Bitcoin Is Forming A Symmetrical Triangle – Can BTC Reclaim $100K?

25 Diciembre 2024 - 11:30AM

NEWSBTC

Bitcoin delighted investors with a Christmas Eve surge, climbing

from $92,300 to an intraday high of $99,400. The swift rally has

reignited bullish sentiment as the price successfully held a

critical demand level, signaling strength and positioning BTC to

challenge the psychological $100,000 milestone. Market participants

are now closely watching Bitcoin’s next move, anticipating

continued momentum in the coming days. Related Reading: XRP Whales

Keep Buying – Data Reveals Smart Money Prepares For A Rally Top

analyst Carl Runefelt shared a compelling technical analysis on X,

highlighting Bitcoin’s formation of a symmetrical triangle on the

hourly timeframe. This pattern often indicates a period of

consolidation before a significant breakout, and Runefelt believes

BTC is on the verge of such a move. A confirmed break above this

triangle could propel Bitcoin into price discovery, unlocking

further gains and marking a pivotal moment in its current market

cycle. With strong demand levels providing support and technical

patterns aligning for a potential breakout, Bitcoin’s path to

$100,000 appears clearer than ever. However, traders remain

cautious as volatility could still play a role in the short term.

All eyes are on the leading cryptocurrency as it enters a critical

phase, with investors eagerly awaiting confirmation of a new leg in

its historic bull run. Bitcoin Looks Ready To Rally Again Bitcoin

appears primed for another rally into price discovery, maintaining

a bullish structure after holding critical demand levels. This

resilience underscores the market’s confidence in BTC’s ability to

reclaim the $100,000 mark and push higher, with both analysts and

investors closely monitoring its price action for confirmation. Top

analyst Carl Runefelt recently shared an insightful technical

analysis on X, highlighting a symmetrical triangle pattern on

Bitcoin’s hourly chart. Symmetrical triangles often indicate a

period of consolidation before a breakout, and Runefelt suggests

that BTC is poised to break upward. He further identified $100,700

as a key level; surpassing it would signal strong bullish momentum,

potentially driving Bitcoin to new all-time highs. Conversely, he

cautioned that a drop to $95,200 would signal weakness, indicating

a bearish turn in the short term. Runefelt’s analysis aligns with

market sentiment, as many traders view Bitcoin’s current

consolidation as a precursor to significant upward movement. If BTC

confirms a breakout above the triangle, it could trigger a surge of

buying activity, driving the price into uncharted territory.

However, a failure to sustain momentum above critical levels may

lead to heightened volatility, challenging Bitcoin’s bullish

outlook. Related Reading: If History Repeats Dogecoin Has Potential

For A Parabolic Rally – Details For now, the leading cryptocurrency

holds steady, with all eyes on the pivotal $100,700 mark. If

Bitcoin successfully breaks this resistance, it could ignite the

next phase of its bull run, reaffirming its position as the

dominant force in the crypto market. Price Action: Key Levels To

Watch Bitcoin is currently trading at $98,400, marking a notable 7%

surge from its recent local lows of $92,000. This recovery

highlights renewed bullish momentum, with the price reclaiming the

critical 4-hour 200 EMA, a key indicator of short-term strength.

BTC now faces a significant hurdle as it attempts to push above the

4-hour 200 MA, which sits at $98,470. Reclaiming the 200 MA would

confirm Bitcoin’s bullish trajectory, potentially igniting

aggressive buying activity to propel the price above the

psychological $100,000 mark. Breaking this level would not only

reinforce market confidence but could also trigger further upside

momentum, pushing BTC into new all-time highs. Related Reading:

Solana Holds Weekly Support At $180 – Analyst Expects $330 Mid-Term

On the flip side, failure to reclaim the 200 MA could result in

Bitcoin consolidating below $100,000. This would likely lead to a

period of sideways price action, with traders awaiting fresh

catalysts to determine the next move. Featured image from Dall-E,

chart from TradingView

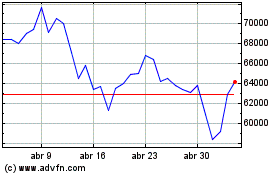

Bitcoin (COIN:BTCUSD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Bitcoin (COIN:BTCUSD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024