Bitcoin Hashrate Falls Off, Miners Expecting Pause In Bull Run?

19 Noviembre 2024 - 5:00AM

NEWSBTC

On-chain data shows the Bitcoin Hashrate has seen a setback

recently, a potential indication that miners may not believe the

asset’s run would last. Bitcoin Mining Hashrate Has Declined Since

Its All-Time High The “Hashrate” refers to a metric that keeps

track of the miners’ total computing power currently attached to

the Bitcoin network. This indicator’s value is measured in terms of

hashes per second (H/s) or the larger and more practical,

terahashes per second (TH/s). Related Reading: Is $135,000

Bitcoin’s Current Ceiling? This Model Says So When the value of

this metric registers an increase, it means new miners are joining

the network, and old ones are expanding their farms. Such a trend

implies that blockchain is a lucrative opportunity for these chain

validators. On the other hand, the declining indicator suggests

some miners have decided to disconnect their rigs from the network,

potentially because they can’t break even anymore. Now, here is a

chart that shows the trend in the 7-day average of the Bitcoin

Mining Hashrate over the past year: As displayed in the above

graph, the 7-day average Bitcoin Hashrate had sharply moved up

earlier and set new records. However, the metric has dropped since

peaking near the 755 million TH/s mark at the start of this month.

The earlier uptrend in the indicator resulted from the

positive price action that the asset had been enjoying, as the

price is directly linked to the miners’ revenue. There are two

ways that these chain validators make their income: the transaction

fees and the block subsidy. The former is dependent on traffic

conditions and can drastically change from day to day. The latter,

on the other hand, has very specific constraints attached to it.

The block subsidy remains fixed in BTC value for about four years,

at the end of which an event called the Halving cuts it exactly in

half. These rewards are also given out at a more or less constant

rate, meaning miners’ daily block subsidy income in BTC terms

always remains quite predictable. Related Reading: Dogecoin Price

Down 7%, But Whales Continue To Buy However, one variable is free

to change, and it’s the USD value of these rewards. Whenever the

price rises, so does the block subsidy revenue of the miners. This

is why the Hashrate tends to see growth in bullish periods. Bitcoin

has been exploring new highs recently, but the Hashrate has

interestingly stayed muted. The indicator is around 723 million,

which means it has declined by more than 4% since the peak. This

trend could signal that the miners expect the current rally to face

an obstacle. BTC Price At the time of writing, Bitcoin is floating

about $91,900, up over 8% in the last seven days. Featured image

from Dall-E, Blockchain.com, chart from TradingView.com

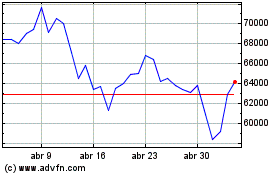

Bitcoin (COIN:BTCUSD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Bitcoin (COIN:BTCUSD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024