Here’s What Will Happen If Bitcoin Respects This MVRV Ratio Support Level

04 Octubre 2024 - 8:00PM

NEWSBTC

A CryptoQuant analyst using the pseudonym “tugbachain” has recently

shed light on a key trend within the Bitcoin market. Posting on the

CryptoQuant QuickTake platform, the analyst focused on the Market

Value to Realized Value (MVRV) ratio, an important metric in the

Bitcoin market. According to tugbachain, the MVRV ratio shows a

historical downward trend. Should this trend continue or get

breached, it may lead to a major impact on Bitcoin. Related

Reading: Bitcoin’s NVT Cross Signals a Local Top – Is a Major

Correction Looming? MVRV Ratio And Its Impending Impact On Bitcoin

The MVRV ratio, as explained by tugbachain, is a tool used to gauge

whether a cryptocurrency is overvalued or undervalued. This ratio

is calculated by comparing the market value to the realized value

of Bitcoin, providing insights into investor behavior and market

trends. The analyst highlighted that the MVRV has proven useful in

identifying market tops, bottoms, and notable peaks and troughs

over the years. The MVRV ratio has historically demonstrated three

major Bitcoin halving cycles, each marked by unique price behavior

and investor sentiment. The current ratio sits around 1.9, with

significant support noted at 1.75. The question raised by

tugbachain is whether breaking the downtrend could lead to a rise

in the MVRV ratio to the 4-6 range, which has historically signaled

a Bitcoin peak. The analyst wrote in the post: Currently, the MVRV

ratio shows a historical downtrend with significant support at

1.75. With the ratio now sitting at 1.9, the question arises: if it

breaks the downtrend and reverses the downtrend, could it once

again climb to the 4-6 range, marking a Bitcoin peak as seen in

previous cycles? BTC Market Performance And Technical Outlook

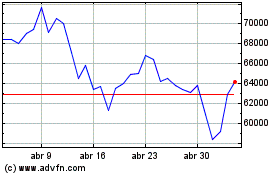

Bitcoin has seen heightened price activity in recent weeks in the

broader market context. The asset rallied above $66,000 last week,

sparking enthusiasm in the crypto community with hopes for a

bullish October, playfully termed “Uptober.” However, this upward

momentum was short-lived, as BTC experienced a notable price

correction soon after. Within the past week alone, Bitcoin has seen

a decline of around 7.2%, falling to a trading price of $61,496 at

the time of writing. Despite this correction, BTC has rebounded

slightly, posting a modest 1.9% gain over the past 24 hours. Aside

from tugbachain’s analysis, other crypto market analysts have

provided additional perspectives on the MVRV ratio’s implications

for BTC. Ali, a prominent analyst on the social media platform X,

has pointed out that the MVRV ratio’s behavior since May has

notably impacted Bitcoin’s price movements. Related Reading: Here

Is Why The Bitcoin Bull Run Hasn’t Started, According To Analyst

Ali observed that each rejection of the MVRV ratio from its 90-day

average has historically led to a significant correction in

Bitcoin’s price. According to Ali, the latest rejection has already

resulted in a 10% drop, suggesting the possibility of further

downside pressure. Featured image created with DALL-E, Chart From

TradingView

Bitcoin (COIN:BTCUSD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Bitcoin (COIN:BTCUSD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024