of our stock which is less than a month

old will have almost doubled from the levels seen in July, which

improves the proposition for our customers .

Over the course of the last year, we have made substantial

progress on initiatives to improve our stock efficiency on an

ongoing basis, and in FY24 we will see these measures ramp up. On

the own-brand side, our Test & React pilot has been a

resounding success. As a reminder, we define Test & React to be

product that moves from initial design to available on site in less

than three weeks. This enables us to react to fashion trends and

produce product we know our customers want. We have now launched

c.500 Test & React options, reducing lead times to around two

weeks and with close to two-thirds of each product run selling

through in the first seven days. When it comes to partner brands,

the technology and team are now in place to enable us to scale up

the number of brands operating on the Partner Fulfils model in the

next twelve months, providing additional width and depth to our

assortment while simultaneously reducing inventory risk and

enabling us to better curate our local product offering in

international markets.

These initiatives will be transformative for our customer

proposition and for our ability to generate profit and cash. There

is still a lot for us to learn, but we have an experienced and

dedicated team. To support this transformation, I have appointed

Elena Martínez Ortiz as Senior Product Director. Elena joined ASOS

as Womenswear Director in August 2022, following nearly 18 years at

Inditex, where she most recently held the role of Product Director.

Elena has been instrumental in the launch of Test & React and

is the driving force behind our speed to market initiatives. In her

new role, Elena becomes the single leader of our product

organisation, with responsibility for all ASOS-owned brands and

partner brands sold through ASOS. This will simplify our

decision-making and hence accelerate our speed to market, a pivotal

driver of the relevance of our product.

Improving profitability

Our new commercial model improves our profitability, requiring

lower investment into discounting as well as potentially increasing

basket value and customer lifetime value once fully operational. We

have already seen these benefits on a small scale through our Test

& React trials with no promotional investment needed to sell

through c.60% of each product launch in seven days across c.500

options produced to date, more than offsetting the higher cost of

goods for product created under this model. On our partner brands,

our rollout of DTC ("Direct-to-Consumer") solutions including

Partner Fulfils will also reduce the risk of inventory overhang

typical of branded product sold through our Retail model that is

often ordered around 9 months ahead of the point of purchase.

These benefits will accelerate as we scale up our flexible stock

models. However , the core improvements we have implemented over

FY23 to drive the more than 35% YoY improvement in order

profitability and 100% improvement in H2 EBIT include:

- Targeted action to improve the behaviour of our least

profitable customers including reduced marketing contact and

restrictions on Buy Now, Pay Later solutions at checkout, with a

positive impact on our return rate since these changes were

introduced. We have also recently launched personalised marketing

to improve the profitability of our entire customer base.

- Charging for returns in a number of non-core markets or

introducing charges for returns made after fourteen days but within

the twenty-eight day returns window (and hence maximising our

opportunity to resell returned product at full price).

- Optimisation of the distribution network resulting in a c.20%

reduction in our UK fixed warehouse cost per unit despite inflation

headwinds.

While some of these profitability measures have led to higher

levels of churn (23.3m active customers at FY23, down c.9% YoY (11)

and c.3% from P3) we have exited our least profitable orders and

customers as evidenced by the c.35% increase in profit per order

over the period and lower than expected returns rate. We are laying

the right foundations for sustainably profitable and cash

generative growth. We will provide a more detailed update on our

FY24 strategy alongside our FY23 results.

FY23 results announcement

Our FY23 results announcement and analyst presentation will take

place on 25 October 2023.

Notes

(1) Constant currency is calculated to take account of hedged

rate movements on hedged sales and spot rate movements on unhedged

sales.

(2) Adjusted revenue e xcludes non-underlying jobber income

associated with the transition to the new Commercial Model across

FY23.

(3) Like-for-like sales are adjusted to remove the benefit of

the additional three days of trading in P4 FY23 (1 June to 3

September 2023) vs. P4 FY22 (1 June to 31 August 2022) and the

additional three days of trading in FY23 (1 September 2022 to 3

September 2023) vs. FY22 (1 September 2021 to 31 August 2023). The

impact of the additional days is c.3% at group level in P4 FY23 and

c.1% in FY23.

(4) All numbers subject to rounding throughout this document.

Revenue is stated at constant currency, adjusted for non-underlying

items, based on like-for-like sales (as defined in note 3 above)

and excludes Russia from the FY22 comparative base period following

the decision to suspend trade in Russia on 2 March 2022, unless

otherwise stated. Any other adjusted measures exclude

non-underlying items.

