Bitcoin Bears Crushed: $100M In Crypto Shorts See Flush As BTC Breaks $63,000

15 Julio 2024 - 1:00PM

NEWSBTC

Data shows the cryptocurrency derivatives market has registered

significant liquidations after the Bitcoin rally above the $63,000

mark. Bitcoin Rally Has Resulted In Short Liquidations On

Derivatives Market According to data from CoinGlass, the latest

volatility in the cryptocurrency market has led to large

liquidations on the derivatives side. “Liquidation” here naturally

refers to the process that any open contract undergoes where its

platform forcibly closes it off after it has amassed losses of a

certain degree. Related Reading: Bitcoin Recovery Stalls As HODLers

Apply Selling Pressure The table below shows how the derivatives

liquidations have looked during the last 24 hours: It would appear

that the cryptocurrency derivatives market has registered total

liquidations of $126 million in the past day. Out of these, almost

$101 million of the contracts were short ones. This figure is

equivalent to more than 80% of the total, implying that these

investors betting on a bearish outcome for the market were the most

heavily affected by the latest volatility. This naturally makes

sense, as assets across the sector have seen green returns in this

window, led by Bitcoin’s rally. A mass liquidation event like this

latest one is popularly called a “squeeze“, and as shorts were the

side that contributed to a majority of these liquidations, the

squeeze would be known as a “short squeeze.” During a squeeze,

liquidations end up feeding further into the price move that caused

them, thus unleashing a cascade of further liquidations. As such,

the sharp price surge in the past day would in part be fueled by

the short squeeze. Related Reading: Bitcoin Crash Forced Weak Hands

Into Largest Loss-Taking Since 2022 Lows: Report As for the

breakdown of this latest squeeze for the various symbols, it would

seem like Bitcoin has come out on top like usual with around $45

million in liquidations. Ethereum (ETH) and Solana (SOL) have made

up the rest of the top three with $24 million and $8 million in

liquidations, respectively. Interestingly, while most of the sector

has seen the dominance of short liquidations, XRP (XRP) on fourth

has seen longs edge out instead. This may be down to the fact that

the coin has overall only moved sideways while the rest have

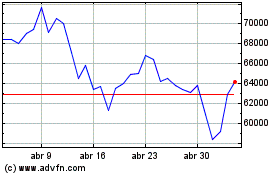

rallied. BTC Has Managed To Reclaim The $62,000 Support Level With

the latest rally, Bitcoin has been able to make some significant

recovery, with its price even briefly surging above the $63,000

level earlier in the day. The chart below shows what the coin’s

surge has looked like: According to data from the market

intelligence platform IntoTheBlock, Bitcoin is now floating above

the significant on-chain support level of $62,000. “While

resistance is strong above, enough bullish momentum can prevent

selling pressure,” notes the analytics firm. Featured image from

Dall-E, CoinGlass.com, IntoTheBlock.com, chart from TradingView.com

Bitcoin (COIN:BTCUSD)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Bitcoin (COIN:BTCUSD)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024