How Low Can Dogecoin Go Before It Rebounds? Expert Forecasts

20 Diciembre 2024 - 3:30PM

NEWSBTC

Over the past 12 days, Dogecoin (DOGE) has endured a sharp

decline, shedding more than 40% of its value. After trading above

$0.48 on December 8, the meme-inspired cryptocurrency briefly sank

to $0.2638 by December 20, prompting a wave of speculation about

its near-term direction. The backdrop to this drawdown has been the

broader crypto market’s response to US Federal Reserve policy

signals, with the latest downturn largely attributed to more

hawkish projections from the Federal Open Market Committee (FOMC).

While the Fed’s December meeting delivered a widely expected 25

basis point rate cut, the real shock came from the revised dot

plot, which pointed to fewer future cuts than previously

anticipated. The market had hoped for three rate cuts in 2025, but

the FOMC’s guidance now leans toward just two, suggesting a more

cautious approach amid persistent inflationary pressures. This

shift in outlook triggered broad-based selling in risk-on assets,

including cryptocurrencies. Bitcoin (BTC) dropped below $93,000,

and altcoins -20% drawdowns. Within 24 hours, a staggering $1.17

billion in long positions were liquidated across the crypto

markets. How Low Can Dogecoin Go? A number of prominent analysts

have weighed in on DOGE’s retreat, framing it within the context of

historical patterns and macro-level drivers. Technical analyst

Kevin (@Kev_Capital_TA) highlights the significance of previous

cycles. He notes that, historically, Dogecoin has experienced

multiple significant corrections en route to its cycle tops,

stating that the current pullback—similar to past 50%

drawdowns—could be part of a normal bull market structure rather

than a sign of systemic weakness. Related Reading: Dogecoin Trading

Volume Rises Over $6.5 Billion As Liquidations Cross $31 Million,

What’s Going On? According to Kevin, “In the previous cycle

Dogecoin had three separate 50% corrections on the way to its cycle

top. If we tap macro structured support and the macro golden pocket

right below that would be roughly a 45% correction from the high

which based off historical analyses would be just enough for us to

resume uptrend. If we lose $0.26 cents on a weekly close then I

would start to seriously worry about this market structure but

until then this should be treated as a normal bull market

pullback.” Kevin also underscores Bitcoin’s influence over the

altcoin landscape. Instead of focusing solely on DOGE’s standalone

chart, he encourages traders to “not be hyper focused on altcoin

charts” to gauge the market’s macro direction. BTC remains the

pivotal asset whose price action often dictates sentiment across

the broader crypto space. Kevin illustrated this point by sharing a

BTC/USDT liquidation heatmap, suggesting the market may seek to

flush out lower liquidity pockets before any meaningful rebound.

“Let’s go snag all that liquidity at $95K-90K and then we can start

talking about a bounce. Until then no reason to over analyze. From

a fundamental standpoint the market is overreacting to what Powell

is saying and not actually listening to him. Just because rate cut

projections,” he writes. Related Reading: Ex-Hedge Fund Guru Bets

Big On Dogecoin As ‘Core Crypto Bet’ Balo (@btcbalo), another

crypto analyst, reinforces the importance of the $0.26 level. He

points out that Dogecoin “still has a few days to save the weekly,”

indicating that a weekly close above this threshold would maintain

a structurally sound market framework. A successful defense of the

$0.26 zone could set the stage for a renewed uptrend, potentially

targeting a return to $0.42—what Balo views as a critical pivot

point. Reclaiming $0.42 would, in his words, allow DOGE to

“teleport” toward the $4 mark, a scenario he associates with a

full-scale bull run recovery. A third analyst, CEO

(@Investments_CEO), brings a historical perspective, suggesting

that DOGE’s current pattern aligns with its multi-year cyclical

nature. “DOGE appears to be aligning with its typical 3-4 year

cycle. Zoom out,” he states. The analyst refers to DOGE’s price

action following its previous cycle fractal. Back in 2021, Dogecoin

experienced its first major run-up approaching its all-time high

(ATH). After a 50% correction, DOGE resumed its rally, broke

through the ATH, and then entered price discovery. As mentioned

earlier, this scenario could align with the $0.26 price target. At

press time, DOGE traded at $0.26919. Featured image created with

DALL.E, chart from TradingView.com

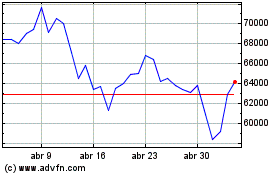

Bitcoin (COIN:BTCUSD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Bitcoin (COIN:BTCUSD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024