Is Ethereum About To Take Off? Analysts Weigh In Amid ETF Approval Date Rumors

27 Junio 2024 - 11:00PM

NEWSBTC

Ethereum (ETH)’s struggles to regain the last cycle’s heights have

brewed a bearish sentiment among some sectors of the crypto

community. Its performance during Q2 has seemingly continued to

fuel the sentiment. However, with rumors of an ETH ETF

(Exchange-Traded Fund) approval being around the corner, analysts

believe the ‘King of Altcoins’ is about to hit the “ETH season.”

Related Reading: Bitwise CIO Expects $15 Billion To Flow Into Spot

Ethereum ETFs, How Will ETH React? Will Ethereum Spot ETF Come Next

Week? On Wednesday, Reuters revealed sources close to some

investment firms believe that Ethereum ETFs will be approved next

week. The rumors follow the Securities and Exchange Commission

(SEC) Chair, Gary Gensler, comments regarding the investment

products’ approval. Earlier this week, Gensler spoke at the

Bloomberg Invest Summit, revealing that the approval process is

“working smoothly.” The launch of the highly anticipated products

is expected to come this summer and could be as early as July.

According to Reuters, industry executives and lawyers involved with

the applicants believe the Ethereum ETF could be approved within

the next two weeks. Per the report, the ETH approval could come as

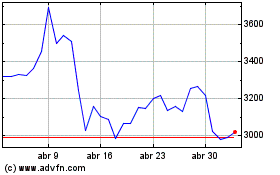

soon as July 4. A month ago, ETH’s price soared by over 30% in

anticipation of an SEC’s approval, going from the $3,000 mark to

the $3,900 price range. Since then, the second-largest

cryptocurrency has retraced to the $3,200 support zone.

Nonetheless, the ‘King of Altcoins’ saw a positive impact from the

recent ETF rumors. Ethereum rose by 2.5% following the news,

recovering the $3,400 support zone it lost at the beginning of the

week. Is ‘ETH Season’ Around The Corner? Crypto analyst Jelle

believes that ETH might be ready for take-off despite the

expectations of “an underwhelming ETF launch.” To the analyst, ETH

“looks ready for a massive push higher” as it tests key levels the

week before the alleged approval. Per his chart, the cryptocurrency

is testing the support of a downtrend within the accumulation

range. Jelle considers that if ETH pushes into $4,000 again, it

might not “stop anytime soon.” To him, the “nearly three years in

the making breakout” into the expansion zone will kickstart the

“ETH season.” Similarly, Daan Crypto Trades pointed out that

Ethereum is still consolidating against a “massive 2-year-long

downtrend line.” Per the trader, the May pump highs are the place

to break. A “higher high above 0.0575” would “flip the market

structure to bullish.” Moreover, Crypto Yoddha highlighted the

falling wedge pattern in the ETHBTC chart. The trader suggested

that a breakout will come “anytime now.” This analysis was also

shared by trader Miky Bull, who considers Ethereum “fully ripe for

a rally from the retest of fib .618 level.” Related Reading:

Ethereum Price Roadblocks: What’s Hindering A Fresh Increase?

Despite being down by over 10% from the May pump, ETH has seen a

3.6% increase in the last 24 hours. As of this writing, the ‘King

of Altcoins’ is exchanging hands at $3,450. Featured Image from

Unsplash.com, Chart from TradingView.com

Ethereum (COIN:ETHUSD)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Ethereum (COIN:ETHUSD)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024