(5) Includes retail sales, wholesale and income from other

services comprising delivery receipt payments, marketing services

and commission on partner-fulfilled sales.

(6) Adjusted EBIT is Earnings before Interest and Tax excluding

non-underlying items.

(7) BRC-KPMG Retail Sales Monitor, July / August 2023 showing

decline in UK online non-food sales in 4 weeks to 26 August 2023.

Kantar data total online market |16-35 year old (total) | 12 weeks

ending 25 June 2023, 23 July 2023 and 20 August 2023 showing online

adultwear spend among 16-35 year old cohort in decline and

continuing to underperform the wider market.

(8) Profit per order based on variable contribution. YTD profit

per order based off September 2022 - July 2023 data vs September

2021- July 2022.

(9) H2 FY23 adjusted gross margin excludes the gross profit

impact of the stock write-off announced at FY22.

(10) Free cashflow guidance is excluding all incremental

refinancing costs (interest, arrangement and advisor fees).

(11) Active customers are defined as having shopped in the last

12 months as at 3 September 2023, and are quoted to exclude Russian

active customers. Including Russian customers, active customers

have declined c.12% YoY and c.3% from P3 2023.

Investor and Analyst conference call:

ASOS will be hosting a conference call for analysts and

investors at 8.30am (UK time) on 26(th) September 2023. To access

live please dial +44 20 4587 0498 / +44 800 358 1035 , and use

passcode: 763128.

A recording of this webcast will be available on the ASOS Plc

website later today:

https://www.asosplc.com/investor-relations/

For further information:

ASOS plc Tel: 020 7756 1000

Jose Antonio Ramos Calamonte, Chief Executive

Officer

Sean Glithero, Interim Chief Financial Officer

Michelle Wilson, Senior Director of Strategy

and Corporate Development

Holly Cassell, Head of Investor Relations

Website: www.asosplc.com/investors

Teneo Tel: 0 20 7353

4200

Jonathan Sibun / Will Palfreyman

JPMorgan Cazenove Tel: 020 7742 4000

Bill Hutchings / Will Vanderspar

Numis Securities Tel: 020 7260 1000

Alex Ham / Jonathan Wilcox / Tom Jacob

Berenberg

Tel: 020 3207 7800

Matthew Armitt / Richard Bootle / Marie Moy

Background note

ASOS is a destination for fashion-loving 20-somethings around

the world, with a purpose to give its customers the confidence to

be whoever they want to be. Through its app and mobile/desktop web

experience, available in nine languages and in over 200 markets,

ASOS customers can shop a curated edit of nearly 50,000 products,

sourced from nearly 900 global and local third-party brands

alongside a mix of fashion-led own-brand labels - ASOS Design, ASOS

Edition, ASOS 4505, Collusion, Reclaimed Vintage, Topshop, Topman,

Miss Selfridge and HIIT. ASOS aims to give all of its customers a

truly frictionless experience, with an ever-greater number of

different payment methods and hundreds of local deliveries and

return options, including Next-Day Delivery and Same-Day Delivery,

dispatched from state-of-the-art fulfilment centres in the UK, US

and Germany.

Forward looking statements:

This announcement may include statements that are, or may be

deemed to be, "forward-looking statements" (including words such as

"believe", "expect", "estimate", "intend", "anticipate" and words

of similar meaning). By their nature, forward-looking statements

involve risk and uncertainty since they relate to future events and

circumstances, and actual results may, and often do, differ

materially from any forward-looking statements. Any forward-looking

statements in this announcement reflect management's view with

respect to future events as at the date of this announcement. Save

as required by applicable law, the Company undertakes no obligation

to publicly revise any forward-looking statements in this

announcement, whether following any change in its expectations or

to reflect events or circumstances after the date of this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBELLLXKLXBBB

(END) Dow Jones Newswires

September 26, 2023 02:00 ET (06:00 GMT)

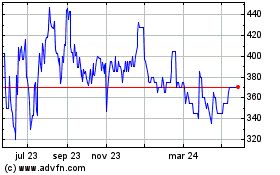

Asos (AQSE:ASC.GB)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

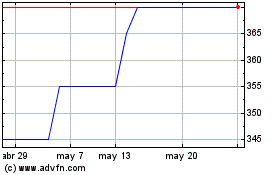

Asos (AQSE:ASC.GB)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025