Ethereum Could Be Set To Explore New Highs As On-Chain Metrics Light Up

12 Noviembre 2024 - 1:30AM

NEWSBTC

On-chain data shows metrics related to network activity have spiked

for Ethereum recently, something that could pave way for a further

rally. Ethereum Transaction Volume & Whale Transfer Count Have

Spiked Recently According to data from the on-chain analytics firm

Santiment, Ethereum has seen an uplift in two activity-related

metrics. The indicators in question are the Transaction Volume and

the Whale Transaction Count. The first of these, the “Transaction

Volume,” keeps track of the total amount of the cryptocurrency (in

USD) that users on the ETH network are shifting across the network

with their transactions. Related Reading: Dogecoin To As High As

$23? This Pattern Could Hint So When the value of this metric is

high, it means the ETH blockchain is processing the transfer of a

large number of coins right now. Such a trend suggests the

investors actively invest in asset trading. On the other hand, the

low indicator implies the interest in the cryptocurrency may

currently be low as the holders are only moving around a low amount

of ETH. Now, here is a chart that shows the trend in the

Transaction Volume for Ethereum over the last few months: As

displayed in the above graph, the Ethereum Transaction Volume has

registered a sharp surge recently, implying interest in the asset

has increased alongside the price rally. This could be considered a

constructive development for the cryptocurrency, as an increasing

network activity is generally required for rallies to be

sustainable. In the past, some price moves have kicked off sharply,

but the Transaction Volume didn’t register much of an increase at

the same time. Such moves generally died out before long. The chart

also contains the data for the other metric of relevance here, the

“Whale Transaction Count.” This indicator measures the total amount

of ETH transfers valued at more than $100,000. Transactions of this

scale are assumed to be coming from the whale entities, so the

Whale Transaction Count reflects the activity level of the

big-money investors. From the graph, it’s apparent that this

indicator has also spiked for Ethereum recently, which implies that

the recent increase in the volume isn’t just a sign of interest

from the smaller investors but also the humongous hands. Naturally,

it’s impossible to say based off these indicators alone, whether

the investors are buying or selling, as all types of transactions

look the same from their view. Because ETH has seen a sharp rally

recently, this activity has probably been for accumulation so far.

Related Reading: Bitcoin Holder Profits Now 121%: How Much Higher

Can BTC Go? The analytics firm explains, Expect any growth from

Bitcoin, during this bull run, to see profits redistribute into

Ethereum and potentially push it toward its own all-time high while

its network activity looks very healthy. ETH Price After observing

a surge of more than 27% over the last seven days, Ethereum has

broken beyond the $3,150 level. Featured image from Dall-E,

Santiment.net, chart from TradingView.com

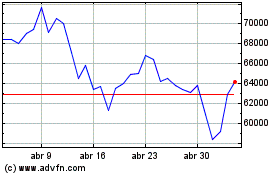

Bitcoin (COIN:BTCUSD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Bitcoin (COIN:BTCUSD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024